Market Overview

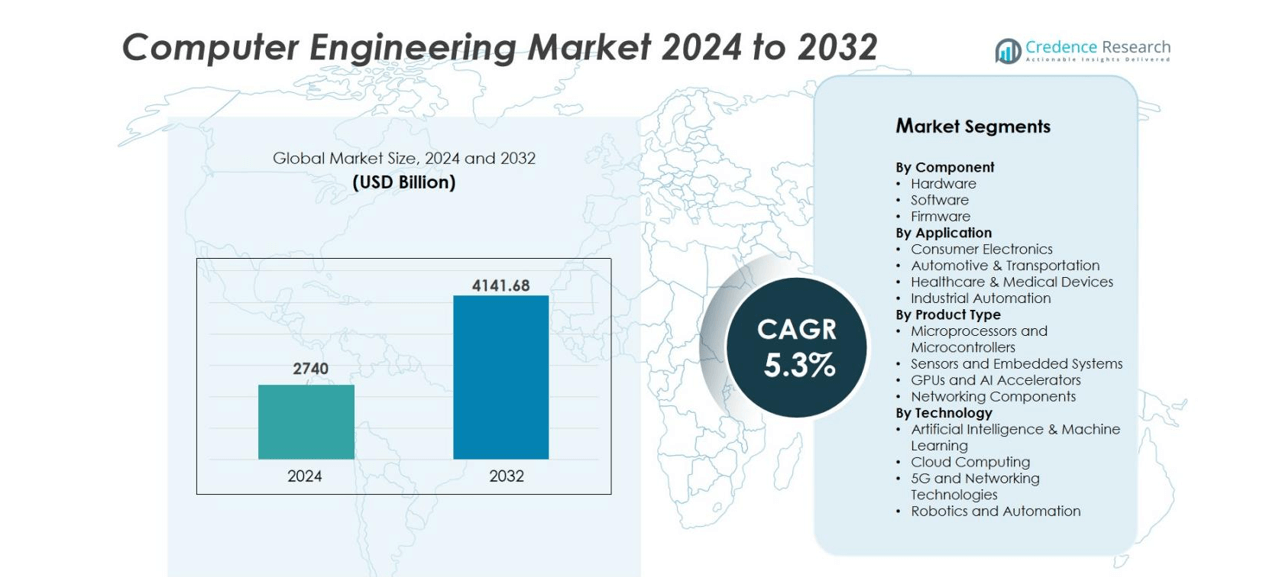

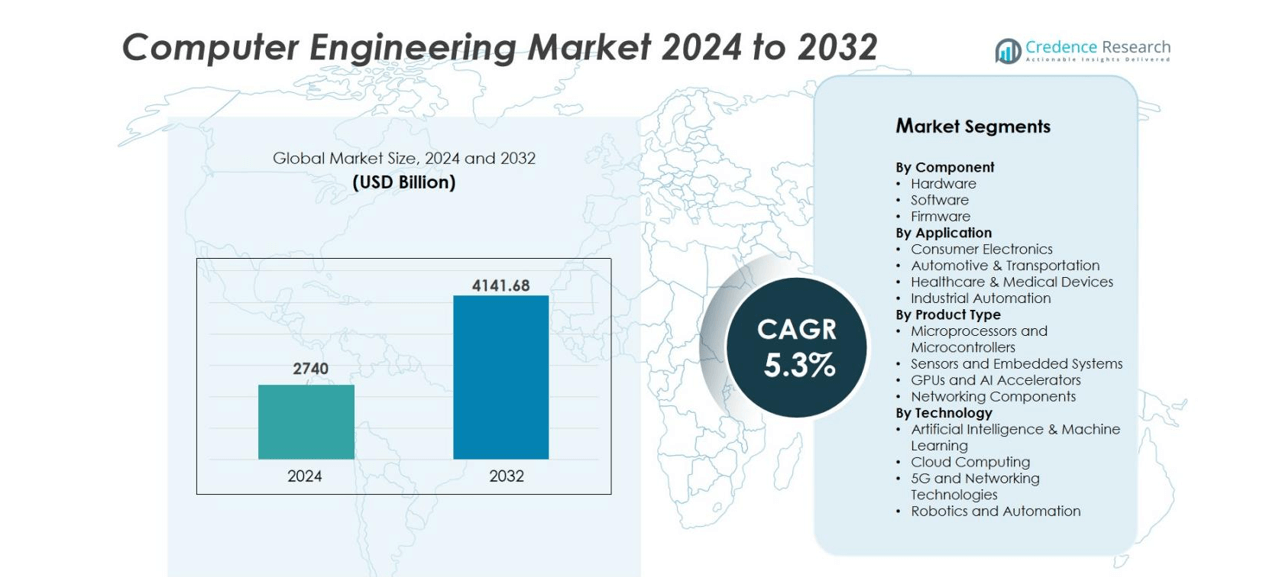

Computer Engineering market size was valued USD 2740 Billion in 2024 and is anticipated to reach USD 4141.68 Billion by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Computer Engineering Market Size 2024 |

USD 2740 Billion |

| Computer Engineering Market, CAGR |

5.3% |

| Computer Engineering Market Size 2032 |

USD 4141.68 Billion |

The Computer Engineering market includes major players such as Intel Corporation, Nvidia Corporation, STMicroelectronics N.V., Synopsys, Inc., National Instruments Corporation, Lattice Semiconductor Corporation, Teradyne, Inc., Xilinx, Inc., Averna Technologies, Inc., and SolidCAM Ltd. These companies focus on advanced chipsets, AI accelerators, embedded systems, and automation tools that support data centers, consumer electronics, and industrial applications. North America leads the global market with 35% share, driven by strong semiconductor production, cloud infrastructure, and R&D investment. Asia-Pacific follows with 30% share, supported by large chip fabrication capacity and high consumer electronics demand, while Europe holds nearly 25%, driven by automotive electronics and Industry 4.0 adoption.

Market Insights

- The Computer Engineering market was valued at USD 2740 Billion in 2024 and is forecast to reach USD 4141.68 Billion by 2032, growing at a CAGR of 5.3%.

- Rising demand for AI processors, microcontrollers, and embedded systems in consumer electronics and industrial automation drives steady growth, with hardware holding the largest segment share of 52%.

- Advanced trends include AI accelerators, custom semiconductor designs, edge computing, and 5G-enabled devices, supported by expanding data centers and smart manufacturing.

- The market remains competitive with Intel, Nvidia, STMicroelectronics, Synopsys, and Xilinx leading innovation in processors, GPUs, and design automation, while partnerships boost product development and technology integration.

- North America leads with 35% share due to strong semiconductor infrastructure, followed by Asia-Pacific with 30% supported by large chip fabrication capacity, and Europe with 25% driven by automotive electronics and Industry 4.0.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

Hardware holds the dominant share in the Computer Engineering market with 52% share. Growth comes from demand for high-performance chips, storage devices, and networking hardware used in data centers, smart devices, and industrial systems. Companies launch advanced processors and edge servers to support AI, 5G, and cloud workloads. Software expands due to automation tools, simulation platforms, and system design frameworks used by enterprises and developers. Firmware remains smaller but essential for device control, security, and power management. Rising adoption of embedded systems and automation keeps hardware ahead during the forecast period.

- For instance, HPE introduced the ProLiant Compute DL380a Gen12 servers featuring NVIDIA RTX PRO 6000 GPUs, delivering three times better price-to-performance for enterprise AI workloads.

By Application

Consumer electronics leads with around 34% market share because smartphones, wearables, gaming consoles, and smart home devices require continuous upgrades in processors and embedded solutions. Automotive and transportation follow due to increased use of sensors, AI chips, and connectivity units in autonomous and electric vehicles. Healthcare devices adopt embedded systems for diagnostics, vital monitoring, and imaging. Industrial automation grows fast with robotics, PLC systems, and machine-vision tools improving plant efficiency. The strong replacement cycle and high shipment volume keep consumer electronics in the leading position.

- For instance, embedded software in medical imaging equipment such as portable ultrasound machines and blood analyzers improves diagnostic accuracy and speed.

By Product Type

Microprocessors and microcontrollers account for the largest share, holding nearly 40% of the product type segment. These chips power consumer electronics, automotive control units, industrial robots, and medical equipment. GPUs and AI accelerators gain momentum as enterprises deploy AI for analytics, autonomous navigation, and high-speed computing. Sensors and embedded systems expand across IoT devices, smart factories, and real-time monitoring platforms. Networking components also see steady demand due to 5G rollout, data center expansion, and cloud communication. The wide usage of microprocessors in every electronic system keeps this segment dominant.

Key Growth Drivers

Rising Adoption of AI, IoT and Edge Computing

The Computer Engineering market expands rapidly due to large-scale deployment of AI, IoT, and edge computing devices across commercial and industrial sectors. Enterprises integrate smart sensors, microcontrollers, and embedded processors to automate workflows and enable real-time decision-making. AI chips improve speech processing, image analytics, and predictive maintenance in industries such as automotive, healthcare, and manufacturing. Edge computing reduces latency by processing data close to the user, which increases demand for compact processors, networking boards, and firmware-controlled devices. Consumer electronics such as smartphones, smart TVs, wearables, and home automation systems also adopt AI and IoT, pushing semiconductor and hardware suppliers to scale production.

- For instance, ZF’s TempAI platform uses AI to enhance propulsion systems in automotive electric vehicles, boosting efficiency and predictive maintenance capabilities.

Expansion of Data Centers and Cloud Infrastructure

Rising digital transformation and cloud adoption generate significant demand for high-performance servers, advanced processors, GPUs, and networking components. Hyperscale data centers require powerful compute units to manage large datasets, real-time analytics, and secure storage transfers. Cloud service providers upgrade storage, virtualization software, and network accelerators to support 5G, remote work, and enterprise automation. This creates strong demand for firmware, hardware-integrated security, and energy-efficient processors. AI and machine learning workloads further fuel adoption of high-bandwidth memory, parallel processing, and GPU clusters.

- For instance, Microsoft expanded Azure Local’s cloud infrastructure to support hundreds of servers with enhanced SAN storage integration, enabling enterprises to maintain sovereign data residency while scaling complex workloads.

Rapid Growth in Automotive Electronics and Industrial Automation

Electric vehicles, ADAS systems, and autonomous platforms require high-performance processors, AI accelerators, and safety-critical embedded systems. Automotive companies integrate sensors, radar units, battery management systems, and navigation processors to meet global safety and emission standards. In parallel, industrial automation accelerates adoption of robotics, PLCs, machine-vision systems, and predictive maintenance platforms. Factories use rugged embedded boards and edge AI processors to improve productivity, reduce downtime, and manage real-time quality inspection. Industrial IoT networks connect machinery to cloud-based control centers, increasing demand for secure networking components and firmware-based control units.

Key Trends & Opportunities

Growth of AI Chips, GPUs, and Custom Semiconductor Designs

Companies invest heavily in specialized chips that support AI workloads, deep learning, and high-speed processing. GPU-based acceleration improves cloud analytics, 3D rendering, healthcare imaging, and autonomous navigation. Custom ASICs and SoCs reduce power consumption and deliver faster inference speeds for edge devices and robotics. This opens opportunities for semiconductor firms to develop domain-specific processors tailored for smart manufacturing, automotive electronics, and industrial automation. The shift from general-purpose processors to AI-optimized chips fuels design innovation and strengthens demand across commercial and industrial sectors.

- For instance, NVIDIA’s latest Blackwell-architecture GPUs incorporate 208 billion transistors, manufactured by TSMC using a 4nm process, enhancing performance for cloud analytics and autonomous navigation.

Rise of Smart Devices and Embedded Intelligence Across Industries

AI-enabled smart devices form a major opportunity as consumers adopt smart home products, wearables, and connected appliances. Industrial users deploy embedded intelligence in robots, logistics systems, and energy grids to improve operational efficiency. Healthcare systems use embedded chips for remote monitoring, imaging tools, and portable diagnostics. This increases demand for microcontrollers, wireless modules, firmware security, and low-power processors. Companies developing compact, power-efficient embedded boards and real-time operating systems gain strong market advantage as digital adoption rises worldwide.

- For instance, Philips introduced the Biosensor BX100, also known as Healthdot in some markets, in 2020 as a wearable monitoring patch capable of tracking patient vitals in real-time. The device received FDA 510(k) clearance for use in general care settings to monitor key vitals such as heart rate and respiratory rate.

Key Challenges

Semiconductor Supply Chain Disruptions and Manufacturing Complexity

The market faces challenges from semiconductor shortages, limited foundry capacity, and geopolitical disruptions. Advanced chip manufacturing requires high-precision fabrication, expensive lithography equipment, and long development cycles. Any supply chain delay impacts consumer electronics, automotive production, and industrial automation. High competition for raw materials also increases production cost, affecting margins for device manufacturers. Companies must diversify supply chains, invest in chip-design innovation, and build strategic partnerships with foundries to maintain product continuity and price stability.

Cybersecurity Risks and Hardware-Level Vulnerabilities

As systems become more connected and data-driven, cybersecurity threats increase across embedded devices, cloud servers, and industrial networks. Hardware-level vulnerabilities enable attackers to exploit processors, firmware, and control units. Breaches cause system failures, data leaks, and safety risks in sectors like automotive, defense, and healthcare. Companies invest in secure boot systems, encryption, and intrusion-detection hardware to protect real-time operations. The rise of connected vehicles and industrial IoT expands the threat surface, forcing device manufacturers to implement stronger firmware security, testing protocols, and vulnerability detection frameworks.

Regional Analysis

North America

North America leads the Computer Engineering market with 35% share. Strong presence of semiconductor manufacturers, AI developers, and cloud providers supports wide adoption of advanced processors, GPU clusters, and networking hardware. The U.S. drives demand through hyperscale data centers, autonomous vehicle projects, smart factories, and defense electronics. High investment in R&D, chip design, and cybersecurity keeps the region ahead in technology innovation. Consumer electronics and industrial automation also expand due to strong IoT implementation and digital transformation. Government initiatives to boost domestic semiconductor production further strengthen long-term market growth.

Europe

Europe accounts for close to 25% of the Computer Engineering market, supported by growth in automotive electronics, robotics, and industrial automation. Germany, France, and the UK lead adoption of embedded processors, AI chips, and advanced control units in electric vehicles and smart manufacturing. Medical device companies drive additional demand for microcontrollers and firmware-based safety systems. The region invests heavily in clean-energy infrastructure and smart grids, increasing the need for secure processors and networking components. Strong regulatory standards and expansion of Industry 4.0 projects maintain steady hardware and software deployment.

Asia-Pacific

Asia-Pacific holds 30% market share and remains the fastest-growing region. China, Japan, South Korea, and Taiwan serve as global hubs for semiconductor manufacturing, consumer electronics, and telecom equipment. Rapid deployment of 5G networks and smart devices boosts adoption of microprocessors, sensors, and embedded systems. The region benefits from large chip fabrication capacity and rising demand for AI-enabled consumer electronics. India expands its role in software engineering, cloud services, and embedded system development. Strong investment in electric vehicles, robotics, and industrial IoT ensures sustained market growth.

Latin America

Latin America contributes 5% share, driven by gradual adoption of cloud computing, digital payments, and smart manufacturing technologies. Brazil and Mexico lead regional demand for embedded processors, networking hardware, and data center infrastructure. Telecommunications upgrades and growth of fintech services push local investment in secure computing platforms. Consumer electronics import volumes also support market expansion. However, limited semiconductor production and economic fluctuations slow large-scale adoption. Government initiatives focused on digital transformation and industrial automation are expected to improve market penetration over the forecast period.

Middle East & Africa

The Middle East & Africa region holds 5% share, growing through investments in smart city development, cloud computing, and digital government services. Gulf economies deploy advanced networking systems, cybersecurity platforms, and IoT infrastructure across energy, utilities, and transportation. Data centers expand in the UAE, Saudi Arabia, and South Africa to support cloud-based workloads and enterprise automation. Healthcare systems adopt embedded electronics for diagnostics and connected monitoring. However, limited manufacturing capacity and reliance on imports restrict hardware availability. Continued digitalization and 5G rollout are expected to increase market opportunities.

Market Segmentations:

By Component

- Hardware

- Software

- Firmware

By Application

- Consumer Electronics

- Automotive & Transportation

- Healthcare & Medical Devices

- Industrial Automation

By Product Type

- Microprocessors and Microcontrollers

- Sensors and Embedded Systems

- GPUs and AI Accelerators

- Networking Components

By Technology

- Artificial Intelligence & Machine Learning

- Cloud Computing

- 5G and Networking Technologies

- Robotics and Automation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Computer Engineering market features a mix of global semiconductor leaders, hardware manufacturers, software developers, and embedded system providers that focus on high-performance computing and automation solutions. Companies invest heavily in advanced chip design, AI processors, and power-efficient architectures to support data centers, edge devices, and industrial applications. Hardware players expand production of microprocessors, GPUs, and networking components, while software vendors offer simulation tools, design automation platforms, and firmware security systems. Strategic partnerships between semiconductor firms, cloud providers, automotive OEMs, and electronics manufacturers help accelerate innovation in smart vehicles, robotics, and IoT ecosystems. Leading market participants also focus on acquisitions and product launches to strengthen technology portfolios and reduce dependency on external suppliers. With rising demand for AI workloads, autonomous systems, and high-speed connectivity, competition intensifies around performance, power efficiency, and hardware-level security. As a result, vendors prioritize R&D investment, localized chip production, and integrated system solutions to maintain market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SolidCAM Ltd

- Intel Corporation

- National Instruments Corporation

- STMicroelectronics N.V

- Synopsys, Inc

- Lattice Semiconductor Corporation

- Averna Technologies, Inc

- Xilinx, Inc

- Nvidia Corporation

- Teradyne, Inc

Recent Developments

- In September 2025, NVIDIA and OpenAI announced a landmark strategic partnership to deploy at least 10 gigawatts of NVIDIA systems for OpenAI’s next-generation AI infrastructure.

- In September 2025, NVIDIA and Intel Corporation announced a landmark collaboration to co-develop advanced chips for data centers and personal computing.

- In August 2025, Broadcom Inc. announced its collaboration with NVIDIA to bring the latest AI technology to VMware Cloud Foundation (VCF).

- In May 2025, E4 Computer Engineering and UNICOM Engineering announced a strategic partnership focused on accelerating AI infrastructure solutions in the Italian and Swiss markets.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, Product, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for AI processors and GPUs will increase across data centers and autonomous platforms.

- Embedded systems will gain wider adoption in consumer electronics, healthcare, and smart factories.

- Edge computing will reduce latency and push growth in compact, high-performance chips.

- Automotive electronics will expand with ADAS, EV control units, and autonomous navigation systems.

- Semiconductor manufacturers will invest in advanced nodes, chip miniaturization, and power-efficient designs.

- Secure firmware and hardware-based cybersecurity will become mandatory for connected devices.

- 5G networks will boost demand for high-speed networking components and cloud infrastructure.

- Data centers will scale capacity, driving growth in microprocessors, GPUs, and storage controllers.

- Custom SoCs and ASICs will rise as companies optimize chips for AI and robotics.

- Digital transformation in developing regions will improve adoption of industrial automation and smart devices.