Market Overview

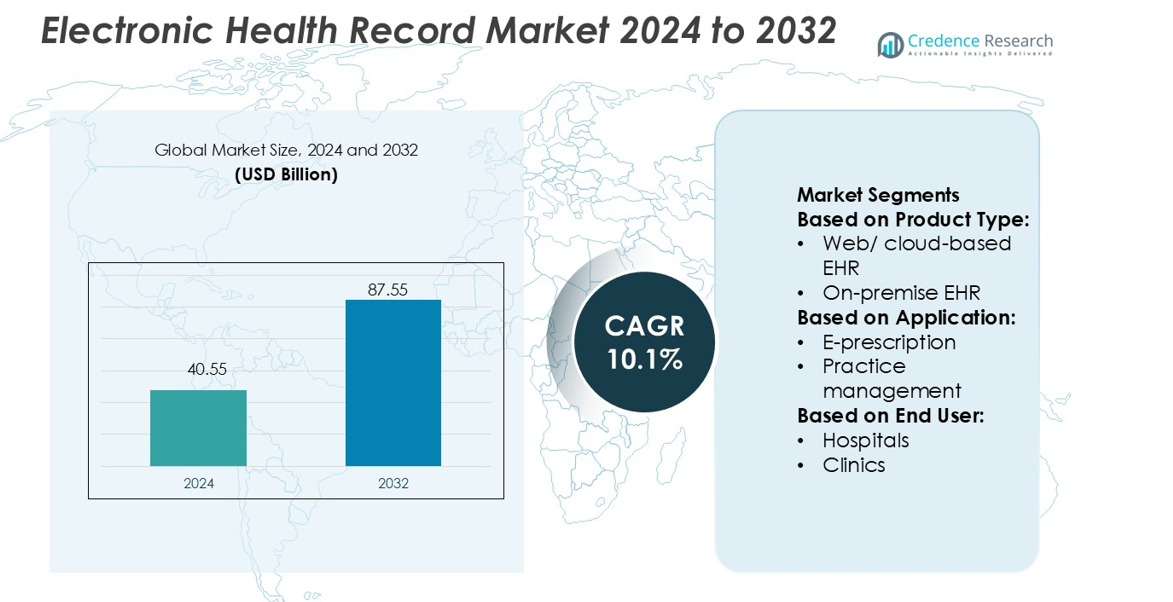

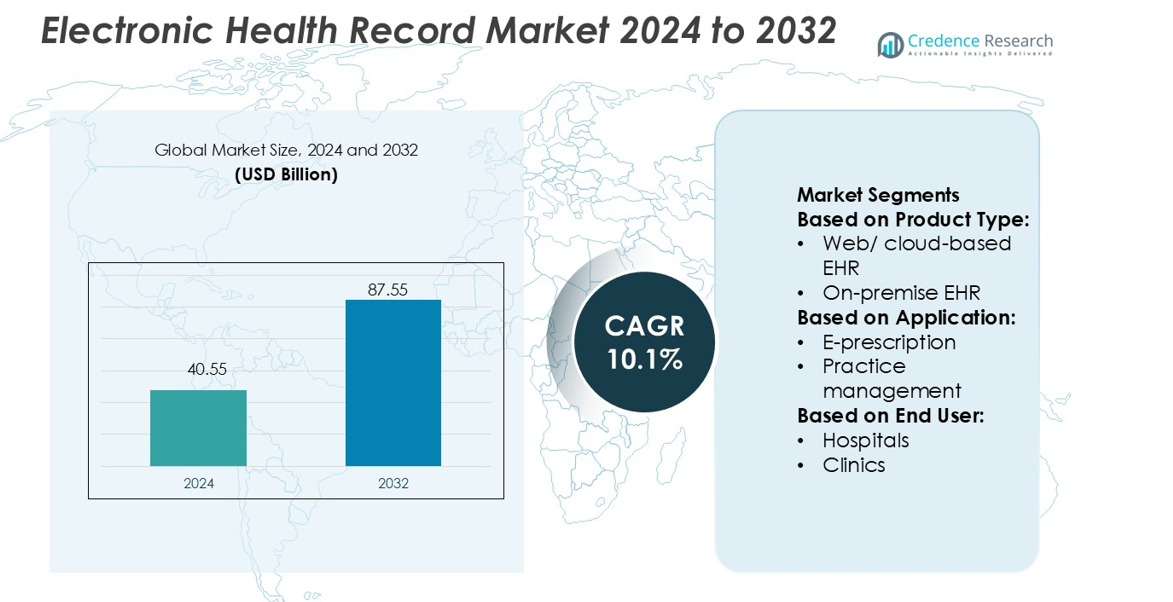

Electronic Health Record Market size was valued USD 40.55 billion in 2024 and is anticipated to reach USD 87.55 billion by 2032, at a CAGR of 10.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electronic Health Record Market Size 2024 |

USD 40.55 billion |

| Electronic Health Record Market, CAGR |

10.1% |

| Electronic Health Record Market Size 2032 |

USD 87.55 billion |

The Electronic Health Record market includes major vendors offering cloud-based platforms, analytics, and interoperability tools for hospitals and clinics. Key companies expand product portfolios to support e-prescriptions, telehealth, revenue cycle management, and secure patient data access. North America remains the leading region with 38% share, driven by strong digital infrastructure, federal health IT programs, and high adoption among large healthcare networks. Vendors invest in AI-enabled decision support, mobile access, and cybersecurity to meet regulatory standards and reduce clinical workload. Growing integration with imaging systems, labs, pharmacies, and insurance platforms continues to push modernization across the global healthcare ecosystem.

Market Insights

- The Electronic Health Record Market reached USD 40.55 billion in 2024 and will grow to USD 87.55 billion by 2032 at a CAGR of 10.1%.

- Demand rises due to cloud-based EHR platforms, faster digital workflows, e-prescriptions, and automated billing services across large and small healthcare facilities.

- Vendors expand AI-backed analytics, telehealth integration, patient portals, and cybersecurity tools to reduce errors, strengthen compliance, and improve clinical outcomes.

- Data security concerns, high installation cost in small clinics, and slow interoperability in developing countries remain key restraints for wider adoption.

- North America leads with 38% share due to strict IT regulations and hospital digitization, while cloud-based deployment holds a dominant segment share driven by lower upfront expenses and faster upgrades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Web/cloud-based EHR holds the dominant share due to easy deployment, lower upfront costs, and remote accessibility. Healthcare providers prefer subscription-based models with real-time updates, automated backups, and reduced IT maintenance. Cloud platforms allow quick scalability for large hospitals and small clinics, improving data exchange between departments. Interoperability with telehealth, imaging systems, and laboratory platforms drives adoption in developed markets. On-premise EHR remains relevant among institutions handling sensitive patient data with strict internal data control policies, but higher setup and hardware requirements slow growth compared to cloud systems.

- For instance, CureMD Healthcare’s cloud EHR supports over 15,000 providers and integrates more than 450 certified labs through a single interface, enabling secure multi-location access with sub-3 second chart loading time for clinicians.

By Application

E-prescription is the leading application due to regulatory encouragement and medication safety benefits. Digital prescriptions reduce handwriting errors, drug-to-drug interactions, and pharmacy dispensing mistakes. Many countries promote e-prescription compliance to track controlled substances and minimize fraud. Practice management and patient management also expand as hospitals integrate scheduling, billing, and clinical workflows in a unified interface. Population health management gains traction for chronic disease tracking and preventive care analytics. Verification, accuracy, and real-time data exchange are key drivers for high adoption across healthcare systems.

- For instance, ModMed platform has powered 1.7 billion clinical diagnoses processed across its specialty-specific EHR systems. ModMed also reports handling 718 million patient check-in encounters recorded in its system to date.

By End-user

Hospitals account for the largest market share because they manage high patient volumes and complex medical records. Multi-department coordination requires centralized access to patient histories, diagnostics, and treatment plans, making EHR essential for workflow continuity. Large hospital networks invest in integrated modules for clinical decision support, imaging data, telehealth, and revenue cycle management. Clinics and ambulatory surgical centers adopt EHR systems to improve appointment tracking and claims processing. Smaller end-users benefit from cloud-based solutions with low upfront investment and simple interfaces tailored for routine care.

Key Growth Drivers

Growing Need for Digital Healthcare Integration

Healthcare providers adopt EHR systems to replace paper-based records and improve data accuracy. Digital records allow coordinated care, faster diagnostics, and real-time patient updates across multiple departments. Governments encourage electronic documentation to reduce clinical errors and maintain unified health databases. Telemedicine growth and remote monitoring also depend on EHR connectivity, pushing hospitals and clinics to upgrade legacy systems. Better interoperability supports data sharing between labs, pharmacies, and imaging centers, improving treatment outcomes and administrative efficiency.

- For instance, McKesson Corporation operates an expansive clinical data exchange network (part of its Prescription Technology Solutions and related businesses) that connects more than 4,800 hospitals and 50,000 physician practices, with automated routing for over 1.5 billion annual lab and prescription transactions.

Government Programs and Compliance Requirements

Many countries enforce digital health regulations to promote transparency, safety, and data reporting. Incentive programs, national e-health initiatives, and mandatory reporting standards drive EHR adoption across public and private sectors. Healthcare facilities that meet compliance rules receive financial support and performance-based incentives, while non-compliant facilities face penalties. Mandated e-prescription, digital billing, and population health reporting increase system usage. These policy frameworks encourage hospitals and small practices to invest in certified EHR platforms and improve long-term documentation quality.

- For instance, eClinicalWorks provides a certified EHR platform that supports more than 180,000 physicians and 850,000 medical professionals across the globe. The platform includes robust e-prescribing capabilities and connects to a vast network of pharmacies.

Rising Demand for Advanced Analytics and Decision Support

Healthcare professionals rely on EHR software to track clinical data and support better decisions. Integrated analytics help identify disease patterns, improve diagnosis accuracy, and monitor chronic patients. AI-based alerts prevent medication errors and highlight high-risk cases. Hospitals use data insights for resource planning, patient flow management, and operational cost control. As preventive care programs expand, data-driven models become essential for population health initiatives. The need for fast access to medical history and structured patient information strengthens EHR adoption worldwide.

Key Trends & Opportunities

Cloud-Based and Mobile EHR Expansion

Cloud platforms gain traction because healthcare providers want flexible, scalable, and low-maintenance systems. Mobile access allows doctors to review patient charts, lab results, and prescriptions from any connected device. Small clinics and ambulatory centers adopt subscription-based solutions to avoid hardware costs. Vendors offer automated updates, cybersecurity tools, and telehealth integration, making cloud systems attractive for modern digital care models. As remote consultation increases, mobile-friendly EHR unlocks new growth opportunities in both emerging and developed markets.

- For instance, CareCloud’s cloud EHR supports more than 40,000 active healthcare providers and handles over 58 million patient records on its network. The CareCloud Companion mobile app enables physicians to access charts, notes, and diagnostic reports with a documented average login-to-record load time of under 3 seconds.

AI, Interoperability, and Automation Growth

EHR systems now include AI for predictive analytics, automated coding, and clinical decision alerts. Interoperability modules allow data exchange between hospitals, pharmacies, imaging centers, and insurance companies. Automated workflows reduce documentation time, helping doctors spend more time on patient care. Health information exchange (HIE) networks expand digital sharing across regions and care settings. These upgrades support personalized medicine, early disease detection, and streamlined billing, improving revenue cycle performance and medical accuracy.

- For instance, Epic’s Care Everywhere network supports clinical data exchange across more than 12,000 healthcare organizations and transfers over 22 million patient records each day.

Opportunity from Value-Based and Preventive Care Models

Global health systems shift from fee-based treatment to value-based outcomes, prioritizing early diagnosis and long-term patient management. EHR platforms support outcome tracking, chronic disease planning, and remote monitoring. Insurers and governments favor data-driven assessments for reimbursement, pushing hospitals to adopt stronger documentation tools. Preventive screening, vaccination monitoring, and wellness programs depend on real-time health records. This transition opens new opportunities for analytics-focused EHR vendors and population health platforms.

Key Challenges

High Implementation Cost and Workflow Disruption

EHR adoption requires software licensing, data migration, staff training, and hardware upgrades. Small clinics often avoid large investments or delay migration from paper systems. Initial deployment disrupts daily workflows, causing slower patient processing and higher administrative pressure. Some facilities struggle with change management as staff adapt to digital entry and new protocols. Although cloud systems reduce costs, full-scale integration remains expensive for large hospitals with legacy infrastructure.

Data Security Risks and Interoperability Issues

EHR systems face cybersecurity threats, including ransomware and unauthorized data access. Hospitals must follow strict data protection standards to prevent breaches and loss of sensitive health records. Many platforms still lack seamless interoperability, causing delays in data sharing across vendors or care settings. Incomplete integration leads to duplicate tests, administrative errors, and limited clinical visibility. These issues reduce user trust and force healthcare providers to invest heavily in security and compliance upgrades.

Regional Analysis

North America

North America leads the Electronic Health Record (EHR) market with 38% share, supported by strong healthcare IT adoption, strict regulatory reporting, and high spending per patient. Hospitals use EHR systems for interoperability, billing accuracy, and clinical decision support. The U.S. benefits from federal incentives, Meaningful Use standards, and cloud-based upgrades in large health networks. Canada focuses on unified patient records and telehealth integration across provinces. Vendors expand analytics, e-prescription, and mobile access to meet physician demand. Rising chronic diseases and digital appointments continue to strengthen regional growth and modernization of legacy systems.

Europe

Europe holds 27% share due to nationwide e-health policies, cross-border data standards, and strong public healthcare funding. The EU promotes secure patient data exchange, e-prescription services, and digital health passports that boost EHR integration across hospitals and clinics. Germany, France, and the U.K. accelerate cloud migration and mobile access for physicians. Governments support cybersecurity, AI diagnostics, and interoperability frameworks to link primary care and specialty centers. Demand increases in Eastern Europe, driven by digital reforms, new hospital infrastructure, and training programs for medical staff.

Asia-Pacific

Asia-Pacific captures 23% share and represents the fastest-growing region. Governments invest in digital health records to improve care access, insurance claims, and population health tracking. China, Japan, India, Australia, and South Korea enhance hospital digitization and adopt cloud-based platforms due to lower cost and scalable deployment. Mobile health, telemedicine, and AI tools integrate with EHRs for remote prescriptions and diagnostics. Private hospitals expand digital workflows to compete on patient experience and efficiency. Large patient populations and rising chronic diseases push demand for secure data management and analytics-backed treatments.

Latin America

Latin America accounts for 7% share with steady progress in Brazil, Mexico, Chile, and Colombia. Public hospitals digitize medical records to reduce paper-based errors, improve billing, and coordinate care. Private clinics adopt cloud-based EHRs for cost savings and faster deployment. Governments work on interoperability and data protection rules to support national digital health frameworks. Telehealth expansion after the pandemic increases demand for secure record access across remote regions. Vendors offer multilingual platforms and mobile portals for patients, boosting engagement and driving modernization in urban healthcare networks.

Middle East & Africa

The Middle East & Africa hold 5% share, driven by modernization of hospital infrastructure and new health insurance systems. Gulf countries invest in smart hospitals, AI-enabled diagnostics, and integrated digital platforms for patient data. Public health programs in Saudi Arabia and UAE expand national EHR networks to improve service quality and reduce medical errors. In Africa, adoption rises in private hospitals and urban clinics using cloud-based EHRs for affordability and scalability. International partnerships, training programs, and donor-funded projects strengthen digital transformation despite infrastructure and connectivity challenges.

Market Segmentations:

By Product Type:

- Web/ cloud-based EHR

- On-premise EHR

By Application:

- E-prescription

- Practice management

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electronic Health Record market remains highly competitive, with key players such as CureMD Healthcare, Greenway Health, LLC, Modernizing Medicine, McKesson Medical-Surgical Inc., eClinicalWorks, CareCloud, Inc., Epic Systems Corporation, Medical Information Technology, Inc., Athenahealth, Inc., and AdvancedMD, Inc. The Electronic Health Record market is driven by advanced digital capabilities, cloud migration, and strong demand for interoperable platforms. Vendors upgrade systems with AI-backed clinical decision support, e-prescription tools, data security layers, and integration with diagnostic labs and pharmacies. Cloud-based EHR solutions grow rapidly due to lower upfront costs and easier deployment for hospitals and clinics of all sizes. Companies focus on patient engagement features such as mobile portals, telehealth connectivity, appointment reminders, and secure access to medical history. Data analytics, population health tools, and regulatory compliance remain major investment areas. Continuous product innovation, strategic partnerships, and regional expansion define competition, while the shift toward unified healthcare information platforms strengthens long-term market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CureMD Healthcare

- Greenway Health, LLC

- Modernizing Medicine

- McKesson Medical-Surgical Inc.

- eClinicalWorks

- CareCloud, Inc.

- Epic Systems Corporation

- Medical Information Technology, Inc.

- Athenahealth, Inc.

- AdvancedMD, Inc.

Recent Developments

- In January 2025, Maruti Suzuki unveiled the production-spec version of its first electric SUV, the e Vitara, at the Bharat Mobility Global Auto Expo. The vehicle was showcased as a preview for the market.

- In June 2024, Munich Re Life US and Clareto today announced a new digital solution, Automated EHR Summarizer, which provides an intelligent and intuitive synopsis of EHR data. This solution provides the data in two formats that include user-friendly human-readable HTML report and structured digital data for integration into rules, models, and analytics.

- In May 2024, Lohia Auto released the ‘Humsafar IAQ,’ an electric three-wheeler designed for short-distance travel and last-mile connectivity. It features a range of 185 km per charge, a top speed of 48 kmph, and a seating capacity for one driver and four passengers.

- In January 2024, Eli Lilly introduced LillyDirect, a digital platform designed to streamline purchasing specific medications for patients with prescriptions addressing conditions like diabetes, obesity, and migraine. This platform offers direct access to medications by linking patients with independent teleHealth

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Cloud-based EHR platforms will gain wider adoption due to easier scaling and lower IT costs.

- AI and predictive analytics will support faster diagnosis, automated reporting, and clinical decision support.

- Interoperability standards will improve seamless data exchange between hospitals, clinics, labs, and pharmacies.

- Patient portals and mobile apps will expand self-service access to reports, prescriptions, and appointment management.

- Telehealth integration will become a default feature in EHR systems for remote care and virtual consultations.

- Cybersecurity investments will rise to protect sensitive health records and ensure regulatory compliance.

- Voice recognition and NLP tools will help reduce documentation workload for physicians and support real-time charting.

- Governments will push national digital health programs, boosting adoption in public hospitals and rural networks.

- Data-driven population health tools will help manage chronic diseases and large-scale screening programs.

- Vendors will expand globally with localized languages, regional compliance, and scalable cloud deployment models.