Market Overview

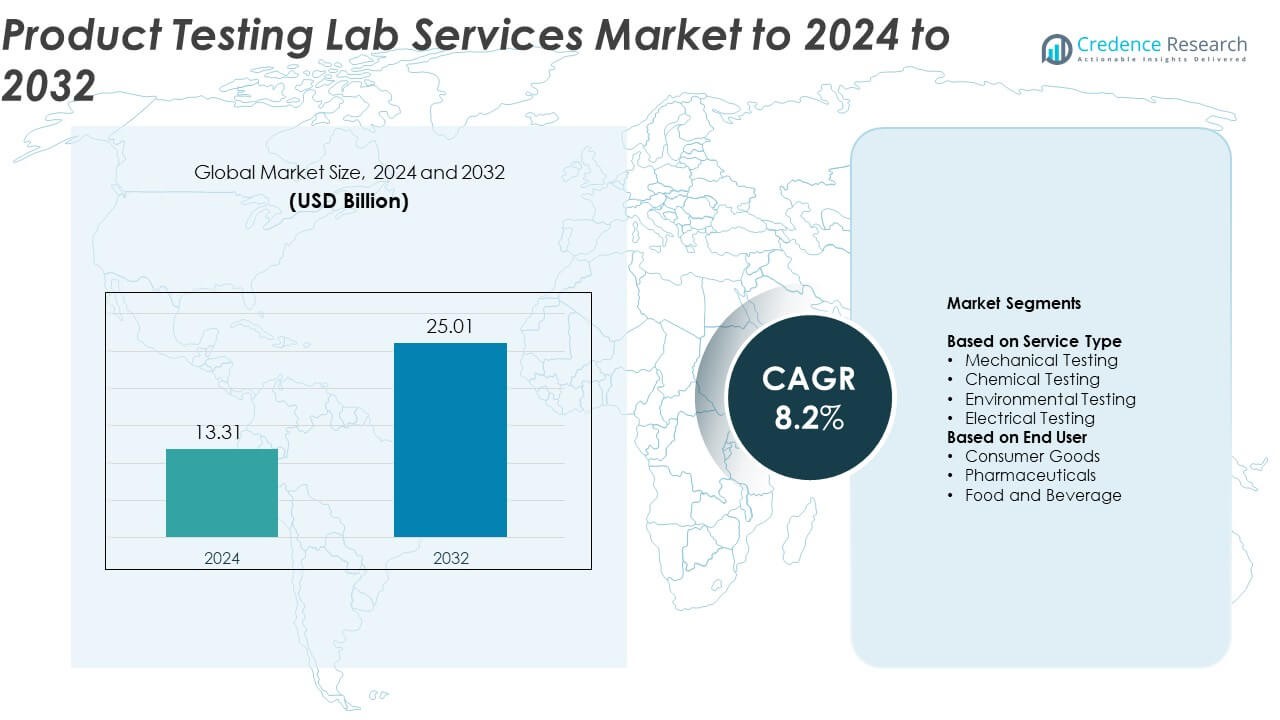

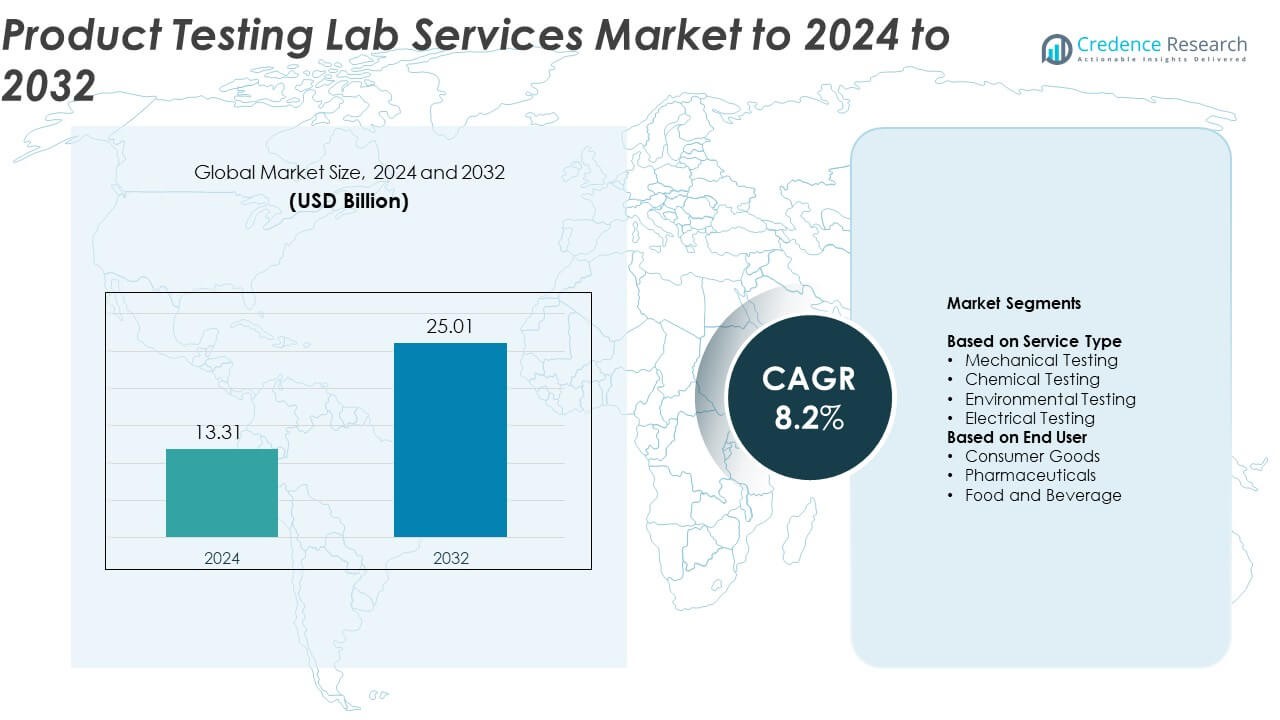

Product Testing Lab Services Market size was valued at USD 13.31 Billion in 2024 and is anticipated to reach USD 25.01 Billion by 2032, at a CAGR of 8.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Product Testing Lab Services Market Size 2024 |

USD 13.31 Billion |

| Product Testing Lab Services Market, CAGR |

8.2% |

| Product Testing Lab Services Market Size 2032 |

USD 25.01 Billion |

The product testing lab services market is dominated by leading companies including Bureau Veritas, Eurofins Scientific, Applus+, DEKRA SE, Element Materials Technology, Exova Group Limited, ALS Limited, TÜV SÜD, Intertek Group plc, DNV GL, BSI Group, SGS SA, CSA Group, NSF International, and UL LLC. These players hold strong global networks and advanced testing capabilities across diverse industries such as consumer goods, pharmaceuticals, and electronics. North America leads the global market with a 37.6% share in 2024, supported by stringent regulatory standards and advanced infrastructure, followed by Europe with 29.4% and Asia Pacific with 24.1%. Continuous innovation and digitalization of testing systems drive competitiveness across these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The product testing lab services market was valued at USD 13.31 Billion in 2024 and is projected to reach USD 25.01 Billion by 2032, expanding at a CAGR of 8.2%.

- Increasing regulatory compliance and safety standards across industries drive the demand for advanced testing and certification services worldwide.

- Rising adoption of AI-driven testing platforms and automated inspection systems is transforming efficiency and accuracy in laboratory operations.

- The market is moderately consolidated, with key players focusing on technological innovation, strategic partnerships, and sustainable testing solutions to enhance competitiveness.

- North America leads with a 37.6% market share in 2024, followed by Europe with 29.4% and Asia Pacific with 24.1%, while the mechanical testing segment dominates overall with 36.8% share due to strong demand in industrial and automotive applications.

Market Segmentation Analysis:

By Service Type

The mechanical testing segment dominates the product testing lab services market with nearly 36.8% share in 2024. This leadership is driven by its critical role in ensuring product durability, structural integrity, and compliance across sectors such as automotive, aerospace, and construction. Rising adoption of advanced testing methods like fatigue, tensile, and impact analysis enhances product performance validation. The growing regulatory emphasis on safety and reliability standards, particularly for materials and components used in industrial applications, continues to strengthen the demand for mechanical testing services worldwide.

- For instance, Instron servohydraulic fatigue systems test specimens up to 5,000 kN.

By End User

The consumer goods segment leads the market with approximately 38.2% share in 2024. This dominance is supported by stringent global safety and quality regulations for electronics, textiles, and household products. Increasing consumer awareness of product reliability and sustainability has intensified third-party testing requirements. Expanding e-commerce trade and cross-border distribution have also accelerated demand for independent certification and compliance testing. The ongoing integration of digital inspection technologies and AI-based quality assessment tools further enhances efficiency in consumer product evaluation.

- For instance, SGS operates 2,500+ labs across 115 countries with 99,500 employees.

Key Growth Drivers

Rising Regulatory Compliance Requirements

Stringent product safety and quality regulations across industries are driving the need for independent testing services. Governments and international bodies are enforcing strict certification standards to ensure product reliability and consumer safety. This regulatory pressure compels manufacturers to partner with accredited testing laboratories. The growing number of compliance mandates in sectors like electronics, automotive, and pharmaceuticals continues to expand the demand for specialized product testing services globally.

- For instance, Bureau Veritas runs 1,600+ offices and labs and employs 84,000 people.

Increasing Product Complexity and Innovation

Rapid technological advancements have increased the complexity of modern products, necessitating advanced testing methodologies. Manufacturers are integrating new materials, electronic components, and digital systems that require multi-dimensional validation. Testing labs are investing in AI-driven and automated systems to deliver precise, efficient, and faster results. This trend supports innovation while maintaining product safety and performance standards, fueling market growth across industries.

- For instance, a Cognex-powered robotic cell processed 350–410 eyeglass cases per hour at Zenni.

Expanding Global Trade and Cross-Border Regulations

The rise in international trade and cross-border product distribution has strengthened the demand for third-party testing and certification. Countries with differing quality standards require comprehensive validation before products enter new markets. This dynamic is encouraging manufacturers to rely on global testing networks to ensure compliance and reduce recall risks. The expanding reach of e-commerce and global supply chains further accelerates this demand.

Key Trends & Opportunities

Adoption of Digital and Automated Testing Platforms

Testing laboratories are increasingly integrating digital technologies, automation, and data analytics to improve accuracy and efficiency. AI-based inspection tools, remote monitoring systems, and predictive testing models enhance turnaround times and quality assurance. These digital advancements reduce human error and support high-volume testing. As industries embrace Industry 4.0 principles, the adoption of smart lab infrastructure creates strong opportunities for innovation and cost optimization.

- For instance, Universal Robots reports 100,000 collaborative robots sold worldwide supporting automated inspection tasks.

Growing Focus on Sustainability and Eco-Certification

The shift toward sustainable production practices is creating new opportunities for eco-focused testing services. Manufacturers are prioritizing recyclable materials, energy efficiency, and reduced emissions, requiring environmental validation at every stage of production. Testing labs are developing specialized protocols for eco-certification and green compliance. This evolution supports both corporate sustainability goals and consumer demand for environmentally responsible products.

- For instance, Thermo Fisher expanded environmentally preferable lab products to more than 60,000 in 2024.

Key Challenges

High Operational and Infrastructure Costs

Product testing laboratories face high capital and maintenance costs due to advanced equipment, skilled personnel, and accreditation processes. Establishing modern testing infrastructure that meets global standards demands continuous investment. Smaller testing firms often struggle to compete with established players offering comprehensive service portfolios. These financial constraints can limit scalability and restrict technological adoption in cost-sensitive regions.

Shortage of Skilled Professionals

The increasing sophistication of testing technologies requires highly skilled professionals with expertise in data analysis, materials science, and regulatory compliance. However, the global shortage of qualified technicians and engineers poses a major challenge for testing facilities. Training and retention costs continue to rise as laboratories compete for talent. This skill gap can delay project timelines and affect testing accuracy, impacting service efficiency.

Regional Analysis

North America

North America dominates the product testing lab services market with a share of nearly 37.6% in 2024. The region’s leadership is driven by stringent product safety regulations from agencies such as the FDA, EPA, and CPSC. High demand from the consumer goods, pharmaceutical, and electronics sectors fuels steady growth. The United States remains the primary hub due to advanced testing infrastructure and the presence of major certified laboratories. Rising innovation in automotive and electrical testing services further supports the region’s dominance and continuous technological adoption.

Europe

Europe accounts for around 29.4% share of the product testing lab services market in 2024. The region benefits from strict quality standards such as CE marking and REACH compliance, particularly in chemicals, machinery, and food safety. Germany, the UK, and France lead in offering accredited testing and certification services. Growing focus on environmental sustainability and green compliance supports expansion in eco-testing and energy efficiency assessments. Continuous modernization of industrial testing facilities and harmonization of regulatory frameworks across the EU further strengthen regional growth prospects.

Asia Pacific

Asia Pacific holds approximately 24.1% share of the product testing lab services market in 2024 and is expected to witness the fastest growth through 2032. Expanding manufacturing bases in China, Japan, India, and South Korea are driving strong demand for testing services across electronics, automotive, and consumer goods. The region’s growth is fueled by increasing exports, evolving safety standards, and the adoption of advanced testing technologies. Rising foreign investments and the growing number of accredited testing facilities are further supporting the expansion of regional market capacity.

Latin America

Latin America captures about 5.3% share of the global product testing lab services market in 2024. The region’s growth is supported by increasing regulatory enforcement and industrial diversification in Brazil and Mexico. Demand is rising from food and beverage, pharmaceuticals, and consumer goods sectors. Regional governments are strengthening product certification and quality assurance frameworks to align with international standards. Investments in local testing facilities and partnerships with international certification bodies are enhancing market accessibility and reliability across key industries.

Middle East & Africa

The Middle East & Africa region accounts for nearly 3.6% share of the product testing lab services market in 2024. Growing infrastructure development, consumer product imports, and pharmaceutical expansion are contributing to market growth. The United Arab Emirates and Saudi Arabia are leading in laboratory modernization and accreditation initiatives. Increased government emphasis on product safety compliance and energy efficiency standards is driving the adoption of testing services. Expanding trade activities and ongoing diversification in industrial manufacturing sectors continue to support regional progress.

Market Segmentations:

By Service Type

- Mechanical Testing

- Chemical Testing

- Environmental Testing

- Electrical Testing

By End User

- Consumer Goods

- Pharmaceuticals

- Food and Beverage

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the product testing lab services market is characterized by the presence of major global players such as Bureau Veritas, Eurofins Scientific, Applus+, DEKRA SE, Element Materials Technology, Exova Group Limited, ALS Limited, TÜV SÜD, Intertek Group plc, DNV GL, BSI Group, SGS SA, CSA Group, NSF International, and UL LLC. These companies focus on expanding their testing portfolios through advanced automation, digital analytics, and specialized certification services to meet evolving regulatory standards. Strategic mergers, acquisitions, and regional expansions enhance their service reach and technical expertise. Leading firms emphasize sustainability testing, product lifecycle validation, and rapid turnaround solutions to gain competitive advantage. Continuous investments in laboratory infrastructure, AI-based inspection systems, and cloud-integrated data management strengthen operational efficiency. The market competition remains intense, driven by technological innovation, global accreditation capabilities, and growing customer demand for reliable and traceable product testing solutions.

Key Player Analysis

- Bureau Veritas

- Eurofins Scientific

- Applus+

- DEKRA SE

- Element Materials Technology

- Exova Group Limited

- ALS Limited

- TÜV SÜD

- Intertek Group plc

- DNV GL

- BSI Group

- SGS SA

- CSA Group

- NSF International

- UL LLC

Recent Developments

- In 2025, Eurofins announced the expansion of its Consumer Product Testing network in Bangalore, India, doubling the laboratory’s footprint and enhancing capabilities to meet textile, apparel, footwear, and leather goods market needs.

- In 2025, TÜV SÜD expanded its test laboratory in Frankfurt, Germany, adding new testing facilities for car charging plugs, performance testing for tiny batteries, power tools, and chemical testing including PFAS analysis, strengthening safety, sustainability, and performance testing capacities.

- In 2025, Applus+ opened a new high-tech testing and certification hub in Qingpu, Shanghai, China, spanning 8,000 m² with multidisciplinary labs focused on automotive electronics (EMC, OTA, safety), medical device testing, software, and cybersecurity evaluation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Service Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing global regulatory mandates will continue to drive demand for independent product testing services.

- Advancements in automation and AI-driven testing will enhance efficiency and accuracy across laboratories.

- Rising product complexity will increase the need for multi-parameter and performance-based testing solutions.

- Expansion of e-commerce and cross-border trade will boost certification and compliance requirements.

- Environmental and sustainability testing will gain prominence with green product certification demand.

- Increased investment in digital lab infrastructure will improve operational scalability and data transparency.

- Collaboration between manufacturers and accredited labs will strengthen product reliability standards.

- Emerging economies will witness rapid expansion of testing facilities to meet export needs.

- Integration of cloud-based testing data systems will support faster decision-making and traceability.

- Growing consumer awareness of safety and quality will sustain long-term market growth potential.