Market Overview:

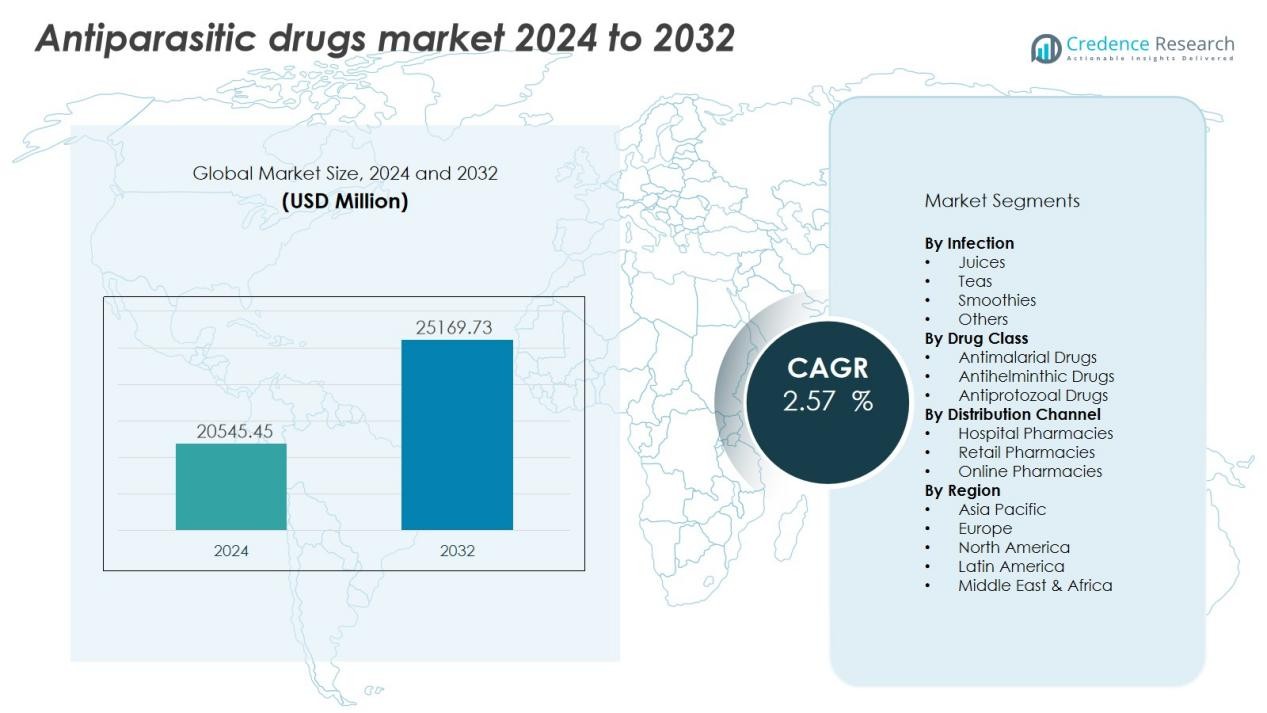

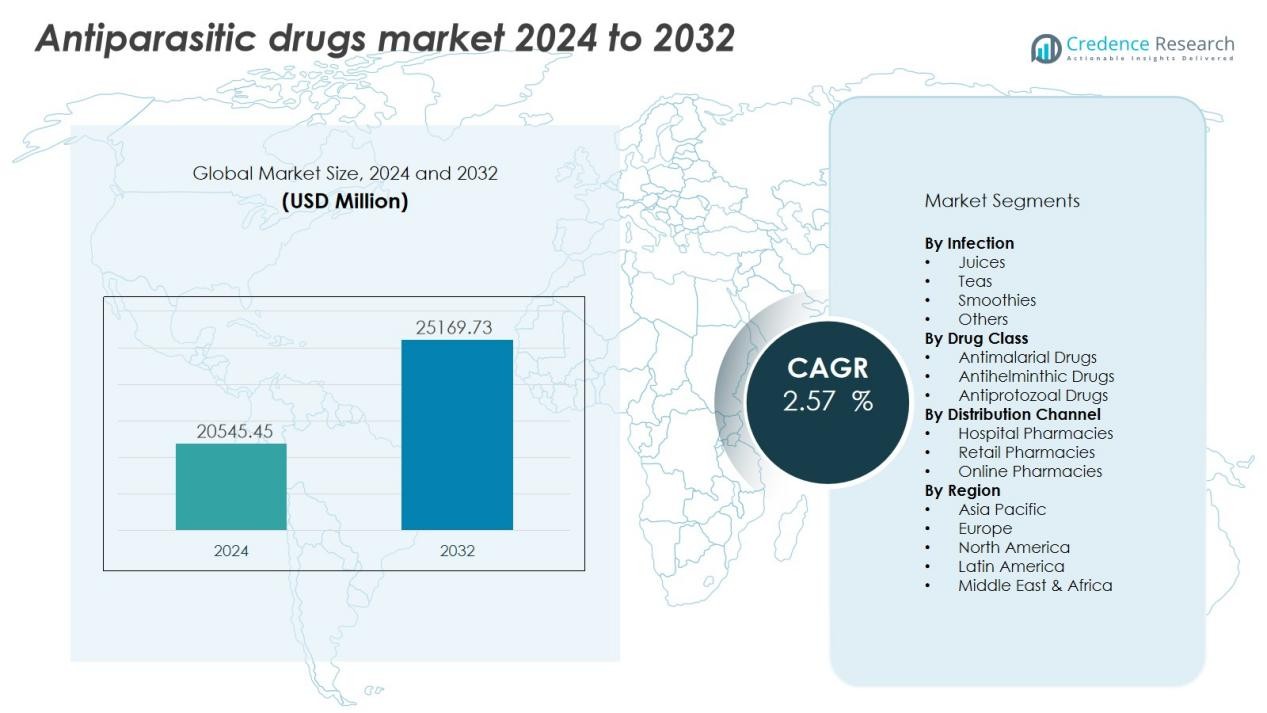

The Antiparasitic drugs market size was valued at USD 20545.45 million in 2024 and is anticipated to reach USD 25169.73 million by 2032, at a CAGR of 2.57 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Antiparasitic Drugs Market Size 2024 |

USD 20545.45 Million |

| Antiparasitic Drugs Market, CAGR |

2.57% |

| Antiparasitic Drugs Market Size 2032 |

USD 25169.73 Million |

Market growth is primarily driven by increasing awareness of parasitic diseases, improved diagnostic capabilities, and the introduction of combination therapies with higher efficacy and reduced resistance. Pharmaceutical innovation targeting neglected tropical diseases and zoonotic infections strengthens product pipelines. Government programs promoting mass drug administration and global health initiatives by organizations like WHO and UNICEF also contribute significantly to demand growth, particularly in low- and middle-income countries.

Regionally, North America dominates the market due to strong healthcare infrastructure, high awareness levels, and the presence of major pharmaceutical manufacturers. Asia-Pacific is expected to witness the fastest growth, driven by high disease prevalence, government-led control programs, and expanding healthcare access in countries such as India and China. Europe maintains steady growth with regulatory focus on veterinary antiparasitic products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Antiparasitic Drugs Market was valued at USD 17,936.22 million in 2018, reached USD 20,545.45 million in 2024, and is projected to reach USD 25,169.73 million by 2032, expanding at a CAGR of 2.57% during the forecast period.

- North America leads with a 34% share in 2024 due to strong healthcare infrastructure, robust R&D, and widespread access to advanced drug formulations. Europe follows with 26%, supported by regulatory strength and pharmaceutical innovation, while Asia-Pacific holds 28%, driven by expanding healthcare access and public health programs.

- Asia-Pacific is the fastest-growing region, supported by high disease prevalence, government deworming initiatives, and rapid improvement in healthcare systems across India, China, and Southeast Asia.

- By Infection, protozoan infections dominate the market with a 47% share in 2024, driven by the global prevalence of malaria and leishmaniasis.

- By Drug Class, antimalarial drugs hold a 43% share, supported by strong therapeutic adoption and the effectiveness of artemisinin-based combination therapies.

Market Drivers:

Market Drivers:

Rising Global Prevalence of Parasitic Infections Across Humans and Animals

The Antiparasitic Drugs Market grows steadily due to the widespread occurrence of parasitic infections worldwide. Diseases such as malaria, leishmaniasis, and schistosomiasis continue to affect millions annually, creating consistent therapeutic demand. In livestock and companion animals, rising infection rates drive the adoption of veterinary antiparasitic products to protect animal health and prevent zoonotic transmission. The market benefits from growing awareness campaigns and preventive healthcare measures promoted by international health organizations.

- For instance, Novartis’ antimalarial treatment, Coartem, surpassed 400 million delivered treatments worldwide, substantially contributing to malaria management efforts.

Advancements in Drug Formulations and Combination Therapies

Continuous innovation in drug formulations enhances treatment outcomes and patient compliance. Pharmaceutical companies focus on developing combination therapies that reduce drug resistance and improve efficacy against multiple parasites. Modern antiparasitic drugs integrate novel mechanisms of action and improved delivery systems for better bioavailability. It supports long-term disease management while minimizing adverse effects and resistance risks. These innovations strengthen product pipelines and boost clinical adoption.

- For instance, researchers developing albendazole nanocrystal formulations using tea saponins as natural stabilizers achieved a 4.65-fold increase in the plasma AUC of albendazole sulfoxide (the primary active metabolite) compared to conventional albendazole formulations in rat studies, significantly improving the potential for treating conditions like hydatid cysts and neurocysticercosis.

Expanding Government Programs and Global Health Initiatives

Strong support from public health programs drives market expansion. Initiatives by WHO, UNICEF, and national health ministries promote mass drug administration and disease elimination campaigns in endemic regions. Governments allocate funds to combat neglected tropical diseases through community outreach and free medication distribution. These initiatives enhance accessibility, particularly in low-income regions, ensuring steady market growth. It also encourages collaborations between global agencies and pharmaceutical firms for wider drug availability.

Growing Demand from the Veterinary and Agricultural Sectors

Increased awareness of animal health boosts demand for antiparasitic products in livestock and companion animals. Veterinary antiparasitic drugs prevent productivity losses and ensure food safety within the agricultural supply chain. Companies invest in species-specific formulations to address diverse animal health challenges. Expanding pet ownership and livestock farming further strengthen product adoption. It positions veterinary applications as a key growth pillar for the overall market.

Market Trends:

Growing Shift Toward Novel Drug Combinations and Advanced Therapeutic Approaches

The Antiparasitic Drugs Market experiences a growing trend toward combination therapies and next-generation formulations designed to combat resistance. Pharmaceutical companies develop multi-target drugs that address multiple parasitic species simultaneously, improving treatment success rates. Research focuses on innovative molecules with extended activity, shorter treatment durations, and fewer side effects. It supports patient adherence and expands the market beyond traditional single-agent drugs. Advances in biotechnology and genomics accelerate drug discovery for resistant strains of malaria, leishmaniasis, and nematode infections. Companies also explore nanoparticle-based and controlled-release delivery systems to optimize drug performance and prolong therapeutic effects.

- For example, Cipargamin (KAE609), developed by Novartis, achieved very rapid parasite clearance with a median parasite clearance time of just 8 hours—compared to 24 hours for artemether-lumefantrine—demonstrating the potential of next-generation compounds with accelerated therapeutic action.

Rising Focus on Veterinary Applications and Preventive Healthcare Strategies

The market shows strong traction in veterinary antiparasitic drugs driven by the growing importance of animal welfare and food safety. Livestock farmers and pet owners increasingly prefer preventive treatments to reduce infection risk and improve productivity. Pharmaceutical manufacturers develop long-acting injectables, chewable tablets, and topical solutions to enhance convenience and effectiveness. It aligns with stricter animal health regulations and greater awareness of zoonotic disease transmission. Global players expand distribution networks in rural and emerging regions to meet demand for affordable veterinary products. Digital tools for parasite surveillance and smart dosing systems gain attention among veterinarians and producers. This shift toward prevention and early intervention reinforces sustainable growth across both human and animal health segments.

- For Instance, Zoetis’ Simparica Trio combination chewable has been administered to over 15 million dogs in five years, protecting against heartworm disease, ticks, fleas, and specific intestinal parasites like roundworms and hookworms. It is effective against fleas, killing them within 4 hours of administration with 100% effectiveness within 8 hours.

Market Challenges Analysis:

Rising Drug Resistance and Limited Innovation in New Molecules

The Antiparasitic Drugs Market faces growing challenges from increasing parasite resistance to existing drug classes. Continuous use of the same formulations in human and veterinary medicine reduces long-term efficacy and complicates treatment protocols. Limited R&D investment in novel antiparasitic molecules slows innovation and restricts therapeutic options. It creates dependency on combination therapies and reformulated products instead of breakthrough drugs. High development costs and lengthy regulatory approval timelines further discourage new entrants. The emergence of multidrug-resistant malaria and helminth infections highlights the urgent need for alternative treatments and improved surveillance mechanisms.

Regulatory Barriers and Accessibility Issues in Developing Regions

Strict regulatory frameworks and complex approval procedures delay product launches in key markets. Pharmaceutical firms often struggle with varying compliance requirements across countries, increasing development costs and timelines. In many low-income regions, limited healthcare infrastructure and high drug prices reduce accessibility to essential antiparasitic medicines. It affects patient outcomes and undermines public health initiatives aimed at disease control. Supply chain inefficiencies and inadequate distribution networks also hinder timely drug availability. Counterfeit and substandard products remain a concern in unregulated markets, impacting safety, efficacy, and brand credibility.

Market Opportunities:

Expansion of R&D and Focus on Novel Antiparasitic Molecules

The Antiparasitic Drugs Market offers strong opportunities through research investments in next-generation therapeutics. Pharmaceutical companies are accelerating efforts to develop novel molecules that overcome drug resistance and improve patient safety. It enables the discovery of new chemical entities and biologics for human and veterinary applications. Academic and industrial collaborations support faster clinical validation and commercialization. Funding programs by WHO and national health agencies encourage innovation in neglected tropical disease treatments. The integration of AI-driven screening platforms and genomics-based drug design also enhances R&D productivity and discovery speed.

Emerging Demand in Developing Economies and Animal Health Segments

Rising healthcare investments in emerging economies create a major growth window for antiparasitic drugs. Expanding rural healthcare networks in Asia, Africa, and Latin America improve accessibility to essential medicines. It drives mass treatment programs and preventive healthcare adoption. The growing livestock sector and increasing pet ownership fuel veterinary drug demand. Manufacturers target affordable and long-acting formulations to meet regional needs. Strategic partnerships with local distributors strengthen supply chains and rural market penetration. These factors collectively position emerging regions as high-potential markets for sustainable expansion.

Market Segmentation Analysis:

By Infection

The Antiparasitic Drugs Market is segmented into protozoan, helminthic, and ectoparasitic infections. Protozoan infections hold the largest share due to the high global prevalence of malaria, leishmaniasis, and amoebiasis. Rising healthcare awareness and public programs targeting these diseases sustain strong product demand. Helminthic infections continue to affect large rural populations, supporting consistent drug consumption in developing regions. It benefits from government-led deworming campaigns and improved access to oral formulations. Ectoparasitic infections such as lice and scabies are gaining attention through dermatology-focused therapies and preventive treatments.

- For instance, Novartis delivered 1 billion courses of artemisinin-based combination therapy (ACT) for malaria treatment since 1999, with more than 430 million pediatric treatments supplied without profit to malaria-endemic countries, directly enabling treatment of millions of P. falciparum infections annually.

By Drug Class

Antiparasitic drugs are categorized into antimalarial, antihelminthic, and antiprotozoal classes. Antimalarial drugs dominate due to the high incidence of malaria and the availability of effective combinations such as artemisinin-based therapies. Antihelminthic agents follow, supported by their extensive use in both human and veterinary medicine. It benefits from product innovations and improved safety profiles. Antiprotozoals maintain steady growth with increasing use in gastrointestinal and tropical disease management. Continuous product development and WHO-endorsed treatment programs support this segment’s long-term expansion.

- For instance, Novartis’ Coartem has delivered over 1 billion malaria treatment courses globally (including over 500 million pediatric treatments), with a verified cure rate consistently exceeding 95% for uncomplicated Plasmodium falciparum infection, as documented in numerous clinical trials and reports meeting the World Health Organization (WHO) efficacy criteria.

By Distribution Channel

The market includes hospital pharmacies, retail pharmacies, and online platforms. Hospital pharmacies lead due to the rising number of parasitic disease treatments requiring prescription-based drugs. Retail pharmacies offer broad accessibility across urban and rural settings, enhancing patient convenience. It supports strong product turnover through over-the-counter formulations. Online channels are expanding rapidly, driven by digital healthcare adoption and direct-to-consumer sales models.

Segmentations:

By Infection

- Protozoan Infections

- Helminthic Infections

- Ectoparasitic Infections

By Drug Class

- Antimalarial Drugs

- Antihelminthic Drugs

- Antiprotozoal Drugs

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds a 34% share of the global Antiparasitic Drugs Market in 2024, driven by strong healthcare infrastructure and high awareness of parasitic diseases. The United States dominates due to advanced pharmaceutical R&D and a robust presence of leading manufacturers. Supportive reimbursement frameworks and government-led disease control initiatives strengthen market penetration. It benefits from widespread access to prescription drugs and advanced diagnostic capabilities that ensure early treatment. Veterinary antiparasitic products also see strong demand due to high pet ownership and livestock management standards. Canada contributes to regional growth through rising healthcare spending and the adoption of preventive treatment protocols.

Europe

Europe accounts for 26% share in 2024, supported by established healthcare systems and regulatory focus on both human and veterinary antiparasitic therapies. Germany, France, and the United Kingdom lead in pharmaceutical innovation and high-quality drug production. It gains further momentum through public health awareness programs targeting parasitic infections in humans and animals. Widespread availability of prescription and over-the-counter antiparasitic drugs drives consumer access. Strong presence of contract manufacturing organizations enhances supply efficiency across the region. The region’s emphasis on sustainable drug formulations and safety standards also supports market consistency.

Asia-Pacific

Asia-Pacific represents 28% of the global market in 2024 and is expected to record the fastest growth during the forecast period. High prevalence of parasitic diseases in India, China, and Southeast Asia drives strong therapeutic demand. Expanding healthcare access and government-led deworming programs accelerate consumption. It benefits from rapid urbanization, growing awareness of animal health, and improved affordability of essential drugs. Local pharmaceutical companies are strengthening production capabilities to meet rising domestic needs. Strategic partnerships with international firms improve product quality, research collaboration, and rural distribution coverage.

Key Player Analysis:

- Pfizer Inc (U.S.),

- Hoffmann-La Roche Ltd (Switzerland)

- Mylan N.V. (U.S.)

- Fresenius Kabi AG (Germany)

- Hikma Pharmaceuticals PLC (U.K.)

- Novartis AG (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sanofi (France)

- Arbor Pharmaceuticals, Inc (U.S.)

- Alkem Labs Ltd (India)

Competitive Analysis:

The Antiparasitic Drugs Market features a competitive landscape dominated by global pharmaceutical leaders focusing on innovation and strategic expansion. Key players include Pfizer Inc. (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Mylan N.V. (U.S.), GlaxoSmithKline plc (U.K.), Sanofi S.A. (France), Bayer AG (Germany), and Novartis AG (Switzerland). These companies invest heavily in R&D to develop advanced formulations and address resistance challenges. It emphasizes collaborations with global health organizations to expand drug accessibility in endemic regions. Strategic mergers, product line extensions, and distribution partnerships strengthen market positions. Regional players compete through cost-effective generics and targeted therapies, creating balanced global and local competition. The industry’s focus on sustainable manufacturing and regulatory compliance continues to shape the long-term competitive outlook

Recent Developments:

- In September 2024, Viatris, formed from the merger of Mylan N.V. and Pfizer’s Upjohn division, announced cash tender offers for certain outstanding notes in a financial update.

- In July 2025, Pfizer completed a global licensing agreement with 3SBio, granting exclusive development and commercialization rights to certain products outside China.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Infection, Drug Class, Distribution Channel and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Antiparasitic Drugs Market is expected to witness steady expansion driven by evolving treatment needs and rising awareness.

- The market will see continuous demand for advanced formulations addressing resistant parasite strains.

- Drug innovation will focus on combination therapies that improve efficacy and minimize treatment duration.

- Expanding government initiatives in disease-endemic countries will strengthen preventive healthcare programs.

- It will benefit from increasing collaborations between pharmaceutical firms and global health organizations.

- Veterinary antiparasitic drugs will gain traction with growing emphasis on livestock health and food safety.

- Digital health tools will improve diagnosis accuracy, treatment monitoring, and distribution efficiency.

- Manufacturers will focus on cost-effective production and sustainable formulation to meet regulatory standards.

- Emerging markets in Asia-Pacific, Latin America, and Africa will remain key growth centers due to improving healthcare access.

- It will continue to evolve through technological integration, R&D investment, and patient-centered therapeutic innovation.

Market Drivers:

Market Drivers: