Market Overview

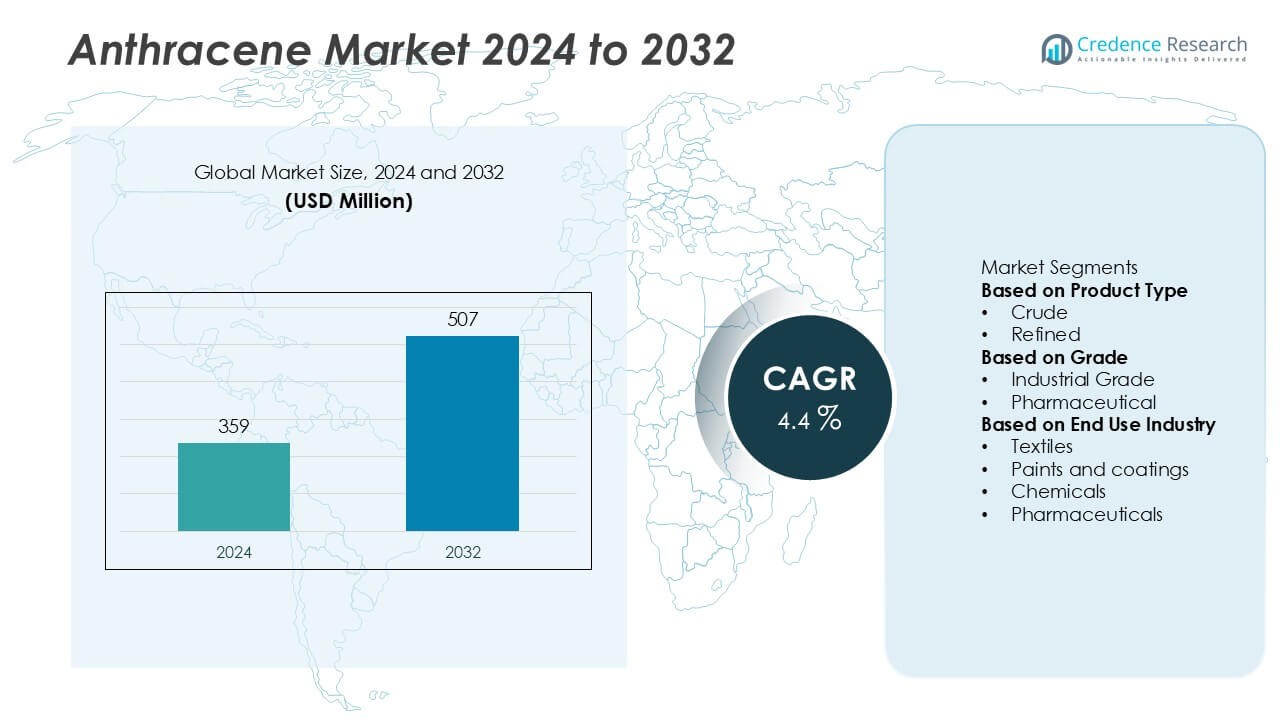

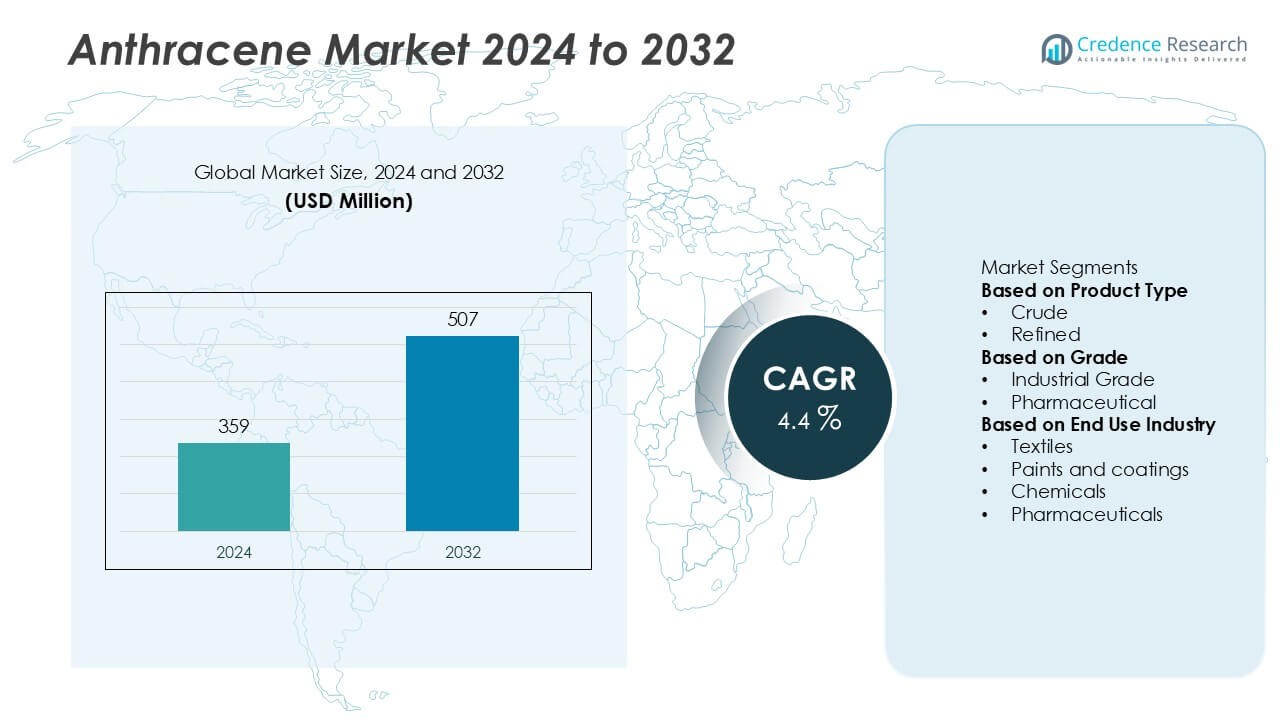

The Anthracene Market was valued at USD 359 million in 2024 and is projected to reach USD 507 million by 2032, growing at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anthracene Market Size 2024 |

USD 359 Million |

| Anthracene Market, CAGR |

4.4% |

| Anthracene Market Size 2032 |

USD 507 Million |

The anthracene market is led by key players such as Tokyo Chemical Industry Co., Ltd., CHEMOS GmbH & Co. KG, Fisher Scientific, Kishida Chemical Co., Ltd., Vitas-M Laboratory Ltd., SAE Manufacturing Specialties Corp, Junsei Chemical Co., Ltd., KANTO CHEMICAL CO., INC, Santa Cruz Biotechnology, Inc., and Anward. These companies collectively account for a significant portion of the global supply, emphasizing high-purity products and sustainable manufacturing processes. Asia-Pacific dominates the market with 41% share in 2024, driven by strong demand from the chemical, textile, and electronics sectors. North America follows with 26% share, supported by advancements in specialty chemicals and organic electronics, while Europe holds 22%, driven by stringent quality standards and innovation in eco-friendly dye and pigment production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global anthracene market was valued at USD 359 million in 2024 and is projected to reach USD 507 million by 2032, expanding at a CAGR of 4.4% during the forecast period.

- Market growth is driven by rising demand for anthraquinone-based dyes, coatings, and intermediates, alongside increasing applications in electronics and specialty chemicals.

- Emerging trends include a growing focus on sustainable production methods, advancements in purification technologies, and research into high-purity anthracene for organic semiconductor and photonic applications.

- The market features moderate competition with key players such as Tokyo Chemical Industry Co., Ltd., Fisher Scientific, CHEMOS GmbH & Co. KG, and Santa Cruz Biotechnology, Inc., emphasizing R&D, capacity expansion, and regulatory compliance.

- Regionally, Asia-Pacific leads with 41% market share, followed by North America at 26% and Europe at 22%, while the refined anthracene segment holds the largest 58% share by product type.

Market Segmentation Analysis:

By Product Type

The anthracene market is segmented into crude and refined product types. The refined anthracene segment dominated the market in 2024, accounting for approximately 58% of the total share. Its dominance is driven by widespread use in the production of anthraquinone, dyes, and advanced chemical intermediates, where high-purity compounds are essential for performance consistency. The refined form also finds growing application in electronic and photonic materials, supported by advancements in purification technologies. Meanwhile, the crude anthracene segment continues to serve traditional uses in basic dye manufacturing and research applications.

- For instance, Tokyo Chemical Industry Co., Ltd. achieved high-purity anthracene output exceeding 99.9% through advanced sublimation techniques at its Ibaraki facility, enabling superior performance in optoelectronic materials and OLED synthesis processes.

By Grade

Based on grade, the anthracene market is divided into industrial grade and pharmaceutical grade. The industrial grade segment held the largest market share of around 67% in 2024, primarily due to its extensive utilization in the chemical, textile, and coating industries. This grade is favored for its cost-effectiveness and suitability in producing intermediates such as anthraquinone, which is widely used in dyes and pulp bleaching. The pharmaceutical grade segment, though smaller, is projected to grow steadily, driven by increasing research into anthracene derivatives for potential medical and biochemical applications.

- For instance, Kishida Chemical Co., Ltd. offers high-purity anthracene and other chemicals that are used in the synthesis of pharmaceutical drugs and as materials in biochemical assays.

By End-Use Industry

In terms of end-use, the market is categorized into textiles, paints and coatings, chemicals, and pharmaceuticals. The chemicals segment emerged as the dominant end-use sector, capturing about 43% of the market share in 2024. This leadership stems from anthracene’s essential role as a precursor in the synthesis of anthraquinone, phthalic anhydride, and other aromatic intermediates. Rapid industrial expansion and the growing demand for specialty chemicals across Asia-Pacific further support this segment’s growth. The textiles and paints industries also contribute significantly, driven by the rising need for durable and high-performance synthetic dyes and pigments.

Key Growth Drivers

Expanding Demand from Dye and Pigment Industries

The growing use of anthracene as a key raw material in dye and pigment manufacturing is a major driver of market growth. Its derivative, anthraquinone, serves as an essential intermediate in producing synthetic dyes used across textiles, coatings, and printing industries. The rising global demand for high-performance, colorfast, and environmentally stable dyes, particularly in emerging economies, continues to fuel consumption. Additionally, expanding textile production and urbanization-driven decorative paint demand are further accelerating anthracene’s adoption in colorant manufacturing processes.

- For instance, CHEMOS GmbH & Co. KG is a supplier and producer of chemical specialties for lab and industry use, offering a portfolio of around 200,000 raw materials in quantities up to 100 metric tonnes.

Advancements in Organic Electronics and Photonics

Increasing applications of anthracene in organic electronic materials, including organic light-emitting diodes (OLEDs), photoconductors, and organic semiconductors, are strengthening market growth. Anthracene’s superior luminescent and charge-transport properties make it highly suitable for optoelectronic applications. The growing consumer electronics market, coupled with innovation in display technologies and sensors, has heightened demand for high-purity anthracene. Continuous R&D investments by manufacturers to improve performance efficiency and material purity are expected to further support its adoption in advanced electronic and photonic components.

- For instance, researchers have reported that certain high-purity anthracene derivative crystals exhibit a high photoluminescence quantum yield of approximately 40.3% and a high carrier mobility of up to 4.7 cm²/V·s, significantly enhancing their performance potential in OLED research and organic semiconductor fabrication.

Rising Industrialization and Chemical Production Expansion

Rapid industrialization, particularly across Asia-Pacific, is driving the expansion of anthracene consumption in chemical manufacturing. As a key intermediate in the production of anthraquinone and phthalic anhydride, anthracene benefits from increasing demand for specialty and fine chemicals. The growth of downstream industries, including coatings, plastics, and agrochemicals, also contributes to this trend. Additionally, expanding production capacities and infrastructure investments in developing regions are enhancing supply stability, enabling cost-effective processing, and supporting the overall growth trajectory of the anthracene market.

Key Trends & Opportunities

Growing Focus on Sustainable and Eco-Friendly Production

The global shift toward sustainable chemical manufacturing is prompting producers to adopt cleaner production technologies for anthracene. Companies are exploring eco-friendly extraction and purification methods from coal tar and other sources to reduce environmental impact. Moreover, the development of green dyes and low-emission coatings derived from anthracene-based intermediates offers lucrative opportunities. Regulatory support for environmentally responsible processes and the growing preference for sustainable materials among end-use industries are likely to strengthen this trend over the coming years.

- For instance, KANTO CHEMICAL CO., INC. (a leading supplier of high-purity chemicals) has implemented various environmental and safety measures as part of its responsible care activities, which include efforts to save energy, reduce industrial waste, and reduce the emissions of PRTR target substances, such as chlorine-based solvents, while ensuring strict compliance with Japan’s environmental standards.

Increasing Research on Novel Anthracene Derivatives

Ongoing research into new anthracene derivatives with enhanced electronic, photonic, and biochemical properties presents significant growth opportunities. These derivatives are gaining attention for their potential applications in pharmaceuticals, organic solar cells, and advanced sensor technologies. Collaborative efforts between research institutions and industry players are driving innovations in molecular design and synthesis efficiency. As these high-value derivatives find broader applications across emerging technology sectors, they are expected to unlock new revenue streams and diversify market potential.

- For instance, Junsei Chemical Co., Ltd. sells general laboratory reagents, including basic anthracene, which is known to exhibit blue fluorescence under ultraviolet radiation and is a common building block in organic chemistry research for applications such as organic semiconductors and fluorescent sensors.

Key Challenges

Environmental and Regulatory Constraints

Stringent environmental regulations related to coal tar processing and polycyclic aromatic hydrocarbon (PAH) emissions pose a major challenge for the anthracene market. Anthracene extraction and refining involve complex procedures that generate hazardous byproducts, requiring costly mitigation measures and compliance efforts. Growing global emphasis on emission control and waste management has increased operational costs for producers. These constraints are compelling manufacturers to invest in cleaner technologies, which, while necessary, can limit short-term profitability and hinder small-scale operators’ market participation.

Availability of Substitutes and Volatile Raw Material Prices

The availability of alternative organic compounds and substitutes for anthracene-based intermediates in certain chemical applications has created competitive pressure. Additionally, fluctuations in coal tar availability and prices significantly impact anthracene production costs. Dependence on byproducts from the steel and coke industries further adds to supply instability. Manufacturers are challenged to maintain consistent production margins amid raw material volatility. This has prompted the need for supply chain diversification and efficiency-driven production strategies to sustain market competitiveness.

Regional Analysis

North America

North America held around 26% of the anthracene market share in 2024, driven by strong demand from the chemical and electronics industries. The United States dominates regional consumption due to its advanced manufacturing infrastructure and ongoing R&D investments in organic semiconductors and high-performance coatings. Increasing adoption of anthracene derivatives in optoelectronic devices and specialty chemicals continues to support market expansion. Moreover, stringent quality standards and technological innovation in purification processes are enhancing product performance, while sustainability initiatives and cleaner coal tar extraction methods are reinforcing the region’s competitive advantage.

Europe

Europe accounted for 22% of the anthracene market share in 2024, supported by a well-established chemical and dye manufacturing base. Germany, the United Kingdom, and France are key contributors, driven by demand for anthraquinone-based dyes and pigments in textiles, automotive coatings, and industrial applications. The region’s strong focus on sustainability and regulatory compliance has encouraged the adoption of eco-friendly anthracene processing methods. Continued investment in research and development, particularly in advanced materials and organic electronics, is expected to enhance growth potential despite regulatory challenges surrounding polycyclic aromatic hydrocarbon management.

Asia-Pacific

Asia-Pacific dominated the global anthracene market with 41% market share in 2024, owing to rapid industrialization and expanding chemical production capacities. China, India, and Japan serve as major hubs for dye, pigment, and coating manufacturing, where anthracene plays a vital role as a precursor. Rising demand from the textile and electronics industries, coupled with cost-effective production, drives strong regional growth. Additionally, growing investments in advanced materials, increasing export activities, and favorable government initiatives to boost domestic chemical manufacturing are reinforcing Asia-Pacific’s leadership in the global anthracene market through 2032.

Latin America

Latin America captured 6% of the anthracene market share in 2024, primarily driven by growth in Brazil and Mexico’s chemical and textile sectors. Expanding industrialization and the rising adoption of synthetic dyes in regional textile production are supporting demand. The paints and coatings segment is also contributing to market expansion, fueled by construction growth and automotive manufacturing. Although limited local production capacity poses a challenge, increasing imports and partnerships with international suppliers are helping the region strengthen its position in the global anthracene supply chain.

Middle East & Africa

The Middle East & Africa region accounted for 5% of the anthracene market share in 2024, reflecting gradual growth supported by developing industrial and chemical infrastructure. Countries such as Saudi Arabia, the UAE, and South Africa are witnessing increasing investments in petrochemicals and specialty chemicals. Growing demand for dyes, coatings, and intermediates from construction and textile industries is further driving consumption. However, limited technological expertise and dependence on imports remain challenges. Ongoing industrial diversification efforts and government initiatives to attract chemical manufacturing investments are expected to boost regional growth prospects through 2032.

Market Segmentations:

By Product Type

By Grade

- Industrial Grade

- Pharmaceutical

By End Use Industry

- Textiles

- Paints and coatings

- Chemicals

- Pharmaceuticals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the anthracene market features prominent players such as Tokyo Chemical Industry Co., Ltd., CHEMOS GmbH & Co. KG, Fisher Scientific, Kishida Chemical Co., Ltd., Vitas-M Laboratory Ltd., SAE Manufacturing Specialties Corp, Junsei Chemical Co., Ltd., KANTO CHEMICAL CO., INC, Santa Cruz Biotechnology, Inc., and Anward. These companies compete through innovation in product quality, purification techniques, and expansion of global distribution networks. The market exhibits moderate consolidation, with leading firms focusing on strengthening supply chains and expanding manufacturing capacities to meet rising demand from chemical, pharmaceutical, and electronic sectors. Strategic partnerships, acquisitions, and R&D investments are integral to maintaining competitive advantage and ensuring compliance with evolving environmental regulations. Additionally, manufacturers are emphasizing sustainable production processes and high-purity anthracene derivatives to cater to specialized applications, particularly in organic semiconductors, dyes, and advanced materials, shaping the industry’s competitive dynamics through 2032.

Key Player Analysis

- Tokyo Chemical Industry Co., Ltd.

- CHEMOS GmbH & Co. KG

- Fisher Scientific

- Kishida Chemical Co., Ltd.

- Vitas-M Laboratory Ltd.

- SAE Manufacturing Specialties Corp

- Junsei Chemical Co., Ltd.

- KANTO CHEMICAL CO., INC.

- Santa Cruz Biotechnology, Inc.

- Anward

Recent Developments

- In September 2025, Kishida Chemical Co., Ltd. continued to offer anthracene with a 90% purity chemical grade, with updates to its catalog and availability for research and synthesis applications.

- In February 2025, Tokyo Chemical Industry Co., Ltd. launched new grades of anthracene, including high-purity products (purified by sublimation and zone refined, >99.5% GC), alongside regular anthracene (min. 97.0% GC).

- In 2024, Vitas-M Laboratory Ltd. maintained a comprehensive collection, providing both anthracene and its derivatives (e.g., anthracene and anthracene-9-carbaldehyde), accessible for custom quotes and screening in pharmaceutical R&D.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Grade, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The anthracene market is expected to witness steady growth driven by expanding applications in dyes, coatings, and advanced materials through 2032.

- Increasing demand for high-purity anthracene in electronic and photonic applications will enhance its adoption across technology-driven sectors.

- Rapid industrialization in emerging economies will continue to strengthen production and consumption across Asia-Pacific.

- Ongoing research into novel anthracene derivatives will open new opportunities in pharmaceuticals and organic electronics.

- Sustainable and eco-friendly production methods will become a key focus area for manufacturers to meet environmental standards.

- Strategic collaborations and capacity expansions will help companies enhance their global footprint and market competitiveness.

- Rising demand from specialty chemical industries will drive consistent growth across industrial-grade anthracene production.

- Technological innovations in purification and refining processes will improve product quality and cost efficiency.

- Regulatory support for cleaner production processes will encourage sustainable industry transformation.

- Increasing investment in R&D and advanced manufacturing infrastructure will shape the long-term growth trajectory of the anthracene market.