Market Overview:

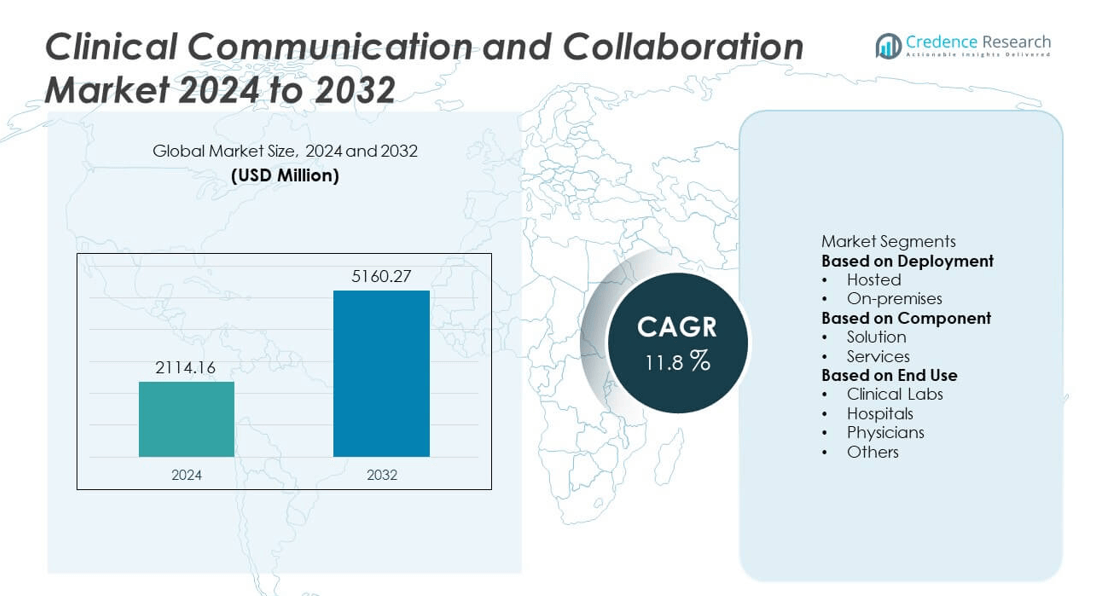

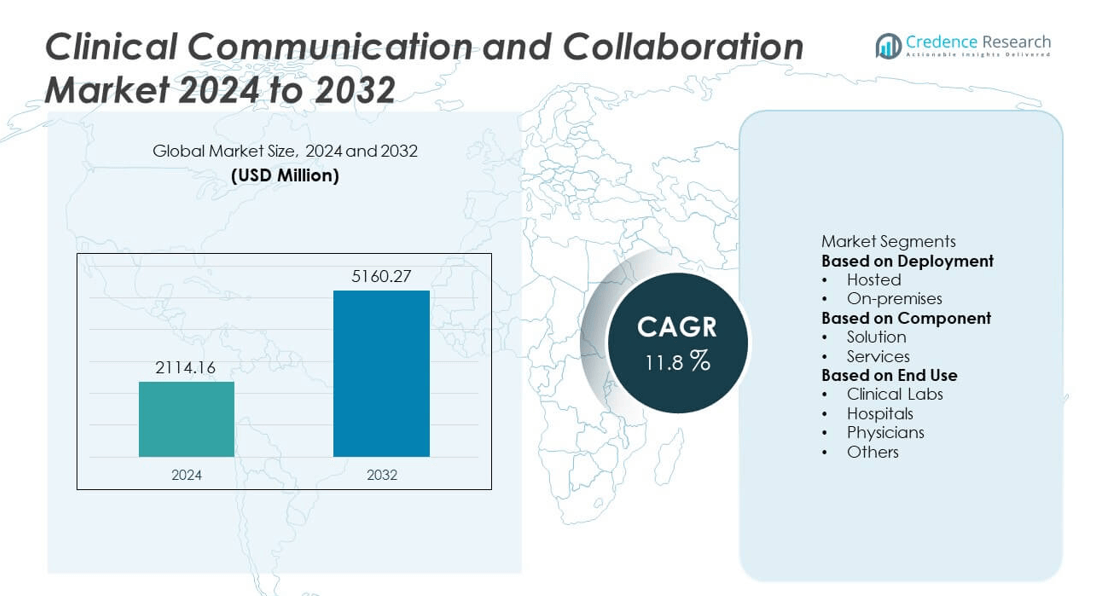

The Clinical Communication and Collaboration (CC&C) Market was valued at USD 2114.16 million in 2024 and is projected to reach USD 5160.27 million by 2032, growing at a CAGR of 11.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Clinical Communication and Collaboration Market Size 2024 |

USD 2114.16 million |

| Clinical Communication and Collaboration Market, CAGR |

11.8% |

| Clinical Communication and Collaboration MarketSize 2032 |

USD 5160.27 million |

The Clinical Communication and Collaboration market is led by key players such as Cisco Systems, Inc., Halo Health Systems, Intel Corporation, NEC Corporation, Oracle, TNS Inc. (AGNITY Inc.), Avaya LLC, Microsoft, Spok Holdings Inc., and HILLROM & WELCH ALLYN (Baxter International). These companies dominate through innovative cloud-based communication platforms that enhance workflow efficiency, patient safety, and data security. Microsoft, Cisco, and Oracle lead in AI-driven and cloud-integrated healthcare communication systems, while Baxter and Halo Health focus on clinical workflow optimization. North America held the largest market share of 41.8% in 2024, driven by advanced healthcare infrastructure and rapid digital adoption, followed by Europe at 27.5% and Asia-Pacific at 24.6%, the fastest-growing region supported by rising telehealth and hospital modernization initiatives.

Market Insights

- The Clinical Communication and Collaboration market was valued at USD 2114.16 million in 2024 and is projected to reach USD 5160.27 million by 2032, expanding at a CAGR of 11.8% during the forecast period.

- Rising demand for real-time communication among healthcare professionals and the shift toward patient-centered care are driving market growth.

- Key trends include the integration of AI, mobile-based communication, and cloud platforms to improve collaboration, workflow automation, and clinical decision-making.

- The market is competitive, with major players such as Cisco, Microsoft, Oracle, and Baxter focusing on secure, HIPAA-compliant communication tools and digital transformation strategies.

- North America led the market with a 41.8% share in 2024, followed by Europe at 27.5% and Asia-Pacific at 24.6%, while the hosted deployment segment accounted for 63.5% of the market due to its scalability and cost-efficiency in healthcare communication systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment

The hosted segment dominated the Clinical Communication and Collaboration market in 2024, accounting for 63.5% of the total share. Its leadership is attributed to the increasing adoption of cloud-based platforms that offer scalability, lower infrastructure costs, and easy accessibility. Hosted solutions enable seamless data sharing across multiple healthcare facilities, improving communication efficiency and care coordination. The growing preference for remote and mobile healthcare delivery supports the demand for hosted CC&C systems. Vendors are enhancing security and compliance features to meet HIPAA and GDPR standards, further driving adoption across hospitals and clinics.

- For instance, Cisco Systems launched its Webex Cloud for Healthcare platform, supporting over 1.8 million secure virtual consultations annually across major hospital networks. The system integrates AI-driven noise removal and encrypted patient data sharing across 190 countries, ensuring real-time collaboration and compliance with global data regulations.

By Component

The solution segment held the largest share of 69.2% in the Clinical Communication and Collaboration market in 2024. The segment’s dominance stems from rising demand for integrated communication tools that support secure messaging, voice, video, and clinical data exchange. Healthcare organizations are adopting CC&C platforms to reduce response times and improve collaboration between care teams. Advanced solutions integrating EHRs and AI-driven alerts are enhancing workflow automation and clinical decision-making. Continuous innovation by key players in interoperability and mobile compatibility is further boosting solution deployment across healthcare networks.

- For instance, Spok Holdings’ solutions process over 70 million messages each month for its customers, which include over 2,200 hospitals. The company’s clinical communication platforms, such as Spok Care Connect, use EHR integration to improve workflows and reduce communication delays, which in turn leads to improved patient response times and clinical coordination efficiency.

By End Use

Hospitals led the Clinical Communication and Collaboration market in 2024, capturing 54.6% of the total share. Their leadership is driven by the need for real-time coordination among multidisciplinary teams, particularly in emergency and critical care settings. Hospitals are adopting CC&C systems to enhance patient safety, streamline handoffs, and reduce communication errors. Integration with hospital information systems and nurse call platforms improves workflow efficiency and response times. The growing focus on digital transformation, coupled with increased investments in healthcare IT infrastructure, continues to fuel adoption among hospitals worldwide.

Key Growth Drivers

Increasing Demand for Streamlined Clinical Communication

The rising need for efficient, real-time communication among healthcare professionals is a major growth driver for the Clinical Communication and Collaboration market. Traditional communication systems are being replaced by unified digital platforms that improve coordination between physicians, nurses, and administrative teams. These platforms help reduce delays, enhance workflow management, and improve patient safety. The growing emphasis on timely decision-making and error reduction in hospitals continues to drive adoption of secure, integrated CC&C solutions across global healthcare institutions.

- For instance, Hillrom’s Voalte Platform enabled over 230 million secure messages and 5.2 million voice calls annually across 2,000 healthcare sites. The system’s integration with patient monitoring devices improved clinical alarm response times by 25%, enhancing patient safety and operational efficiency.

Growing Adoption of Mobile and Cloud-Based Healthcare Platforms

Healthcare facilities are rapidly adopting mobile and cloud-based communication systems to support flexible, scalable, and secure clinical collaboration. Mobile-enabled CC&C tools allow clinicians to access patient data, communicate instantly, and share updates across departments. Cloud deployment offers cost efficiency and ensures data accessibility from any location, which is especially critical in remote and telehealth services. The shift toward digital health infrastructure and 24/7 connectivity is accelerating cloud-based CC&C adoption across hospitals, clinics, and laboratories.

- For instance, Microsoft Cloud for Healthcare provides secure communication and AI-driven collaboration through services operating in the more than 60 Azure regions and over 140 countries globally, with standard Teams features supporting up to 300 participants per session.

Rising Focus on Patient-Centered and Value-Based Care

The healthcare industry’s transition toward value-based care is boosting the demand for effective communication tools that improve patient outcomes. Clinical communication platforms streamline information exchange, ensuring that care teams remain aligned during diagnosis, treatment, and follow-up. By integrating with EHRs and telemedicine systems, these platforms enable coordinated, patient-centric care delivery. Hospitals adopting value-based models are increasingly leveraging CC&C technologies to enhance engagement, reduce readmission rates, and strengthen patient satisfaction.

Key Trends & Opportunities

Integration with Artificial Intelligence and Analytics

AI-driven analytics are transforming the Clinical Communication and Collaboration landscape. Intelligent algorithms enable automated alert management, voice-to-text transcription, and predictive response systems. These integrations help reduce clinician workload, identify workflow bottlenecks, and improve patient triage efficiency. Real-time insights generated from communication data support faster decision-making and operational optimization. The growing use of AI enhances both communication accuracy and overall hospital productivity, creating new opportunities for innovation in smart healthcare ecosystems.

- For instance, the Oracle Health Clinical AI Agent uses speech, language, and generative AI capabilities integrated within the EHR to automate and unify a range of clinical workflows, such as generating draft notes and proposing follow-up actions like lab tests and referrals.

Expansion of Telemedicine and Remote Care Collaboration

The rise of telemedicine has created significant opportunities for CC&C adoption. As remote consultations and virtual care models become more prevalent, healthcare providers are implementing cloud-based communication platforms to maintain secure and seamless coordination. These solutions enable video conferencing, document sharing, and team communication across geographies. Telehealth integration also supports multidisciplinary collaboration between specialists. With patient engagement shifting toward virtual channels, CC&C technologies are becoming central to enabling efficient and compliant remote healthcare delivery.

- For instance, NEC Corporation provides various healthcare IT solutions in Japan and is a key player in the growing Japanese telemedicine market. NEC has conducted trials for remote medical examinations using 5G technology, which enabled the real-time sharing of images from a 4K camera and allowed a specialist to guide a local doctor as if present in the room.

Key Challenges

Data Security and Compliance Risks

Ensuring data privacy and compliance with healthcare regulations such as HIPAA, GDPR, and HITECH remains a major challenge. CC&C platforms handle sensitive patient information, making them vulnerable to cyberattacks and data breaches. Healthcare organizations must implement encryption, access control, and secure authentication protocols. However, balancing convenience with security can be difficult, particularly in multi-device environments. The increasing sophistication of cyber threats underscores the need for robust security frameworks and continuous monitoring in clinical communication systems.

Integration Challenges with Legacy Systems

Many hospitals still rely on outdated IT infrastructures that are not easily compatible with modern communication platforms. Integrating new CC&C systems with legacy EHRs and hospital management systems can be complex and resource-intensive. This often leads to operational delays and data synchronization issues. Smaller healthcare facilities, in particular, face cost and expertise constraints in implementing these integrations. Vendors are focusing on developing API-based and interoperable solutions, but achieving seamless connectivity across fragmented systems remains a persistent industry challenge.

Regional Analysis

North America

North America dominated the Clinical Communication and Collaboration market in 2024, accounting for 41.8% of the total share. The region’s leadership is supported by advanced healthcare infrastructure, widespread adoption of digital health technologies, and strong regulatory frameworks for data security. Hospitals in the United States and Canada are integrating cloud-based communication tools to improve workflow efficiency and patient engagement. Key players such as Microsoft, Vocera Communications, and TigerConnect continue to expand their portfolios through AI-driven and HIPAA-compliant solutions. Rising telemedicine adoption and healthcare digitalization further strengthen North America’s market dominance.

Europe

Europe held 27.5% of the Clinical Communication and Collaboration market share in 2024, driven by strong government support for digital health initiatives and patient safety programs. Countries such as Germany, the United Kingdom, and France are leading in adopting interoperable communication platforms integrated with EHR systems. The European Union’s emphasis on cross-border healthcare coordination and data protection under GDPR is fueling demand for secure CC&C solutions. Investments in telehealth and mobile communication platforms across hospitals and clinics are also contributing to market growth. Collaborations between technology providers and healthcare systems continue to expand region-wide adoption.

Asia-Pacific

Asia-Pacific accounted for 24.6% of the Clinical Communication and Collaboration market in 2024 and is projected to experience the fastest growth through 2032. The region’s expansion is fueled by increasing investments in healthcare IT, growing hospital digitalization, and rapid telemedicine adoption. Countries such as China, Japan, India, and South Korea are focusing on modernizing clinical infrastructure and enhancing care coordination. Cloud-based communication tools are being widely implemented to support remote consultation and real-time collaboration among healthcare teams. The rising number of healthcare startups and favorable government initiatives are further accelerating market penetration in this region.

Latin America

Latin America captured 3.8% of the Clinical Communication and Collaboration market in 2024, driven by growing healthcare modernization efforts and digital transformation initiatives. Countries such as Brazil and Mexico are leading in adopting secure communication platforms for hospitals and clinics. The region’s expanding telehealth network and government-backed health IT programs are improving accessibility to digital communication tools. Despite infrastructure challenges, the increasing demand for mobile-based clinical collaboration solutions is propelling growth. Strategic partnerships between technology providers and local healthcare organizations are fostering stronger market presence across Latin American economies.

Middle East & Africa

The Middle East & Africa accounted for 2.3% of the global Clinical Communication and Collaboration market in 2024. Growth in this region is driven by expanding healthcare infrastructure, smart hospital initiatives, and increasing adoption of cloud-based communication tools. Countries like the UAE, Saudi Arabia, and South Africa are leading through digital healthcare investments and e-health strategies. The focus on improving patient safety, workflow efficiency, and remote collaboration supports rising CC&C deployment. Although limited internet penetration remains a challenge in some areas, ongoing digital transformation and government funding are expected to sustain steady market growth.

Market Segmentations:

By Deployment

By Component

By End Use

- Clinical Labs

- Hospitals

- Physicians

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Clinical Communication and Collaboration market is shaped by major players such as Cisco Systems, Inc., Halo Health Systems, Intel Corporation, NEC Corporation, Oracle, TNS Inc. (AGNITY Inc.), Avaya LLC, Microsoft, Spok Holdings Inc., and HILLROM & WELCH ALLYN (Baxter International). These companies are focusing on enhancing interoperability, secure communication, and real-time data sharing across healthcare networks. Service providers are integrating artificial intelligence, analytics, and mobile-based collaboration tools to improve care coordination and patient outcomes. Strategic partnerships, mergers, and acquisitions are strengthening market positioning and expanding global reach. Vendors are also emphasizing compliance with healthcare data protection standards such as HIPAA and GDPR to ensure secure communication. Continuous innovation in unified communication platforms and the rising demand for mobile-first collaboration solutions are driving competitive differentiation in the evolving clinical communication ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Oracle Corporation unveiled a strategic partnership with Cleveland Clinic and G42 to launch an AI-based global healthcare delivery platform using Oracle Cloud Infrastructure and Oracle Health applications.

- In October 2024, Microsoft Corporation announced new healthcare-focused AI models available via Azure AI and introduced a public-preview “healthcare agent service” in Copilot Studio to support secure, compliant clinical operations.

- In March 2024, Avaya LLC announced its “Avaya Communication and Collaboration Suite”, supporting on-premises, private-cloud and public-cloud deployment options, with integrations for Microsoft Teams and Zoom Workplace.

- In August 2023, TigerConnect, a trusted leader in clinical collaboration for healthcare, announced that its Physician Scheduling solution has been recognized as a validated vendor by KLAS Research in the Physician Scheduling category

Report Coverage

The research report offers an in-depth analysis based on Deployment, Component, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as hospitals accelerate digital communication adoption for care coordination.

- AI and analytics integration will enhance real-time decision-making and patient monitoring efficiency.

- Cloud-based platforms will dominate due to their scalability, flexibility, and lower operational costs.

- Mobile health applications will gain traction for remote consultations and secure data exchange.

- Interoperability standards will improve seamless communication across diverse healthcare systems.

- Vendors will focus on HIPAA-compliant and cybersecurity-enhanced communication solutions.

- The adoption of voice-over-IP and video-enabled platforms will streamline telemedicine workflows.

- Integration of collaboration tools with electronic health records will improve data accessibility.

- Asia-Pacific will emerge as the fastest-growing region due to healthcare modernization and telehealth expansion.

- Strategic partnerships among tech firms and healthcare providers will drive innovation in unified communication systems.