Market Overview

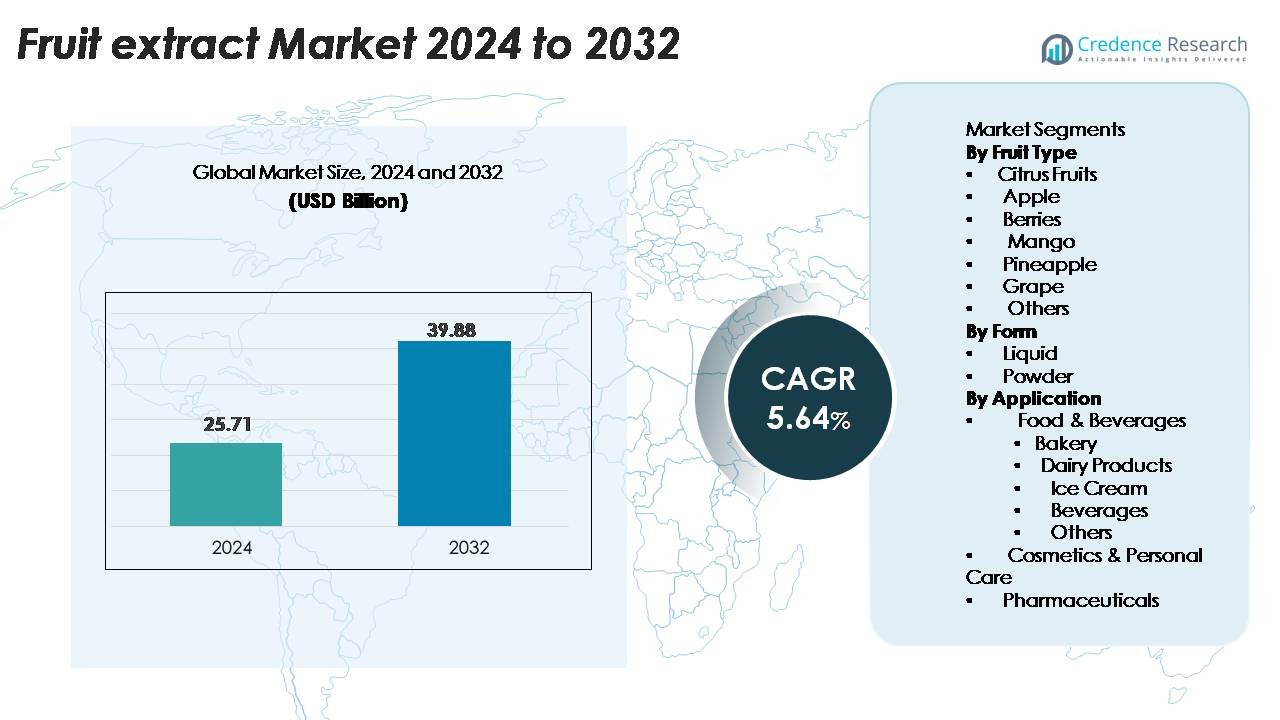

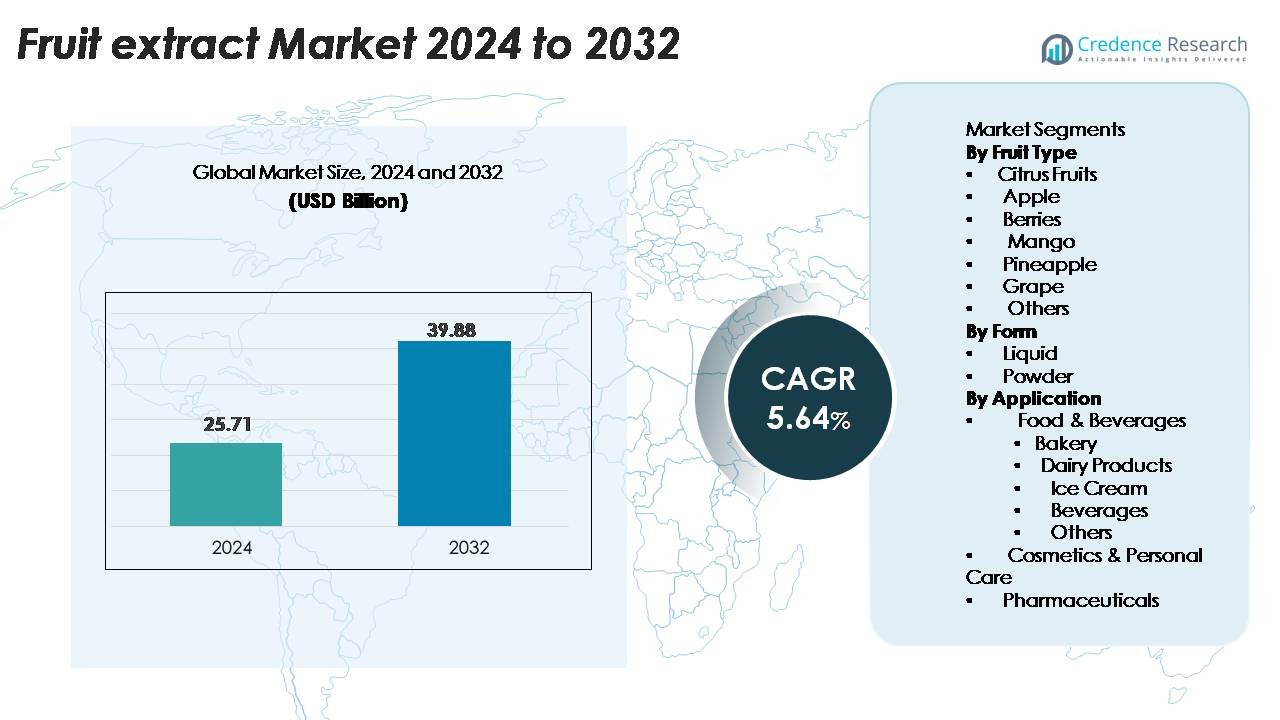

The Fruit Extract Market was valued at USD 25.71 billion in 2024 and is anticipated to reach USD 39.88 billion by 2032, registering a CAGR of 5.64% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fruit Extract Market Size 2024 |

USD 25.71 Billion |

| Fruit Extract Market , CAGR |

5.64% |

| Fruit Extract Market Size 2032 |

USD 39.88 Billion |

Top players in the fruit extract market include Symrise, Döhler GmbH, AGRANA Beteiligungs-AG, International Flavors & Fragrances Inc., Sensient Technologies Corporation, Kerr by Ingredion, Naturalin Bio-Resources, ABC Fruits, Citrofrut, and TBF Group. These companies focus on clean-label ingredients, advanced extraction methods, and strong supply chains to meet rising demand from beverage, nutraceutical, and cosmetic manufacturers. Asia Pacific leads the market with a 25.7% share, driven by large fruit production, expanding food processing industries, and growing preference for natural flavors in India, China, and Japan. North America and Europe remain strong due to high consumption of functional beverages and strict regulatory support for natural additives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 25.71 billion in 2024 and will hit USD 39.88 billion by 2032, at a CAGR of 5.64%.

- Clean-label demand drives heavy use of natural flavors, colors, and sweeteners in food, beverages, nutraceuticals, and cosmetics. Brands replace artificial additives with fruit-based concentrates to meet safety norms.

- Citrus holds the largest fruit type share at 30%, supported by use in juices, gummies, syrups, and skincare. Liquid extracts lead form share at 55%, while beverages remain the top application, holding 35%.

- Top players invest in solvent-free extraction, microencapsulation, and organic sourcing. Partnerships with farmers secure raw materials and reduce price swings. Global suppliers compete on purity, flavor strength, and traceability.

- Asia Pacific leads with 7% share, backed by strong fruit production and beverage processing. Europe follows with 28.4% due to clean-label rules, while North America holds 32.6% with high nutraceutical adoption.

Market Segmentation Analysis:

By Fruit Type

Citrus fruits lead the fruit type segment with the highest market share due to strong demand in flavoring, nutraceuticals, and vitamin-rich beverages. Citrus extracts contain natural antioxidants and vitamin C, which supports use in immunity-boosting products. Food manufacturers use orange, lemon, and lime extracts for clean-label formulations and sugar-free flavor enhancement. Berries show growing use in functional drinks and skincare because of high anthocyanin content. Apple, mango, pineapple, and grape extracts remain popular across confectionery and bakery applications. Rising consumer preference for natural flavoring supports steady expansion across all sub-categories.

- For instance, Citrus extracts naturally contain valuable compounds like vitamin C and flavonoids, and Symrise standardizes its products to ensure these beneficial components are present in a consistent, functional amount.

By Form

Liquid extracts hold the dominant share as they blend easily in beverages, syrups, sauces, and personal care emulsions. Beverage producers prefer liquid form because it delivers stronger aroma, faster solubility, and long shelf stability. Bakery and dairy brands add liquid fruit concentrates to maintain taste consistency and natural coloring. Powder extracts grow at a steady pace due to better transport convenience, longer storage life, and suitability for dry mixes, supplements, and instant drinks. Sports nutrition and pharmaceutical manufacturers increasingly adopt spray-dried powders for capsule fillings and functional blends.

- For instance, “Döhler GmbH produces orange liquid concentrate (typically around 65 °Brix), which is used to create juices and smoothies. When reconstituted to a single-strength juice (approximately 2 to 12 °Brix), the product typically has a pH range of 3.3 to 4.0, and Döhler uses advanced techniques to ensure uniform flavor and consistency in the final beverages.”

By Application

Food and beverages represent the leading application segment with the largest share, driven by high use in juices, dairy, ice creams, confectionery, and ready-to-drink products. Beverage production remains the dominant sub-segment due to strong demand for flavored, fortified, and clean-label drinks. Bakery and dairy producers adopt fruit extracts for natural sweetness, coloring, and antioxidant benefits. Cosmetics and personal care companies use fruit-based actives in anti-aging, exfoliating, and skin-brightening formulations. Pharmaceutical manufacturers utilize extracts for supplements, gummies, and syrups focused on digestion, immunity, and detox benefits.

Key Growth Drivers

Rising Demand for Natural and Clean-Label Ingredients

Consumers now avoid artificial flavors, synthetic colors, and chemical additives. This shift increases the use of natural fruit extracts as flavoring, coloring, and sweetening agents. Food producers reformulate drinks, confectionery, dairy, and bakery items to gain “clean-label” claims. Retailers promote products with no preservatives and natural taste enhancers, which pushes higher extract usage. Extracts help brands meet regulatory limits on artificial additives in many countries. Growing vegan and plant-based lifestyles also support this move. Natural extracts offer aroma retention, shelf stability, and sugar reduction benefits. This wide appeal makes clean-label adoption one of the strongest demand drivers in the market.

- For instance, Symrise produces a range of natural citrus concentrates and flavorings which are used by food and beverage manufacturers to meet consumer demand for natural and clean-label products.

Growth of Functional Food, Nutraceuticals, and Immunity-Boosting Products

Functional food and beverage consumption continues to rise worldwide. Fruit extracts contain vitamins, polyphenols, and antioxidants, supporting immunity, heart health, digestion, and detoxification. Producers add citrus, berry, and grape extracts to supplements, gummies, capsules, and wellness drinks. Health-focused consumers prefer natural sources over synthetic vitamins, which increases fruit extract use in nutraceuticals. The post-pandemic shift toward preventive health also boosts demand. Sports nutrition brands add concentrated powders for recovery and endurance. Botanical combinations with fruit extracts help in weight management and gut health. This growth makes functional nutrition a stable and long-term demand driver.

- For instance,”Döhler GmbH supplies grape seed extracts that are often standardized to high concentrations, typically ranging from 70% to over 95% proanthocyanidins (or 700 to 950 mg/g), which are widely used in capsules and wellness drinks.

Rising Use in Cosmetics, Personal Care, and Pharmaceutical Formulations

Fruit extracts are widely used in skincare, haircare, and oral care products. They offer natural acids, enzymes, and antioxidants that support anti-aging, brightening, exfoliation, and skin repair. Companies add berry, citrus, grape seed, and apple actives in serums, creams, scrubs, and shampoos. The clean beauty trend encourages chemical-free ingredient replacements. Extract-based actives help brands gain organic, vegan, and dermatologically safe claims. Pharmaceutical producers use fruit extracts in syrups, gummies, chewables, and digestion-related formulations. Higher R&D spending in herbal medicine and plant-based therapeutics also strengthens market expansion. Together, these applications widen commercial opportunities beyond foods.

Key Trends & Opportunities

Growing Penetration of Organic and Sustainable Extracts

Demand for organic fruit extracts continues to rise. Consumers expect pesticide-free, non-GMO, and environmentally responsible sourcing. Producers invest in traceable supply chains and organic certifications for juices, concentrates, and powders. Cold-pressing, freeze-drying, and solvent-free extraction help retain nutrients and aroma. Cosmetic and personal care brands promote organic claims to attract premium buyers. Sustainable farming partnerships with growers reduce waste and improve raw material quality. Brands explore upcycling of fruit peels and seeds for antioxidants and natural colorants. This sustainability shift creates premium pricing, brand differentiation, and certification-based market opportunities.

- For instance, Naturalin Bio‑Resources Co. produces organic cactus extract with 5:1 concentration and standardized 3 % piscidic acid, using solvent-free extraction to maintain nutrient integrity.

Innovation in Extraction and Processing Technologies

Companies adopt advanced extraction technologies to improve yield, flavor strength, and nutrient retention. Techniques like supercritical CO₂ extraction, membrane filtration, and enzymatic processing deliver higher purity and solvent-free output. Spray-drying improves stability and shelf life for powdered extracts. Continuous R&D supports sugar-reduced concentrates with richer flavor profiles. Ready-to-use microencapsulated extracts help beverage and bakery makers maintain aroma in heat-processed foods. These innovations allow expansion into functional beverages, infant food, and medical nutrition. Improved processing efficiency also reduces manufacturing cost and energy consumption, creating competitive advantage.

- For instance, Symrise employs its patented SymTrap extraction technology, which includes the use of supercritical CO₂ for certain applications like ginger, to produce natural botanical extracts. For berry extracts, such as from bilberries (Vaccinium myrtillus), Symrise uses the SymTrap process to achieve a standardized anthocyanin content of up to 25% or 36%, concentrating the compounds from trace amounts.

Key Challenges

Raw Material Price Volatility and Supply Chain Instability

Fruit extract production depends on seasonal harvests and climate conditions. Floods, droughts, and temperature swings reduce fruit yield and increase procurement cost. Price volatility affects citrus, berries, grapes, and tropical fruits the most. Transportation delays and cold-chain failures cause raw material spoilage. Manufacturers must manage storage, freezing, and inventory to prevent shortages. Many countries rely on imported raw fruits or concentrates, which increases currency and freight cost risk. These uncertainties create inconsistent supply and margin pressure for processors and end-use companies.

Strict Regulatory Standards and Quality Compliance

Fruit extracts used in food, supplements, and personal care face strict purity and labeling requirements. Governments enforce limits on pesticide residues, heavy metals, and microbial contamination. Organic and clean-label products require expensive certification and auditing. Differing regulatory frameworks across regions increase complexity for exporters. Any deviation in taste, aroma, or color also affects brand consistency. Companies must invest in testing, traceability, and food safety systems, increasing production cost. Smaller producers face difficulty meeting these standards, which limits market entry and growth.

Regional Analysis

North America

North America holds the largest share of the fruit extract market at around 32.6% in 2024. The region benefits from strong consumer demand for natural ingredients in food, beverages, and personal care products. Expanding use of botanical extracts in nutraceuticals and functional foods also fuels market growth. The U.S. leads due to established manufacturing infrastructure and regulatory support for clean-label ingredients. Canada’s rising preference for antioxidant-rich fruit extracts in cosmetics further supports regional expansion. Growing adoption across industries ensures North America maintains its leadership through ongoing innovation and product diversification.

Europe

Europe accounts for nearly 28.4% of the global fruit extract market in 2024. Increasing focus on health-conscious lifestyles and sustainable sourcing practices drives regional demand. Countries like Germany, France, and the U.K. show strong consumption of fruit-based nutraceuticals and organic food products. Regulatory emphasis on natural formulations and consumer preference for chemical-free ingredients also strengthen growth. The cosmetics and personal care industries actively integrate fruit extracts in anti-aging and skin-care products, enhancing market expansion. Rising investment in sustainable agriculture and clean-label trends reinforces Europe’s competitive position in the global market.

Asia-Pacific

Asia-Pacific captures about 25.7% share of the fruit extract market in 2024. The region’s growth is driven by expanding food processing and cosmetics industries, coupled with rising disposable incomes. China, India, and Japan lead consumption due to strong awareness of plant-based health supplements and traditional herbal formulations. Increasing penetration of natural ingredients in beverages and functional foods supports sustained market expansion. Local manufacturers invest in extraction technology to improve yield and purity, catering to export demand. Rapid urbanization and consumer preference for natural health products position Asia-Pacific as the fastest-growing region globally.

Latin America

Latin America represents nearly 7.9% share of the global fruit extract market in 2024. The region benefits from abundant raw material availability and growing interest in natural, organic products. Brazil, Mexico, and Chile dominate production due to their extensive fruit cultivation and export potential. Expanding applications in dietary supplements, skincare, and natural flavorings support market development. Government efforts to promote agro-industrial innovation and sustainability further encourage extraction industry growth. Rising export demand for tropical fruit extracts positions Latin America as a key supply hub for global manufacturers.

Middle East & Africa

The Middle East and Africa account for around 5.4% share of the global fruit extract market in 2024. Demand is rising as consumers shift toward natural wellness and plant-based nutrition products. The United Arab Emirates and South Africa lead due to strong import networks and expanding cosmetic and beverage industries. Growing awareness of herbal and fruit-based health benefits drives adoption in local markets. Efforts to develop regional extraction facilities and improve agricultural output are strengthening domestic production. Increasing participation of international companies in joint ventures supports long-term market development.

Market Segmentations:

By Fruit Type

- Citrus Fruits

- Apple

- Berries

- Mango

- Pineapple

- Grape

- Others

By Form

By Application

- Food & Beverages

- Bakery

- Dairy Products

- Ice Cream

- Beverages

- Others

- Cosmetics & Personal Care

- Pharmaceuticals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The fruit extract market features a mix of global ingredient manufacturers, regional processors, and specialized botanical extract suppliers. Leading companies focus on expanding production capacity, improving extraction purity, and developing organic and clean-label product lines. Many players invest in cold-pressed, enzymatic, and solvent-free technologies to improve nutrient retention and flavor strength. Strategic acquisitions and partnerships with fruit growers help secure raw material supply and control quality. Major brands also target high-growth segments such as functional beverages, nutraceuticals, cosmetics, and herbal pharmaceuticals. Product innovation includes microencapsulated powders for better stability in heat-processed foods and high-concentration liquids for ready-to-drink formats. Companies expand their distribution networks across Asia Pacific, North America, and Europe to serve multinational food and beverage clients. Sustainability commitments, traceability systems, and organic certifications provide competitive advantage in premium markets. As consumer preference shifts toward natural ingredients, competition intensifies in flavor enhancement, sugar reduction, and antioxidant-rich formulations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Symrise (Germany)

- Citrofrut (Mexico)

- Naturalin Bio-Resources Co. (China)

- Kerr by Ingredion (U.S.)

- Döhler GmbH (Germany)

- AGRANA Beteiligungs-AG (Austria)

- International Flavors & Fragrances Inc. (U.S.)

- ABC Fruits (India)

- TBF Group (Ukraine)

- Sensient Technologies Corporation (U.S.)

Recent Developments

- In February 2023, AUSTRIA JUICE GmbH, one of the key fruit extract and flavors manufacturing companies, launched its latest organic juice concentrate, including a new pomegranate berry mix and lime guava drink at BioFach 2023.

- In May 2022, Agrana AG, a global food and beverage ingredients company, collaborated with wholesale company RWA Raiffeisen Ware Austria AG to install a 556-kWp solar array on a fruit concentrate plant in Lower Austria.

Report Coverage

The research report offers an in-depth analysis based on Fruit type, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will increase investment in advanced extraction technologies to improve yield and purity.

- Demand for natural‑label and clean‑label products will drive greater adoption of fruit extracts.

- Functional beverages and snacks will incorporate fruit extracts to meet health‑conscious consumer needs.

- Regions in Asia‑Pacific and Latin America will record faster growth due to rising disposable incomes and changing diets.

- Cosmetic and personal‑care brands will expand use of fruit extracts for antioxidant and skin‑benefit claims.

- Supply‑chain sustainability will become a key competitive differentiator in the fruit extract sector.

- Organic and exotic fruit‑extract variants will gain premium positioning in high‑end food and beverage segments.

- Producers will diversify into novel fruits and under‑utilised parts (such as peel or seeds) to reduce waste and cost.

- Partnerships between growers, extractors, and formulators will increase to secure raw‑material quality and consistency.

- Regulatory emphasis on ingredient transparency and safety will push extract suppliers to adopt stricter standards and certifications.