Market Overview:

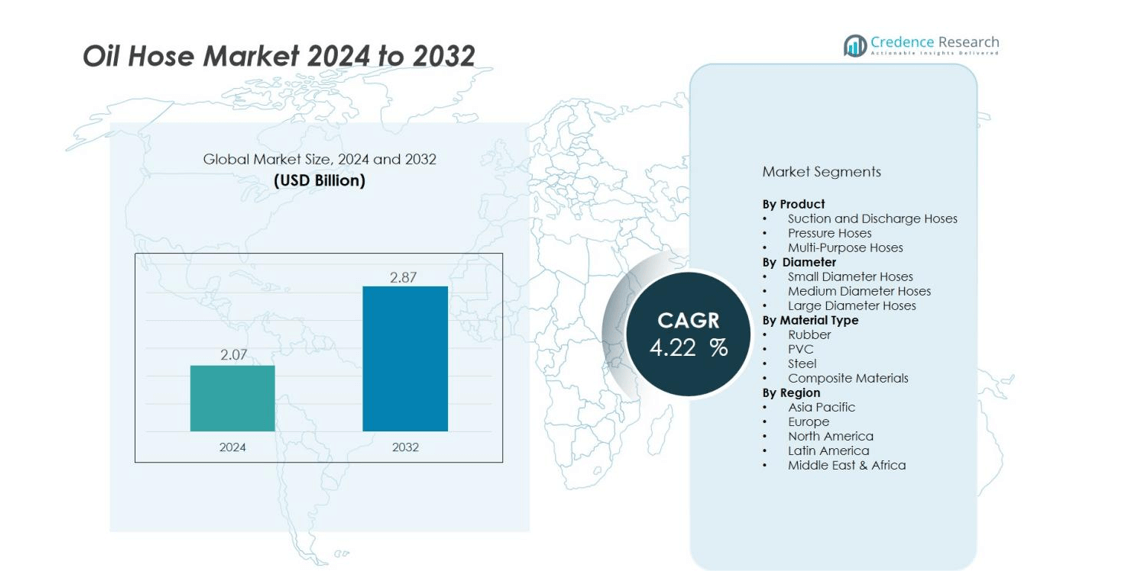

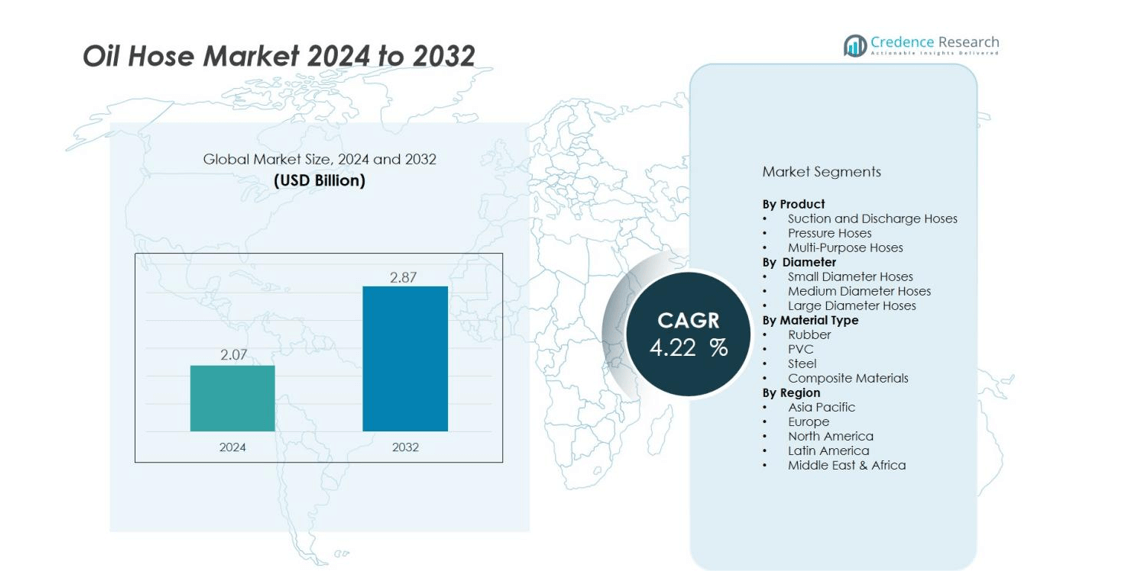

The Oil Hose Market size was valued at USD 2.07 billion in 2024 and is anticipated to reach USD 2.87 billion by 2032, at a CAGR of 4.22 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Oil Hose Market Size 2024 |

USD 2.07 billion |

| Oil Hose Market, CAGR |

4.22% |

| Oil Hose Market Size 2032 |

USD 2.87 billion |

Key drivers of the market include rising global oil and gas exploration and production activities, particularly in offshore and deep-water fields, which drive demand for high-performance hoses capable of handling extreme pressures and harsh environments. Additionally, stricter safety and environmental standards are pushing manufacturers toward advanced materials and smart-monitoring hose systems, enhancing reliability and lifespan for end-users.

Regionally, Latin America currently dominates the oil hose market due to abundant oil reserves in countries such as Brazil and Venezuela. The Middle East & Africa also hold significant share driven by petroleum-rich nations. Meanwhile, Asia Pacific is poised for the highest growth rate, supported by expanding oil and gas infrastructure, rising energy demand, and industrialization in countries such as China and India.

Market Insights:

- The Oil Hose Market was valued at USD 2.07 billion in 2024 and is expected to reach USD 2.87 billion by 2032, growing at a CAGR of 4.22% during the forecast period.

- North America holds the largest market share at 35%, driven by significant offshore reserves and investments in exploration and production technologies.

- Asia-Pacific, accounting for 30% of the market share, is the fastest-growing region due to rapid industrialization and rising energy demand in China and India.

- Europe and the Middle East together hold 25% of the market share, with growth fueled by offshore projects in the North Sea and petroleum-rich regions in the Middle East.

- In terms of product type, suction and discharge hoses dominate, followed by pressure hoses. Rubber and composite materials are the most widely used in the Oil Hose Market, with a large portion of the market driven by their flexibility and strength.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increased Oil and Gas Exploration Activities

One of the major drivers of the Oil Hose Market is the continuous growth in global oil and gas exploration activities. With the demand for energy increasing, oil producers are focusing on new exploration sites, particularly in offshore and deep-water reserves. This shift to more challenging environments requires robust and reliable hose solutions capable of handling extreme pressures, temperatures, and corrosive conditions. The need for specialized hoses in these settings pushes the demand for advanced, high-quality products within the market.

- For Instance, BP utilizes AI and digital technologies in its exploration and production operations and made 12 discoveries in 2025, including the Bumerangue find offshore Brazil. The Bumerangue discovery in the deepwater Santos Basin is described as one of BP’s largest in 25 years

Strict Environmental and Safety Regulations

Stringent environmental and safety regulations are fueling the growth of the Oil Hose Market. Governments and industry regulators are implementing tighter standards to ensure the safe transfer of petroleum products, particularly in offshore and subsea environments. Compliance with these regulations requires the use of hoses that can withstand various environmental stressors, such as pressure fluctuations, temperature extremes, and chemical exposure. The adoption of safety-focused hoses designed for specific applications is therefore becoming a critical factor in the market’s expansion.

- For Instance, Dunlop Oil & Marine did produce API 17K certified hoses, specific confirmation of the 25-year design life and 30-inch maximum bore for that particular product line is missing from reliable public sources.

Technological Advancements in Hose Manufacturing

Technological advancements in hose materials and manufacturing techniques are significantly driving the Oil Hose Market. Innovations in hose construction, such as the use of high-performance synthetic rubbers and composite materials, improve the durability and flexibility of hoses. These developments enhance hose longevity, reduce maintenance needs, and enable better performance in complex oil transfer operations. The focus on smarter, more durable hose technologies aligns with growing market demand for efficient, reliable fluid transfer systems in the oil and gas industry.

Expansion of Oil and Gas Infrastructure in Emerging Markets

The expansion of oil and gas infrastructure in emerging markets is a key driver of the Oil Hose Market. Rapid industrialization, particularly in countries like India and China, is increasing demand for oil and gas, thus necessitating the development of supporting infrastructure. As these markets expand, they require a more extensive range of hoses for various applications, from drilling operations to transportation systems. The construction of new refineries, pipelines, and storage facilities in these regions further drives the demand for specialized oil hoses.

Market Trends:

Adoption of Advanced Materials and Sensor‑Enabled Systems

Manufacturers in the Oil Hose Market keep replacing conventional rubbers with polymers, composites and elastomers built for higher pressures and harsher environments. They install sensors and smart monitoring modules into hose assemblies to guard against leaks, fatigue and operational failures. Buyers now demand products that offer predictive maintenance capability, longer service life and minimal downtime. The shift to real‑time data collection within hose systems drives premium pricing and differentiation. Suppliers respond by co‑designing solutions with end‑users in upstream and mid‑stream oil operations.

- For Instance, Certain high-pressure hydraulic hoses manufactured by companies like those under the Dunlop Hiflex brand incorporate four to six spiral layers of high-tensile steel wire reinforcement, achieving maximum working pressures in the range of 400 to over 450 bar (around 6,000 psi or more), enabling deployment in extreme downstream and offshore applications

Growing Focus on Sustainability and Lifecycle Efficiency

The Oil Hose Market witnesses a growing emphasis on sustainable production and lifecycle management of hose systems. Manufacturers launch recyclable hoses and eco‑friendly elastomers that reduce environmental impact while meeting safety standards. End‑users favour hose systems that reduce energy consumption, lower maintenance costs and extend replacement intervals. Lifecycle cost becomes a key decision metric rather than just initial purchase price. This trend encourages greater collaboration among material scientists, hose producers and end operators to embed sustainability in design and use.

- For Instance, TRICOFLEX produces Irriflex and Primabel hoses using up to 70% recycled PVC, making them 100% recyclable, according to company information.

Market Challenges Analysis:

Fluctuating Raw Material Prices and Supply Chain Disruptions

The Oil Hose Market faces significant challenges due to volatile raw material prices and disruptions in global supply chains. Many oil hoses require high-performance polymers and composite materials, which are subject to price fluctuations. The increasing demand for these materials often leads to shortages and delays, impacting manufacturing timelines. Suppliers struggle to maintain cost efficiency while meeting the demand for high-quality hoses. Such instability poses difficulties for both manufacturers and end-users, leading to increased production costs and potential project delays in the oil and gas sector.

Complex Regulatory Compliance and Standards

Complying with evolving safety, environmental, and industry regulations is another key challenge for the Oil Hose Market. Regulations regarding offshore oil extraction, petroleum transport, and chemical exposure are continuously becoming stricter. This requires manufacturers to continuously upgrade their product offerings to meet new safety and environmental standards. However, the process of redesigning products to ensure compliance can be costly and time-consuming. Failure to adhere to these regulations could lead to severe penalties and reputational damage for manufacturers, further complicating the market landscape.

Market Opportunities:

Expansion in Emerging Markets Driving Demand for Infrastructure

The Oil Hose Market holds significant growth potential in emerging economies where rapid industrialization and infrastructure expansion are underway. Countries in Asia-Pacific, Africa, and Latin America are increasing their investment in oil and gas infrastructure, including exploration, production, and transportation facilities. This expansion creates a demand for reliable and high-performance hoses that can withstand diverse environmental conditions. Manufacturers have the opportunity to cater to these markets by offering customized solutions tailored to local needs, positioning themselves as key suppliers in these rapidly growing regions.

Technological Advancements in Hose Solutions for Enhanced Performance

The Oil Hose Market is set to benefit from advancements in hose manufacturing technologies, including the development of smart, sensor-enabled hoses. These innovations allow for real-time monitoring of hose conditions, reducing the risk of failure and increasing operational efficiency. As operators prioritize safety and cost-efficiency, the demand for these advanced solutions rises. Manufacturers have a chance to capitalize on this trend by offering high-tech hose products with extended lifecycles, predictive maintenance capabilities, and improved environmental resistance. This trend presents a strong opportunity to differentiate products in a competitive market.

Market Segmentation Analysis:

By Product

The Oil Hose Market is segmented by product type, which includes suction and discharge hoses, pressure hoses, and multi-purpose hoses. Suction and discharge hoses dominate the market due to their critical role in transporting oil and gas in offshore and onshore operations. Pressure hoses, used in high-pressure applications, are seeing increased demand in deep-water exploration projects. Multi-purpose hoses, which can be used for a variety of oil and gas transport needs, are popular among operators seeking flexibility. Each product type caters to specific operational requirements, contributing to the overall market growth.

- For Instance, Eaton’s Kevlar-reinforced PTFE high-pressure hose assemblies, such as the AE319 series, offer minimum room temperature burst pressures of 16,000 psi and maximum operating capacities of 4,000 psi for most sizes from -4 through -12.

By Material Type

The market is also segmented by material type, including rubber, PVC, steel, and composite materials. Rubber hoses, particularly those reinforced with steel wire, are the most commonly used due to their flexibility and resistance to extreme conditions. Steel hoses are favored in high-pressure applications for their durability and strength. Composite hoses, made from a blend of materials like fiberglass and thermoplastics, are gaining traction due to their lightweight properties and resistance to corrosion. The choice of material influences hose performance and lifespan, driving demand for more advanced and durable options.

- For instance, Gates Corporation’s MegaSys™ MXG 4K hydraulic hose demonstrates this advancement, offering a 4,000 psi (pounds per square inch) constant pressure rating while being 30% lighter than comparable conventional hoses.

By Diameter

The Oil Hose Market is segmented by diameter, ranging from small to large. Smaller diameter hoses, typically used in low-volume transport or transfer applications, have steady demand in refineries and small-scale operations. Larger diameter hoses are required for high-volume transportation in offshore drilling and pipeline systems, where oil needs to be moved efficiently over long distances. The growth of offshore and deep-water exploration is driving increased demand for larger diameter hoses capable of handling significant fluid volumes.

Segmentations:

By Product

- Suction and Discharge Hoses

- Pressure Hoses

- Multi-Purpose Hoses

By Material Type

- Rubber

- PVC

- Steel

- Composite Materials

By Diameter

- Small Diameter Hoses

- Medium Diameter Hoses

- Large Diameter Hoses

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America – Leading Market for Oil Hose Solutions

North America holds a dominant position in the Oil Hose Market, accounting for 35% of the global share in 2024. The market in this region is driven by the continuous expansion of oil and gas production activities, particularly in the U.S. and Canada. The presence of vast offshore reserves and significant investments in exploration and production technologies boosts the demand for durable and high-performance oil hoses. Stringent safety regulations in North America also support the growth of advanced hose solutions designed for high-pressure and extreme environments. With the ongoing push for sustainable energy and the development of hydraulic fracturing, North America remains a key player in the market.

Asia-Pacific – Rapid Growth Driven by Industrialization

Asia-Pacific is the fastest-growing region in the Oil Hose Market, holding 30% of the market share in 2024. The region’s rapid industrialization, particularly in countries like China and India, is driving the demand for oil hoses in exploration, extraction, and transportation. Rising investments in energy infrastructure and oil and gas exploration, along with increasing energy consumption, support the expansion of the oil hose market. As the region continues to focus on expanding its oil reserves and refining capabilities, the need for robust, high-performance hoses becomes critical, offering significant growth opportunities for manufacturers in Asia-Pacific.

Europe and Middle East – Strong Demand for Offshore and Onshore Projects

Europe and the Middle East account for 25% of the global Oil Hose Market share in 2024. In Europe, the market growth is primarily driven by offshore oil and gas exploration, particularly in the North Sea. The Middle East, with its vast oil reserves, is witnessing substantial investments in extraction and transportation infrastructure, further propelling the demand for specialized hoses. With growing regulations and an increased focus on safety and environmental standards, both regions require advanced hose solutions that can withstand extreme conditions, contributing to the steady growth of the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The market features several prominent players including Horizon Hose, Parker Hannifin Corporation, Goodyear Rubber Products, Dunlop Hiflex, and ZEC S.p.A.. Parker Hannifin holds a global leadership position by leveraging its broad product portfolio and deep engineering capabilities. ZEC S.p.A. serves niche high‑pressure thermoplastic hose segments and differentiates through lightweight solutions. Goodyear Rubber Products focuses on hose fabrication and distribution, enabling strong regional reach and customization. Horizon Hose competes through cost‑effective offerings geared to transfer and suction applications. Dunlop Hiflex emphasizes system solutions for oil & gas, mining and offshore sectors, strengthening its value proposition. Overall, players compete through material innovation, service support and global footprint. The market rewards suppliers who deliver durability, regulatory compliance and tailored diameter or pressure specifications. It favors those who integrate sensor‑enabled monitoring or advanced composites. Price competition remains intense, yet manufacturers who shift toward premium segments maintain higher margins. This competitive landscape ensures evolving technology and differentiation define success within the oil hose market.

Recent Developments:

- In November 2025, Parker Hannifin Corporation announced its acquisition of Filtration Group Corporation for $9.25 billion, aiming to expand Parker’s filtration and aftermarket offerings.

- In September 2025, Parker Hannifin completed the acquisition of Curtis Instruments, a leader in motor speed controllers and electrification components, for approximately $1 billion in cash.

Report Coverage:

The research report offers an in-depth analysis based on Product, Material Type, Diameter and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The future of the Oil Hose Market appears promising, with several key trends and developments shaping its growth.

- Advancements in materials science will lead to more durable, lightweight, and corrosion-resistant hoses.

- Increasing demand for deep-water exploration will drive the need for high-performance hoses capable of withstanding extreme pressure and environmental conditions.

- The growth of offshore and subsea oil and gas exploration projects will significantly boost demand for specialized hoses.

- Smart hoses with integrated sensors for real-time monitoring will become more common, improving safety and maintenance efficiency.

- Manufacturers will focus on expanding their product offerings to cater to the growing demand from emerging markets in Asia-Pacific, Latin America, and Africa.

- The rise of eco-friendly materials and recyclable hoses will play a crucial role in addressing environmental concerns and meeting regulatory standards.

- Technological innovations in hose manufacturing, including 3D printing and automation, will lead to improved production efficiency.

- The demand for multi-purpose hoses across various applications, including drilling, refining, and transportation, will continue to rise.

- Regulatory pressure on safety standards will encourage manufacturers to develop hoses that offer better leak prevention and enhanced durability.

- The increasing trend of digitalization in the oil and gas industry will drive further innovation and integration of advanced hose technologies.