Market Overview:

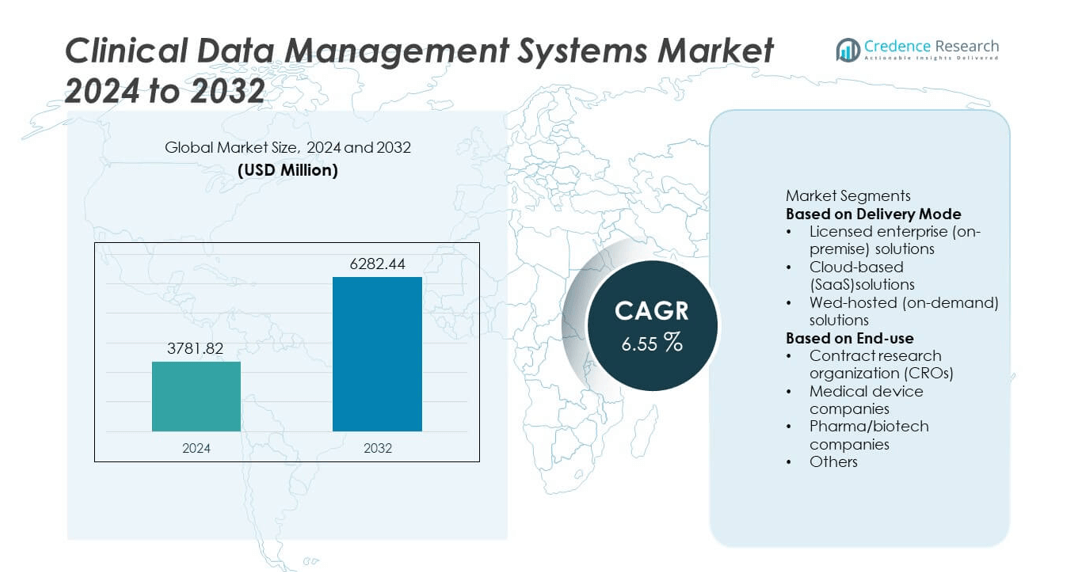

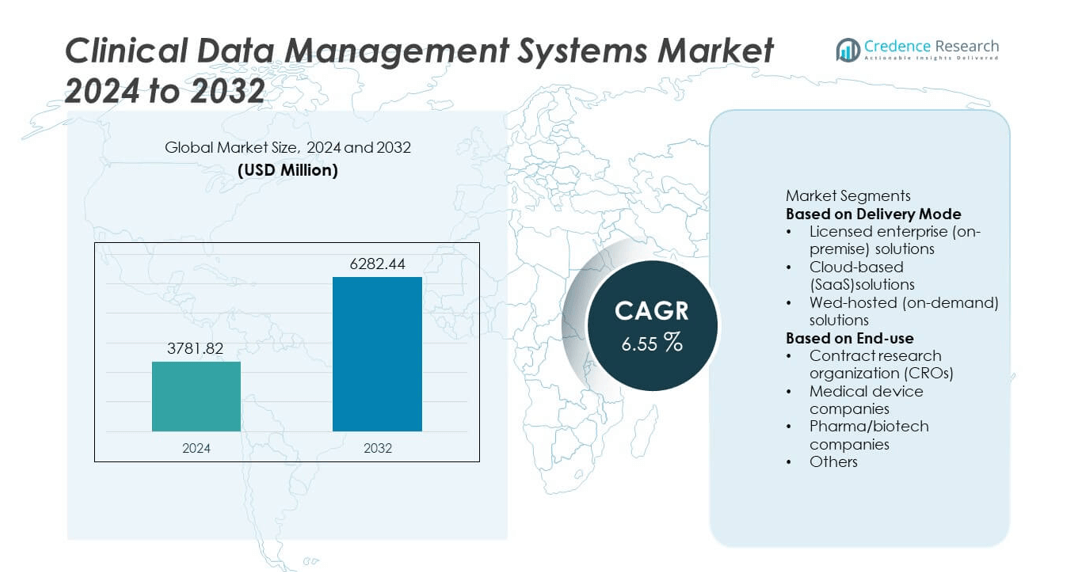

The Clinical Data Management Systems (CDMS) market was valued at USD 3781.82 million in 2024 and is projected to reach USD 6282.44 million by 2032, expanding at a CAGR of 6.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Clinical Data Management Systems Market Size 2024 |

USD 3781.82 million |

| Clinical Data Management Systems Market, CAGR |

6.55% |

| Clinical Data Management Systems Market Size 2032 |

USD 6282.44 million |

The Clinical Data Management Systems market is dominated by leading players such as Fortress Medical, Oracle Corporation, Ennov, Veeva System, Axiom Real-Time Metrics, OpenClinica LLC, eClinical Solutions LLC, IBM Watson Health, CIMS Global, and Medidata Solutions (Dassault Systems). These companies drive market growth through advanced data capture, integration, and validation technologies that enhance clinical research accuracy and regulatory compliance. North America led the global market with a 42.6% share in 2024, supported by strong pharmaceutical R&D investments and widespread adoption of cloud-based clinical platforms. Europe followed with 27.8%, while Asia-Pacific accounted for 23.7%, emerging as the fastest-growing region due to increasing clinical trial activities and digital healthcare advancements.

Market Insights

- The Clinical Data Management Systems market was valued at USD 3781.82 million in 2024 and is projected to reach USD 6282.44 million by 2032, growing at a CAGR of 6.55% during the forecast period.

- Growing demand for efficient data capture, validation, and regulatory compliance in clinical trials is driving market growth, supported by increasing R&D activities in the pharmaceutical and biotechnology sectors.

- The market trend is shifting toward cloud-based and web-hosted solutions, which held a combined share of 63.8% in 2024 due to flexibility, scalability, and cost-effectiveness.

- Competition among key players such as Oracle, Medidata Solutions, Veeva Systems, and IBM Watson Health centers on enhancing real-time analytics, AI integration, and interoperability to support complex clinical trial management.

- North America dominated the market with a 42.6% share in 2024, followed by Europe at 27.8% and Asia-Pacific at 23.7%, reflecting strong digital healthcare adoption and expanding clinical research networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Delivery Mode

The cloud-based (SaaS) solutions segment dominated the Clinical Data Management Systems market in 2024, accounting for 53.8% of the total share. Its leadership is driven by the growing preference for flexible, scalable, and cost-efficient data management solutions in clinical research. Cloud-based systems enable real-time data access, multi-site collaboration, and seamless integration with electronic data capture and analytics tools. Increasing adoption by pharmaceutical and biotechnology companies to support decentralized trials and remote monitoring also fuels segment growth. Enhanced data security, faster deployment, and compliance with regulatory frameworks further strengthen the dominance of cloud-based platforms.

- For instance, Oracle Corporation’s Clinical One platform helps reduce study setup times by an average of 50% or greater, with some trials getting up and running in a matter of days. It allows for rapid configuration of complex randomization and trial supply management (RTSM) strategies in days rather than months, without custom programming.

By End-use

Pharma/biotech companies held the largest share of 48.6% in the Clinical Data Management Systems market in 2024. Their dominance stems from the surge in clinical trial activity, rising drug development costs, and growing reliance on advanced data management tools for regulatory compliance. These organizations use CDMS platforms to streamline patient data collection, enhance trial accuracy, and accelerate product approvals. The demand for AI-integrated and cloud-enabled systems is increasing to handle complex multi-phase trials efficiently. Continuous investments in R&D and data standardization initiatives reinforce the leadership of pharma and biotech companies in this segment.

- For instance, Veeva Systems supported more than 500 life science organizations through its Veeva Vault Clinical Suite, and is incorporating AI-assisted workflows to enable faster trial data validation and TMF document classification.

Key Growth Drivers

Rising Clinical Trial Volume and Complexity

The growing number of clinical trials across therapeutic areas is driving demand for advanced Clinical Data Management Systems. Pharmaceutical and biotechnology firms require efficient tools to manage large, multi-site, and complex datasets. CDMS platforms streamline data collection, validation, and reporting, ensuring faster regulatory submissions. Increasing focus on precision medicine and real-world evidence generation further boosts adoption. As global trials expand, demand for automated, compliant, and scalable data management solutions continues to rise, enhancing operational efficiency and trial accuracy.

- For instance, Medidata Solutions Rave EDC platform supported over 36,000 trials across approximately 2,300 customers (sponsor organizations and partners), handling more than 70 billion data points annually with integrated AI tools for real-time data quality monitoring.

Shift Toward Digital and Cloud-Based Data Management

The transition from manual and on-premise systems to digital, cloud-based platforms is a key growth catalyst. Cloud-enabled CDMS solutions offer flexibility, remote access, and real-time collaboration across global research teams. The integration of AI and analytics enables faster data cleaning, error detection, and predictive analysis. This digital transformation supports decentralized and virtual trials, reducing timelines and operational costs. The growing adoption of SaaS-based models among pharmaceutical and contract research organizations further accelerates market growth.

- For instance, eClinical Solutions’ elluminate platform processed data from clinical trials, integrating data points annually, enabling life science companies to achieve faster data review through automated cloud-based analytics.

Growing Emphasis on Regulatory Compliance and Data Integrity

Stringent regulatory standards from bodies such as the FDA, EMA, and ICH are driving the need for compliant and validated data management systems. CDMS platforms ensure audit trails, secure access, and standardized data capture that meet global regulatory requirements. The emphasis on Good Clinical Practice (GCP) and 21 CFR Part 11 compliance is encouraging healthcare organizations to adopt advanced systems. As regulators demand more transparent and accurate trial data, CDMS vendors are enhancing traceability and automation features to support compliance and data integrity.

Key Trends & Opportunities

Integration of Artificial Intelligence and Automation

AI and automation are reshaping clinical data management by improving accuracy, reducing manual errors, and enhancing decision-making speed. Machine learning algorithms are being applied for data validation, anomaly detection, and real-time quality monitoring. Automation streamlines repetitive processes such as data entry and query resolution, allowing faster trial completion. These technologies improve scalability and enable predictive insights that support adaptive clinical trials. As AI becomes integral to CDMS, vendors are increasingly embedding intelligent analytics for proactive risk assessment and efficiency gains.

- For instance, in a study with the Highlands Oncology Group, an IBM Watson Health AI solution for clinical trial matching cut the time required to screen patients for clinical trial eligibility by 78%, reducing the process time from 1 hour and 50 minutes of manual curation to just 24 minutes.

Rising Adoption of Decentralized and Hybrid Clinical Trials

The global shift toward decentralized and hybrid trial models is creating new opportunities for CDMS adoption. Remote data collection from wearable devices, ePROs, and telemedicine platforms requires advanced systems capable of managing diverse data sources. Cloud-based CDMS platforms enable real-time synchronization and ensure consistent data quality across sites. This trend supports patient-centric research and accelerates trial execution timelines. The growing use of digital health technologies and virtual study designs continues to drive demand for flexible, interoperable CDMS solutions.

- For instance, OpenClinica’s digital trial platform has powered over 15,000 studies and supported more than three million patients worldwide, offering capabilities to integrate data from various sources to support remote patient monitoring and real-time data analysis.

Key Challenges

High Implementation and Maintenance Costs

Despite their advantages, Clinical Data Management Systems involve high implementation and operational expenses. Smaller research institutions and CROs often face budget constraints that limit adoption. Costs associated with customization, staff training, and system integration add to financial challenges. Additionally, frequent updates required to maintain regulatory compliance and data security increase expenditure. Vendors are responding by offering modular and subscription-based models, but affordability remains a significant barrier, especially in developing healthcare markets.

Integration Challenges with Legacy Systems

Integrating modern CDMS platforms with existing legacy infrastructure remains a major challenge for healthcare organizations. Many legacy systems lack interoperability, resulting in data silos and inconsistencies across trial operations. Transitioning from paper-based or outdated electronic systems can cause delays, data migration errors, and compliance risks. Organizations must invest in skilled IT teams and robust integration frameworks to ensure smooth adoption. Vendors are addressing this challenge by developing API-driven and interoperable CDMS architectures to improve data flow and connectivity across diverse systems.

Regional Analysis

North America

North America dominated the Clinical Data Management Systems market in 2024, accounting for 41.6% of the total share. The region’s leadership is driven by the strong presence of pharmaceutical and biotechnology companies, advanced clinical research infrastructure, and high regulatory compliance standards. The U.S. leads adoption due to widespread use of electronic data capture (EDC) and cloud-based CDMS platforms. Continuous investment in R&D, digital health initiatives, and data integration technologies further supports market growth. Increasing demand for real-world evidence and precision medicine enhances the region’s focus on efficient, secure, and scalable clinical data management solutions.

Europe

Europe held 27.8% of the Clinical Data Management Systems market share in 2024, supported by a growing number of clinical trials and strong data protection regulations. Countries such as Germany, the United Kingdom, and France are leading adopters due to their advanced healthcare systems and emphasis on compliance with EMA and GDPR frameworks. The region’s pharmaceutical industry increasingly leverages AI-integrated and cloud-enabled CDMS platforms to streamline trial operations. Rising collaborations between CROs and technology providers are promoting innovation in data management. Europe’s focus on transparency and cross-border clinical research further sustains steady market expansion.

Asia-Pacific

Asia-Pacific captured 23.9% of the Clinical Data Management Systems market in 2024 and is projected to grow fastest during the forecast period. The region’s growth is driven by expanding clinical research activities, government support for healthcare digitization, and cost-efficient trial operations. Countries such as China, India, Japan, and South Korea are investing in advanced data management and cloud technologies. The rising number of local CROs and pharmaceutical firms adopting EDC and AI-driven platforms accelerates adoption. Increasing international collaborations and a focus on patient-centric research position Asia-Pacific as a key hub for clinical data innovation.

Latin America

Latin America accounted for 4.2% of the Clinical Data Management Systems market in 2024, supported by growing clinical research investments and healthcare modernization. Countries like Brazil, Mexico, and Argentina are leading adoption due to improving regulatory standards and expanding pharmaceutical trials. The region’s increasing engagement in multinational research collaborations is driving demand for compliant and cost-effective CDMS platforms. Cloud-based and web-hosted systems are gaining traction for remote data accessibility and simplified operations. Although infrastructure limitations persist, rising partnerships between global vendors and local institutions continue to enhance clinical research efficiency across the region.

Middle East & Africa

The Middle East & Africa held 2.5% of the global Clinical Data Management Systems market in 2024. The region’s growth is supported by increasing healthcare digitalization, expanding clinical trial activity, and government initiatives promoting research infrastructure. The UAE, Saudi Arabia, and South Africa are leading markets, emphasizing adoption of cloud-based CDMS platforms for data security and regulatory compliance. Global CROs are partnering with regional healthcare institutions to streamline trial processes. Despite challenges in data integration and limited technical expertise, growing investments in clinical research and digital health are gradually strengthening market development across the region.

Market Segmentations:

By Delivery Mode

- Licensed enterprise (on-premise) solutions

- Cloud-based (SaaS)solutions

- Wed-hosted (on-demand) solutions

By End-use

- Contract research organization (CROs)

- Medical device companies

- Pharma/biotech companies

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Clinical Data Management Systems market is defined by major players such as Fortress Medical, Oracle Corporation, Ennov, Veeva System, Axiom Real-Time Metrics, OpenClinica LLC, eClinical Solutions LLC, IBM Watson Health, CIMS Global, and Medidata Solutions (Dassault Systems). These companies are leading through innovations in electronic data capture, automation, and AI-driven analytics to enhance clinical trial efficiency and regulatory compliance. Market leaders focus on integrating advanced SaaS platforms with cloud-based and AI-enabled data management capabilities. Strategic collaborations with pharmaceutical and biotech firms are expanding their market presence. Vendors are emphasizing interoperability, real-time data validation, and compliance with GxP and FDA 21 CFR Part 11 standards. Continuous advancements in decentralized clinical trial technology, predictive analytics, and automated data workflows are intensifying competition. The growing adoption of AI and cloud platforms across global life science companies continues to shape a data-centric and innovation-driven market environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Flortress Medical

- Oracle Corporation

- Ennov

- Veeva System

- Axiom Real-Time Metrics

- OpenClinica, LLC

- eClinical Solutions LLC

- IBM Watson Health

- CIMS Global

- Medidata Solutions (Dassault Systems)

Recent Developments

- In August 2025, Veeva Systems and IQVIA announced a global clinical and commercial partnership, enabling reciprocal access to software, data and services for life sciences customers.

- In March 2025, Medidata Solutions (a Dassault Systèmes brand) unveiled its “New Patient, Study, and Data Experiences” at NEXT London 2025, leveraging AI-driven enhancements across its platform.

- In June 2024, Ennov announced its acquisition of the ‘Enterprise Technology’ division from Calyx SaaS to expand its clinical-data and trial-documentation portfolio.

Report Coverage

The research report offers an in-depth analysis based on Delivery Mode, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as pharmaceutical and biotech firms increase clinical research activities.

- Cloud-based and SaaS platforms will dominate due to scalability and remote accessibility.

- AI and machine learning will enhance data accuracy, monitoring, and predictive analytics.

- Integration with electronic data capture and eClinical systems will streamline workflows.

- Regulatory compliance tools will gain importance with stricter global data standards.

- Partnerships between CROs and tech providers will drive innovation in trial data management.

- Real-time data visualization will improve trial transparency and decision-making.

- Blockchain adoption will strengthen data integrity and traceability across trials.

- Asia-Pacific will emerge as the fastest-growing region due to expanding clinical trial activity.

- The focus on automation and interoperability will redefine future data management efficiency.