Market Overview

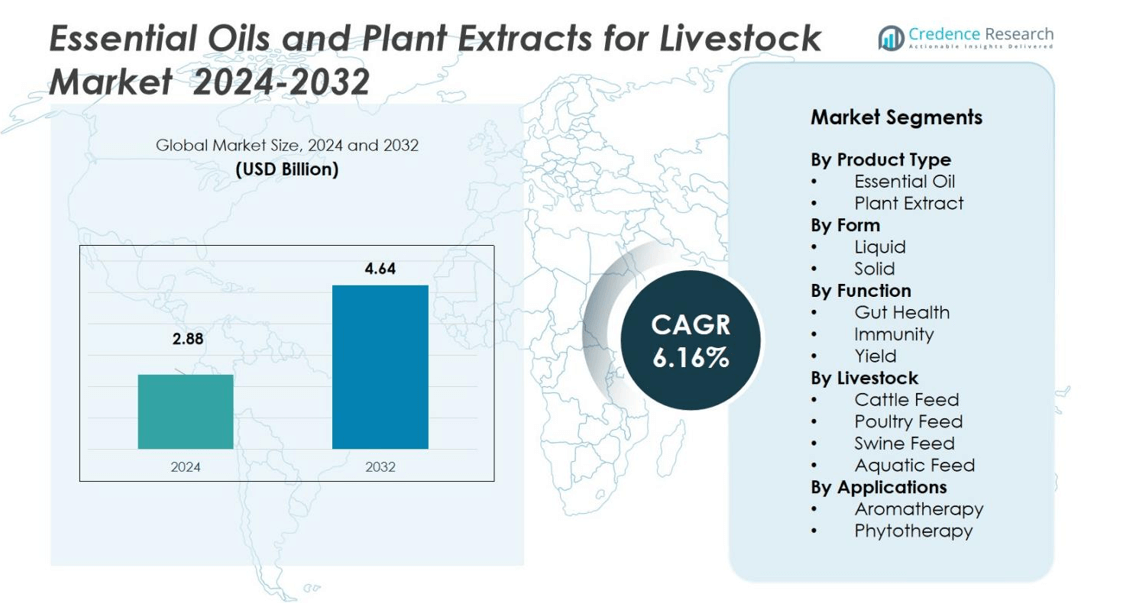

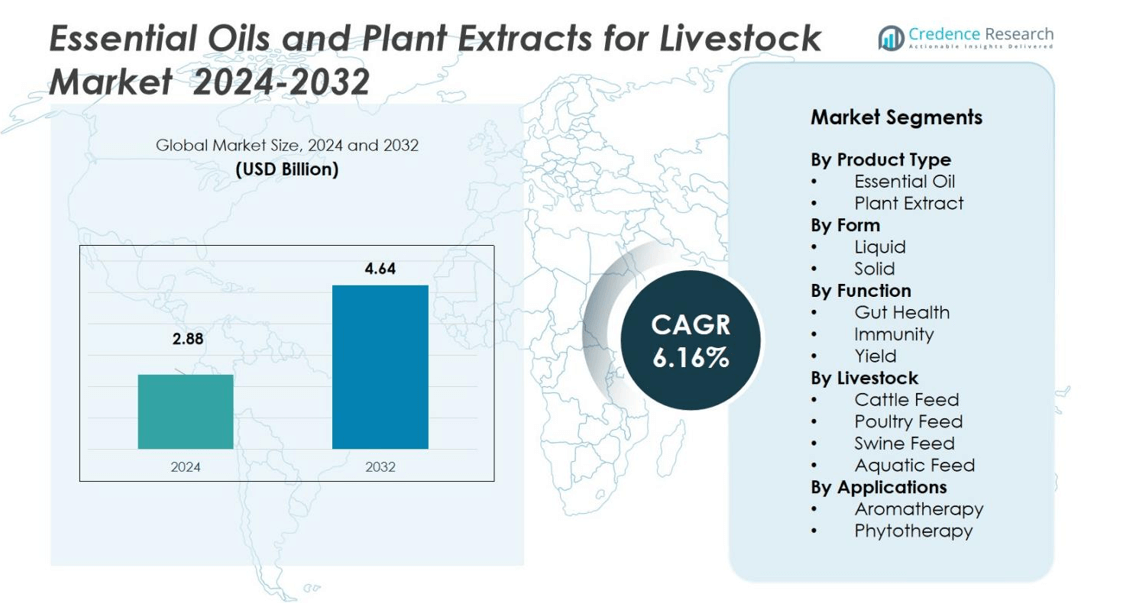

The Essential Oils and Plant Extracts for Livestock Market size was valued at USD 2.88 billion in 2024 and is anticipated to reach USD 4.64 billion by 2032, growing at a CAGR of 6.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Essential Oils and Plant Extracts for Livestock Market Size 2024 |

USD 2.88 billion |

| Essential Oils and Plant Extracts for Livestock Market, CAGR |

6.16% |

| Essential Oils and Plant Extracts for Livestock Market Size 2032 |

USD 4.64 billion |

The Essential Oils and Plant Extracts for Livestock Market is driven by strong competition among leading players such as Olmix S.A., Orffa, Herbavita, Panagro Health & Nutrition, Trouw Nutrition Hifeed BV, Indian Herbs Specialties Pvt. Ltd., Provitim, Phytosynthese, Manghebati, and Herbarom Laboratoire. These companies focus on formulating standardized and species-specific blends that enhance animal growth, immunity, and gut health. Strategic initiatives such as mergers, product innovations, and regional expansion strengthen their global presence. Continuous investment in R&D and sustainable extraction technologies enables these firms to improve product efficacy and quality consistency. Asia-Pacific emerged as the leading region, holding a 33% market share in 2024, driven by expanding livestock production and increasing demand for antibiotic-free feed additives. North America followed with a 31% share, supported by advanced animal nutrition research and strict regulatory guidelines promoting natural feed ingredients. Europe, with a 28% share, benefits from sustainability-driven livestock production systems.

Market Insights

- The Essential Oils and Plant Extracts for Livestock Market was valued at USD 2.88 billion in 2024 and is expected to reach USD 4.64 billion by 2032, growing at a CAGR of 6.16% during the forecast period.

- Rising demand for antibiotic-free and natural feed additives drives market growth, as essential oils improve gut health, immunity, and feed conversion efficiency in livestock.

- Key trends include technological advancements in extraction and encapsulation methods and the growing adoption of customized, species-specific formulations across poultry, swine, and cattle segments.

- Leading companies such as Olmix S.A., Orffa, Herbavita, and Trouw Nutrition Hifeed BV focus on innovation, partnerships, and expansion into emerging economies to strengthen market positioning.

- Asia-Pacific leads with a 33% share, followed by North America (31%) and Europe (28%), while the essential oils segment dominates with 58% share due to its proven health and performance benefits.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Essential oils dominate the market with a 58% share in 2024, driven by their strong antimicrobial and antioxidant properties that improve livestock productivity and health. They are widely used as natural feed additives to replace antibiotic growth promoters. Products such as oregano, thyme, and cinnamon oils enhance digestion and reduce pathogen load, boosting animal performance. Plant extracts, holding the remaining 42%, are gaining ground due to their rich bioactive compounds, supporting immune function and stress resistance across poultry and swine farming.

- For instance, Cargill Incorporated offers Nutrena and Naturewise poultry feeds with essential oils that maintain gut health and strengthen the immune system.

By Form

The liquid form segment leads with a 62% market share in 2024, attributed to its superior bioavailability and ease of mixing in feed and water systems. Liquids allow precise dosage control, ensuring consistent nutrient absorption and enhanced animal performance. Their growing preference in large-scale poultry and dairy farms supports demand. The solid form, accounting for 38%, finds use in dry feed formulations, offering better storage stability and cost-effectiveness for small and medium livestock operations.

- For instance, Cargill, through its Diamond V brand, offers LiquiCare RTU, a ready-to-use liquid postbiotic product for dairy and beef cattle, which supports gut health and immune function to help manage stress.

By Function

Gut health applications hold the dominant 54% share in 2024, driven by the rising focus on improving feed efficiency and nutrient absorption without antibiotics. Essential oils and plant extracts such as garlic, ginger, and oregano support intestinal microflora balance and reduce harmful bacteria. The immunity segment captures 32% as producers adopt natural alternatives to enhance disease resistance. The yield improvement function holds 14%, supported by increasing demand for productivity optimization and meat quality enhancement in intensive livestock systems.

Key Growth Drivers

Rising Shift Toward Natural Feed Additives

Growing restrictions on antibiotic growth promoters have accelerated the adoption of natural feed alternatives. Essential oils and plant extracts enhance digestion, improve gut microbiota, and promote healthier livestock performance. Producers are integrating these bioactive compounds to maintain productivity while meeting consumer demand for residue-free meat and dairy. This shift is reinforced by stricter global feed regulations and expanding awareness of antimicrobial resistance, positioning plant-based additives as sustainable solutions across poultry, swine, and ruminant sectors.

- For instance, Evonik Industries AG launched PhytriCare IM, a plant-based feed premix rich in flavonoids, in 2023, which is accessible across the EU and supports improved livestock health through natural botanical extracts.

Expanding Livestock Production and Meat Consumption

Rising global meat and dairy demand directly boosts the need for efficient feed solutions. Essential oils and plant extracts help enhance feed conversion rates, animal health, and overall productivity, making them vital for modern farming operations. Rapid industrialization of livestock production, particularly in Asia-Pacific and Latin America, drives large-scale integration of these additives. Their multifunctional benefits in promoting growth, immunity, and feed palatability further strengthen adoption among feed manufacturers and livestock producers.

- For instance, Laboratoires Phodé’s Oleobiotec Poultry, a blend of standardized essential oils and spices, has demonstrated a 2.8% reduction in feed conversion ratio (FCR), supporting improved poultry feed efficiency worldwide.

Growing Focus on Animal Health and Welfare

Increasing awareness of animal welfare and disease prevention supports the use of essential oils and plant extracts. These additives offer natural solutions to minimize infection risks and oxidative stress while promoting better gut health. They act as immune enhancers, helping animals resist pathogens without relying on antibiotics. This aligns with the global shift toward preventive veterinary care and sustainable animal nutrition, encouraging investments in herbal and phytogenic feed formulations across the livestock industry.

Key Trends & Opportunities

Integration of Advanced Extraction Technologies

Innovations in extraction methods, such as supercritical CO₂ and cold-press techniques, improve the purity and efficacy of essential oils and plant extracts. These advancements enhance bioavailability and consistency, making formulations more potent and stable for feed use. Companies are investing in R&D to develop standardized blends targeting specific livestock functions like digestion or stress reduction. The adoption of green extraction technologies also supports sustainability goals, driving long-term opportunities in premium-grade phytogenic feed solutions.

- For instance, Nor-Feed France has implemented supercritical CO₂ extraction to produce citrus-based phytogenic feed additives, yielding higher purity and bioactive content while maintaining consistent batch quality.

Increasing Use of Customized Feed Blends

Manufacturers are shifting toward customized feed formulations that combine essential oils and plant extracts for targeted outcomes. These blends are tailored to species-specific needs, production cycles, and local environmental factors. For instance, poultry formulations may focus on gut modulation, while swine blends enhance immune response. The growing trend of precision livestock farming promotes such personalization, helping producers improve efficiency and profitability while ensuring compliance with evolving feed safety and environmental standards.

- For instance, Delacon offers phytogenic feed additives targeting swine health, with products that reduce stress-related weight loss by up to 20% while enhancing overall performance.

Key Challenges

High Production and Standardization Costs

The extraction and purification of essential oils and plant compounds require advanced technology, driving up production costs. Maintaining consistent quality and potency across batches is challenging due to variations in raw material sources and climatic conditions. This limits scalability for small manufacturers and raises prices for end-users. Furthermore, achieving uniform standards across global markets remains difficult, affecting regulatory approvals and large-scale commercialization of phytogenic feed additives.

Limited Awareness and Technical Knowledge Among Farmers

Despite proven benefits, adoption among small and medium-scale livestock farmers remains low due to limited awareness and technical expertise. Many producers lack guidance on proper dosage, combinations, and handling of essential oils and plant extracts. Inconsistent field results caused by improper application further deter usage. Expanding educational programs, training initiatives, and technical support is essential to bridge this gap and accelerate market penetration, especially in developing regions.

Regional Analysis

North America

North America held a 31% market share in 2024, driven by the rising demand for antibiotic-free livestock feed and high awareness of animal health. The U.S. leads the region, supported by advanced feed technologies and regulatory support for natural additives. Producers increasingly use essential oils and plant extracts to improve meat quality, digestion, and immunity in poultry and cattle. Strong investments in R&D by feed manufacturers and collaborations with veterinary institutes foster innovation. The growing preference for sustainable and residue-free animal products continues to reinforce market expansion across the region.

Europe

Europe accounted for a 28% market share in 2024, fueled by stringent EU regulations banning antibiotic growth promoters and promoting natural feed ingredients. Countries such as Germany, France, and the Netherlands dominate adoption due to strong livestock sectors and advanced production practices. The region emphasizes clean-label and sustainable animal nutrition, encouraging the integration of essential oils like oregano, thyme, and garlic. Rising consumer preference for organic meat and dairy products also strengthens demand. The European market benefits from strong policy support, innovation in phytogenic formulations, and rising awareness of animal welfare.

Asia-Pacific

Asia-Pacific emerged as the leading region with a 33% market share in 2024, supported by rapid growth in meat consumption and livestock farming in China, India, and Southeast Asia. Expanding middle-class populations and increasing protein demand boost the use of performance-enhancing feed additives. Governments promote feed quality improvements and sustainable agriculture practices, encouraging the shift toward plant-based formulations. Local producers and international players invest in cost-effective solutions to meet growing demand. The region’s dynamic livestock expansion and focus on productivity enhancement make it the fastest-growing market for essential oils and plant extracts.

Latin America

Latin America captured a 5% market share in 2024, with Brazil and Mexico leading due to strong poultry and beef production industries. The growing export of high-quality animal protein drives the adoption of natural feed solutions that enhance yield and product quality. Local feed producers are increasingly partnering with global suppliers to introduce plant-based additives. Supportive government initiatives for sustainable livestock farming further boost growth. The market benefits from rising demand for eco-friendly production systems, particularly in export-focused agribusinesses targeting North American and European buyers.

Middle East & Africa

The Middle East & Africa region held a 3% market share in 2024, showing gradual growth as livestock producers adopt herbal and essential oil-based feed additives. Rising awareness of animal health and the need to reduce antibiotic use support market expansion. Countries like South Africa, Saudi Arabia, and the UAE are investing in sustainable livestock systems to enhance productivity. Increasing import dependence on meat and dairy encourages producers to improve domestic yield. Growing partnerships between local feed companies and international ingredient suppliers are helping bridge technology and supply gaps across the region.

Market Segmentations:

By Product Type

- Essential Oil

- Plant Extract

By Form

By Function

- Gut Health

- Immunity

- Yield

By Livestock

- Cattle Feed

- Poultry Feed

- Swine Feed

- Aquatic Feed

By Applications

- Aromatherapy

- Phytotherapy

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Essential Oils and Plant Extracts for Livestock Market features key players such as Olmix S.A., Orffa, Herbavita, Panagro Health & Nutrition, Trouw Nutrition Hifeed BV, Indian Herbs Specialties Pvt. Ltd., Provitim, Phytosynthese, Manghebati, and Herbarom Laboratoire. These companies compete through innovation in product formulation, regional expansion, and strategic partnerships with feed manufacturers. Leading firms focus on developing standardized and species-specific blends that enhance gut health, immunity, and feed efficiency. R&D efforts center on improving extraction techniques and ensuring consistent bioactive concentration for better efficacy. Global players are expanding into Asia-Pacific and Latin America to leverage growing livestock production. Meanwhile, collaborations between local producers and multinational suppliers support cost-effective manufacturing and distribution. The market shows moderate concentration, with established firms dominating through brand reputation, regulatory compliance, and sustained investment in sustainable animal nutrition solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Olmix S.A.

- Orffa

- Herbavita

- Panagro Health & Nutrition

- Trouw Nutrition Hifeed BV

- Indian Herbs Specialties Pvt. Ltd.

- Provitim

- Phytosynthese

- Manghebati

- Herbarom Laboratoire

Recent Developments

- In October 2023, Evonik China Co., Ltd. entered a joint venture with Shandong Vland Biotech Co., Ltd. to strengthen their presence in global animal gut health solutions. Operating as Evonik Vland Biotech (Shandong) Co., Ltd., the new entity is headquartered in Binzhou, China, with Evonik holding a 55% majority stake.

- In May 2023, Alltech partnered with Agolin, a firm focused on plant-based animal nutrition technologies. The collaboration aims to advance eco-friendly feed solutions that improve cattle productivity while supporting long-term sustainability objectives.

- In February 2023, Evonik Industries AG launched its first plant-based feed premix, PhytriCare IM. This formulation, composed of flavonoid-rich plant extracts, became available across European Union markets. The company also began regulatory procedures to expand product approvals in additional international regions.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Function, Livestock, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural and antibiotic-free feed additives will continue to rise globally.

- Asia-Pacific will remain the fastest-growing region due to livestock expansion and protein demand.

- Technological advancements in extraction and encapsulation will enhance product stability and efficacy.

- Feed manufacturers will increase investment in customized, species-specific phytogenic formulations.

- Sustainability goals will drive the adoption of eco-friendly and renewable plant-based additives.

- Partnerships between global and local companies will strengthen distribution networks and product reach.

- Regulatory frameworks promoting antibiotic bans will further support market growth.

- Research on synergistic blends of essential oils and plant extracts will gain momentum.

- Growing consumer awareness of food safety and quality will support market penetration.

- Rising adoption of digital livestock management systems will optimize feed formulation efficiency.