Market overview

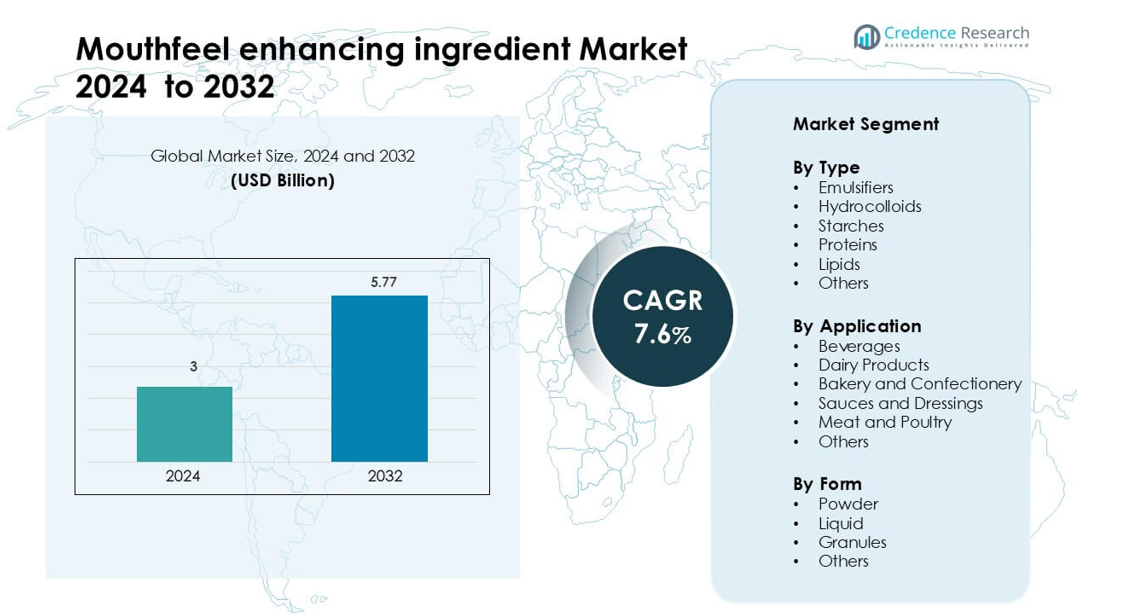

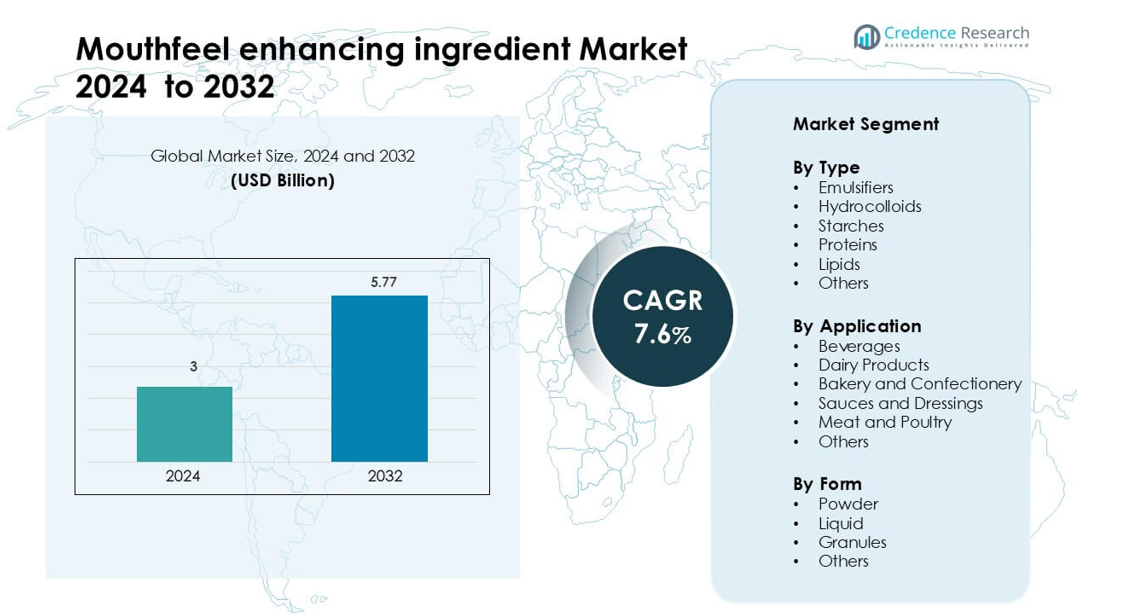

Mouthfeel enhancing ingredient Market was valued at USD 3 billion in 2024 and is anticipated to reach USD 5.77 billion by 2032, growing at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mouthfeel Enhancing Ingredient Market Size 2024 |

USD 3 billion |

| Mouthfeel Enhancing Ingredient Market, CAGR |

7.6% |

| Mouthfeel Enhancing Ingredient Market Size 2032 |

USD 5.77 billion |

The mouthfeel enhancing ingredient market is shaped by major players such as Sensient Technologies Corporation, Cargill, Incorporated, Tate & Lyle, International Flavors & Fragrances, Givaudan, Corbion N.V., Kerry Group, Symrise AG, Ingredion Incorporated, and Firmenich. These companies compete through advanced emulsifiers, hydrocolloids, and starch-based systems that enhance creaminess, viscosity, and overall sensory appeal across beverages, dairy, bakery, and plant-based foods. They invest in clean-label solutions, texture innovation, and regional expansion to meet rising global demand. Asia-Pacific leads the market with a 37% share, supported by rapid growth in packaged foods, dairy alternatives, and ready-to-drink beverages across major economies.

Market Insights

- The global mouthfeel enhancing ingredient market was valued at USD 3 in 2024 and is projected to reach USD 5.77 by 2032, expanding at a CAGR of 7.6 % during the forecast period.

- Strong demand for smooth, creamy, and stable textures in beverages and dairy drives adoption, with emulsifiers holding a 32% type share and powder form leading with a 47% share due to easy handling and shelf stability.

- Clean-label preference, growth of plant-based foods, and rising use of hydrocolloids and specialty starches shape key trends, especially in dairy alternatives and high-protein drinks.

- Competitive intensity remains high as global players focus on natural solutions, tailored texture systems, and regional capacity expansion, while raw material variability and reformulation complexity act as restraints.

- Asia-Pacific leads with a 37% regional share, followed by North America at 33% and Europe at 28%, reflecting strong packaged food consumption, growing beverage demand, and expanding plant-based product adoption across major markets

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Emulsifiers lead the type segment with a 32% share, driven by their strong role in improving texture, stability, and smoothness across diverse food systems. These additives help create uniform dispersion in fat–water mixtures, which enhances creaminess in beverages, spreads, and sauces. Hydrocolloids expand due to rising demand for thickening and gelling solutions in clean-label products. Starches support cost-effective viscosity control in processed foods, while proteins gain traction in high-protein formulations. Lipids and other specialty agents advance steadily as brands develop richer textures for premium categories.

- For instance, Cargill’s plant-based lecithin solutions are derived exclusively from plants (soybean, sunflower, rapeseed). These solutions have been used to improve dough release, moisture retention, and fat dispersion in bakery applications. In confectionery applications, they help adjust viscosity and reduce the need for expensive cocoa butter, keeping costs in check.

By Application

Beverages dominate the application segment with a 29% share, supported by strong use in dairy drinks, plant-based beverages, and nutritional blends that require smooth mouthfeel and reduced grittiness. These formulations rely on stabilizers and emulsifiers to maintain suspension and enhance sensory appeal. Dairy products remain a major user as manufacturers focus on creamy textures in yogurts, desserts, and cheese alternatives. Bakery and confectionery brands adopt these ingredients to enhance softness and moisture retention. Sauces, dressings, and meat products also grow due to rising demand for richer, more uniform textures.

- For instance, Kerry Group developed a stabilizer system for a whole-grain dairy-based protein beverage that delivered 8 g of whole grains and 8 g of milk protein per 8-oz glass while maintaining uniform suspension through ultra-high-temperature pasteurisation.

By Form

Powder form holds the leading position with a 47% share, driven by easy handling, long shelf life, and strong compatibility with dry blending processes. Powdered emulsifiers and hydrocolloids are widely used in bakery mixes, instant beverages, and dairy applications because they disperse quickly and provide consistent performance. Liquid forms gain traction in sauces, dressings, and ready-to-drink beverages that need rapid solubility. Granules expand in industrial setups seeking reduced dusting and improved flow. Other specialized forms progress as manufacturers design tailored delivery systems for advanced texture control.

Key Growth Drivers

Growing Demand for Premium Texture Experiences

Rising consumer interest in smooth, creamy, and indulgent textures drives strong demand for mouthfeel enhancing ingredients across food and beverage categories. Brands focus on sensory appeal because texture influences product acceptance as much as taste. This shift encourages wider use of emulsifiers, hydrocolloids, and specialized starches to deliver richness in beverages, dairy items, sauces, and plant-based foods. Clean-label trends also push manufacturers to replace artificial thickeners with natural gums and proteins. Premiumization in ready-to-drink beverages and high-protein snacks strengthens adoption as companies refine viscosity, creaminess, and stability. Growing urban lifestyles, rising income levels, and the popularity of café-style products further boost the need for advanced texture solutions.

- For instance, Ingredion Incorporated reports that 79% of consumers agree that texture impacts their overall satisfaction with a food product, and 8 in 10 say they are likely to recommend a product based on its texture.

Expansion of Plant-Based and Low-Fat Formulations

The rapid rise of plant-based, low-fat, and reduced-sugar products increases demand for mouthfeel enhancers that compensate for lost creaminess and body. Milk alternatives, meat analogues, and functional beverages require stabilizers and structured lipids to achieve desirable thickness and smoothness. Plant-protein products often struggle with grainy textures, prompting stronger dependence on hydrocolloids, modified starches, and emulsification systems. As consumers shift to health-focused diets, manufacturers look for solutions that maintain indulgent mouthfeel without added fat or sugar. This trend expands opportunities for natural gums, enzymatically modified starches, and next-generation protein-based mouthfeel agents designed for clean-label alignment.

- For instance, one published study demonstrated that a binary mixture of modified oat flour and faba bean protein isolate used at 2 % (w/w) produced plant-based Pickering emulsions with droplet sizes ranging 14.00 to 20.57 µm, yielding a thick consistency and smooth shear-thinning behaviour in a non-dairy cream alternative.

Rising Use of Advanced Food Processing Technologies

Innovations in high-shear mixing, micro-emulsification, and cold-processing systems enable better dispersion and improved functionality of mouthfeel ingredients. Modern processing unlocks smoother textures in beverages, soups, desserts, and fortified foods while reducing ingredient usage and improving cost efficiency. Growth in ready-to-drink nutrition products pushes adoption of technologies that prevent sedimentation and enhance fluid consistency. Companies use encapsulation and controlled-release systems to deliver richer textures while protecting ingredient stability. As automation expands in food manufacturing, producers increasingly choose mouthfeel enhancers that perform reliably under diverse processing conditions, supporting consistent quality in large-scale production.

Key Trends and Opportunities

Growing Preference for Clean-Label Texture Systems

Consumers now prefer natural, minimally processed solutions, which drives manufacturers to replace synthetic emulsifiers and thickeners with plant-derived hydrocolloids, natural starches, and protein-based stabilizers. This shift creates opportunities for suppliers offering label-friendly texture systems that still deliver stability, viscosity, and creaminess. Food brands explore botanical gums, pulse proteins, and fermentation-derived ingredients that improve texture without compromising transparency or nutritional claims. As clean-label regulations strengthen across regions, companies invest in simple ingredient lists that still support desirable mouthfeel across beverages, baked goods, sauces, and dairy alternatives.

- For instance, ADM’s Stabrium™ Hydrocolloid Solutions 100 and 200 were formulated as dry blends of plant-based ingredients that helped a yoghurt alternative brand reduce its ingredient list from 9 to 6 distinct texture modifiers, while achieving comparable viscosity and syneresis control.

R&D Focus on Customized Texture Profiles

Manufacturers now develop tailored texture solutions that fit distinct product categories, such as velvety dairy alternatives, airy bakery fillings, or gel-based confectionery. Growing interest in multisensory eating experiences encourages brands to focus on mouth-coating effects, melt-in-mouth sensations, and enhanced moisture retention. Companies expand R&D efforts to design blends that perform across varied pH levels, temperature cycles, and processing environments. This focus opens opportunities for hybrid systems that combine proteins, lipids, and hydrocolloids to deliver precise textures for premium and functional food launches.

- For instance, Ingredion consistently highlights the importance of texture in consumer preference and uses its own research, such as the “Texture Research study” and the global ATLAS database, to demonstrate ingredient performance.

Increasing Demand from Functional and Nutritional Products

Functional beverages, sports nutrition products, and fortified foods require consistent viscosity and smoothness to improve consumer acceptance. As high-protein and high-fiber formulations become more common, demand rises for ingredients that reduce chalkiness and enhance flow. This trend opens space for advanced emulsifiers, fiber-based texturizers, and heat-stable gums optimized for nutraceutical applications. Companies leverage this shift to introduce specialized systems that sustain mouthfeel even under thermal processing or long-term storage.

Key Challenges

Raw Material Price Instability

Price fluctuations in natural gums, plant-based proteins, starch derivatives, and lipid sources create uncertainty for manufacturers. Climatic changes, limited regional cultivation, and supply chain disruptions often affect the availability of raw materials used in texture-enhancing systems. This instability increases production costs and pressures companies to optimize formulations or find alternative sources. Smaller manufacturers face greater challenges due to lower procurement power. Maintaining consistent product performance also becomes difficult when ingredient specifications vary due to crop quality issues. These factors create a persistent challenge for market expansion.

Complexity in Achieving Clean-Label and High-Performance Balance

Delivering indulgent mouthfeel while meeting clean-label demands remains a major technical challenge. Natural alternatives often have limitations related to flavor masking, stability, or functionality under heat and shear conditions. Reformulation becomes complex when replacing synthetic emulsifiers or modified starches without compromising texture, shelf life, or processing efficiency. Brands must also comply with regional regulations that restrict certain hydrocolloids or additives. R&D efforts grow more intensive as companies attempt to create minimal-ingredient formulations with performance comparable to conventional systems. This balance continues to challenge manufacturers across product categories.

Regional Analysis

North America

North America holds a 33% share of the mouthfeel enhancing ingredient market, supported by strong demand for premium textures in beverages, dairy, and functional nutrition products. The region benefits from advanced food processing technologies and high adoption of clean-label stabilizers and emulsifiers. Growth in plant-based milk, protein-enriched drinks, and reduced-fat formulations increases the need for hydrocolloids and specialty starches. Major manufacturers focus on customized texture systems for ready-to-drink beverages and bakery applications. The mature packaged food sector and rising interest in indulgent yet healthy products keep North America a leading market for advanced mouthfeel solutions.

Europe

Europe accounts for a 28% share of the market, driven by strict quality standards, clean-label requirements, and a strong focus on natural texture systems. Dairy and bakery remain major users as manufacturers enhance creaminess, softness, and stability in premium and artisanal products. Plant-based food growth strengthens demand for hydrocolloids and protein-based texturizers that address grainy or thin textures. The region’s mature regulatory environment accelerates adoption of natural gums, enzymatically modified starches, and structured lipids. Innovation in low-fat spreads, sauces, and confectionery also supports sustained regional consumption of mouthfeel enhancing ingredients.

Asia-Pacific

Asia-Pacific leads with a 37% share, supported by rapid growth in packaged foods, beverages, and dairy alternatives across China, India, and Southeast Asia. Rising incomes and urban lifestyles drive demand for smooth, creamy, and indulgent textures in ready-to-drink beverages, bakery goods, and snack products. Expansion of plant-based and fortified beverages boosts use of stabilizers and emulsifiers that improve suspension and mouth-coating properties. Local manufacturers increasingly invest in hydrocolloids and advanced starches to match global texture standards. Fast-growing foodservice and convenience sectors strengthen Asia-Pacific’s position as the fastest-expanding market.

Latin America

Latin America holds a 7% share, driven by rising consumption of dairy drinks, flavored beverages, and bakery products that require improved mouthfeel. Brazil and Mexico lead adoption as manufacturers enhance creaminess and consistency in affordable and value-added food products. The region shows growing interest in natural gums and starch-based solutions for clean-label reformulations. Expansion of ready-to-eat and on-the-go products increases reliance on stabilizers that provide uniform textures under warm climates. Although cost-sensitive, the market benefits from increasing investments in texture optimization for sauces, snacks, and confectionery.

Middle East & Africa

The Middle East & Africa region accounts for a 5% share, supported by growing demand for processed foods, dairy products, and flavored beverages that require consistent mouthfeel. Higher temperatures increase the need for stabilizers and emulsifiers that maintain viscosity and prevent separation. Urbanization and rising interest in premium bakery, confectionery, and ready-to-drink beverages strengthen adoption of hydrocolloids and modified starches. Manufacturers in the Gulf countries focus on texture improvement to match international product standards. Although growth is gradual, increasing investments in food manufacturing capacity enhance the long-term outlook for mouthfeel enhancing ingredients.

Market Segmentations:

By Type

- Emulsifiers

- Hydrocolloids

- Starches

- Proteins

- Lipids

- Others

By Application

- Beverages

- Dairy Products

- Bakery and Confectionery

- Sauces and Dressings

- Meat and Poultry

- Others

By Form

- Powder

- Liquid

- Granules

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the mouthfeel enhancing ingredient market features a mix of global ingredient suppliers, specialized stabilizer manufacturers, and innovation-driven formulation companies that compete through technology, product range, and clean-label alignment. Leading players focus on advanced hydrocolloids, emulsifiers, modified starches, and structured lipids designed to enhance creaminess, viscosity, and texture consistency across beverages, dairy products, bakery items, sauces, and plant-based foods. Companies strengthen their portfolios through R&D investments, patented texture systems, and customer-specific formulation support. Many suppliers expand clean-label and natural ingredient lines to meet rising demand for botanical gums and minimally processed solutions. Strategic partnerships with food manufacturers help deliver customized texture profiles for emerging categories such as protein-rich drinks, low-fat dairy alternatives, and functional beverages. Global players also expand production capacity in Asia-Pacific and Latin America to serve high-growth regions and reduce supply risks. Continuous innovation, sustainability focus, and tailored technical services define the competitive intensity in this market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Givaudan announced that it is developing technologies focused on masking off-notes and enhancing mouthfeel to create more authentic meat-like textures in plant-based applications.

- In April 2023, Sensient introduced a vegetable-protein extract called “Nacre”, positioned as a clean-label, low-salt, high-protein flavoring solution that boosts umami and delivers pleasant mouthfeel across applications including plant-based meats, snacks, sauces, soups and bakery

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for clean-label mouthfeel solutions will rise across beverages and dairy alternatives.

- Plant-based food growth will increase the need for advanced hydrocolloids and emulsifiers.

- Texture optimization will become essential in high-protein and functional nutrition products.

- Companies will adopt natural gums and protein-based systems to replace synthetic ingredients.

- Encapsulation and structured lipid technologies will gain wider use for improved creaminess.

- Customized texture blends will expand to support premium bakery and confectionery launches.

- Regional manufacturers will increase capacity to reduce supply risks and improve availability.

- AI-assisted formulation tools will help design targeted mouthfeel profiles faster.

- Sustainability goals will drive development of bio-based and low-impact texturizing agents.

- Regulatory focus on transparency will accelerate innovation in minimally processed texture systems.