Market Overview

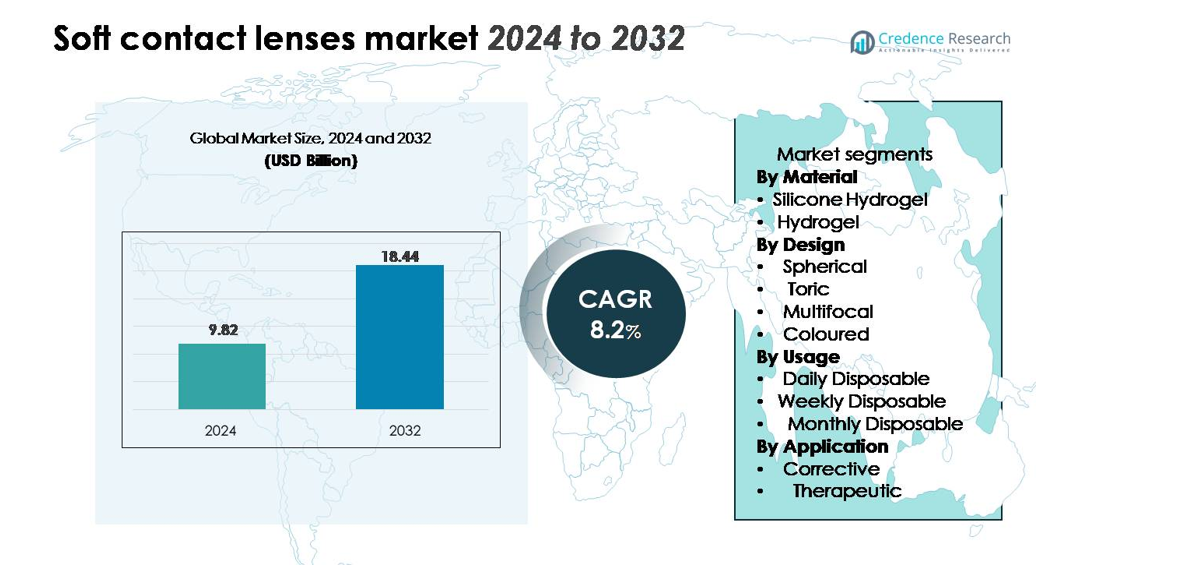

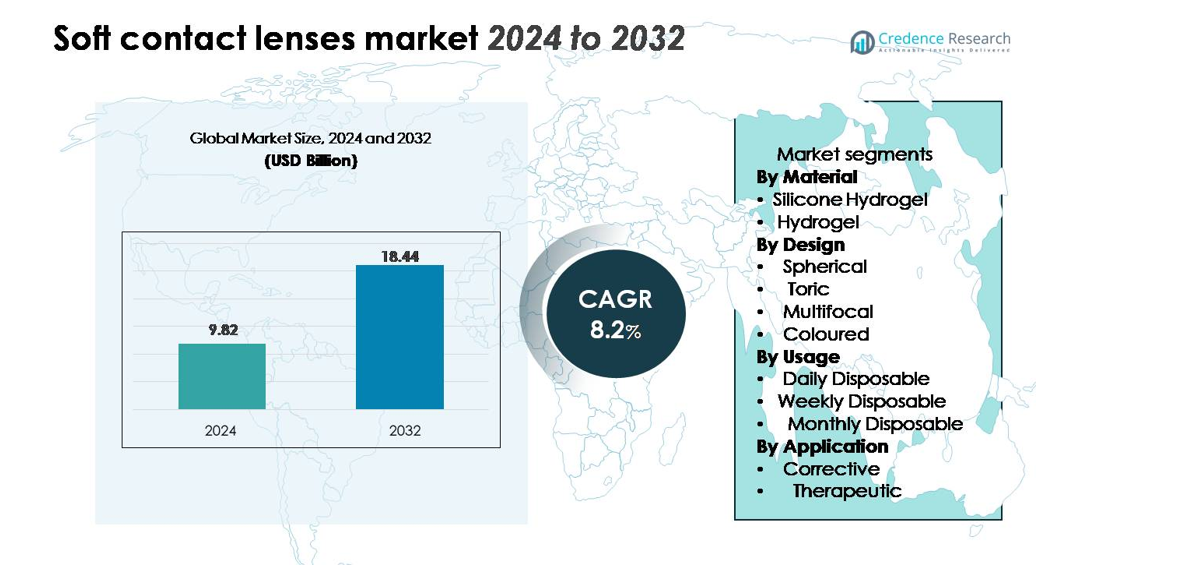

The Soft Contact Lenses Market was valued at USD 9.82 billion in 2024 and is projected to reach USD 18.44 billion by 2032, expanding at a CAGR of 8.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Soft Contact Lenses Market Size 2024 |

USD 9.82 billion |

| Soft Contact Lenses Market, CAGR |

8.2% |

| Soft Contact Lenses Market Size 2032 |

USD 18.44 billion |

The soft contact lenses market is led by major players including Johnson & Johnson Vision Care, Alcon, CooperVision, Bausch + Lomb, and Carl Zeiss Meditec AG. These companies dominate through advanced materials, innovative designs, and extensive global distribution. Johnson & Johnson Vision Care leads with its Acuvue range, known for high oxygen permeability and comfort, while Alcon’s Precision1 and Dailies Total1 strengthen its position in premium daily disposables. CooperVision focuses on toric and multifocal designs for specialized corrections. North America remains the largest market, holding a 39% share in 2024, driven by advanced eye care infrastructure, high consumer awareness, and strong adoption of daily disposable lenses.

Market Insights

- The Soft Contact Lenses Market was valued at USD 9.82 billion in 2024 and is projected to reach USD 18.44 billion by 2032, expanding at a CAGR of 8.2% during the forecast period.

- The market growth is driven by rising cases of myopia and astigmatism, increasing awareness of vision correction, and advancements in silicone hydrogel materials that enhance oxygen permeability and comfort.

- Growing adoption of cosmetic and lifestyle-oriented lenses, along with the integration of smart and wearable technologies, represents a key trend shaping product innovation and consumer preferences.

- The competitive landscape is led by Johnson & Johnson Vision Care, Alcon, CooperVision, Bausch + Lomb, and Carl Zeiss Meditec AG, focusing on material innovation, digital retail expansion, and sustainable packaging.

- Regionally, North America leads with a 39% share, followed by Europe (31%) and Asia-Pacific (23%); by material, silicone hydrogel lenses dominate with a 63% share due to superior comfort and breathability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

The silicone hydrogel segment dominates the soft contact lenses market with a 63% share in 2024. Its dominance is driven by superior oxygen permeability and enhanced comfort, which reduce dryness and eye irritation during prolonged wear. Silicone hydrogel lenses are preferred for extended and daily use due to their ability to maintain ocular health and reduce hypoxia-related issues. The hydrogel segment continues to serve cost-sensitive consumers, particularly in developing markets, where affordability and availability make it a viable alternative for short-duration wearers.

- For instance, Johnson & Johnson Vision Care’s Acuvue Oasys (2-week reusable) lenses offer an oxygen transmissibility (Dk/t) value of 147 x 10⁻⁹ (at -3.00D center thickness), enabling longer wear time, including approved extended (overnight) wear schedules, while maintaining corneal health.

By Design

The spherical design segment leads the market, holding a 47% share in 2024. These lenses are widely used for correcting common refractive errors such as myopia and hyperopia, offering simple fitting and affordability. Growing adoption of toric and multifocal lenses among patients with astigmatism and presbyopia supports market diversity. Coloured lenses are gaining attention in the cosmetic and fashion industries, with brands promoting custom shade options. Increasing awareness of aesthetic applications is expected to fuel growth in the coloured and lifestyle-oriented lens categories.

- For instance, CooperVision’s Biofinity spherical lenses feature Aquaform Comfort Science technology with an oxygen permeability of 160 Dk/t (at -3.00D), ensuring prolonged comfort and consistent visual acuity.

By Usage

Daily disposable lenses account for the largest market share of 52% in 2024, favored for convenience and hygiene benefits. Consumers prefer these lenses for their reduced risk of infections and maintenance-free nature, aligning with the trend toward single-use medical products. Weekly and monthly disposable lenses remain popular among regular users seeking affordability and sustainability through lower plastic waste. Advancements in material durability and moisture retention are encouraging broader adoption across healthcare and cosmetic applications, strengthening the overall soft contact lenses market growth.

Key Growth Drivers

Rising Prevalence of Refractive Errors

The growing number of individuals diagnosed with refractive vision disorders such as myopia, hyperopia, and astigmatism is driving strong demand for soft contact lenses. According to global health studies, over 2.2 billion people experience vision impairment, with myopia being the most common condition. Soft contact lenses offer superior comfort, breathability, and visual clarity compared to conventional eyeglasses, making them a preferred corrective solution. Increasing awareness of eye health, coupled with the availability of custom-fitted and daily disposable lenses, continues to expand adoption among both youth and working professionals worldwide.

- For instance, CooperVision’s MiSight 1 day lenses use dual-focus optical design, clinically shown to slow myopia progression by 59% in children aged 8–12 years.

Advancements in Lens Material and Design

Ongoing innovations in lens technology are enhancing product quality, durability, and comfort. Manufacturers are introducing silicone hydrogel materials that allow higher oxygen transmission, reducing dryness and irritation during extended wear. Features such as UV protection, moisture-locking polymers, and anti-deposition coatings are improving long-term eye safety. In addition, companies are investing in smart lenses capable of monitoring intraocular pressure and glucose levels. These advancements are attracting a wider customer base and driving product premiumization within the soft contact lenses market.

- For instance, Alcon’s Dailies Total1 lenses use a water gradient technology with a surface water content of 80%, providing high oxygen transmissibility of 156 Dk/t, which significantly reduces dryness and irritation during extended wear

Expanding E-commerce and Digital Retail Channels

The growth of online distribution channels has transformed the accessibility and affordability of soft contact lenses. Consumers increasingly prefer e-commerce platforms for their convenience, competitive pricing, and home delivery options. Digital eye-care solutions, including virtual fittings and AI-based prescription renewals, have further enhanced customer engagement. Leading brands collaborate with online retailers and subscription-based services to strengthen recurring sales. The expansion of omnichannel strategies is increasing market penetration, particularly among younger demographics accustomed to digital purchasing experiences.

Key Trends & Opportunities

Growth of Cosmetic and Lifestyle-Oriented Lenses

The rising popularity of coloured and lifestyle-oriented lenses is reshaping market dynamics beyond traditional vision correction. These lenses cater to aesthetic preferences, offering users options for eye colour enhancement or complete transformation. Fashion-conscious consumers and influencers are driving demand, especially across Asia-Pacific markets. Manufacturers are launching safe, comfortable cosmetic lenses made with biocompatible materials and UV protection. The convergence of healthcare and fashion presents lucrative opportunities for product diversification and brand differentiation in the premium lens segment.

- For instance, Alcon Air Optix Colors lenses offer nine distinct shades and feature SmartShield technology, which helps maintain lens surface smoothness and provides a protective layer against irritating deposits, thereby ensuring long-lasting comfort during daily wear.

Integration of Smart and Wearable Technologies

The incorporation of smart technologies into contact lenses is an emerging frontier in eye-care innovation. Companies are developing lenses embedded with micro-sensors capable of tracking glucose levels, measuring intraocular pressure, and providing augmented reality (AR) features. These next-generation lenses combine health monitoring with vision enhancement, appealing to both medical and tech-savvy consumers. Strategic partnerships between lens manufacturers and technology firms are accelerating R&D activities. This convergence of healthcare and IoT technologies creates new opportunities for early entrants in smart vision solutions.

- For instance, Mojo Vision independently miniaturized electronic components to create the “Mojo Lens” prototype, a smart contact lens with AR functionality. This lens incorporated the world’s smallest and densest microLED display (0.48 mm in diameter with 14,000 pixels per inch), along with an ARM processor, eye-tracking sensors, and medical-grade micro-batteries integrated into a rigid gas-permeable scleral lens.

Sustainability and Eco-Friendly Product Development

Environmental awareness is shaping the design and packaging of soft contact lenses. Manufacturers are shifting toward biodegradable materials and recyclable packaging to minimize waste from daily disposables. Initiatives such as take-back programs and eco-conscious production practices are gaining traction among leading brands. The demand for sustainable lenses aligns with global efforts to reduce plastic pollution and promote responsible consumption. Companies adopting green manufacturing processes and transparent sustainability commitments are likely to gain a competitive edge in the coming years.

Key Challenges

Risk of Eye Infections and Improper Usage

Despite their advantages, soft contact lenses pose risks when used incorrectly. Poor hygiene, extended wear, and inadequate cleaning can lead to eye infections such as keratitis and conjunctivitis. Misuse among first-time users and the lack of regular ophthalmic check-ups exacerbate these risks. Such complications may discourage consumers and raise safety concerns among healthcare professionals. To mitigate this, manufacturers and clinics must emphasize user education, promote daily disposables, and provide detailed care instructions to sustain trust and compliance.

High Cost of Premium and Advanced Lenses

The elevated cost of silicone hydrogel and smart lenses remains a key restraint, especially in developing markets. Advanced lenses incorporating UV filters, moisture-retention technology, or biosensors require expensive materials and complex production processes. This limits affordability for middle-income consumers and restricts adoption in regions with low healthcare spending. Additionally, frequent replacement cycles further increase long-term expenses. Manufacturers face the challenge of balancing innovation with cost efficiency, making affordable yet high-quality lenses essential for broader market expansion.

Regional Analysis

North America

North America dominates the soft contact lenses market with a 39% share in 2024. The region benefits from a large population affected by refractive errors, advanced eye care infrastructure, and early adoption of innovative lens technologies. High consumer spending power and the presence of key manufacturers such as Johnson & Johnson Vision Care and Alcon support steady market expansion. Rising demand for daily disposables and cosmetic lenses, coupled with increased e-commerce penetration, continues to boost sales. The United States remains the key revenue hub, accounting for the majority of North American market demand.

Europe

Europe holds a 31% share of the global soft contact lenses market in 2024, driven by strong consumer awareness and widespread adoption of premium eye care products. Countries such as Germany, France, and the United Kingdom lead demand due to high myopia prevalence and growing preference for silicone hydrogel lenses. Technological advancements, regulatory approvals, and the presence of established optical retail chains enhance market stability. Additionally, growing cosmetic lens demand in younger demographics supports diversification within the region’s lens portfolio. Sustainable packaging and eco-friendly production trends also influence purchasing decisions.

Asia-Pacific

Asia-Pacific captures a 23% market share and is the fastest-growing region in the soft contact lenses market. The rise in urbanization, changing fashion trends, and growing awareness of vision correction solutions are key growth drivers. Increasing disposable income and expansion of online retail channels have accelerated lens adoption in China, Japan, and South Korea. Regional manufacturers are focusing on cost-effective, high-quality lens materials to cater to the expanding middle-class population. Moreover, the cosmetic and lifestyle-oriented lens segments are gaining strong traction among young consumers seeking fashion-based vision products.

Latin America

Latin America accounts for a 4% share of the global market in 2024, with Brazil and Mexico being the leading contributors. The region’s market growth is supported by the rising prevalence of vision problems and growing acceptance of modern corrective lenses. Increasing distribution through optical retail chains and online platforms is expanding consumer access. However, price sensitivity and limited availability of premium lenses restrict higher adoption rates. Strategic partnerships with healthcare providers and promotional awareness campaigns are expected to strengthen market penetration across emerging Latin American economies.

Middle East & Africa

The Middle East & Africa region holds a 3% share of the global soft contact lenses market. Growth is primarily driven by increasing awareness of vision correction and expanding access to ophthalmic care facilities. The UAE and Saudi Arabia represent key markets due to growing demand for luxury and cosmetic lenses. The gradual expansion of optical retail networks and online platforms enhances product availability. However, the market faces challenges from lower consumer affordability and limited local manufacturing capacity. Investments in healthcare infrastructure and awareness initiatives are gradually improving market prospects.

Market Segmentations:

By Material

- Silicone Hydrogel

- Hydrogel

By Design

- Spherical

- Toric

- Multifocal

- Coloured

By Usage

- Daily Disposable

- Weekly Disposable

- Monthly Disposable

By Application

- Corrective

- Therapeutic

- Cosmetic

- Prosthetic

- Lifestyle-oriented

By Distribution Channel

- Retail Optical Stores

- Hospitals & Ophthalmology Clinics

- E-commerce

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The soft contact lenses market is highly competitive, featuring leading players such as Johnson & Johnson Vision Care, Alcon, CooperVision, Bausch + Lomb, and Carl Zeiss Meditec AG. These companies dominate through extensive product portfolios, advanced material technologies, and strong global distribution networks. Continuous R&D investments focus on enhancing oxygen permeability, comfort, and moisture retention in silicone hydrogel lenses. Firms are also expanding into smart and cosmetic lens segments to diversify offerings. Strategic partnerships with optical retailers and e-commerce platforms strengthen their market presence. For instance, Alcon’s Precision1 and Johnson & Johnson’s Acuvue Oasys brands lead in premium daily disposables due to their superior comfort and hydration technologies. Emerging players such as Menicon Co., Seed Co. Ltd., and Hoya Corporation are focusing on customized lens designs and sustainable packaging solutions. The competitive environment remains innovation-driven, with companies prioritizing digital sales channels and personalized vision correction solutions to sustain growth

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CooperVision

- Shine

- Bausch + Lomb

- ORION Vision Group

- Contamac

- Menicon

- Johnson & Johnson

- SEED Co.

- specialeyes

- Alcon

Recent Developments

- In 2025, Bausch & Lomb expanded its ophthalmic portfolio by launching the enVista Aspire monofocal and toric lenses in the European market. These lenses were designed for implantation in the capsular bag to correct aphakia and provide an extended depth of focus. This strategic expansion strengthened the company’s presence in the market, addressing the rising demand for advanced intraocular solutions and enhancing its competitive positioning in Europe.

- In November 2024, Alcon announced the launch of Precision7, a one-week replacement soft contact lens featuring advanced technology to provide 16 hours of comfort and precise vision in both spherical and toric designs. This innovation expanded Alcon’s product portfolio in the market, strengthening its competitive position by addressing consumer demand for long-lasting comfort and improved visual performance.

Report Coverage

The research report offers an in-depth analysis based on Material, Design, Usage, Application, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for daily disposable lenses will continue to rise due to hygiene and convenience benefits.

- Advancements in silicone hydrogel materials will enhance oxygen flow and long-term comfort.

- Smart contact lenses with health monitoring features will attract new consumer segments.

- Growth in cosmetic and coloured lenses will strengthen the lifestyle and fashion-oriented market.

- E-commerce and digital eye-care platforms will become major sales channels for lens manufacturers.

- Sustainability initiatives will drive innovation in biodegradable lenses and recyclable packaging.

- Personalized lens design using AI and 3D modeling will improve vision accuracy and comfort.

- Expanding eye-care infrastructure in emerging economies will boost product accessibility and adoption.

- Strategic partnerships among lens manufacturers and tech companies will accelerate innovation cycles.

- Rising awareness of vision health will sustain steady growth across corrective and therapeutic applications.