Market Overview

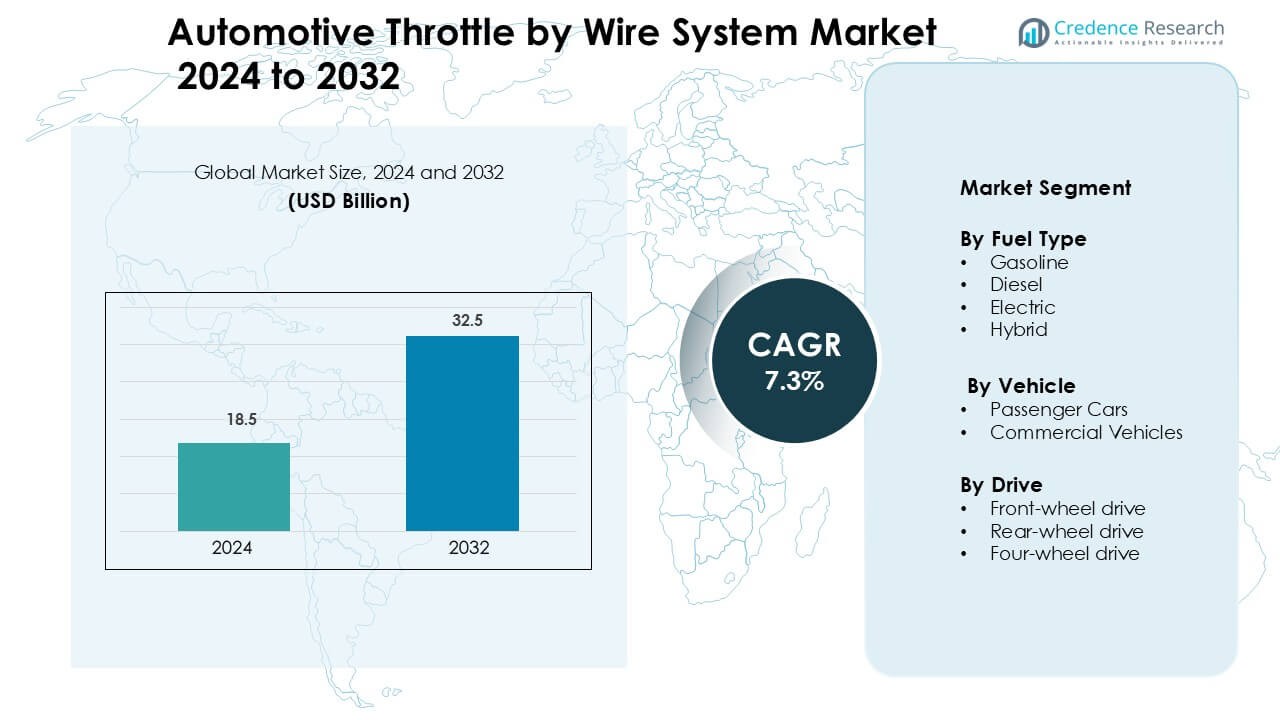

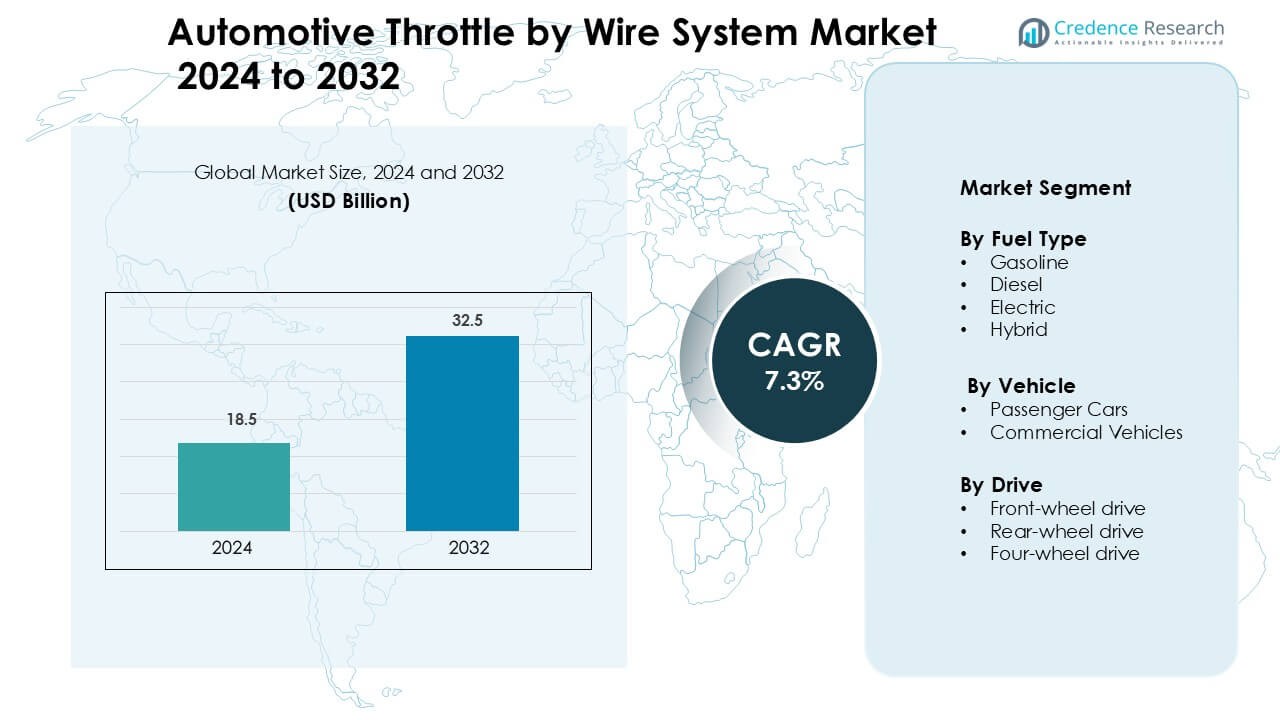

Automotive Throttle by Wire System Market was valued at USD 18.5 billion in 2024 and is anticipated to reach USD 32.5 billion by 2032, growing at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Throttle by Wire System Market Size 2024 |

USD 18.5 Billion |

| Automotive Throttle by Wire System Market, CAGR |

7.3% |

| Automotive Throttle by Wire System Market Size 2032 |

USD 32.5 Billion |

Key players in the Automotive Throttle‑By‑Wire System Market include Robert Bosch GmbH, Continental AG, Denso Corporation, ZF Friedrichshafen AG and Aptiv PLC, which command the industry through extensive OEM relationships, global manufacturing presence and advanced R&D capabilities. These firms lead by delivering high‑precision sensor‑actuator modules and full throttle‑by‑wire systems for ICE and EV applications. Regionally, the North America region dominates the market, accounting for 31.8 % of global share in 2023, thanks to strong EV uptake, mature automotive electronics infrastructure and stringent emissions regulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Market size reached USD 18.5 billion in 2024 and is projected to grow at a CAGR of 7.3% through to 2035.

- Stringent emissions norms and rising EV/hybrid adoption drive demand for electronic throttle‑by‑wire systems, especially in the gasoline fuel type sub‑segment holding the largest share.

- Key trends include the shift to electric and hybrid vehicles, integration of throttle‑by‑wire into ADAS and drive‑by‑wire architectures, plus rising aftermarket retrofit opportunities.

- Competitive dynamics reflect consolidation among Tier‑1 suppliers with global footprints; development cost and integration complexity act as market restraints, especially for smaller OEMs.

- Regionally, North America dominates the market with the highest share (over 30 %), while Asia‑Pacific offers the fastest growth thanks to large automotive production hubs and electrification momentum.

Market Segmentation Analysis:

By Fuel Type

In the fuel type segmentation of the Automotive Throttle‑By‑Wire System Market, the gasoline sub‑segment holds dominance, capturing the largest share due to its established base in internal combustion engine (ICE) vehicles. This leads growth because throttle‑by‑wire technology allows manufacturers to meet stricter emissions and fuel‑efficiency demands for gasoline engines. Meanwhile, the electric and hybrid sub‑segments are registering the fastest growth, driven by the electrification trend and regulatory mandates favouring lower‑emission powertrains.

- For instance, Bosch is a major global supplier of electronic throttle control (ETC) systems and has supplied over 100 million throttle valves.

By Vehicle Type

In the vehicle‑type segmentation, the passenger car segment is the dominant sub‑segment in the throttle‑by‑wire systems market, reflecting the large volume of light vehicles and strong adoption of advanced control technologies therein. Passenger cars push demand via enhanced driver‑assistance and fuel‑savings features, prompting OEMs to integrate throttle‑by‑wire systems. Meanwhile, the commercial vehicle segment is also growing as stricter emission regulations and fleet electrification drive the use of electronic throttle control in trucks and buses.

- For instance, Denso Corporation reports supplying electronic throttle-body modules for over 20 million passenger cars globally, demonstrating strong passenger-car penetration.

By Drive Type

Within the drive‑type segmentation, front‑wheel drive (FWD) is the dominant sub‑segment, securing the largest market share, owing to its prevalence in compact and midsize passenger cars globally. FWD’s cost‑effectiveness and fuel‑efficiency advantages make it a preferred configuration for vehicles adopting throttle‑by‑wire technologies. Meanwhile, rear‑wheel drive (RWD) and four‑wheel drive (4WD) segments are gaining ground as SUVs and performance vehicles increasingly incorporate advanced throttle control systems to satisfy off‑road, performance and all‑terrain requirements.

Key Growth Drivers

Stringent Emissions and Fuel Efficiency Regulations

Global regulatory bodies continue tightening emissions and fuel‑economy standards, compelling automakers to adopt advanced systems like throttle‑by‑wire (TBW). The shift from mechanical linkage to electronically controlled throttle enables more accurate air‑fuel control and reduced emissions, aligning with mandates in regions such as Europe and North America. Consequently, demand for TBW systems rises as manufacturers integrate them to ensure compliance while sustaining performance and efficiency.

- For instance, Bosch’s electronic throttle valve model DV-E/RKL-E5.9 has been supplied in over 100 million units worldwide and features a throttle-plate actuation time of under 100 milliseconds, enabling faster and more precise air-mass regulation.

Electrification of Powertrains and EV/Hybrid Growth

The accelerating uptake of electric vehicles (EVs) and hybrid powertrains boosts the need for TBW technologies. These systems provide precise throttle management and smoother torque control in EVs and hybrids, which lack mechanical throttle linkages As OEMs scale battery electric vehicles and plug‑in hybrids, the TBW market expands accordingly, driven by the novel control demands of electrified vehicles.

- For instance, Denso produces powertrain components for EVs and hybrids (including power control units and battery monitoring units), accelerator pedal/throttle-by-wire modules.

Integration with Advanced Driver Assistance Systems (ADAS) and Automotive Electronics

Modern vehicles increasingly feature ADAS, connectivity, and semi‑autonomous systems, which rely on electronic throttle inputs for rapid response and system coordination. The TBW architecture enables seamless integration with electronic control units (ECUs), traction/stability control, and drive‑by‑wire subsystems. This growing integration requirement prompts OEMs and suppliers to adopt TBW solutions, further propelling market growth.

Key Trends & Opportunities

Growing Demand in Electric and Hybrid Vehicle Segments

As automakers pivot toward EVs and hybrids, TBW systems emerge as core enablers of the electrified drivetrain. Enhanced management of throttle response, energy efficiency, and torque delivery in battery‑electric and hybrid models positions TBW as a strategic component. Suppliers and vehicle manufacturers have the opportunity to develop optimized TBW modules tailored for electrified platforms and thereby capture early‑mover advantages.

- For instance, Denso Corporation reports supplying TBW modules tailored for hybrid-electric applications that have undergone more than 10 million cumulative vehicle installations.

Emergence of Connected, Autonomous and Drive‑by‑Wire Architectures

Vehicles increasingly rely on electronic control over traditional mechanical systems—accelerator, steering, braking—creating synergy with TBW architectures. The trend toward fully drive‑by‑wire systems and autonomous vehicles offers TBW providers a pathway to embed their technologies within broader vehicle electronic frameworks Additionally, aftermarket opportunities exist for retrofits or upgrades in connected vehicles, where TBW systems improve responsiveness and safety‑related control functions.

- For instance, Wipro is involved in automotive engineering and software, specific, highly detailed hardware specifications for a safety-critical “drive-by-wire” system in production vehicles would typically be subject to rigorous industry standards and testing.

Key Challenges

High Cost and Complexity of Development & Integration

Implementing TBW systems involves significant investment in sensors, actuators, software and failsafe architectures. Smaller OEMs or component suppliers may face cost barriers, particularly when shifting from mechanical to electronic throttle systems. The complexity of integration with other vehicle control systems increases certification burdens and may slow widespread adoption in cost‑sensitive vehicle segments.

Safety, Reliability and Cyber‑Security Concerns

Electronic throttle systems replace mechanical linkages, raising questions around system failures, unintended acceleration risks and cyber‑vulnerability in connected vehicles. Manufacturers must ensure TBW systems meet stringent safety, redundancy and cybersecurity standards, which adds design and validation burden. This challenge can delay adoption or increase costs for vehicle programs that require full system assurance under regulatory scrutiny.

Regional Analysis

North America

North America holds an estimated ~25% of the global throttle-by-wire systems market. The region benefits from strong OEM presence, advanced vehicle electronics adoption, and regulatory pressure on emissions and fuel-efficiency. The United States, in particular, is a leading adopter of electronic throttle systems in mainstream and premium vehicles, and Tier-1 suppliers are actively integrating these systems into hybrid and EV architectures. The favourable infrastructure and high per-vehicle electronics content continue to support market growth and strengthen the region’s share.

Europe

Europe captures approximately ~20% of the market for throttle-by-wire systems. Stringent emission standards (such as Euro 6/7), a strong automotive manufacturing base in Germany, France and the UK, and an early shift toward electrified powertrains drive demand for advanced throttle control systems. OEMs are focusing on improving mechatronic integration, actuation precision and software-driven control in European platforms, helping the region to maintain a significant presence in this market segment.

Asia-Pacific

Asia-Pacific commands the largest share of the global market roughly ~35-40% thanks to its massive vehicle production base, rapid EV and hybrid vehicle deployment, and strong automotive component industry in China, Japan, South Korea and India. The region’s scale in passenger vehicle output, rising vehicle electronics budgets and favourable government policies for electrification drive high adoption of throttle-by-wire systems. Consequently, Asia-Pacific remains the dominant regional market.

Latin America

Latin America contributes a more modest share around ~7-8% of the throttle-by-wire market. Growth is led by Brazil and Mexico, where increasing local vehicle production and component localisation are enhancing availability of electronic throttle systems. However, economic volatility, lower average vehicle content than developed markets and slower transition to electrified powertrains limit the region’s share relative to larger regions.

Middle East & Africa

The Middle East & Africa region holds roughly ~5-6% of the global market for throttle-by-wire systems. Vehicle markets in the UAE, Saudi Arabia and South Africa are gradually transitioning toward more electronics‐intensive components, but lower manufacturing base, less stringent regulatory pressure and a slower rate of electrification mean that uptake is behind other regions. Still, rising premium vehicle sales and aftermarket modernisation are improving penetration over time.

Market Segmentations:

By Fuel Type

- Gasoline

- Diesel

- Electric

- Hybrid

By Vehicle

- Passenger Cars

- Commercial Vehicles

By Drive

- Front-wheel drive

- Rear-wheel drive

- Four-wheel drive

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Automotive Throttle‑By‑Wire System Market remains moderately concentrated, dominated by well‑established automotive Tier‑1 suppliers such as Robert Bosch GmbH, Continental AG and Denso Corporation, which collectively hold significant global market shares. These leading players enjoy advantages through global manufacturing footprints, deep OEM relationships and extensive R&D investment in sensor‑actuator integration and electronic control units. Meanwhile, a broader tier of suppliers, including Magneti Marelli S.p.A., ZF Friedrichshafen AG and Aptiv PLC, actively compete by innovating on cost‑effective architectures, modular systems and drive‑by‑wire platforms. As electrification and autonomy trends accelerate, suppliers expand collaborations and pursue strategic partnerships to differentiate offering, create scale and address evolving OEM demands for electronic throttle control systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cruise LLC

- Lyft, Inc.

- MOIA

- Uber Technologies INC.

- NAVYA

- Beijing Xiaoju Technology Co., Ltd.

- Zoox, Inc.

- Aptiv

- Tesla

- Waymo LLC

Recent Developments

- In September 2025, Lyft Launched a robotaxi pilot in Atlanta with May Mobility. Vehicles feature a redundant drive-by-wire stack and 360° sensing.

- In June 2025, MOIA Held the world premiere of the series ID. Buzz AD in Hamburg.

Report Coverage

The research report offers an in-depth analysis based on Fuel Type, Vehicle, Drive and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness stronger integration of throttle‑by‑wire systems in electric and hybrid vehicles as OEMs prioritize powertrain efficiency.

- Manufacturers will invest in modular and scalable electronic throttle platforms to support various vehicle types and worldwide regulatory demands.

- Throttle‑by‑wire systems will become more deeply embedded within ADAS and autonomous driving architectures, boosting demand from connected vehicle uptake.

- Growth will accelerate in Asia‑Pacific as production volumes rise and vehicle electrification expands across China, India and Southeast Asia.

- Suppliers will increasingly form strategic alliances and joint ventures to share R&D costs and penetrate new regional markets faster.

- Front‑wheel‑drive vehicles will continue dominating sub‑segment share, but four‑wheel‑drive applications will gain traction due to SUV and off‑road demand.

- Automation of throttle mapping and real‑time diagnostics will advance, enabling predictive maintenance and over‑the‑air updates for electronic systems.

- Entry into emerging regions (“Latin America & Middle East & Africa”) will broaden as local manufacturers adopt electronic throttle systems to meet emissions standards.

- Cost pressures and complexity will lead suppliers to focus on lighter, low‑power actuator designs and integrated ECU modules.

- Regulatory pressures on emissions and safety will compel faster replacement of mechanical throttle linkages, driving retrofit and aftermarket opportunities.