Market Overview:

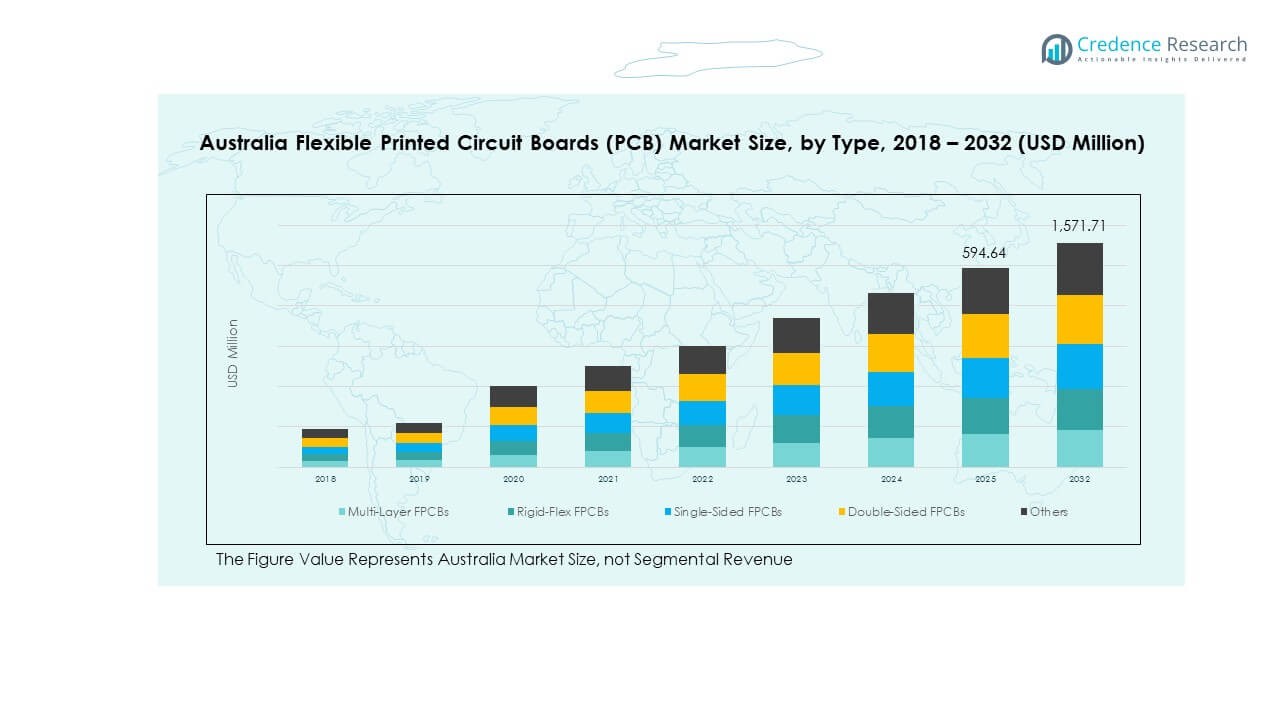

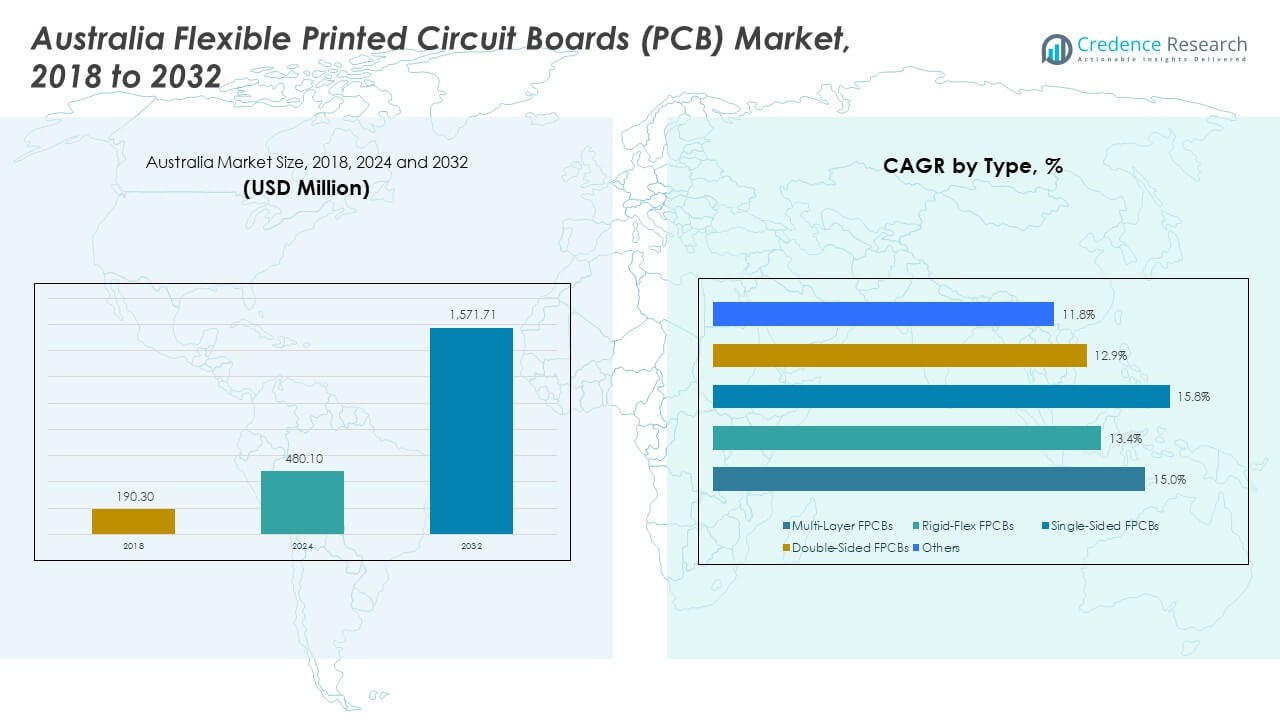

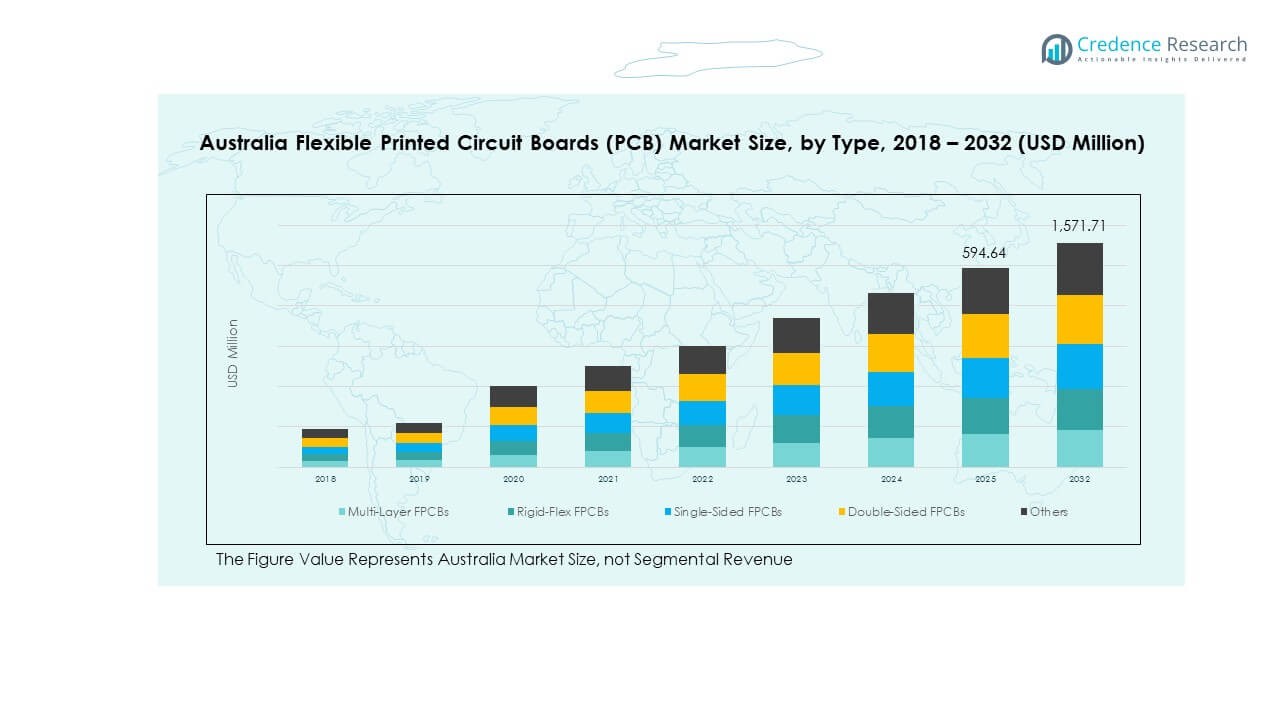

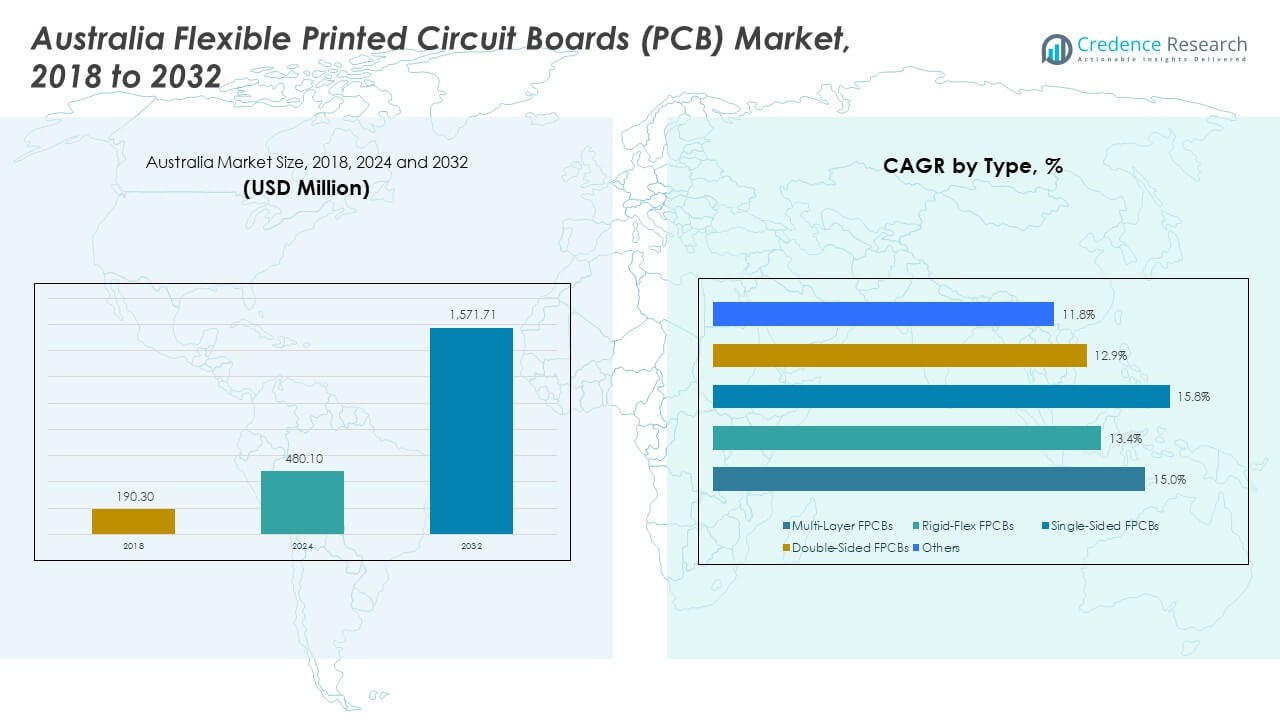

The Australia Flexible Printed Circuit Boards (PCB) Market size was valued at USD 190.30 million in 2018, increased to USD 480.10 million in 2024, and is anticipated to reach USD 1,571.71 million by 2032, growing at a CAGR of 14.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Flexible Printed Circuit Boards (PCB) Market Size 2024 |

USD 480.10 Million |

| Australia Flexible Printed Circuit Boards (PCB) Market, CAGR |

14.90% |

| Australia Flexible Printed Circuit Boards (PCB) Market Size 2032 |

USD 1,571.71 Million |

The market growth is driven by expanding applications in compact consumer electronics, automotive systems, and industrial automation. Rising demand for lightweight, high-performance circuit solutions supports the shift toward flexible PCBs over rigid alternatives. Manufacturers are investing in multilayer and high-density interconnect (HDI) technologies to meet miniaturization needs. The adoption of flexible circuits in wearables, smartphones, and EV power modules enhances electrical performance, reduces assembly costs, and supports thermal management efficiency.

Regionally, Australia benefits from robust electronics manufacturing and strong imports of advanced semiconductor components from Japan, South Korea, and China. New South Wales and Victoria lead due to concentrated R&D centers and growing demand from automotive and healthcare sectors. Emerging areas in Queensland and Western Australia are witnessing increased adoption driven by renewable energy and smart infrastructure projects, making these regions key to future market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Australia Flexible Printed Circuit Boards (PCB) Market was valued at USD 190.30 million in 2018, reached USD 480.10 million in 2024, and is projected to attain USD 1,571.71 million by 2032, growing at a CAGR of 14.90% during the forecast period.

- Eastern Australia leads with 52% share, supported by advanced manufacturing, R&D infrastructure, and the presence of global electronics producers in New South Wales and Victoria.

- Western and Southern Australia hold 31% share, driven by strong industrial automation, renewable energy expansion, and adoption of flexible PCBs in mining control systems and power electronics.

- Northern Australia, accounting for 17% share, is the fastest-growing region, led by defense modernization programs, aerospace innovation, and rising electronics assembly capacity in Darwin.

- By type, Multi-Layer FPCBs represent around 38% share, dominating complex industrial and telecom applications, while Rigid-Flex FPCBs hold nearly 24%, expanding rapidly across automotive and aerospace systems.

Market Drivers:

Market Drivers:

Rising Demand for Compact and Lightweight Electronic Devices

The Australia Flexible Printed Circuit Boards (PCB) Market benefits from increasing demand for compact and high-efficiency consumer electronics. Smartphones, wearables, and medical monitoring devices increasingly rely on flexible circuits for space optimization and improved reliability. It supports miniaturization while maintaining signal integrity across multiple layers. Flexible PCBs enable reduced interconnections, lowering assembly time and enhancing durability. This compatibility with curved and foldable designs strengthens their adoption in next-generation devices. The ongoing shift toward smaller and more functional electronics drives consistent volume growth. Manufacturers also explore advanced substrates to improve thermal management. The industry’s focus on portable innovation accelerates its penetration into emerging electronics segments.

- For instance, TTM Technologies’ flex/rigid-flex modules achieved up to 10 conductive layers with laser-drilled microvias, enabling space savings in design. It supports miniaturization while maintaining signal integrity across multiple layers. Flexible PCBs enable reduced interconnections, lowering assembly time and enhancing durability.

Growing Integration of Electronics in Automotive and Industrial Systems

Expanding automotive electronics and industrial automation systems create strong momentum for flexible PCB applications. It supports advanced driver-assistance systems, infotainment units, and battery management systems requiring compact, vibration-resistant circuit structures. Flexible PCBs withstand harsh environments, ensuring reliability in high-temperature and dynamic conditions. The demand for electric vehicles strengthens market relevance through lightweight circuit integration. Industrial robotics and process automation also rely on flexible PCBs for seamless signal transmission. This technological alignment increases operational efficiency and design flexibility in complex assemblies. Continuous R&D in automotive-grade materials improves long-term stability and heat tolerance. The sector benefits from alignment with electrification and connected-vehicle trends.

- For instance, rigid-flex systems offered by TTM integrate rigid sections with flex areas in one board, resulting in 20 % fewer solder joints in automotive control modules. It supports advanced driver-assistance systems, infotainment units, and battery management systems requiring compact, vibration-resistant circuit structures. Flexible PCBs withstand harsh environments, ensuring reliability in high-temperature and dynamic conditions.

Technological Advancements in Fabrication and Material Innovation

Rapid developments in polymer substrates and circuit etching techniques propel the adoption of flexible PCBs across industries. The shift toward polyimide and liquid crystal polymer materials enhances temperature resistance and mechanical flexibility. It encourages production of multi-layered boards suited for high-frequency communication systems. Laser direct imaging and roll-to-roll manufacturing methods improve precision and reduce production costs. Advanced additive processes enable thinner layers with greater conductivity. Manufacturers invest in eco-friendly production and low-halogen materials to align with sustainability standards. Continuous innovation in lamination and microvia drilling boosts design freedom and circuit density. The combination of improved materials and process automation enhances long-term reliability in demanding electronic environments.

Rising Adoption of Flexible PCBs in Healthcare and Aerospace Applications

Healthcare and aerospace sectors increasingly integrate flexible PCBs for precision-driven operations. It allows lightweight medical sensors, diagnostic wearables, and implantable devices to function with higher accuracy. Aerospace systems use flexible PCBs for signal routing under extreme mechanical stress. These boards reduce wiring complexity and improve performance reliability in compact control modules. Advanced sensor integration within medical devices enhances data transmission and patient monitoring efficiency. High endurance against thermal and mechanical fatigue ensures consistent operation in mission-critical equipment. Continuous innovation in sterilization-compatible materials expands their use in medical instruments. Growing government focus on medical electronics manufacturing supports domestic development and supply chain resilience.

Market Trends:

Shift Toward High-Density Interconnect (HDI) and Multi-Layer Design Adoption

The Australia Flexible Printed Circuit Boards (PCB) Market is witnessing strong movement toward high-density interconnect and multi-layered architectures. The trend supports higher data transfer speeds and compact integration in IoT and 5G devices. It drives innovation in fine-pitch patterning and microvia structures that enhance circuit performance. Manufacturers deploy advanced imaging and laser drilling systems to enable ultra-thin layers. The use of multi-layer flexible PCBs enables integration of complex power and signal circuits. This architecture suits miniaturized communication and automotive systems demanding space efficiency. Growing production of smart devices amplifies demand for denser and faster circuit layouts. The focus on higher connectivity and reliability makes HDI adoption a defining market trend.

- For instance, TTM’s HDI flex offerings feature stacked microvias and fine line widths as low as 50 µm, enabling signal paths in ultra-thin layers. It drives innovation in fine-pitch patterning and microvia structures that enhance circuit performance. Manufacturers deploy advanced imaging and laser drilling systems to enable ultra-thin layers

Sustainability and Environmentally Responsible Manufacturing Practices

Sustainability influences manufacturing trends through adoption of recyclable substrates and green production processes. It encourages use of halogen-free laminates and water-based etchants to reduce waste output. Manufacturers increasingly employ closed-loop systems to manage chemical use in etching and plating. The focus on low-carbon manufacturing aligns with Australia’s environmental goals. Use of bio-based films and lead-free soldering compounds strengthens compliance with global standards. This transition not only supports eco-conscious branding but also enhances long-term cost efficiency. Energy-efficient production methods and waste recovery mechanisms redefine value chain competitiveness. Industry collaborations focus on lifecycle management and end-of-life PCB recycling.

- For instance, manufacturers use halogen-free polyimide laminates that emit fewer fumes during production and meet RoHS and REACH compliance. It encourages use of halogen-free laminates and water-based etchants to reduce waste output. Manufacturers increasingly employ closed-loop systems to manage chemical use in etching and plating; for instance, certain fabs reuse >70 % of plating bath water.

Integration of Flexible PCBs in Smart Infrastructure and Renewable Energy Projects

Smart infrastructure development and renewable energy projects drive new use cases for flexible PCBs in control and monitoring systems. The Australia Flexible Printed Circuit Boards (PCB) Market benefits from smart grid deployment, solar monitoring devices, and EV charging systems. It enables compact circuit placement in constrained installations and supports IoT-driven energy management. Lightweight flexible circuits optimize sensor networks across distributed infrastructure. Manufacturers target high thermal stability products to withstand outdoor and variable conditions. The adoption of flexible PCBs in power converters and inverters enhances reliability and efficiency. Smart city projects encourage partnerships among electronics manufacturers and renewable solution providers. Growing investment in sustainable technology enhances long-term industry prospects.

Rising Focus on Domestic Electronics Manufacturing and Supply Chain Localization

Government initiatives and private investments are reshaping the local electronics production landscape. It strengthens supply chain self-reliance and encourages PCB manufacturing within Australia. Tax incentives and R&D programs support collaboration between research institutions and industry leaders. The shift reduces dependency on overseas suppliers, ensuring stable component availability. Companies invest in regional production facilities to serve telecom, defense, and healthcare markets. Enhanced local capabilities improve turnaround times and customization options. Adoption of advanced automation and digital inspection tools boosts manufacturing efficiency. Increasing domestic PCB output aligns with Australia’s industrial modernization and national resilience strategy.

Market Challenges Analysis:

High Production Costs and Material Dependency on Imports

The Australia Flexible Printed Circuit Boards (PCB) Market faces challenges due to high production expenses and dependency on imported materials. Polyimide films, copper foils, and specialty resins used in fabrication often come from foreign suppliers. It exposes local manufacturers to currency fluctuations and supply chain delays. Limited domestic production capacity increases procurement costs and extends lead times. High setup costs for advanced laser drilling and imaging equipment restrict new entrants. Small-scale producers struggle to achieve economies of scale compared with Asian competitors. Regulatory compliance with safety and environmental standards further increases operational overhead. Sustaining profitability amid volatile material prices remains a persistent challenge for manufacturers.

Complex Manufacturing Processes and Limited Skilled Workforce Availability

Fabrication of flexible PCBs requires precise control of etching, lamination, and circuit alignment. It demands skilled technicians and engineers experienced in micro-patterning technologies. Australia’s limited technical workforce slows process adoption and productivity scaling. The lack of domestic training infrastructure creates reliance on foreign expertise for advanced process setup. Complex multi-layer designs often lead to yield losses and rework issues. High defect rates in bending and thermal cycling reduce production efficiency. Limited industry-academia collaboration delays innovation in local manufacturing processes. The combination of workforce shortage and technological barriers constrains industry competitiveness against established Asian producers.

Market Opportunities:

Expanding Application Scope in Electric Mobility and Smart Devices

The Australia Flexible Printed Circuit Boards (PCB) Market offers strong opportunities in electric mobility and connected technologies. It supports design of compact EV control systems, battery management modules, and autonomous driving sensors. Growing investment in charging infrastructure fuels long-term product demand. Flexible PCBs also enable integration in foldable smartphones, smartwatches, and AR glasses. Rising local manufacturing of wearable electronics encourages R&D collaborations. It enhances domestic innovation capacity and reduces dependence on imports. Advancements in material flexibility and thermal endurance strengthen prospects across diverse sectors.

Emerging Collaborations and Technological Upgrades in Advanced PCB Fabrication

Collaboration between technology providers and local manufacturers fosters knowledge exchange and capability expansion. It encourages adoption of AI-driven inspection and roll-to-roll printing systems. Government-backed innovation hubs support start-ups entering the PCB design ecosystem. Automation in photolithography and quality control enhances precision and reduces waste. Increasing investment in research centers drives breakthroughs in conductive inks and bio-compatible materials. Localized innovation strengthens the country’s competitive stance in high-tech manufacturing. Integration of new process technologies positions Australia as a regional hub for next-generation PCB development.

Market Segmentation Analysis:

By Type

The Australia Flexible Printed Circuit Boards (PCB) Market is segmented into Multi-Layer FPCBs, Rigid-Flex FPCBs, Single-Sided FPCBs, Double-Sided FPCBs, and Others. Multi-Layer FPCBs hold a dominant position due to their high circuit density and suitability for complex electronic assemblies. It supports advanced applications in communication modules, industrial control units, and medical devices. Rigid-Flex FPCBs gain traction across aerospace and defense sectors for their durability and resistance to vibration. Single-sided and double-sided variants cater to cost-sensitive consumer electronics and automotive uses requiring simpler connections. The “Others” category includes emerging hybrid designs that integrate flexible and stretchable substrates for next-generation devices. Continuous material improvement and laser processing technology enhance product reliability and adoption across all segments.

- For instance, Unimicron Technology Corporation developed its “PCBeam™” ultra-thin multilayer substrate capable of supporting data rates above 40 Gbps and enabled board thicknesses under 0.3 mm. It supports advanced applications in communication modules, industrial control units, and medical devices. Rigid-Flex FPCBs gain traction across aerospace and defense sectors for their durability and resistance to vibration.

By End Use

By end use, the market includes Industrial Electronics, Aerospace & Defense, IT & Telecom, Automotive, Consumer Electronics, and Others. Industrial electronics account for significant demand due to automation and sensor integration across production systems. Aerospace & defense rely on flexible PCBs for weight reduction and high-performance communication systems. IT & Telecom benefit from the miniaturization trend in data transmission equipment and 5G infrastructure. Automotive applications expand rapidly with electric vehicles, ADAS, and infotainment platforms requiring compact and heat-resistant circuitry. Consumer electronics remain a vital contributor supported by wearables, smartphones, and display modules. It continues evolving with growth in healthcare instrumentation and renewable energy equipment, marking broad adoption across diverse end-use verticals.

- For instance, flex boards by Unimicron support board-to-board connectivity in industrial controllers with build-ups optimizing thermal dissipation and space. Aerospace & defense rely on flexible PCBs for weight reduction and high-performance communication systems; for example, rigid-flex modules certified for aerospace vibration and shock environments underpin avionics assemblies.

Segmentation:

By Type:

- Multi-Layer FPCBs

- Rigid-Flex FPCBs

- Single-Sided FPCBs

- Double-Sided FPCBs

By End Use:

- Industrial Electronics

- Aerospace & Defense

- IT & Telecom

- Automotive

- Consumer Electronics

By Country:

Australia (analyzed by type and end-use revenue distribution)

Regional Analysis:

Eastern Australia – Dominant Electronics Manufacturing Hub (52% Market Share)

Eastern Australia leads the Australia Flexible Printed Circuit Boards (PCB) Market with 52% share, driven by strong industrial and commercial activity in New South Wales and Victoria. These states host major electronics manufacturing, R&D centers, and technology startups supporting PCB innovation. It benefits from established infrastructure, advanced design capabilities, and skilled engineering talent. The presence of global OEMs and strong logistics connectivity enhances component import and distribution efficiency. Investments in medical electronics, defense systems, and 5G communication networks continue strengthening demand. Local manufacturers focus on developing multi-layer and rigid-flex PCBs to serve high-value sectors. The regional dominance reflects its ability to align manufacturing with evolving digital and automation trends.

Western and Southern Australia – Expanding Industrial and Mining Automation Base (31% Market Share)

Western and Southern Australia collectively hold 31% share, supported by growing applications of flexible PCBs in mining automation, renewable energy systems, and industrial control devices. The regions witness increased deployment of electronic monitoring and safety systems requiring flexible interconnects. It benefits from government-backed industrial diversification programs and renewable energy initiatives. Local companies focus on improving PCB durability to withstand harsh environments and temperature variations. Investments in power electronics and IoT-based mining solutions accelerate regional market growth. Adelaide’s electronics manufacturing corridor and Perth’s energy projects contribute to increasing product utilization. The trend toward automation and smart grid systems continues to expand PCB integration across heavy industries.

Northern Australia – Emerging Growth Territory for Defense and Aerospace Electronics (17% Market Share)

Northern Australia accounts for 17% market share and demonstrates rapid growth driven by defense modernization and aerospace expansion programs. The region’s proximity to Asia-Pacific trade routes strengthens its strategic importance in electronics supply and maintenance operations. It supports flexible PCB applications in radar, avionics, and communication modules for defense contractors. Ongoing defense projects and joint manufacturing collaborations attract foreign technology partnerships. Local assembly units in Darwin and neighboring zones are upgrading fabrication capabilities to meet export standards. The region’s emerging industrial parks provide infrastructure for small and mid-sized PCB manufacturers. It continues evolving as a strategic node supporting Australia’s defense, aerospace, and advanced manufacturing value chain.

Key Player Analysis:

Competitive Analysis:

The Australia Flexible Printed Circuit Boards (PCB) Market is moderately consolidated, with key players focusing on technological innovation and domestic capability expansion. It features a competitive landscape shaped by companies such as TTM Technologies Australia, NCAB Group, Eltek Ltd., and Kyocera Australia. These firms emphasize high-density interconnect development, precision manufacturing, and eco-friendly production to strengthen their market presence. Strategic collaborations and local R&D investments enhance customization and delivery efficiency. Smaller firms like Cirtex Pty Ltd. and All Flex Print Pty Ltd. target niche sectors such as aerospace and industrial electronics. Intense competition encourages consistent upgrades in design flexibility, material quality, and sustainability performance.

Recent Developments:

- In September 2025, TTM Technologies expanded its ultra-small RF component offerings with new ultra-small RF crossover and splitter components designed for applications in telecom, test and measurement, and commercial off-the-shelf mil-aero sectors. These products feature high-frequency performance in compact, surface-mount formats, demonstrating TTM’s commitment to advancing mmWave and broadband analog/digital solutions for evolving industry needs.

- In August 2025, Eltek Ltd. reported strong second-quarter results with 20 percent quarter-over-quarter revenue growth and margin expansion to 24 percent. The company remains committed to expanding its production capacity, with all equipment delivered to date successfully installed and performing to specifications. Construction for the core investment plan—new 60-meter coating lines—is progressing smoothly on schedule. However, the company announced a delay in the delivery of the first coating line, now expected to arrive at the facility toward the end of 2025.

- In July 2025, TTM Technologies introduced the MSK5065RH, a compact, radiation-hardened switching regulator optimized for demanding space and defense environments. This module represents part of TTM’s expanding space-grade microelectronics portfolio, delivering robust performance and exceptional radiation tolerance in a compact footprint ideal for next-generation satellite and spacecraft systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on type, end use, and country. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for lightweight and high-flexibility PCBs will rise across advanced automotive systems.

- Healthcare electronics adoption will accelerate with miniaturized diagnostic and wearable devices.

- Smart infrastructure and renewable energy projects will boost domestic PCB integration.

- Advancements in high-density interconnect technology will improve product performance and design efficiency.

- Localized production and government incentives will strengthen supply chain resilience.

- Collaboration between manufacturers and universities will drive next-generation circuit design research.

- Increased investment in AI-driven inspection tools will enhance quality control in fabrication.

- Sustainable manufacturing practices will gain traction through eco-friendly materials and recycling initiatives.

- Growth in electric mobility will create strong demand for thermally stable flexible PCBs.

- Continuous innovation in hybrid and stretchable circuits will unlock new commercial and industrial applications.

Market Drivers:

Market Drivers: