Market overview

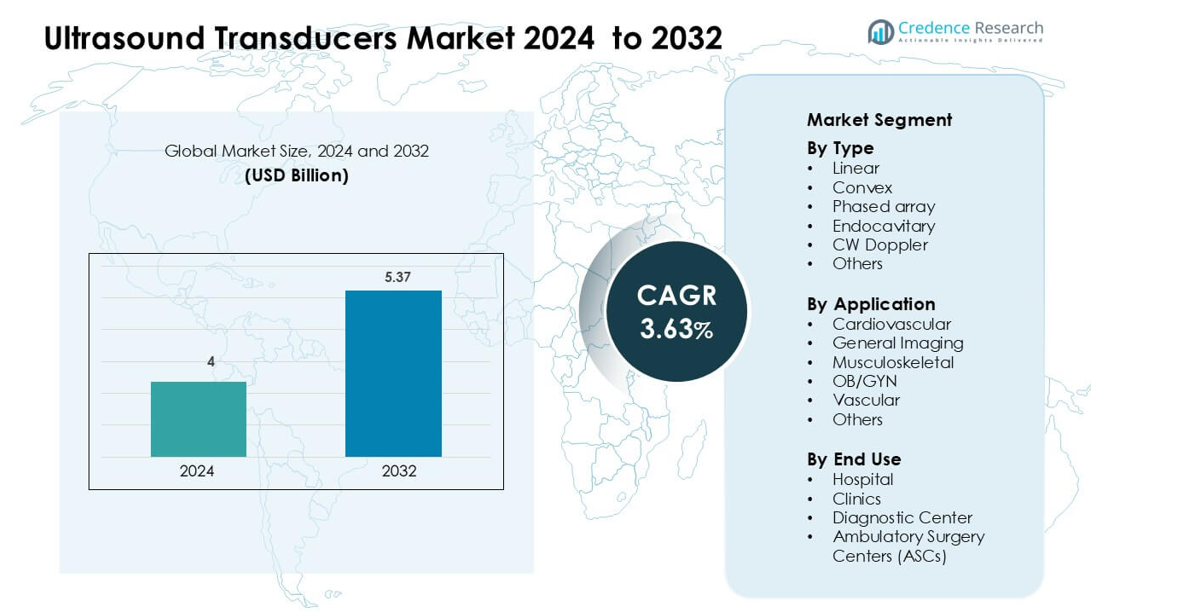

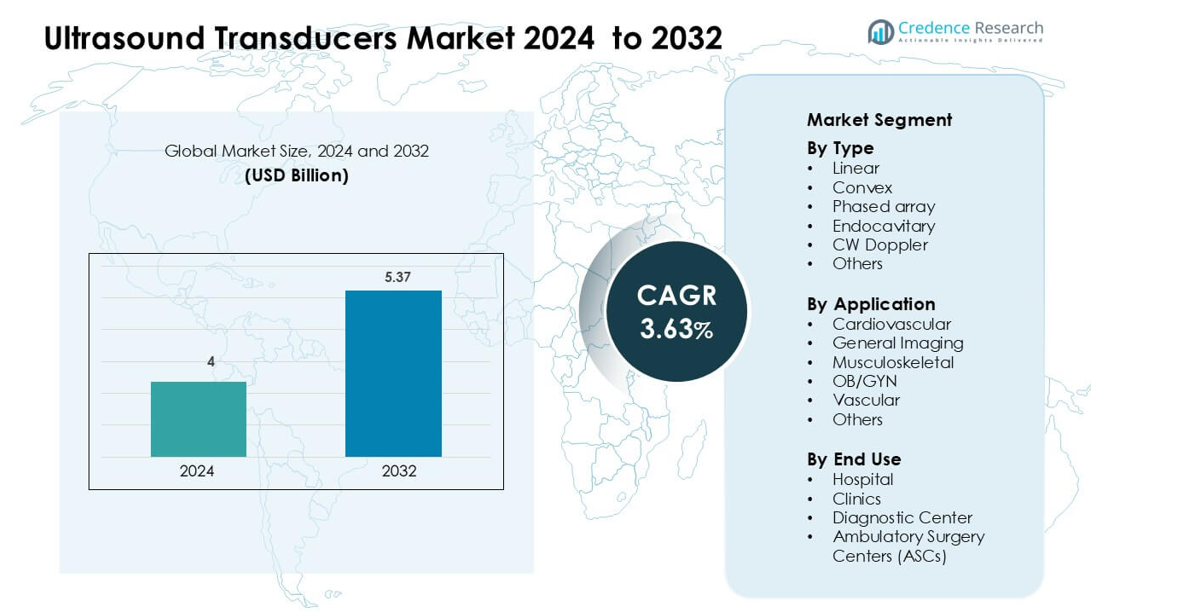

Ultrasound Transducers Market was valued at USD 4 billion in 2024 and is anticipated to reach USD 5.37 billion by 2032, growing at a CAGR of 3.63 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ultrasound Transducers Market Size 2024 |

USD 4 billion |

| Ultrasound Transducers Market, CAGR |

3.63% |

| Ultrasound Transducers Market Size 2032 |

USD 5.37 billion |

The Ultrasound Transducers Market is led by major global imaging companies such as Siemens Healthineers AG, GE HealthCare, Koninklijke Philips N.V., Canon Medical Systems Corporation, Hitachi, Ltd., Samsung Medison Co., Ltd., FUJIFILM Holdings Corporation, Esaote SpA, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., and Analogic Corporation. These players compete through advanced probe technologies, AI-supported imaging, durable materials, and strong clinical integration across radiology, cardiology, and OB/GYN. North America remains the leading region with 38% market share, driven by high adoption of premium ultrasound systems, strong healthcare spending, and continuous upgrades in diagnostic infrastructure across hospitals and imaging centers.

Market Insights

- The Ultrasound Transducers Market reached USD 4 billion in 2024 and is projected to hit USD 5.37 billion by 2032, growing at a CAGR of 3.63% during the forecast period.

- Strong demand for non-invasive diagnostics drives adoption, led by linear transducers holding a 34% share due to high use in vascular, musculoskeletal, and general imaging workflows.

- Key trends include rising deployment of portable and point-of-care ultrasound, expanding usage of 3D/4D imaging, and increasing integration of AI-supported probes for automated measurement and improved clarity.

- Competitive intensity grows as Siemens Healthineers, GE HealthCare, Philips, Canon Medical, Mindray, and Samsung Medison focus on advanced materials, ergonomic probe designs, and portfolio expansion across clinical applications.

- North America leads with 38%, followed by Europe at 28% and Asia-Pacific at 24%, supported by strong hospital investments and broader adoption across cardiology, radiology, and OB/GYN segments

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the global ultrasound transducers market (segmented by product type: linear, convex, phased array, endocavitary, CW Doppler and others), the convex transducer sub‑segment emerges as dominant, commanding approximately 47.2% of the market in 2024. The strong position of the convex type is driven by its versatility in a wide range of clinical scenarios especially abdominal, transvaginal and transrectal imaging where its wider field and deeper penetration offer diagnostic advantages. Additional drivers include increasing prevalence of chronic abdominal and gynecological conditions globally, as well as continuous improvements in transducer technology (higher resolution, enhanced ergonomics) that favour the convex format.

- For instance, GE HealthCare’s 6C2 curved array convex probe supports a frequency range of 6 – 2 MHz, a focal range of 40 – 220 mm, and a sector angle of 62°, optimised for

By Application

Within application segmentation (cardiovascular, general imaging, musculoskeletal, OB/GYN, vascular, others), the general imaging category holds the largest share about 41.7% in 2024. This dominance stems from the broad use of ultrasound across many organ systems and specialties (e.g., abdominal, small organs, emergency point‑of‑care), making general imaging the backbone of transducer demand. Key growth drivers include rising awareness and adoption of non‑invasive diagnostic imaging, the aging population with higher incidence of multi‑system imaging needs, and technological innovations (such as improved image quality and portability) that broaden use‐cases.

- For instance, Philips s general‑imaging transducer line features the mL 26‑8 linear array probe which operates at frequencies up to 26 MHz and down to 8 MHz, enabling superficial structure.

By End Use

Looking at the end‑user segmentation (hospitals & clinics, diagnostic centres, ambulatory surgery centres (ASCs)), the hospitals & clinics segment dominates, holding roughly 56.8% of the market in 2024. The leadership of this segment is driven by hospitals’ extensive diagnostic infrastructure, higher imaging volumes, broad service mix (inpatient, outpatient, emergency) and capacity to invest in advanced ultrasound systems and associated transducers. Moreover, as healthcare systems worldwide respond to increased disease burdens and ageing populations, hospitals remain the primary setting for deploying ultrasound transducer technology.

Key Growth Drivers

Rising Demand for Advanced Diagnostic Imaging

Growing use of non-invasive imaging drives strong adoption of ultrasound transducers across hospitals and diagnostic centers. Healthcare providers need real-time and radiation-free imaging for cardiovascular screening, prenatal monitoring, and abdominal analysis, which increases the demand for high-performance transducers. The rise in chronic conditions such as heart disease and liver disorders pushes clinicians to use ultrasound more frequently for early diagnosis. Advancements in beamforming, signal processing, and high-density arrays improve clarity, which encourages replacement of older probes. Point-of-care ultrasound also expands usage in emergency departments and primary care. Manufacturers introduce lightweight, ergonomic, and AI-supported models that enable faster workflow and easier integration with portable scanners. This creates a strong need for reliable, multi-frequency probes that deliver clear images across different clinical settings. Growing government investment in public health imaging programs further stimulates market growth across emerging economies.

- For instance, GE IC5‑9D Endocavity/Transvaginal Transducer operates in a frequency band of 5 – 9 MHz, specifically designed for transvaginal and endocavity use with up to 128° field of view, enabling enhanced detection of gynecological and prenatal structures.

Expansion of Point-of-Care and Portable Ultrasound Systems

The shift toward portable and handheld ultrasound systems drives significant growth in transducer demand because these devices use specialized compact probes. Clinical teams now prefer point-of-care ultrasound for bedside diagnosis, trauma assessment, and emergency care, which increases the need for durable and versatile probes. Miniaturized electronics and advanced piezoelectric materials help manufacturers design lighter transducers with better sensitivity. These improvements help clinicians perform rapid assessments in ambulances, rural clinics, sports medicine, and military operations. Portable systems also reduce patient load on imaging departments, which expands adoption. The rise of tele-ultrasound and remote scanning further supports probe deployment across decentralized care models. Strong preference for wireless connectivity and battery-efficient probes reinforces development activity among suppliers. As portable systems penetrate developing markets and outpatient centers, the demand for low-cost, high-performance transducers continues to accelerate across multiple applications.

- For instance, SONOQUE C3C Wireless Portable Ultrasound Probe connects via WiFi to smartphones or tablets.

Technological Advancements in Piezoelectric and CMUT Materials

Innovation in transducer materials is a major driver because it improves image resolution, durability, and clinical versatility. Capacitive Micromachined Ultrasonic Transducers (CMUTs) and Single Crystal Piezoelectric materials offer higher bandwidth, better sensitivity, and superior penetration depth compared with conventional PZT ceramics. These technologies support advanced imaging modes such as elastography, tissue harmonic imaging, and 3D/4D scanning. Manufacturers now integrate micro-fabrication and improved backing layers to reduce noise and enhance signal consistency. These enhancements help clinicians view smaller anatomical structures with higher accuracy, which improves diagnostic outcomes. New material technologies also enable smaller probe footprints, flexible arrays, and heat-resistant housings suitable for continuous use. Strong patent activity and R&D investment among transducer suppliers accelerate adoption. The rise of AI-assisted ultrasound systems further increases demand for high-fidelity probes capable of delivering precise and consistent data for automated interpretation.

Key Trends & Opportunities

Shift Toward 3D/4D and AI-Enabled Imaging

The market sees strong movement toward 3D/4D ultrasound solutions that require advanced transducers capable of capturing faster frame rates and higher data volumes. Clinicians increasingly rely on volumetric imaging in OB/GYN, cardiology, and oncology because it improves anatomical visualization and allows detailed fetal assessment, valve analysis, and tumor mapping. AI-enabled ultrasound platforms enhance probe performance by supporting automated measurements, image enhancement, and workflow optimization. This helps reduce operator dependency and enables faster diagnosis in busy clinical environments. As healthcare systems pursue automation in imaging, demand for smart transducers with integrated sensors and data-driven processing continues to grow. 3D/4D imaging also opens opportunities for premium-grade probes with stronger signal fidelity, improving adoption among tertiary hospitals and specialized centers. These innovations help manufacturers differentiate products in a competitive market, creating new revenue opportunities.

- For instance, the Philips X7-2 xMATRIX Array Ultrasound Transducer supports Philips volumetric imaging with an extended operating frequency range of 2 to 7 MHz (or 7–2 MHz) and 2,500 elements, enabling advanced 3D/4D imaging in pediatric and adult cardiac applications.

Growing Adoption of Wireless and Wearable Ultrasound Devices

Wireless and wearable ultrasound devices create new opportunities for transducer manufacturers as healthcare shifts toward mobile and continuous monitoring solutions. Wireless probes improve patient mobility, reduce cable-related failure points, and support streamlined sterilization processes. Wearable ultrasound patches enable monitoring of cardiac output, fetal movement, and musculoskeletal conditions without continuous operator presence. These devices use flexible and embedded transducer arrays built with advanced polymer and micromachining technologies. Adoption increases in telemedicine, home monitoring, and sports healthcare, driving demand for compact and energy-efficient probes. Manufacturers also explore cloud-connected designs that store and analyze scan data in real time. As remote patient monitoring expands globally, wireless transducers become essential in decentralized care pathways. The trend aligns with broader healthcare digitalization, creating long-term growth opportunity for companies investing in lightweight, reusable, and AI-linked probe technologies.

- For instance, the Vave Universal Wireless Probe supports full‑body imaging and is cleared under FDA submission K241051 for home‑, ambulance‑ and clinic‑use.

Rising Use of Ultrasound in Emerging Clinical Applications

Several new clinical areas are adopting ultrasound due to advances in imaging quality and probe design, creating strong expansion opportunities. Ultrasound now supports liver assessment, lung scanning, nerve blocks, vascular access, and tumor ablation planning. Emergency medicine, anesthesia, urology, and orthopedics increasingly integrate ultrasound into routine workflows, which expands demand for specialized transducers. High-frequency probes allow dermatology teams to detect skin tumors and monitor wound healing. In oncology, elastography-enabled probes help clinicians assess tissue stiffness for early tumor diagnosis. Growing adoption of fusion imaging increases need for probes compatible with navigation systems. Veterinary medicine and life-science research also present emerging opportunities as providers seek affordable imaging tools. Expansion into new use cases strengthens long-term demand for multipurpose, high-resolution, and application-specific transducers across global healthcare markets.

Key Challenges

High Cost of Advanced Transducers and System Integration

Advanced ultrasound transducers require sophisticated materials, micro-fabrication processes, and specialized calibration steps, which significantly raises production costs. These expenses limit adoption among small clinics, rural hospitals, and low-budget diagnostic centers. High acquisition cost also impacts replacement cycles, making facilities delay upgrades or favor refurbished probes. Integration with next-generation ultrasound systems adds further cost burden because premium probes often require compatible consoles, software upgrades, or proprietary connectors. Maintenance expenses and frequent sterilization cycles increase risk of physical damage, adding to long-term operational costs. The price gap between standard and high-performance probes continues to challenge broader market penetration. This cost pressure affects both suppliers and end users, creating barriers to widespread adoption of advanced ultrasound imaging technologies in developing regions.

Short Product Lifespan and Risk of Probe Damage

Ultrasound transducers face significant wear due to frequent handling, sterilization, and repeated use in high-volume departments such as emergency care and obstetrics. Cable strain, drop impacts, and membrane degradation reduce probe lifespan and raise replacement frequency. High-frequency probes, which use delicate components, are particularly vulnerable to damage. This increases downtime and leads to workflow disruption in busy imaging units. Inadequate cleaning protocols can cause internal moisture buildup, affecting acoustic performance. The need for strict disinfection after each use also accelerates material fatigue. These issues create recurring financial and operational challenges for healthcare providers. Manufacturers must invest heavily in durable materials and robust housing designs to address these pain points, but such improvements increase device cost. Short lifespan concerns remain a major obstacle in optimizing long-term imaging efficiency.

Regional Analysis

North America

North America holds the largest share of the Ultrasound Transducers Market at 38%, supported by strong adoption of advanced imaging technologies and widespread availability of high-end diagnostic infrastructure. Hospitals and diagnostic centers invest heavily in premium probes for cardiology, radiology, and OB/GYN applications. Growth strengthens as point-of-care ultrasound expands across emergency care and primary clinics. Major manufacturers launch AI-enabled probes that improve workflow and reduce operator dependency. Rising burden of chronic diseases increases demand for accurate and early imaging. Favorable reimbursement policies also support rapid system upgrades, reinforcing regional dominance.

Europe

Europe accounts for 28% of the Ultrasound Transducers Market, driven by strong emphasis on non-invasive diagnostics and increasing use of ultrasound in cardiology, oncology, and prenatal care. Countries such as Germany, France, and the UK invest in high-resolution probes that support 3D/4D imaging and elastography. Adoption increases as public health systems upgrade aging diagnostic fleets and expand ambulatory care centers. Growing use of portable ultrasound improves accessibility in emergency and rural settings. Continuous R&D investment by regional manufacturers strengthens technology advancement. Regulatory focus on imaging quality and patient safety further drives steady growth across the region.

Asia-Pacific

Asia-Pacific captures 24% of the Ultrasound Transducers Market, supported by rapid healthcare expansion, rising diagnostic imaging needs, and increasing burden of cardiovascular and maternal health conditions. China, India, Japan, and South Korea drive strong adoption as hospitals upgrade to digital and portable ultrasound systems. Local manufacturers provide cost-effective probes, improving access across mid-tier and rural facilities. Government investment in maternal care and chronic disease screening strengthens ultrasound utilization. Growing medical tourism and rising private hospital spending fuel demand for advanced transducers. The region shows the fastest growth due to large patient volume and expanding imaging capacity.

Latin America

Latin America holds 6% of the Ultrasound Transducers Market, driven by gradual modernization of diagnostic services and rising adoption of portable ultrasound systems. Brazil, Mexico, and Argentina lead the region as healthcare providers expand imaging capabilities across public and private hospitals. Demand grows for cost-efficient probes that support general imaging, OB/GYN, and emergency care. Limited budgets encourage procurement of mid-range and refurbished units, but premium transducers see slow adoption. Training programs for clinicians and growing investment in maternal health screening improve uptake. Despite economic challenges, the region shows steady growth in ultrasound accessibility.

Middle East & Africa

The Middle East & Africa region holds 4% of the Ultrasound Transducers Market, supported by rising investments in healthcare infrastructure and growing demand for non-invasive imaging across maternal care and chronic disease diagnosis. Gulf countries such as the UAE and Saudi Arabia lead adoption of advanced transducers, especially for cardiology and radiology. African nations focus on portable and battery-powered systems to support rural diagnostics. Partnerships with global manufacturers improve access to high-quality probes. Limited reimbursement and budget constraints slow adoption of premium systems, yet increasing government focus on diagnostic expansion drives continued market development.

Market Segmentations:

By Type

- Linear

- Convex

- Phased array

- Endocavitary

- CW Doppler

- Others

By Application

- Cardiovascular

- General Imaging

- Musculoskeletal

- OB/GYN

- Vascular

- Others

By End Use

- Hospital

- Clinics

- Diagnostic Center

- Ambulatory Surgery Centers (ASCs)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Ultrasound Transducers Market features an intense competitive landscape dominated by diversified global imaging vendors and specialized probe manufacturers. Siemens Healthineers, GE HealthCare, and Koninklijke Philips N.V. lead with broad ultrasound portfolios, deep R&D capacity, and strong hospital relationships across cardiology, radiology, and OB/GYN. Canon Medical Systems Corporation, FUJIFILM Holdings Corporation, Hitachi, Ltd., and Samsung Medison Co., Ltd. strengthen competition with premium cart-based and portable systems that use high-performance convex, linear, and phased-array probes. Shenzhen Mindray Bio-Medical Electronics Co., Ltd. expands aggressively in value and mid-range segments, especially in emerging markets. Analogic Corporation and Esaote S.p.A. focus on niche clinical areas and OEM partnerships, supplying advanced probe technologies and specialized systems. Players compete on image quality, durability, ergonomics, AI-enabled features, and after-sales service coverage, while also pursuing collaborations, product launches, and geographic expansion to secure long-term market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Samsung Medison Co., Ltd. At ISUOG 2025, Samsung Medison showcased the upgraded HERA Z20 women’s health system. The launch highlighted the ultra-compact Mini ER7 transvaginal probe, with a 63% smaller head to reduce gynecological exam discomfort.

- In February 2025, Canon Medical Systems Corporation Canon Medical introduced the Aplio beyond premium ultrasound system at ECR 2025. The platform features new single-crystal and matrix transducers, including a refined convex probe with improved resolution and penetration.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for portable and point-of-care ultrasound systems will accelerate transducer upgrades.

- AI-enabled probes will improve image quality and reduce operator dependency across clinical settings.

- 3D and 4D transducers will gain wider adoption for fetal assessment and cardiac imaging.

- Hospitals will replace aging probes faster as durability and material standards improve.

- Wireless and handheld probe designs will expand in emergency, home care, and remote diagnostics.

- Specialized high-frequency probes will see rising use in dermatology, orthopedics, and vascular imaging.

- Manufacturers will increase investment in CMUT and single-crystal technologies to enhance performance.

- Multi-purpose transducers will gain traction as providers seek cost-efficient imaging solutions.

- Emerging markets will contribute strong growth due to expanding diagnostic infrastructure.

- Strategic partnerships and OEM collaborations will shape product innovation and market penetration.