Market Overview:

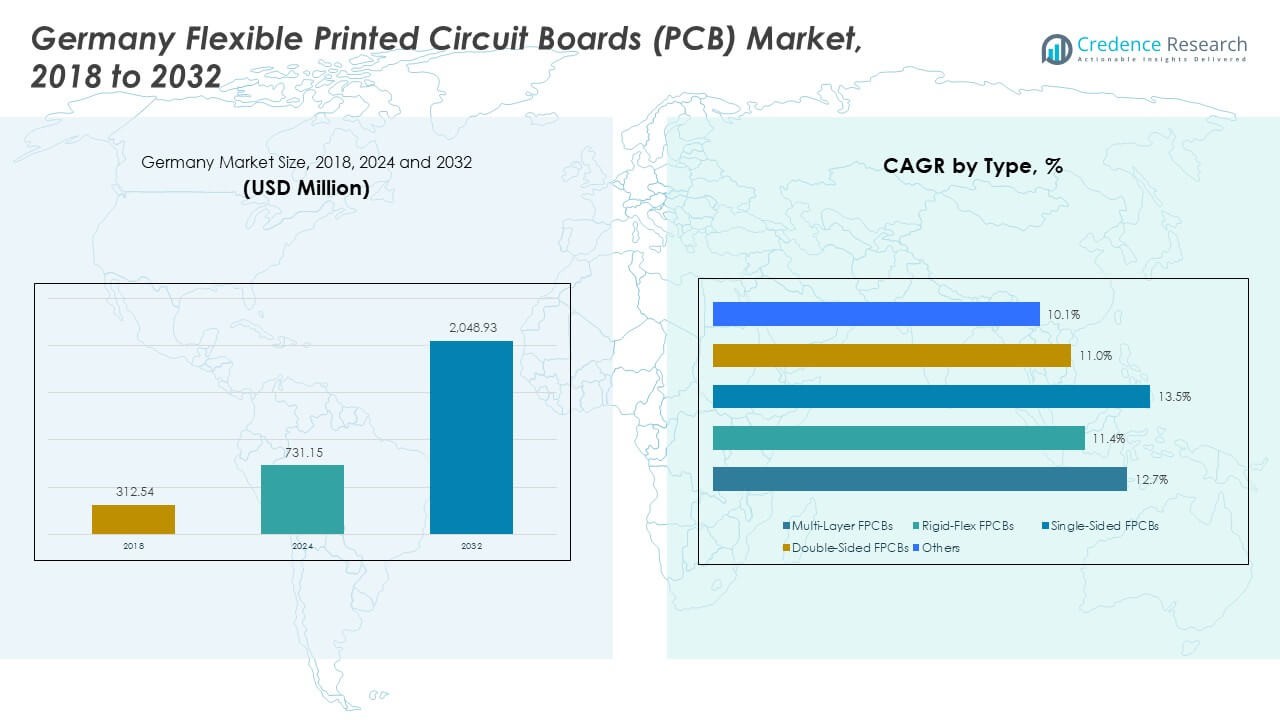

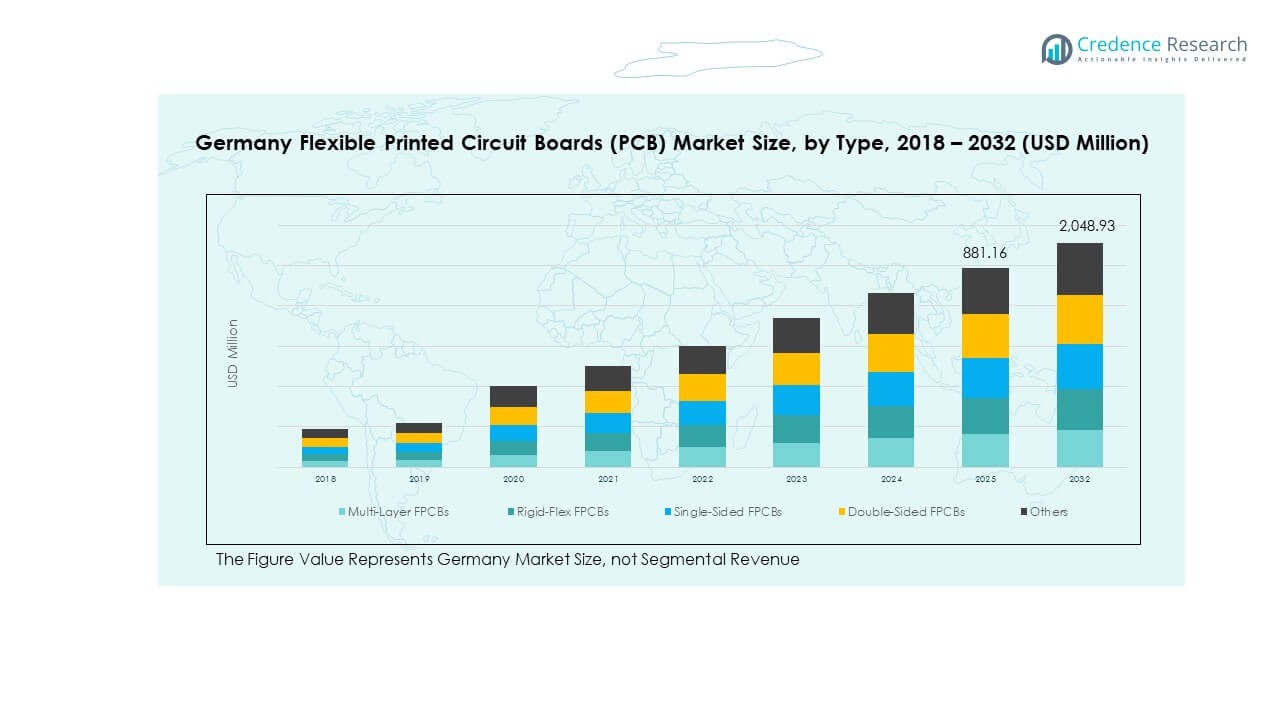

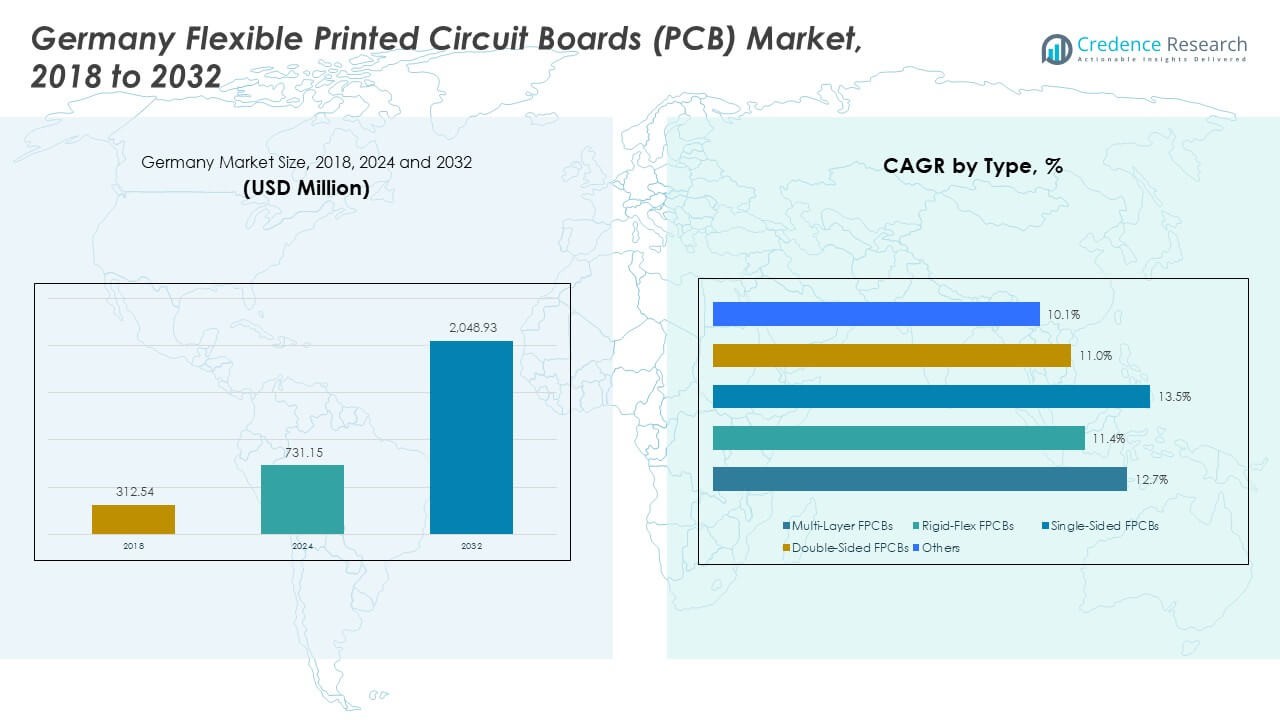

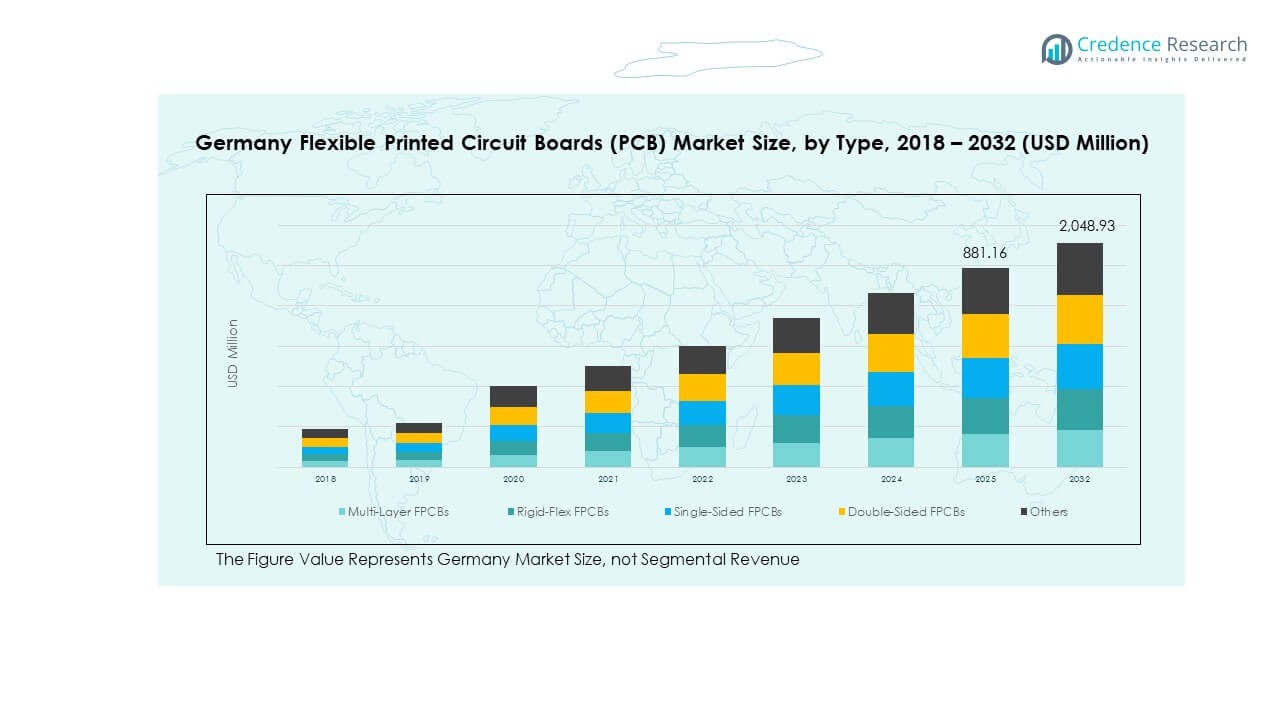

The Germany Flexible Printed Circuit Boards (PCB) Market size was valued at USD 312.54 million in 2018, rising to USD 731.15 million in 2024, and is anticipated to reach USD 2,048.93 million by 2032, growing at a CAGR of 12.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Flexible Printed Circuit Boards (PCB) Market Size 2024 |

USD 731.15 Million |

| Germany Flexible Printed Circuit Boards (PCB) Market, CAGR |

12.81% |

| Germany Flexible Printed Circuit Boards (PCB) Market Size 2032 |

USD 2,048.93 Million |

The market growth is driven by Germany’s advanced electronics manufacturing ecosystem and high adoption of miniaturized components in automotive and industrial electronics. Increasing demand for lightweight and space-efficient designs in EV control systems, ADAS modules, and telecommunication devices fuels flexible PCB usage. Moreover, growing investments in smart factories and automation enhance demand for multi-layer and rigid-flex circuits, offering improved reliability and performance across complex assembly environments.

Geographically, southern and western Germany lead the market due to strong automotive and industrial electronics production hubs in Bavaria, Baden-Württemberg, and North Rhine-Westphalia. Eastern regions, including Saxony and Thuringia, are emerging centers supported by semiconductor and microelectronics clusters. The growing presence of PCB manufacturing facilities, along with R&D investments in flexible hybrid electronics, positions Germany as a strategic hub in the European flexible PCB value chain.

Market Insights:

- The Germany Flexible Printed Circuit Boards (PCB) Market was valued at USD 312.54 million in 2018, reached USD 731.15 million in 2024, and is projected to hit USD 2,048.93 million by 2032, growing at a CAGR of 12.81% during the forecast period.

- Southern and Western Germany lead with 52% market share, supported by strong industrial electronics and automotive production clusters in Bavaria, Baden-Württemberg, and North Rhine-Westphalia.

- Northern Germany follows with 28% share, driven by expanding renewable energy, electronics manufacturing, and defense industries, while Eastern Germany holds 20%, benefitting from semiconductor and medical electronics investments.

- The fastest-growing region is Eastern Germany, holding 20% share, boosted by new semiconductor fabrication facilities in Saxony and Thuringia and innovation in medical and photonics-based flexible circuits.

- By type, Multi-Layer FPCBs command 42% share due to advanced integration and reliability, while Rigid-Flex FPCBs hold 27%, reflecting their growing role in aerospace, industrial, and medical device applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Adoption of Flexible Electronics Across Automotive and Industrial Sectors

The Germany Flexible Printed Circuit Boards (PCB) Market grows with increasing integration of flexible electronics in vehicles and industrial systems. Automakers use flexible PCBs in advanced driver assistance systems, infotainment modules, and EV battery control units. Industrial automation also benefits from compact circuit structures that enhance control precision and reduce space requirements. Demand for high reliability under vibration and heat conditions strengthens adoption in robotic assemblies. Companies focus on high-density interconnects and lightweight substrates for efficient power management. These developments expand market penetration in mobility and smart manufacturing. It continues to attract investments from tier-one suppliers and electronics firms driving innovation in connectivity.

- For instance, Würth Elektronik GmbH & Co. KG supplies PCB-based power distribution units rated for up to 1000 V in EVs, enabling compact flexible modules in battery systems. Automakers use flexible PCBs in advanced driver assistance systems and infotainment modules, in one project Würth implemented modular power boards that carry currents beyond 150 A at 70 °C with press-fit technology. Industrial automation also benefits from compact circuit structures that enhance control precision and reduce space requirements.

Growing Demand for Miniaturized and Lightweight Consumer Devices

Miniaturization in consumer electronics strongly drives flexible PCB adoption across smartphones, tablets, and wearables. The need for thinner and bendable circuit structures supports compact product designs without compromising performance. OEMs integrate multi-layer FPCBs for power delivery and advanced signal routing in high-performance devices. It benefits from rising 5G adoption and sensor-rich product designs requiring flexibility and space optimization. German design centers emphasize durability and heat resistance in portable devices. R&D investments target advanced polyimide materials and new lamination techniques for precision. The transition toward flexible hybrid circuits fuels continuous material innovation. Strong collaboration between OEMs and PCB manufacturers accelerates design customization.

- For instance, AT&S Austria Technologie & Systemtechnik AG developed its 2.5D® cavity flexible PCB technology which allows boards to bend 90° or even 180° during installation, enabling extremely thin assemblies for driver assistance and camera modules. The need for thinner and bendable circuit structures supports compact product designs without compromising performance. OEMs integrate multi-layer FPCBs for power delivery and advanced signal routing in high-performance devices. It benefits from rising 5G adoption and sensor-rich product designs requiring flexibility and space optimization.

Technological Advancements in Manufacturing and Design Precision

Automation in PCB fabrication and material enhancement strengthens the market. Laser drilling, roll-to-roll processing, and automated optical inspection improve yield and consistency. It supports production of thinner, fine-line, and complex multi-layer structures. Manufacturers integrate rigid-flex combinations to achieve better circuit density for compact systems. Adoption of advanced adhesives and copper-clad laminates ensures better thermal stability. German producers focus on improving substrate adhesion and signal transmission for high-frequency use. The transition toward additive manufacturing streamlines prototyping cycles and lowers design costs. Continuous innovation enhances manufacturing precision while reducing defect ratios.

Expanding Role of Flexible PCBs in Renewable Energy and Medical Devices

Renewable energy systems and medical devices create new growth areas for the market. Flexible PCBs power monitoring systems in solar inverters and wind control modules. It enables compact, lightweight configurations suited for medical imaging and implantable devices. Hospitals demand flexible circuits for compact diagnostic tools and wearable health sensors. High resistance to heat and chemical exposure enhances performance in medical and industrial environments. Companies emphasize biocompatible and stretchable circuit substrates to improve patient comfort. Integration with IoT platforms strengthens performance monitoring and maintenance. These applications highlight the diversification of demand across multiple high-growth verticals.

Market Trends:

Integration of Flexible PCBs in Electric and Autonomous Vehicles

The Germany Flexible Printed Circuit Boards (PCB) Market experiences rising integration in electric and autonomous vehicles. These circuits support high-speed data transfer between sensors, control modules, and battery systems. Flexible architectures enhance thermal performance and reduce wiring complexity. Manufacturers design circuits to withstand temperature fluctuations in EV propulsion systems. The need for lighter components accelerates adoption in battery packs and inverters. It drives innovation in copper foils and dielectric materials to handle voltage fluctuations. Automotive OEMs collaborate with PCB suppliers to improve signal reliability and EMI protection. Such developments enhance efficiency across next-generation automotive electronics.

- For instance, AT&S offers flexible and rigid-flex PCBs specifically aimed at automotive applications where circuits run between sensors, control modules and battery systems, supporting high-speed data transfer. Flexible architectures enhance thermal performance and reduce wiring complexity; such boards from AT&S can be bent or twisted during assembly to fit tight spaces in EV propulsion systems.

Increased Use of Rigid-Flex and Hybrid Circuits for Complex Assemblies

Rigid-flex and hybrid circuits gain traction across defense, aerospace, and industrial automation. These designs combine rigidity with flexibility, ensuring mechanical stability under pressure and movement. It benefits manufacturers targeting lightweight, compact, and high-performance modules. German engineering centers adopt hybrid circuits for avionics and control panels demanding reliability and longevity. Advanced bonding and lamination processes improve design endurance and precision. Material science innovations focus on optimizing dielectric strength and thermal resistance. Integration of AI-based design tools simplifies layout complexity and minimizes errors. Growing use of rigid-flex boards strengthens modular design flexibility across critical applications.

- For instance, AT&S uses its flexible and rigid-flex PCB solutions in avionics and satellite systems, offering hybrid structures that integrate bendable and rigid segments to meet demanding mechanical and thermal environments. These designs combine rigidity with flexibility, ensuring mechanical stability under pressure and movement in control panels and aerospace equipment. It benefits manufacturers targeting lightweight, compact and high-performance modules. German engineering centres adopt hybrid circuits for control systems demanding reliability and longevity.

Rise of Sustainable and Eco-Friendly PCB Manufacturing Practices

Sustainability trends reshape production methods in the market. Manufacturers shift toward halogen-free laminates and solvent-free processes to reduce emissions. Recyclable materials and low-energy etching technologies improve environmental compliance. It aligns with Germany’s national circular economy goals and EU sustainability directives. Companies adopt green chemistry and dry processing to minimize waste generation. Sustainable production enhances corporate reputation and attracts eco-conscious clients. Equipment vendors develop precision cleaning systems to limit water usage. Green manufacturing becomes an essential part of supplier selection and competitive differentiation.

Advancements in High-Frequency and 5G-Compatible PCB Designs

5G rollout stimulates innovation in high-frequency flexible PCBs. Telecommunication equipment demands superior impedance control and signal stability. German manufacturers focus on ultra-thin dielectrics and advanced copper foils to minimize signal loss. It supports antenna modules, IoT devices, and compact radar systems. Companies explore new resin systems to improve high-frequency performance. AI-driven simulation tools enhance circuit optimization for millimeter-wave applications. Integration with miniaturized connectors further boosts design scalability. The demand for precise, low-latency communication drives continued material and process advancements.

Market Challenges Analysis:

High Production Cost and Complex Manufacturing Requirements

The Germany Flexible Printed Circuit Boards (PCB) Market faces cost challenges due to intricate fabrication processes and material expenses. Multi-layer and rigid-flex designs require precision alignment, specialized adhesives, and high-quality substrates. Manufacturers invest heavily in advanced laser equipment and inspection systems to maintain yield rates. It increases production costs, limiting affordability for small-scale OEMs. Supply constraints of polyimide films and copper foils add volatility to pricing. High energy costs in Germany also impact operational margins. Companies struggle to balance quality and cost-efficiency without compromising reliability. The complexity of maintaining process consistency across volumes creates additional financial pressure.

Shortage of Skilled Technicians and Dependence on Imports for Materials

The market experiences workforce shortages, especially in advanced PCB design and lamination. Skilled technicians for high-frequency circuit manufacturing remain limited. It hampers scalability in domestic production and delays technology adoption. Dependence on imported raw materials like copper foils, polyimide sheets, and adhesives exposes manufacturers to supply risk. Import delays and geopolitical disruptions affect delivery schedules. Smaller players find it challenging to maintain inventory for just-in-time production. Regulatory compliance requirements on environmental standards also raise operational burdens. Manufacturers must address talent development and local material sourcing to remain competitive.

Market Opportunities:

Expansion of Flexible PCB Applications in Smart Manufacturing and IoT Devices

Emerging smart factory ecosystems generate strong opportunities for the Germany Flexible Printed Circuit Boards (PCB) Market. IoT-enabled sensors, controllers, and communication modules increasingly depend on flexible circuits. These systems improve space utilization, energy efficiency, and real-time performance. It enables seamless integration across distributed networks and control panels. Growth in Industry 4.0 initiatives drives localized PCB production capabilities. Smart manufacturing adoption strengthens collaboration between component makers and automation firms. Demand for reliable interconnects supports innovation in flexible hybrid designs for connected environments.

Growth in Semiconductor Packaging and Integration of 3D Flexible Electronics

Semiconductor advancements create new potential for flexible PCB adoption in 3D packaging and miniaturized assemblies. Flexible substrates allow tighter circuit folding and improved heat dissipation in advanced chip modules. It supports compact architecture in memory stacks and wearable sensors. German R&D centers focus on embedding passive components into flexible layers. Collaboration between PCB producers and semiconductor foundries enhances vertical integration. Expansion of next-generation chip packaging technologies broadens the market’s long-term growth horizon.

Market Segmentation Analysis:

By Type

The Germany Flexible Printed Circuit Boards (PCB) Market features diverse product categories that meet specific performance and design needs. Multi-Layer FPCBs lead due to their high circuit density and reliability in compact systems used in advanced electronics and vehicles. Rigid-Flex FPCBs gain traction in aerospace and medical sectors where durability and vibration resistance are critical. Single-Sided FPCBs remain popular in low-cost consumer and industrial applications demanding simple interconnections. Double-Sided FPCBs serve communication, automotive, and control modules requiring greater connectivity. The “Others” segment includes emerging stretchable and hybrid substrates supporting innovation in wearable and flexible devices. It benefits from continuous improvements in materials, laminates, and manufacturing precision across every product type.

- For instance, AT&S Austria Technologie & Systemtechnik AG now produces multilayer PCBs with up to 78 layers in its portfolio, demonstrating the depth of its multilayer capability. Multi-Layer FPCBs lead due to their high circuit density and reliability in compact systems used in advanced electronics and vehicles.

By End Use

Diverse applications drive flexible PCB deployment across major German industries. Industrial electronics lead due to automation, robotics, and control systems requiring flexible and heat-resistant circuits. The automotive sector follows, supported by EV growth and demand for compact, high-performance modules in ADAS and infotainment systems. IT and telecom applications depend on flexible PCBs for data transfer, connectivity, and 5G infrastructure. Aerospace and defense rely on rigid-flex configurations for mission-critical equipment and avionics. Consumer electronics utilize thin, lightweight boards in smartphones, tablets, and wearables. The “Others” category covers healthcare and energy segments expanding flexible electronics use in monitoring and smart devices. It sustains long-term growth through integration with next-generation technologies.

- For instance, Würth Elektronik GmbH & Co. KG’s “REDline Power Box Twin” integrates a PCB area of 160 × 150 mm inside an IP66/69K housing for automotive power distribution systems. Industrial electronics lead due to automation, robotics, and control systems requiring flexible and heat-resistant circuits. The automotive sector follows, supported by EV growth and demand for compact, high-performance modules in ADAS and infotainment systems.

Segmentation:

By Type

- Multi-Layer FPCBs

- Rigid-Flex FPCBs

- Single-Sided FPCBs

- Double-Sided FPCBs

- Others

By End Use

- Industrial Electronics

- Aerospace & Defense

- IT & Telecom

- Automotive

- Consumer Electronics

- Others

By Region (Country-wise Scope within Europe)

- Germany

- Italy

- France

- United Kingdom

- Spain

- Rest of Europe

Regional Analysis:

Southern and Western Germany – Industrial and Automotive Powerhouses (52% Share)

Southern and western Germany dominate the market with a 52% share, driven by strong industrial and automotive ecosystems. Bavaria, Baden-Württemberg, and North Rhine-Westphalia host key electronics and automotive component manufacturers. The presence of large OEMs and Tier-1 suppliers supports consistent demand for high-density, multi-layer, and rigid-flex PCBs. It benefits from well-developed R&D infrastructure and advanced automation capabilities across semiconductor and automotive clusters. Integration of flexible PCBs into EV modules, ADAS systems, and robotics enhances regional leadership. Growing investment in Industry 4.0 and precision manufacturing strengthens long-term growth and export capacity. These regions remain focal points for technological innovation and product design evolution.

Northern Germany – Expanding Electronics and Renewable Energy Ecosystem (28% Share)

Northern Germany accounts for nearly 28% share, supported by its growing electronics manufacturing base and renewable energy investments. Hamburg, Lower Saxony, and Schleswig-Holstein promote smart grid systems and offshore energy infrastructure, boosting flexible PCB adoption. It supports compact control modules, power converters, and sensor systems used in wind and solar technologies. The presence of industrial ports facilitates efficient export logistics for electronic components. Collaboration between research institutes and local PCB manufacturers enhances innovation in flexible hybrid circuits. Increasing automation in shipbuilding and defense sectors also contributes to demand growth. The region’s transition toward smart energy solutions drives sustainable production opportunities.

Eastern Germany – Emerging Hub for Semiconductor and Medical Electronics (20% Share)

Eastern Germany holds around 20% share and shows rapid advancement through semiconductor and medical electronics production. Saxony and Thuringia lead this growth with strong microelectronics and photonics clusters. It benefits from public R&D funding and partnerships with global chipmakers investing in Dresden’s semiconductor valley. Flexible PCBs are widely adopted in diagnostic equipment, imaging systems, and next-generation packaging lines. Expanding cleanroom facilities and material innovation hubs foster competitiveness in high-precision applications. Collaboration with universities supports skilled workforce development and research commercialization. Eastern Germany’s focus on high-value manufacturing positions it as an emerging innovation corridor within the national PCB landscape.

Key Player Analysis:

- Mektec Europe GmbH

- Würth Elektronik GmbH & Co. KG

- Eurocircuits GmbH

- NCAB Group Germany

- Cicor Germany

- Elvia PCB Germany

- AT&S Germany

- PCB-POOL GmbH

- Maxeler GmbH

- Entelechy Group

Competitive Analysis:

The Germany Flexible Printed Circuit Boards (PCB) Market remains competitive, with key players focusing on product innovation, material enhancement, and localized production. It includes major companies such as Würth Elektronik GmbH & Co. KG, KSG Leiterplatten GmbH, AT&S AG, TTM Technologies, and Schweizer Electronic AG. These firms emphasize lightweight, high-reliability, and thermally stable designs suited for automotive, industrial, and telecom applications. Strategic collaborations with semiconductor and automotive manufacturers support technology adoption and vertical integration. Local producers strengthen their position through R&D investments, sustainability initiatives, and automation-focused facilities. Continuous advancements in miniaturization and design flexibility further reinforce market competitiveness.

Recent Developments:

- In October 2025, Cicor Group signed an agreement to acquire two production sites from the Western Switzerland electronics supplier Valtronic on October 27, 2025. As a result of the transaction, the Cicor Group grew by around 220 employees and generates additional revenue of at least CHF 20 million.

- In October 2025, Cicor Technologies Ltd. announced its firm intention to acquire UK-based TT Electronics PLC. Under the terms of the offer, TT shareholders will receive 100 pence in cash and 0.0028 Cicor shares per TT share. The total transaction equity value amounts to approximately CHF 303 million (equivalent to £287 million).

- In May 2025, Würth Elektronik announced a strategic partnership with the Hong Kong Science and Technology Parks Corporation (HKSTP) for a three-year collaboration. Under this partnership, Würth Elektronik launched the first pilot Engineering Service Programme in InnoPark, providing professional support to about 100 microelectronics-related startups and SMEs in both Science Park and InnoPark.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type and End Use segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for flexible and lightweight circuitry in automotive and consumer electronics will drive long-term adoption.

- Expansion of 5G networks and IoT connectivity will elevate production of high-frequency flexible PCBs.

- Integration of automation and digital design tools will improve fabrication precision and scalability.

- Growth in EV and renewable energy applications will expand demand for durable and thermally efficient PCBs.

- Hybrid and rigid-flex designs will gain preference in aerospace, medical, and defense sectors.

- Sustainability goals will encourage use of recyclable substrates and energy-efficient processes.

- Regional manufacturing capacity will increase through partnerships between OEMs and PCB fabricators.

- Continuous R&D investment will enhance dielectric materials and adhesion performance.

- Domestic supply chain development will reduce dependency on imported raw materials.

- Increased public-private collaboration will strengthen innovation hubs and workforce training initiatives.