Market Overview

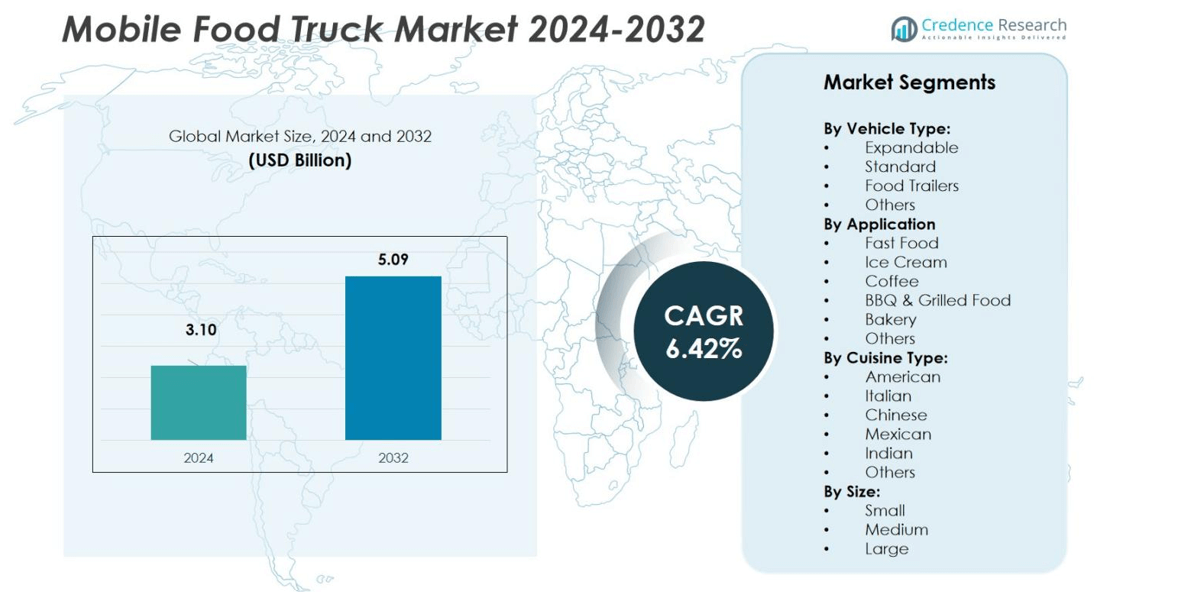

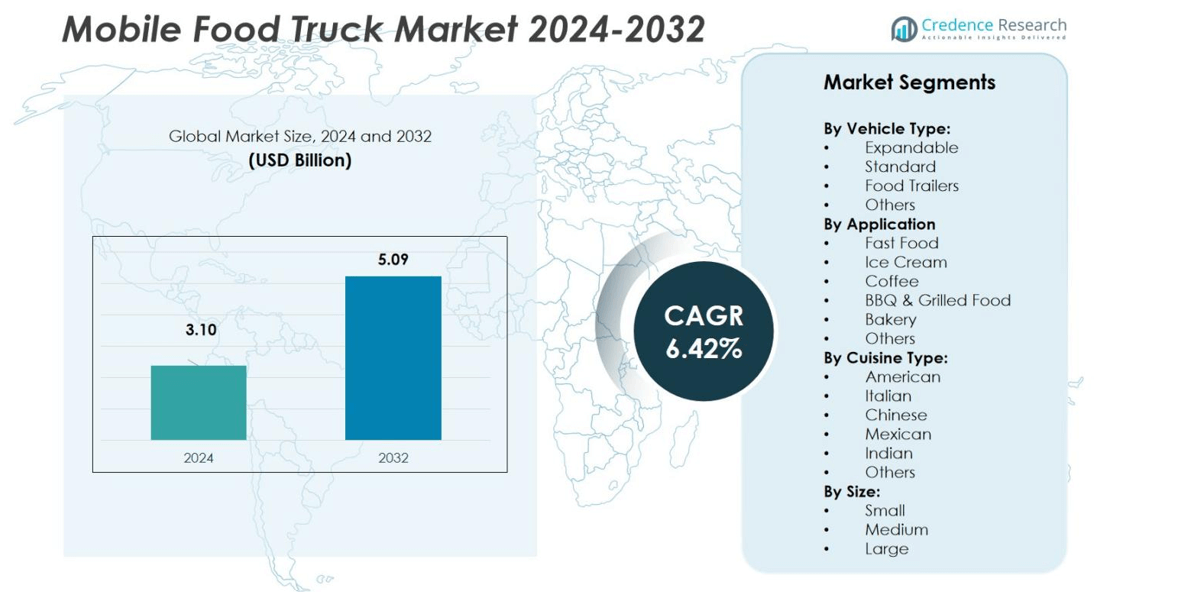

The Mobile Food Truck Market size was valued at USD 3.10 billion in 2024 and is anticipated to reach USD 5.09 billion by 2032, growing at a CAGR of 6.42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mobile Food Truck Market Size 2024 |

USD 3.10 billion |

| Mobile Food Truck Market, CAGR |

6.42% |

| Mobile Food Truck Market Size 2032 |

USD 5.09 billion |

The Mobile Food Truck Market is led by major players such as Starbucks Corporation, Airstream Inc., Cruising Kitchens LLC, Bella Manufacturing, Roaming Hunger LLC, Mallaghan Engineering Ltd., Custom Concessions Inc., Apex Specialty Vehicles, Baskin-Robbins, and AA Cater Truck Manufacturing Co. Inc. These companies focus on innovation, modular kitchen integration, and eco-friendly truck designs to enhance performance and customer appeal. Strategic collaborations and technology adoption, including GPS tracking and AI-driven ordering systems, are strengthening competitiveness. North America leads the global market with a 34% share in 2024, supported by a strong street food culture, high urban mobility, and well-established food service infrastructure.

Market Insights

- The Mobile Food Truck Market was valued at USD 3.10 billion in 2024 and is projected to reach USD 5.09 billion by 2032, expanding at a CAGR of 6.42%.

- Growing demand for convenient, affordable, and high-quality street dining options is driving market growth.

- Sustainability, electric-powered trucks, and digital ordering systems are shaping new market trends and customer engagement.

- The market is moderately fragmented, with key players like Starbucks Corporation, Airstream Inc., Cruising Kitchens LLC, and Bella Manufacturing focusing on design innovation and collaborations.

- North America leads with a 34% share, followed by Asia Pacific at 29%, while the fast food application segment dominates with 42% of the total market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle Type:

Expandable food trucks dominate the mobile food truck market, accounting for 38% of the total share in 2024. Their large space, flexibility, and ability to accommodate multiple kitchen setups make them highly preferred among established food brands and event caterers. Standard trucks hold a significant portion due to their cost-effectiveness and ease of mobility, ideal for small entrepreneurs. Food trailers are also gaining traction with low investment needs and easy customization. Rising demand for versatile and fully equipped mobile kitchens continues to drive the growth of expandable food trucks globally.

- For instance, VTI Studios’ multi-concept modular trucks feature interchangeable kitchen components that enable food truck owners to switch menus within hours, catering to changing customer demands and trends.

By Application:

The fast food segment leads the market with 42% share in 2024, driven by the increasing popularity of quick-service meals and affordable street dining. Mobile trucks serving burgers, sandwiches, and fries are expanding across urban and suburban areas. The coffee segment is growing steadily, supported by the rise of specialty and artisanal beverages. Ice cream and bakery trucks attract family-oriented customers, especially at seasonal events. The convenience of mobile operations and increasing food delivery integration fuel the dominance of fast food applications.

- For instance, Toyota Australia launched the FCV Diner, a hydrogen-powered food truck equipped with a mobile kitchen, demonstrating innovation in eco-friendly food delivery.

By Cuisine Type:

The American cuisine segment dominates the market with 46% share in 2024, attributed to the widespread demand for burgers, fried foods, and comfort snacks. These trucks are easily adaptable to various locations and attract diverse age groups. Mexican and Italian cuisines are also growing quickly, offering fusion and gourmet options that cater to changing consumer tastes. Indian and Chinese cuisines are gaining popularity due to their unique flavors and portable serving styles. The rising global appetite for multicultural food experiences supports the strong presence of American cuisine trucks.

Key Growth Drivers

Rising Demand for Convenient and Affordable Dining

The growing urban workforce and busy lifestyles are driving demand for quick, affordable, and accessible dining options. Mobile food trucks offer restaurant-quality meals at lower prices, attracting both working professionals and students. Their ability to operate in multiple locations and serve diverse cuisines enhances accessibility. Cities worldwide are promoting street food zones, further supporting expansion. This convenience-based appeal positions food trucks as a strong alternative to traditional eateries, fueling consistent growth in the mobile food truck market.

- For instance, Kona Ice LLC has gained prominence by offering shaved ice desserts through colorful trucks, using mobile ordering and contactless payment to serve busy customers rapidly.

Expansion of Street Food Culture and Events

The increasing popularity of food festivals, outdoor events, and pop-up experiences is accelerating mobile food truck demand. These trucks provide flexible, low-cost entry for new entrepreneurs and established brands seeking local engagement. They also serve as promotional tools for restaurants to test new menus. Event organizers favor mobile setups due to their mobility and low infrastructure needs. The growing global street food culture, especially in North America and Asia, continues to strengthen the adoption of mobile food trucks.

- For instance, Billi’s, a food truck fleet in Arezzo, Italy, sold over 250,000 sandwiches and served more than 300,000 customers in a year across 150 events like the Lucca Summer Festival and National Formula 1 Grand Prix, significantly boosting their restaurant brand revenue.

Technological Integration and Modern Vehicle Designs

Advancements in kitchen technology, GPS tracking, and digital payment systems have transformed food truck operations. Modern vehicles feature energy-efficient appliances, smart cooking equipment, and solar power options, reducing operational costs. GPS-enabled mobility allows better route planning and customer targeting. Online ordering and social media marketing further enhance visibility and brand loyalty. These innovations streamline business management and improve profitability, encouraging more entrepreneurs and food brands to invest in advanced mobile food truck models.

Key Trends and Opportunities

Sustainability and Eco-Friendly Truck Designs

The growing emphasis on environmental sustainability is shaping innovation in the mobile food truck market. Many operators are shifting toward electric or hybrid-powered vehicles to reduce emissions. Eco-friendly packaging and locally sourced ingredients enhance green branding and attract conscious consumers. Manufacturers are designing lightweight trucks with low fuel consumption and recyclable materials. These sustainable approaches not only improve environmental performance but also offer cost savings over time, presenting a strong opportunity for long-term business growth.

- For instance, HungryWheels, a Delhi-based manufacturer, offers zero-emission food trucks designed specifically to reduce environmental footprint without compromising performance.

Expansion into Corporate and Institutional Catering

Food trucks are increasingly partnering with corporate parks, schools, and healthcare facilities to offer on-site catering. This expansion beyond street operations provides consistent revenue and higher brand exposure. Flexible scheduling allows trucks to serve breakfast, lunch, and event-based needs in one day. The growing demand for diverse, fresh, and affordable meals in institutional settings offers a major growth opportunity. Such collaborations help food truck operators build stable business models and expand their presence across multiple service verticals.

- The Salty Donut partnered with Aramark at University of Central Florida beginning with monthly food-truck visits and then shifting to bi-weekly service in response to student demand.

Key Challenges

Regulatory Barriers and Licensing Issues

Varying regional regulations, complex licensing procedures, and health compliance standards pose challenges for food truck operators. Cities often enforce strict zoning laws and limited permits, restricting operation areas and hours. Compliance with food safety, waste disposal, and fire safety requirements adds to operational delays. Smaller vendors face difficulties navigating these bureaucratic processes, slowing market entry. Streamlined policies and uniform regulations are essential to support sustainable growth and ensure fair competition within the mobile food truck industry.

Rising Competition and Profit Margin Pressure

The growing number of food trucks and low entry barriers have intensified market competition. Operators face shrinking profit margins due to rising ingredient costs, fluctuating fuel prices, and seasonal demand variations. Established brands and franchised trucks dominate prime locations, limiting opportunities for smaller vendors. Customer loyalty also remains low, as consumers constantly seek new dining experiences. To overcome this challenge, businesses are focusing on menu differentiation, technology adoption, and strategic collaborations to maintain profitability and market presence.

Regional Analysis

North America

North America leads the global mobile food truck market with a 34% share in 2024, driven by a strong street food culture and high consumer spending on convenient dining. The United States dominates due to the growing number of gourmet and themed food trucks operating in urban centers such as Los Angeles, New York, and Chicago. Canada is witnessing similar expansion, supported by flexible regulations and mobile business incentives. Increasing participation in food festivals, university campuses, and corporate catering continues to sustain steady market growth across the region.

Europe

Europe holds a 27% share in the global market, supported by the rising popularity of food truck festivals and demand for premium street food. The U.K., Germany, and France are major contributors, driven by the adoption of innovative cuisines and growing tourism activity. European consumers prefer mobile trucks offering sustainable packaging and locally sourced ingredients. Government initiatives promoting small-scale entrepreneurship further encourage market expansion. The integration of technology in ordering and cashless payments enhances customer experience, solidifying Europe’s position as a growing hub for modern food truck operations.

Asia Pacific

Asia Pacific accounts for a 29% market share in 2024, with strong growth in countries such as China, India, Japan, and South Korea. The expanding middle-class population, rising urbanization, and increasing outdoor dining trends are fueling demand. Food trucks in this region cater to diverse cuisines and are often found near business districts, tourist attractions, and educational campuses. Supportive government policies promoting small enterprises in India and Japan encourage new entrants. The popularity of fusion food and mobile cafés also drives innovation, making Asia Pacific one of the fastest-growing regional markets.

Latin America

Latin America represents an 8% share of the market in 2024, driven by growing demand for affordable and quick dining options. Brazil and Mexico are key markets, where food trucks serve local cuisines such as tacos, empanadas, and grilled meats. Urbanization and tourism expansion have contributed to the increasing visibility of mobile food vendors. Despite limited access to financing and regulatory barriers in some regions, partnerships with event organizers and hospitality operators are strengthening. The focus on mobile entrepreneurship and digital food delivery integration further enhances the market outlook in this region.

Middle East & Africa

The Middle East & Africa hold a 6% market share in 2024, showing steady growth fueled by tourism, leisure events, and rising youth interest in street food culture. The UAE and Saudi Arabia are key contributors, with strong support from hospitality-driven developments and festivals. Mobile food trucks are gaining traction in city centers, beaches, and entertainment zones. Local operators are adopting premium designs and gourmet menus to attract high-income consumers. Increasing investment in tourism and food festivals, coupled with relaxed licensing frameworks, is likely to drive further expansion across the region.

Market Segmentations:

By Vehicle Type:

- Expandable

- Standard

- Food Trailers

- Others

By Application

- Fast Food

- Ice Cream

- Coffee

- BBQ & Grilled Food

- Bakery

- Others

By Cuisine Type:

- American

- Italian

- Chinese

- Mexican

- Indian

- Others

By Size:

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Mobile Food Truck Market features key players such as Starbucks Corporation, Airstream Inc., Mallaghan Engineering Ltd., Custom Concessions Inc., Roaming Hunger LLC, Baskin-Robbins, AA Cater Truck Manufacturing Co. Inc., Cruising Kitchens LLC, Bella Manufacturing, and Apex Specialty Vehicles. The market remains moderately fragmented, with a mix of global brands, specialized vehicle manufacturers, and regional food service operators. Companies focus on innovation in truck design, modular kitchens, and sustainability features to enhance performance and mobility. Strategic collaborations between food brands and truck fabricators are increasing to deliver customized and energy-efficient mobile kitchens. Premium food chains and franchises are expanding their reach through branded food trucks, improving brand engagement and accessibility. Digital ordering systems, GPS integration, and social media-based promotions have become essential competitive tools. Ongoing technological upgrades and regional expansion strategies continue to shape the competitive dynamics of this fast-evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bella Manufacturing

- Airstream Inc.

- Cruising Kitchens LLC

- Starbucks Corporation

- Roaming Hunger LLC

- Mallaghan Engineering, Ltd.

- Custom Concessions Inc.

- Apex Specialty Vehicles

- Baskin-Robbins

- AA Cater Truck Manufacturing Co Inc

Recent Developments

- In October 2025, Goode Bird, part of Goode Company, reintroduced its operations through a mobile food truck format in Houston. The brand now rotates among Goode Company restaurant sites, offering flexible dining services and expanding reach within the city.

- In May 2025, Eggrollin’, a collaboration between Sari-Sari and Stuffed Burritos, launched its new fusion food truck in San Antonio. The truck specializes in innovative egg-roll recipes and caters to late-night and event-based crowds.

- In April 2023, Toyota Australia introduced its FCV Express Diner hydrogen fuel cell-powered food truck. The initiative highlights the company’s push toward sustainable mobility and low-emission commercial applications in the mobile food industry.

- In 2023, Roaming Hunger LLC entered a strategic partnership with Shore Capital Partners LLC to expand operational support for food truck and mobile vendor businesses. The collaboration focuses on creating an integrated platform that enhances logistics, catering coordination, and vendor management efficiency

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Application, Cusine Type, Size and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The mobile food truck market will experience steady growth driven by urban lifestyle changes.

- Expansion of street food festivals and local events will boost truck-based dining demand.

- Technological upgrades like GPS tracking and digital ordering will enhance operational efficiency.

- Electric and hybrid food trucks will gain popularity due to sustainability goals.

- Franchise-based food truck chains will expand across developed and emerging markets.

- Rising consumer interest in diverse and ethnic cuisines will fuel menu innovation.

- Integration with online food delivery platforms will improve accessibility and visibility.

- Custom-built modular kitchen designs will attract small entrepreneurs and large brands alike.

- Government support for mobile entrepreneurship will encourage new entrants in developing regions.

- Increased competition will drive companies to focus on quality, hygiene, and customer experience.