Market Overview

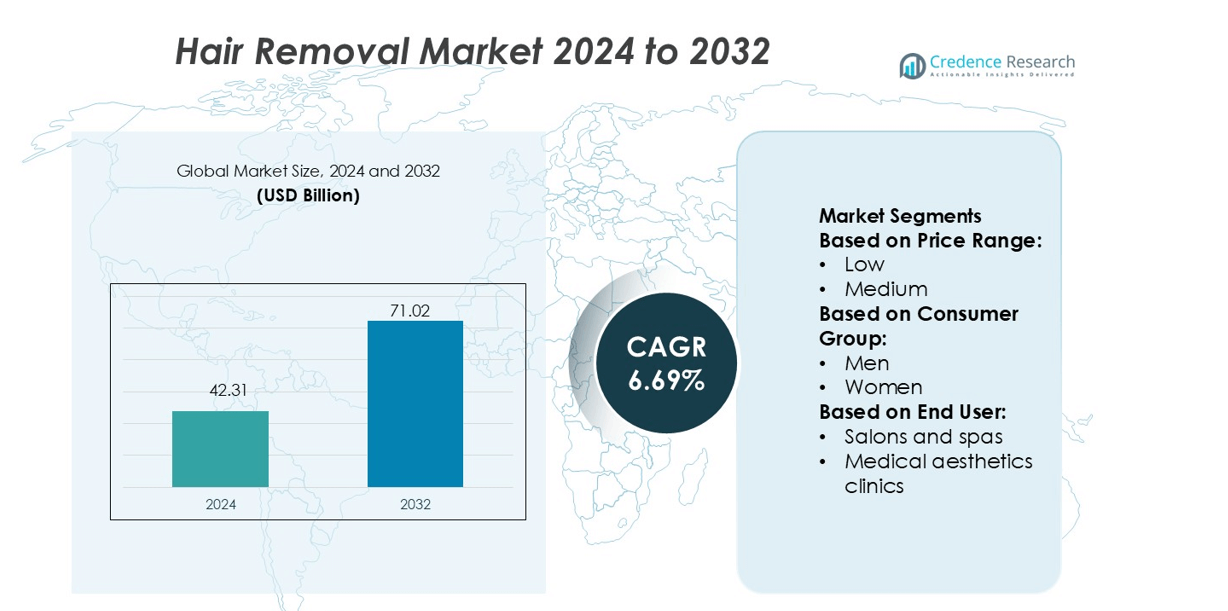

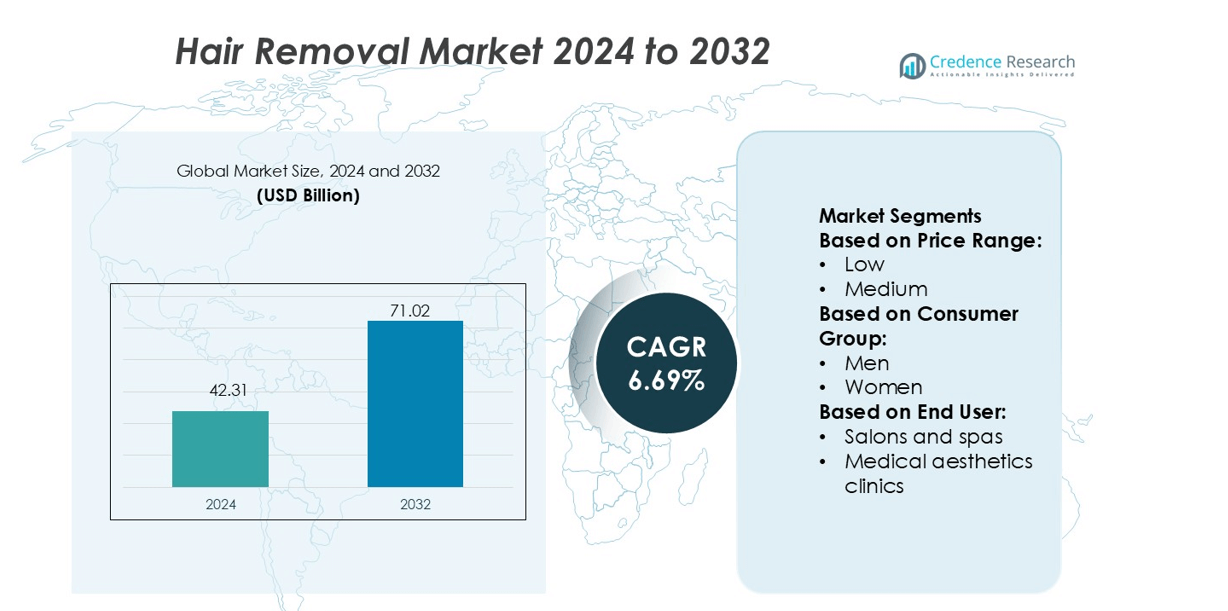

Hair Removal Market size was valued USD 42.31 billion in 2024 and is anticipated to reach USD 71.02 billion by 2032, at a CAGR of 6.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hair Removal Market Size 2024 |

USD 42.31 billion |

| Hair Removal Market, CAGR |

6.69% |

| Hair Removal Market Size 2032 |

USD 71.02 billion |

The hair removal market features strong competition with global and regional brands offering creams, razors, wax strips, and laser devices. Key players focus on dermatology-tested formulas, sensitive-skin products, and advanced home-use technologies to attract a broad consumer base across salons and household users. Product diversification, sustainable packaging, and online promotion strengthen their brand presence. North America leads the global market with 33% share, supported by high spending on personal grooming, strong adoption of at-home IPL devices, and a well-established network of dermatology clinics and med-spas. Growing demand for painless procedures and male grooming continues to reinforce the region’s leadership.

Market Insights

- Hair Removal Market size was valued USD 42.31 billion in 2024 and is anticipated to reach USD 71.02 billion by 2032, at a CAGR of 6.69% during the forecast period.

- Demand rises due to personal grooming awareness, sensitive-skin formulations, and pain-free laser solutions across professional centers and home-use devices.

- North America leads with 33% share, driven by high spending on IPL devices and strong dermatology clinic networks, while Asia Pacific grows fastest as young consumers adopt salon and at-home products.

- Creams and wax strips dominate volume sales, while laser and IPL devices expand share due to long-term benefits and premium pricing.

- Competition intensifies as brands offer vegan formulas, sustainable packaging, and online subscription kits, while restraints include treatment costs and skin-sensitivity risks in some consumer groups.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Price Range

The medium price range segment holds the largest share due to strong demand for durable and feature-rich devices. Consumers prefer mid-range epilators, trimmers, and laser tools that offer balance between cost and performance. Wider online availability, attractive discounts, and brand-backed warranties also support sales. Rising interest in at-home semi-professional grooming encourages users to upgrade from basic low-priced tools. The low-cost category serves entry-level buyers, while premium devices gain traction among tech-driven users seeking pain-reduction features and long treatment life.

- For instance, Helios Lifestyle Private Limited supplies grooming tools under the Bombay Shaving Company brand that use stainless-steel blades engineered with 0.1 mm edge precision and 600 mAh rechargeable batteries supporting 80 minutes of continuous trimming.

By Consumer Group

Women remain the dominant consumer group with the highest market share, supported by consistent grooming habits and broader product awareness. Women-focused offerings, including facial epilators, body trimmers, and laser kits, expand retail demand across both online and offline channels. Marketing campaigns, beauty influencers, and rising adoption of long-term hair reduction solutions fuel repeat purchases. Men’s grooming grows steadily as beard-shaping tools, body groomers, and painless hair removal products gain popularity, but the category still trails women in total revenue contribution.

- For instance, P&G’s Braun “Skin i·expert IPL” system reads the user’s skin tone 80 times per second using SensoAdapt™ sensors and emits up to 6 J/cm² of energy per flash for full-body treatments under ten minutes.

By End User

Personal use leads the segment due to strong adoption of at-home grooming devices across urban and semi-urban areas. Compact trimmers, epilators, and DIY laser kits offer privacy, lower long-term cost, and quick results, driving higher household penetration. Salons and spas follow with steady demand for waxing tools and semi-professional laser systems, while medical aesthetics clinics focus on advanced laser hair reduction with longer-lasting outcomes. Professional users in beauty clinics expand service offerings, but home-based usage continues to account for the largest share.

Key Growth Drivers

Rising Focus on Personal Grooming and Hygiene

Personal grooming has become a key lifestyle habit for men and women. Social media, beauty trends, and fashion standards push demand for smooth and clean skin. Young consumers also prefer quick and painless options for regular grooming. More people buy razors, creams, and trimmers for home use. Brands use digital marketing and celebrity endorsements to build trust. This shift boosts sales of low-cost and beginner-friendly products. As grooming becomes part of daily routines, the market gains strong and steady growth across urban and semi-urban areas.

- For instance, Sally Hansen’s “Complete Salon Manicure” formula incorporates a keratin complex that delivers up to 64 % stronger nails and up to 10 days of chip-resistant wear.

Growing Use of Laser and IPL Technologies in Clinics

Laser and IPL treatments gain demand due to long-lasting results. Clinics offer fast procedures with reduced regrowth and smoother skin. Advanced devices work on different skin tones and hair types with safer cooling systems. Dermatologists recommend these methods to reduce cuts, burns, and skin irritation. Lower session time supports working professionals and frequent travelers. Subscription packages and EMI plans also attract more users. As technology becomes affordable, clinics and medical centers install new machines, driving strong growth in professional hair removal services.

- For instance, Emjoi’s “eRase e6” epilator removes hairs as short as 0.3 mm and uses tweezers that open and close 180 times per second.

Expanding Online Retail and Product Innovation

E-commerce boosts sales with wide product choices, discounts, and doorstep delivery. Users compare brands, read reviews, and buy grooming kits, trimmers, and waxing tools. Companies add skin-friendly formulas, hypoallergenic creams, and long-lasting blades. New electric shavers with charge indicators and waterproof designs increase customer comfort. Subscription models for razor refills and grooming packs support repeat purchases. Online influencers teach safe methods and promote trending tools. These factors increase awareness and make the buying process easy, helping the market grow across many regions.

Key Trends & Opportunities

High Demand for Organic and Chemical-Free Products

Consumers prefer natural and skin-safe products. Traditional hair removal creams may cause rashes and dryness. To solve this, brands add herbal oils, aloe vera, and plant extracts. These products suit users with sensitive skin, teenagers, and first-time buyers. Clean-label and cruelty-free claims build strong trust. Growing vegan beauty trends push new product development. Retailers promote natural waxing strips and sugar-based wax kits. As awareness rises, organic products become a strong opportunity for new and premium brands in the market.

- For instance, Nair™ Hair Remover Cream with Aloe & Lanolin (Material No. 42016528) from Church & Dwight uses Potassium Thioglycolate as a depilating agent plus Aloe barbadensis leaf juice as a botanical skin-conditioning component.

Growth of At-Home DIY Hair Removal Solutions

Busy lifestyles increase demand for fast and easy home solutions. Users avoid salon visits due to cost, time, or privacy concerns. Electric trimmers, ready-to-use wax strips, and washable razors offer painless and quick grooming. Smart epilators include rechargeable batteries, low noise motors, and wet-dry use. Online tutorials help beginners learn safe steps. Seasonal grooming during festivals, weddings, and vacations boosts sales across regions. Brands that offer compact, travel-friendly, and skin-softening products gain a strong advantage.

- For instance, the Philips Bodygroom 7000 (BG7030/49) offers 80 minutes of cordless use from a 1-hour charge, supports 5 trim-length settings (3 mm to 11 mm), and uses a 4-direction pivoting head with hypo-allergenic foil for skin comfort.

Rising Male Grooming and Targeted Marketing

Men now show rising interest in body grooming. Sales of trimmers, razors, and hair removal creams increase across metros and smaller cities. Brands launch male-focused products with strong fragrances and fast-action formulas. Advertising on sports platforms and social media attracts young buyers. Gyms, fitness clubs, and salons promote chest and back hair removal for a cleaner look. As male grooming grows, companies gain a large new customer base, opening fresh opportunities in online and offline channels.

Key Challenges

Risk of Skin Allergies and Side Effects

Some people face rashes, redness, bumps, and dryness after hair removal. Creams and wax may harm sensitive skin due to strong chemicals. Razors may cause cuts or infections if used without care. Laser and IPL sessions may burn the skin when handled by untrained staff. Negative experiences reduce customer trust and slow repeat purchases. Brands must improve patch-test advice, skin-safe formulas, and dermatologist-tested labels. Safety training in salons and clinics is also important to reduce customer complaints.

High Cost of Professional and Laser Treatments

Laser and IPL treatments need advanced machines and trained staff. This increases service prices in clinics and salons. Many customers cannot afford full treatment cycles, which require multiple sessions. High cost reduces demand in small towns and price-sensitive markets. Cheaper options like razors and creams limit the growth of premium services. To overcome this, clinics offer EMI plans and seasonal discounts. Still, cost remains a strong barrier for many users, slowing wider adoption of advanced technologies.

Regional Analysis

North America

North America leads the hair removal market with 33% share, driven by strong consumer spending on personal grooming and fast adoption of advanced hair reduction technologies. Laser hair removal clinics, dermatology centers, and med-spas see steady demand due to high awareness of permanent and semi-permanent solutions. The U.S. holds the largest contribution, supported by early product launches, FDA-cleared devices, and strong adoption of at-home IPL systems. A growing male grooming segment also supports market growth, as men opt for services for back, chest, and beard shaping. High disposable income levels and marketing by aesthetic brands strengthen market momentum.

Europe

Europe accounts for 28% share, led by high preference for professional salon services and dermatology-based aesthetic treatments. Consumers in Germany, France, Italy, and the U.K. spend heavily on laser, waxing, and depilatory products backed by strict safety standards and premium skincare trends. The demand for pain-free laser systems, cold wax strips, and organic depilatory creams remains high. European salons focus on sustainable, vegan, and fragrance-free formulations, supporting product innovation. The growing working-class population and rising emphasis on personal hygiene boost recurring spending. Male grooming and full-body treatment packages in medical aesthetic clinics also drive consistent revenue across key countries.

Asia Pacific

Asia Pacific holds 26% share, representing the fastest-growing region due to expanding urban lifestyles, rising disposable income, and beauty awareness across India, China, Japan, and South Korea. Affordable salon chains and home-use laser devices attract young consumers seeking long-term solutions. International beauty brands introduce localized formulas for sensitive skin and humid climates, boosting product demand. South Korea and Japan lead in premium at-home devices, while India and China drive high volume sales in depilatory creams and wax products. Social media promotions, influencer marketing, and growing acceptance of male grooming further enhance market growth and regional product adoption.

Latin America

Latin America captures 8% share, supported by rising consumer interest in grooming and the expansion of affordable salon services in Brazil, Mexico, Argentina, and Chile. Waxing and depilatory creams dominate due to low cost and wide availability. Brazil remains the largest market as consumers opt for both salon-based and home-use waxing systems. International device manufacturers partner with local distributors to expand IPL and diode laser offerings. The influence of beauty culture and seasonal demand around summer events increases spending. However, price sensitivity keeps low-cost products in demand, while premium laser clinics gain gradual attention among urban consumers.

Middle East & Africa

The Middle East & Africa region accounts for 5% share, supported by strong demand for long-term hair reduction due to cultural grooming preferences and high salon presence in UAE, Saudi Arabia, and South Africa. Dermatology clinics and medical aesthetic centers experience consistent demand for laser-based treatments, especially diode and Alexandrite systems that suit diverse skin types common in the region. Premium waxing services and sugar wax products attract local consumers. Expanding female workforce participation and rising tourism in the UAE increase spending on beauty and spa services. However, limited affordability in parts of Africa slows market penetration of advanced devices.

Market Segmentations:

By Price Range:

By Consumer Group:

By End User:

- Salons and spas

- Medical aesthetics clinics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the hair removal market includes Helios Lifestyle Private Limited, Procter & Gamble, SI&D (Aust) Pty Ltd, Sally Hansen, Vijohnkart.com, Revitol, Emjoi, Inc., Church & Dwight Co., Inc., Philips Personal Care B.V., and Reckitt Bencheriser Group PLC. The hair removal market is defined by rapid product innovation, strong branding, and wide retail penetration. Global and regional manufacturers focus on dermatology-tested creams, precision razors, waxing systems, and home-use laser devices that cater to sensitive skin and long-term grooming needs. Many brands expand their portfolio with vegan, fragrance-free, and chemical-safe formulations to meet rising customer preference for clean beauty. Companies also strengthen omnichannel strategies by partnering with supermarkets, pharmacies, e-commerce platforms, and salon chains for greater accessibility. Marketing campaigns driven by social media influencers and celebrity endorsements help attract younger consumers. Increasing demand for men’s grooming ranges further intensifies competition, while tech-focused firms invest in advanced IPL and diode laser devices for professional and household use.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Helios Lifestyle Private Limited

- Procter & Gamble

- SI&D (Aust) Pty Ltd

- Sally Hansen

- com

- Revitol

- Emjoi, Inc.

- Church & Dwight Co., Inc.

- Philips Personal Care B.V.

- Reckitt Bencheriser Group PLC

Recent Developments

- In February 2025, HairOriginals secured in a Series A funding round to scale its operations and enhance its presence in international markets. The funding is aimed at expanding the brand’s global footprint and strengthening its supply chain and technology capabilities.

- In October 2024, CurrentBody finalized the acquisition of Tria Beauty. Tria was an extremely early innovator in at-home laser technology and went on to create an excellent at-home skin rejuvenating laser. CurrentBody has disrupted skincare routines through cutting-edge beauty technology.

- In May 2024, Reveal Lasers launched Nirvana, a laser hair removal tool featuring an 810nm diode laser and designed for enhanced efficacy, comfort, and efficiency.

- In February 2023, Philips India launched BRR454 Facial Hair Remover in India aiming to cater to multitasking women by providing such innovative devices. In this product, the company has focused on gentle hair removal experience with the technology of a 360-degree hypoallergenic head

Report Coverage

The research report offers an in-depth analysis based on Price Range, Consumer Group, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for permanent and semi-permanent solutions will increase as consumers shift from traditional hair removal methods.

- Home-use laser and IPL devices will gain higher adoption due to convenience and long-term cost savings.

- Male grooming will expand further, driven by beard shaping and full-body treatment trends.

- Dermatology-tested and sensitive-skin formulations will rise in demand across creams and waxing products.

- Salons and aesthetic clinics will invest in advanced diode and Alexandrite laser systems for faster procedures.

- Vegan, cruelty-free, and chemical-free hair removal products will attract eco-conscious users.

- E-commerce platforms will continue to drive product accessibility and personalized purchase experience.

- Subscription-based grooming kits and refillable product lines will expand recurring revenue models.

- Influencer-led marketing and social media awareness will boost adoption among young consumers.

- Emerging markets will witness strong growth as beauty awareness and disposable income rise.