Market Overview:

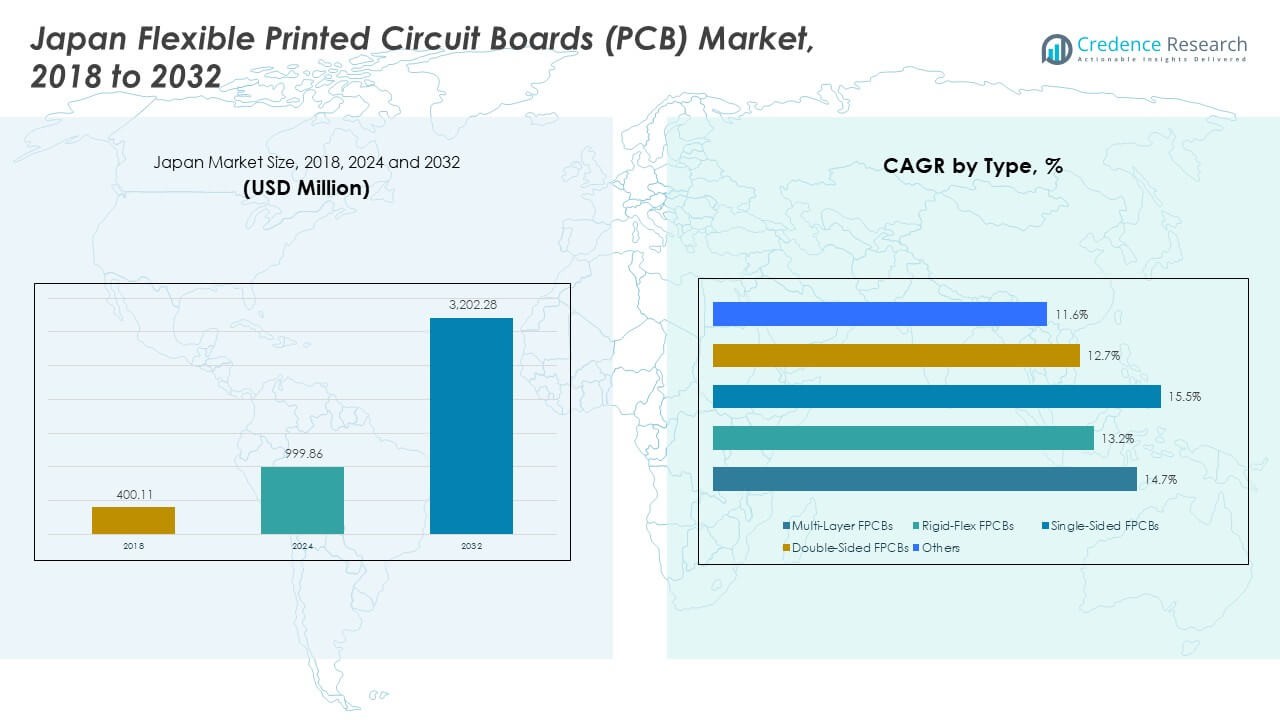

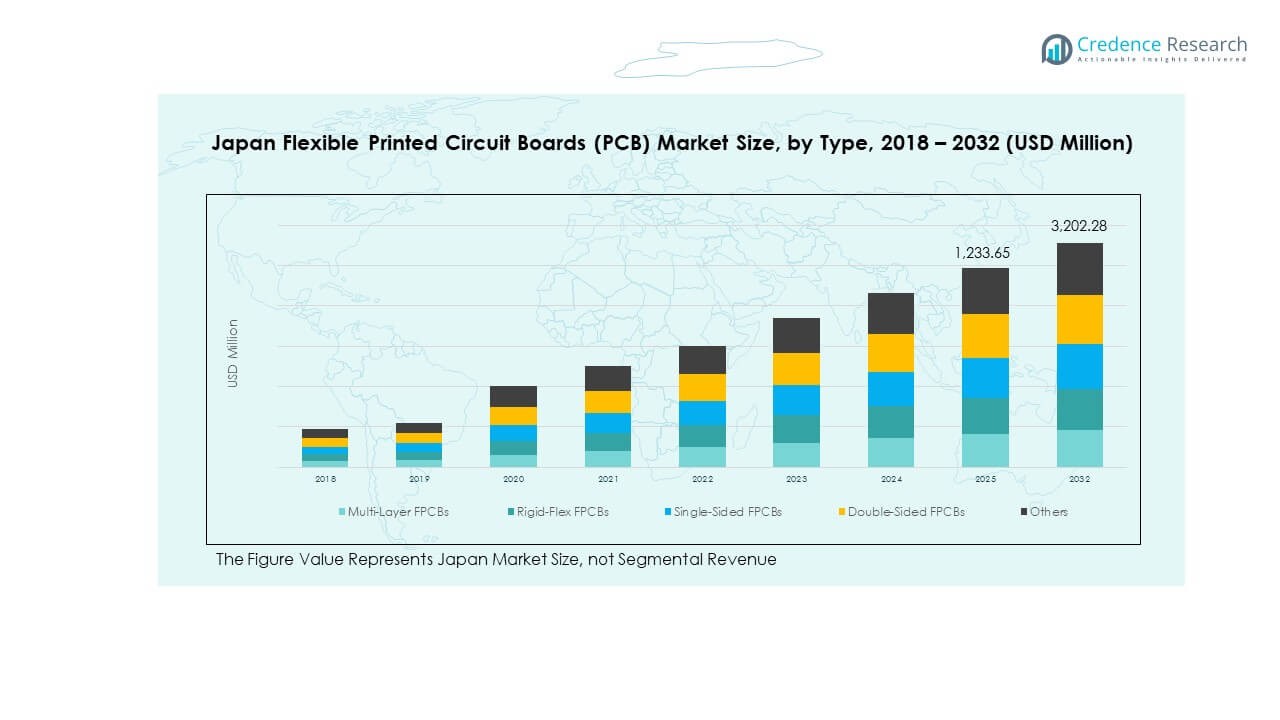

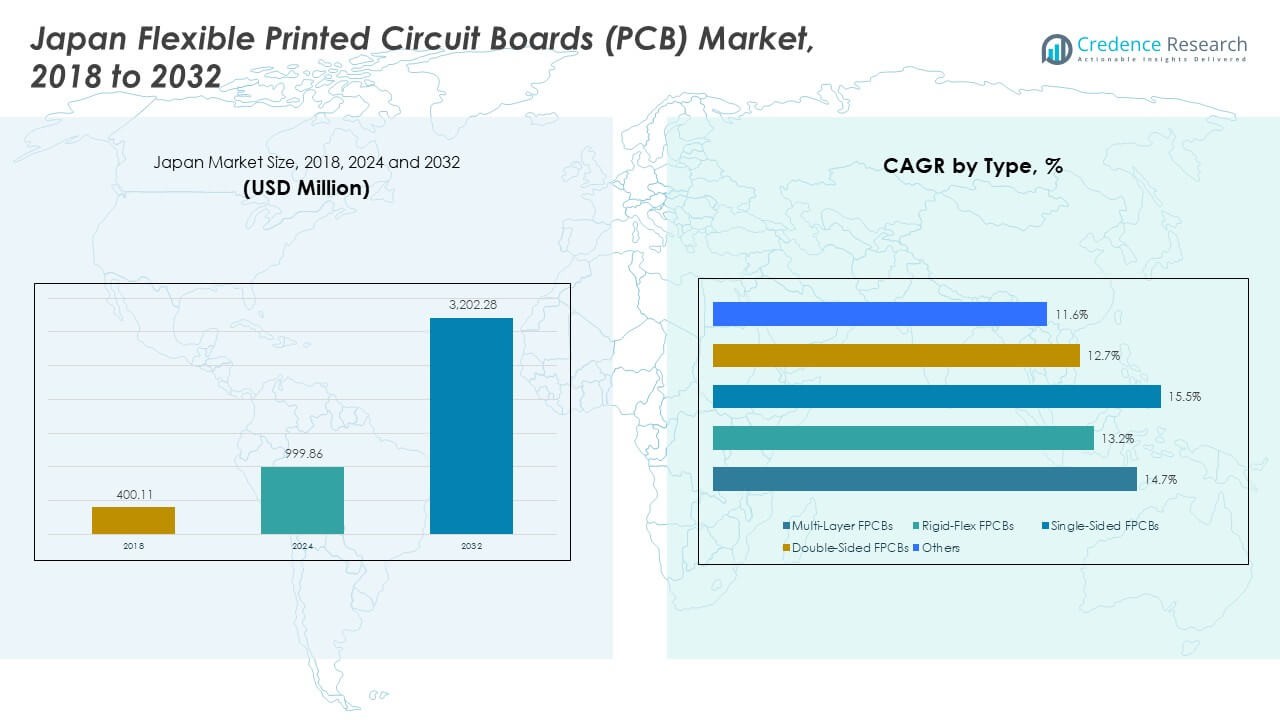

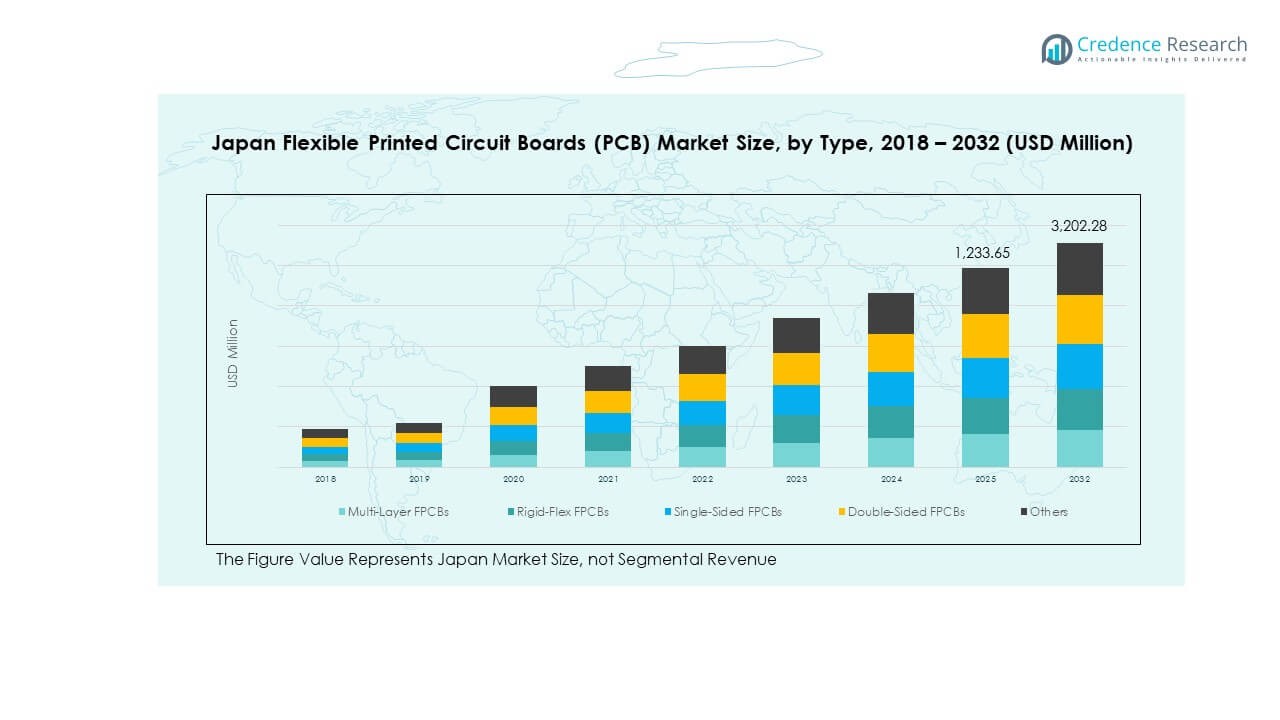

The Japan Flexible Printed Circuit Boards (PCB) Market size was valued at USD 400.11 million in 2018, reaching USD 999.86 million in 2024, and is anticipated to reach USD 3,202.28 million by 2032, growing at a CAGR of 14.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Flexible Printed Circuit Boards (PCB) Market Size 2024 |

USD 999.86 Million |

| Japan Flexible Printed Circuit Boards (PCB) Market, CAGR |

14.60% |

| Japan Flexible Printed Circuit Boards (PCB) Market Size 2032 |

USD 3,202.28 Million |

Market growth is driven by increasing adoption of compact electronic devices and demand for lightweight, high-performance interconnects. Expanding use of FPCBs in smartphones, automotive electronics, and medical devices strengthens the market position. Manufacturers are focusing on high-density interconnect (HDI) and multi-layer flexible designs to improve reliability and reduce space in miniaturized systems. Strong R&D investments in flexible substrates, along with technological advances in polymer materials, support next-generation electronics production in Japan.

Japan remains a key regional hub for electronics manufacturing, led by high domestic demand and export strength in East Asia. Tokyo and Osaka host several production facilities that supply components to major smartphone and automotive brands. Neighboring countries like South Korea and Taiwan show rising FPCB production, but Japan leads in innovation and precision engineering. Southeast Asian markets are emerging as manufacturing extensions due to lower costs and supply chain diversification.

Market Insights:

Market Insights:

- The Japan Flexible Printed Circuit Boards (PCB) Market was valued at USD 400.11 million in 2018, reached USD 999.86 million in 2024, and is projected to hit USD 3,202.28 million by 2032, expanding at a CAGR of 14.60% during 2025–2032.

- East Asia holds 62% of the total share, driven by Japan’s advanced electronics base and export strength; North America holds 18%, led by aerospace and medical sectors; Europe accounts for 14%, supported by automotive and renewable electronics adoption.

- South Asia is the fastest-growing region with a 6% share, driven by government-backed manufacturing initiatives in India, Vietnam, and Thailand, attracting investment in low-cost PCB production.

- By type, Multi-Layer FPCBs dominate with 38% share, supported by high circuit density and compact designs in consumer and automotive applications.

- Rigid-Flex FPCBs follow with 26% share, reflecting strong use in aerospace, medical, and high-durability electronics segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Miniaturized and High-Performance Electronic Devices

The Japan Flexible Printed Circuit Boards (PCB) Market is driven by the growing integration of compact, lightweight, and high-density electronic components. Smartphones, wearables, and medical devices rely on flexible circuits for space-efficient design. It supports advanced connectivity and reliable signal transmission in smaller enclosures. Automotive and industrial sectors use FPCBs to improve durability and reduce wiring complexity. The shift toward 5G communication devices accelerates innovation in thin and multi-layer flexible substrates. Increasing preference for foldable and bendable devices enhances material engineering investments. High production standards and automation strengthen Japan’s leadership in flexible electronics manufacturing.

- For instance, Fujikura Printed Circuits Ltd. provides 60 GHz antenna-FPCs designed for high-frequency transmission and bending durability. It supports advanced connectivity and reliable signal transmission in smaller enclosures. Automotive and industrial sectors use FPCBs to improve durability and reduce wiring complexity.

Expanding Automotive Electronics and EV Component Adoption

Automotive manufacturers rely on flexible PCBs to enhance safety systems, infotainment modules, and advanced driver-assistance systems. Japan’s strong automotive base accelerates integration of flexible circuits in electric vehicles (EVs). It supports compact power management systems and sensor modules critical for performance optimization. High thermal resistance and vibration endurance make flexible PCBs ideal for in-vehicle electronics. Expanding EV infrastructure increases the demand for efficient interconnect technologies. Collaboration between OEMs and PCB producers focuses on reliability and reduced maintenance. The market benefits from government-backed e-mobility initiatives and energy-efficient automotive innovations.

- For instance, Sumitomo Electric Printed Circuits, Inc. developed FPCs that withstand 150 °C for 3,000 h and meet bond-strength criteria of ≥ 3.4 N/cm under JPCA standards. Japan’s strong automotive base accelerates integration of flexible circuits in electric vehicles (EVs). It supports compact power-management systems and sensor modules critical for performance optimization.

Technological Advancements in Flexible Substrate and Material Innovation

Constant material improvements boost the lifespan and functionality of flexible circuits. Polyimide and polyester substrates dominate production due to heat resistance and dimensional stability. It allows miniaturized device manufacturers to achieve precise signal integrity under compact configurations. Japan’s R&D sector leads advancements in copper-clad laminates and fine-pitch circuitry. Continuous process refinement enhances yield rates and cost efficiency. The integration of laser drilling and high-speed imaging improves trace accuracy. Technological synergies with semiconductor packaging drive innovation in hybrid flexible-rigid systems.

Strong Focus on High-Density Interconnect (HDI) and Multi-Layer Designs

Manufacturers focus on developing HDI and multi-layer configurations for next-generation electronics. It supports complex architectures used in advanced computing, aerospace, and telecommunication devices. The market benefits from Japan’s expertise in photolithography and etching precision. Rising IoT device production fuels demand for high data transmission speed and compact connections. Strategic partnerships with electronic OEMs optimize product customization. The adoption of roll-to-roll fabrication techniques enhances scalability and throughput. Quality control and testing protocols strengthen performance consistency across production lines.

Market Trends:

Market Trends:

Growing Integration of FPCBs in Consumer and Medical Electronics

The Japan Flexible Printed Circuit Boards (PCB) Market experiences steady integration across high-end consumer and healthcare devices. Smartwatches, fitness trackers, and diagnostic equipment require ultra-flexible and bio-compatible circuits. It supports wearable technologies that need constant bending and high signal reliability. The healthcare sector adopts FPCBs in hearing aids and imaging systems. Continuous sensor miniaturization stimulates long-term design evolution. Market participants invest in precision coating and encapsulation processes. The rise of personalized electronics sustains consistent product development efforts.

- For instance, Fujikura’s flexible printed circuits support ultra-fine circuitry, impedance-control lines, and foldable form-factors such as wearable modules and high-speed signal paths. Smartwatches, fitness trackers, and diagnostic equipment require ultra-flexible and bio-compatible circuits. It supports wearable technologies that need constant bending and high signal reliability.

Transition Toward Eco-Friendly and Recyclable Circuit Materials

Manufacturers increasingly prioritize sustainability in production to meet Japan’s green manufacturing goals. Eco-friendly substrates and halogen-free laminates gain strong traction across flexible PCB applications. It encourages innovation in low-impact etching and non-toxic adhesives. Leading producers implement closed-loop recycling for copper and conductive films. Regulations promoting circular economy drive adoption of biodegradable components. Green certification programs influence procurement choices of electronics brands. The shift aligns production practices with national environmental commitments.

- For instance, Nippon Mektron reports delivery performance above 97% and invests in connector-free multi-layer FPCs with reduced material waste. Eco-friendly substrates and halogen-free laminates gain strong traction across flexible PCB applications. It encourages innovation in low-impact etching and non-toxic adhesives.

Adoption of Advanced Manufacturing and Automation Technologies

Automation plays a crucial role in improving yield, accuracy, and turnaround time for FPCB manufacturing. The Japan Flexible Printed Circuit Boards (PCB) Market benefits from robotic handling and AI-based defect detection systems. It ensures consistent quality across micro-scale assemblies and fine circuitry. Laser direct imaging enhances pattern alignment precision. Digital twins and smart factory systems reduce manual error and downtime. AI-driven inspection minimizes production rejections in multilayer circuits. Continuous investment in automation expands domestic output capabilities.

Expanding Role of Flexible Circuits in 5G and AI Hardware Systems

Next-generation communication devices and AI-driven computing platforms depend heavily on FPCBs. It supports compact, heat-tolerant interconnects critical for advanced processors and data modules. Japan’s leading semiconductor companies integrate flexible substrates into high-speed data paths. The growing rollout of 5G networks demands robust PCB signal integrity and miniaturization. Technological collaborations among telecom and materials firms stimulate product optimization. Increasing use of advanced packaging technologies supports flexible design innovation. The segment gains momentum from AI-based smart device ecosystems.

Market Challenges Analysis:

High Production Cost and Complexity in Multilayer Fabrication Processes

The Japan Flexible Printed Circuit Boards (PCB) Market faces cost pressures from intricate manufacturing steps. Multilayer structures require precise lamination and inspection processes, increasing operational expenses. It demands skilled labor and capital-intensive cleanroom environments. Thin copper traces and fine-pitch features raise defect risks during etching. Raw material price fluctuations further challenge profit margins. The limited availability of specialized machinery restricts scalability. Smaller manufacturers struggle to match the high quality and yield rates of large-scale producers.

Supply Chain Constraints and Limited Raw Material Availability

Dependence on imported copper foils and polymer films creates vulnerability in the supply chain. It exposes local manufacturers to geopolitical and logistical disruptions. Rising energy costs affect production scheduling and throughput. Limited domestic sources for advanced substrates extend lead times. Semiconductor sector competition for similar materials intensifies procurement challenges. Regulatory compliance for export and waste management adds administrative burden. Supply diversification and localized sourcing remain ongoing industry priorities.

Market Opportunities:

Emergence of Flexible Electronics in Next-Generation Mobility and Healthcare Systems

The Japan Flexible Printed Circuit Boards (PCB) Market holds growth prospects in autonomous mobility and medical device innovation. Flexible interconnects enable high-reliability data transmission in compact modules. It supports lighter and more adaptive designs in robotics and imaging equipment. Expanding EV and diagnostic device ecosystems generate new revenue streams. Technological alliances between FPCB firms and sensor developers encourage rapid commercialization.

Rising Demand for Custom Design and Hybrid Integration Solutions

Clients increasingly request customized designs combining flexible and rigid boards for compact devices. It strengthens Japan’s role in delivering precision engineering solutions across advanced applications. Hybrid PCB configurations meet performance requirements in aerospace, 5G, and consumer electronics. The push for miniaturization opens niche opportunities for high-value fabrication services. Strategic innovation partnerships expand the country’s global technological influence.

Market Segmentation Analysis:

By Type

The Japan Flexible Printed Circuit Boards (PCB) Market features a diverse type landscape catering to different performance and structural needs. Multi-Layer FPCBs dominate due to their superior circuit density and suitability for compact, high-performance electronics. Rigid-Flex FPCBs gain wide adoption in automotive and aerospace systems where durability and vibration resistance are essential. Single-Sided FPCBs remain preferred for cost-effective consumer and industrial devices requiring simpler interconnections. Double-Sided FPCBs find strong use in communication and control modules that demand enhanced flexibility. The “Others” category includes emerging hybrid and stretchable circuits designed for wearable and medical technologies. It supports innovation through continuous substrate improvements and precision fabrication processes.

- For instance, performance standards for rigid-flex boards require temperature tolerance from –40 °C to 150 °C and vibration resistance for long-term vehicle service. Single-Sided FPCBs remain preferred for cost-effective consumer and industrial devices requiring simpler interconnections.

By End Use

End-use applications define the structural and material evolution of flexible PCBs. Consumer electronics lead demand with rapid advancements in smartphones, tablets, and wearable devices. Automotive applications expand with electrification and increasing use of ADAS and infotainment systems. Industrial electronics adopt flexible PCBs for compact controllers and high-temperature sensors. IT and telecom sectors use them for 5G base stations, network modules, and smart routers. Aerospace and defense rely on FPCBs for lightweight radar and navigation assemblies. The “Others” category includes healthcare, robotics, and IoT device manufacturers seeking compact and high-reliability interconnects. It benefits from Japan’s advanced manufacturing ecosystem and continuous investment in miniaturized electronic design.

- For instance, FPCs used in LED and battery modules exceed 500 mm in length to meet industrial wiring demands. IT and telecom sectors use them for 5G base stations, network modules, and smart routers

Segmentation:

Segmentation:

By Type

- Multi-Layer FPCBs

- Rigid-Flex FPCBs

- Single-Sided FPCBs

- Double-Sided FPCBs

- Others

By End Use

- Industrial Electronics

- Aerospace & Defense

- IT & Telecom

- Automotive

- Consumer Electronics

- Others

By Country (Scope of Analysis)

- Japan (Primary Focus)

- Country-wise Revenue Analysis

- Type-wise Revenue Distribution

- End-Use-wise Revenue Distribution

Regional Analysis:

Dominance of East Asia in Global Flexible PCB Production

The Japan Flexible Printed Circuit Boards (PCB) Market holds a leading position in East Asia, which captures nearly 62% of the global market share. Japan’s dominance stems from its robust electronics manufacturing base and technological precision. It benefits from strong domestic demand in consumer electronics and automotive applications. Companies such as Nippon Mektron and Fujikura lead production capacity through advanced multilayer and rigid-flex PCB technologies. The country’s integration of automation, cleanroom environments, and material science expertise enhances reliability and export potential. Strong trade partnerships across China, South Korea, and Taiwan support Japan’s role as a technology hub for flexible circuitry.

Expanding Growth Across North America and Europe

North America accounts for about 18% market share, driven by strong adoption of advanced electronic systems and defense-grade applications. The U.S. leads demand for flexible PCBs in aerospace, EV, and medical device production. It focuses on miniaturization and flexible substrate adoption to improve energy efficiency. Europe contributes around 14% market share, with Germany, France, and the U.K. at the forefront of automotive and industrial electronics innovation. European manufacturers emphasize sustainability and recyclable materials to meet environmental regulations. It experiences rising demand for flexible circuitry in renewable energy and automation sectors. Both regions benefit from Japan’s technological exports and partnership initiatives in semiconductor and PCB manufacturing.

Emerging Opportunities in South Asia and Rest of the World

South Asia and the Rest of the World together represent nearly 6% of the market share, showing steady but promising growth. India, Vietnam, and Thailand are emerging as low-cost production alternatives, supported by government initiatives in electronics manufacturing. It attracts foreign direct investments and collaborations with Japanese and Korean firms. The Middle East and Latin America record rising use of flexible PCBs in automotive assembly, telecom infrastructure, and industrial automation. Africa remains in an early adoption phase, focusing on electronics assembly through regional partnerships. Expanding local fabrication facilities and training programs enhance future scalability and reduce supply dependence on East Asia.

Key Player Analysis:

- Nippon Mektron Ltd.

- Fujikura Ltd.

- Sumitomo Electric Industries

- Ibiden Co., Ltd.

- Meiko Electronics

- Meiko Network Japan

- Dowa Electronics Materials

- Tokai Rubber Industries

- Shin-Etsu Chemical Co., Ltd.

- Kyocera Corporation

Competitive Analysis:

The Japan Flexible Printed Circuit Boards (PCB) Market features strong competition led by domestic giants and global electronics manufacturers. It is characterized by technological leadership, precision engineering, and deep integration across the supply chain. Key players such as Nippon Mektron, Fujikura, and Sumitomo Electric Industries dominate through continuous innovation in multilayer and rigid-flex PCB technologies. Ibiden and Kyocera enhance market competitiveness with high-reliability solutions for automotive and semiconductor applications. Strategic partnerships, product differentiation, and quality certification standards shape the competitive landscape. The industry’s focus on sustainable manufacturing and automation keeps Japan at the forefront of global PCB production.

Recent Developments:

- On October 14, 2025, Meiko Network Japan launched a three-year Medium-Term Management Plan called “MEIKO Transition,” commencing in FY2025, and is decisively executing two transitions—”Business Transition” and “Human Transition.” The company announced it had exceeded its FY2025 forecasts with actual results surpassing expectations, attributing this to improved profitability in its core Meiko Gijuku schools and growth in Japanese language schools, alongside extraordinary income from the sale of investment securities.

- In September 2025, Ibiden announced plans to establish a production facility for integrated circuit package substrates at its Ono manufacturing site specifically for use in AI servers, aiming to enhance output to cater to increasing demand driven by the worldwide surge in artificial intelligence technologies. The company expects fiscal 2025 demand for substrates tied to generative AI servers to nearly double from the previous year, with plans to upgrade equipment during fiscal 2025, expanding output across three factories to five production lines.

- On May 29, 2025, Dowa Electronics Materials Co., Ltd., a subsidiary of Dowa Holdings Co., Ltd., launched sales of the world’s top-class high-power Surface-Mount Device (SMD) with short-wavelength infrared (SWIR) LED technology. The 5 mm square high-power SMD was showcased at the Laser World of Photonics 2025 event held from July 24-27, 2025, in Munich, Germany, with the company planning to soon introduce a 3 mm-square SMD version.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type and End Use segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for lightweight, high-density flexible PCBs will increase with miniaturized electronic products.

- Automotive electrification will expand applications of heat-resistant and vibration-proof FPCBs.

- R&D in polymer substrates will enhance reliability for foldable and wearable electronics.

- Domestic manufacturers will lead in automation and green production processes.

- 5G and IoT networks will drive large-scale adoption of high-speed flexible interconnects.

- Japan will maintain a leadership role in multilayer PCB innovation and export capacity.

- Partnerships between FPCB makers and semiconductor firms will intensify product integration.

- Medical and defense electronics will emerge as strong growth verticals.

- Investment in smart manufacturing will improve yield efficiency and global competitiveness.

- Sustainability mandates will encourage recyclable materials and eco-friendly PCB designs.

Market Insights:

Market Insights: Market Trends:

Market Trends: Segmentation:

Segmentation: