Market Overview:

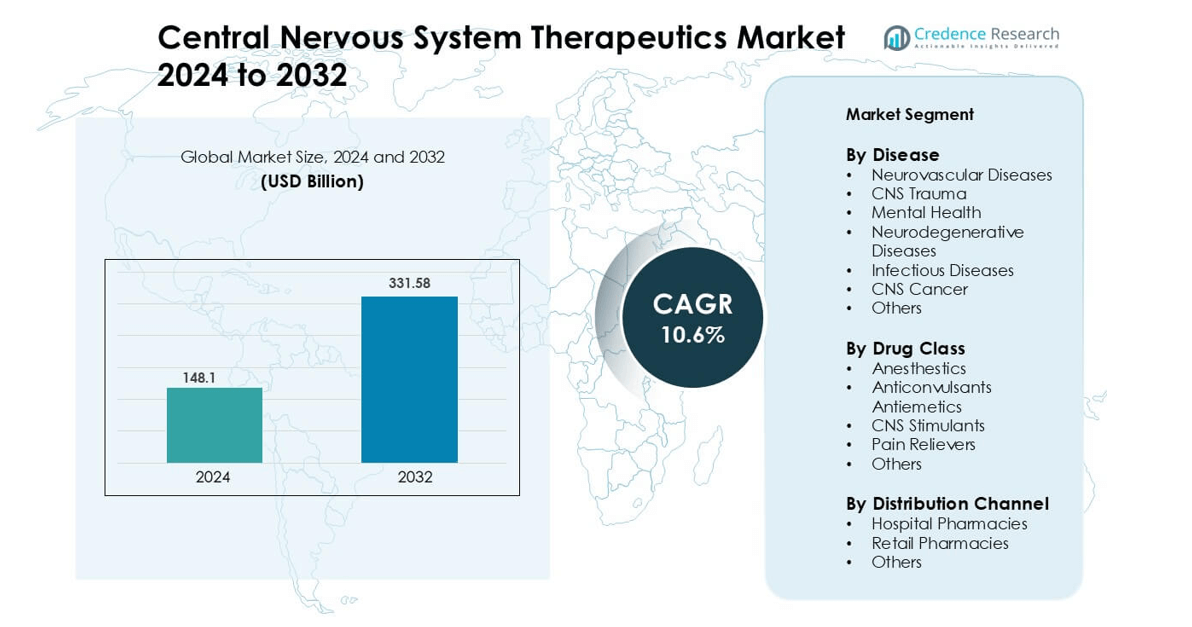

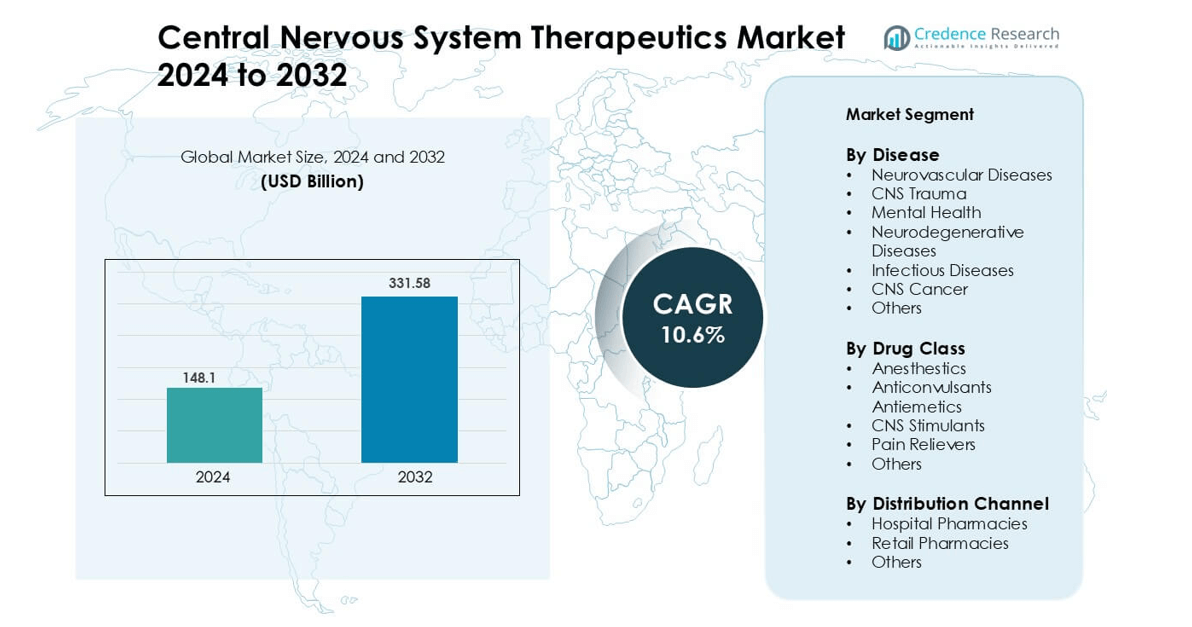

Central Nervous System Therapeutics Market was valued at USD 148.1 billion in 2024 and is anticipated to reach USD 331.58 billion by 2032, growing at a CAGR of 10.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Central Nervous System Therapeutics Market Size 2024 |

USD 148.1 billion |

| Central Nervous System Therapeutics Market, CAGR |

10.6% |

| Central Nervous System Therapeutics Market Size 2032 |

USD 331.58 billion |

The global central nervous system therapeutics market features major players including Biogen, Otsuka Pharmaceutical Co., Ltd., Eli Lilly and Company, Merck & Co., Inc., AstraZeneca, Takeda Pharmaceutical Company Limited, Novartis AG, Teva Pharmaceutical Industries Ltd, Johnson & Johnson Services, Inc. and Pfizer Inc. These firms lead through robust R&D, diversified CNS portfolios, and global distribution networks. The region leading the market is North America, which captured approximately 45% of global revenue in 2024, driven by advanced healthcare infrastructure, high prevalence of CNS disorders, and strong presence of key players.

Market Insights

- The global CNS therapeutics market valued at USD 148.1 billion in 2024 is projected to grow at a CAGR of 10.6% from 2025 to 2032.

- Rising prevalence of CNS disorders such as neurodegenerative diseases and mental health conditions drives demand, with the mental health segment holding the largest revenue share in 2024.

- Innovation in drug development (including disease‑modifying therapies and biomarker‑guided treatments) and digital health expansion support growth and open new opportunities in underserved indications.

- Patent expiries, strong generic competition and long clinical development timelines restrain market expansion and pressure pricing in mature sub‑segments.

- Regionally, North America leads with a market share near 45% in 2024, while Asia‑Pacific is the fastest‑growing region due to rising healthcare access and disease burden

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Disease

The disease segment in the CNS therapeutics market is dominated by the Mental Health sub‑segment, which held a share of approximately 40.2 % in 2024. This leadership stems from the rising global prevalence of anxiety, depression and schizophrenia, alongside greater awareness and treatment access. Continued societal destigmatization and expanded screening are key drivers supporting growth in this segment.

- For instance, Intra-Cellular Therapies was an independent biopharmaceutical company that developed lumateperone. Johnson & Johnson acquired Intra-Cellular Therapies in a landmark deal that closed in April 2025, after the relevant trials were conducted and announced, but before some of the final results were published.

By Drug Class

Within the drug‑class segmentation, the CNS Stimulants category emerged as the dominant sub‑segment with a revenue share of 25.5 % in 2024. Growth in this class is driven by rising incidence of disorders such as ADHD and narcolepsy, plus approval of newer stimulant formulations. Additionally, increased focus on cognitive performance and sleep‑disorder treatments supports uptake in this class.

- For instance, Azstarys (serdexmethylphenidate and dexmethylphenidate) from KemPharm was approved by the U.S. Food & Drug Administration in March 2021 and its pharmacokinetic profile shows a mean terminal elimination half-life of 11.7 hours for the active metabolite (dexmethylphenidate), enabling up to 13 hours of therapeutic efficacy.

By Distribution Channel

For distribution channels, the Hospital Pharmacies segment led the market with roughly 46.3 % of revenue in 2024. Hospitals retain dominance because of their role in acute CNS conditions, complex therapeutics and inpatient care pathways. The demand for specialised CNS drugs needing monitoring and inpatient support further strengthens hospital pharmacy dominance.

Key Growth Drivers

Rising Prevalence of CNS Disorders

The global burden of disorders affecting the central nervous system (CNS) including neurodegenerative, mental‑health and neurovascular diseases is increasing steadily. This growth in incidence directly expands the addressable patient base for CNS therapeutics, driving demand. Moreover, ageing populations in developed markets and rising diagnosis rates in emerging markets intensify the need for effective therapies, which underpins robust market expansion.

- For instance, in the case of neurodegenerative disorders, the number of people living with Alzheimer’s disease and other dementias rose to around 52.6 million globally in 2021.

Innovation in Drug Development and Approval

Advances in neuroscience research, novel mechanisms of action, and fast‑track regulatory pathways are accelerating the introduction of new therapies. This wave of innovation allows companies to target previously unmet needs and command premium pricing, which strengthens revenue potential in the CNS space. Additionally, increasing R&D investment and collaborations enable deeper pipeline growth and expansion of therapeutic options.

- For instance, in the period 2016‑2023 the FDA approved 61 new molecular entities for neurological and rare neurological disorders including 39 small molecules, 13 biologics and 9 novel modality therapies.

Expansion of Healthcare Access and Diagnostic Capabilities

Improved access to healthcare infrastructure, especially in emerging regions, complements enhanced diagnostic tools such as biomarkers and imaging for early CNS disease detection. Earlier diagnosis and broader treatment eligibility broaden the market reach of CNS therapies. Furthermore, telemedicine and digital health tools are enabling better monitoring and patient management, supporting therapy uptake.

Key Trends & Opportunities

Digital Therapeutics and AI in CNS Care

Digital health solutions including mobile apps, remote monitoring and artificial‑intelligence (AI) based diagnostics are gaining traction in CNS therapeutic management. These technologies help optimize treatment regimens, improve adherence and generate real‑world data supporting therapy value propositions. For market participants, integrating digital platforms with pharmaceutical offerings presents a significant opportunity to differentiate and enhance outcomes.

- For instance, Cumulus Neuroscience’s NeuLogiq® platform designed as an AI‑based multi‑domain digital biomarker system for CNS disorders.

Emergence of Disease‑Modifying Therapies (DMTs)

The shift from symptomatic relief toward disease‑modifying approaches in CNS disorders marks a clear opportunity. With growing interest in therapies that alter disease course—especially in neurodegenerative diseases—the value potential for successful approvals is high. Companies that navigate clinical risk and demonstrate meaningful impact stand to gain strong growth proceeds.

- For instance, Eisai Co., Ltd. and Biogen Inc. reported that their anti‑amyloid therapy Leqembi (lecanemab‑irmb) provided a 1.75‑point slower decline on the CDR‑SB scale over four years in early Alzheimer’s disease patients compared to natural history.

Geographic Expansion in Emerging Markets

Emerging economies in Asia‑Pacific, Latin America and Middle East & Africa show rising incidence of CNS disorders and increasing healthcare spend. These regions provide untapped growth potential for CNS therapeutics, especially as regulatory environments evolve and reimbursement frameworks mature. Targeting these geographies early offers an opportunity to build market share and scale globally.

Key Challenges

High Development Costs and Clinical Risk

CNS drug development faces long timelines, high failure rates and complex biology (e.g., blood‑brain barrier issues). These factors inflate cost burdens and deter new entrants, limiting pipeline breadth and increasing payback risk. For companies, securing returns on investment becomes challenging unless innovations deliver clear clinical differentiation.

Reimbursement Pressures and Pricing Constraints

Despite high unmet need, payers in major markets scrutinise value, cost‑effectiveness and real‑world outcomes of CNS therapies. Generic competition and pricing pressures post‑loss of exclusivity further compress margins. Manufacturers must demonstrate tangible patient benefits and cost offsets to maintain profitability, making commercialisation more complex.

Regional Analysis

North America

North America leads the global Central Nervous System Therapeutics Market with approximately 45% market share in 2024, anchored by the US major role. Strong healthcare infrastructure, high neurological-disorder prevalence, and robust R&D investments drive this dominance. The region benefits from advanced reimbursement frameworks that favour innovation and early adoption of novel CNS therapies. While generic-erosion pressures loom, North America’s position remains secure because of high volume and premium pricing for breakthrough treatments.

Europe

Europe accounts for about 25% of the CNS therapeutics market share in 2024. A well-established regulatory environment and mature healthcare systems support consistent uptake of CNS medicines. Countries such as Germany and the United Kingdom lead product launches, with southern markets adding scale. Although cost-effectiveness scrutiny restrains premium pricing somewhat, stable reimbursement and ageing populations underpin reliable demand for neurological and psychiatric treatments.

Asia-Pacific

Asia-Pacific represents around 20% of the global share as of 2024, with the fastest forecast growth among major regions. Rapid urbanisation, expanded healthcare infrastructure, and growing awareness of CNS disorders fuel this dynamic. Key markets include China, India and Japan, where access programmes and regulatory liberalisation accelerate uptake. While average spend per patient remains lower than in developed markets, volume growth is strong and offers major scale opportunities for CNS therapeutics.

Latin America

Latin America holds approximately 3.8% of the global CNS therapeutics market in 2025, signalling under-penetration relative to other regions. Market growth is driven by rising access to CNS medicines, expanding middle-class healthcare coverage and increased public health initiatives. Budget constraints and generics penetration remain challenges. Nonetheless, strategic collaborations and a growing pipeline of region-focused CNS therapies raise optimism for stronger performance going forward.

Middle East & Africa (MEA)

The MEA region contributed about 3.7% of global CNS therapeutics market revenue in 2024. Low baseline treatment access and developing infrastructure limit current size, but the region shows promising expansion potential. Growth hinges on healthcare system upgrades, improved diagnostic services and increased public awareness of CNS disorders. For CNS therapy developers, MEA represents a frontier region where early-mover advantage may yield outsized gains as access gaps close.

Market Segmentations:

By Disease

- Neurovascular Diseases

- CNS Trauma

- Mental Health

- Neurodegenerative Diseases

- Infectious Diseases

- CNS Cancer

- Others

By Drug Class

- Anesthetics

- Anticonvulsants Antiemetics

- CNS Stimulants

- Pain Relievers

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the global Central Nervous System Therapeutics Market is shaped by large pharmaceutical incumbents with broad neurology portfolios and substantial R&D capabilities. Firms such as Biogen, Eli Lilly and Company and Novartis AG drive innovation in neurodegenerative disorders, while Otsuka Pharmaceutical Co., Ltd. and Teva Pharmaceutical Industries Ltd maintain strength in psychiatric and generic therapies. Large‑scale players like Pfizer Inc. and Johnson & Johnson Services, Inc. leverage global distribution to capture market share, and companies including Takeda Pharmaceutical Company Limited and AstraZeneca plc focus on rare CNS conditions. Competitive rivalry remains intense due to patent expirations, generic entry, strategic alliances and emerging biotech threats. The leading companies are increasingly aligning through collaborations, acquisitions and digital technology adoption to maintain differentiation and protect margins in a high‑risk, innovation‑driven sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Novartis AG

- Johnson & Johnson Services, Inc.

- Takeda Pharmaceutical Company Limited

- Pfizer Inc.

- Biogen

- Eli Lilly and Company

- Teva Pharmaceutical Industries Ltd

- Otsuka Pharmaceutical Co., Ltd.

- Merck & Co., Inc.

- Astra Zeneca

Recent Developments

- In September 2025, Novartis reported new Kesimpta® multiple-sclerosis data at ECTRIMS 2025. The studies evaluated outcomes after switching from oral DMTs.

- In March 2025, Novartis announced positive Phase III results for intrathecal onasemnogene abeparvovec in SMA.

- In January 2025, Johnson & Johnson agreed to acquire Intra-Cellular Therapies for ~$14.6 billion, adding CAPLYTA®.

Report Coverage

The research report offers an in-depth analysis based on Disease, Drug class, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as novel biologics and gene therapies enter late‑stage pipelines and gain approvals.

- Growing adoption of digital therapeutics and remote monitoring will enhance treatment access and patient adherence.

- Emerging markets will contribute significantly to growth, driven by increased healthcare infrastructure and rising disease burden in Asia Pacific and Latin America.

- Personalized medicine approaches will gain traction, allowing treatments tailored to individual CNS disorder profiles and boosting therapeutic value.

- Wider use of biomarkers and advanced diagnostics will enable earlier intervention in neurodegenerative diseases, improving outcomes and expanding patient populations.

- Strategic collaborations and M&A activity will accelerate innovation, enabling major players to access niche technologies and expand geographic reach.

- Pricing pressure and reimbursement challenges will persist, forcing manufacturers to prove value and outcomes to maintain profitability.

- Generic and biosimilar entry will increase in mature segments, reducing margins but expanding volume in underserved regions.

- Clinical trial complexity and high attrition rates in CNS drug development will remain a significant risk factor for investors and participants.

- Regulatory harmonisation across regions will support global launches, though differing health systems will require tailored market strategies.