Market Overview

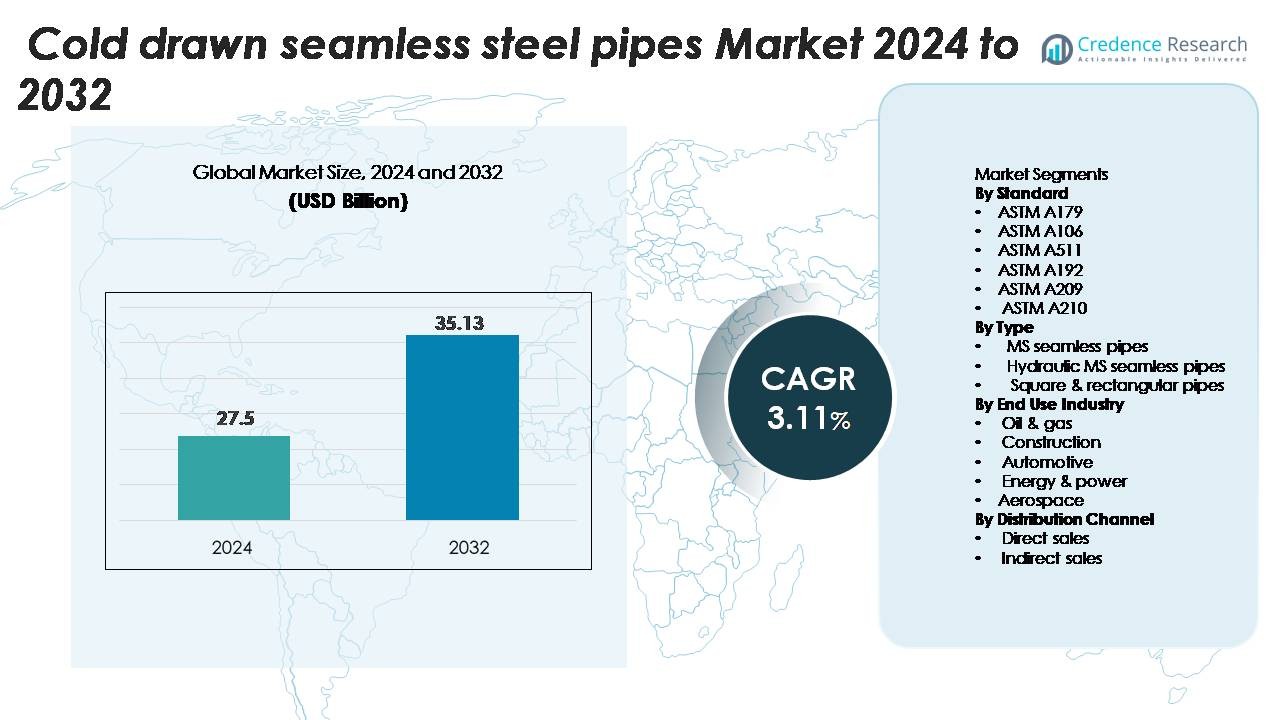

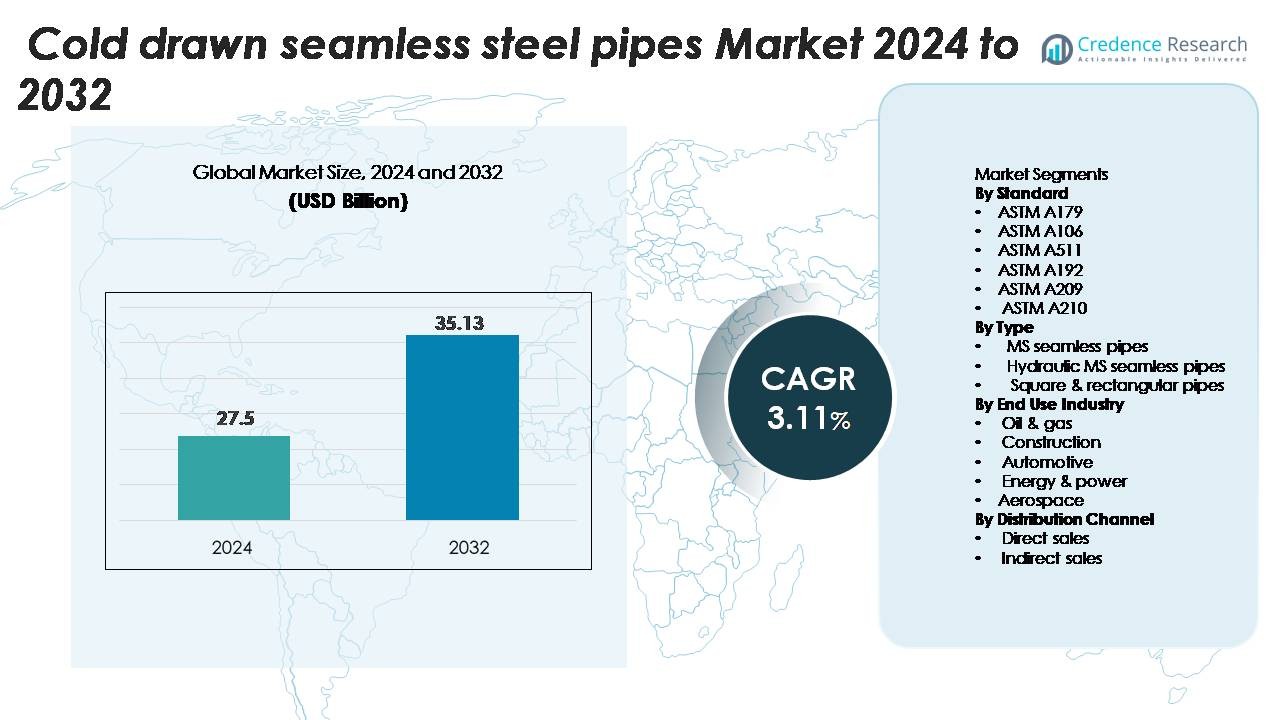

Cold drawn seamless steel pipes market size was valued at USD 27.5 billion in 2024 and is anticipated to reach USD 35.13 billion by 2032, at a CAGR of 3.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cold Drawn Seamless Steel Pipes Market Size 2024 |

USD 27.5 Billion |

| Cold Drawn Seamless Steel Pipes Market, CAGR |

3.11% |

| Cold Drawn Seamless Steel Pipes Market Size 2032 |

USD 35.13 Billion |

Asia-Pacific leads the Cold Drawn Seamless Steel Pipes market with a 38% share, driven by strong demand from construction, energy, and automotive projects across China, India, and Japan. Major players such as ArcelorMittal S.A., PAO Severstal, PAO TMK, SSAB AB, JFE Steel Corporation, Nippon Steel Corporation, PAO Chelpipe, and Indian Oil Corporation Limited focus on high-strength grades, precision tolerances, and efficient production lines to serve critical industries. Piping Technology & Products, Inc. and Hydraulic & Engineering Components Private Limited expand their client base through customized pipe solutions for oil and gas facilities. Europe remains the second-largest region due to ongoing refinery upgrades and industrial modernization. North America continues to grow with pipeline replacements and manufacturing expansion. Continuous capacity upgrades and product innovation help leading companies maintain their market position while meeting strict technical standards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Cold drawn seamless steel pipes market size was valued at USD 27.5 billion in 2024 and is anticipated to reach USD 35.13 billion by 2032, at a CAGR of 3.11%

- Growth is driven by rising pipeline installations, higher pressure handling needs, and strict industry standards that push users toward high-precision, seamless steel pipes for safe fluid transport.

- A key trend is the shift toward customized dimensions and high-strength alloys, which help buyers reduce welding, improve flow efficiency, and extend system life in harsh industrial environments.

- Competition stays intense as ArcelorMittal S.A., PAO TMK, PAO Severstal, Nippon Steel Corporation, and SSAB AB expand capacity, adopt heat-treatment technologies, and focus on precision tolerances for premium applications.

- Asia-Pacific holds 38% share due to large construction and energy projects, while Europe accounts for a notable share from refinery upgrades and automotive output; the oil and gas segment dominates global volume due to long-distance transmission pipelines.

Market Segmentation Analysis

By Standard

The market by standard is led by ASTM A106, holding the largest share due to its widespread use in high-temperature and high-pressure applications. This grade remains a preferred choice for refineries, power plants, and petrochemical facilities because it supports seamless transportation of steam, oil, and gases without deformation. ASTM A179 and ASTM A192 also show strong adoption in heat exchanger and boiler tube production, driven by demand in industrial heating systems. ASTM A209 and ASTM A210 gain traction in superheater and reheater tubes across power generation, while ASTM A511 supports precision mechanical tubing needs.

- For instance, PAO TMK supplies ASTM A106 Grade B pipes with outer diameters up to 720 mm and wall thickness up to 40 mm for refinery furnace and heater lines.

By Type

MS seamless pipes dominate with the largest market share, driven by extensive usage across oil & gas, construction, and infrastructure projects. Their corrosion resistance, smooth finish, and durability make them suitable for fluid conveyance and structural applications. Hydraulic MS seamless pipes continue to gain demand in heavy machinery and hydraulic systems where pressure handling is critical. Square and rectangular pipes witness higher usage in urban infrastructure, furniture frames, and metal fabrication, benefiting from rising commercial construction and modular building trends.

- For instance, PAO Severstal is a major steel producer that manufactures seamless steel pipes suitable for a wide range of industrial applications, including hydraulic systems.

By End-use industry

Oil & gas commands the largest share due to continuous investments in pipeline networks, refinery upgrades, and offshore extraction. These pipes are used for drilling, well casing, and fluid transportation because they withstand extreme temperatures and pressure. Construction follows with growth in urban development and smart city infrastructure. The automotive sector increases adoption for chassis systems, steering components, and precision mechanical parts. Energy & power relies on these pipes for boilers, heat exchangers, and superheaters, while aerospace demands high-strength, lightweight tubes for engine systems and aircraft structures.

Key Growth Drivers

Rising Demand from Oil & Gas and Petrochemical Industries

Cold-drawn seamless steel pipes are widely used in offshore rigs, refineries, and gas processing systems. The sector prefers these pipes because they deliver strong pressure tolerance, smooth internal surfaces, and uniform thickness. Growing investment in shale gas, LNG terminals, offshore drilling, and pipeline upgrades is raising product demand. Many operators are replacing old welded pipelines to reduce leakage, corrosion, and maintenance cost. Cold-drawn seamless pipes support high-temperature fluids and harsh chemicals, which makes them suitable for sour-gas and deep-well operations. Increased adoption in booster stations, subsea lines, and refinery heat-exchanger tubes further strengthens the market position. Companies also prefer the product for better mechanical performance and longer service life, which supports lower lifecycle cost. As new oil and gas projects start across the Middle East, North America, and Asia, manufacturers witness a direct boost in order volume and high-value product sales.

· For instance, PAO TMK supplies cold-drawn seamless line pipes with diameters up to 406.4 mm (16 inches) and operating pressure ratings reaching 35 MPa for offshore gas fields.

Expansion of Automotive and Mechanical Engineering Applications

Automotive, machinery, and heavy-equipment makers are shifting toward seamless pipes for precision parts. These industries use cold-drawn pipes to manufacture fuel-injection tubes, shock absorbers, steering systems, axles, hydraulic cylinders, and mechanical components. Uniform diameter, excellent tensile strength, and improved dimensional accuracy make the product ideal for fast-moving parts that face vibration or high pressure. Electric vehicle platforms and hybrid systems need precision tubing for battery cooling and powertrain systems, which further pushes demand. Manufacturing plants prefer these pipes because they machine easily and deliver cleaner inner bores that improve fluid flow. Industrial automation and robotics also use seamless pipes in actuators and pneumatic lines. Growth in construction equipment, agricultural machinery, forklifts, and industrial pumps supports steady consumption. Many OEMs are also localizing supply chains, which encourages new pipe production facilities in developing countries.

- For instance, Nippon Steel supplies cold-drawn precision tubes for automotive components with diameters ranging from 6 mm to 80 mm and tensile strengths reaching 980 MPa for suspension and steering systems.

Rapid Growth in Power Generation and Energy Infrastructure

Cold-drawn seamless steel pipes are used in thermal power plants, nuclear reactors, and gas-fired units. Power stations require high-performance tubes that can handle extreme temperature and steam pressure. Seamless pipes reduce leaks in boilers, heat exchangers, and superheaters, which helps extend plant life. Grid modernization projects and district-heating networks also boost demand for corrosion-resistant and heat-resistant tubing. Renewable projects such as geothermal power plants use seamless pipes for brine transport and steam reinjection. Hydrogen transportation, carbon capture systems, and energy storage plants are emerging areas where seamless pipes deliver strong durability and pressure performance. Many countries are upgrading old power systems, which creates a large replacement market. Growing energy security goals in Asia and Africa further increase pipeline installation and power-equipment procurement, directly supporting the cold-drawn seamless pipe supply chain.

Key Trends & Opportunities

Shift Toward High-Strength and alloy-grade seamless pipes

Manufacturers are producing high-alloy and corrosion-resistant grades to serve demanding projects. Grades such as duplex, nickel-alloy, chromium-molybdenum, and stainless steel improve heat resistance, tensile strength, and chemical stability. These materials reduce failure risks in sour-gas processing, high-pressure boilers, and deep-well drilling. Demand is rising from refineries, aerospace component makers, shipbuilding, and advanced machinery producers. Material innovation also supports weight reduction and longer fatigue life. Large infrastructure projects require long-length seamless lines with consistent microstructure, which encourages advanced heat-treatment and automated drawing lines. This trend opens opportunities for premium product pricing and long-term supply contracts with EPC contractors.

- For instance, Nippon Steel produces duplex stainless seamless pipes with tensile strengths above 750 MPa for high-pressure offshore pipelines.

Automation, digital inspection, and precision manufacturing

Producers are adopting CNC drawing, real-time wall-thickness control, and nondestructive testing to improve pipe quality. Digital inspection tracks defects, ovality, and dimensional tolerance during production, which reduces scrap. Smart manufacturing helps companies meet strict standards for automotive, aerospace, and nuclear sectors. Robotic handling and surface finishing lower labor cost and increase output stability. This shift allows large-scale customization for thin-wall tubing, multi-grade orders, and special sizes. Companies that invest in automated mills can supply global clients and meet tight delivery schedules. Industry 4.0 adoption also helps suppliers win contracts in high-precision markets where defect rates must remain extremely low.

- For instance, JFE Steel uses a new ‘teachingless’ robotic system and automated handling lines to process small-diameter seamless tubes at its Chita Works, which speeds up operations and helps maintain consistent surface quality.

Key Challenges

Volatile raw-material prices and high production cost

Seamless steel pipe production depends on quality billets, alloying metals, and energy input. Price swings in iron ore, scrap, nickel, chromium, and molybdenum create uncertainty in profit margins. Cold drawing involves annealing, pickling, multiple reduction steps, and precision heat treatment, which increases cost versus welded pipes. High energy prices push operating costs for mills and heat-treatment facilities. Smaller manufacturers struggle to compete with large integrated steel mills that control billet supply. When market demand slows, high inventory cost becomes a burden. These factors make it difficult to maintain stable pricing in competitive tenders, especially in construction and automotive contracts.

Stringent standards and certification requirements

Cold-drawn seamless pipes must meet international codes such as ASTM, ASME, EN, and API for pressure vessels, boilers, and line pipes. Each sector requires strict testing, including ultrasonic inspection, hydrostatic testing, chemical analysis, hardness checks, and dimensional tolerance control. Meeting these standards increases capital investment in machinery and lab equipment. Delays in certification or failed batches can lead to shipment rejection and financial loss. Exporters also face additional compliance and documentation rules when selling to the U.S., Europe, or Middle East. Smaller producers often lack the advanced testing capability needed for nuclear, aerospace, or high-temperature alloy supply, which limits market reach.

Regional Analysis

North America

North America holds 23% market share. The United States dominates due to strong investment in shale gas extraction, refinery modernization, and pipeline replacement projects. Manufacturers supply cold-drawn seamless steel pipes for hydraulic systems, heat exchangers, OCTG tubing, and high-pressure flowlines. The automotive sector adds steady demand from shock absorbers, fuel injection tubes, and precision mechanical components. Canada’s mining and oil sands operations require corrosion-resistant alloy grades, which increases premium product consumption. The presence of advanced steel mills, strict quality standards, and established supply chains also supports continuous growth for domestic producers and regional distributors.

Europe

Europe accounts for 26% market share, driven by industrial machinery, nuclear power programs, and automotive production hubs in Germany, Italy, and France. Cold-drawn seamless steel pipes are widely used in boilers, pressure vessels, hydraulic cylinders, and vehicle components requiring tight dimensional tolerance. EU regulations on equipment safety boost demand for certified, high-strength alloy products. Eastern Europe is expanding pipeline and chemical plant construction, increasing orders for stainless and duplex grades. The shift toward hydrogen transport and district heating networks also strengthens future consumption. Local mills maintain strong technological capability, enabling Europe to remain a key exporter.

Asia-Pacific

Asia-Pacific leads with 38% market share, supported by large-scale oil refining, power generation, and industrial manufacturing bases in China, India, Japan, and South Korea. Rapid construction of petrochemical complexes, natural gas pipelines, and heavy machinery plants boosts high-pressure seamless pipe demand. China produces a major share of global output and continues to expand premium-grade alloy production. India’s automotive and construction equipment industries also consume significant volumes. Strong infrastructure spending, steel capacity expansion, and low-cost production enhance supply chain strength. Growing geothermal and renewable energy investments create new opportunities for corrosion-resistant grades across the region.

Latin America

Latin America holds 7% market share. Demand is driven by oil and gas projects in Brazil, Mexico, and Argentina, where offshore development and pipeline repairs require seamless pipes with high tensile strength. Mining operations in Chile and Peru also support consumption of alloy-grade pipes for high-pressure slurry transport. The region imports a substantial portion of its requirements due to limited domestic manufacturing capacity. Modernization of refineries, fertilizer plants, and petrochemical complexes is creating new procurement cycles. Expanding automotive assembly and agricultural machinery production also contributes to steady industrial demand.

Middle East & Africa

Middle East & Africa maintain 6% market share, largely supplied by pipeline infrastructure, crude processing facilities, and water desalination plants. Countries such as Saudi Arabia, UAE, and Qatar require seamless pipes for high-temperature fluid transfer, boiler tubes, and refinery units. Africa’s mining and power sectors add pockets of demand, especially for corrosion-resistant and thick-wall grades. Most consumption is import-driven, supported by suppliers from Asia and Europe. Ongoing expansion of LNG terminals, petrochemical plants, and enhanced oil recovery projects is expected to raise procurement volumes, especially for stainless and alloy steel seamless pipes.

Market Segmentations:

By Standard

- ASTM A179

- ASTM A106

- ASTM A511

- ASTM A192

- ASTM A209

- ASTM A210

By Type

- MS seamless pipes

- Hydraulic MS seamless pipes

- Square & rectangular pipes

By End Use Industry

- Oil & gas

- Construction

- Automotive

- Energy & power

- Aerospace

By Distribution Channel

- Direct sales

- Indirect sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the cold-drawn seamless steel pipe market includes global steel producers, specialty alloy manufacturers, and precision tubing companies. Leading players focus on advanced metallurgy, heat treatment capability, and automated drawing lines to achieve tight tolerance and defect-free inner surfaces. Companies compete by offering a wide product portfolio across carbon steel, stainless steel, duplex, nickel alloys, and heat-resistant grades. Strategic priorities include long-term supply contracts with oil and gas operators, EPC contractors, automotive OEMs, and power plant developers. Many producers invest in nondestructive testing systems, CNC cold-drawing machines, and digital inspection tools to improve quality consistency and meet strict ASTM, EN, and API standards. Local suppliers in Asia and Eastern Europe compete on price and scale, while North American and European mills focus on premium-grade, high-precision products. Mergers, capacity expansions, and regional distribution hubs are rising as companies work to cut lead times and serve global customers more effectively.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PAO Severstal

- Piping Technology & Products, Inc.

- SSAB AB

- Indian Oil Corporation Limited

- ArcelorMittal S.A.

- PAO TMK

- Nippon Steel Corporation

- Hydraulic & Engineering Components Private Limited

- JFE Steel Corporation

- PAO Chelpipe

Recent Developments

- In April 03 2025, SSAB signed an Early Service Agreement with SMS group for a new cold-rolling complex at its Luleå facility, advancing sustainable steel production.

- In March 2025, Severstal began production of large-diameter steel pipes at its Izhora Pipe Plant featuring a new “Kolchuga” protective glass-thermoplastic coating for a major client.

Report Coverage

The research report offers an in-depth analysis based on Standard, Type, End use industry, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as oil and gas companies expand pipeline networks.

- Automotive OEMs will use more high-strength seamless pipes for fuel and safety systems.

- Manufacturers will invest in precision drawing and heat treatment technologies.

- Digital inspection and non-destructive testing will improve quality control.

- Asia-Pacific will remain the highest consumption region across industries.

- Europe and North America will grow due to refinery upgrades and industrial replacement projects.

- Customized pipe sizes will reduce welding and material waste in complex installations.

- New corrosion-resistant alloys will support offshore and high-pressure operations.

- Strategic partnerships between mills and EPC contractors will increase long-term supply contracts.

- Sustainability goals will push producers to adopt energy-efficient production and scrap recycling.