Market Overview

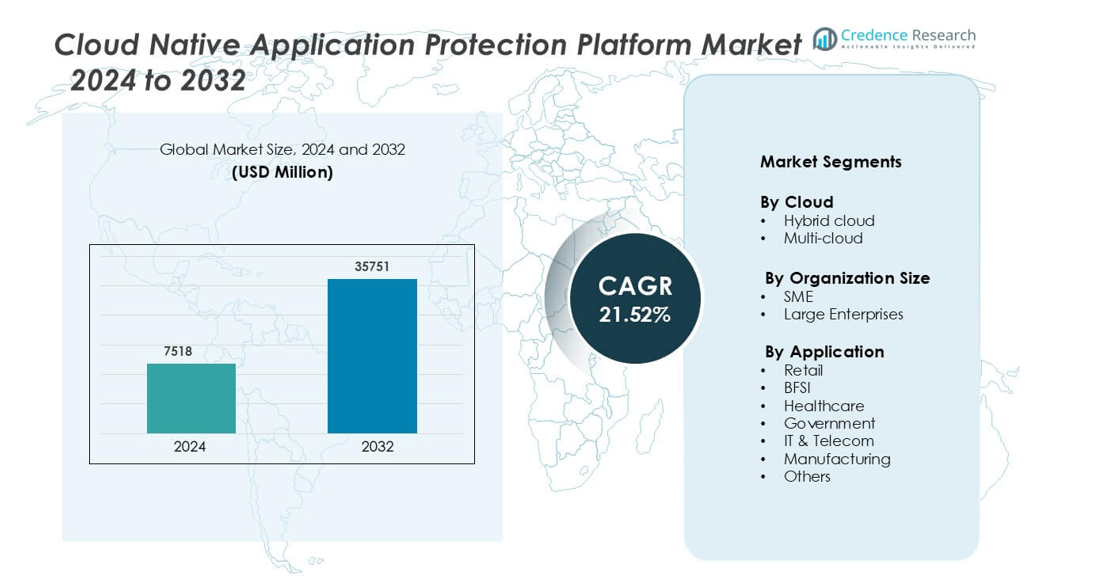

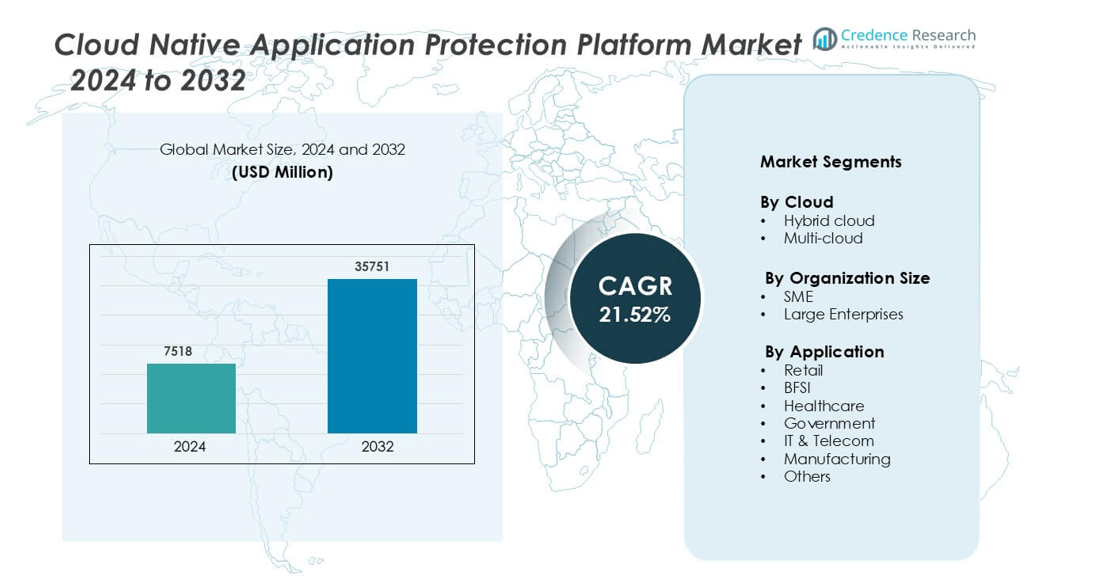

Cloud Native Application Protection Platform market was valued at USD 7518 million in 2024 and is anticipated to reach USD 35751 million by 2032, growing at a CAGR of 21.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud Native Application Protection Platform Market Size 2024 |

USD 7518 million |

| Cloud Native Application Protection Platform Market, CAGR |

21.52% |

| Cloud Native Application Protection Platform Market Size 2032 |

USD 35751 million |

Global leaders in the Cloud Native Application Protection Platform market include Palo Alto Networks, CrowdStrike, Fortinet, Trend Micro, Qualys, Tenable, LaceWorks, Zscaler, Checkpoint Security, and ABBYY. These companies compete by offering unified platforms that secure containers, APIs, multi-cloud workloads, and DevSecOps pipelines. Palo Alto Networks and CrowdStrike lead with strong cloud workload protection, AI-driven threat detection, and deep Kubernetes visibility, while Zscaler and Fortinet expand secure access and identity governance for distributed cloud environments. North America remains the leading region, holding 38% market share due to strong cloud adoption, compliance demands, and cybersecurity investments across BFSI, IT, telecom, and public sectors.

Market Insights

- The Cloud Native Application Protection Platform market reached USD 7518 million in 2024 and is projected to hit USD 35751 million by 2032, growing at a CAGR of 21.52%.

- Growing cloud adoption and rising cybersecurity risks drive deployment of CNAPP solutions, with large enterprises holding the biggest segment share due to complex workloads and stricter compliance demands.

- Multi-cloud and hybrid cloud trends accelerate adoption, as organizations require unified workload security, posture management, and API protection across AWS, Azure, and GCP environments.

- Competition remains strong among major players including Palo Alto Networks, CrowdStrike, Fortinet, Trend Micro, Zscaler, and LaceWorks, with vendors investing in AI-driven analytics, container security, and automated remediation.

- North America leads the market with 38% regional share, supported by high cloud spending and strong regulatory frameworks, while SMB adoption rises in Asia-Pacific, contributing to one of the fastest regional growth rates.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Cloud

Hybrid cloud holds the dominant share in the Cloud Native Application Protection Platform market. Enterprises adopt hybrid environments to balance data control, compliance, and scalability. The hybrid model supports legacy applications while enabling cloud-native workloads, creating strong transition flexibility. Companies prefer hybrid deployment to manage sensitive data on-premises and leverage public cloud resources for modern workloads. Multi-cloud is growing as organizations diversify cloud vendors to avoid lock-in and reduce downtime risks. Security automation and unified visibility across clouds drive demand for CNAPP solutions in both deployment models, but hybrid cloud remains the leading contributor to market revenue.

- For instance, Palo Alto Networks Prisma Cloud supports more than 5,000 built-in compliance rules and secures workloads across AWS, Azure, and GCP within a single dashboard.

By Organization Size

Large enterprises lead the market, holding the highest share due to complex IT infrastructure and wider attack surfaces. These organizations invest heavily in cloud security tools to protect microservices, APIs, containers, and Kubernetes workloads at scale. Stringent compliance requirements, especially in regulated industries, push large enterprises to deploy CNAPP platforms offering real-time threat detection and posture management. SMEs represent a rising segment, supported by cloud adoption and cost-effective SaaS-based security platforms. However, large enterprises remain the chief revenue generator due to higher security spending and advanced workload protection needs.

- For instance, CrowdStrike’s Falcon platform analyzes more than trillions security events per day and secures workloads across major clouds and on-premise infrastructure.

By Application

IT and Telecom is the dominant application segment, contributing the highest share. The sector runs large-scale distributed workloads, containerized applications, and multi-cloud deployments, increasing the need for workload protection and runtime security. Threat detection, API monitoring, and CI/CD pipeline security drive strong CNAPP demand in telecom and IT services. BFSI and healthcare follow due to strict regulatory frameworks and high data sensitivity. Government, manufacturing, retail, and others continue adopting cloud-native security to protect digital services and maintain uptime. Despite broad adoption, IT and Telecom remains the top revenue-contributing segment.

Key Growth Drivers

Rising Adoption of Cloud-Native Architectures

The shift from monolithic systems to microservices, containers, and Kubernetes clusters is a major growth driver for the Cloud Native Application Protection Platform market. Organizations move workloads to the cloud for agility, faster deployment, and scalable application delivery, but this transition increases attack surfaces. Traditional security tools cannot monitor dynamic, containerized environments, creating strong demand for CNAPP solutions that provide identity management, runtime protection, and threat detection at workload level. CNAPP platforms integrate DevSecOps practices and enable continuous vulnerability scanning across CI/CD pipelines. As companies expand digital services, the need to secure APIs, serverless functions, and multi-cloud workloads continues to accelerate adoption. This architectural shift ensures long-term demand for advanced cloud-native security platforms.

- For instance, the internal use of Prisma Cloud by Palo Alto Networks to secure a large and complex environment involving 100,000 containers and over 50,000 compute instances.

Increasing Compliance and Data Security Requirements

Strict data protection regulations drive enterprises to secure cloud workloads more aggressively. Industries such as BFSI, healthcare, and government handle sensitive data and face heavy penalties for breaches and compliance failures. CNAPP platforms offer continuous posture monitoring, policy enforcement, and automated compliance reporting across hybrid and multi-cloud infrastructures. Visibility into cloud configuration, identity access management, and audit trails further supports regulatory adherence. Unauthorized access, misconfigurations, and unmanaged identities remain key breach sources, pushing companies to invest in centralized cloud security solutions. As cloud adoption expands, data privacy frameworks such as GDPR, HIPAA, and industry-specific mandates reinforce the need for integrated CNAPP deployments.

- For instance, the Qualys Cloud Platform (recently renamed the Qualys Enterprise TruRisk™ Platform) processes more than 3 trillion security events each year and conducts more than 6 billion IP scans annually.

Rising Incidents of Cloud Security Breaches

Rapid digital transformation increases cyber risks, making cloud-native workloads prime targets for attacks. Vulnerabilities in containers, API misuse, and lateral movement within cloud environments create high exposure. CNAPP platforms deliver real-time threat detection, anomaly analysis, and automated remediation to reduce breach impact. Enterprises deploy workload segmentation, identity-based access, and runtime protection to counter advanced threats. As attacks become more automated and sophisticated, CNAPP tools with AI-driven detection gain strong demand. High-profile ransomware incidents, data exfiltration, and supply chain compromises further accelerate spending on cloud workload security. The rising cost of breaches and reputational damage ensures continued investment in proactive cloud-native defense.

Key Trend & Opportunity

Growth in Multi-Cloud and Hybrid Deployments

Organizations increasingly distribute workloads across multiple cloud vendors to improve resilience, cost efficiency, and vendor flexibility. However, multi-cloud and hybrid architectures create fragmented visibility and inconsistent security policies, driving adoption of CNAPP platforms. These platforms centralize monitoring, identity control, compliance tracking, and workload security across AWS, Azure, GCP, and on-premise environments. As edge computing and distributed applications expand, demand for unified CNAPP solutions continues to rise. Vendors offering deep integration, automated remediation, and container-aware scanning gain strong advantage. This shift presents a major long-term opportunity for CNAPP providers as multi-cloud becomes the standard operating model.

- For instance, Microsoft Defender for Cloud protects workloads spanning Azure, AWS, and GCP from a single console.

Integration of AI and Automation in Cloud Security

AI, machine learning, and automated remediation are transforming cloud-native security. Modern CNAPP solutions analyze behavioral patterns, detect anomalies, and block attacks in real time. Automation reduces manual effort, speeds incident response, and eliminates misconfigurations, which remain a key cause of cloud breaches. Security teams use AI-driven alerts, risk scoring, and policy recommendations to strengthen cloud governance. As organizations struggle with growing cloud complexity and cybersecurity skill shortages, automated CNAPP platforms present a major market opportunity. Vendors investing in predictive analytics, autonomous remediation, and intelligent threat monitoring hold strong competitive positioning.

- For instance, Palo Alto Networks Prisma Cloud uses machine learning models trained on more than 1 trillion cloud data points collected from customer deployments worldwide. The platform automatically detects misconfigurations and runtime threats and executes more than 5,000 policy checks across containers and serverless workloads.

Key Challenge

Lack of Skilled Cloud Security Professionals

The market faces a significant talent gap, slowing adoption of advanced cloud-native protection platforms. Many organizations lack teams trained in securing containers, Kubernetes clusters, CI/CD pipelines, and API interactions. As workloads scale, misconfigurations, weak IAM policies, and unmanaged cloud assets increase breach risks. Enterprises rely on CNAPP platforms, but implementation and policy optimization require expert knowledge. The shortage of cybersecurity specialists forces companies to outsource or adopt automated solutions, increasing operational burden. This skills gap remains a major barrier to large-scale and efficient deployment of cloud-native protection.

Complexity in Managing Distributed Workloads

Cloud-native environments involve dynamic workloads that continuously scale and update, creating complex security landscapes. Securing containers, microservices, serverless functions, and distributed data flows requires unified visibility and orchestration. Many companies struggle to integrate CNAPP with existing security systems, identity platforms, and compliance workflows. Managing multi-cloud infrastructure adds further complexity due to diverse configurations and vendor-specific architectures. Without coordinated policies, inconsistent security controls emerge, increasing risks. This challenge slows adoption and raises operational costs, making seamless integration critical for market expansion.

Regional Analysis

North America

North America holds the largest market share (38%) in the Cloud Native Application Protection Platform market. Organizations in the region are early adopters of cloud-native technologies, Kubernetes, and microservices, driving demand for advanced workload security. Strong presence of leading cloud providers, cybersecurity vendors, and mature DevSecOps practices further boosts adoption. High frequency of cyberattacks and strict regulations, particularly in BFSI and healthcare, increase spending on CNAPP platforms. Enterprises focus on securing multi-cloud operations, API traffic, and runtime environments. The U.S. remains the key revenue contributor due to large-scale digital transformation across enterprises and government sectors.

Europe

Europe accounts for a significant market share (18%), supported by strict regulatory frameworks such as GDPR and industry-specific compliance mandates. Enterprises in countries like Germany, the UK, and France deploy CNAPP platforms to prevent data breaches, secure containers, and maintain policy governance across hybrid environments. Digitalization of banking, healthcare, and public services creates strong opportunities for cloud-native security. Growing cloud investments and rising cyber risks drive adoption of CNAPP with automated compliance reporting and threat detection. Vendors expand partnerships and managed services to support European enterprises with limited cloud security workforce.

Asia-Pacific

Asia-Pacific demonstrates the fastest growth and increasing market share (27%) within the CNAPP market. Rapid cloud migration across IT, telecom, banking, and e-commerce industries drives demand for cloud-native security. Countries like China, India, Japan, and Singapore invest heavily in public and multi-cloud deployments to support digital services. However, rising ransomware cases, API attacks, and data privacy regulations push enterprises toward integrated CNAPP platforms. Expanding 5G infrastructure, digital payments, and start-up ecosystems further accelerate adoption. Local and global vendors form alliances to deliver scalable cloud workload protection across diverse and distributed environments.

Latin America

Latin America is emerging as a growing market, gaining a moderate share (7%) as enterprises expand cloud adoption. Countries such as Brazil, Mexico, and Chile invest in digital banking, e-commerce, and government cloud initiatives. However, limited cybersecurity skills and budget constraints slow large-scale deployments. Despite challenges, increasing cyberattacks and regulatory pressure encourage adoption of CNAPP for API security, identity management, and workload protection. Cloud service providers partner with local enterprises to deliver managed security services and SaaS-based solutions, supporting market growth across the region.

Middle East & Africa

The Middle East & Africa market holds a smaller share (5%) but shows steady expansion. Government-led digital transformation, fintech adoption, and cloud investments in the UAE, Saudi Arabia, and South Africa drive demand for CNAPP platforms. Organizations prioritize workload protection, identity governance, and compliance monitoring to secure public and hybrid cloud deployments. Energy, banking, and telecom sectors lead adoption due to rising cyber risks and reliance on distributed applications. Partnerships with global cybersecurity vendors and regional data centers further strengthen market potential, positioning the region for sustained growth.

Market Segmentations:

By Cloud

By Organization Size

By Application

- Retail

- BFSI

- Healthcare

- Government

- IT & Telecom

- Manufacturing

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Cloud Native Application Protection Platform market features global cybersecurity leaders and specialized cloud-native security vendors. Companies such as Palo Alto Networks, CrowdStrike, Fortinet, Trend Micro, Qualys, and Tenable strengthen portfolios with CNAPP capabilities to secure workloads, APIs, containers, and Kubernetes environments. Vendors focus on unified platforms combining posture management, workload protection, identity governance, and runtime security. Strategic acquisitions, partnerships, and product integrations drive market competition as players expand into multi-cloud and hybrid deployments. Key providers invest in AI-based threat detection, automated incident response, and compliance reporting to meet enterprise security needs. Growing demand from regulated sectors pushes vendors to offer scalability, shared visibility for DevSecOps teams, and lower false positives. As cloud adoption accelerates across industries, competition intensifies between full-stack security platforms and niche CNAPP providers offering deep workload analysis and container-focused security.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Trend Micro

- Fortinet

- Qualys

- CrowdStrike

- Palo Alto Networks

- Zscaler

- ABBYY

- Tenable

- LaceWorks

- Checkpoint Security

Recent Developments

- In October 2024, Fortinet introduced Lacework FortiCNAPP, an AI-driven platform that secures everything from code to cloud through a single vendor. This platform enhances Lacework’s existing offerings by providing automated remediation, blocking active runtime threats, and offering detailed insights into FortiGuard Outbreak Alerts, which highlight new and emerging threats and their associated risks.

- In October 2023, Palo Alto Networks released Prisma Cloud Darwin, targeting the gap between developers and security professionals. The company asserts that securing applications from code to the cloud requires preventing risks from entering the development pipeline and avoiding breaches in production

Report Coverage

The research report offers an in-depth analysis based on Cloud, Organization Size, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of CNAPP solutions will rise as enterprises shift deeper into cloud-native architectures.

- Multi-cloud and hybrid environments will drive demand for unified workload visibility and policy enforcement.

- AI and machine learning will enhance real-time threat detection and automated remediation.

- DevSecOps integration will become standard as security moves earlier into CI/CD pipelines.

- Identity-based access control will gain priority as misconfigurations and credential abuse remain major attack vectors.

- Container, serverless, and API security will grow faster than traditional cloud protection tools.

- Vendors will expand partnerships with cloud providers to offer native integrations and simplified deployment.

- Managed security services will increase as enterprises face skill shortages in cloud security teams.

- Regulations and data privacy laws will push organizations toward automated compliance monitoring.

- Asia-Pacific will continue to post the highest growth rate as digital transformation accelerates across banking, telecom, and e-commerce.