Market Overview

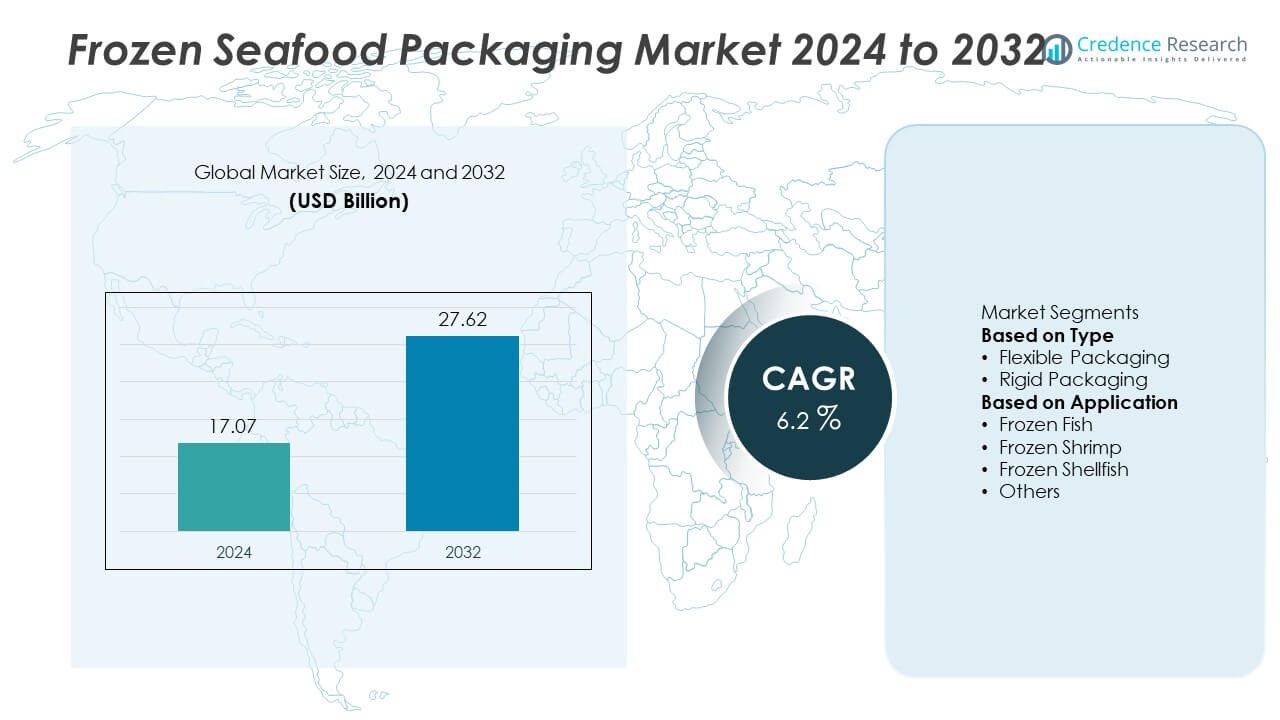

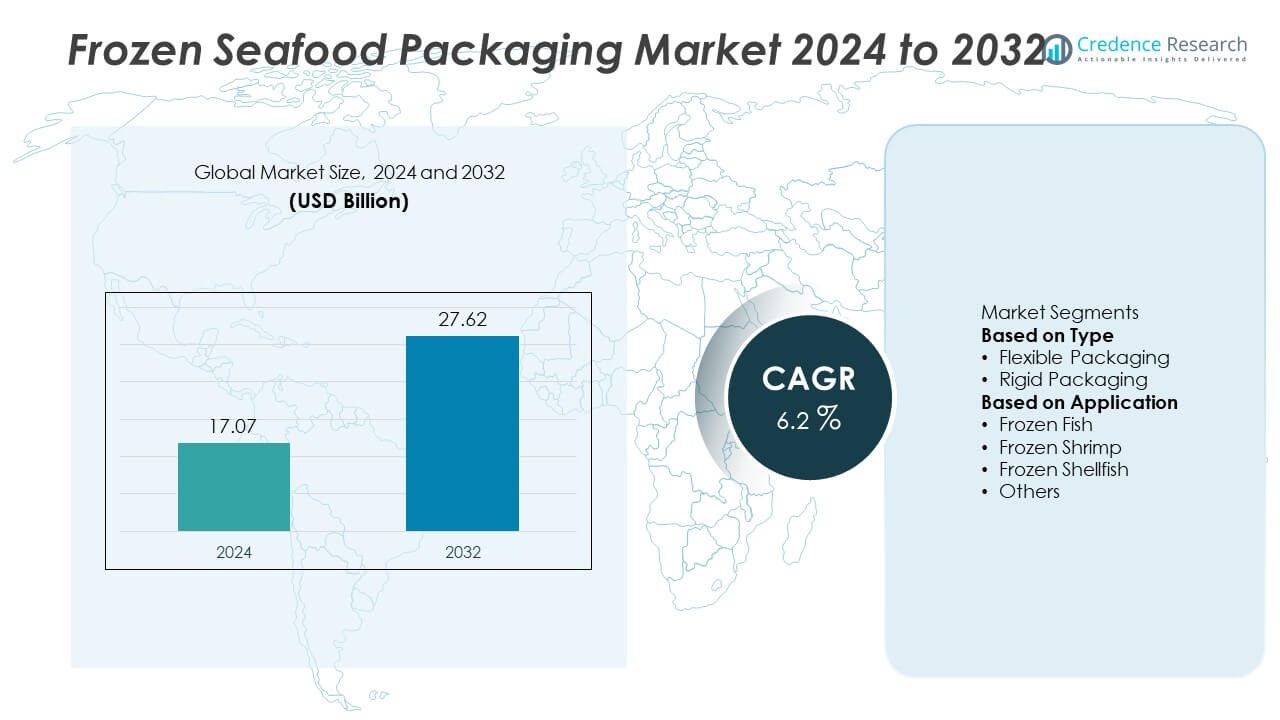

The Frozen Seafood Packaging market was valued at USD 17.07 billion in 2024 and is projected to reach USD 27.62 billion by 2032, growing at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Frozen Seafood Packaging Market Size 2024 |

USD 17.07 Billion |

| Frozen Seafood Packaging Market, CAGR |

6.2% |

| Frozen Seafood Packaging Market Size 2032 |

USD 27.62 Billion |

The Frozen Seafood Packaging market is led by key players such as Amcor plc, Sealed Air Corporation, Mondi Group, Berry Global Inc., Sonoco Products Company, Huhtamaki Oyj, Coveris Holdings S.A., WestRock Company, Smurfit Kappa Group, and DS Smith Plc. These companies dominate through advanced packaging technologies, sustainable materials, and strong global distribution networks. They focus on innovations such as recyclable films, vacuum sealing, and modified atmosphere packaging to preserve seafood quality. North America leads the global market with a 38.5% share, supported by advanced cold chain logistics and high frozen seafood consumption, followed by Europe with a 29.4% share, driven by stringent sustainability regulations and expanding seafood trade networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Frozen Seafood Packaging market was valued at USD 17.07 billion in 2024 and is expected to reach USD 27.62 billion by 2032, growing at a CAGR of 6.2% during the forecast period.

- Rising global demand for frozen seafood, coupled with advancements in cold chain logistics and packaging innovation, is driving strong market growth.

- Sustainable and recyclable packaging materials, along with smart technologies like vacuum sealing and modified atmosphere packaging, are key emerging trends.

- The market is moderately consolidated, with major players such as Amcor, Sealed Air, Mondi Group, and Berry Global focusing on R&D, sustainability, and material efficiency.

- North America leads the market with a 38.5% share, followed by Europe at 29.4% and Asia-Pacific at 24.2%, while the flexible packaging segment dominates with a 63.4% share due to its cost-effectiveness, lightweight design, and superior product protection.

Market Segmentation Analysis:

By Type

The flexible packaging segment dominated the Frozen Seafood Packaging market in 2024, accounting for a 63.4% share. Its dominance is driven by cost efficiency, lightweight structure, and superior sealing properties that enhance product freshness. Flexible materials such as polyethylene, polypropylene, and multilayer films provide excellent moisture and oxygen barriers, making them ideal for frozen seafood preservation. The segment’s popularity is further supported by sustainability trends, as manufacturers shift toward recyclable and bio-based films. Growing e-commerce seafood sales and global distribution networks continue to strengthen demand for durable, flexible packaging solutions.

- For instance, Amcor plc developed its AmPrima™ PE Plus film, achieving an oxygen transmission rate of less than 0.1 cm³/m²/day and a sealing temperature threshold of 105 °C, enabling full recyclability while maintaining barrier integrity for frozen seafood packaging.

By Application

The frozen fish segment held the largest 48.7% share of the Frozen Seafood Packaging market in 2024. This dominance is attributed to the high global consumption of frozen fish products due to their extended shelf life and convenience. Packaging innovations, such as vacuum sealing and modified atmosphere packaging (MAP), help maintain product quality and prevent freezer burn. Expanding retail presence and growing preference for protein-rich diets are fueling demand. Additionally, advancements in cold chain logistics and export-oriented seafood processing are further supporting market growth for frozen fish packaging.

- For instance, Sealed Air Corporation’s CRYOVAC® vacuum packaging can significantly extend the shelf life of frozen fish, often from several months to a year or more, when stored at temperatures around or below –18 °C (0 °F).

Key Growth Drivers

Rising Global Demand for Frozen Seafood Products

Growing consumer preference for ready-to-cook and long-shelf-life seafood products is driving the market. Changing dietary habits, urbanization, and increased disposable incomes are fueling frozen seafood consumption. Retailers and online platforms are expanding frozen seafood availability across developed and emerging regions. Improved preservation technologies and efficient cold chain logistics are ensuring consistent product quality. This rising global appetite for frozen seafood directly boosts demand for reliable and efficient packaging solutions that maintain freshness and prevent contamination.

- For instance, Huhtamaki Oyj has introduced high-barrier packaging solutions, such as its blueloop™ range, which are designed to be used in demanding applications, including for frozen food, to preserve quality and extend shelf life. The company’s products ensure that foods retain their flavor and texture.

Advancements in Packaging Technologies

Technological innovation is reshaping frozen seafood packaging by improving durability, safety, and sustainability. Developments in barrier films, vacuum sealing, and modified atmosphere packaging (MAP) enhance freshness and extend shelf life. Smart packaging with temperature indicators ensures product integrity throughout the supply chain. Manufacturers are increasingly adopting lightweight, recyclable materials to reduce waste and comply with environmental regulations. These technological upgrades are strengthening supply reliability while addressing both safety and sustainability challenges in the frozen seafood sector.

- For instance, Mondi Group developed its recyclable mono-material polyethylene or polypropylene films, some of which feature high oxygen and moisture barriers to improve preservation and quality control for various food products including seafood

Expansion of Cold Chain and Distribution Networks

The rapid expansion of cold chain infrastructure is a major driver for the frozen seafood packaging market. Enhanced refrigeration facilities, temperature-controlled logistics, and efficient storage systems enable seafood producers to reach distant markets without quality degradation. Emerging economies are investing heavily in cold chain modernization to reduce post-harvest losses. The integration of IoT-based monitoring systems further improves supply efficiency and safety assurance. This expansion supports a wider distribution network, boosting demand for advanced packaging designed to withstand cold and moisture conditions.

Key Trends & Opportunities

Shift Toward Sustainable and Recyclable Packaging

Sustainability is a growing trend shaping the frozen seafood packaging industry. Manufacturers are transitioning to recyclable plastics, biodegradable films, and paper-based packaging to reduce environmental impact. Governments and retailers are implementing eco-labeling and waste reduction mandates, encouraging broader adoption. Consumer preference for eco-friendly packaging is prompting innovation in bio-based polymers and compostable solutions. This shift presents strong opportunities for packaging manufacturers to differentiate through sustainable product lines while supporting global circular economy goals.

- For instance, Coveris Holdings S.A. developed its MonoFlex Thermoform film for meat, fish and poultry applications, engineered as a mono-polyolefin substrate with EVOH barrier layer and nylon-free construction, enabling full recyclability in existing PE or PP streams and replacing multi-material laminates.

Growing Penetration of E-commerce in Seafood Distribution

The rise of online grocery platforms is expanding the reach of frozen seafood globally. E-commerce requires durable, insulated, and leak-proof packaging that preserves temperature stability during transit. This demand is encouraging the use of high-performance materials and smart packaging designs. Direct-to-consumer seafood brands are increasing investment in visually appealing, branded packaging for digital retail. As online seafood sales grow, packaging suppliers are leveraging innovation to meet the dual need for protection and customer convenience.

- For instance, Berry Global Inc. introduced HDPE trays engineered for frozen seafood that can withstand a temperature range from –50 °C to +121 °C, are offered in over 250 tray sizes (including a 326.5 × 267 mm ½-Gastro format), and incorporate up to 30 % recycled content in the material.

Key Challenges

High Packaging and Transportation Costs

Maintaining product integrity in frozen seafood packaging requires specialized materials, temperature control, and advanced logistics, increasing overall costs. The need for multi-layer films, insulated containers, and energy-intensive cold storage adds to expenses. Fluctuations in raw material prices and transportation costs further strain profit margins. Small and medium producers often face financial limitations in adopting advanced packaging systems. Balancing cost-efficiency with performance and sustainability remains a significant challenge for market participants.

Environmental Impact of Plastic Waste

Plastic remains the most commonly used material for frozen seafood packaging due to its durability and moisture resistance. However, its environmental footprint poses a major concern. Improper disposal and recycling limitations contribute to pollution and regulatory scrutiny. Governments are imposing stricter policies on single-use plastics, pressuring manufacturers to innovate sustainable alternatives. Transitioning to eco-friendly materials without compromising food safety or barrier performance is a key challenge, requiring continuous R&D and investment in greener technologies.

Regional Analysis

North America

North America dominated the Frozen Seafood Packaging market in 2024 with a 38.5% share. The region’s strong position is supported by a high demand for frozen seafood, advanced cold chain logistics, and strict food safety standards. The United States leads with significant investments in sustainable and recyclable packaging materials. Technological adoption, including vacuum sealing and modified atmosphere packaging, enhances shelf life and quality. Growing consumer preference for convenient, ready-to-cook seafood options and rising e-commerce food delivery services further contribute to regional growth and innovation in packaging solutions.

Europe

Europe accounted for a 29.4% share of the Frozen Seafood Packaging market in 2024, driven by a well-established seafood processing industry and strict environmental regulations. Countries such as Norway, Spain, and the United Kingdom are leading exporters of frozen seafood, supporting strong packaging demand. The region’s focus on reducing plastic waste has accelerated the shift toward biodegradable and recyclable packaging solutions. Technological innovations in moisture-resistant films and sustainable materials further strengthen the market. Increasing consumption of frozen seafood due to convenience and nutrition awareness fuels continuous market expansion across Europe.

Asia-Pacific

Asia-Pacific held a 24.2% share of the Frozen Seafood Packaging market in 2024, driven by rising seafood consumption and expanding export activities. Major producers like China, India, Thailand, and Vietnam dominate global seafood supply chains. Growing urbanization and income levels are boosting demand for packaged frozen foods. Investments in cold storage infrastructure and modern packaging facilities are enhancing efficiency and shelf-life management. The region’s growing adoption of flexible and cost-effective packaging solutions supports its rapid market expansion, positioning Asia-Pacific as a key growth hub for seafood packaging innovation.

Middle East & Africa

The Middle East and Africa region accounted for a 4.5% share of the Frozen Seafood Packaging market in 2024. Market growth is supported by rising seafood imports, expanding retail networks, and increasing consumer preference for convenient frozen products. Gulf nations such as Saudi Arabia and the UAE are investing in advanced cold chain logistics and sustainable packaging solutions. In Africa, growing seafood consumption and urbanization are gradually improving packaging standards. However, limited infrastructure and high logistics costs remain key challenges, though ongoing government initiatives aim to enhance cold storage capacity and food safety compliance.

Latin America

Latin America captured a 3.4% share of the Frozen Seafood Packaging market in 2024. Growth is driven by strong seafood exports from Chile, Argentina, and Ecuador, particularly shrimp and fish varieties. The region’s packaging industry is expanding with greater adoption of flexible packaging and vacuum-sealed formats to ensure freshness during transport. Rising consumer demand for frozen seafood in urban markets supports packaging innovation. Government efforts to strengthen food quality regulations and sustainability initiatives are expected to drive future development. Despite some logistical challenges, Latin America continues to evolve as a growing market for frozen seafood packaging.

Market Segmentations:

By Type

- Flexible Packaging

- Rigid Packaging

By Application

- Frozen Fish

- Frozen Shrimp

- Frozen Shellfish

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Frozen Seafood Packaging market features leading players such as Amcor plc, Sealed Air Corporation, Mondi Group, Berry Global Inc., Sonoco Products Company, Huhtamaki Oyj, Coveris Holdings S.A., WestRock Company, Smurfit Kappa Group, and DS Smith Plc. These companies compete through product innovation, material advancements, and sustainability-driven packaging solutions. Strategic mergers, acquisitions, and partnerships help them expand global presence and diversify product portfolios. Key players focus on developing high-barrier, recyclable, and eco-friendly packaging materials to meet evolving environmental regulations. Technological innovations in vacuum sealing, moisture control, and modified atmosphere packaging enhance seafood preservation and shelf life. Additionally, investments in lightweight and flexible packaging formats are improving efficiency across cold chain logistics. The market remains moderately consolidated, with global leaders emphasizing R&D, automation, and circular economy initiatives to maintain a competitive edge in frozen seafood packaging solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amcor plc

- Sealed Air Corporation

- Mondi Group

- Berry Global Inc.

- Sonoco Products Company

- Huhtamaki Oyj

- Coveris Holdings S.A.

- WestRock Company

- Smurfit Kappa Group

- DS Smith Plc

Recent Developments

- In 2025, Berry Global Inc. unveiled a comprehensive seafood packaging solutions display at the Foodex exhibition, featuring recyclable HDPE trays with up to 30 % recycled content and enhanced sealing films designed for seafood protection in frozen applications.

- In April 2024, Sealed Air Corporation introduced its CRYOVAC® vacuum-skin packaging technology for seafood that extended shelf life by 30 % compared to prior packaging systems.

- In 2024, Coveris Holdings S.A. launched next-generation multilayer films tailored for frozen seafood packaging that delivered 40 % improved barrier properties and enhanced puncture resistance compared to their prior generation films.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sustainable and recyclable packaging materials will continue to shape market growth.

- Technological advancements in barrier films and sealing methods will enhance product shelf life.

- Expansion of cold chain logistics will improve seafood quality and distribution efficiency.

- Increasing e-commerce sales of frozen seafood will boost demand for durable and insulated packaging.

- Adoption of smart and temperature-indicating packaging will ensure better product safety.

- Manufacturers will focus on lightweight and flexible packaging solutions to reduce costs.

- Government regulations promoting eco-friendly materials will drive innovation in green packaging.

- Strategic collaborations between seafood producers and packaging firms will strengthen supply networks.

- Growth in seafood exports from Asia-Pacific will increase demand for high-performance packaging.

- North America, Europe, and Asia-Pacific will remain key regions driving innovation and consumption in the market.