Market Overview:

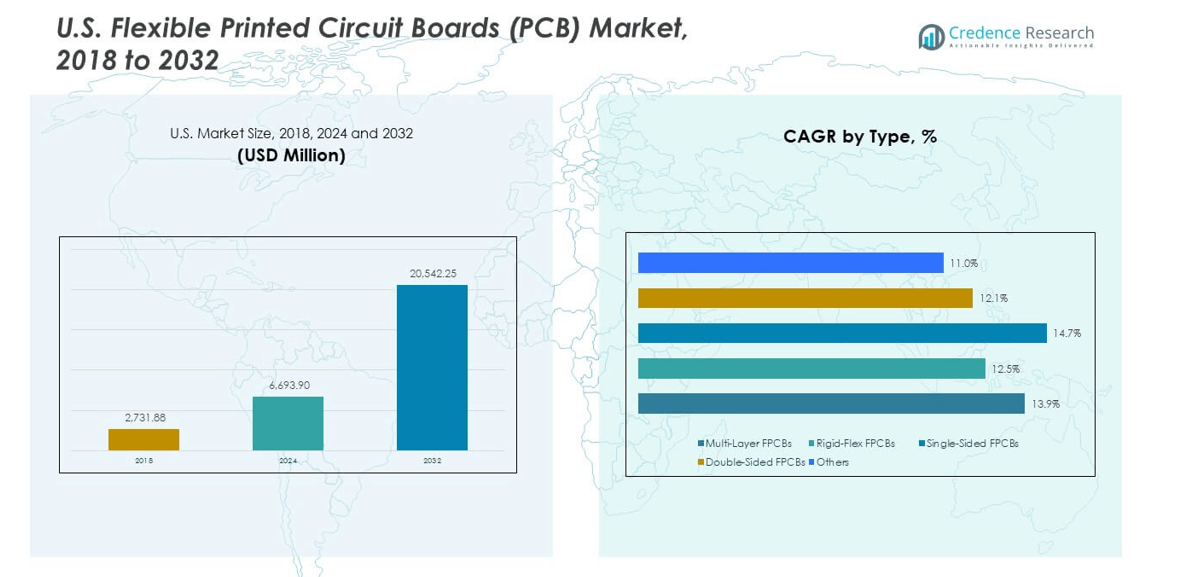

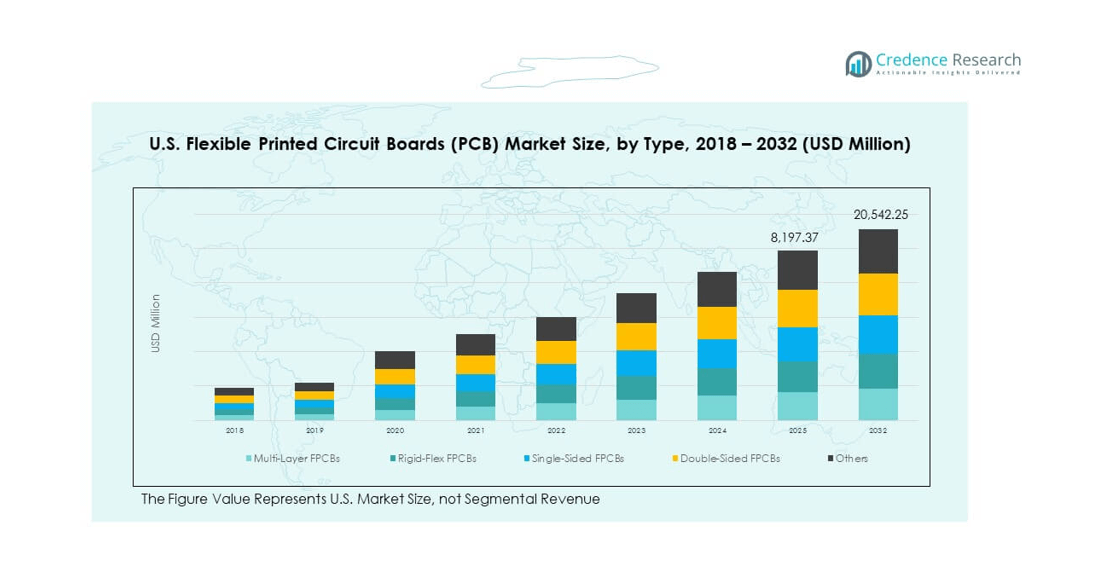

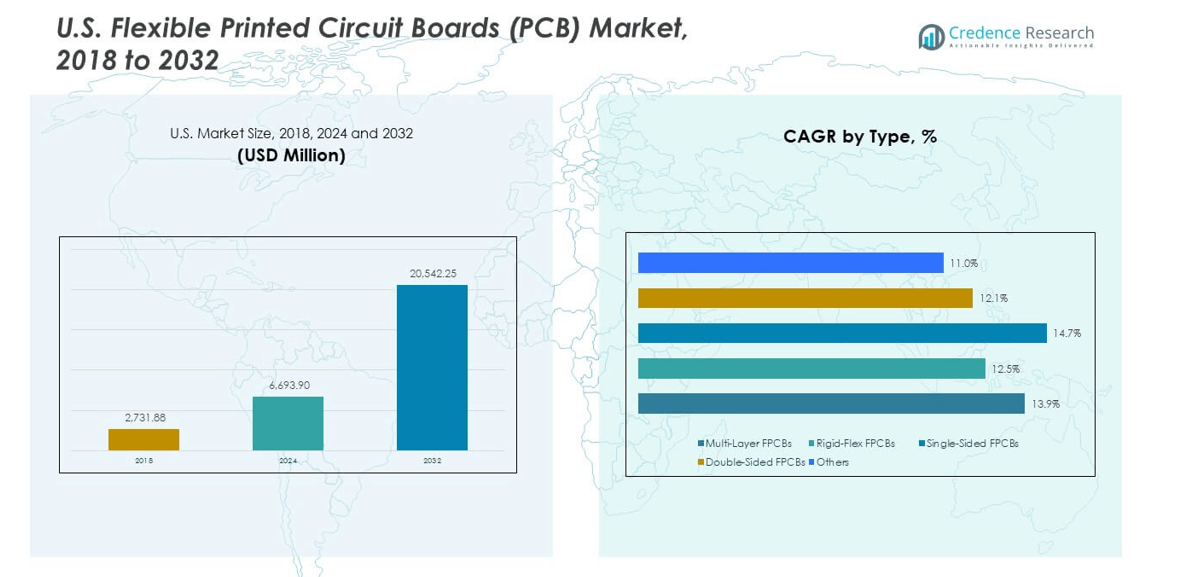

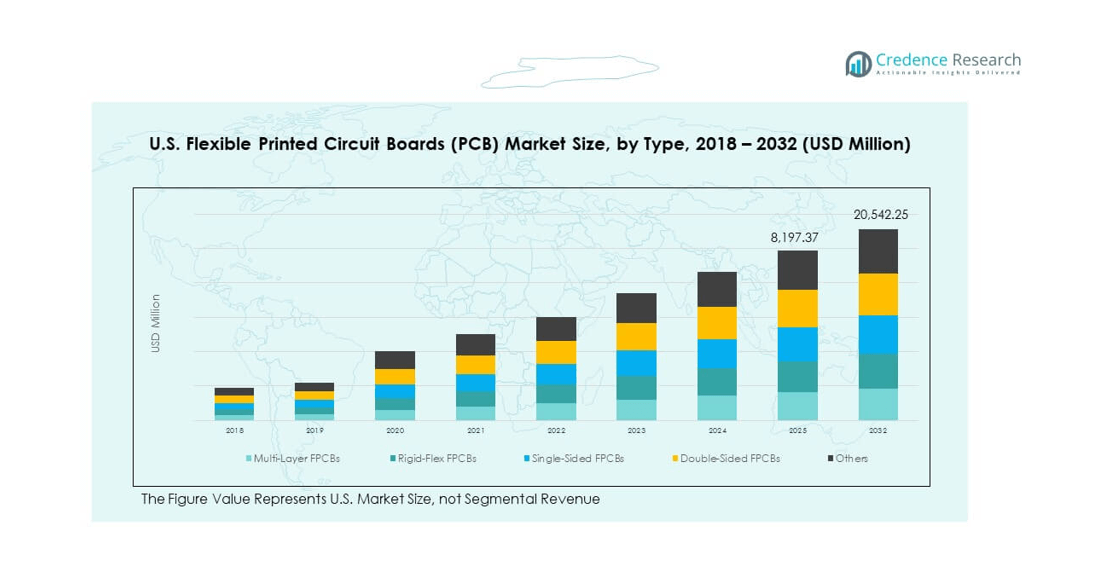

The U.S. Flexible Printed Circuit Boards (PCB) Market size was valued at USD 2,731.88 million in 2018, increased to USD 6,693.90 million in 2024, and is anticipated to reach USD 20,542.25 million by 2032, registering a CAGR of 14.02% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Flexible Printed Circuit Boards (PCB) Market Size 2024 |

USD 6,693.90 million |

| U.S. Flexible Printed Circuit Boards (PCB) Market, CAGR |

14.20% |

| U.S. Flexible Printed Circuit Boards (PCB) Market Size 2032 |

USD 20,542.25 million |

Growth in the U.S. flexible PCB market is driven by rising demand for compact electronic devices, automotive electronics, and advanced connectivity solutions. Increasing adoption of 5G technology, electric vehicles, and smart wearables encourages manufacturers to enhance flexibility, signal integrity, and miniaturization. Expanding investment in high-speed data transmission and medical electronics supports the adoption of multi-layer and rigid-flex PCBs. The market also benefits from ongoing innovations in materials and manufacturing technologies that improve circuit durability and reliability.

Regionally, the U.S. holds a dominant position due to strong presence of semiconductor, automotive, and consumer electronics industries. The West Coast, led by California, drives innovation through major electronics design hubs and R&D centers. Emerging growth is also seen in states like Texas and Arizona, supported by new manufacturing facilities and federal incentives for onshore production. Strategic collaborations and expanding fabrication capacities strengthen the country’s competitiveness in global PCB exports.

Market Insights:

- The U.S. Flexible Printed Circuit Boards (PCB) Market was valued at USD 2,731.88 million in 2018, reached USD 6,693.90 million in 2024, and is expected to hit USD 20,542.25 million by 2032, growing at a CAGR of 14.02%.

- North America (48%), Asia-Pacific (32%), and Europe (15%) dominate the market, driven by strong manufacturing infrastructure, advanced R&D, and rising adoption of flexible electronics.

- Asia-Pacific, with a 32% share, remains the fastest-growing region due to large-scale PCB fabrication in China, Japan, and South Korea, supported by cost-effective production and global exports.

- By type, Multi-Layer FPCBs lead the segment with over 40% share, driven by high-density design demand in automotive and consumer electronics applications.

- Rigid-Flex FPCBs follow with around 25% share, fueled by usage in aerospace, defense, and medical systems requiring compact and durable interconnections.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Adoption of Compact and High-Performance Electronic Devices Across Consumer and Industrial Segments

The U.S. Flexible Printed Circuit Boards (PCB) Market experiences strong growth from increasing demand for miniaturized consumer electronics and compact industrial systems. Smartphones, tablets, and wearables integrate flexible PCBs to save space and enhance electrical performance. It benefits from the surge in IoT-enabled products that require high-density circuit integration and lightweight configurations. Industrial automation systems, including robotics and control units, rely on flexible circuits for durability in high-vibration environments. Automotive infotainment, ADAS modules, and battery management systems further strengthen demand. Enhanced reliability, thermal performance, and reduced wiring complexity contribute to faster adoption. Consumer preferences for slimmer, more efficient devices reinforce the need for advanced FPCBs across product categories.

- For instance, Trackwise Designs plc delivered a 72-meter long multi-layer flexible PCB using polyimide laminate and copper plating with ±5 µm circuit consistency — demonstrating how size and precision scale in advanced applications. Smartphones, tablets, and wearables integrate flexible PCBs to save space and enhance electrical performance.

Technological Advancements in Material Science and Manufacturing Processes Enhancing Reliability and Efficiency

Innovation in materials such as polyimide and liquid crystal polymers supports the durability and flexibility of FPCBs. The industry is witnessing an increase in fine-pitch and high-layer-count designs that enable stronger electrical performance. It also gains from laser drilling and automated optical inspection technologies that ensure precision and reduce defect rates. Manufacturing processes are evolving toward eco-friendly etching and additive fabrication, improving efficiency and yield. Integration of surface-mount technologies accelerates mass production while reducing waste. The ability to withstand extreme temperatures and chemical exposure broadens usage across automotive and aerospace industries. These advancements collectively position flexible PCBs as critical components in next-generation electronics design.

- For instance, polyimide materials have demonstrated thermal stability at temperatures up to 500 °C and chemical resistance in harsh environments. The industry is witnessing an increase in fine-pitch and high-layer-count designs that enable stronger electrical performance. It also gains from laser drilling and automated optical inspection technologies that ensure precision and reduce defect rates.

Expanding Role of 5G Infrastructure and High-Speed Communication Devices in Driving Market Demand

Widespread 5G network deployment accelerates the use of high-frequency and low-loss FPCBs in communication modules. The U.S. Flexible Printed Circuit Boards (PCB) Market benefits from rising investments in base stations, data centers, and antenna systems. It supports the manufacturing of compact, signal-stable circuits required for high-data transmission environments. FPCBs are integral to smartphones, routers, and automotive connectivity modules supporting 5G applications. Telecommunications companies increasingly adopt flexible substrates to minimize signal interference and improve transmission reliability. The market also benefits from growing use in IoT and cloud infrastructure components. Continuous investment in fiber-optic expansion further stimulates circuit innovation and performance optimization.

Growing Adoption of Electric Vehicles and Advanced Driver Assistance Systems in Automotive Sector

The U.S. automotive industry continues to integrate flexible PCBs into EV battery systems, power modules, and infotainment dashboards. It enables compact circuit designs that reduce weight and improve efficiency. The increasing shift toward electric and hybrid vehicles drives steady PCB demand for high-temperature and vibration-resistant circuits. FPCBs enhance the durability and connectivity of advanced driver assistance systems and LED lighting modules. Manufacturers are aligning production with automotive-grade quality standards and environmental compliance. Integration with sensors and power distribution units enhances safety and energy efficiency. The growing EV ecosystem and rising semiconductor integration in vehicles significantly strengthen the country’s demand outlook.

Market Trends:

Emergence of Flexible Hybrid Electronics and Printed Sensor Integration Across Diverse Industries

The U.S. Flexible Printed Circuit Boards (PCB) Market is evolving with flexible hybrid electronics that merge traditional circuits and printed sensors. It enables adaptive designs suitable for wearable devices, healthcare monitoring systems, and smart textiles. Printed biosensors and stretchable circuits support emerging medical technologies. Integration of advanced conductive inks allows seamless connectivity in bendable substrates. Research institutions collaborate with manufacturers to develop high-performance printed components for aerospace and defense uses. Wearable healthcare devices, including glucose and ECG monitors, rely on flexible circuitry for continuous operation. The trend drives cross-sector innovation, connecting healthcare, industrial, and consumer electronics.

- For instance, Molex, LLC engineers have bonded over one billion LEDs to silver printed circuits on polyester, achieving trace widths as narrow as 0.127 mm and FFC tails at 0.50 mm pitch — underlining the capability of hybrid flexible circuits. It enables adaptive designs suitable for wearable devices, healthcare monitoring systems, and smart textiles. Printed biosensors and stretchable circuits support emerging medical technologies.

Shift Toward Eco-Friendly Manufacturing and Sustainable Material Utilization in PCB Fabrication

Environmental sustainability becomes a defining trend in flexible PCB manufacturing across the U.S. market. Companies are replacing traditional chemicals with water-based or solvent-free etching solutions. It promotes compliance with strict environmental and disposal regulations. The adoption of recyclable substrate materials like bio-polyimide enhances product lifecycle management. Manufacturers invest in cleaner production technologies and energy-efficient lamination systems. Waste reduction through additive processes contributes to cost savings and better yield. Corporate sustainability programs drive the adoption of green packaging and RoHS-compliant materials. The overall transition strengthens brand reputation and aligns with global environmental standards.

- For instance, Molex’s packaging technology for its Percept Current Sensors uses 99 % less water in PCB manufacturing and avoids copper sludge generation — showing how production can align with environmental goals. Companies are replacing traditional chemicals with water-based or solvent-free etching solutions.

Increased Integration of Automation and AI-Driven Quality Control in Manufacturing Operations

Automation plays a transformative role in PCB manufacturing by improving precision and production speed. The U.S. Flexible Printed Circuit Boards (PCB) Market sees growing deployment of AI-driven inspection systems and robotic assembly lines. It enables predictive defect detection and higher output consistency. Machine vision tools monitor intricate layers during fabrication, ensuring better yield. Smart manufacturing environments integrate digital twins to optimize resource allocation. Real-time data analytics enhance operational efficiency and traceability. These technological shifts minimize downtime, reduce labor dependency, and elevate quality standards across mass production.

Rising Demand for Customized and Application-Specific PCB Solutions Among OEMs and Start-ups

Demand for tailor-made FPCBs is increasing among OEMs seeking optimized designs for specific product architectures. It supports diverse needs across automotive, telecom, aerospace, and medical electronics. Custom layouts improve assembly performance and signal accuracy under varying operational loads. Start-ups developing niche devices prefer modular PCB structures for quick prototyping. The shift toward shorter product cycles encourages flexible, scalable design frameworks. Manufacturers leverage advanced CAD and simulation tools to refine prototypes rapidly. This customization trend enhances collaboration between suppliers and device manufacturers, improving time-to-market competitiveness.

Market Challenges Analysis:

High Production Costs and Complexity in Multilayer PCB Manufacturing Affecting Profit Margins

The U.S. Flexible Printed Circuit Boards (PCB) Market faces cost challenges from high-end material requirements and complex production stages. Multilayer boards demand precision alignment, advanced lamination, and controlled cleanroom environments. It leads to higher capital investment and operational expenditure for manufacturers. Limited local suppliers for specialized materials like LCP and adhesives increase procurement costs. Design complexity further raises the risk of production errors and rework. Equipment maintenance and testing costs reduce overall profitability for smaller firms. These challenges restrict price competitiveness against imports from cost-efficient Asian suppliers, influencing long-term margins.

Supply Chain Constraints and Skilled Labor Shortages Impacting Production Scalability and Timely Delivery

Global supply chain disruptions and dependence on imported raw materials remain major hurdles. The market struggles with long lead times for copper foils, coverlays, and polyimide films. It affects production timelines and delivery schedules for OEMs. Shortage of skilled technicians with experience in flexible PCB assembly worsens output delays. Training new workers for precision fabrication and inspection requires extensive time and resources. Logistic fluctuations increase shipping costs, reducing competitiveness in export markets. Companies are investing in local material sourcing and workforce development to overcome these structural constraints.

Market Opportunities:

Expansion of Domestic Fabrication Facilities Supported by Federal Incentives and Onshoring Policies

The U.S. Flexible Printed Circuit Boards (PCB) Market gains new opportunities through domestic production expansion and incentive-based manufacturing. Federal policies promoting semiconductor and electronics onshoring encourage investment in PCB fabrication infrastructure. It supports supply chain resilience and reduces dependency on foreign imports. Establishing advanced production hubs across states like Texas and Arizona enhances innovation capacity. Localized manufacturing shortens delivery times for defense and aerospace applications. Strategic partnerships with R&D institutions accelerate technology transfer and strengthen competitiveness in high-precision electronics manufacturing.

Integration of Flexible PCBs into Emerging Sectors Like Healthcare, AR/VR, and Renewable Energy Systems

Rapid innovation in wearable healthcare, virtual reality, and renewable energy applications creates strong growth potential. It allows flexible circuits to power diagnostic sensors, VR headsets, and solar power converters. Healthcare device makers utilize stretchable PCBs for real-time monitoring and patient comfort. Renewable energy systems adopt flexible boards in lightweight power modules and converters. The growing synergy between electronics miniaturization and smart functionality drives the market’s expansion into diverse sectors with high long-term value.

Market Segmentation Analysis:

By Type

The U.S. Flexible Printed Circuit Boards (PCB) Market is segmented into Multi-Layer, Rigid-Flex, Single-Sided, Double-Sided, and Others. Multi-Layer FPCBs dominate due to high circuit density, superior signal integrity, and suitability for compact, high-performance electronics. Rigid-Flex FPCBs hold a growing share supported by demand in aerospace, defense, and medical systems requiring vibration resistance and reliability. Single-Sided and Double-Sided variants cater to cost-sensitive consumer electronics and automotive applications. The “Others” category includes hybrid and stretchable circuits gaining traction in wearable devices and healthcare technologies through flexible substrate innovation.

- For instance, by leveraging its rigid-flex substrate technology that withstands 150,000 flex cycles, Samsung Electro‑Mechanics achieved a space-saving product architecture in mobile devices. Rigid-Flex FPCBs hold a growing share supported by demand in aerospace, defense, and medical systems requiring vibration resistance and reliability.

By End Use

The market serves diverse sectors including Industrial Electronics, Aerospace & Defense, IT & Telecom, Automotive, Consumer Electronics, and Others. Industrial Electronics benefit from the adoption of automation systems requiring durable interconnects. Aerospace and Defense sectors demand high-reliability PCBs for mission-critical applications. IT & Telecom continues expanding with 5G infrastructure and data center upgrades. Automotive applications, especially in electric vehicles and ADAS systems, drive strong consumption of flexible boards. Consumer Electronics remains the largest contributor through smartphones, tablets, and wearables integrating lightweight circuitry.

- For instance, Jabil Inc. integrated printed-circuit-substrate modules into industrial robotics that reduced connector counts by 40 %. Aerospace and Defense sectors demand high-reliability PCBs for mission-critical applications. It supports avionics and unmanned systems where circuit boards must meet stringent shock and thermal specifications. IT & Telecom continues expanding with 5G infrastructure and data center upgrades.

Segmentation:

By Type

- Multi-Layer FPCBs

- Rigid-Flex FPCBs

- Single-Sided FPCBs

- Double-Sided FPCBs

- Others

By End Use

- Industrial Electronics

- Aerospace & Defense

- IT & Telecom

- Automotive

- Consumer Electronics

- Others

By Country (For U.S. Regional Focus)

Regional Analysis:

The U.S. Flexible Printed Circuit Boards (PCB) Market holds a dominant position in North America with 48% regional share, reflecting its advanced manufacturing base and strong demand across key industries. The country’s leadership is reinforced by a high concentration of semiconductor fabrication facilities and electronics design centers in states such as California, Texas, and Arizona. It benefits from federal incentives supporting reshoring of PCB and semiconductor production, which enhance supply chain resilience. The U.S. also drives innovation in material science, automation, and miniaturization to meet performance and sustainability goals. Major automotive and aerospace manufacturers increasingly rely on domestic FPCB suppliers to ensure quality and compliance with regulatory standards. Continuous expansion of 5G networks, EV production, and defense modernization programs sustains steady market growth.

The country’s western region leads production and innovation due to the presence of Silicon Valley and major technology clusters. It accounts for a substantial share of national output, supported by advanced R&D and the availability of skilled labor. The Midwest region shows rising adoption driven by automotive and industrial electronics manufacturing, particularly in Michigan and Ohio. It benefits from ongoing investments in automation and connected vehicle technologies. The Southern states, including Texas, are strengthening their footprint through new semiconductor and flexible circuit fabrication plants. These regions collectively reinforce the U.S. position as a hub for innovation and high-value electronics production.

The northeastern region plays a key role in research, prototyping, and defense electronics. States such as Massachusetts and New York focus on developing advanced materials and PCB design software for aerospace and medical devices. It also benefits from collaborations between universities, startups, and established technology firms. The strong network of design centers and precision engineering capabilities contributes to continuous product evolution. With ongoing federal and private investments, regional diversification ensures balanced growth and supply stability across the nation. The U.S. remains the strategic core of North American flexible PCB development, aligning technology, innovation, and manufacturing strength to maintain its global leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Samsung Electro-Mechanics

- NOK Corporation

- Flex Ltd.

- Jabil Inc.

- Fujikura Ltd.

- Multi-Fineline Electronix, Inc. (MFLEX)

- Sumitomo Electric Industries, Ltd.

- TTM Technologies, Inc.

- Nippon Mektron Ltd.

- Zhen Ding Technology Holding Ltd.

Competitive Analysis:

The U.S. Flexible Printed Circuit Boards (PCB) Market features strong competition among established global and domestic manufacturers. It includes leading companies such as Samsung Electro-Mechanics, NOK Corporation, Flex Ltd., Jabil Inc., Fujikura Ltd., and TTM Technologies. These players focus on product innovation, reliability, and large-scale production efficiency to meet demand across consumer electronics, automotive, and aerospace sectors. Continuous investment in automation, material innovation, and multilayer circuit design enhances their market position. Strategic partnerships with semiconductor and OEM companies strengthen the value chain and improve supply continuity. It benefits from regional manufacturing expansion supported by advanced fabrication and sustainability-driven R&D. The competition remains dynamic, driven by technology leadership and capacity expansion initiatives across major players.

Recent Developments:

- In July 2025, TTM Technologies, Inc. announced the acquisition of a 750,000-square-foot facility in Eau Claire, Wisconsin. The facility was previously owned and operated by TDK for the production of disk drive products and is in excellent condition with the necessary infrastructure to support advanced technology PCB manufacturing. This acquisition represents TTM’s second facility in Wisconsin, joining its longtime Chippewa Falls site. The Eau Claire facility enhances the company’s ability to support future high-volume U.S. production of advanced technology PCBs across key markets, particularly data center computing and networking for generative AI applications.

- In June 2025, Jabil announced a planned multi-year $500 million investment to expand its footprint in the Southeast United States to support cloud and AI data center infrastructure customers. This significant commitment will enable new large-scale manufacturing capabilities, capital investments, and workforce development, with the facility expected to be operational by mid-calendar year 2026.

- In April 2025, Samsung Electro-Mechanics held the “2025 Win-Win Cooperation Day” with its partner companies, signing a “Partnership Ecosystem Enhancement Agreement” with the Win-Win Growth Committee and partner companies. As part of the agreement, Samsung Electro-Mechanics committed to providing approximately KRW 200 billion from 2025 to 2027 to support capacity building for small and medium-sized enterprises in their supply chain.

Report Coverage:

The research report offers an in-depth analysis based on Type, End Use, and Country segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of electric and hybrid vehicles will sustain long-term demand for high-reliability flexible PCBs.

- Growth in 5G infrastructure and data centers will drive next-generation multilayer circuit innovations.

- Miniaturization trends across consumer electronics will boost demand for compact flexible assemblies.

- Integration of automation and AI in PCB manufacturing will improve yield and reduce operational costs.

- Collaboration between OEMs and fabricators will enhance customization and product scalability.

- Federal incentives promoting onshore production will increase domestic manufacturing competitiveness.

- Development of recyclable and bio-based substrates will align with sustainability objectives.

- Expansion of defense and aerospace programs will strengthen high-end PCB requirements.

- Continuous R&D investment will accelerate adoption of hybrid flexible electronics across sectors.

- Industry consolidation through mergers and acquisitions will improve supply chain efficiency and capacity utilization.