Market Overview

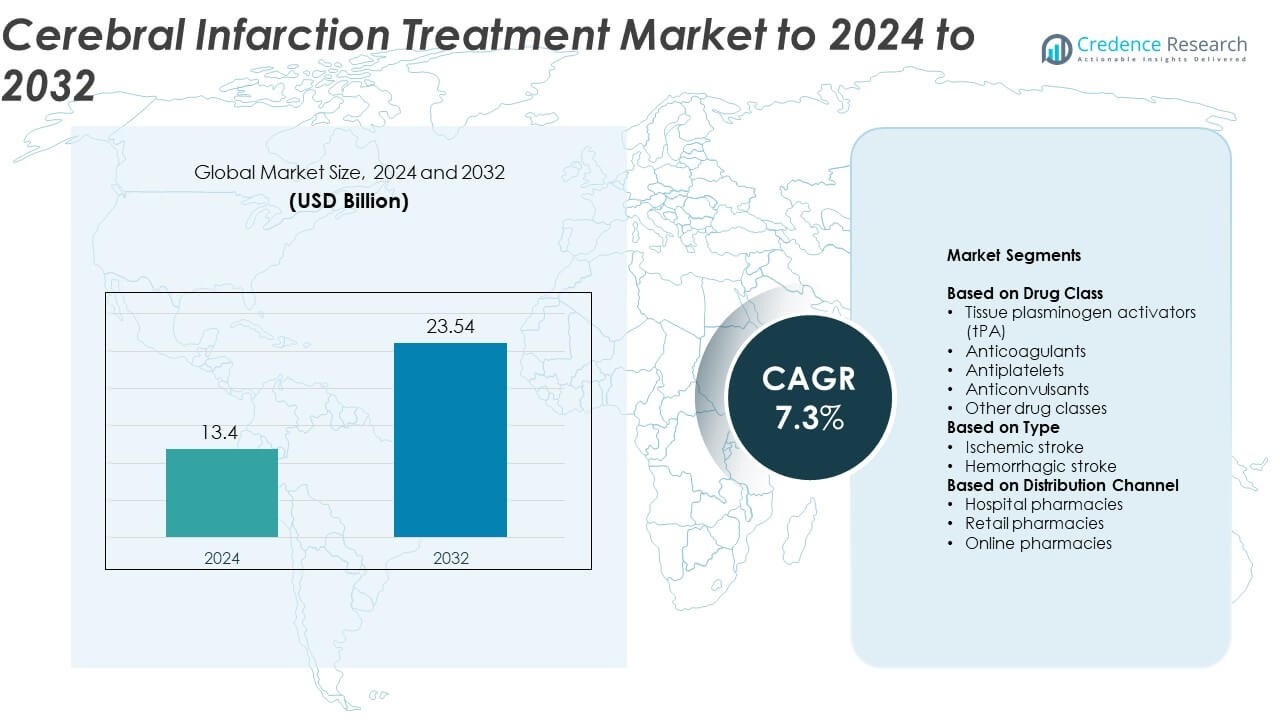

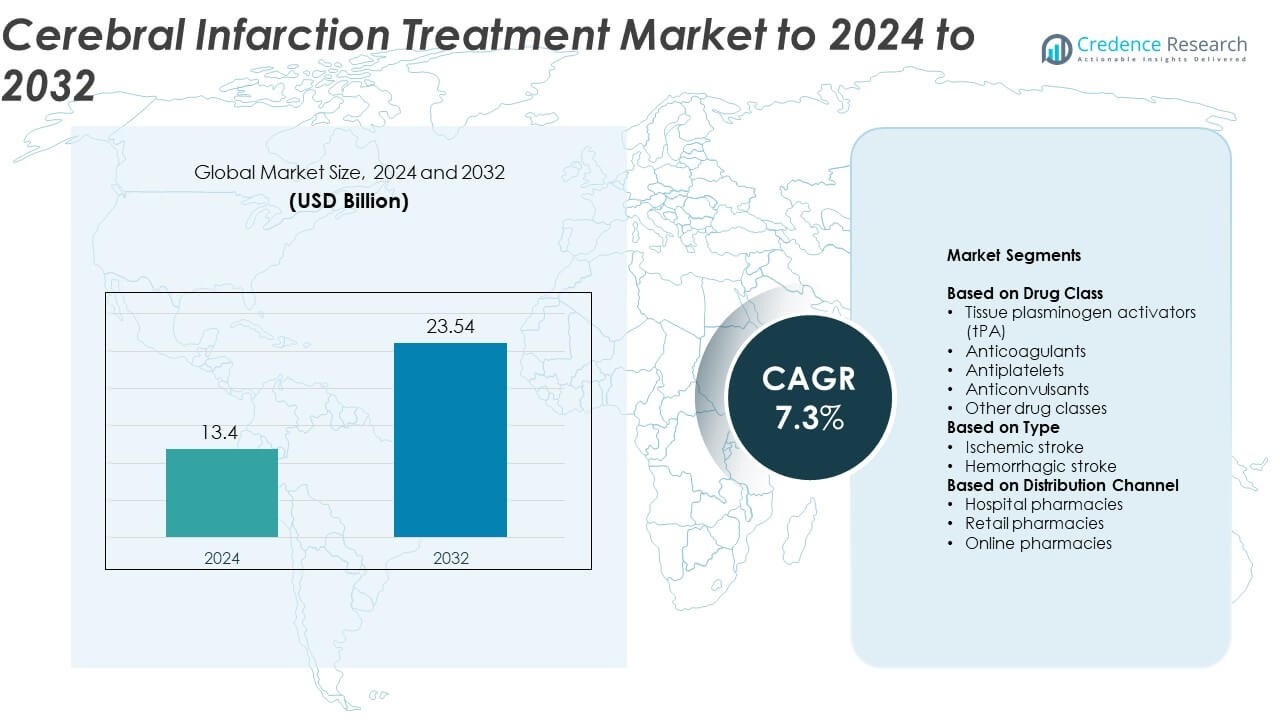

Cerebral Infarction Treatment Market size was valued at USD 13.4 Billion in 2024 and is anticipated to reach USD 23.54 Billion by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cerebral Infarction Treatment Market Size 2024 |

USD 13.4 Billion |

| Cerebral Infarction Treatment Market, CAGR |

7.3% |

| Cerebral Infarction Treatment Market Size 2032 |

USD 23.54 Billion |

The cerebral infarction treatment market is dominated by major pharmaceutical companies including AstraZeneca, Pfizer, Bayer, Biogen, Johnson & Johnson, Merck & Co., Abbott Laboratories, Boehringer Ingelheim, Novartis, Sanofi, and Amgen. These players lead through extensive R&D investments, innovative drug development, and strategic alliances focused on advanced thrombolytic and neuroprotective therapies. North America remains the leading region, accounting for approximately 39.2% share in 2024, driven by superior healthcare infrastructure and early adoption of new treatments. Europe follows with 28.5% share, supported by strong clinical research networks, while Asia Pacific is emerging rapidly with 22.6% share due to growing healthcare access and rising stroke incidence.

Market Insights

- The cerebral infarction treatment market was valued at USD 13.4 Billion in 2024 and is projected to reach USD 23.54 Billion by 2032, expanding at a CAGR of 7.3%.

- Rising stroke prevalence, aging populations, and growing awareness of early intervention are driving demand for advanced thrombolytic and neuroprotective therapies.

- Increasing use of AI-assisted diagnostics and precision medicine is shaping treatment innovation, improving recovery rates and reducing hospital stays.

- The market is moderately consolidated, with key players focusing on R&D collaborations, clinical trials, and product expansions to strengthen global reach.

- North America holds 39.2% share, followed by Europe with 28.5% and Asia Pacific with 22.6%, while tissue plasminogen activators lead the drug class segment with 39.6% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Drug Class

The tissue plasminogen activators segment dominates the cerebral infarction treatment market with nearly 39.6% share in 2024. This dominance is due to their proven effectiveness in dissolving blood clots and restoring cerebral blood flow during acute ischemic strokes. The increasing adoption of recombinant tPA formulations, such as alteplase and tenecteplase, is enhancing rapid intervention outcomes. Rising clinical awareness and advancements in thrombolytic therapy protocols across developed healthcare systems further support this segment’s leadership, while antiplatelets and anticoagulants continue to expand their role in long-term stroke prevention.

- For instance, Genentech’s Activase label specifies 0.9 mg/kg dosing, capped at 90 mg, with a 1-minute bolus then infusion over 60 minutes.

By Type

The ischemic stroke segment holds the largest market share of around 77.4% in 2024. This segment’s leadership stems from the high global prevalence of ischemic events caused by arterial blockages and lifestyle-related risk factors such as hypertension and diabetes. Improved diagnostic imaging and early intervention strategies have boosted treatment demand for ischemic strokes. Additionally, continuous innovations in endovascular therapy and clot retrieval techniques are reinforcing the dominance of this segment in overall cerebral infarction management.

- For instance, Medtronic’s SWIFT PRIME trial enrolled 196 patients within a 6-hour window to test Solitaire thrombectomy plus IV tPA versus IV tPA alone.

By Distribution Channel

Hospital pharmacies account for the leading share of about 61.8% in 2024. Their dominance is attributed to the immediate availability of emergency care drugs and specialist supervision required during stroke treatment. The rising establishment of advanced stroke units within hospitals enhances direct access to tissue plasminogen activators and supportive care. Moreover, growing inpatient admissions for acute stroke management and the integration of hospital-based digital dispensing systems continue to strengthen this distribution channel’s role in the market.

Key Growth Drivers

Rising Prevalence of Stroke Cases

The growing incidence of stroke globally is a major driver for the cerebral infarction treatment market. Sedentary lifestyles, unhealthy diets, and an aging population are increasing the risk of ischemic and hemorrhagic strokes. The rising patient pool fuels demand for advanced therapeutic options, including thrombolytic agents and anticoagulants. Increasing hospital admissions for acute stroke management and higher investments in healthcare infrastructure further accelerate treatment adoption, particularly in developed markets with advanced emergency response systems.

- For instance, Apple’s Heart Study enrolled 419,297 participants to detect atrial fibrillation, a key stroke risk factor, demonstrating large-scale digital screening reach.

Advancements in Neurovascular Treatment Technologies

Technological innovations in neurovascular devices and pharmacological therapies significantly boost market growth. The development of rapid-acting thrombolytic drugs, image-guided interventions, and mechanical thrombectomy systems enhances treatment precision and recovery outcomes. Integration of AI-based imaging and robotic-assisted surgery supports early diagnosis and reduces treatment delays. Continuous R&D activities by pharmaceutical and medtech companies expand the therapeutic landscape, improving patient prognosis and survival rates in both ischemic and hemorrhagic stroke cases.

- For instance, Stryker’s Trevo Registry was designed to enroll up to 2,000 patients across multiple centers, capturing real-world thrombectomy usage.

Government Initiatives and Awareness Programs

Supportive public health initiatives and awareness campaigns about early stroke recognition contribute to stronger market growth. Governments and healthcare organizations are implementing national stroke programs to improve emergency response and treatment accessibility. Expanding reimbursement policies for acute stroke therapies and hospital-based interventions further drive adoption. Growing training efforts for healthcare professionals and investment in telemedicine strengthen early diagnosis and management, particularly in emerging economies with limited specialist availability.

Key Trends & Opportunities

Shift Toward Personalized and Precision Medicine

The market is witnessing a strong shift toward precision medicine and individualized treatment approaches. Genetic profiling and biomarker-based drug selection enhance treatment efficacy while minimizing adverse effects. Pharmaceutical companies are increasingly developing targeted drugs tailored to patient-specific physiological responses. Integration of predictive analytics in stroke management supports personalized care, while growing adoption of pharmacogenomics is expected to create new opportunities for effective cerebral infarction therapies.

- For instance, Genomadix’s FDA-cleared Cube CYP2C19 test identifies *2, *3, and *17 variants from a buccal swab in 1 hour.

Expansion of Digital Health and Remote Monitoring

Digital health integration is transforming stroke prevention and post-treatment monitoring. Wearable devices and mobile health applications enable real-time tracking of vital parameters and early symptom detection. Remote consultation platforms are improving access to neurologists, especially in rural areas. AI-powered predictive tools and tele-stroke programs ensure timely diagnosis and treatment, reducing mortality and long-term disabilities. This digital transformation enhances patient engagement and opens new opportunities for healthcare providers.

- For instance, Viz.ai’s VALIDATE study showed a 39.5-minute reduction from arrival to first neuro-interventional contact, and the platform is deployed in over 1,800 hospitals.

Key Challenges

High Treatment Costs and Limited Access

The high cost of advanced stroke therapies and specialized interventions remains a major barrier in low- and middle-income regions. Access to thrombolytic drugs, endovascular devices, and skilled professionals is limited in many hospitals. Inadequate healthcare infrastructure and low insurance coverage restrict patient affordability. This challenge is especially prominent in developing countries, where the cost of acute and post-stroke care burdens both patients and healthcare systems.

Risk of Complications and Treatment Limitations

Certain therapies, including tissue plasminogen activators, carry risks of bleeding and adverse reactions, restricting their use in some patients. Strict administration time windows limit therapeutic effectiveness in delayed cases. Additionally, limited availability of safe long-term anticoagulant options poses a challenge for recurrent stroke prevention. Ongoing safety concerns and side effects associated with current drugs continue to hinder broader adoption and clinical acceptance in specific patient populations.

Regional Analysis

North America

North America holds the largest share of about 39.2% in the cerebral infarction treatment market in 2024. The region’s dominance is driven by advanced healthcare infrastructure, strong reimbursement frameworks, and early adoption of innovative neurovascular therapies. High awareness about stroke management and the presence of leading pharmaceutical and medical device companies support consistent growth. The United States accounts for the majority of revenue, supported by rising stroke prevalence, strong R&D investment, and rapid uptake of AI-based diagnostic systems across hospitals and stroke centers.

Europe

Europe represents around 28.5% share of the cerebral infarction treatment market in 2024. The growing elderly population and increasing incidence of ischemic stroke are key factors driving demand for treatment solutions. Countries such as Germany, France, and the United Kingdom are investing in comprehensive stroke care networks to improve patient outcomes. Government-backed awareness initiatives and expanding access to advanced thrombolytic therapies support market expansion. Rising collaborations between hospitals and pharmaceutical companies further strengthen the region’s position in advanced cerebral infarction care.

Asia Pacific

Asia Pacific accounts for approximately 22.6% share of the cerebral infarction treatment market in 2024. The market is growing rapidly due to increasing stroke prevalence in densely populated countries such as China, India, and Japan. Rising healthcare expenditure, growing awareness of stroke prevention, and improved hospital infrastructure are boosting treatment adoption. Local pharmaceutical manufacturers are expanding generic drug production to enhance affordability. Additionally, supportive government programs for early diagnosis and rehabilitation are accelerating market growth, particularly in urban healthcare centers.

Latin America

Latin America holds a market share of nearly 5.6% in 2024. The region’s growth is supported by expanding healthcare access, rising stroke incidence, and growing public health initiatives focused on cardiovascular disease prevention. Countries such as Brazil and Mexico are witnessing higher adoption of advanced stroke management protocols. However, limited infrastructure in rural areas and high treatment costs continue to challenge widespread accessibility. Increasing private hospital investments and telemedicine integration are helping bridge treatment gaps and enhance the availability of neurovascular care.

Middle East & Africa

The Middle East & Africa region captures around 4.1% share of the cerebral infarction treatment market in 2024. Growth is mainly driven by increasing government focus on healthcare modernization and the rising burden of lifestyle-related disorders. Urban hospitals in Gulf countries are improving stroke diagnosis and emergency treatment facilities. However, access to specialized stroke therapies remains limited in several African nations due to inadequate resources. Expanding pharmaceutical distribution networks and regional collaborations are expected to gradually enhance treatment accessibility across the region.

Market Segmentations:

By Drug Class

- Tissue plasminogen activators (tPA)

- Anticoagulants

- Antiplatelets

- Anticonvulsants

- Other drug classes

By Type

- Ischemic stroke

- Hemorrhagic stroke

By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the cerebral infarction treatment market features leading players such as AstraZeneca, Pfizer, Bayer, Biogen, Johnson & Johnson, Merck & Co., Abbott Laboratories, Boehringer Ingelheim, Novartis, Sanofi, Amneal Pharmaceuticals, F. Hoffmann-La Roche, Amgen, Otsuka Holdings, Daiichi Sankyo Company, and Novo Nordisk. The market is characterized by strong R&D focus, with companies prioritizing next-generation anticoagulants, neuroprotective agents, and recombinant therapies. Strategic collaborations with research institutions and hospitals are accelerating innovation in ischemic stroke management. Firms are investing heavily in AI-based diagnostic integration and precision medicine to enhance patient outcomes. Mergers, acquisitions, and pipeline diversification strategies are strengthening their global presence. Additionally, growing emphasis on regulatory approvals and regional partnerships enables faster market penetration and competitive advantage in both developed and emerging economies.

Key Player Analysis

- AstraZeneca

- Pfizer

- Bayer

- Biogen

- Johnson & Johnson

- Merck & Co.

- Abbott Laboratories

- Boehringer Ingelheim

- Novartis

- Sanofi

- Amneal Pharmaceuticals

- F. Hoffmann-La Roche

- Amgen

- Otsuka Holdings

- Daiichi Sankyo Company

- Novo Nordisk

Recent Developments

- In 2025, Johnson & Johnson MedTech launched the CEREGLIDE™ 92 catheter system, designed to allow physicians to achieve large distal access for acute ischemic stroke revascularization.

- In 2025, Boehringer Ingelheim launched a groundbreaking fast-acting acute ischemic stroke treatment in the UAE.

- In 2022, Abbott launched the Amplatzer Talisman PFO Occlusion System in Europe, designed to treat Patent Foramen Ovale (PFO) in stroke patients, featuring a pre-attached occluder to reduce preparation time for healthcare professionals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising global stroke incidence and aging populations.

- Advancements in thrombolytic and neuroprotective drugs will enhance treatment outcomes.

- AI-based imaging and early diagnostic tools will improve emergency response efficiency.

- Expanding tele-stroke networks will boost treatment access in remote areas.

- Increased government investment in stroke prevention programs will support market expansion.

- Personalized medicine and biomarker-based therapies will gain stronger clinical adoption.

- Hospitals will continue to dominate as the primary distribution channel for acute care drugs.

- Pharmaceutical collaborations will accelerate innovation in next-generation stroke therapeutics.

- Growth in emerging economies will be driven by improving healthcare infrastructure.

- Digital monitoring and rehabilitation tools will play a key role in long-term patient management.