Market Overview:

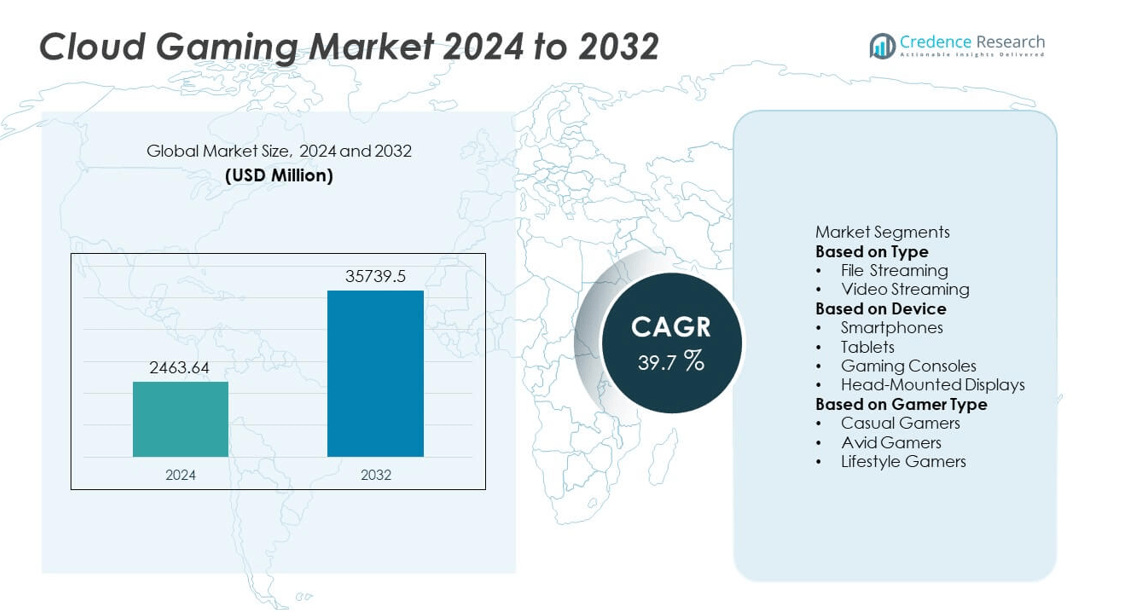

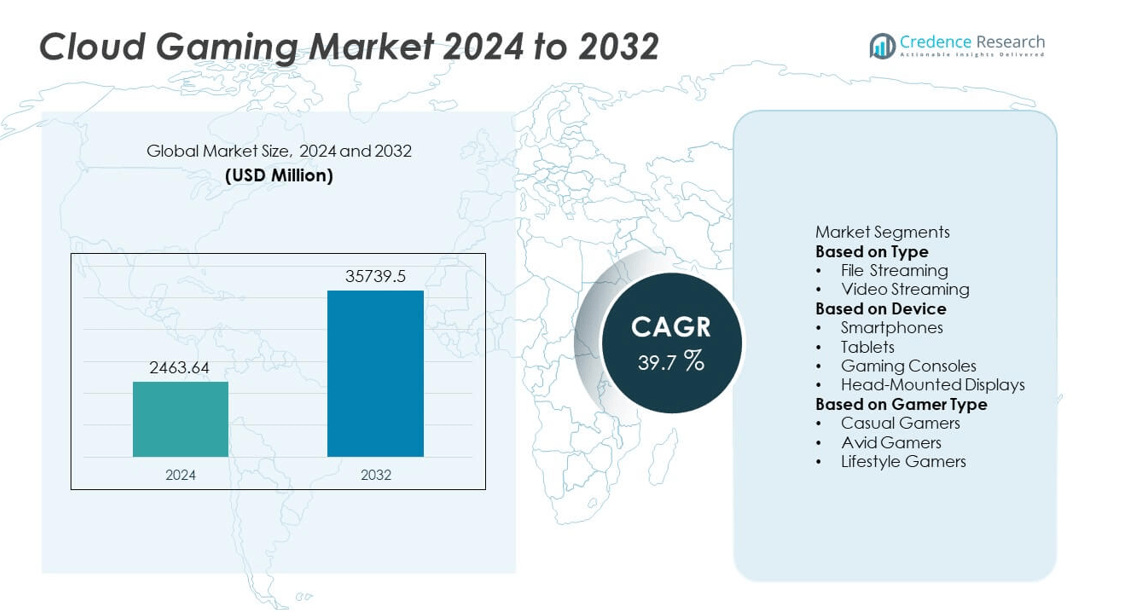

The Cloud Gaming Market was valued at USD 2463.64 million in 2024 and is projected to reach USD 35739.5 million by 2032, expanding at a CAGR of 39.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud Gaming Market Size 2024 |

USD 2463.64 million |

| Cloud Gaming Market, CAGR |

39.7% |

| Cloud Gaming Market Size 2032 |

USD 35739.5 million |

The cloud gaming market is led by major companies including Sony Interactive Entertainment, Microsoft Corporation, NVIDIA Corporation, Amazon Web Services, Inc., Google LLC, Apple Inc., Intel Corporation, Electronic Arts, Inc., International Business Machines Corporation (IBM Corporation), and Backbone Labs. These players focus on expanding platform ecosystems, improving streaming performance, and integrating AI-driven optimization for enhanced user experience. North America dominated the market in 2024 with a 36.8% share, driven by strong infrastructure and widespread 5G connectivity. Asia-Pacific followed with 28.9%, supported by rapid smartphone adoption and growing investments from regional gaming and telecom providers.

Market Insights

- The cloud gaming market was valued at USD 2463.64 million in 2024 and is projected to reach USD 35739.5 million by 2032, growing at a CAGR of 39.7% during the forecast period.

- Strong demand for on-demand gaming, 5G deployment, and reduced hardware dependence drive market expansion. Cloud infrastructure investments by major companies such as NVIDIA, Microsoft, and Amazon strengthen performance and accessibility.

- Key trends include AI-driven streaming optimization, cross-platform integration, and the growing appeal of subscription-based gaming services across mobile and console platforms.

- The market is highly competitive, with Sony Interactive Entertainment, Google, and Microsoft leading through extensive content libraries and global reach.

- Regionally, North America held 36.8% of the market in 2024, followed by Asia-Pacific at 28.9% and Europe at 27.4%, while smartphones accounted for 52.7% of the device segment, making it the largest contributor to overall market revenue.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Video streaming dominated the cloud gaming market in 2024, accounting for 69.4% of the total share. Its leadership stems from the widespread adoption of low-latency streaming services that eliminate download requirements. The segment benefits from robust cloud infrastructure, enabling instant gameplay across devices with minimal buffering. Growing integration of adaptive bitrate technology enhances real-time performance and graphics quality. Increasing platform offerings from NVIDIA GeForce Now, Xbox Cloud Gaming, and Amazon Luna continue to attract users seeking seamless, high-resolution gaming experiences across multiple network environments.

- For instance, NVIDIA’s GeForce NOW service supports over 4,000 games in its cloud library as of late 2024/early 2025. The service operates through a global network of NVIDIA-managed and partner data centers. NVIDIA recommends a network latency of less than 80 milliseconds (ms) from a data center for an acceptable experience, though less than 40ms is recommended for the best performance.

By Device

Smartphones held the largest share of 52.7% in the cloud gaming market in 2024. The dominance is driven by rapid 5G rollout, growing mobile gaming user base, and affordable subscription plans. Enhanced GPU performance and high-refresh-rate displays in modern smartphones support smooth streaming of AAA titles. Developers are optimizing interfaces and controls for mobile platforms, boosting engagement. Cross-device play and integration with portable accessories further strengthen adoption. Expanding gaming ecosystems from companies such as Samsung and Apple are also pushing mobile-based cloud gaming accessibility globally.

- For instance, Apple’s A17 Pro chip delivered a 6-core GPU capable of real-time hardware-accelerated ray tracing, enabling native console-level games like Resident Evil Village on iPhone 15 Pro.

By Gamer Type

Casual gamers led the market in 2024, representing 44.6% of the total share. This segment thrives due to the ease of access and affordability offered by subscription-based cloud gaming models. Casual players favor short, flexible gaming sessions without the need for expensive hardware. The growing catalog of lightweight and cross-genre titles from platforms such as Google Play Games and Xbox Game Pass enhances participation. Expanding social and multiplayer gaming options encourage continued user engagement, making casual gamers a vital driver of market expansion.

Key Growth Drivers

Advancements in 5G and Network Infrastructure

The deployment of 5G networks is a primary growth driver for the cloud gaming market. High-speed, low-latency connectivity enables real-time streaming of high-definition games without lag or buffering. Telecom operators and cloud providers are collaborating to expand network coverage, ensuring stable gameplay experiences. For instance, Ericsson reported over 1.6 billion 5G subscriptions globally by 2024, enhancing access to cloud-based entertainment. As network quality improves, the adoption of mobile and cross-platform gaming continues to accelerate worldwide.

- For instance, Ericsson reported surpassing 2.3 billion active 5G subscriptions globally by the end of 2024, with around 320 commercial 5G networks launched. This rapid infrastructure rollout supported average mobile data speeds of over 240 Mbps in some major markets, improving cloud gaming responsiveness and visual fidelity.

Rising Demand for Cross-Platform Gaming

Gamers increasingly prefer cross-platform compatibility, allowing seamless gameplay across smartphones, consoles, and PCs. This demand has encouraged service providers to develop unified gaming ecosystems supported by cloud technology. Cloud gaming removes hardware barriers, enabling players to stream AAA titles on any connected device. Major companies such as Microsoft and NVIDIA have enhanced interoperability features in Xbox Cloud Gaming and GeForce Now, supporting multiplayer engagement and larger user communities, thus driving rapid subscriber growth.

- For instance, Microsoft integrated over 400 titles into its Xbox Cloud Gaming ecosystem with cross-platform functionality for Windows, Android, and iOS devices. NVIDIA’s GeForce NOW platform similarly continues to expand its library, now supporting over 4,500 games through a combination of “Ready-to-Play” and “Install-to-Play” features that are supported by real-time synchronization across PCs and mobile devices.

Growing Subscription-Based Models

Subscription-based gaming services are fueling revenue growth by offering affordability and flexibility. Users gain access to large game libraries without expensive consoles or downloads. Companies such as Sony, Amazon, and Google are expanding subscription offerings to attract diverse gamer types. Continuous addition of new titles, free trials, and multi-device accessibility strengthen market penetration. This shift from one-time purchases to recurring subscriptions ensures steady revenue streams and customer retention, transforming how players consume digital entertainment.

Key Trends & Opportunities

Integration of AI and Cloud Optimization

Artificial intelligence is revolutionizing gameplay personalization, predictive analytics, and server optimization. AI-driven systems enhance graphics rendering, reduce lag, and analyze user preferences to improve recommendations. Companies like NVIDIA leverage AI for dynamic upscaling, offering smoother and visually enhanced experiences. These innovations boost platform efficiency and attract more users, creating strong opportunities for technological partnerships and advanced gaming solutions within the evolving cloud gaming ecosystem.

- For instance, NVIDIA Corporation’s DLSS 4 uses its fifth-generation Tensor Cores to generate up to three frames per rendered frame on GeForce RTX 50 Series GPUs.

Expansion into Emerging Markets

Rising smartphone penetration and affordable data plans in Asia-Pacific, Latin America, and the Middle East are expanding the cloud gaming user base. Countries such as India, Brazil, and Indonesia are witnessing significant growth in mobile-based gaming consumption. Local telecom partnerships and regional content development are fostering stronger market presence. These emerging economies present major opportunities for cloud gaming providers aiming to capture untapped audiences and establish early brand loyalty through localized strategies.

- For instance, NetEase has launched a beta version of a cloud gaming platform in China that initially supported 38 games, including titles from other publishers like Tencent. The company has also partnered with Antom to provide more seamless, localized payment options, including mobile wallets and local bank transfers, for gamers in various regions like Japan.

Key Challenges

Latency and Bandwidth Constraints

Despite 5G growth, consistent low-latency performance remains a technical hurdle, especially in rural or developing areas. Network congestion and limited bandwidth can lead to frame drops and delayed responses, degrading user experience. Maintaining high-quality streaming for graphic-intensive games demands advanced compression and adaptive bitrate solutions. Providers must invest heavily in infrastructure to ensure reliability and user satisfaction, which can significantly increase operational costs in competitive markets.

Content Licensing and Monetization Issues

Licensing agreements between developers, publishers, and cloud providers often restrict content availability across platforms. Complex revenue-sharing models and regional licensing differences delay new releases on cloud services. Balancing developer profits while maintaining affordable subscription prices remains difficult. Additionally, piracy risks and intellectual property concerns complicate monetization. Resolving these issues through transparent partnerships and fair revenue frameworks is crucial for sustaining long-term growth in the global cloud gaming industry.

Regional Analysis

North America

North America dominated the cloud gaming market in 2024, accounting for 36.8% of the total share. The region’s leadership is driven by advanced internet infrastructure, widespread 5G deployment, and strong adoption of subscription-based gaming models. Key players such as Microsoft, NVIDIA, and Amazon have established robust cloud ecosystems, offering high-quality streaming and cross-platform accessibility. Growing investments in AI-driven graphics optimization and VR integration further strengthen the market. Increasing gamer spending and the popularity of esports continue to support revenue growth, solidifying North America’s position as the global innovation hub for cloud gaming.

Europe

Europe captured 27.4% of the global cloud gaming market in 2024, supported by widespread broadband access and growing digital entertainment consumption. The region benefits from favorable regulations promoting data privacy and fair competition among streaming platforms. Countries such as the United Kingdom, Germany, and France lead adoption due to strong gaming communities and cloud infrastructure investments. Companies like Ubisoft and Shadow PC are expanding their streaming portfolios to meet demand. The ongoing integration of 5G networks and cross-border digital policies continues to enhance user experience and market scalability across the region.

Asia-Pacific

Asia-Pacific accounted for 28.9% of the cloud gaming market in 2024, emerging as the fastest-growing regional segment. Rapid smartphone penetration, affordable data plans, and expanding 5G connectivity drive user engagement. Major markets such as China, Japan, South Korea, and India are witnessing strong platform launches from Tencent, Sony, and NetEase. Localized content, esports expansion, and mobile-first gaming strategies are fueling high adoption rates. Regional partnerships between telecom operators and cloud providers are also enhancing accessibility, positioning Asia-Pacific as a key growth engine for the global cloud gaming ecosystem.

Latin America

Latin America held 4.2% of the global cloud gaming market in 2024, supported by rising internet penetration and growing mobile gaming activity. Countries like Brazil and Mexico are leading adoption due to increased investment in digital infrastructure. The region’s young population and affordable subscription plans are encouraging higher participation. Partnerships between telecom operators and global gaming platforms are improving streaming quality. However, network reliability and latency remain ongoing challenges. Continued 5G expansion and localized pricing strategies are expected to accelerate the market’s future growth across Latin America.

Middle East & Africa

The Middle East & Africa accounted for 2.7% of the global cloud gaming market in 2024. The region’s growth is driven by improving broadband connectivity, urbanization, and increasing interest in online gaming. The UAE, Saudi Arabia, and South Africa are leading markets, supported by government initiatives promoting digital transformation. International players are collaborating with local telecom firms to enhance streaming performance. Despite infrastructural challenges in rural areas, the adoption of 5G networks and rising disposable income are fostering gradual market expansion, creating new opportunities for cloud gaming service providers.

Market Segmentations:

By Type

- File Streaming

- Video Streaming

By Device

- Smartphones

- Tablets

- Gaming Consoles

- Head-Mounted Displays

By Gamer Type

- Casual Gamers

- Avid Gamers

- Lifestyle Gamers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cloud gaming market remains highly competitive, with major players such as Sony Interactive Entertainment, Intel Corporation, Electronic Arts, Inc., Microsoft Corporation, Backbone Labs, Google LLC, Amazon Web Services, Inc., International Business Machines Corporation (IBM Corporation), Apple Inc., and NVIDIA Corporation driving technological innovation and service expansion. Companies are investing heavily in infrastructure, latency reduction, and AI-based optimization to deliver seamless gaming experiences. Strategic collaborations between cloud providers and telecom operators are enhancing network performance and geographic reach. Microsoft’s Xbox Cloud Gaming and NVIDIA’s GeForce Now continue to lead in user engagement, supported by extensive content libraries and subscription models. Meanwhile, Amazon and Google are focusing on scalable platforms integrated with existing ecosystems like Prime Gaming and Google Play. The competitive environment is marked by rapid advancements in graphics streaming, multi-device interoperability, and partnerships aimed at improving accessibility and affordability for global gamers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sony Interactive Entertainment

- Intel Corporation

- Electronic Arts, Inc.

- Microsoft Corporation

- Backbone Labs

- Google LLC

- Amazon Web Services, Inc.

- International Business Machines Corporation (IBM Corporation)

- Apple Inc.

- NVIDIA Corporation

Recent Developments

- In November 2025, NVIDIA Corporation confirmed its cloud gaming service GeForce NOW will launch in India this November, extending its RTX-powered game streaming network.

- In October 2025, Amazon Web Services, Inc. (via Luna) released a redesign of its cloud gaming service focused on party-style multiplayer “GameNight” features for Prime members.

- In August 2025, Microsoft Corporation expanded its Xbox Cloud Gaming service to Game Pass Core and Standard tiers, making cloud play accessible beyond the Ultimate tier.

- In November 2024, Sony Interactive Entertainment enabled cloud streaming (beta) of select PS5 games via the PlayStation Portal handheld for PlayStation Plus Premium members

Report Coverage

The research report offers an in-depth analysis based on Type, Device, Gamer Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The cloud gaming market will experience rapid growth driven by expanding 5G infrastructure.

- Subscription-based models will become the dominant revenue source across global platforms.

- AI and machine learning will enhance graphics optimization and reduce latency.

- Cross-platform compatibility will encourage wider adoption among mobile and console gamers.

- Cloud service providers will invest more in edge computing to improve performance.

- Partnerships between telecom operators and gaming firms will expand service accessibility.

- Emerging markets in Asia-Pacific and Latin America will see the fastest adoption rates.

- Advances in AR and VR integration will create new immersive gaming experiences.

- Competition will intensify as tech giants and gaming studios launch proprietary platforms.

- Enhanced data privacy regulations will shape future cloud gaming infrastructure and partnerships.