Market Overview:

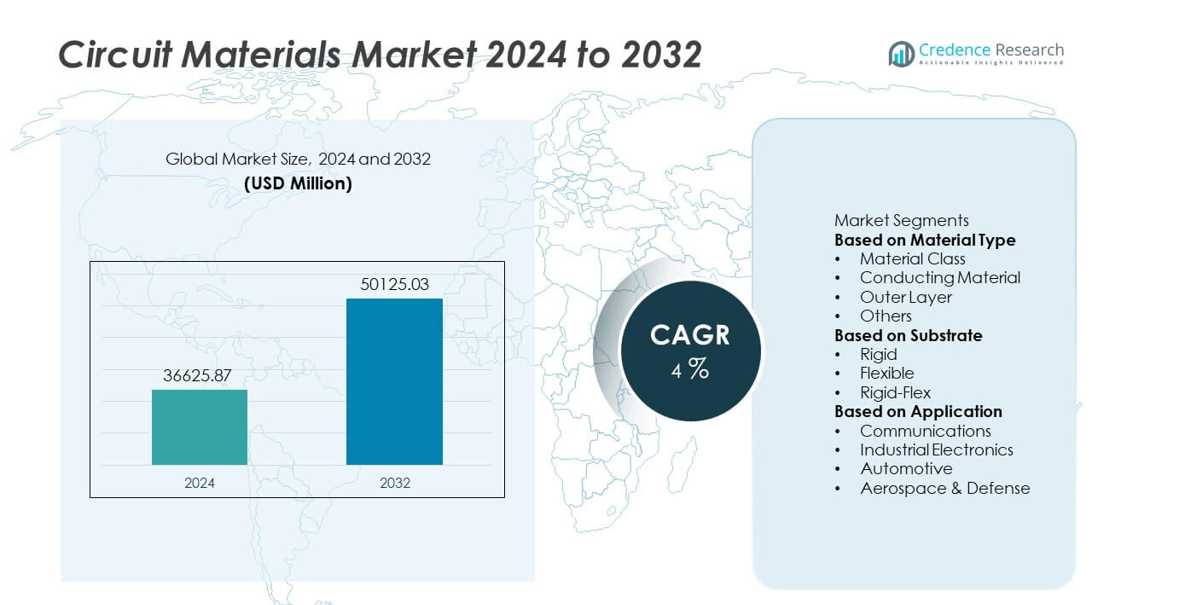

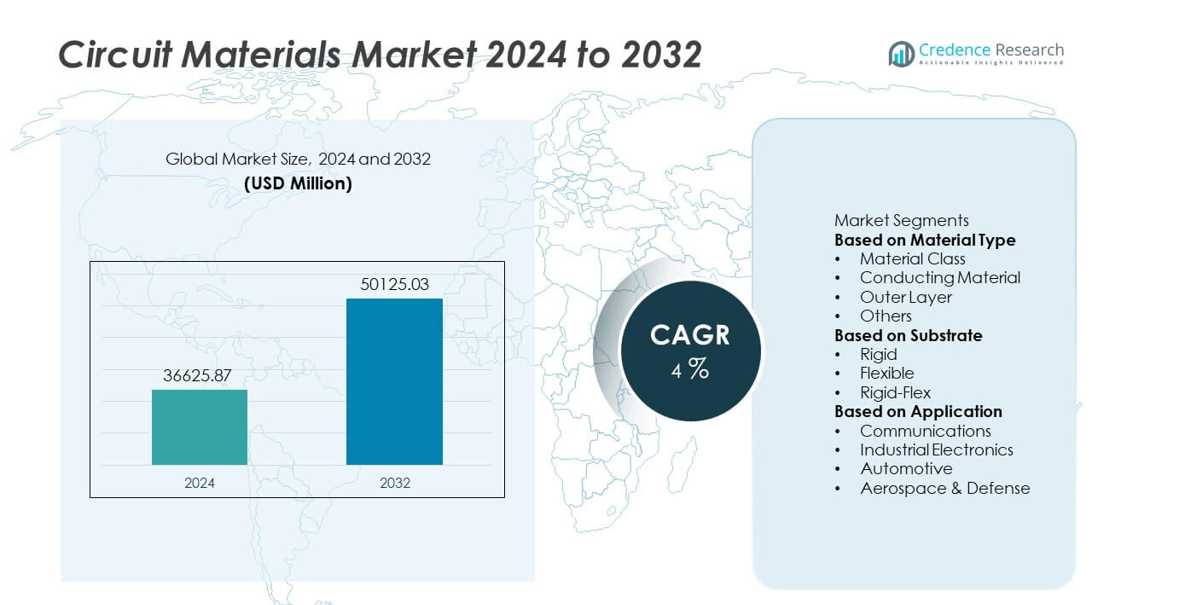

The global circuit materials market was valued at USD 36,625.87 million in 2024 and is projected to reach USD 50,125.03 million by 2032, growing at a compound annual growth rate (CAGR) of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Circuit Materials Market Size 2024 |

USD 36,625.87 million |

| Circuit Materials Market, CAGR |

4% |

| Circuit Materials Market Size 2032 |

USD 50,125.03 million |

The circuit materials market is led by key players including Rogers Corporation, Kingboard Laminates Holdings Ltd, Panasonic Corporation, DuPont, Isola Group, Mitsubishi Materials Corporation, Shengyi Technology Co. Ltd, ITEQ Corporation, Taiflex Scientific Co. Ltd, and Nikkan Industries Co. Ltd. These companies dominate through continuous innovation in high-frequency laminates, advanced substrates, and environmentally sustainable materials. Asia-Pacific emerged as the leading region with a 36.9% market share in 2024, driven by large-scale electronics manufacturing and 5G infrastructure development. North America followed with 28.2%, supported by strong demand from automotive and aerospace industries, while Europe accounted for 24.6%, led by sustainability initiatives and advanced PCB production.

Market Insights

- The global circuit materials market was valued at USD 36,625.87 million in 2024 and is projected to reach USD 50,125.03 million by 2032, growing at a CAGR of 4%.

- Rising demand for high-performance electronics, electric vehicles, and 5G infrastructure is driving the market for advanced circuit laminates and substrates.

- Key trends include the shift toward eco-friendly, halogen-free materials and the growing adoption of flexible and rigid-flex substrates in compact device manufacturing.

- Leading companies such as Rogers Corporation, Panasonic Corporation, DuPont, and Kingboard Laminates Holdings Ltd are investing in R&D, sustainable materials, and regional production expansion to maintain competitiveness.

- Asia-Pacific dominated the market with a 36.9% share in 2024, followed by North America with 28.2% and Europe with 24.6%, while conducting materials led the segment with a 43.6% share due to their widespread use in high-speed electronic circuits.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material Type

Conducting materials dominated the circuit materials market with a 43.6% share in 2024. Their superior electrical conductivity and compatibility with high-speed circuit designs make them essential in advanced electronics manufacturing. Copper remains the most widely used conducting material due to its balance of performance, cost, and availability. Growing demand for miniaturized and high-frequency circuits in smartphones, servers, and automotive electronics continues to drive this segment. Meanwhile, innovations in low-loss dielectric materials and outer layers support efficient heat dissipation and signal transmission in next-generation printed circuit boards.

- For instance, Rogers Corporation introduced RO4830™ Plus laminates optimized for 76–81 GHz radar systems, featuring a dielectric constant of 3.03 and insertion loss of 1.5 dB/inch at 77 GHz. These materials enable superior signal integrity for high-frequency automotive radar and 5G base station designs.

By Substrate

Rigid substrates held the largest share of 57.2% in 2024, driven by their extensive use in consumer electronics, automotive control units, and industrial systems. Their high mechanical strength, dimensional stability, and cost-effectiveness make them ideal for multilayer circuit boards. Demand is further boosted by large-scale PCB manufacturing in Asia-Pacific and rising integration of automation systems. Flexible and rigid-flex substrates are gaining momentum due to lightweight construction and adaptability for wearable devices, flexible displays, and compact electronic modules used in aerospace and medical equipment.

- For instance, Shengyi Technology Co., Ltd. invested CNY 1.4 billion to establish a copper-clad laminate plant in Thailand, adding advanced production capacity for high-reliability rigid and flexible PCB substrates tailored for automotive and AI server applications.

By Application

The communications segment led the circuit materials market with a 36.4% share in 2024, supported by the rapid deployment of 5G networks and data transmission systems. High-frequency and low-loss materials are increasingly used to enhance signal integrity and performance in base stations, routers, and antennas. The growing penetration of IoT and cloud computing infrastructure also contributes to strong demand. Automotive and industrial electronics follow closely, driven by rising use of electronic control units, sensors, and power modules. Aerospace and defense applications continue to expand with demand for high-reliability and thermal-resistant materials.

Key Growth Drivers

Rising Demand for High-Performance Electronic Devices

The growing use of high-performance electronic devices such as smartphones, wearables, and advanced computing systems is driving demand for superior circuit materials. Manufacturers are focusing on materials with improved dielectric strength, heat resistance, and signal integrity to support faster data transmission and miniaturization. The expansion of 5G infrastructure, IoT networks, and AI-based electronics further strengthens the need for reliable and efficient printed circuit board (PCB) materials capable of operating under high-frequency and thermal stress conditions.

- For instance, Panasonic Corporation offers the XPEDION R-5515 ultra-low transmission loss circuit board material, which achieves a dielectric constant (Dk) of 3.06 and a dissipation factor (Df) of 0.002 at 14 GHz.

Expansion of Electric Vehicles and Automotive Electronics

The rapid adoption of electric vehicles (EVs) and smart automotive technologies is a key driver of circuit material demand. EV systems require high-temperature, vibration-resistant materials for control units, battery management, and safety systems. The growing integration of ADAS, infotainment, and connectivity modules increases PCB complexity and performance requirements. Manufacturers are developing advanced laminates and copper foils to improve current-carrying capacity and durability, meeting automotive reliability standards while supporting energy-efficient and lightweight vehicle architectures.

- For instance, Mitsubishi Materials Corporation introduced high-tensile rolled copper foil with a thickness of 6 µm and conductivity exceeding 95% IACS, optimized for EV inverters and on-board chargers. This development enhances thermal management and ensures stable power delivery under continuous high-load operating conditions.

Growth in Communication Infrastructure and 5G Deployment

The rollout of 5G networks is creating strong demand for high-frequency and low-loss circuit materials. Telecom base stations, antennas, and network routers depend on materials that ensure superior signal transmission and thermal management. The need for multi-layer PCBs and advanced substrates is growing as communication systems operate at higher frequencies. Manufacturers are focusing on resin systems and reinforced substrates that minimize signal delay and improve power handling, enabling efficient performance in next-generation communication devices and wireless infrastructure.

Key Trends & Opportunities

Adoption of Eco-Friendly and Halogen-Free Materials

Sustainability is emerging as a major trend in the circuit materials market, with growing adoption of halogen-free and recyclable materials. Regulations promoting reduced carbon footprints and safer disposal practices are driving the shift toward green laminates and substrates. Manufacturers are developing bio-based resins and low-emission materials without compromising electrical performance. This shift presents an opportunity for companies to capture environmentally conscious markets while complying with stringent global environmental standards in electronics manufacturing.

- For instance, Kingboard Laminates Holdings Ltd. launched a halogen-free CCL series using modified epoxy resin systems that reduce bromine content below 900 ppm and achieve a thermal decomposition temperature above 350°C. These laminates meet RoHS and REACH compliance, supporting sustainable production in high-frequency communication devices.

Rising Integration of Flexible and Rigid-Flex Circuits

The growing demand for lightweight, compact, and flexible electronic designs is promoting the use of flexible and rigid-flex circuit materials. These substrates are increasingly used in wearable devices, foldable smartphones, aerospace systems, and medical electronics. They offer excellent flexibility, durability, and space efficiency, supporting innovative product designs. Advancements in polyimide films and adhesive technologies further enhance thermal performance, creating new opportunities for manufacturers to cater to the next generation of miniaturized and multifunctional electronics.

- For instance, Taiflex Scientific Co., Ltd. introduced polyimide-based flexible copper-clad laminates with a thickness of 12 µm and tensile strength exceeding 150 MPa, designed for foldable OLED displays and advanced sensor modules. These materials deliver superior bending reliability, maintaining electrical stability after over 100,000 flex cycles.

Key Challenges

High Cost of Advanced Materials and Manufacturing Processes

The development of high-performance circuit materials involves complex manufacturing techniques and premium raw materials, increasing overall production costs. Advanced laminates, high-speed substrates, and low-loss materials require precision processing and stringent quality control. Small and mid-scale manufacturers face difficulties adopting these technologies due to high capital requirements. This cost barrier limits widespread adoption in price-sensitive markets, compelling producers to balance innovation with affordability while maintaining consistent quality and performance standards.

Supply Chain Disruptions and Raw Material Shortages

Global supply chain disruptions and fluctuations in raw material availability present major challenges to the circuit materials market. Shortages of copper foil, glass fiber, and resin compounds impact production timelines and pricing stability. Geopolitical uncertainties and transportation delays have further strained sourcing and logistics. Manufacturers are diversifying their supplier base and investing in localized production to mitigate risks. However, maintaining consistent material quality and ensuring cost-effective supply remain persistent challenges in a highly competitive environment.

Regional Analysis

North America

North America held a 28.2% share of the global circuit materials market in 2024, driven by strong demand from the automotive, aerospace, and telecommunications industries. The region benefits from the rapid expansion of 5G infrastructure, electric vehicle production, and defense electronics manufacturing. The United States leads the market with advanced PCB fabrication capabilities and growing adoption of high-frequency materials. Increasing investments in semiconductor R&D and miniaturized component production further enhance regional growth. Canada and Mexico contribute through expanding industrial electronics and automotive assembly sectors supported by regional trade initiatives.

Europe

Europe accounted for 24.6% of the circuit materials market in 2024, supported by its advanced automotive and industrial manufacturing base. Countries such as Germany, France, and the United Kingdom are key contributors due to strong PCB production and EV adoption. The region emphasizes sustainability, driving demand for halogen-free and recyclable materials. Technological developments in aerospace and defense electronics also boost consumption of high-reliability substrates. Strict EU environmental regulations and investment in energy-efficient electronic systems continue to shape the market’s direction, encouraging innovation in lightweight and high-performance circuit materials.

Asia-Pacific

Asia-Pacific dominated the global circuit materials market with a 36.9% share in 2024, owing to its large-scale electronics manufacturing ecosystem. China, Japan, South Korea, and India serve as major production hubs for consumer electronics, automotive systems, and communication devices. Rapid urbanization and 5G rollout have accelerated PCB demand across multiple industries. Strong government support for domestic semiconductor fabrication and renewable energy systems further strengthens growth. The region’s competitive labor costs, robust supply chain, and adoption of flexible circuit technologies position it as the fastest-growing market globally.

Latin America

Latin America captured a 6.3% share of the circuit materials market in 2024, led by Brazil and Mexico’s expanding electronics and automotive sectors. Growing investments in communication infrastructure and industrial automation are supporting steady demand for circuit laminates and substrates. The adoption of energy-efficient systems in manufacturing and transportation is creating new opportunities. Local PCB production remains limited, but import partnerships with Asian and North American suppliers sustain market supply. Government initiatives promoting digital connectivity and electric mobility continue to encourage investment in advanced circuit material technologies.

Middle East & Africa

The Middle East and Africa held a 4% share of the global circuit materials market in 2024, driven by growth in industrial automation, telecommunications, and defense sectors. Gulf nations such as the UAE and Saudi Arabia are investing in smart city projects and renewable energy systems that require advanced electronic materials. In Africa, increasing electrification and local electronics assembly are boosting demand for cost-effective circuit substrates. The expansion of regional manufacturing capabilities and partnerships with international suppliers are expected to enhance market presence and long-term growth potential.

Market Segmentations:

By Material Type

- Material Class

- Conducting Material

- Outer Layer

- Others

By Substrate

- Rigid

- Flexible

- Rigid-Flex

By Application

- Communications

- Industrial Electronics

- Automotive

- Aerospace & Defense

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The circuit materials market is highly competitive, with leading companies such as Rogers Corporation, Kingboard Laminates Holdings Ltd, Panasonic Corporation, Nikkan Industries Co. Ltd, Taiflex Scientific Co. Ltd, Isola Group, Mitsubishi Materials Corporation, Shengyi Technology Co. Ltd, DuPont, and ITEQ Corporation driving innovation and market expansion. These players focus on developing advanced laminates, high-frequency substrates, and eco-friendly materials to meet the growing demand from communication, automotive, and industrial electronics sectors. Strategic initiatives such as capacity expansion, R&D investment, and technological collaborations are central to maintaining market leadership. Companies are also emphasizing sustainable manufacturing processes, halogen-free materials, and lightweight composites to align with global environmental standards. The competition is further intensified by the rapid adoption of 5G infrastructure and electric vehicle components, prompting key players to strengthen global supply chains and expand production capabilities across Asia-Pacific and North America.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Rogers Corporation launched the new RO4830™ Plus thermoset laminates for automotive radar sensor applications, supporting 76-81 GHz millimetre-wave PCBs with a dielectric constant of ~3.03 at 77 GHz and an insertion loss of 1.5 dB/inch.

- In June 2024, Rogers Corporation announced plans to wind down manufacturing of advanced circuit materials at its Evergem (Belgium) plant by mid-2025, in order to improve factory utilization, reduce costs and increase margins.

- In August 2023, Kingboard Laminates Holdings Ltd. reported that during H1 the company added upstream copper-foil capacity of 450 tonnes/month in Lianzhou and plans to add another 300 tonnes/month in H2; it also plans to expand laminate sheet capacity in Thailand by 400,000 sheets/month.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Substrate, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing demand for high-performance electronic components.

- Growth in 5G and IoT technologies will accelerate the adoption of advanced circuit materials.

- Electric vehicle production will drive demand for heat-resistant and durable laminates.

- Manufacturers will focus on halogen-free and recyclable materials to meet sustainability goals.

- Technological innovation will enhance signal integrity and thermal performance in PCBs.

- Flexible and rigid-flex substrates will gain traction in wearable and compact devices.

- Asia-Pacific will remain the leading market due to strong electronics manufacturing.

- Strategic partnerships and capacity expansions will strengthen global supply networks.

- Rising investments in semiconductor and communication infrastructure will boost material demand.

- Companies will emphasize cost optimization and supply chain resilience to maintain competitiveness.