Market Overview:

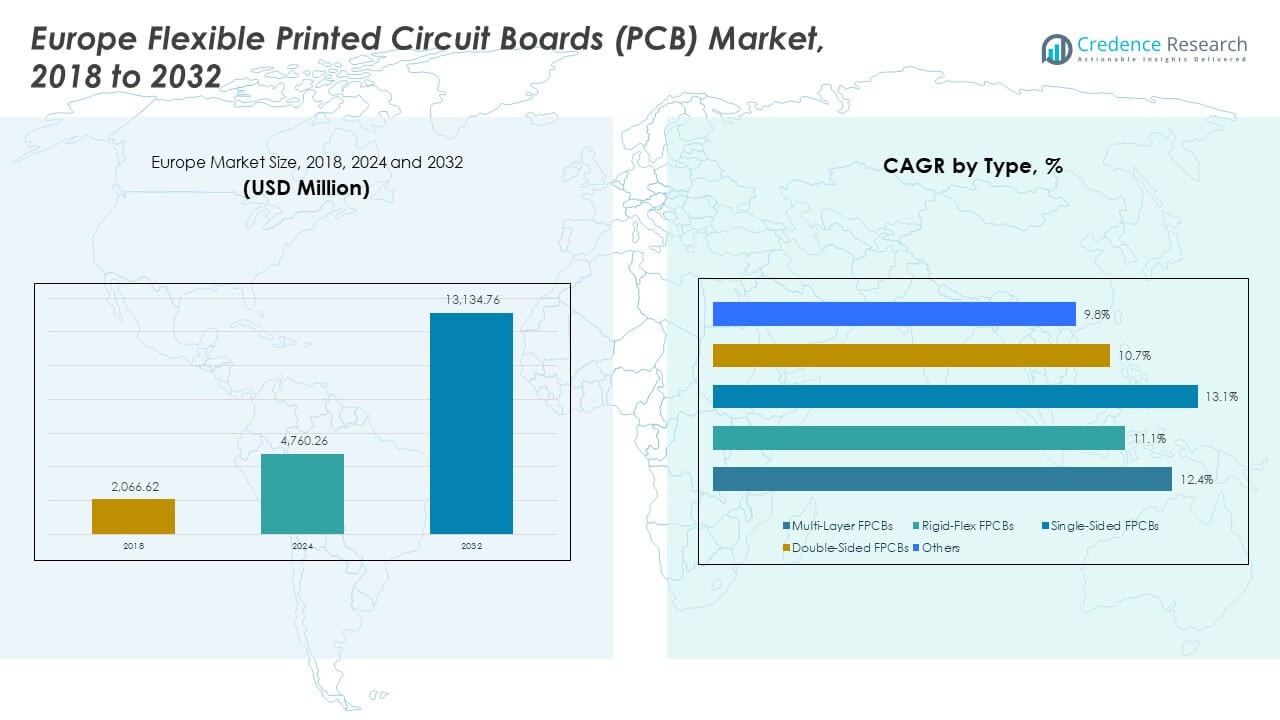

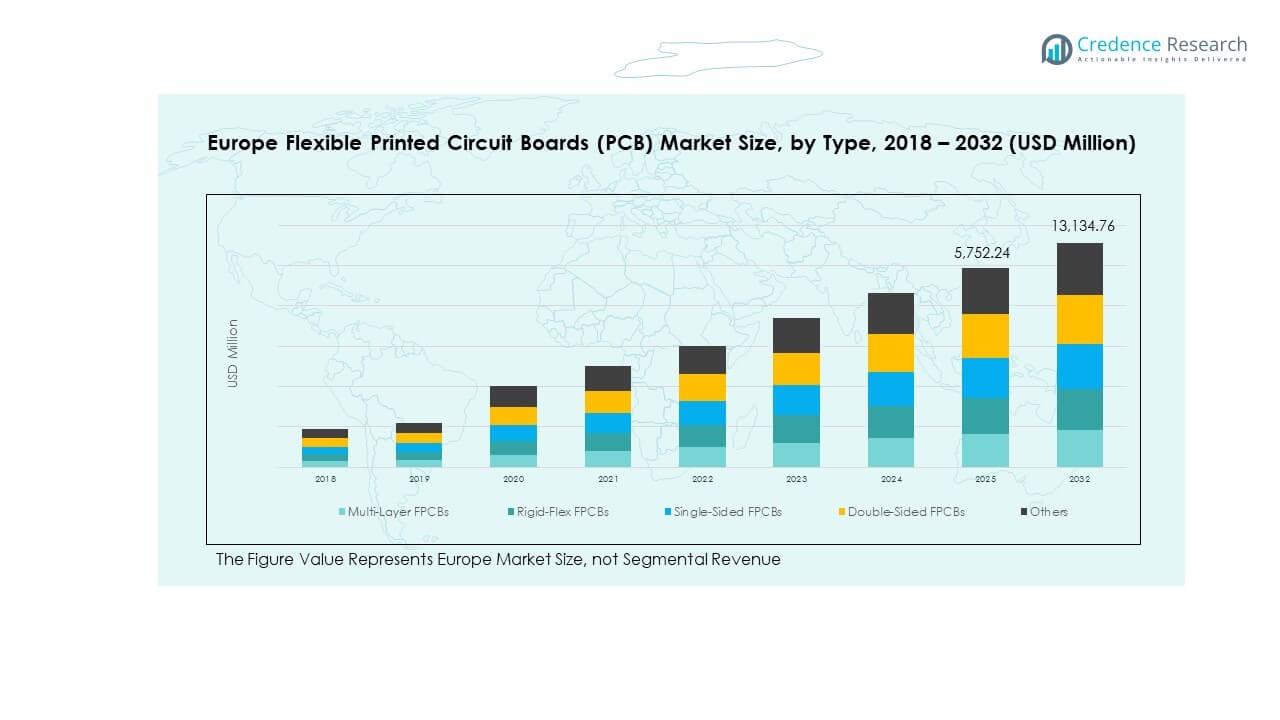

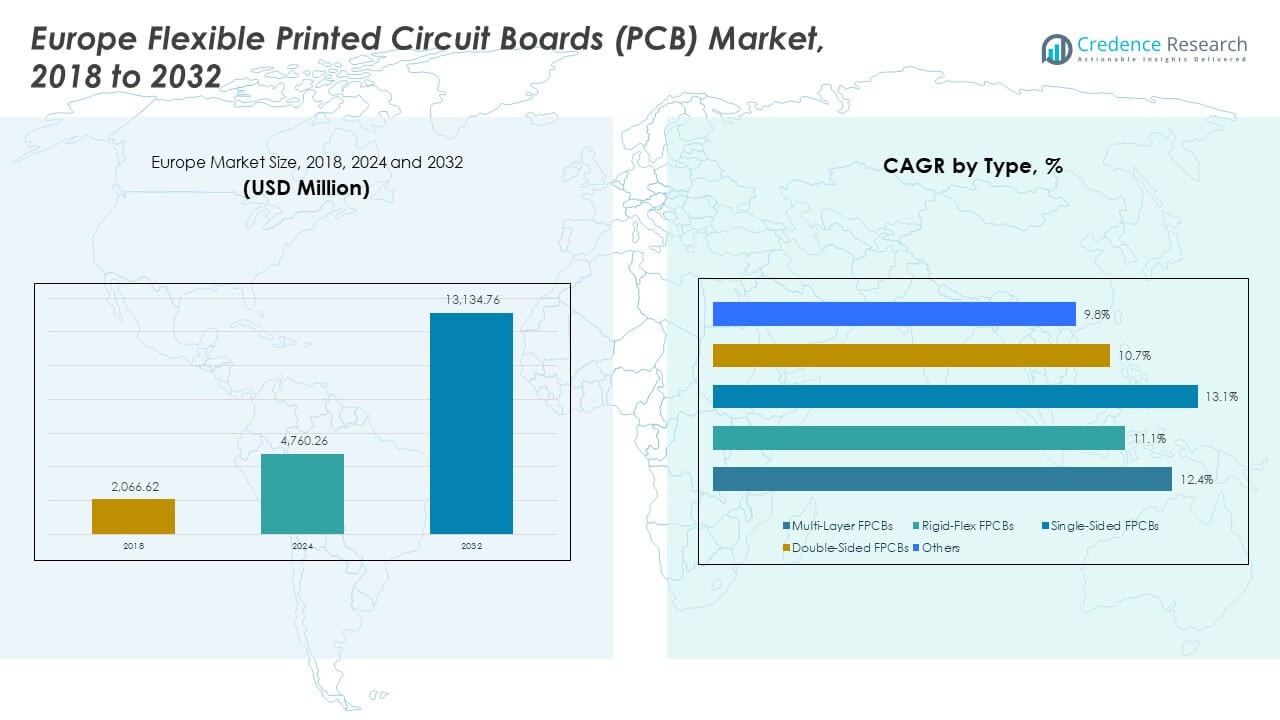

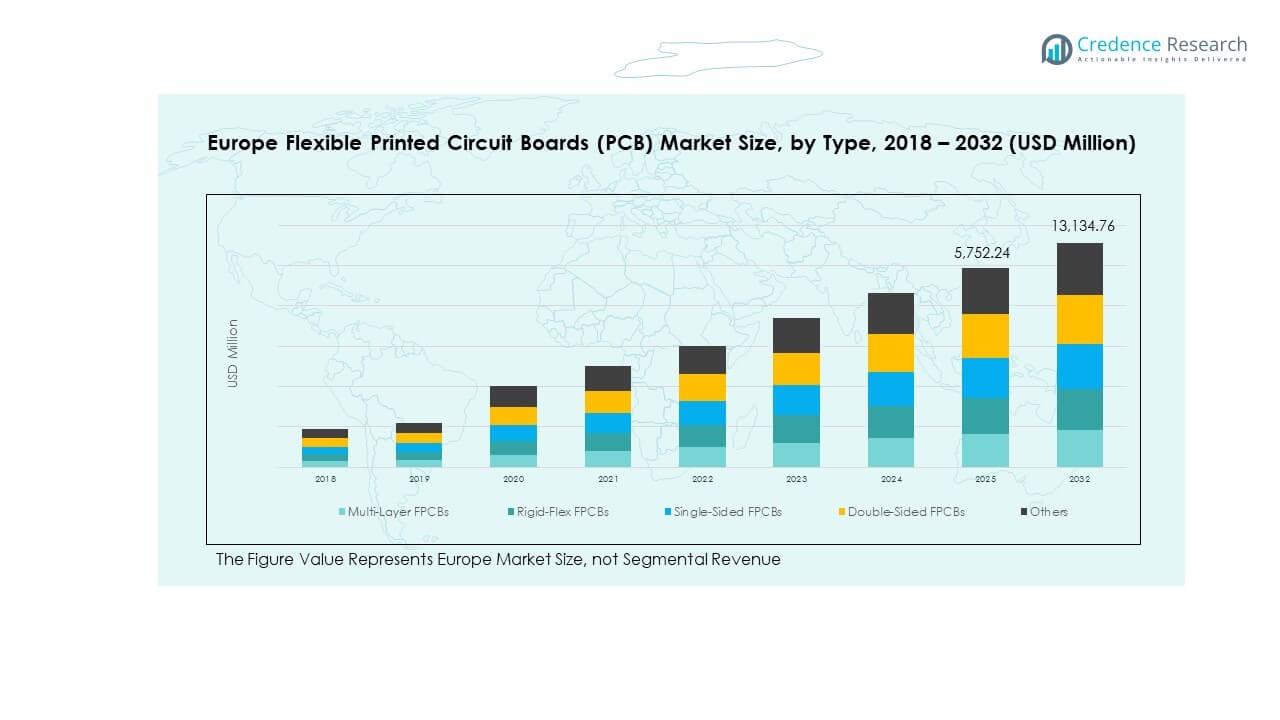

The Europe Flexible Printed Circuit Boards (PCB) Market size was valued at USD 2,066.62 million in 2018 to USD 4,760.26 million in 2024 and is anticipated to reach USD 13,134.76 million by 2032, at a CAGR of 12.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Flexible Printed Circuit Boards (PCB) Market Size 2024 |

USD 4,760.26 Million |

| Europe Flexible Printed Circuit Boards (PCB) Market, CAGR |

12.50% |

| Europe Flexible Printed Circuit Boards (PCB) Market Size 2032 |

USD 13,134.76 Million |

The market growth is driven by advancements in flexible electronics manufacturing and the increasing adoption of IoT-enabled devices. Rising demand for high-density interconnect (HDI) circuits in automotive safety systems and wearable technology is fueling adoption. Expanding production of electric vehicles and growing investment in 5G infrastructure also enhance the demand for durable, high-speed FPCBs. Continuous innovation in flexible substrates and enhanced reliability of multilayer designs strengthen their use in dynamic operating environments.

Regionally, Western Europe dominates the market, led by Germany, France, and the United Kingdom due to established automotive and electronics manufacturing ecosystems. Germany leads in FPCB demand, supported by major automotive OEMs and industrial automation companies. Meanwhile, Central and Eastern Europe are emerging as strong manufacturing hubs owing to low production costs and increasing foreign investments. Countries such as Poland and Hungary are witnessing rapid expansion of PCB assembly facilities to serve growing European electronics and EV markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Europe Flexible Printed Circuit Boards (PCB) Market was valued at USD 2,066.62 million in 2018 and is expected to reach USD 13,134.76 million by 2032, growing at a CAGR of 12.50% during the forecast period.

- Western Europe holds the largest market share at 46%, driven by advanced automotive and electronics industries in Germany, France, and the United Kingdom. Central Europe follows with 29% share, with countries like Poland and Hungary benefiting from cost-efficient manufacturing and strong electronics assembly capabilities.

- The fastest-growing region is Eastern Europe, with a 25% share, driven by increasing investment in industrial electronics, defense applications, and the expansion of local PCB production facilities in countries like Russia and Italy.

- Multi-layer FPCBs represent the largest segment in the market, contributing significantly to the overall market size. Rigid-flex FPCBs are also a prominent segment, with substantial demand across automotive and aerospace applications.

- The distribution of segments in 2024 shows multi-layer FPCBs accounting for the largest share, followed by rigid-flex FPCBs. Single-sided and double-sided FPCBs exhibit steady growth as they cater to consumer electronics and industrial applications.

Market Drivers:

Rising Adoption of Flexible Electronics in Automotive and Healthcare Applications

The Europe Flexible Printed Circuit Boards (PCB) Market benefits from increasing use of flexible electronics in automotive systems and medical devices. Automakers integrate FPCBs into sensors, infotainment modules, and driver assistance systems for lightweight and compact designs. Healthcare manufacturers use these boards in diagnostic imaging systems and wearable monitors to improve reliability and patient comfort. The rising adoption of electric vehicles drives more integration of power control and battery management circuits. Demand for enhanced connectivity and smart mobility solutions further fuels PCB deployment. It enables greater circuit density and durability under harsh conditions. The expanding need for precision electronics sustains demand across these sectors.

- For instance, BMW Group uses flexible PCBs in its advanced driver assistance systems (ADAS), improving sensor connectivity and signal transmission in compact automotive modules. In healthcare, companies like Medtronic integrate FPCBs in wearable glucose monitors, enhancing patient comfort and reliability while reducing device size.

Expansion of Miniaturized Consumer Electronics Across Europe

The market experiences steady growth due to the rising production of compact consumer electronics. Smartphones, tablets, and wearable devices rely on multilayer flexible PCBs for efficient performance in limited spaces. Manufacturers prioritize flexible circuits for their ability to withstand repeated mechanical stress without loss of functionality. The demand for thinner devices with higher data transfer rates accelerates design innovations in FPCBs. It drives adoption among OEMs seeking reduced assembly costs and improved energy efficiency. Advancements in 5G smartphones and IoT-connected devices also expand the usage scope. The strong consumer electronics manufacturing base across Germany and the Netherlands enhances the supply network.

- For instance, Apple Inc. is a prime example, utilizing multilayer flexible PCBs in its iPhones and wearables, including the Apple Watch, where compact, high-performance designs are critical. Manufacturers prioritize flexible circuits for their ability to withstand mechanical stress, evident in the Samsung Galaxy Fold, where FPCBs enable the flexible OLED display to withstand thousands of folds without losing performance.

Increasing Investments in Smart Manufacturing and Industrial Automation

Strong automation adoption across European industries fuels PCB demand for robotics and control systems. The integration of intelligent sensors and machine-to-machine communication platforms depends heavily on high-density interconnect circuits. Manufacturers employ FPCBs to improve signal reliability and flexibility in compact control modules. The growing preference for lightweight and bendable electronic components enables better space management in automation panels. It contributes to operational efficiency and precision control across factories. Expanding government initiatives promoting Industry 4.0 accelerate technology upgrades in European manufacturing facilities. This transition reinforces the need for flexible, durable, and high-speed electronic interconnects.

Advancement in High-Speed Communication and IoT Ecosystems

Europe’s strong focus on digital transformation supports the need for advanced interconnect technology. Rapid rollout of 5G networks and expansion of IoT applications stimulate FPCB adoption in telecom and data infrastructure. Manufacturers require flexible circuits to connect sensors, processors, and wireless modules efficiently. It helps maintain signal integrity and low latency in compact network devices. Demand for higher bandwidth communication hardware pushes investment in flexible multilayer designs. The expanding use of connected devices across logistics, healthcare, and smart cities also strengthens product demand. Continuous R&D in advanced materials enhances product efficiency and design adaptability.

Market Trends:

Emergence of Sustainable and Eco-Friendly PCB Manufacturing Processes

Sustainability trends reshape production standards across Europe’s electronics sector. Manufacturers are shifting toward halogen-free laminates and recyclable substrates to meet environmental regulations. It encourages innovation in biodegradable materials and low-emission manufacturing. The Europe Flexible Printed Circuit Boards (PCB) Market aligns with regional sustainability goals through cleaner production practices. Companies adopt waterless etching technologies and energy-efficient deposition systems to reduce waste. Demand from eco-conscious consumers supports supply chain transformation. This trend establishes Europe as a leader in environmentally responsible electronics manufacturing.

- For instance, Panasonic adopted a halogen-free PCB technology in its automotive applications, minimizing harmful substances while maintaining durability. Schneider Electric has also integrated eco-friendly manufacturing processes in its flexible circuit production, using waterless etching to reduce waste.

Integration of Advanced Materials and Layer Structures for Performance Enhancement

The market is witnessing a shift toward advanced materials that enhance conductivity and mechanical stability. Polyimide and polyester films dominate due to superior flexibility and heat resistance. Emerging designs incorporate copper-clad laminates and nanocomposite coatings for higher reliability. It enables improved circuit strength under extreme temperature and vibration. Manufacturers explore hybrid structures that combine rigid and flexible segments for multifunctional applications. These innovations enhance design precision in automotive and aerospace electronics. Growing R&D initiatives from regional PCB producers accelerate adoption of such technologies.

Increased Adoption of 3D and Additive Manufacturing in PCB Fabrication

Rapid advances in 3D printing technologies are revolutionizing FPCB prototyping and production. Additive manufacturing allows complex layer customization and shorter design cycles. The trend supports small-batch and high-mix production for European electronics companies. It promotes localized manufacturing and reduces dependence on imports. The Europe Flexible Printed Circuit Boards (PCB) Market benefits from this cost-efficient model, offering agility to meet evolving customer needs. 3D techniques enhance trace alignment, reducing circuit weight while improving conductivity. This transition marks a new phase in precision electronic fabrication.

Growing Focus on Miniaturization and Multi-Functional Device Integration

Electronic product designers demand components that combine functionality with compactness. Manufacturers produce thinner flexible boards capable of supporting higher circuit density. It allows device makers to integrate wireless, optical, and power modules into a single layout. The miniaturization trend is prominent across wearables, aerospace control systems, and automotive electronics. FPCBs enable high reliability in confined assemblies while maintaining mechanical endurance. Companies invest in fine-pitch interconnects and embedded components for next-generation products. Continuous innovation in photolithography and precision etching drives this transition.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Processes

The Europe Flexible Printed Circuit Boards (PCB) Market faces cost pressures due to sophisticated production stages. Complex lamination and precision alignment processes increase material wastage and equipment maintenance costs. High investment requirements in cleanroom facilities and advanced fabrication tools restrict smaller manufacturers. It challenges scalability and profitability in a competitive environment. The dependency on imported raw materials such as copper foil and polyimide films further raises costs. Fluctuations in supply chain availability influence pricing stability across European suppliers. Manufacturers must adopt automation to reduce labor and operational expenses. Limited access to skilled technicians for advanced PCB assembly adds to the challenge.

Stringent Environmental Regulations and Technological Standardization Issues

European regulations governing electronic waste and chemical emissions demand strict compliance from manufacturers. The need for RoHS and REACH certification extends development timelines and increases documentation requirements. It limits flexibility for smaller firms adapting to changing norms. Lack of uniform standards across member countries also complicates design validation and testing. Rapid technological shifts in circuit density and substrate composition add another complexity layer. Companies must balance innovation with environmental and technical conformity. Adapting to multiple national and EU-level regulations increases overall production costs. This regulatory intensity often delays new product rollouts.

Market Opportunities:

Expansion of Electric Vehicles and Renewable Energy Systems

The growing transition toward electric mobility offers vast growth potential for FPCB producers. Automakers use flexible circuits in battery management, charging interfaces, and control modules to optimize vehicle performance. The Europe Flexible Printed Circuit Boards (PCB) Market benefits from government incentives supporting EV manufacturing and green energy infrastructure. It creates new opportunities for suppliers to deliver high-temperature, durable circuit solutions. Integration of renewable energy monitoring systems also expands PCB application scope. Investments in EV charging networks further strengthen market prospects.

Rising Adoption of Flexible Circuits in Medical and Wearable Devices

The European healthcare sector increasingly relies on flexible circuits to enable miniaturized, patient-centric devices. FPCBs are vital in diagnostics, biosensors, and implantable devices due to their lightweight and biocompatible properties. It helps medical firms develop efficient, flexible designs that improve accuracy and durability. Rising consumer focus on preventive care accelerates demand for wearable health trackers. The ongoing digitalization of healthcare systems supports continuous innovation in flexible circuit design. This expansion establishes long-term opportunities for PCB manufacturers targeting medical electronics.

Market Segmentation Analysis:

By Type

The Europe Flexible Printed Circuit Boards (PCB) Market is segmented into multi-layer, rigid-flex, single-sided, double-sided, and others. Multi-layer FPCBs hold the leading share owing to their use in compact, high-performance electronics across automotive, aerospace, and telecommunications sectors. Rigid-flex FPCBs gain traction for their reliability and mechanical stability in advanced industrial systems. Single and double-sided boards serve cost-sensitive consumer and industrial electronics applications that require simple circuit layouts. It benefits from continuous advancements in copper-clad materials and heat-resistant polymers. Manufacturers focus on flexible multilayer architectures to support miniaturization, higher data speed, and enhanced design flexibility.

- For instance, Tesla integrates multi-layer flexible PCBs in its battery management systems, enhancing energy efficiency and reducing weight in its electric vehicles. Rigid-flex FPCBs are gaining momentum for their mechanical stability and reliability, especially in complex systems.

By End Use

By end use, the market is classified into industrial electronics, aerospace and defense, IT and telecom, automotive, consumer electronics, and others. Automotive and consumer electronics collectively account for a major revenue share due to demand for lightweight, flexible interconnects in infotainment and power modules. IT and telecom applications continue to expand with rising 5G adoption and data transmission needs. Aerospace and defense utilize high-reliability circuits for sensors and communication systems. Industrial electronics adopt FPCBs for automation and smart manufacturing control systems. It gains additional strength from rapid growth in wearable and IoT-enabled consumer devices across Europe.

- For instance, Volkswagen uses flexible FPCBs in its electric vehicles’ power and infotainment systems, enabling more compact designs and higher system reliability. IT and telecom applications are expanding, driven by the demand for higher-speed data transmission, with companies like Ericsson adopting flexible PCBs in their 5G base stations for efficient signal processing and reduced system size.

Segmentation:

By Type

- Multi-Layer FPCBs

- Rigid-Flex FPCBs

- Single-Sided FPCBs

- Double-Sided FPCBs

- Others

By End Use

- Industrial Electronics

- Aerospace & Defense

- IT & Telecom

- Automotive

- Consumer Electronics

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Western Europe Leading the Market Landscape

Western Europe dominates the Europe Flexible Printed Circuit Boards (PCB) Market with nearly 46% share, driven by strong automotive and electronics manufacturing clusters. Germany anchors this dominance through its advanced automotive ecosystem and high concentration of PCB producers. France and the United Kingdom contribute significantly due to ongoing digital transformation and high adoption of 5G and IoT technologies. The region benefits from robust R&D infrastructure, established semiconductor supply chains, and a high focus on miniaturized consumer devices. It leverages design innovation and high-end production standards to maintain a leadership position. Strong collaboration between OEMs and component manufacturers sustains technological advancement.

Central Europe Expanding as a Manufacturing Hub

Central Europe holds around 29% of the market share, supported by growing industrial automation and increased investment in electronics assembly. Poland, Hungary, and the Czech Republic are becoming preferred manufacturing locations due to lower production costs and skilled labor availability. The region is witnessing rapid expansion of flexible circuit manufacturing facilities to cater to Western European OEMs. It benefits from strategic proximity to major automotive and industrial centers, enabling quick supply chain turnaround. Government-backed programs promoting industrial digitization strengthen its competitive position. Rising foreign direct investment in electronics and EV component manufacturing continues to enhance regional capacity.

Southern and Eastern Europe Emerging with Niche Growth

Southern and Eastern Europe collectively capture about 25% of the total market, reflecting gradual adoption of advanced PCB technologies. Italy and Spain contribute through consumer electronics and telecommunication infrastructure development. Russia and other Eastern European nations are investing in local production facilities to reduce import dependency. It shows growing potential in defense electronics, renewable energy systems, and industrial control applications. Expanding demand for cost-efficient flexible circuits from domestic manufacturers drives steady growth. The improving logistics network and access to EU-supported industrial funds further accelerate technology adoption across these regions.

Key Player Analysis:

- Samsung Electro-Mechanics

- NOK Corporation

- Flex Ltd.

- Jabil Inc.

- Fujikura Ltd.

- Multi-Fineline Electronix, Inc. (MFLEX)

- Sumitomo Electric Industries, Ltd.

- TTM Technologies

- Nippon Mektron Ltd.

- Zhen Ding Technology Holding Ltd.

Competitive Analysis:

The Europe Flexible Printed Circuit Boards (PCB) Market features intense competition driven by innovation, material advancements, and strategic partnerships. It is dominated by global and regional players focusing on automotive, consumer electronics, and industrial applications. Leading firms such as Samsung Electro-Mechanics, Flex Ltd., Jabil Inc., Fujikura Ltd., and NOK Corporation maintain strong positions through product diversification and R&D investment. Companies are expanding multilayer and rigid-flex product portfolios to meet demand for miniaturized, high-reliability circuits. Continuous development in flexible substrates and signal integrity solutions defines the competitive edge. The market reflects a balanced presence of established manufacturers and emerging local producers adopting advanced fabrication technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on type and end-use segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Multi-layer and rigid-flex FPCBs will continue leading due to demand from advanced electronics.

- Automotive and consumer electronics applications will expand rapidly across Europe.

- Rising EV production will create new opportunities for flexible interconnect technologies.

- Investments in 5G and IoT infrastructure will boost telecom-based FPCB adoption.

- Integration of eco-friendly materials will shape future production practices.

- Local manufacturing expansion in Central Europe will reduce import dependency.

- Technological innovation in ultra-thin and high-speed designs will improve performance.

- Medical wearables and diagnostic devices will become strong growth contributors.

- Ongoing R&D partnerships between OEMs and PCB manufacturers will enhance design quality.

- The market will see steady consolidation through mergers and capacity expansions across key economies.