Market overview

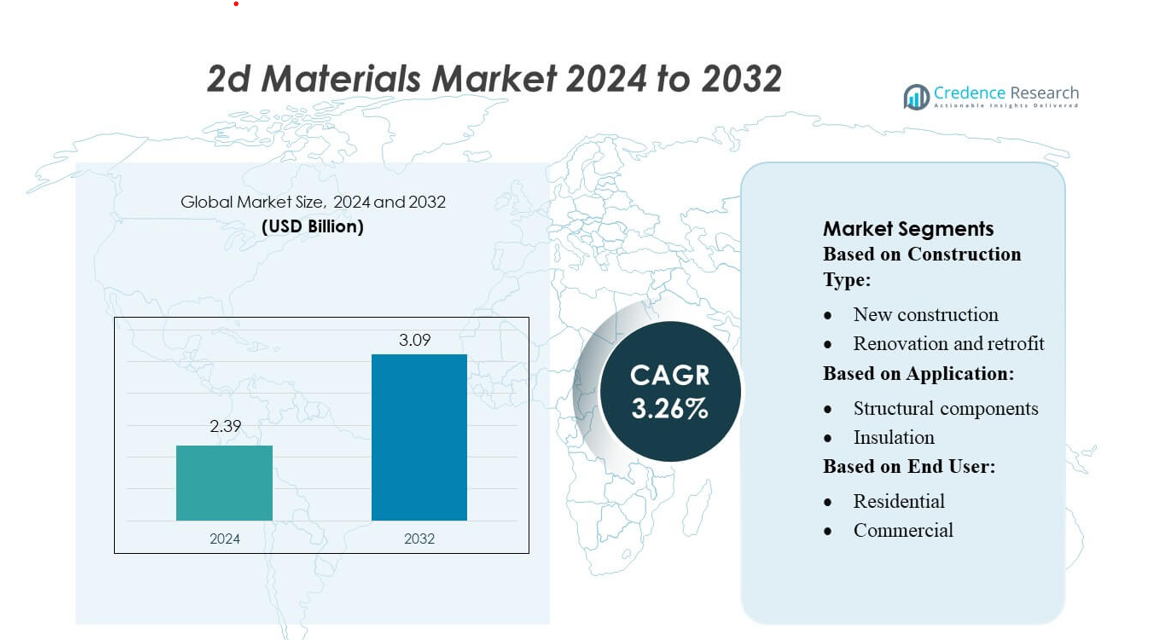

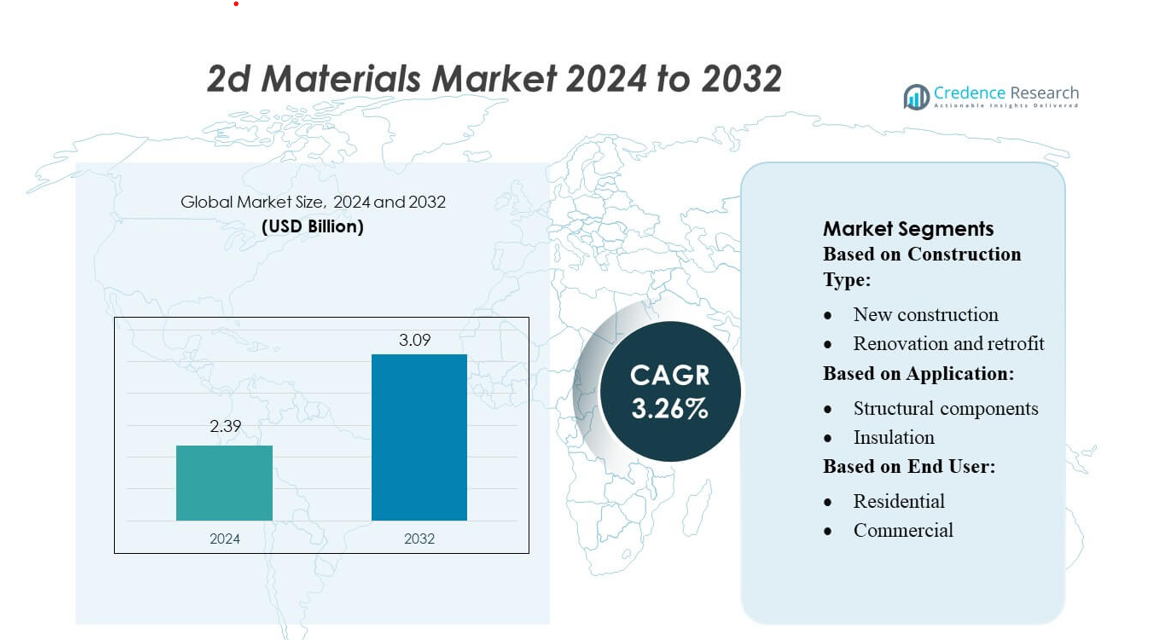

2d Materials Market size was valued USD 2.39 billion in 2024 and is anticipated to reach USD 3.09 billion by 2032, at a CAGR of 3.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| 2D Materials Market Size 2024 |

USD 2.39 billion |

| 2D Materials Market, CAGR |

3.26% |

| 2D Materials MarketSize 2032 |

USD 3.09 billion |

The 2D Materials Market continue to expand their capabilities through advanced material engineering, scalable production technologies, and strategic research partnerships. Top players maintain a strong focus on high-quality graphene, transition metal dichalcogenides, and other atom-thin materials to support applications across electronics, energy storage, composites, and sensors. Their competitive strengths include proprietary exfoliation methods, improved material purity, and integration with semiconductor manufacturing workflows. North America holds the leading position in the global market with an approximate 38% share, driven by extensive R&D investments, robust university–industry collaborations, and rapid commercialization of next-generation 2D material-based technologies.

Market Insights

- The 2D Materials Market reached USD 2.39 billion in 2024 and is projected to hit USD 3.09 billion by 2032, reflecting a steady CAGR of 3.26% throughout the forecast period.

- Market growth accelerates as industries adopt advanced graphene and TMD-based solutions, supported by improved material purity, scalable synthesis methods, and rising demand from electronics, composites, and energy storage applications.

- Strong trends emerge in semiconductor integration, flexible electronics, and high-performance batteries, with companies prioritizing proprietary exfoliation technologies and high-conductivity material grades.

- Competitive intensity rises as global players expand R&D capabilities, invest in pilot-scale manufacturing, and form research partnerships, while market restraints stem from production complexity, high processing costs, and challenges in achieving consistent large-area material quality.

- North America leads the market with 38% regional share, followed by Asia-Pacific as the fastest-growing region, while graphene remains the dominant segment with over 45% share, driven by broad commercial scalability and expanding industrial applicability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Construction Type

The 2D materials market demonstrates strong growth across construction categories, with new construction emerging as the dominant sub-segment, holding nearly 58% market share. Its lead stems from large-scale adoption of graphene-enhanced composites, 2D nanocoatings, and ultra-light structural materials in modern building frameworks. Developers increasingly prefer 2D-enabled solutions to improve load capacity, energy efficiency, and durability in new projects. The segment benefits from green-building mandates, rapid urbanization, and rising integration of smart-material technologies in commercial and residential construction, reinforcing its high-volume demand.

- For instance, Graphenea S.A. has successfully achieved industrial-grade reproducibility through its 8-inch (200-mm) CVD graphene wafer platform. The company’s production in an ISO Class 7 cleanroom focuses on scaling up processes for potential high-volume applications.

By Application

Across applications, structural components account for the largest share, commanding approximately 34% of the market, driven by the rising use of graphene, MXenes, and other 2D nano-reinforcements to enhance tensile strength, corrosion resistance, and thermal stability. These materials improve mechanical performance while reducing overall structural weight, making them highly suitable for advanced building assemblies. Insulation, flooring, wall panels, and roofing applications follow as manufacturers incorporate 2D coatings and membranes for moisture barriers, thermal regulation, and extended material longevity. Decorative and specialty uses gain traction with increasing demand for ultra-thin and high-performance surface finishes.

- For instance, Alcoa Inc. developed the Ampliforge™ process, a hybrid additive and subtractive manufacturing technique designed to enhance the structural integrity and performance of 3D-printed aluminum components.

By End User

The industrial sector leads the 2D materials market, holding around 40% market share, as manufacturers adopt high-strength 2D composites, advanced coatings, and electro-thermal materials for heavy equipment, process infrastructure, and high-performance fabrication environments. Industries value properties such as superior conductivity, abrasion resistance, and chemical stability, which significantly reduce maintenance and operational downtime. Commercial and residential end users expand steadily with rising application of 2D materials in smart buildings, energy-efficient designs, and protective surfaces. Infrastructure use grows as public projects integrate 2D-based reinforcement materials to improve structural resilience and sustainability.

Key Growth Drivers

Rising Demand for High-Performance and Lightweight Materials

The 2D materials market expands rapidly as industries adopt lightweight, durable, and high-strength materials to enhance product performance across construction, electronics, energy, and automotive applications. Graphene, MXenes, and other 2D nanomaterials support superior tensile strength, conductivity, and corrosion resistance, enabling next-generation structural components and protective coatings. Manufacturers increasingly rely on these materials to reduce weight, improve energy efficiency, and extend operational life cycles. This demand accelerates commercialization efforts, broadens industrial usage, and strengthens investment in advanced material engineering and high-performance nanocomposite solutions.

- For instance, ACS Material, LLC sells single-layer CVD graphene films and emphasizes performance scalability for industrial use. The films reliably deliver an optical transmittance of approximately 95% to 97%, which is standard for high-quality monolayer graphene.

Expansion of Smart Building and Energy-Efficient Construction

Growing emphasis on sustainable and energy-efficient buildings drives the adoption of 2D materials in insulation systems, thermal regulation layers, infrared-reflective coatings, and moisture-barrier membranes. Their ability to enhance structural resilience while reducing energy loss positions them as essential components in modern construction technologies. Governments support these innovations through green-building mandates and carbon-reduction policies that encourage integration of advanced materials. The trend significantly boosts demand for graphene-based coatings, MXene thermal films, and 2D-embedded composites used in facades, wall panels, roofing, and insulation systems across commercial and residential projects.

- For instance, Sixth Element has published detailed specifications for its “Electrical Conduction Type Graphene” powders (types SE1231, SE1232, SE1233-S, SE1233-L, SE1234). These powders are described with specific metrics such as: tap density less than 0.1 g/cm³, BET specific surface area ranging from 180 to 900 m²/g depending on grade, and D₅₀ median particle sizes of up to 50 µm for SE1233-L.

Advancements in Scalable Production and Material Functionalization

Continued progress in large-area synthesis, liquid exfoliation, chemical vapor deposition, and functionalization techniques supports broader industrial uptake of 2D materials. Manufacturers now achieve better layer uniformity, higher purity levels, and improved integration with polymers, metals, and cement-based systems. These advancements reduce production costs and make 2D materials more accessible for high-volume applications in construction, electronics, and industrial manufacturing. Expanded R&D investment, coupled with commercialization of pilot-scale manufacturing systems, strengthens market scalability and encourages development of multi-functional 2D composites tailored for end-use performance requirements.

Key Trends & Opportunities

Growing Use of 2D Nanomaterials in Structural Reinforcement

A major trend involves using graphene and related 2D additives in concrete, steel, and polymer composites to significantly enhance compressive strength, crack resistance, and durability. Construction companies integrate small quantities of 2D materials to achieve notable improvements in structural performance, creating opportunities for high-strength, low-weight building components. This trend aligns with increasing demand for resilient infrastructure capable of withstanding climate stress, heavy load cycles, and long-term wear. New application areas such as prefabricated building modules and advanced façade systems further expand opportunities for structural-grade 2D composites.

- For instance, Thomas Swan’s Elicarb® Graphene Materials Grade Powder (PR0953) features a typical lateral flake size of ~5 µm, a sheet resistance of 15-25 Ω/□ when cast as a 35 mm-diameter film (30 mg graphene powder) and a sp² carbon content of ~98 % by weight.

Rising Adoption of 2D Coatings for Surface Protection

The market sees substantial opportunity in ultra-thin protective coatings made from graphene, hexagonal boron nitride, and other 2D materials. Their exceptional barrier properties against moisture, chemicals, abrasion, and UV degradation make them valuable for flooring, wall panels, roofing, and industrial equipment. These coatings extend the lifespan of building materials while reducing maintenance costs, appealing to both commercial and infrastructure developers. Growing interest in antimicrobial, self-cleaning, and thermal-responsive coatings broadens prospective applications and encourages investment in targeted formulations for specific end-use environments.

- For instance, Aerogel Technologies’ Airloy® composite panels offer both structural and insulating performance in one component. Airloy X103 material with a density of 0.20 g/cm³ can support compressive loads up to 2 MPa and maintains a low thermal conductivity of 26-29 mW/m·K.

Integration of 2D Materials in Smart and Sustainable Infrastructure

As infrastructure modernization accelerates, 2D materials gain attention for their applicability in sensors, conductive pathways, energy-harvesting layers, and structural health-monitoring systems. Their unique electrical and mechanical characteristics enable smart bridges, buildings, and roadways that continuously monitor stress levels, temperature variations, and material degradation. Opportunities strengthen as governments prioritize resilient, digitalized infrastructure. Additionally, 2D materials support integration of renewable-energy components such as thin-film photovoltaics and thermal-management solutions, positioning them as core enablers of next-generation, sustainable infrastructure planning.

Key Challenges

High Production Costs and Limited Large-Scale Commercialization

Despite strong potential, many 2D materials face high production costs due to complex synthesis processes, stringent purity requirements, and limited availability of industrial-scale manufacturing facilities. Achieving consistent layer quality and defect control remains technically challenging, restricting widespread market adoption. Manufacturers must invest heavily in R&D and scaling technologies, slowing commercialization for cost-sensitive construction and industrial applications. These limitations hinder price competitiveness compared to conventional materials, reducing adoption in large-volume segments such as concrete reinforcement and building composites.

Regulatory Uncertainty and Environmental Safety Concerns

The market encounters challenges related to evolving regulatory frameworks and limited long-term environmental safety data for various 2D nanomaterials. Concerns regarding toxicity, occupational exposure, waste disposal, and environmental persistence necessitate extensive testing and compliance with emerging global standards. These regulatory gaps create uncertainty for manufacturers and delay product approvals, particularly in construction and industrial applications where safety validation is critical. Addressing these concerns requires coordinated initiatives focused on lifecycle assessment, standardized testing protocols, and transparent safety guidelines for responsible commercialization.

Regional Analysis

North America

North America holds approximately 32% market share in the 2D materials market, supported by strong adoption of graphene-based composites, advanced coatings, and high-performance nanomaterials across construction, aerospace, and industrial sectors. The region benefits from robust R&D ecosystems, extensive government funding, and early commercialization of 2D-enabled structural materials and insulation technologies. Construction firms increasingly integrate MXene-enhanced coatings, graphene cement additives, and nano-barrier layers in high-efficiency building projects. Rising sustainability mandates, durable material requirements, and smart building initiatives further accelerate demand, while leading universities and startups continue driving technological advancements and scalable production methods.

Europe

Europe captures nearly 28% of the global market, driven by strong sustainability frameworks, strict building regulations, and rapid integration of energy-efficient materials in residential and commercial construction. The region sees widespread adoption of graphene-reinforced concrete, ultra-thin barrier coatings, and advanced insulation films due to growing environmental compliance pressures. Countries such as Germany, the U.K., and France lead in large-scale R&D programs focused on functional 2D composites and eco-friendly building materials. Expansion of smart infrastructure, combined with increasing public investments in green construction technologies, strengthens Europe’s position as a major hub for 2D material innovation and deployment.

Asia-Pacific

Asia-Pacific dominates the 2D materials market with approximately 38% share, supported by extensive construction activity, rapid urbanization, and strong government-backed nanotechnology programs. China, South Korea, and Japan lead in large-scale production of graphene, hBN, and MXenes, enabling cost advantages and broader industrial adoption. Construction companies increasingly deploy 2D-reinforced concrete, thermal conductive films, and nanocoatings to enhance structural resilience and longevity. Expanding smart city projects and infrastructure modernization efforts amplify demand across commercial, residential, and industrial applications. The region’s vast manufacturing base and accelerating R&D commercialization further solidify its leadership.

Latin America

Latin America accounts for nearly 7% market share, with adoption of 2D materials gradually increasing across infrastructure upgrades, commercial construction, and industrial applications. Countries such as Brazil, Mexico, and Chile integrate graphene-enhanced cement additives, protective coatings, and thermal regulation films in new building designs to improve durability and structure life span. The region benefits from growing foreign investments, government-backed modernization programs, and rising demand for cost-effective high-performance materials. Although production capabilities remain limited, partnerships with global suppliers and expanding pilot projects in sustainable construction are enhancing regional market penetration.

Middle East & Africa

The Middle East & Africa region holds around 5% of the market, influenced by growing interest in high-performance materials for large-scale infrastructure, smart city initiatives, and extreme-environment construction needs. Developers increasingly adopt 2D-based thermal barriers, anti-corrosion coatings, and lightweight reinforcement materials to address high temperatures and long-term structural stress. Countries such as the UAE, Saudi Arabia, and South Africa explore applications of graphene-enhanced concretes and coatings to improve resilience and reduce maintenance costs. While adoption is emerging, ongoing mega-projects and technology partnerships create strong opportunities for wider deployment of 2D materials.

Market Segmentations:

By Construction Type:

- New construction

- Renovation and retrofit

By Application:

- Structural components

- Insulation

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The 2D materials market features a competitive landscape shaped by leading innovators, including XG Sciences, Inc., Graphenea S.A., Alcoa Inc., Versarien plc, ACS Material, LLC, NanoXplore Inc., 2D Semiconductors Inc., Sixth Element Materials Technology Co., Ltd., Thomas Swan & Co. Ltd., and 2D Layer Materials Pte. Ltd. The 2D materials market is defined by rapid technological advancement, strong research collaboration, and increasing commercialization across construction, electronics, industrial manufacturing, and energy applications. Companies focus on scaling high-quality graphene, MXenes, and hBN production while improving cost efficiency, material uniformity, and functionalization capabilities. The market remains innovation-driven, with significant investment in chemical vapor deposition, liquid-phase exfoliation, and hybrid composite development to meet performance requirements such as enhanced strength, conductivity, and corrosion resistance. Partnerships with universities, government research programs, and industry end users accelerate product validation and support broader adoption. As demand grows for lightweight, durable, and energy-efficient materials, competition intensifies around proprietary processing technologies, application-specific product lines, and global expansion strategies to serve emerging and advanced markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- XG Sciences, Inc.

- Graphenea S.A.

- Alcoa Inc.

- Versarien plc

- ACS Material, LLC

- NanoXplore Inc.

- 2D Semiconductors Inc.

- Sixth Element Materials Technology Co., Ltd.

- Thomas Swan & Co. Ltd.

- 2D Layer Materials Pte. Ltd.

Recent Developments

- In June 2025, Pennsylvania State University scientists constructed the first CMOS-based computer made completely of two-dimensional materials, and not silicon. This breakthrough demonstrated the promise of nanoscale materials to overcome traditional semiconductors, a key advance toward smaller, faster, and more energy-efficient electronic devices in the technological applications of the future.

- In November 2024, the 2D-Pilot Line (2D-PL), a new European Commission-funded project, was launched to build upon the earlier 2D-EPL program. The 2D-PL project aims to mature and integrate 2D materials like graphene and transition metal dichalcogenides (TMDCs) into semiconductor devices for photonics and electronics, thereby creating a robust European ecosystem for this technology.

- In November 2024, BASF inaugurated a new production line in Heerenveen, the Netherlands. This expansion underscores BASF’s dedication to bolstering its manufacturing capabilities in the region. It aligns with the company’s strategy to address the surging demand for innovative and sustainable solutions.

- In August 2024, Alcoa Corporation acquired Alumina Limited. With the acquisition, Alcoa now fully owns the Alcoa World Alumina and Chemicals (AWAC) joint venture, previously held at a 60% stake, which includes several bauxite mines and alumina refineries across key regions such as Australia, Brazil, and Guinea

Report Coverage

The research report offers an in-depth analysis based on Construction Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as construction, electronics, and energy sectors increase adoption of high-performance graphene, MXenes, and related 2D materials.

- Advancements in scalable synthesis and cost-efficient production will accelerate commercialization across large-volume applications.

- Demand for durable, lightweight composites will rise as smart building and infrastructure projects integrate 2D-enhanced structural materials.

- Protective coatings using 2D nanomaterials will gain traction due to superior barrier, thermal, and anti-corrosion properties.

- Integration of 2D materials in sensors and monitoring systems will strengthen as smart infrastructure initiatives accelerate.

- Regulatory clarity and standardized safety assessments will improve global market confidence and adoption.

- Industrial users will increasingly adopt 2D-reinforced materials to extend equipment lifespan and reduce maintenance cycles.

- R&D in multifunctional 2D composites will expand, enabling tailored performance for specific end-use industries.

- Technological collaboration between research institutes and manufacturers will support faster innovation cycles.

- Growing sustainability goals will drive demand for energy-efficient and environmentally resilient 2D material solutions.