Market Overview

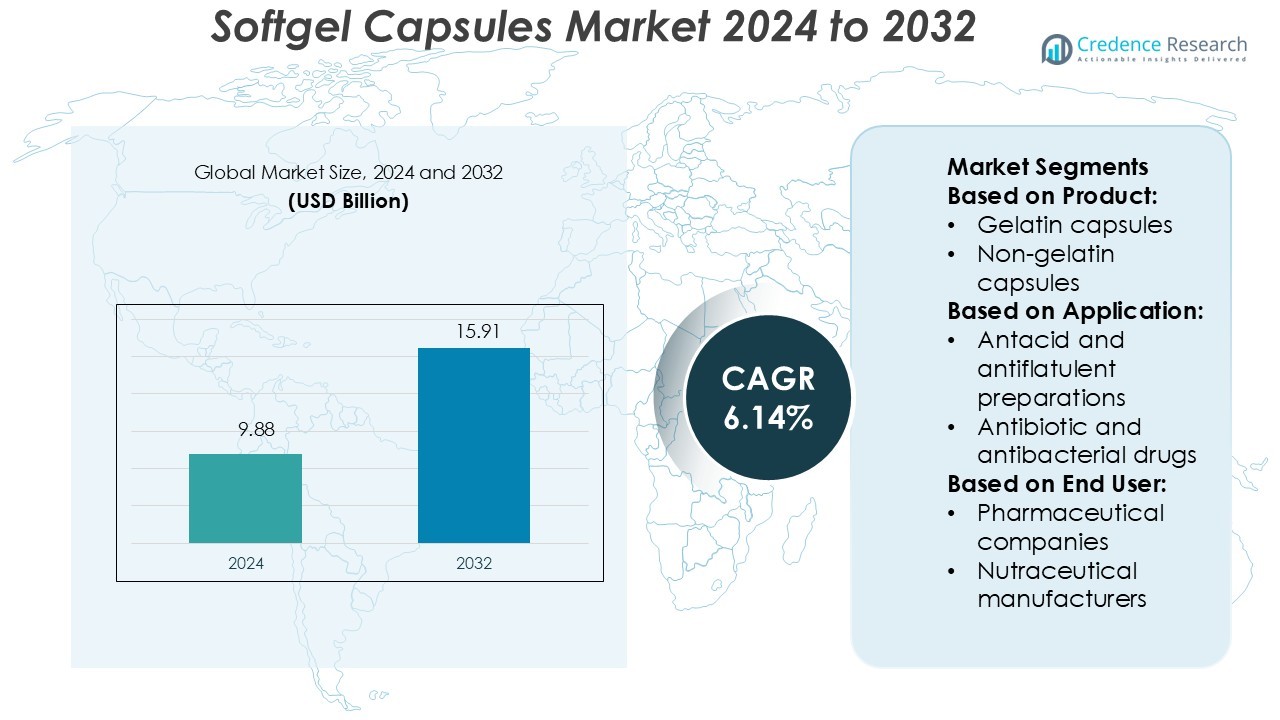

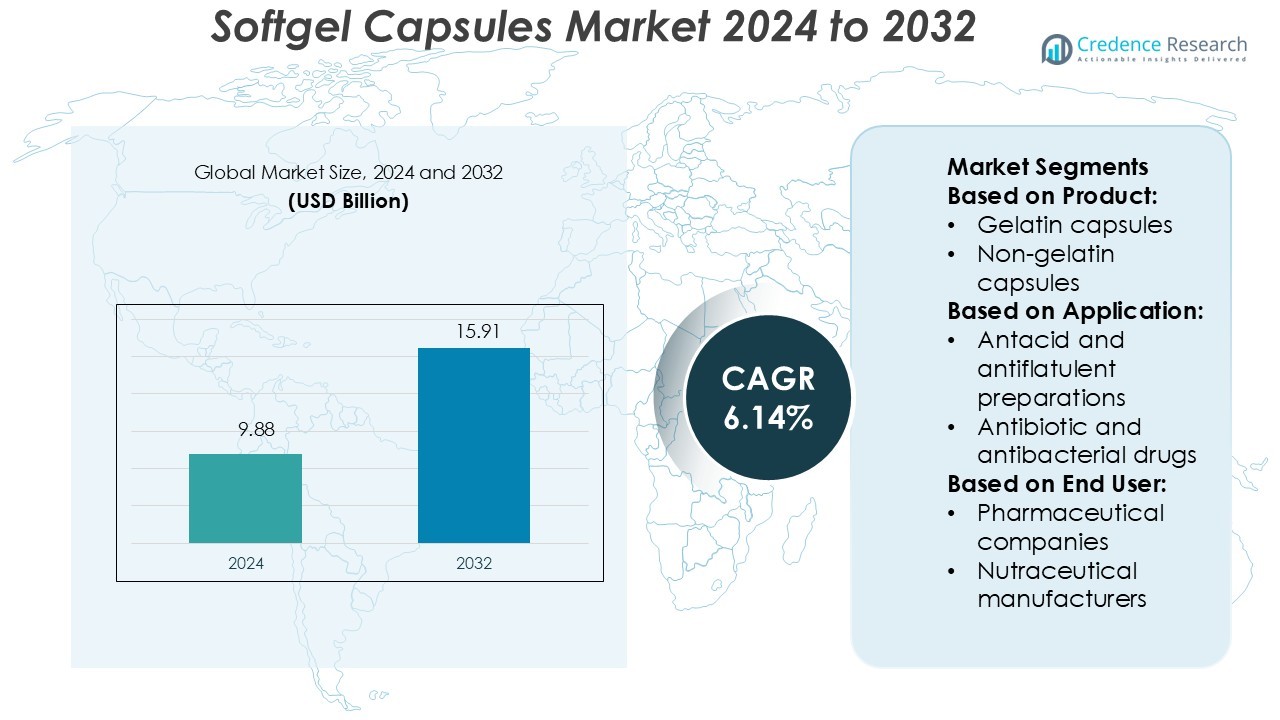

Softgel Capsules Market size was valued USD 9.88 billion in 2024 and is anticipated to reach USD 15.91 billion by 2032, at a CAGR of 6.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Softgel Capsules Market Size 2024 |

USD 9.88 Billion |

| Softgel Capsules Market, CAGR |

6.14% |

| Softgel Capsules Market Size 2032 |

USD 15.91 Billion |

The Softgel Capsules Market is highly competitive, with major players including ACG Worldwide, Bright Pharma Caps, CapsCanada, Capsuline, Chemcaps, Fortcaps Healthcare, Lonza, Natural Capsules, Qingdao Yiqing, and Roquette Frères. These companies focus on enhancing encapsulation technologies, expanding plant-based capsule production, and meeting global nutraceutical and pharmaceutical demand. Lonza leads with advanced HPMC and gelatin capsule innovations, while ACG Worldwide and Roquette Frères emphasize sustainable and clean-label solutions. North America dominates the global market with a 36% share, driven by robust pharmaceutical manufacturing, rising nutraceutical consumption, and strong regulatory frameworks that support advanced dosage form development and innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Softgel Capsules Market was valued at USD 9.88 billion in 2024 and is projected to reach USD 15.91 billion by 2032, growing at a CAGR of 6.14%.

- Rising demand for nutraceutical and dietary supplements is driving market expansion, supported by consumer preference for easy-to-swallow and high-bioavailability dosage forms.

- The market is witnessing a strong shift toward plant-based and non-gelatin capsules, reflecting global trends in vegan and allergen-free formulations.

- Key players such as Lonza, ACG Worldwide, and Roquette Frères lead innovation in encapsulation technologies and sustainability-focused manufacturing practices.

- North America dominates with a 36% share, followed by Europe at 28%, while the gelatin capsule segment remains the largest contributor, supported by its superior stability and compatibility across pharmaceutical and nutraceutical applications.

Market Segmentation Analysis:

By Product

Gelatin capsules dominate the Softgel Capsules Market with the largest share, driven by their superior bioavailability and ease of digestion. These capsules are widely used for enclosing oils and fat-soluble drugs, enhancing absorption rates. Pharmaceutical companies favor gelatin-based formats due to their smooth texture, extended shelf life, and compatibility with various formulations. For instance, key manufacturers invest in bovine and porcine gelatin sources to maintain high-quality standards and regulatory compliance. Non-gelatin variants such as HPMC and starch-based capsules are gaining traction among vegan consumers and for moisture-sensitive formulations, further diversifying the market landscape.

- For instance, Qingdao Yiqing Biotechnology Co., Ltd. produces a variety of capsules, including gelatin capsules, that meet various standards, including those from the USP and EP. As of recently, the company reports an annual capsule capacity of up to 60 billion capsules.

By Application

The antibiotic and antibacterial drugs segment holds the dominant share in the Softgel Capsules Market, driven by the need for precise dosage and improved patient compliance. Softgel formulations enhance the bioavailability of active pharmaceutical ingredients, ensuring faster therapeutic effects. For instance, leading pharmaceutical companies develop softgel-based antibiotic solutions for better stability and controlled release in gastrointestinal absorption. Antacid and antiflatulent preparations also witness notable demand due to their rapid action and convenience, while other therapeutic areas such as vitamins and dietary supplements expand usage across preventive healthcare applications.

- For instance, Bright-Poly brand of USDA Organic certified capsules has an annual production capacity of approximately 1.5 billion capsules. These capsules provide a superior oxygen barrier, making them ideal for encapsulating oxygen-sensitive materials like enzymes and live bacteria.

By End User

Pharmaceutical companies represent the leading end-user segment, accounting for the highest market share owing to large-scale adoption of softgel formulations for prescription and over-the-counter drugs. Their focus on patient-friendly delivery systems and enhanced product aesthetics boosts adoption rates. For instance, pharmaceutical manufacturers leverage automated encapsulation technologies to achieve uniform dosing and large-volume production efficiency. Nutraceutical manufacturers follow closely, driven by rising consumer interest in supplements for immunity, cardiovascular health, and nutrition. The “other end use” category includes contract manufacturing organizations supporting small-scale firms with specialized softgel production services.

Key Growth Drivers

Rising Demand for Nutraceutical and Dietary Supplements

Increasing health awareness and preventive healthcare practices are driving demand for nutraceutical softgel capsules. Consumers prefer easy-to-swallow formats for vitamins, omega-3 fatty acids, and herbal extracts. Manufacturers are expanding production capacities to meet this surge. For instance, companies such as Catalent, Inc. have increased softgel manufacturing capabilities to serve the growing supplement market. The focus on lifestyle-related disease prevention and immune health continues to strengthen the demand for nutraceutical-based softgel formulations globally.

- For instance, Roquette introduced MICROCEL® 103 SD and MICROCEL® 113 SD microcrystalline cellulose grades. These grades offer an average water activity (Aw) of no more than 0.2% and 0.1%, respectively, ensuring improved stability for moisture-sensitive formulations.

Technological Advancements in Encapsulation Techniques

Advances in encapsulation technologies are improving the efficiency, stability, and shelf life of softgel capsules. Modern rotary die encapsulation machines allow precise control over fill weight and material thickness. For instance, Lonza Group introduced enhanced encapsulation systems that enable uniform distribution of active ingredients and reduced oxidation rates. These innovations enhance bioavailability and accelerate product development, supporting pharmaceutical and nutraceutical manufacturers in launching diverse formulations quickly and cost-effectively.

- For instance, Fortcaps Healthcare Ltd. uses an automated dipping process to produce over 6.5 billion capsules annually. Their state-of-the-art facilities utilize 16 fully automatic capsule manufacturing machines, ensuring efficient and precise production of Empty Hard Gelatin (EHG) and Pullulan (Satvik certified veg) capsules.

Growing Adoption of Plant-Based and Non-Gelatin Capsules

The shift toward plant-based, vegetarian, and vegan-friendly capsules is accelerating market growth. Consumers increasingly seek products free from animal-derived ingredients, pushing companies to develop HPMC and starch-based alternatives. For instance, Aenova Group launched plant-derived softgel variants suitable for temperature-sensitive and moisture-sensitive formulations. These eco-friendly and allergen-free options appeal to ethical consumers and support regulatory compliance in regions with restrictions on animal-based ingredients.

Key Trends & Opportunities

Expansion in Personalized and Functional Formulations

The rise of personalized nutrition and functional medicine presents new opportunities for targeted softgel formulations. Manufacturers are integrating customized nutrient blends for specific health needs such as immunity, cognition, and energy enhancement. For instance, firms are using advanced R&D tools to tailor formulations with optimized release profiles and taste-masking features. This trend supports differentiation in a competitive market and aligns with the growing consumer preference for individualized health solutions.

- For instance, ACG’s ZRO series encapsulation machines, such as the ZRO 90T and ZRO 200T models, offer maximum speeds of 90,000 and 200,000 capsules per hour, respectively.

Strategic Collaborations and Contract Manufacturing Growth

Partnerships between pharmaceutical firms and contract manufacturing organizations (CMOs) are expanding softgel production capabilities. These collaborations help companies scale production, ensure quality, and accelerate product launches. For instance, Thermo Fisher Scientific’s contract manufacturing services have enabled clients to streamline softgel formulation development. The outsourcing trend benefits small and mid-sized enterprises by reducing operational costs and focusing on core competencies such as innovation and marketing.

- For instance, Natural Capsules has significantly expanded its hard-shell capsule manufacturing capabilities. The company now operates facilities with an annual production capacity of 19.50 billion empty hard gelatin (EHG) and HPMC capsules, a figure reported as of the end of FY25.

Key Challenges

High Production Costs and Capital Investment

Softgel capsule manufacturing requires significant investment in specialized equipment and skilled labor. The need for strict temperature and humidity control adds to production costs. For instance, smaller nutraceutical brands often struggle to meet regulatory and quality standards due to limited budgets. These financial constraints hinder scalability and delay product commercialization, particularly in emerging markets with limited access to advanced encapsulation technology.

Regulatory Compliance and Ingredient Limitations

Stringent regulatory standards for excipients, gelatin sourcing, and stability testing pose major challenges. Manufacturers must comply with region-specific guidelines, increasing time-to-market and operational complexity. For instance, variations in FDA, EMA, and CFDA requirements create hurdles for global distribution. Ingredient restrictions, particularly for animal-based gelatin, further limit product flexibility. These challenges demand continuous monitoring and reformulation efforts to ensure consistent market presence across multiple regions.

Regional Analysis

North America

North America holds the dominant share of 36% in the Softgel Capsules Market, supported by a well-established pharmaceutical and nutraceutical manufacturing base. The United States leads due to strong consumer awareness of dietary supplements and advanced drug delivery technologies. For instance, firms like Catalent and Thermo Fisher Scientific operate large-scale facilities offering softgel encapsulation services. Rising health consciousness and FDA-approved production standards drive innovation and demand across both prescription and OTC products. Canada and Mexico also contribute through expanding nutraceutical exports and rising preventive healthcare investments.

Europe

Europe accounts for 28% of the Softgel Capsules Market, driven by growing demand for vegan and plant-based formulations. The region’s strict regulatory framework encourages manufacturers to adopt high-quality, non-gelatin alternatives. For instance, Lonza Group’s Capsugel division in Switzerland focuses on developing HPMC and starch-based capsules for pharmaceutical and nutraceutical clients. Germany, the UK, and France remain major production hubs, supported by advanced R&D facilities and consumer preference for premium supplements. The region’s focus on sustainability and clean-label products continues to boost market penetration across diverse healthcare segments.

Asia Pacific

Asia Pacific holds a 23% share and is the fastest-growing region in the Softgel Capsules Market, fueled by expanding pharmaceutical manufacturing and dietary supplement adoption. Countries like China, India, and Japan lead due to increasing healthcare expenditure and consumer focus on wellness. For instance, India’s nutraceutical producers are investing in softgel production lines to meet export demands. The region benefits from a large population base, supportive government policies, and rising disposable incomes. Growing awareness of herbal and traditional formulations further promotes regional growth.

Latin America

Latin America represents 8% of the market, supported by the rising popularity of nutraceuticals and vitamins among urban consumers. Brazil and Mexico dominate regional sales, benefiting from growing pharmaceutical manufacturing capabilities and import partnerships. For instance, regional companies are adopting advanced encapsulation techniques to produce cost-effective softgel formulations for local and export markets. Favorable trade agreements and expanding retail healthcare networks drive demand. However, limited awareness and economic disparities pose moderate challenges to consistent market growth.

Middle East & Africa

The Middle East & Africa collectively account for 5% of the global Softgel Capsules Market, showing steady expansion through increasing healthcare infrastructure and consumer awareness. The UAE, Saudi Arabia, and South Africa are key growth contributors due to rising pharmaceutical imports and nutraceutical consumption. For instance, several international capsule manufacturers have established regional distribution partnerships to serve local markets efficiently. Government-led healthcare initiatives and a growing middle-class population support steady adoption. However, price sensitivity and limited production capacities restrain faster regional development.

Market Segmentations:

By Product:

- Gelatin capsules

- Non-gelatin capsules

By Application:

- Antacid and antiflatulent preparations

- Antibiotic and antibacterial drugs

By End User:

- Pharmaceutical companies

- Nutraceutical manufacturers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Softgel Capsules Market is characterized by the strong presence of key players such as Qingdao Yiqing, Bright Pharma Caps, Roquette Frères, Fortcaps Healthcare, ACG Worldwide, Natural Capsules, Chemcaps, Lonza, Capsuline, and CapsCanada. The Softgel Capsules Market is defined by continuous innovation, strategic partnerships, and expanding production capacities. Manufacturers are focusing on advanced encapsulation technologies to improve drug bioavailability, stability, and shelf life. The industry is witnessing a growing shift toward plant-based and non-gelatin capsules to meet consumer demand for vegan and allergen-free options. Contract manufacturing and outsourcing are becoming major trends, enabling cost efficiency and faster product launches. Companies are also investing in automation, quality control, and sustainable raw material sourcing to strengthen global competitiveness and align with evolving regulatory and environmental standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Qingdao Yiqing

- Bright Pharma Caps

- Roquette Frères

- Fortcaps Healthcare

- ACG Worldwide

- Natural Capsules

- Chemcaps

- Lonza

- Capsuline

- CapsCanada

Recent Developments

- In May 2025, ACG introduced the personalized capsule machine (PCM), a patented technology for on-demand capsule formulation. In partnership with Art of You, ACG expanded portfolio in personalized nutrition solutions.

- In March 2024, Lonza announced an agreement with Roche to acquire Genentech’s biologics manufacturing site in California. This is expected to significantly enhance Lonza’s biologics manufacturing capability and make it one of the largest sites globally.

- In December 2023, Amneal Pharmaceuticals, Inc. and Strides Pharma Science Limited together launched ofIcosapent ethyl acid soft gel capsules, a product referencing VASCEPA. The product has been in-licensed from Strides, and commercialized by Amneal in the fourth quarter of 2023.

- In March 2023, VANTAGE NUTRITION, an ACG company, acquired ComboCap, Inc. in the U.S. and BioCap in South Africa, intending to expand their technology and footprint in North America and across the globe.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for plant-based and non-gelatin capsules will continue to increase globally.

- Technological innovations will enhance encapsulation precision and improve bioavailability.

- Manufacturers will invest more in automation to boost large-scale production efficiency.

- Expansion in personalized nutrition will drive customized softgel formulations.

- Regulatory harmonization will simplify cross-border manufacturing and product approvals.

- Growth in nutraceutical consumption will strengthen market presence in developing economies.

- Sustainability-focused manufacturing practices will gain importance across leading firms.

- Strategic mergers and acquisitions will enhance global supply chain capabilities.

- The pharmaceutical sector will increasingly adopt softgels for controlled-release drugs.

- Rising e-commerce and digital health trends will support higher supplement accessibility.