Market Overview

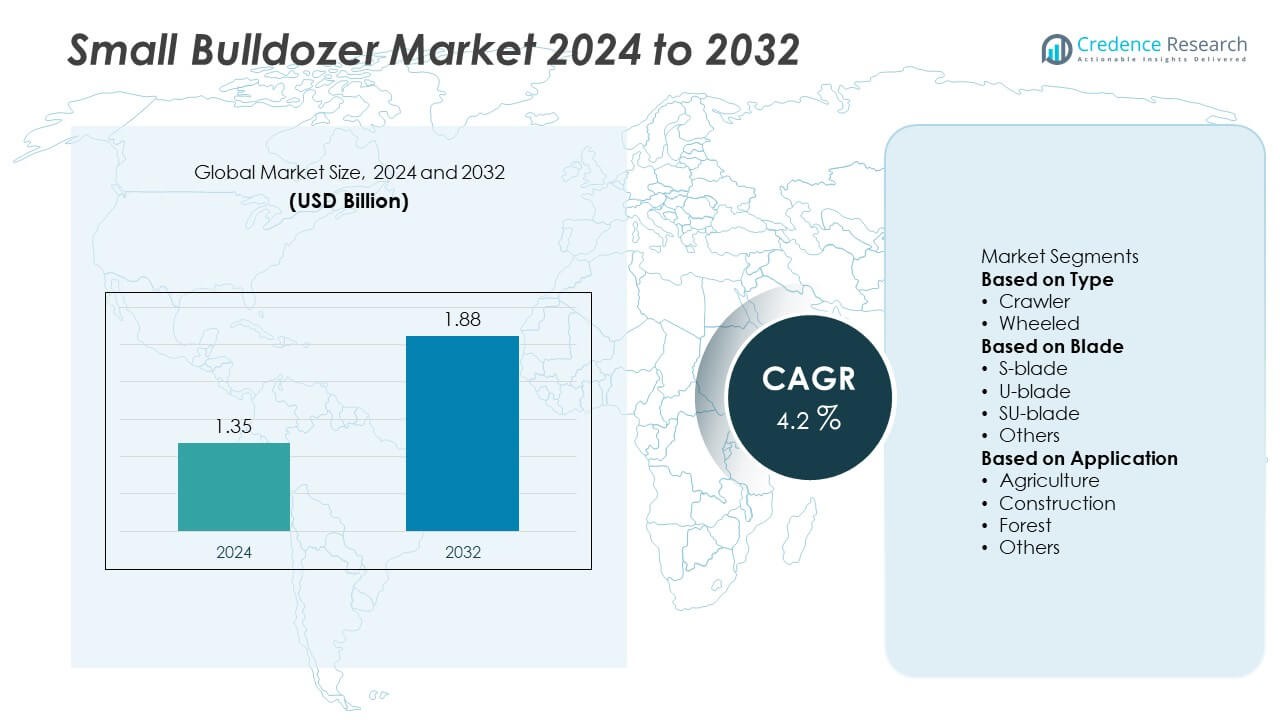

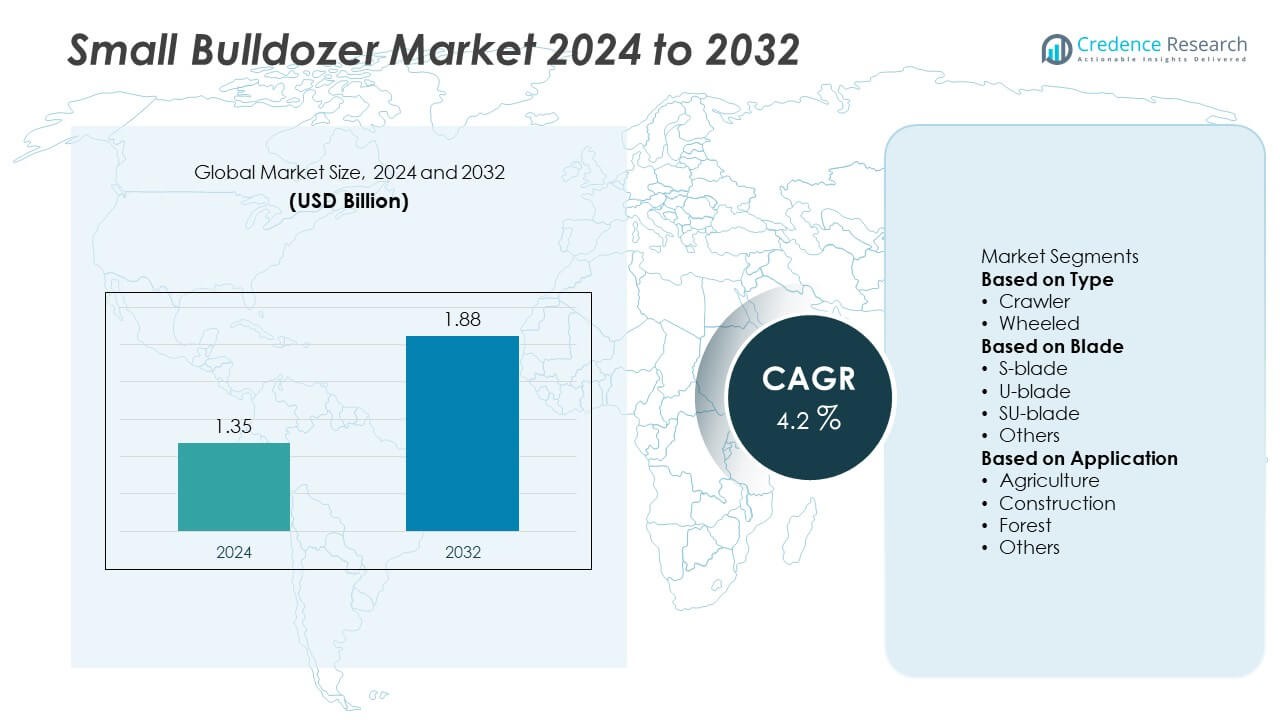

The Small Bulldozer Market was valued at USD 1.35 billion in 2024 and is projected to reach USD 1.88 billion by 2032, registering a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Small Bulldozer Market Size 2024 |

USD 1.35 Billion |

| Small Bulldozer Market, CAGR |

4.2% |

| Small Bulldozer Market Size 2032 |

USD 1.88 Billion |

The Small Bulldozer Market is led by major players including Caterpillar Inc., Komatsu Ltd., Deere & Company, Liebherr Group, CNH Industrial N.V., Shantui Construction Machinery Co., Ltd., Doosan Infracore Co., Ltd., Volvo Construction Equipment, Guangxi Liugong Machinery Co., Ltd., and XCMG Construction Machinery Co., Ltd. These companies dominate through continuous innovation, robust global distribution, and efficient equipment designs optimized for compact construction and agricultural applications. North America held the largest market share of 36.7% in 2024, driven by extensive infrastructure modernization and equipment replacement cycles. Asia-Pacific followed with a 34.5% share, supported by rapid urbanization and government investments in rural development, while Europe accounted for 19.8%, propelled by sustainable construction practices and growing adoption of energy-efficient machinery.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Small Bulldozer Market was valued at USD 1.35 billion in 2024 and is projected to reach USD 1.88 billion by 2032, growing at a CAGR of 4.2% during the forecast period.

- Rising demand for compact and fuel-efficient earthmoving machinery in construction and agriculture sectors drives market growth, with crawler-type bulldozers leading the segment with a 62.4% share in 2024.

- Market trends include increasing adoption of electric and hybrid bulldozers, integration of GPS-based control systems, and automation for precision grading.

- Leading players such as Caterpillar, Komatsu, and Liebherr focus on technological innovation, strategic partnerships, and regional manufacturing expansion to strengthen their market presence.

- North America held the largest share at 36.7%, followed by Asia-Pacific at 34.5% and Europe at 19.8%, driven by infrastructure development, smart construction initiatives, and rising investment in compact equipment for urban and rural projects.

Market Segmentation Analysis:

By Type

The crawler segment dominated the small bulldozer market in 2024 with a 63.4% share. Crawler bulldozers provide high traction and stability on uneven or soft terrains, making them ideal for construction, agriculture, and forestry applications. Their superior pushing power and ability to operate in confined spaces support demand across infrastructure and land-clearing projects. The wheeled bulldozer segment is growing steadily due to its mobility and lower maintenance requirements, appealing to urban construction and road maintenance tasks where quick maneuverability is prioritized.

- For instance, Caterpillar Inc. developed its D3 crawler bulldozer with a 104-horsepower Cat C3.6 engine and a typical operating weight of around 9,362 kg (20,640 lbs), featuring the Cat Stable Blade™ and Slope Assist™ systems that aid in maintaining grade, ensuring high-quality results on job sites.

By Blade

The SU-blade segment held the largest share of 41.2% in 2024, driven by its versatility in heavy-duty applications such as leveling and material pushing. Combining the benefits of straight and universal blades, SU-blades provide optimal load retention and effective soil handling. Their adoption in road construction, land grading, and mining sites continues to increase. Meanwhile, S-blade bulldozers are gaining traction for fine grading and precision work, while U-blade variants are used in large-scale earthmoving projects requiring high material capacity.

- For instance, Komatsu Ltd. equipped its D71EX-24 crawler dozer with a 4.2 m³ SU-blade and a Tier 4 Final 179-kW engine, enabling precise dozing and automatic load control through its Intelligent Machine Control 2.0 (IMC 2.0) platform, enhancing blade fill accuracy and operator efficiency in mid-size construction operations.

By Application

The construction segment led the small bulldozer market in 2024 with a 47.6% share, supported by infrastructure development, road expansion, and urban renewal projects. Small bulldozers are increasingly deployed for grading, site preparation, and landscaping tasks in confined city environments. The agriculture segment follows, driven by their use in field leveling, land clearing, and farm development. Forestry applications are expanding as small bulldozers are used for logging trails and soil preparation. Growing mechanization across rural economies continues to strengthen demand across diverse applications.

Key Growth Drivers

Infrastructure Development and Urbanization

Rapid infrastructure development and urban expansion are major drivers of the small bulldozer market. Governments across developing economies are investing heavily in road construction, housing, and industrial projects. Small bulldozers are preferred for grading, backfilling, and site preparation in tight urban areas where maneuverability is essential. Increasing demand for compact construction machinery suited for confined worksites continues to drive sales. Public and private infrastructure initiatives, such as smart city projects and rural connectivity programs, further boost equipment adoption.

- For instance, Volvo Construction Equipment launched the DD25 Electric compact dozer with a 48-volt lithium-ion battery system providing up to 4 hours of continuous operation and zero on-site emissions, specifically designed for urban infrastructure development and noise-restricted zones.

Growing Mechanization in Agriculture and Forestry

Expanding agricultural mechanization is enhancing the use of small bulldozers for land clearing, soil preparation, and irrigation construction. Farmers and forestry operators are adopting compact bulldozers to improve productivity and reduce manual labor. Their versatility in leveling fields, managing slopes, and creating access paths strengthens their demand in rural regions. Rising investments in agricultural infrastructure and government subsidies for farm equipment purchases continue to support steady market growth in this sector.

- For instance, Shantui Construction Machinery Co., Ltd. introduced its SD16TL wetland bulldozer, featuring a 120-horsepower Weichai engine and extended 920 mm track shoes for improved flotation in soft soil, enabling efficient paddy field preparation and forestry land clearing across humid agricultural zones.

Advancements in Equipment Design and Efficiency

Technological innovations in small bulldozer design, including improved engines, hydraulic systems, and operator comfort, are fueling market expansion. Modern models feature GPS-based guidance, telematics, and fuel-efficient powertrains that enhance operational precision and reduce emissions. Compact, energy-efficient bulldozers designed for varied terrain use are gaining traction in both developed and emerging markets. Manufacturers are focusing on integrating digital monitoring systems for predictive maintenance, improving machine uptime and reducing operating costs for end users.

Key Trends & Opportunities

Adoption of Electric and Hybrid Bulldozers

The market is witnessing a gradual shift toward electric and hybrid small bulldozers due to growing environmental regulations and sustainability goals. These models offer reduced fuel consumption, lower noise levels, and minimal emissions. Leading manufacturers are investing in alternative energy powertrains and battery-based systems to enhance eco-efficiency. Rising focus on green construction and emission-free job sites is expected to accelerate the adoption of electric-powered compact bulldozers in urban projects and environmentally sensitive areas.

- For instance, John Deere introduced the 850 X-Tier E-Drive dozer, which features a dual-path electric-drive transmission paired with a 9.0L diesel engine. This hybrid system delivers improved pushing power (up to 10% more productivity in high-load applications) and can reduce fuel consumption by up to 20% in light to moderate loads, while also enabling a quieter operation suitable for various environments.

Integration of Telematics and Smart Control Systems

The increasing use of telematics and automation in construction equipment presents significant opportunities for the small bulldozer market. GPS-based control, real-time monitoring, and automated blade positioning improve grading accuracy and fuel efficiency. Operators benefit from data-driven insights on performance, maintenance, and productivity. Manufacturers are leveraging IoT platforms to provide remote diagnostics and equipment tracking. This digital transformation is enhancing machine lifecycle management and driving higher demand for connected, intelligent bulldozer systems.

- For instance, Deere & Company’s JDLink connectivity monitors over 500,000 machines worldwide, transmitting operational data every 15 seconds for performance optimization.

Key Challenges

High Ownership and Maintenance Costs

The high initial investment and ongoing maintenance expenses pose challenges for small contractors and agricultural users. Fuel costs, spare parts, and servicing requirements contribute to total ownership expenses. Smaller operators often opt for used or rented machinery to manage costs, limiting new equipment sales. Manufacturers face pressure to introduce cost-effective models without compromising performance. Financial support programs and flexible leasing options are being introduced to address these affordability concerns.

Shortage of Skilled Operators and Training Gaps

The lack of skilled operators capable of handling modern, technology-integrated bulldozers remains a key challenge. Advanced machines require specialized training for efficient and safe operation. In many developing regions, limited access to vocational training centers hampers adoption rates. This shortage affects productivity, increases the risk of equipment misuse, and leads to higher downtime. Equipment manufacturers and government agencies are collaborating to expand operator training programs and certification initiatives to bridge this gap.

Regional Analysis

North America

North America held a 37.2% share of the small bulldozer market in 2024, driven by large-scale construction, infrastructure upgrades, and growing use in residential and commercial projects. The United States leads regional demand due to strong investment in highway rehabilitation, urban redevelopment, and energy projects. Technological adoption, including GPS and telematics-based systems, enhances equipment efficiency and operator safety. Canada’s emphasis on sustainable construction practices further boosts demand for compact, fuel-efficient models. The region benefits from the strong presence of leading manufacturers and robust rental networks supporting equipment accessibility.

Europe

Europe accounted for a 27.8% share of the small bulldozer market in 2024, supported by increased adoption in infrastructure modernization and renewable energy projects. Countries such as Germany, France, and the United Kingdom are key contributors, focusing on compact machinery for urban and industrial construction. Stringent emission standards drive manufacturers to develop energy-efficient and electric bulldozers. Growth in rail expansion, housing redevelopment, and forestry management projects sustains steady demand. The region’s emphasis on automation and precision construction further supports market penetration of technologically advanced small bulldozers.

Asia-Pacific

Asia-Pacific dominated the small bulldozer market in 2024 with a 41.6% share, propelled by rapid urbanization, industrialization, and large-scale infrastructure development. China, India, and Japan are major markets, driven by highway construction, mining, and agricultural mechanization. Government initiatives promoting smart cities and rural development projects fuel sustained equipment demand. The region also benefits from local manufacturing capabilities and cost-efficient production. Rising construction activities across Southeast Asia and the expansion of renewable energy installations further contribute to regional growth, making Asia-Pacific the fastest-growing market globally.

Latin America

Latin America captured a 5.3% share of the small bulldozer market in 2024, driven by infrastructure development and agricultural expansion in countries such as Brazil and Mexico. Government-backed programs to modernize transport and utility networks are strengthening demand for compact, versatile equipment. Growing investment in urban housing projects and renewable energy installations supports steady market growth. However, economic fluctuations and limited access to financing hinder broader adoption. Increasing regional partnerships with global manufacturers and rental service providers are expected to improve equipment availability and operational efficiency.

Middle East & Africa

The Middle East & Africa region held a 3.6% share of the small bulldozer market in 2024, supported by strong construction activity in the Gulf Cooperation Council (GCC) countries and infrastructure expansion in Africa. Saudi Arabia and the UAE are investing heavily in smart city and tourism development projects, boosting the need for compact earthmoving equipment. In Africa, growing urbanization and agricultural mechanization are key demand drivers. Despite challenges such as limited financing and import dependence, rising government focus on infrastructure modernization continues to strengthen market growth across the region.

Market Segmentations:

By Type

By Blade

- S-blade

- U-blade

- SU-blade

- Others

By Application

- Agriculture

- Construction

- Forest

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Small Bulldozer Market is defined by major players such as Caterpillar Inc., Komatsu Ltd., Deere & Company, Liebherr Group, CNH Industrial N.V., Shantui Construction Machinery Co., Ltd., Doosan Infracore Co., Ltd., Volvo Construction Equipment, Guangxi Liugong Machinery Co., Ltd., and XCMG Construction Machinery Co., Ltd. These companies focus on advanced product engineering, fuel efficiency, and automation technologies to enhance performance and durability. Leading manufacturers are expanding their product portfolios with compact, low-emission models designed for construction, agriculture, and forestry applications. Strategic collaborations, dealership expansions, and aftermarket support are key competitive strategies driving customer retention. Additionally, digital integration such as GPS-based grading systems and remote monitoring is becoming a major differentiator. Continuous investment in R&D and regional manufacturing capabilities enables companies to strengthen market presence and meet the growing demand for efficient, environmentally compliant bulldozers across developing and developed regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Caterpillar Inc.

- Komatsu Ltd.

- Deere & Company

- Liebherr Group

- CNH Industrial N.V.

- Shantui Construction Machinery Co., Ltd.

- Doosan Infracore Co., Ltd.

- Volvo Construction Equipment

- Guangxi Liugong Machinery Co., Ltd.

- XCMG Construction Machinery Co., Ltd.

Recent Developments

- In April 2025, Komatsu Ltd. announced it will display thirteen new models at Bauma 2025—including next-generation equipment with enhanced smart-construction capabilities; this underscores the brand’s push into compact and small dozer innovations.

- In 2025, Liebherr Group unveiled its new PR 776 Generation 8 crawler dozer, featuring a 70-tonne operating weight and a factory-installed Trimble Ready® kit for streamlined 3D grade control systems.

- In November 2024, CNH Industrial N.V. reported that its construction equipment division is advancing its smaller model range with automated features and alternative-propulsion readiness, citing “update small models” and “future e-models” as focus areas for the light-equipment lineup.

Report Coverage

The research report offers an in-depth analysis based on Type, Blade, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with increasing infrastructure development and construction activities worldwide.

- Demand for compact and fuel-efficient bulldozers will continue to rise in urban projects.

- Technological advancements will drive the adoption of GPS-enabled and autonomous bulldozers.

- Electric and hybrid models will gain popularity due to stricter emission regulations.

- Manufacturers will focus on lightweight designs and improved maneuverability for confined spaces.

- Asia-Pacific will remain the fastest-growing region with large-scale industrial and agricultural development.

- Rental equipment demand will increase as contractors seek cost-efficient machinery solutions.

- Integration of telematics and remote monitoring will enhance fleet efficiency and maintenance.

- Partnerships between equipment makers and construction firms will boost customized product development.

- Sustainability initiatives will promote the use of eco-friendly materials and low-emission engines in new models.