Market Overview

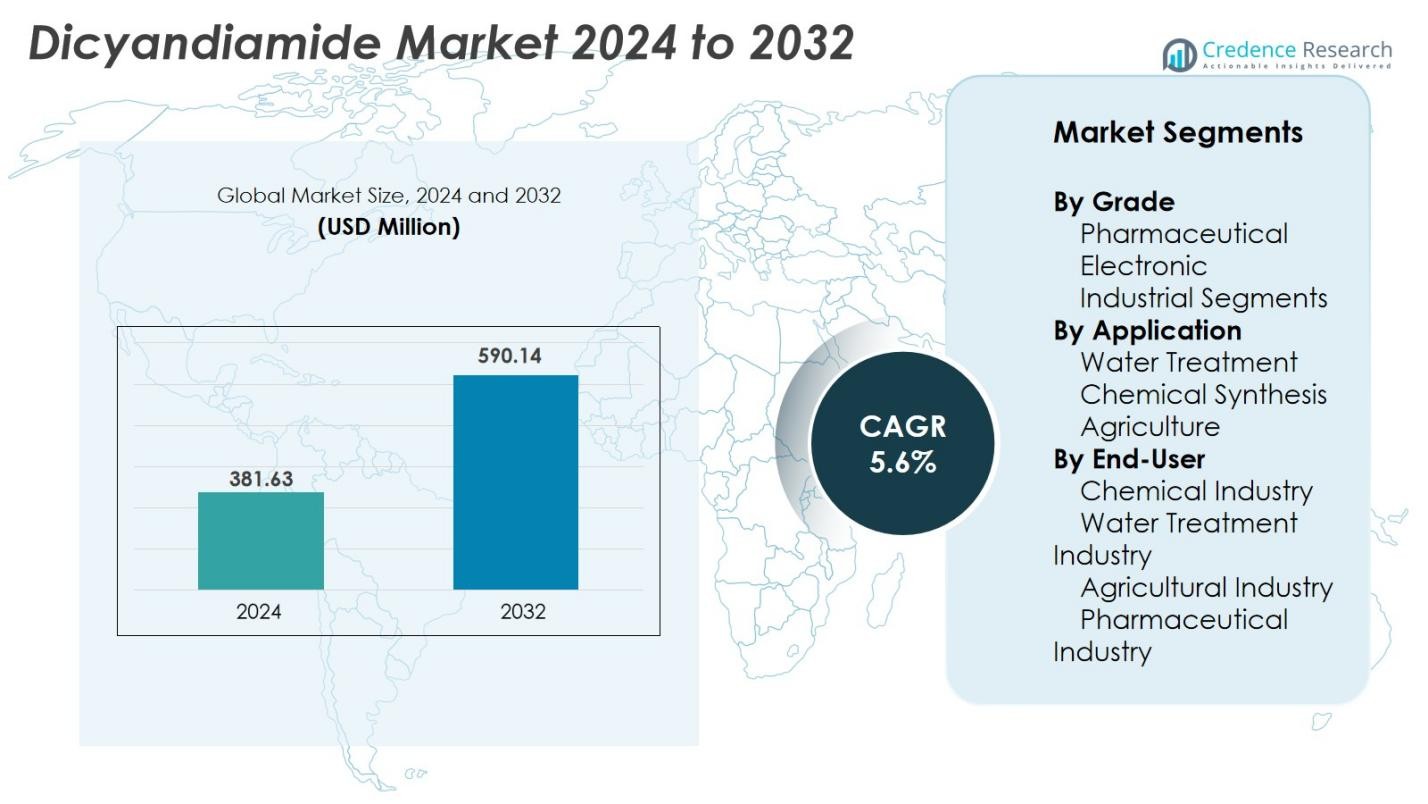

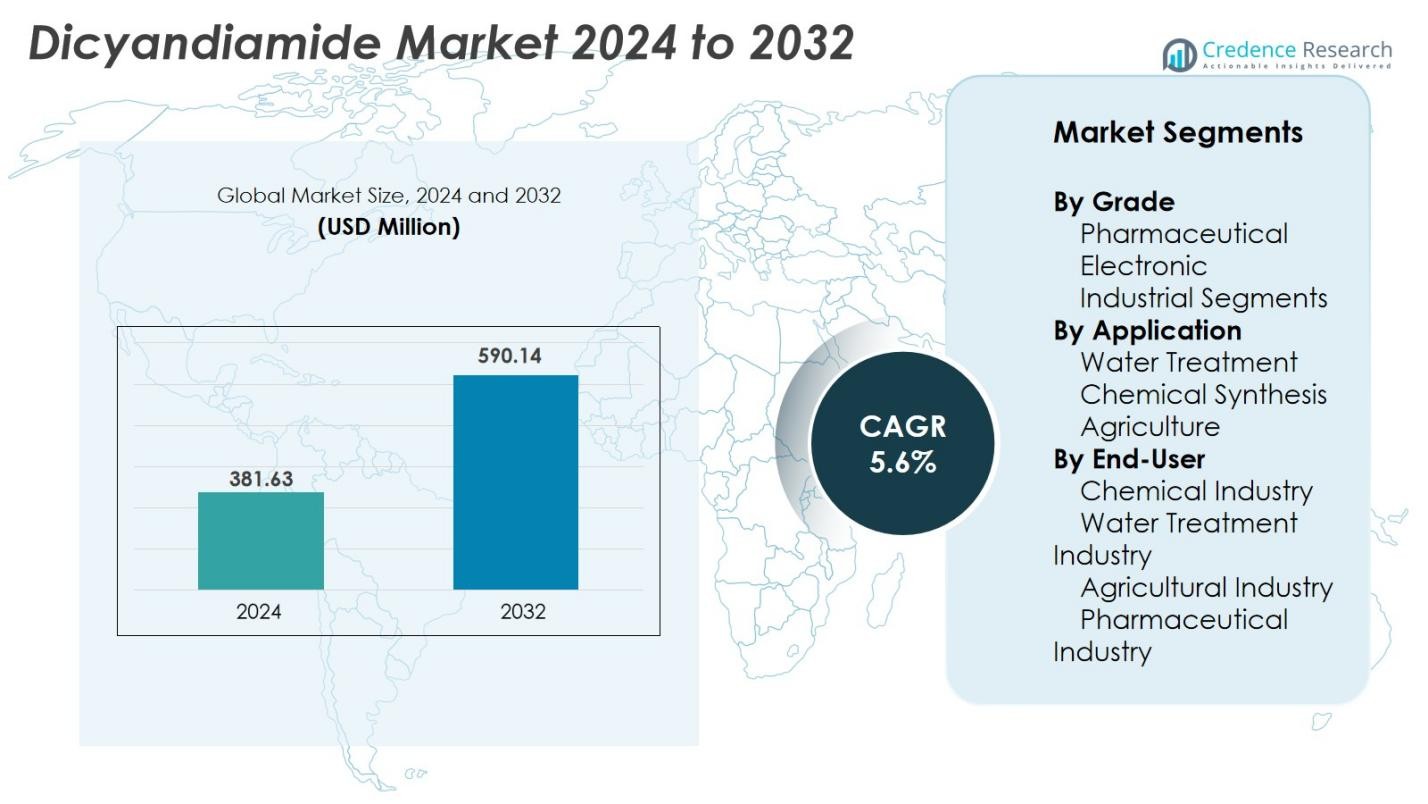

The Dicyandiamide Market size was valued at USD 381.63 million in 2024 and is anticipated to reach USD 590.14 million by 2032, at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dicyandiamide Market Size 2024 |

USD 381.63 Million |

| Dicyandiamide Market, CAGR |

5.6% |

| Dicyandiamide Market Size 2032 |

USD 590.14 Million |

The Dicyandiamide market features key players such as AlzChem Group AG, Nippon Carbide Industries Co., Inc., Beilite Chemical Co., Ltd., and Ningxia Jiafeng Chemicals Co., Ltd, each competing through product innovation, regional expansion, and supply-chain optimisation. The region of Asia Pacific leads the market with approximately 35% of global share, owing to strong growth in manufacturing, electronics, agriculture and pharmaceuticals. Meanwhile, North America holds around 30%, driven by established chemical and pharmaceutical industries, and Europe accounts for about 25%, supported by stringent regulatory standards and mature speciality chemical demand. In addition, rising focus on eco-friendly production practices and increasing investments in advanced synthesis technologies are reshaping market dynamics. Growing demand for high-purity dicyandiamide in electronics and water treatment applications, along with strategic partnerships and capacity expansions by key manufacturers, is further boosting global market competitiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Dicyandiamide market size was valued at USD 381.63 million in 2024 and is projected to reach USD 590.14 million by 2032, growing at a CAGR of 5.6% during the forecast period.

- The market is driven by rising demand in water treatment applications, particularly for municipal and industrial facilities, where dicyandiamide is used as an effective coagulant. The pharmaceutical industry’s growth also contributes significantly, as dicyandiamide plays a vital role in producing antibiotics and bioactive compounds.

- Key market trends include a shift toward eco-friendly dicyandiamide derivatives, aligning with growing sustainability efforts. Technological advancements in chemical synthesis, such as AI and automation in production lines, offer opportunities for more cost-effective and high-quality manufacturing.

- Major players like AlzChem Group AG, Nippon Carbide Industries, and Beilite Chemical are focused on product innovation and regional expansion. Competitive pressures stem from raw material costs and regulatory compliance.

- Asia Pacific leads the market with a 35% share, followed by North America with 30% and Europe at 25%. The Middle East and Latin America account for around 5% each.

Market Segmentation Analysis

By Grade

The Dicyandiamide market is segmented by grade into pharmaceutical, electronic, and industrial grades. Among these, the pharmaceutical grade segment holds the dominant share, accounting for 40% of the market. This segment’s growth is driven by the increasing demand for dicyandiamide as an essential intermediate in the production of various pharmaceutical products, including antibiotics and other bioactive compounds. The rise in healthcare needs, especially in the treatment of chronic diseases, supports the pharmaceutical grade’s market leadership. Additionally, stringent regulatory standards and high purity requirements for pharmaceutical applications boost the demand for this grade.

- For instance, Beilite Chemical Co., Ltd. reports an annual output of 33,000 tons of dicyandiamide (DCDA) from its facility, positioning it as a significant producer of high‑grade DCDA for specialty applications.

By Application

Dicyandiamide finds application across multiple sectors, including water treatment, chemical synthesis, and agriculture. The water treatment segment is the largest, holding around 50% of the market share. This dominance is attributed to the growing need for efficient water purification solutions, where dicyandiamide plays a crucial role as a coagulant in water treatment processes. Additionally, industrial and municipal water treatment applications are expanding, fueled by increasing water scarcity and pollution concerns. Chemical synthesis and agriculture also contribute significantly, driven by the need for fertilizers and specialized chemical products.

- For instance, Alzchem AG (Germany) reports an annual production capacity of 25,000 tons of dicyandiamide at its plant in Schalchen, which underpins its ability to supply large scale water‑treatment and resin‑curing applications.

By End-User

The Dicyandiamide market’s end-user segmentation includes the chemical, water treatment, agricultural, and pharmaceutical industries. The chemical industry is the largest end-user, commanding nearly 38% of the market share. The growing demand for dicyandiamide as a key intermediate in the manufacture of diverse chemicals, such as resins and plastics, is the primary driver of this segment. The agricultural industry follows closely, with a market share of approximately 35%, as dicyandiamide is used in fertilizers and other agrochemicals. Both sectors benefit from rising industrialization, population growth, and increasing demand for advanced agricultural solutions.

Key Growth Drivers

Rising Demand for Water Treatment Solutions

The increasing global demand for clean and safe water is a significant growth driver for the Dicyandiamide market. Dicyandiamide is extensively used in water treatment processes, particularly as a coagulant in municipal and industrial water treatment facilities. As water pollution levels rise due to industrialization, urbanization, and climate change, the need for effective water purification technologies has surged. Dicyandiamide helps in the efficient removal of impurities, making it a critical chemical for water treatment plants. This growing focus on water conservation and quality has resulted in an increased adoption of dicyandiamide across the water treatment sector, further boosting its market growth.

- For instance, Solenis reported that one refinery, after switching to its ChargePac coagulant program, was able to recycle an additional 960,000 m³ of water annually, while reducing sludge production by 8,000 metric tons per year.

Growth in the Pharmaceutical Industry

The pharmaceutical industry is another key driver of the Dicyandiamide market. Dicyandiamide is used in the synthesis of various pharmaceutical products, including antibiotics, antihistamines, and other bioactive compounds. With the rising global healthcare demand, especially in emerging markets, there is a significant surge in the need for high-quality pharmaceutical intermediates. Dicyandiamide plays an essential role in manufacturing these compounds due to its efficiency and cost-effectiveness. Additionally, the increasing prevalence of chronic diseases, such as diabetes and cardiovascular conditions, has further propelled the demand for pharmaceutical products, directly driving the demand for dicyandiamide in the production process.

- For instance, DCDA is used in the synthesis of guanidine nitrate, an intermediate for sulfonamide drugs, and in compounds like Metformin (an antidiabetic medication).

Expansion of the Chemical Industry

The rapid growth of the chemical industry is a major factor fueling the Dicyandiamide market. Dicyandiamide is a versatile intermediate used in the production of resins, plastics, and adhesives, which are vital components of various industrial applications. As industrialization continues to expand, especially in developing economies, the demand for these chemical products is increasing. Furthermore, the push towards more sustainable and efficient materials, such as bio-based plastics and advanced adhesives, has led to higher consumption of dicyandiamide in these formulations. The global expansion of chemical manufacturing facilities and the growing need for specialized chemical products are expected to further enhance the demand for dicyandiamide, contributing to overall market growth.

Key Trends & Opportunities

Adoption of Eco-Friendly Dicyandiamide Alternatives

With increasing environmental concerns and stricter regulations regarding chemical manufacturing processes, there is a growing trend toward eco-friendly alternatives in the Dicyandiamide market. Manufacturers are exploring greener production methods, including the development of dicyandiamide derivatives that have reduced environmental impact. This trend is driven by both regulatory pressures and consumer demand for more sustainable products. The opportunity lies in the innovation of dicyandiamide-based solutions that align with sustainability goals, offering the potential to replace traditional chemicals used in industries like agriculture, water treatment, and pharmaceuticals. Companies that adopt these green alternatives can gain a competitive edge in the market.

- For instance, AlzChem Group AG reports that its dicyandiamide plant in Schalchen reuses around 30,000 tonnes of CO₂ from energy generation every year as a process feedstock instead of releasing it to the atmosphere.

Technological Advancements in Chemical Synthesis

Technological innovations in chemical synthesis and manufacturing processes present significant opportunities for the Dicyandiamide market. Automation and AI integration into production lines are increasing efficiency and reducing costs, while advancements in chemical reaction engineering are improving the yield and purity of dicyandiamide. Additionally, the development of advanced catalysts and optimized reaction conditions is allowing for more efficient production methods. These technological advancements not only improve the cost-effectiveness of dicyandiamide production but also enable the creation of new products and applications, expanding market opportunities. Companies investing in such technologies are poised to meet the growing demand for high-quality dicyandiamide products.

- For instance, innovative continuous synthesis systems have been developed that integrate automated mixing of raw materials like lime nitrogen and carbon dioxide with controlled hydrolysis and polymerization reactors, leading to consistent high-purity dicyandiamide production.

Key Challenges

Raw Material Supply Constraints

The availability of raw materials for dicyandiamide production presents a significant challenge for the market. Dicyandiamide is primarily derived from urea and cyanamide, which are subject to fluctuations in supply and price volatility. Disruptions in the supply chain, such as those caused by geopolitical factors, regulatory changes, or natural disasters, can lead to price hikes and production delays. This volatility can increase production costs for manufacturers, affecting overall profitability and the stability of the market. The reliance on specific raw materials also limits the flexibility of manufacturers to adjust to changing market conditions, posing a challenge for long-term growth.

Regulatory and Environmental Challenges

Regulatory challenges surrounding the production and use of dicyandiamide are another key hurdle in the market. Dicyandiamide and its derivatives are subject to stringent environmental regulations due to their chemical composition and potential toxicity. Compliance with these regulations often requires significant investment in research and development, as well as updates to production processes to meet environmental and safety standards. Additionally, concerns about the environmental impact of dicyandiamide’s by-products, particularly in water treatment and agriculture, have prompted increasing scrutiny from regulatory bodies. Companies must navigate these complex regulatory landscapes while ensuring their products remain viable and competitive.

Regional Analysis

Asia Pacific

The Asia Pacific region leads the dicyandiamide market, commanding 35% of global revenue. Strong manufacturing bases in countries such as China, Japan, and India underpin this dominance, combining large-scale chemical production with robust demand in electronics, agriculture, and pharmaceuticals. The expanding electronics industry in Japan, for instance, and significant textile and fertilizer end-uses in China drive regional growth. Furthermore, government support for industrial growth and continued investments in advanced production technologies are enhancing output capacity. Integration of dicyandiamide in high-value electronics and sustainable agrochemicals further strengthens the region’s leadership position.

North America

In North America, the market holds a 30% share and is supported by well-established pharmaceutical and chemical sectors. The region’s focus on high-purity intermediates and specialty applications such as adhesives and coatings for the construction and automotive industries underpins demand. Elevated standards for manufacturing and strong R&D infrastructure enable high-grade dicyandiamide consumption. Additionally, rising investments in specialty chemicals and growing innovations in resin and polymer formulations are increasing its use. The presence of leading manufacturers and adoption of green chemistry principles further drive the market in the region.

Europe

Europe contributes 25% of the global market for dicyandiamide. Growth is driven by strict environmental and safety regulations such as the EU’s Green Deal and REACH that favor high-performance, compliant chemical intermediates. Applications in advanced electronics, flame retardants, and sustainable fertilizer solutions are prominent in countries like Germany and France. Moreover, innovation in precision agriculture and demand for eco-friendly chemicals are expanding opportunities. The region’s commitment to reducing carbon emissions and promoting sustainable manufacturing further enhances the adoption of high-quality dicyandiamide derivatives across end-use sectors.

Latin America

Latin America accounts for 5% of the market. Although smaller in scale, the region shows budding potential through increasing industrialization, infrastructure development, and growing agricultural applications. Brazil and Mexico are key markets where unmet demand for efficient fertilizers and specialty chemicals offers opportunities for modest expansion. Continued investment in agrochemical technologies and the expansion of textile manufacturing sectors also contribute to demand. Growing export-oriented chemical production and rising foreign investments in sustainable raw materials may further support market growth over the forecast period.

Middle East & Africa (MEA)

The MEA region holds 5% of the global dicyandiamide market. Growth in this region is anchored by investments in infrastructure, water-treatment, and oil & gas sectors. Limited domestic chemical production and reliance on imports pose challenges, but emerging industrial and municipal water-treatment projects are gradually boosting demand. Government initiatives to expand manufacturing and reduce dependence on imports are paving the way for regional capacity building. Furthermore, increased focus on desalination, wastewater treatment, and chemical diversification in countries like the UAE and Saudi Arabia is expected to drive future consumption.

Market Segmentations

By Grade

- Pharmaceutical

- Electronic

- Industrial Segments

By Application

- Water Treatment

- Chemical Synthesis

- Agriculture

By End-User

- Chemical Industry

- Water Treatment Industry

- Agricultural Industry

- Pharmaceutical Industry

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Dicyandiamide market is characterized by a relatively concentrated set of global producers that focus on specialty grades and region-specific applications. Key players—such as AlzChem Group AG, Ningxia Jiafeng Chemicals Co., Ltd., Nippon Carbide Industries Co., Inc., and Beilite Chemical Co., Ltd.—deploy strategies including capacity expansions, product-grade differentiation, and regional distribution partnerships to retain market share. These firms emphasize high-purity pharmaceutical and electronic-grade DCD (dicyandiamide) while balancing bulk industrial-grade volumes to serve diverse segments. Competitive pressures stem from raw-material cost fluctuations, regulatory compliance, and downstream product performance, prompting these companies to invest in R&D and supply-chain optimization. Despite moderate fragmentation, larger players hold the majority share and continue driving consolidation through alliances and acquisitions to expand footprints and strengthen resilience in an evolving market.

Key Player Analysis

- Parachem

- Glentham Life Sciences

- Beilite Chemical Co., Ltd.

- Thermo Scientific Chemicals

- Tokyo Chemical Industry (TCI)

- Ningxia Jiafeng Chemicals Co., Ltd

- Nippon Carbide Industries Co., Inc

- Avantor Inc. by VWR International LLC

- AlzChem Group AG

- Spectrum Chemical Mfg. Corp

Recent Developments

- In February 2025, Beilite Chemical Co., Ltd. announced enhanced production and high‑purity grades of Dicyandiamide used in pharmaceuticals, agriculture and industrial applications.

- In March 2024, Alzchem Group AG received an investment grant of EUR 34.4 million from the EU Commission as part of the ASAP (“Act in Support of Ammunition Production”) funding instrument for capacity expansion of guanidine nitrate and nitroguanidine.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Grade, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is projected to expand steadily with sustained demand across pharmaceuticals, water treatment, agriculture and electronics sectors.

- Growth will be supported by deeper penetration in the Asia Pacific region, which holds roughly 35% share, alongside major contributions from North America 30%and Europe 25%.

- Pharmaceutical grade products accounting for about 40% of segment share will continue to dominate, while industrial‑grade uses gain traction due to water treatment and resin applications.

- Opportunities exist through the development of eco‑friendly dicyandiamide derivatives and novel applications in flame retardants, epoxy resins, and specialty agrochemicals.

- Technological advancements in synthesis and purification will lower costs and improve grade purity, enabling wider application in electronics and high‑performance materials.

- Agricultural demand will increase as nitrogen‑stabilized fertilizers incorporating dicyandiamide become more accepted in sustainable farming practices.

- Water treatment applications will grow as municipalities and industries adopt advanced coagulants to comply with stricter environmental standards.

- Raw material supply constraints and price volatility (e.g., urea and cyanamide feedstocks) will pressure manufacturers to optimise operations and secure upstream partnerships.

- Regulatory and environmental compliance costs will rise, encouraging manufacturers to invest in cleaner production and to adapt product portfolios accordingly.

- Strategic expansion into emerging markets and capacity investments will be key for market players to capture future growth in under‑penetrated regions and segments.