Key Growth Drivers

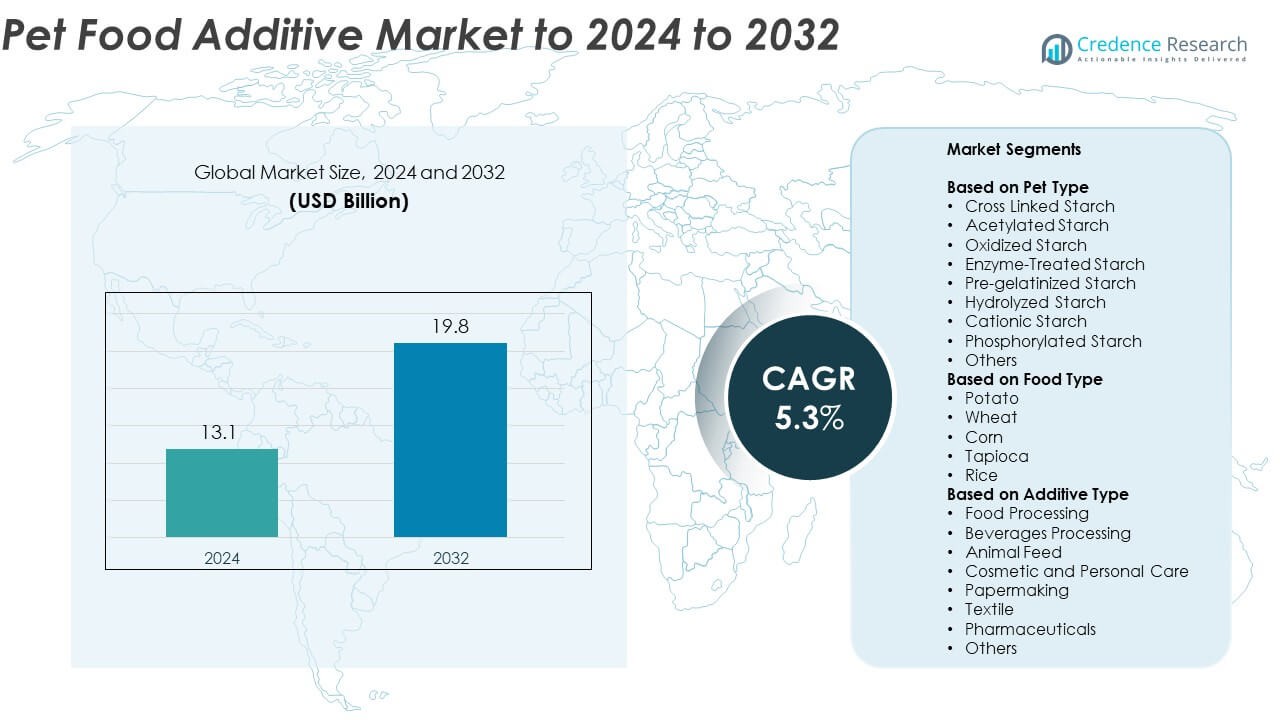

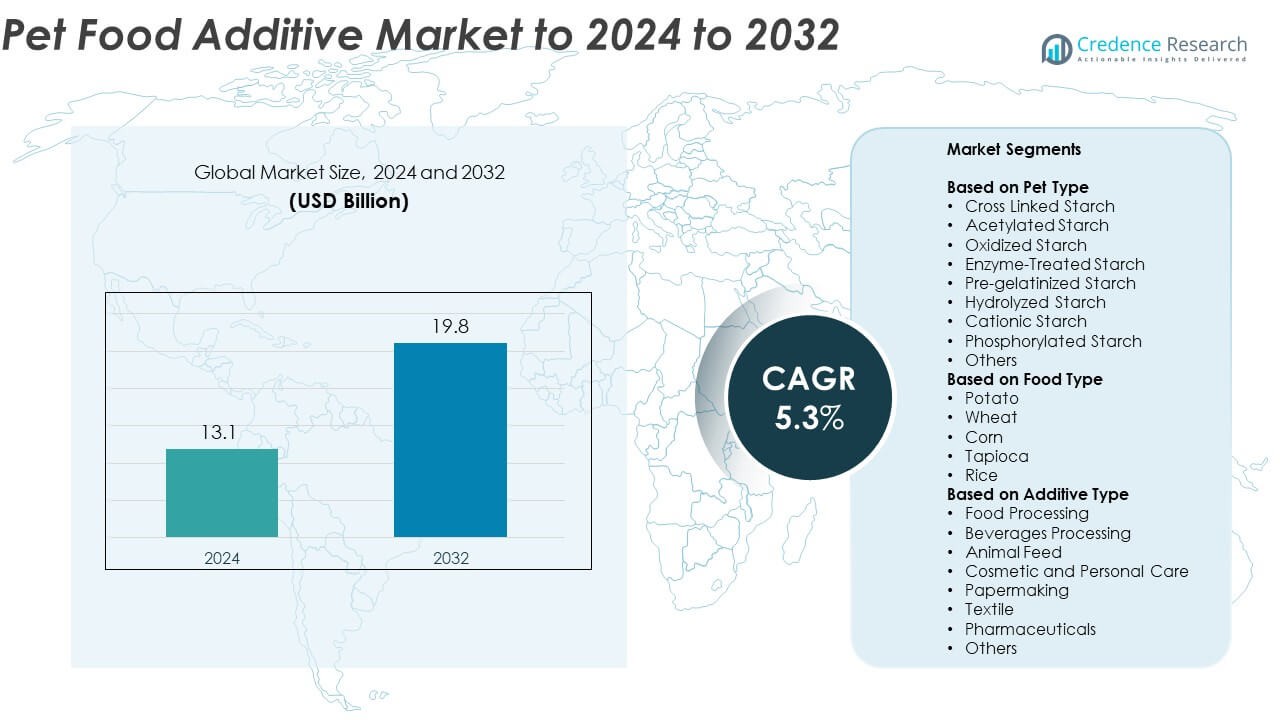

The Pet Food Additive Market size was valued at USD 13.1 billion in 2024 and is anticipated to reach USD 19.8 billion by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pet Food Additive Market Size 2024 |

USD 13.1 Billion |

| Pet Food Additive Market, CAGR |

5.3% |

| Pet Food Additive Market Size 2032 |

USD 19.8 Billion |

The pet food additive market is led by prominent players such as BASF, AFB International, Cargill Incorporated, Adisseo, Alltech, DSM-Firmenich, and Brenntag, which collectively shape global supply and innovation trends. These companies emphasize advanced formulation technologies, sustainable ingredient sourcing, and natural additive development to meet rising demand for high-quality, health-focused pet food products. North America remains the dominant region, accounting for around 38.2% share in 2024, supported by strong consumer awareness and premium product demand. Europe follows with 27.6% share, driven by regulatory emphasis on clean-label formulations, while Asia Pacific, holding 21.8%, exhibits the fastest growth due to increasing pet ownership and expanding pet food manufacturing capacities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The pet food additive market was valued at USD 13.1 billion in 2024 and is projected to reach USD 19.8 billion by 2032, growing at a CAGR of 5.3% during the forecast period.

- Rising pet humanization and preference for premium nutrition drive demand for natural, functional, and safe additives that enhance palatability, texture, and nutrient stability in pet diets.

- Key trends include the rapid adoption of clean-label, plant-based additives and growing R&D investments in bio-based starch derivatives and microencapsulation technologies.

- The market is moderately consolidated, with leading players focusing on product innovation, sustainable sourcing, and regional capacity expansion to strengthen their competitive advantage.

- North America leads with 38.2% share in 2024, followed by Europe at 27.6% and Asia Pacific at 21.8%, while the cross-linked starch segment holds the dominant 31.4% share due to its superior processing performance and stability benefits.

Market Segmentation Analysis:

By Pet Type

The cross-linked starch segment dominates the pet food additive market with nearly 31.4% share in 2024. Its strong position is attributed to its superior water-holding capacity, improved texture stability, and enhanced resistance to processing stress during extrusion and cooking. Cross-linked starch enhances the palatability and shelf life of pet foods, making it preferred in both dry and wet formulations. Increasing focus on maintaining consistent product quality and digestibility in premium pet food categories continues to drive demand for this additive type among major manufacturers.

- For instance, following the acquisition of CP Kelco in late 2024, Tate & Lyle operates in approximately 75 locations across 38 countries with more than 5,000 employees.

By Food Type

The corn-based starch segment leads the pet food additive market with around 38.6% share in 2024. Corn starch is widely used due to its excellent thickening, binding, and texturizing properties that support efficient pet food processing. It provides an economical and stable carbohydrate source while improving kibble expansion and structure. Growing use of non-GMO corn starch and sustainable raw material sourcing further strengthens its adoption. Manufacturers increasingly incorporate modified corn starches to enhance digestibility and nutrient absorption in pet diets.

- For instance, ADM’s corn processing plants normally grind ~59 million bushels of corn per month, underpinning large-scale corn-starch availability.

By Additive Type

The animal feed segment accounts for the largest share of approximately 42.3% in 2024 within the pet food additive market. Its dominance stems from the rising demand for nutritional additives that enhance feed efficiency, taste, and pet health. Functional starch-based additives improve digestibility, reduce anti-nutritional factors, and optimize gut health in companion animals. The growing trend toward premium, grain-free, and protein-balanced pet diets supports the steady use of starch derivatives in feed formulations across both dry and wet food categories.

Market Overview

Rising Pet Humanization and Premiumization

Increasing pet ownership and the trend toward treating pets as family members are driving higher spending on nutrition and wellness. Consumers are demanding high-quality, functional pet foods enriched with additives that enhance taste, texture, and nutritional value. This shift toward premium pet food products, especially in developed markets, fuels strong demand for natural antioxidants, probiotics, and flavor enhancers that support overall pet health and longevity.

- For instance, Nestlé Purina opened a new factory in North Carolina in March 2024 and noted a 24th factory under construction in Ohio to expand premium pet food capacity.

Advancements in Additive Formulation Technologies

Innovations in microencapsulation, enzyme modification, and starch structuring are improving additive functionality in pet food production. These technologies enhance nutrient stability and palatability, extending shelf life and maintaining feed integrity. Leading manufacturers are integrating bio-based and clean-label formulations to meet evolving consumer preferences for safer and sustainable additives. This technological advancement supports efficient production processes and aligns with stricter safety regulations across global pet food markets.

- For instance, Evonik’s AvailOm® omega-3 lysine-complex powder contains a minimum 45% EPA+DHA and is 3–5× more bioavailable than standard softgels, illustrating high-load microencapsulation.

Growing Demand for Nutrient-Dense and Functional Diets

Rising awareness of pet health and nutrition has accelerated the adoption of additive-rich formulations that address digestive health, joint care, and immunity. The inclusion of functional ingredients such as omega fatty acids, prebiotics, and fortified starches improves overall nutrient absorption and gut health. The growing popularity of specialized diets for senior and active pets continues to boost additive consumption across diverse formulations and categories.

Key Trends & Opportunities

Shift Toward Natural and Clean-Label Additives

Pet food producers are increasingly replacing synthetic additives with plant-derived, organic, and minimally processed alternatives. This transition is fueled by consumer demand for transparency, safety, and sustainability. Natural emulsifiers, antioxidants, and stabilizers derived from botanicals and starches are gaining traction. Manufacturers are leveraging this trend to develop cleaner, more environmentally friendly additive lines without compromising performance or shelf life.

- For instance, Cargill invested $2.4 million in upgrades at its sweetener facility in Cikande, Indonesia, to “more than double” its production capacity for organic, non-GMO tapioca syrup. The expansion aimed to achieve an annual tapioca syrup production volume of 12,000 metric tons by 2024 and was driven by the increasing demand for clean-label sweeteners in both the North American and Asian markets.

Sustainability and Circular Economy Integration

The industry is embracing sustainable sourcing and circular production models, emphasizing the reuse of agricultural by-products for additive production. Companies are adopting eco-friendly processes that reduce carbon emissions and energy use. Starch-based additives from renewable crops like corn and tapioca are central to these initiatives. This trend aligns with broader environmental goals and offers a competitive advantage for brands promoting green formulations.

- For instance, Ingredion reports a 22% absolute reduction in company emissions since 2019, aligning starch-based ingredient supply with lower-impact production.

Expansion Across Emerging Pet Care Markets

Rising disposable incomes and changing lifestyles in Asia-Pacific and Latin America are fostering rapid pet ownership growth. This shift increases demand for affordable yet nutritionally balanced pet foods containing additives for flavor, texture, and health enhancement. Local manufacturers are investing in regional production and distribution networks to meet growing demand and expand market penetration across developing economies.

Key Challenges

Stringent Regulatory Standards and Compliance Issues

Global regulations governing additive safety, labeling, and usage limits pose challenges for manufacturers. Compliance with varying regional standards requires extensive testing and documentation, increasing operational costs. Companies must ensure that additives meet both nutritional and safety requirements while maintaining transparency in ingredient disclosure. Regulatory complexities can delay new product launches and restrict smaller producers from entering the market.

Fluctuating Raw Material Prices and Supply Chain Constraints

Volatile prices of key raw materials like corn, wheat, and tapioca affect additive production costs. Supply chain disruptions due to climate conditions, geopolitical tensions, and logistics issues further impact availability. These fluctuations pressure profit margins and challenge consistent product quality. Manufacturers are increasingly adopting risk management strategies, diversifying sourcing channels, and exploring alternative starch sources to ensure supply stability.

Regional Analysis

North America

North America dominates the pet food additive market with around 38.2% share in 2024. The region’s leadership is driven by strong pet ownership rates, premium product demand, and extensive investments in nutrition-focused formulations. Rising awareness about functional and natural additives, especially those improving digestive and immune health, supports market expansion. The presence of leading manufacturers and strict quality regulations further enhance innovation and safety compliance. The United States leads regional growth, with increasing use of starch-based additives in both dry and wet pet food categories to enhance palatability and shelf stability.

Europe

Europe holds nearly 27.6% share of the global pet food additive market in 2024, supported by high adoption of premium and sustainable pet food products. Stringent EU regulations on additive use and labeling encourage the development of clean-label, natural, and non-GMO formulations. Growing consumer preference for health-oriented pet diets is fueling demand for antioxidants, probiotics, and natural starch derivatives. Germany, France, and the United Kingdom lead the regional market due to advanced manufacturing facilities and strong focus on animal welfare. Innovation in bio-based additives continues to strengthen the regional market’s sustainability profile.

Asia Pacific

Asia Pacific accounts for about 21.8% share of the pet food additive market in 2024, emerging as the fastest-growing region. Rising urbanization, increasing disposable incomes, and growing pet adoption in countries such as China, Japan, and India are key factors driving regional demand. Expanding awareness of pet nutrition and a shift toward packaged pet foods are boosting additive consumption. Manufacturers are investing in regional facilities to meet local demand for functional, digestible, and cost-effective formulations. Rapid development of e-commerce distribution channels further accelerates market penetration and enhances accessibility of premium additive-based pet foods.

Latin America

Latin America represents nearly 7.4% share of the global pet food additive market in 2024. Market growth is driven by the expanding middle-class population and increasing expenditure on pet care. Brazil and Mexico lead the region, supported by rising pet food production and exports. The demand for additives that improve taste, texture, and nutrient retention is rising among local manufacturers. Ongoing expansion of modern retail and private-label brands enhances consumer reach. Growing emphasis on affordable, nutritionally balanced products is further driving the integration of starch-based and natural additives across regional production.

Middle East & Africa

The Middle East & Africa region accounts for approximately 5% share of the pet food additive market in 2024. Market growth is supported by expanding urban populations, increasing pet adoption, and a gradual shift from home-prepared meals to commercial pet foods. South Africa, the UAE, and Saudi Arabia are key contributors to demand growth. The market is witnessing rising interest in imported and premium additive-based formulations. However, limited local production and high import dependence create supply challenges. Investments in regional manufacturing and distribution networks are gradually improving accessibility and price competitiveness across the region.

Market Segmentations:

By Pet Type

- Cross Linked Starch

- Acetylated Starch

- Oxidized Starch

- Enzyme-Treated Starch

- Pre-gelatinized Starch

- Hydrolyzed Starch

- Cationic Starch

- Phosphorylated Starch

- Others

By Food Type

- Potato

- Wheat

- Corn

- Tapioca

- Rice

By Additive Type

- Food Processing

- Beverages Processing

- Animal Feed

- Cosmetic and Personal Care

- Papermaking

- Textile

- Pharmaceuticals

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The pet food additive market is highly competitive, featuring established global players such as BASF, AFB International, Cargill Incorporated, TER Chemicals GmbH & Co. KG, Adisseo, Alltech, Hill’s Pet Nutrition, MIAVIT Holding, Brenntag, Turpaz Group, DSM-Firmenich, Gillco Ingredients, and Bentoli. The competition is driven by product innovation, sustainability initiatives, and quality differentiation. Companies are focusing on developing bio-based, natural, and functional additives to align with the growing demand for premium and clean-label pet foods. Strategic partnerships with pet food manufacturers are increasingly used to expand product reach and optimize formulation efficiency. R&D investments in enzymatic and starch-based technologies are supporting enhanced digestibility and nutrient retention. Market participants are also strengthening their regional presence through mergers, acquisitions, and capacity expansions. The rising importance of regulatory compliance and transparent labeling continues to shape competitive strategies, favoring firms with strong technical expertise and global supply chain capabilities.

Key Player Analysis

- BASF

- AFB International

- Cargill Incorporated

- TER Chemicals GmbH & Co. KG

- Adisseo

- Alltech

- Hill’s Pet Nutrition

- MIAVIT Holding

- Brenntag

- Turpaz Group

- DSM-Firmenich

- Gillco Ingredients

- Bentoli

Recent Developments

- In 2025, Brenntag Specialties Animal Nutrition, in partnership with BTSA, presented next-generation natural organic antioxidant solutions for pet food at the Nordic Pet Food Conference in Sweden.

- In 2025, Cargill Incorporated Expanded micronutrition capacity in Austria. Strengthens European premix supply for pet nutrition.

- In 2023, Hill’s Pet Nutrition introduced products featuring MSC-certified pollock and insect proteins to cater to pets with sensitive stomachs and skin conditions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Pet Type, Food Type, Additive Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as pet ownership and spending on premium nutrition rise globally.

- Demand for natural, organic, and clean-label additives will significantly increase across product lines.

- Manufacturers will invest in sustainable sourcing and eco-friendly production of starch-based additives.

- Functional additives supporting digestion, immunity, and joint health will gain higher adoption.

- Technological advances in encapsulation and formulation will improve additive performance and stability.

- Asia Pacific will remain the fastest-growing region driven by urbanization and rising disposable incomes.

- Regulatory focus on additive safety and transparency will drive innovation in compliant formulations.

- Collaboration between additive producers and pet food brands will enhance customized solutions.

- Online retail and e-commerce growth will strengthen global accessibility of additive-based pet foods.

- Increasing use of AI and data analytics in R&D will optimize ingredient combinations and formulation efficiency.