Market Overview:

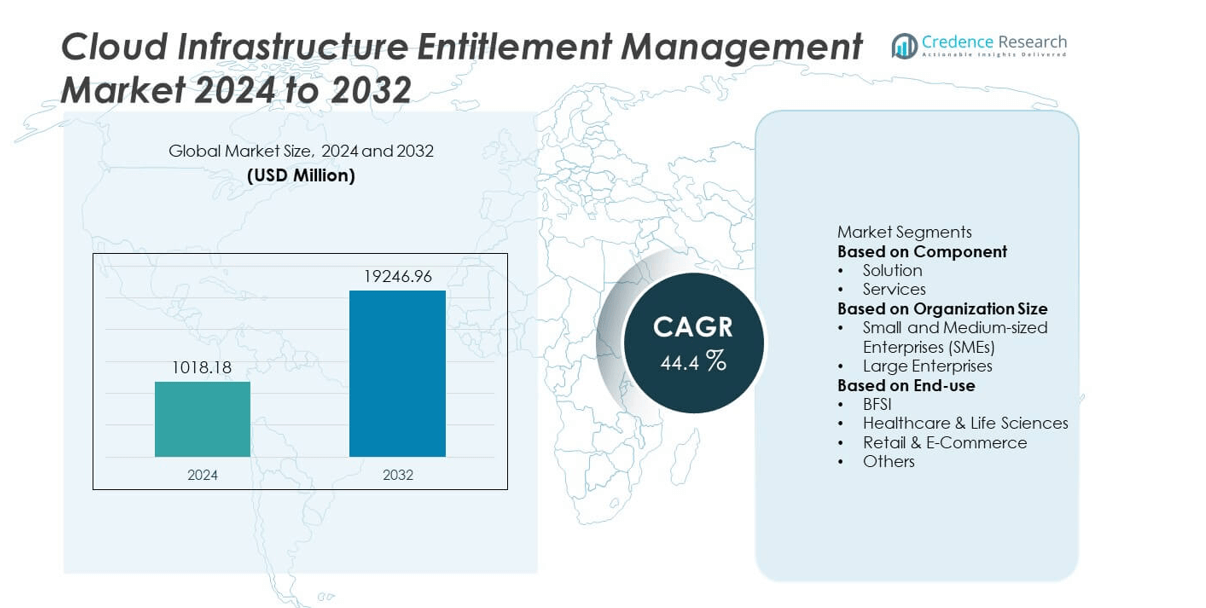

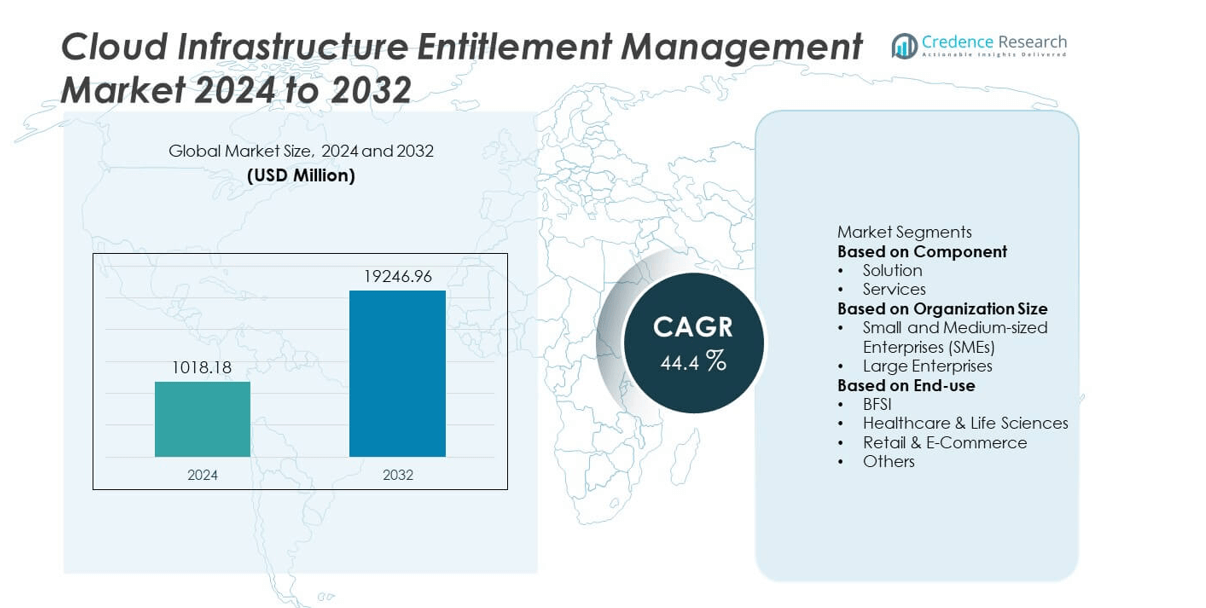

The Cloud Infrastructure Entitlement Management (CIEM) Market was valued at USD 1018.18 million in 2024 and is projected to reach USD 19246.96 million by 2032, growing at a CAGR of 44.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud Infrastructure Entitlement Management Market Size 2024 |

USD 1018.18 million |

| Cloud Infrastructure Entitlement Management Market, CAGR |

44.4% |

| Cloud Infrastructure Entitlement Management Market Size 2032 |

USD 19246.96 million |

The Cloud Infrastructure Entitlement Management market is led by major players including CrowdStrike, Saviynt Inc., CyberArk, BeyondTrust Corporation, Microsoft Corporation, Rapid7, SailPoint Technologies, Inc., Palo Alto Networks, Check Point Software Technologies Ltd, and Zscaler, Inc. These companies focus on enhancing cloud identity governance, access analytics, and automation to secure multi-cloud environments. North America dominated the market in 2024 with a 38.2% share, driven by advanced cybersecurity adoption and regulatory compliance frameworks. Europe followed with 27.6%, supported by strong data protection mandates, while Asia-Pacific accounted for 25.9%, emerging as the fastest-growing region due to rapid digital transformation and cloud migration initiatives.

Market Insights

- The Cloud Infrastructure Entitlement Management market was valued at USD 1018.18 million in 2024 and is projected to reach USD 19246.96 million by 2032, growing at a CAGR of 44.4% during the forecast period.

- Rising adoption of multi-cloud environments and growing cybersecurity concerns drive market expansion, as enterprises seek advanced visibility and access governance tools.

- Key trends include AI-driven automation, zero-trust implementation, and integration with identity and access management systems for enhanced security.

- The market is highly competitive, with players such as Microsoft Corporation, CyberArk, and Palo Alto Networks focusing on product innovation and partnerships to strengthen their global presence.

- North America dominated with 38.2% of the market in 2024, followed by Europe at 27.6% and Asia-Pacific at 25.9%, while the solution segment accounted for 67.5% of total revenue due to strong demand for automated cloud entitlement management platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The solution segment dominated the Cloud Infrastructure Entitlement Management market in 2024, accounting for 67.5% of the total share. This dominance is attributed to growing enterprise adoption of automated tools that manage cloud access permissions and mitigate identity-related risks. CIEM solutions help detect excessive privileges, streamline governance, and ensure compliance with evolving security standards. Increasing multi-cloud deployments and the need for unified visibility across platforms further boost demand. Vendors are integrating AI-driven analytics and automation to enhance detection capabilities and policy enforcement efficiency across large-scale cloud environments.

- For instance, CyberArk enhanced its Identity Security Platform to identify IAM misconfiguration risks across multiple clouds and to automate context-based approval workflows in its Secure Cloud Access product.

By Organization Size

Large enterprises held the largest share of 62.8% in the Cloud Infrastructure Entitlement Management market in 2024. Their leadership is driven by extensive cloud adoption, complex IT ecosystems, and stringent compliance mandates. These organizations prioritize CIEM platforms to monitor access controls across multiple cloud environments, ensuring least-privilege principles and preventing insider threats. The rising frequency of security breaches targeting privileged accounts has accelerated solution deployment. Large enterprises also benefit from scalable integrations with IAM and PAM tools, reinforcing identity governance and access security frameworks globally.

- For instance, SailPoint Technologies, Inc. announced that its CIEM solution, fully integrated within its Identity Security Cloud platform, supports AWS, Azure and Google Cloud and has been named an “Overall Leader” by KuppingerCole in 2025

By End-use

The BFSI sector led the Cloud Infrastructure Entitlement Management market in 2024, representing 34.6% of the total share. Financial institutions demand strong cloud security solutions to safeguard sensitive data, meet regulatory standards, and manage dynamic access rights. Increasing cloud migration for digital banking and fintech services has heightened the need for visibility and real-time control over cloud entitlements. CIEM tools help institutions mitigate risks from overprivileged accounts and automate compliance reporting. Continuous digital transformation across banking and insurance ecosystems drives further adoption, supported by investments in zero-trust and access governance frameworks.

Key Growth Drivers

Rising Cloud Adoption and Multi-Cloud Complexity

The rapid shift toward cloud-based infrastructure has created a strong need for advanced entitlement management solutions. Enterprises increasingly deploy multi-cloud and hybrid models, making access control more complex. CIEM tools provide centralized visibility and automated privilege management across platforms like AWS, Azure, and Google Cloud. This capability helps prevent identity sprawl and privilege misuse. As businesses expand cloud workloads, demand for CIEM solutions continues to grow, ensuring secure, compliant, and efficient access governance across distributed cloud environments.

- For instance, Microsoft Corporation’s Microsoft Entra Permissions Management supports all three major cloud providers (Azure, AWS, GCP) in a unified console.

Increasing Cybersecurity Threats and Insider Risks

Rising incidents of unauthorized access, data breaches, and insider threats are accelerating CIEM adoption. Enterprises face growing challenges in managing excessive cloud permissions and minimizing attack surfaces. CIEM platforms leverage identity analytics and automation to detect anomalies, enforce least-privilege policies, and remediate security gaps. With regulatory frameworks such as GDPR and HIPAA demanding stricter access control, organizations are investing in CIEM to protect critical assets. These solutions have become essential in strengthening cloud identity security and preventing credential-based attacks.

- For instance, CyberArk Software Ltd.’s CyberArk Identity Security Platform introduced just-in-time scoped roles and automatic approval workflows for cloud workloads across multi-cloud environments.

Regulatory Compliance and Governance Requirements

Strict global regulations on data protection and access control are propelling CIEM deployment. Industries such as BFSI, healthcare, and government must demonstrate compliance with standards like ISO 27001 and SOC 2. CIEM solutions simplify audit readiness through automated reporting, continuous monitoring, and policy enforcement. They help organizations maintain transparency and accountability in managing cloud entitlements. As compliance becomes integral to cybersecurity strategies, CIEM platforms play a vital role in supporting governance frameworks and reducing regulatory risks across multi-cloud infrastructures.

Key Trends & Opportunities

Integration of AI and Machine Learning in CIEM

Artificial intelligence is transforming entitlement management by enabling predictive analytics and automated decision-making. AI-driven CIEM systems analyze user behavior patterns to identify abnormal access activity and recommend corrective actions. Machine learning algorithms improve over time, enhancing accuracy in detecting privilege misuse and optimizing access controls. This integration supports continuous, risk-based authorization models, allowing enterprises to manage dynamic cloud environments effectively. The trend toward intelligent automation creates new opportunities for vendors offering AI-enhanced CIEM capabilities for proactive threat mitigation.

- For instance, Microsoft integrated machine learning into Azure AD Identity Protection, analyzing over 65 trillion threat signals daily to detect suspicious sign-ins and compromised credentials. This AI-driven system automatically blocks risky access attempts and enhances adaptive access controls across hybrid cloud environments.

Growing Demand for Zero-Trust Security Frameworks

The adoption of zero-trust architecture is accelerating CIEM market growth. Organizations are transitioning from perimeter-based security to identity-centric access control models. CIEM solutions complement zero-trust principles by providing granular visibility into user privileges and enforcing contextual access policies. As remote work and cloud-native applications expand, enterprises prioritize zero-trust strategies to minimize lateral movement and privilege escalation risks. This alignment between CIEM and zero-trust initiatives presents strong opportunities for vendors to deliver integrated, scalable, and compliance-ready security frameworks.

- For instance, Google’s BeyondCorp Enterprise platform applies zero-trust architecture to secure access for over 150,000 employees and contractors globally. It enforces continuous authentication and device verification, reducing dependency on traditional VPNs while ensuring compliance with dynamic access control standards.

Key Challenges

Integration Complexity with Existing Systems

Implementing CIEM solutions across diverse IT ecosystems remains challenging. Enterprises often rely on multiple identity and access management tools that complicate integration. Aligning CIEM with IAM, PAM, and cloud-native services requires significant configuration and technical expertise. Delays in deployment can hinder visibility and automation benefits. To overcome this, vendors are focusing on developing standardized APIs and flexible architectures. However, integration complexity continues to limit adoption, particularly among organizations with legacy infrastructure and limited cloud governance maturity.

Shortage of Skilled Cybersecurity Professionals

The global shortage of skilled professionals in cloud security poses a major challenge to CIEM adoption. Managing entitlements across hybrid environments demands expertise in identity governance, compliance, and automation. Many organizations struggle to configure and maintain CIEM tools effectively, leading to operational inefficiencies. This talent gap increases reliance on managed services and third-party providers. Expanding workforce training and certifications in cloud access management is crucial to addressing this limitation and ensuring the successful implementation of CIEM solutions worldwide.

Regional Analysis

North America

North America dominated the Cloud Infrastructure Entitlement Management market in 2024, accounting for 38.2% of the total share. The region’s growth is driven by rapid cloud adoption, strong cybersecurity regulations, and increasing investment in identity management solutions. Key players such as Microsoft, IBM, and Palo Alto Networks continue to expand advanced CIEM offerings to meet enterprise security needs. The U.S. leads market demand with a focus on zero-trust architecture and cloud governance frameworks. Ongoing digital transformation across BFSI, healthcare, and IT sectors further strengthens North America’s position as a key revenue contributor.

Europe

Europe captured 27.6% of the global Cloud Infrastructure Entitlement Management market in 2024, supported by strict data protection laws such as GDPR and growing multi-cloud adoption. Enterprises across Germany, France, and the United Kingdom are prioritizing CIEM platforms to enhance compliance and reduce privilege-related risks. The rise in hybrid cloud environments and remote work models has amplified demand for identity-centric security tools. Regional vendors are forming partnerships with global providers to deliver scalable and compliant solutions. Continuous investment in cybersecurity infrastructure drives Europe’s strong market expansion and long-term sustainability.

Asia-Pacific

Asia-Pacific held 25.9% of the Cloud Infrastructure Entitlement Management market in 2024 and is projected to record the fastest growth through 2032. Rapid cloud migration, expanding digital ecosystems, and government-led cybersecurity initiatives are fueling demand. Major economies like China, Japan, India, and South Korea are investing in CIEM tools to secure growing cloud workloads. Increasing adoption among financial institutions and technology firms strengthens the regional market. Local startups are partnering with global players to enhance cloud governance and compliance capabilities, making Asia-Pacific a strategic hub for future CIEM innovations.

Latin America

Latin America accounted for 4.8% of the Cloud Infrastructure Entitlement Management market in 2024, driven by growing cloud adoption among mid-sized enterprises. Countries such as Brazil, Mexico, and Chile are increasing investments in cloud-based security tools to manage identity risks. The region’s expanding fintech sector and government digitalization initiatives are encouraging the deployment of CIEM solutions. However, budget constraints and limited cybersecurity awareness hinder broader adoption. As regional infrastructure improves and cloud compliance standards strengthen, Latin America is expected to witness steady growth in CIEM deployment across key industries.

Middle East & Africa

The Middle East & Africa held 3.5% of the global Cloud Infrastructure Entitlement Management market in 2024. The region’s expansion is supported by growing investments in digital transformation, cloud computing, and cybersecurity modernization. The UAE, Saudi Arabia, and South Africa lead adoption with national strategies focused on data protection and governance. Enterprises are increasingly deploying CIEM tools to manage complex access structures across public and hybrid clouds. Despite infrastructure limitations in rural areas, increasing 5G connectivity and regulatory reforms are fostering gradual yet promising market growth in this region.

Market Segmentations:

By Component

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By End-use

- BFSI

- Healthcare & Life Sciences

- Retail & E-Commerce

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cloud Infrastructure Entitlement Management market is highly competitive, with key players such as CrowdStrike, Saviynt Inc., CyberArk, BeyondTrust Corporation, Microsoft Corporation, Rapid7, SailPoint Technologies, Inc., Palo Alto Networks, Check Point Software Technologies Ltd, and Zscaler, Inc. leading innovation and market expansion. These companies focus on developing advanced CIEM solutions integrating AI, automation, and zero-trust principles to enhance visibility and control over cloud entitlements. Strategic collaborations and acquisitions are common, aiming to strengthen product portfolios and expand geographic reach. Microsoft and CyberArk dominate through integrated identity and access management platforms, while newer entrants like Saviynt and Zscaler are gaining traction with cloud-native and compliance-driven solutions. Continuous investment in analytics, behavioral monitoring, and unified governance tools underscores the industry’s focus on addressing complex multi-cloud security challenges and maintaining competitive differentiation in a rapidly evolving cloud ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CrowdStrike

- Saviynt Inc.

- CyberArk

- BeyondTrust Corporation

- Microsoft Corporation

- Rapid7

- SailPoint Technologies, Inc.

- Palo Alto Networks

- Check Point Software Technologies Ltd

- Zscaler, Inc.

Recent Developments

- In October 2025, Saviynt Inc. announced an integration with the CrowdStrike Falcon platform (available via the CrowdStrike Marketplace)—enhancing its identity security platform, which includes CIEM capabilities.

- In June 2025, SailPoint Technologies, Inc. announced it had been named an “Overall Leader” in the 2025 KuppingerCole Leadership Compass for CIEM, highlighting its cloud-infrastructure identity governance strengths.

- In April 2023, Orca Security introduced Orca CIEM to secure identities and entitlements across multi-cloud environments. It provides visibility, risk detection, and automated remediation for excessive permissions and misconfigurations

Report Coverage

The research report offers an in-depth analysis based on Component, Organization Size, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Cloud Infrastructure Entitlement Management market will witness strong growth driven by rising multi-cloud adoption.

- AI and automation will play a key role in improving identity visibility and access control.

- Zero-trust architecture will become a central framework for CIEM solution deployment.

- Integration with IAM and PAM systems will strengthen end-to-end security governance.

- Regulatory compliance requirements will drive greater enterprise investment in CIEM platforms.

- Cloud-native CIEM solutions will gain popularity for scalability and real-time monitoring.

- Partnerships between cybersecurity vendors and cloud providers will expand market reach.

- Emerging markets in Asia-Pacific and Latin America will see rapid adoption of CIEM tools.

- Continuous innovation in analytics and behavior-based access control will improve threat detection.

- Demand for managed CIEM services will rise as organizations address skill shortages in cloud security.