Market Overview

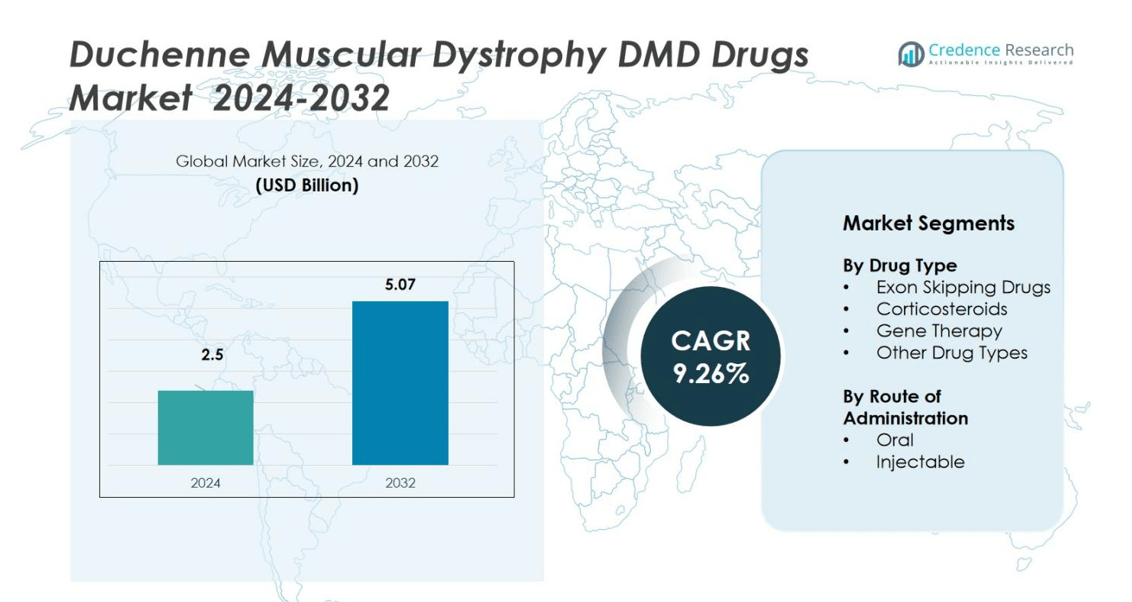

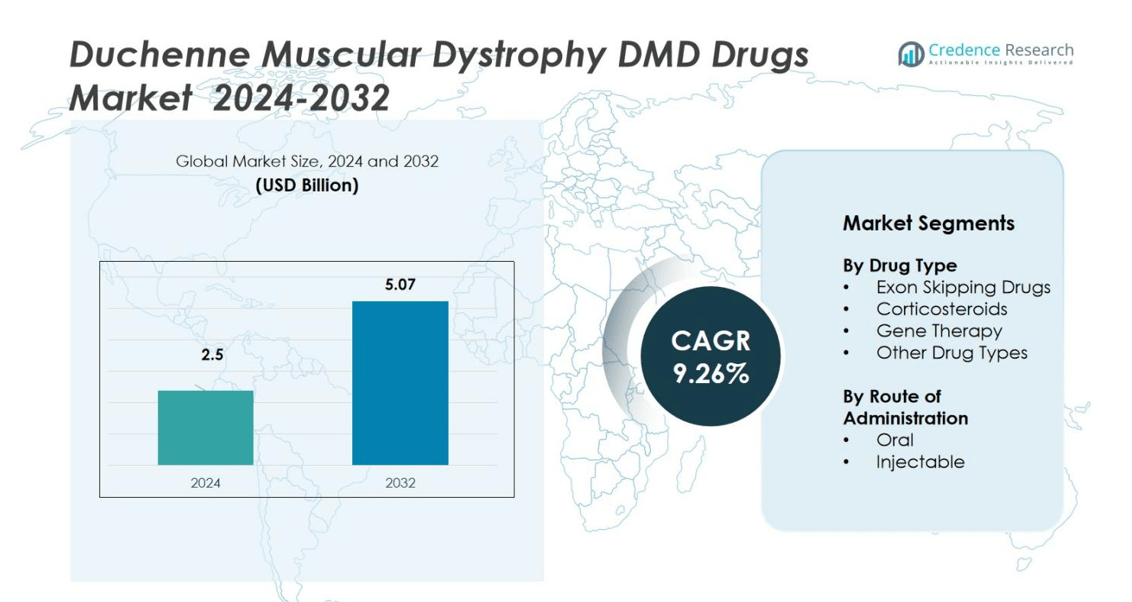

Duchenne Muscular Dystrophy (DMD) Drugs Market size was valued at USD 2.5 billion in 2024 and is anticipated to reach USD 5.07 billion by 2032, growing at a CAGR of 9.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Duchenne Muscular Dystrophy (DMD) Drugs Market Size 2024 |

USD 2.5 billion |

| Duchenne Muscular Dystrophy (DMD) Drugs Market, CAGR |

9.26% |

| Duchenne Muscular Dystrophy (DMD) Drugs Market Size 2032 |

USD 5.07 billion |

The Duchenne Muscular Dystrophy (DMD) Drugs Market is led by key players including Sarepta Therapeutics, Inc., PTC Therapeutics, Capricor Therapeutics, Inc., Catalyst Pharmaceuticals, Inc., ITALFARMACO S.p.A., NS Pharma, Inc., FibroGen, Inc., Santhera Pharmaceuticals, EspeRare Foundation, and Aurobindo Pharma. These companies focus on developing gene therapies, exon-skipping drugs, and corticosteroid-based treatments to improve disease management and patient outcomes. North America dominated the global market with a 47% share in 2024, driven by strong R&D investments, advanced healthcare infrastructure, and supportive regulatory frameworks. Europe and Asia-Pacific follow, benefiting from rising clinical trial activity and growing patient access to innovative therapies.

Market Insights

- The Duchenne Muscular Dystrophy (DMD) Drugs Market was valued at USD 2.5 billion in 2024 and is projected to reach USD 5.07 billion by 2032, expanding at a CAGR of 9.26% during the forecast period.

- Market growth is driven by advancements in gene therapy and exon-skipping technologies that improve treatment precision and long-term outcomes for patients.

- Key trends include the integration of digital health tools, expansion of clinical trials in emerging markets, and increased focus on personalized medicine.

- The market is moderately consolidated, with major players such as Sarepta Therapeutics, PTC Therapeutics, and NS Pharma leading innovation through gene-targeted drugs and strategic collaborations.

- North America holds a 47% market share, followed by Europe (28%) and Asia-Pacific (17%), while the exon-skipping drugs segment dominates with a 38% share due to rising regulatory approvals and improved efficacy.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Drug Type

The Duchenne Muscular Dystrophy (DMD) Drugs Market by drug type is segmented into exon-skipping drugs, corticosteroids, gene therapy, and other drug types. Exon-skipping drugs held the dominant position with a 38% market share in 2024, supported by increasing regulatory approvals and precision medicine approaches. These drugs, such as Sarepta Therapeutics’ eteplirsen and golodirsen, target specific genetic mutations to restore dystrophin production. Rising clinical success rates and ongoing pipeline developments strengthen the adoption of exon-skipping therapies.

- For instance, Elevidys gained expanded FDA approval on June 20, 2024. It now has traditional approval for ambulatory patients ≥4 years and accelerated approval for non-ambulatory patients ≥4 years, broadening access nationwide.

By Route of Administration

Based on route of administration, the market is segmented into oral and injectable drugs. The oral segment accounted for a 57% market share in 2024, driven by the convenience, improved patient compliance, and long-term treatment suitability of corticosteroid formulations such as deflazacort. Oral drugs remain widely prescribed for managing inflammation and slowing disease progression in ambulatory patients. However, the injectable segment is expanding steadily, supported by the increasing launch of gene therapies and exon-skipping treatments that require parenteral administration for optimal efficacy.

- For instance, deflazacort oral suspension received updates in 2024 regarding immunosuppression warnings and dosage adjustments with CYP3A4 inhibitors, highlighting its established clinical use.

Key Growth Drivers

Advancements in Gene Therapy and Exon-Skipping Technologies

Rapid progress in genetic therapies drives strong growth in the DMD drugs market. The success of exon-skipping drugs such as eteplirsen and viltolarsen showcases the potential of personalized medicine for treating mutation-specific cases. Increasing investments in adeno-associated virus (AAV)–based gene therapies improve long-term outcomes by targeting the root cause of the disease. Companies like Sarepta Therapeutics and PTC Therapeutics continue expanding R&D to enhance safety, durability, and access to novel treatment options.

- For instance, Sarepta’s next-generation exon-skipping agent, SRP-5051, showed in clinical trials a 12.2-fold increase in dystrophin expression and a 24.6-fold improvement in exon skipping compared to eteplirsen, highlighting the potential for enhanced efficacy with newer therapies.

Rising Diagnosis Rates and Early Disease Detection

Improved diagnostic tools and newborn screening programs boost early detection of DMD, enabling timely intervention. The adoption of genetic testing and next-generation sequencing helps identify patients suitable for advanced therapies. Governments and health organizations are promoting awareness campaigns to improve disease recognition. This early diagnosis trend enhances patient survival rates and accelerates demand for both corticosteroids and gene-targeted drugs across global healthcare systems.

- For instance, the New York State Newborn Screening Program screened over 15,000 newborns in a pilot study, identifying infants with DMD and allowing early referral for specialized care and clinical trial participation.

Growing Regulatory Support and Drug Approvals

Regulatory agencies such as the U.S. FDA and EMA actively support accelerated approval pathways for DMD drugs. This encourages innovation and faster access to life-saving treatments. Frequent designations like “Orphan Drug” and “Breakthrough Therapy” status enable companies to bring advanced solutions to market efficiently. These supportive frameworks also reduce clinical and commercial risks, motivating pharmaceutical players to expand their DMD-focused portfolios.

Key Trends & Opportunities

Integration of Digital Health and Real-World Evidence

Digital platforms and data analytics are increasingly used to monitor patient outcomes in DMD therapy. Wearable devices and telehealth solutions help track muscle strength and disease progression remotely. Real-world evidence collected from these tools supports better treatment evaluation and post-market surveillance. Pharmaceutical companies leverage this data to refine dosing regimens and improve long-term therapy effectiveness.

- For instance, Aparito, in collaboration with Duchenne UK, developed a wearable device and disease-specific app to continuously monitor physical function and capture patient-reported outcomes in DMD.

Expansion of Clinical Trials in Emerging Markets

Pharmaceutical companies are expanding clinical trial operations into Asia-Pacific and Latin America to access untapped patient populations. This trend helps reduce trial costs and accelerates recruitment for rare disease research. Expanding trials across diverse genetic backgrounds improves understanding of therapy response variations. Governments in these regions are offering incentives and simplified regulatory pathways to attract investments in rare disease research.

- For instance, Novartis is running 17 clinical programs for rare diseases like spinal muscular atrophy and immune thrombocytopenic purpura specifically in India, supported by favorable regulatory pathways and patient access initiatives.

Key Challenges

High Cost of Advanced Therapies

The significant cost of gene therapies and exon-skipping drugs limits accessibility for many patients. Treatments can exceed hundreds of thousands of dollars per patient annually, creating reimbursement challenges. Limited insurance coverage and unequal healthcare infrastructure in developing economies further restrict adoption. This financial barrier pressures governments and private payers to develop sustainable funding mechanisms.

Limited Long-Term Efficacy and Safety Data

Despite recent breakthroughs, long-term efficacy data for several novel therapies remain limited. Safety concerns related to immune reactions and viral vector delivery continue to pose clinical challenges. The need for extended follow-up studies and post-marketing surveillance delays widespread acceptance. Continuous research is essential to ensure durable therapeutic outcomes and patient safety over extended treatment periods.

Regional Analysis

North America

North America dominated the Duchenne Muscular Dystrophy (DMD) Drugs Market with a 47% market share in 2024, driven by high disease awareness, strong healthcare infrastructure, and early adoption of advanced therapies. The U.S. leads regional growth due to extensive research funding, favorable reimbursement policies, and the presence of key companies like Sarepta Therapeutics and PTC Therapeutics. Increasing FDA approvals for gene and exon-skipping therapies strengthen the regional outlook. Supportive initiatives from organizations such as the Muscular Dystrophy Association further enhance patient access to innovative treatments and clinical programs.

Europe

Europe held a 28% market share in 2024, supported by government-backed rare disease programs and well-structured healthcare systems. Countries such as Germany, the U.K., and France lead market expansion through early adoption of gene therapy and supportive reimbursement frameworks. The European Medicines Agency (EMA) continues granting conditional approvals to accelerate DMD drug access. Rising collaborations between pharmaceutical companies and academic institutions enhance innovation and long-term treatment outcomes. Growing patient advocacy networks also contribute to higher diagnosis rates and clinical participation across the region.

Asia-Pacific

The Asia-Pacific region captured a 17% market share in 2024 and is expected to register the fastest growth during the forecast period. Expanding healthcare infrastructure and increased investment in genetic research drive the regional market. Japan and China are leading in clinical studies and regulatory advancements for DMD therapies. Growing awareness, improved access to diagnostics, and expanding patient registries enhance treatment adoption. Strategic partnerships between local and international biopharmaceutical firms foster innovation and technology transfer, strengthening the region’s competitive position in rare disease therapeutics.

Latin America

Latin America accounted for a 5% market share in 2024, led by Brazil and Mexico. The market benefits from growing government efforts to include rare diseases in national healthcare agendas. Increasing collaborations with global pharmaceutical companies help introduce innovative therapies in the region. However, high treatment costs and limited specialized centers continue to restrict access. Expanding participation in international clinical trials and patient advocacy programs is expected to gradually improve treatment availability and market penetration.

Middle East & Africa

The Middle East & Africa region represented a 3% market share in 2024, driven by improving healthcare infrastructure and growing awareness of genetic disorders. Countries such as Saudi Arabia, the UAE, and South Africa are increasing investments in rare disease management. Adoption of advanced diagnostic tools and partnerships with global biopharma firms are enhancing accessibility to DMD therapies. Despite progress, high therapy costs and limited reimbursement policies constrain broader adoption. Ongoing government initiatives to expand clinical research and treatment funding are expected to support future market growth.

Market Segmentations:

By Drug Type

- Exon Skipping Drugs

- Corticosteroids

- Gene Therapy

- Other Drug Types

By Route of Administration

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Duchenne Muscular Dystrophy (DMD) Drugs Market is defined by the presence of leading companies such as Sarepta Therapeutics, Inc., PTC Therapeutics, Capricor Therapeutics, Inc., Catalyst Pharmaceuticals, Inc., ITALFARMACO S.p.A., NS Pharma, Inc., FibroGen, Inc., Santhera Pharmaceuticals, EspeRare Foundation, and Aurobindo Pharma. Sarepta Therapeutics continues to lead with a broad pipeline of exon-skipping and gene therapy products targeting various dystrophin mutations. PTC Therapeutics and NS Pharma are expanding their global footprint with regulatory approvals and new clinical data supporting efficacy in ambulatory and non-ambulatory patients. Capricor Therapeutics focuses on cell-based therapies offering regenerative benefits, while ITALFARMACO and Santhera strengthen their positions with corticosteroid alternatives and mitochondrial function enhancers. The market remains competitive, driven by innovation, partnerships, and accelerated regulatory pathways aimed at addressing the unmet needs of DMD patients worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2024, Novartis completed the acquisition of Kate Therapeutics in a deal worth up to USD 1.1 billion. This move strengthened Novartis’ gene therapy pipeline by adding Kate’s pre-clinical Duchenne Muscular Dystrophy (DMD) program, which uses advanced muscle-targeted AAV vectors.

- In January 2024, Santhera Pharmaceuticals AG launched its drug Agamree (vamorolone) for DMD patients aged four years and above in Germany, and in June 2024 entered an early-access program in China in partnership with Sperogenix Therapeutics.

- In September 2025, Italfarmaco S.p.A. released long-term clinical data on Givinostat, confirming sustained efficacy and safety in slowing disease progression among DMD patients over multi-year studies.

Report Coverage

The research report offers an in-depth analysis based on Drug Type, Route of Administration and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Gene therapy is expected to remain the primary growth driver through expanded clinical adoption.

- Exon-skipping drugs will gain wider approval across additional dystrophin gene mutations.

- Combination therapies will emerge to enhance treatment durability and functional outcomes.

- Regulatory agencies will continue granting accelerated approvals for innovative DMD treatments.

- Increased funding for rare disease research will support new pipeline developments.

- Pharmaceutical partnerships will strengthen manufacturing scalability and global distribution.

- Digital health tools will improve long-term patient monitoring and therapy optimization.

- Asia-Pacific will witness rapid expansion due to improved diagnostics and healthcare access.

- Cost-reduction strategies and reimbursement reforms will enhance treatment affordability.

- Continued advancements in personalized medicine will transform disease management outcomes.