Market Overview

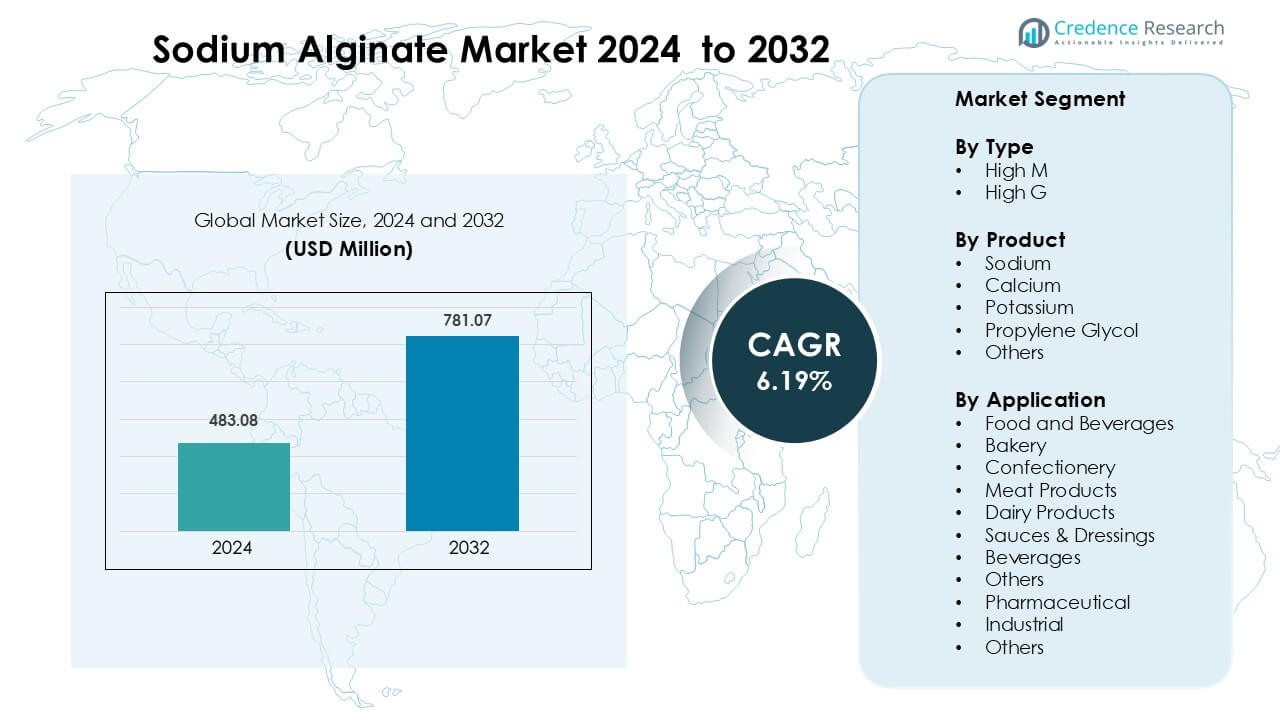

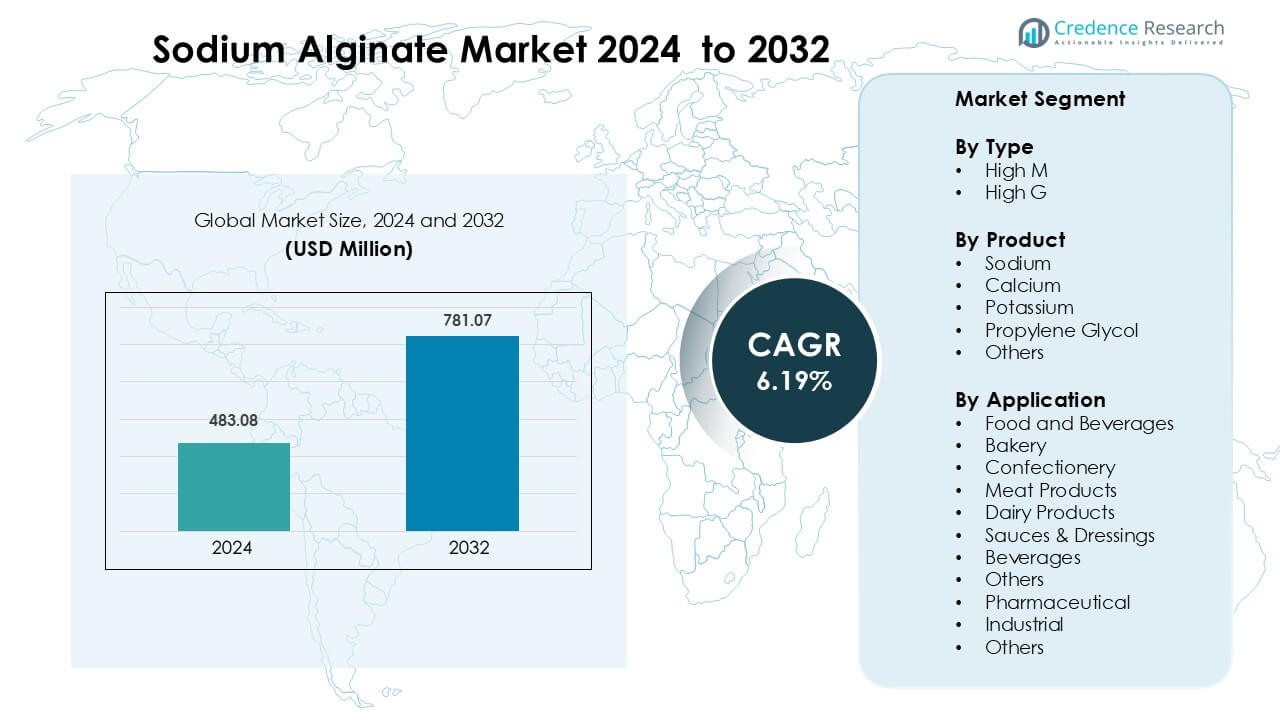

Sodium Alginate Market was valued at USD 483.08 million in 2024 and is anticipated to reach USD 781.07 million by 2032, growing at a CAGR of 6.19 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sodium Alginate Market Size 2024 |

USD 483.08 Million |

| Sodium Alginate Market, CAGR |

6.19% |

| Sodium Alginate Market Size 2032 |

USD 781.07 Million |

The Sodium Alginate Market is shaped by leading manufacturers such as Shandong Jiejing Group Corporation, Marine Biopolymers Limited, Ceamsa, KIMICA, DuPont de Nemours, Inc., BREADFX Euro Prepaid Algaia, Ingredients Solutions, Inc., Algae, American Express Company, and FMC Corporation. These companies compete through high-purity grades, advanced extraction processes, and tailored alginate formulations for food, pharmaceutical, and industrial applications. Asia-Pacific remains the dominant region with a 34% market share in 2024, supported by abundant seaweed resources, large-scale alginate production, and strong demand across food processing, textiles, and biomedical sectors.

Market Insights

- The Sodium Alginate Market reached USD 483.08 million in 2024 and is projected to reach USD 781.07 million by 2032, growing at a CAGR of 6.19%.

- Rising demand in food, dairy, bakery, and pharmaceutical formulations drives growth, with manufacturers using sodium alginate for clean-label thickening, stabilizing, gelling, and controlled-release functions.

- Key trends include growing use in plant-based meat, 3D bioprinting, wound care products, and specialty industrial applications such as textile printing and oil drilling fluids.

- Competition intensifies as companies such as Shandong Jiejing Group, Marine Biopolymers, Ceamsa, KIMICA, DuPont, and FMC focus on high-purity grades, sustainable sourcing, and application-specific innovations.

- Asia-Pacific leads with a 34% share, followed by Europe at 30% and North America at 28%, while the food and beverages segment holds the largest share due to strong adoption in dairy, bakery, sauces, dressings, and confectionery.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

High M sodium alginate dominates this segment with about 56% share in 2024. Manufacturers prefer High M grades because they offer stronger viscosity, better gel elasticity, and improved water retention, making them ideal for food, pharmaceutical, and cosmetic formulations. Demand grows as High M alginate supports stable texture, thickening, and controlled-release properties in capsules and biomedical gels. High G alginate holds the remaining share and is valued for its firm gel strength, which benefits industrial applications such as textile printing, paper coating, and welding rod binders.

- For instance, KIMICA Corporation offers a High-M grade alginate (ALM100) whose 1% aqueous solution has a viscosity between 50–200 mPa·s at 20 °C, and its M/G ratio exceeds 2.0, which enhances its elasticity in biomedical gels.

By Product

Sodium-based alginate leads the segment with nearly 62% share in 2024. Food and pharmaceutical companies favor sodium alginate because it dissolves easily, forms stable gels, and performs well as a thickener, stabilizer, and emulsifier. Growth increases as sodium alginate supports clean-label, plant-based, and low-fat product development across sauces, dairy, and bakery lines. Calcium and potassium alginates follow due to their use in restructured foods and controlled-gel formations. Propylene glycol and other specialty alginate forms gain traction in industrial, cosmetic, and technical applications that require advanced film-forming properties.

- For instance, KIMICA’s Ca-ALG (calcium alginate) forms heat-stable insoluble ion-bridged gels, because calcium ions link carboxyl groups to yield a gel that is insoluble in water.

By Application

Food and beverages dominate the market with about 48% share in 2024. Sodium alginate is widely used in bakery, dairy, confectionery, sauces, and beverage processing for thickening, stabilizing, and texture improvement. Demand rises as brands adopt alginate for plant-based meat, low-calorie foods, and clean-label products. Pharmaceuticals represent another strong segment, driven by alginate’s role in wound dressings, controlled-release drugs, and antacid formulations. Industrial applications grow steadily through usage in textiles, paper, oil drilling fluids, and printing pastes, where alginate enhances viscosity, binding strength, and process efficiency.

Key Growth Drivers

Expansion of Clean-Label and Plant-Based Food Demand

Clean-label and plant-based food products are driving strong growth in the sodium alginate market. Food manufacturers increasingly use sodium alginate as a natural thickener, stabilizer, and gelling agent across dairy alternatives, plant-based meat, bakery fillings, and low-fat dressings. Consumers prefer products without synthetic additives, pushing companies to incorporate safe, plant-derived hydrocolloids such as alginate. Rising demand for vegan texture enhancers supports higher usage in confectionery, sauces, beverages, and ready meals. Sodium alginate helps improve mouthfeel, moisture retention, and product stability, allowing producers to maintain quality while reducing artificial ingredients. This shift in consumer preference supports consistent long-term market growth.

- For instance, Sodium alginate, a natural polysaccharide derived from brown algae, is widely used as a thickening, gelling, and stabilizing agent in the food industry.

Growing Pharmaceutical and Biomedical Applications

Pharmaceutical and biomedical sectors provide a strong boost to the sodium alginate market. Alginate’s biocompatibility, low toxicity, and controlled-release capabilities make it ideal for wound dressings, drug delivery systems, tablet formation, and encapsulated therapies. Hospitals and healthcare companies use alginate dressings to manage burns, ulcers, and surgical wounds due to their moisture control and gel-forming properties. Research labs adopt alginate for cell immobilization, 3D bioprinting, and tissue engineering. The growing focus on regenerative medicine and advanced therapeutics strengthens demand. As global healthcare spending increases and manufacturers invest in new biomedical applications, sodium alginate becomes increasingly essential.

- For instance, FMC BioPolymer’s NovaMatrix® sodium alginate (high-G grade) is used in pharmaceutical excipient applications, enabling oral drug delivery systems with controlled release behavior.

Rising Industrial Use Across Textiles, Paper, and Oil Drilling

Industrial applications significantly expand the sodium alginate market. Textile manufacturers rely on alginate as a high-performance thickener for reactive dye printing, where it enhances color yield and prevents chemical interference. Paper producers use sodium alginate for surface sizing, coating, and improved fiber bonding. The oil and gas sector incorporates alginate in drilling fluids to stabilize viscosity and manage fluid loss. Industrial companies prefer sodium alginate because it is biodegradable, efficient, and safe for handling. With rising investment in manufacturing modernization and growing textile output across Asia-Pacific, industrial-grade alginate demand continues to accelerate.

Key Trend & Opportunity

Adoption of Sodium Alginate in Plant-Based Meat and Advanced Food Texturing

A key market trend is the rapid rise of sodium alginate in plant-based meat and advanced texturizing applications. Alginate helps producers create firm, elastic, meat-like structures through controlled gel formation. Its ability to bind water, enhance juiciness, and improve bite feel makes it ideal for vegan sausages, patties, and seafood analogs. Food companies also use alginate for molecular gastronomy, encapsulation, and stable emulsions. As global plant-based protein consumption increases, manufacturers adopt alginate to differentiate textures and maintain clean-label claims. This trend strengthens alginate’s role as a versatile, natural food engineering ingredient.

- For instance, KIMICA s ALGIN M429S grade sodium alginate is directly marketed for plant-based meat applications when used in vegetable-protein burger patties, it forms firm gels at room temperature that do not collapse during cooking, helping retain shape and water and hence improving cooking yield. KIMICA Corporation.

Growing Use of Alginates in 3D Bioprinting and Regenerative Medicine

The rise of 3D bioprinting and regenerative medicine creates major opportunities for sodium alginate. Its gel-forming behavior and compatibility with living cells make it ideal for bioinks used in tissue scaffolding and organ modeling. Research institutions and biotech firms increasingly rely on alginate to support cell growth, nutrient exchange, and structural integrity in printed constructs. Advancements in personalized medicine, stem cell research, and tissue engineering continue to push demand for high-purity alginate. As medical innovation accelerates, alginate emerges as a foundational biomaterial with strong long-term growth potential.

- For instance, a study on bone-regeneration used a 10 wt% sodium alginate + 10 wt% β-tricalcium phosphate bioink for 3D printing via a Cellink bioprinter; cells (MG-63) showed enhanced proliferation and alkaline phosphatase activity, signaling good bone tissue potential.

Innovation in Modified Alginates for High-Performance Applications

Technological innovation in modified and functionalized alginates presents a significant opportunity. Manufacturers explore chemically tailored alginates with improved gel strength, thermal stability, moisture control, and compatibility with specialty formulations. Food companies demand customized alginate blends for specific textures, while pharmaceutical firms require medical-grade alginates for advanced drug delivery. Industrial users increasingly seek high-viscosity and salt-resistant grades for extreme processing conditions. R&D investment in new extraction, purification, and modification technologies allows companies to supply niche, high-value applications across multiple industries.

Key Challenge

Raw Material Supply Instability Due to Seaweed Dependence

The sodium alginate market faces supply challenges because it depends on brown seaweed harvesting. Seasonal variations, climate change, and marine ecosystem shifts affect seaweed availability and pricing. Environmental regulations in major producing regions, including China, Chile, and Norway, further restrict harvesting volumes. When seaweed supply tightens, alginate manufacturers struggle with cost fluctuations and production delays. Industries that rely on consistent alginate viscosity and purity also face quality variability. These constraints create uncertainty for downstream users in food, pharmaceuticals, and textiles.

Availability of Low-Cost Synthetic and Alternative Hydrocolloids

Competition from alternative hydrocolloids poses a challenge for market growth. Synthetic thickeners, modified starches, gelatin, pectin, and carrageenan often serve similar functional roles at lower cost or with more stable supply. Food manufacturers may substitute alginate when price volatility rises or when formulation needs change. Industrial users may also shift to cheaper binders for textile printing and drilling operations. To overcome this challenge, alginate producers must focus on product differentiation, performance enhancement, and cost efficiency while emphasizing alginate’s natural and clean-label advantages.

Regional Analysis

North America

North America holds about 28% share of the Sodium Alginate Market in 2024. Demand is driven by strong adoption across food processing, pharmaceuticals, and biomedical research. The United States leads consumption due to high usage in wound dressings, drug delivery systems, and clean-label food products. Growth strengthens as plant-based and low-fat formulations gain traction across sauces, dairy alternatives, and bakery products. The region also benefits from advanced R&D in tissue engineering and 3D bioprinting, where alginate serves as a preferred biomaterial. Expanding industrial activity in paper, oil drilling fluids, and textile applications further supports market growth.

Europe

Europe accounts for nearly 30% market share in 2024, supported by mature food and pharmaceutical industries. Countries such as Germany, France, and the U.K. lead demand for high-quality alginate used in bakery fillings, dairy stabilization, and confectionery applications. The region emphasizes natural, plant-derived ingredients, which strengthens alginate’s role in clean-label food production. Pharmaceutical companies use sodium alginate in controlled-release drugs and wound care products. Industrial demand also remains steady due to widespread use in textile printing and paper processing. Strong regulatory standards and advanced manufacturing practices make Europe a consistent growth contributor.

Asia-Pacific

Asia-Pacific dominates the market with about 34% share in 2024, driven by large-scale seaweed harvesting and high alginate production capacity. China, Japan, South Korea, and India lead consumption across food, industrial, and pharmaceutical applications. Rapid urbanization and expansion of processed food sectors support strong sodium alginate usage in dairy, bakery, beverages, and plant-based products. The region’s large textile printing industry drives additional demand for alginate-based thickeners. Growth in pharmaceutical manufacturing and rising investment in biomedical research further strengthen market adoption. Cost-effective production and abundant raw materials make Asia-Pacific the global supply hub.

Latin America

Latin America holds close to 5% share in the Sodium Alginate Market in 2024. Demand rises as countries such as Brazil and Mexico expand their food processing sectors, especially in dairy, meat products, sauces, and confectionery. Local manufacturers adopt sodium alginate for stabilizing textures, improving moisture retention, and enhancing product consistency. Pharmaceutical and cosmetic applications grow steadily through increasing investment in wound care and topical formulations. Industrial usage expands in paper coating and oil drilling operations. Despite slower adoption compared to major regions, rising consumer preference for natural ingredients supports long-term growth.

Middle East & Africa

The Middle East & Africa region captures around 3% market share in 2024. Growth is driven by increasing use of alginates in food manufacturing, especially in dairy, beverages, and processed foods across GCC countries. The oil and gas sector boosts demand through usage in drilling fluids and viscosity-control applications. South Africa contributes through pharmaceutical and cosmetic production that relies on alginate for stabilizing gels and wound care formulations. Limited seaweed availability and high import dependence slow market expansion. However, rising interest in natural food additives and industrial thickening agents supports gradual adoption.

Market Segmentations:

By Type

By Product

- Sodium

- Calcium

- Potassium

- Propylene Glycol

- Others

By Application

- Food and Beverages

- Bakery

- Confectionery

- Meat Products

- Dairy Products

- Sauces & Dressings

- Beverages

- Others

- Pharmaceutical

- Industrial

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Sodium Alginate Market includes strong participation from global and regional manufacturers such as Shandong Jiejing Group Corporation, Marine Biopolymers Limited, Ceamsa, KIMICA, DuPont de Nemours, Inc., BREADFX Euro Prepaid Algaia, Ingredients Solutions, Inc., Algae, American Express Company, and FMC Corporation. Companies compete through advancements in extraction technology, high-purity grades, and customized alginate formulations tailored for food, pharmaceutical, and industrial applications. Leading players invest in sustainable seaweed sourcing, improved processing efficiency, and value-added products such as modified alginates for biomedical and specialty uses. Partnerships with food processors, pharma companies, and industrial manufacturers help expand market presence. Firms also focus on strengthening supply chains due to raw material constraints linked to global seaweed availability. Rising demand for clean-label ingredients, biocompatible materials, and industrial thickeners encourages continuous product innovation, intensifying competition across both high-end and cost-effective segments.

Key Player Analysis

- Shandong Jiejing Group Corporation

- Marine Biopolymers Limited

- Ceamsa

- KIMICA

- DuPont de Nemours, Inc.

- BREADFX Euro Prepaid Algaia

- Ingredients Solutions, Inc.

- Algae

- American Express Company

- FMC Corporation

Recent Developments

- In June 2025, Ceamsa issued its ESG report highlighting an exclusive range of alginates. The document emphasizes tuning gelling time, texture, and viscosity to customer needs, reinforcing Ceamsa’s positioning in tailored alginate solutions for food and other applications.

- In June 2024, Marine Biopolymers Limited received Innovate UK funding for its Alginic-acid to Safety (A2S) project. The grant supports scale-up of alginic acid–based adsorbents for toxic gas filtration, enhancing downstream opportunities for alginate derivatives from seaweed processing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sodium alginate will grow as clean-label and plant-based foods expand globally.

- Pharmaceutical and biomedical applications will increase due to rising use in wound care and drug delivery.

- Adoption in 3D bioprinting and tissue engineering will accelerate as research investments rise.

- Industrial usage will expand in textiles, paper processing, and oil drilling fluids.

- Modified and high-performance alginate grades will gain traction in specialty applications.

- Manufacturers will strengthen seaweed sourcing to reduce supply fluctuations and improve stability.

- Emerging markets will adopt more alginate-based food stabilizers and thickeners.

- Advanced extraction and purification technologies will improve product quality and functional properties.

- Partnerships between food, pharma, and biotech companies will support new formulation development.

- Competition will intensify as global players expand production capacity and diversify product portfolios.