Market Overview:

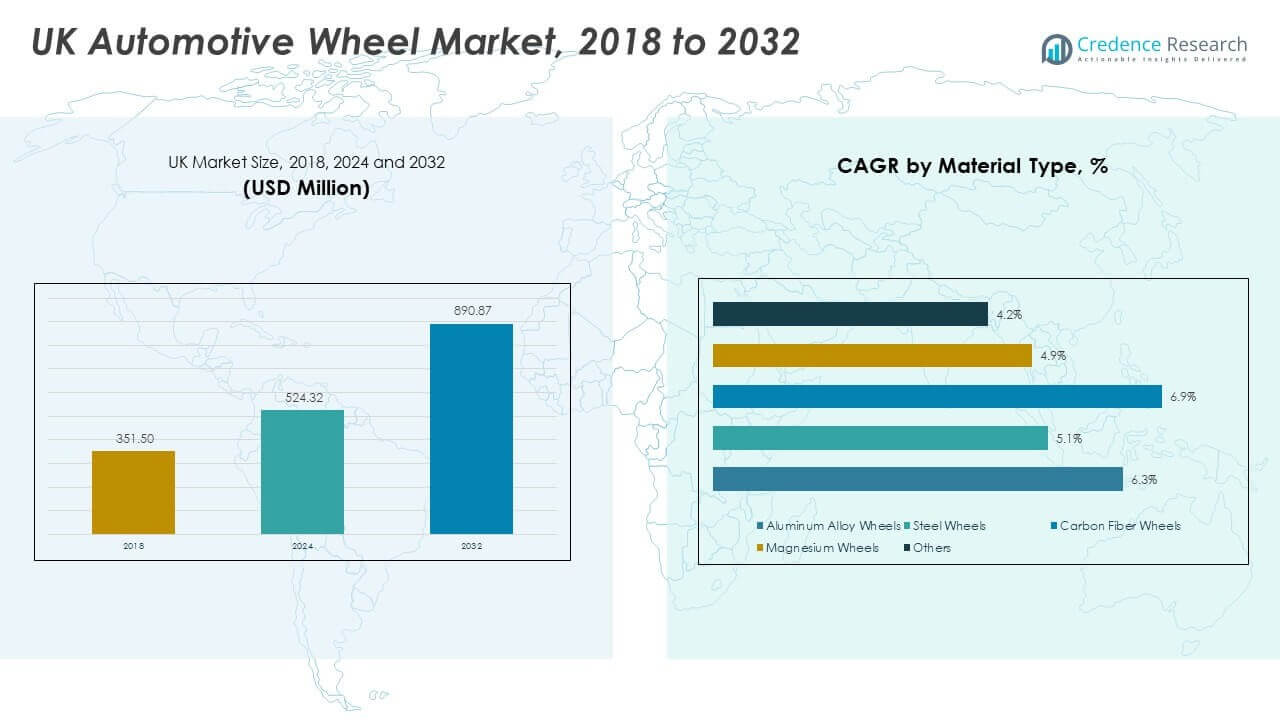

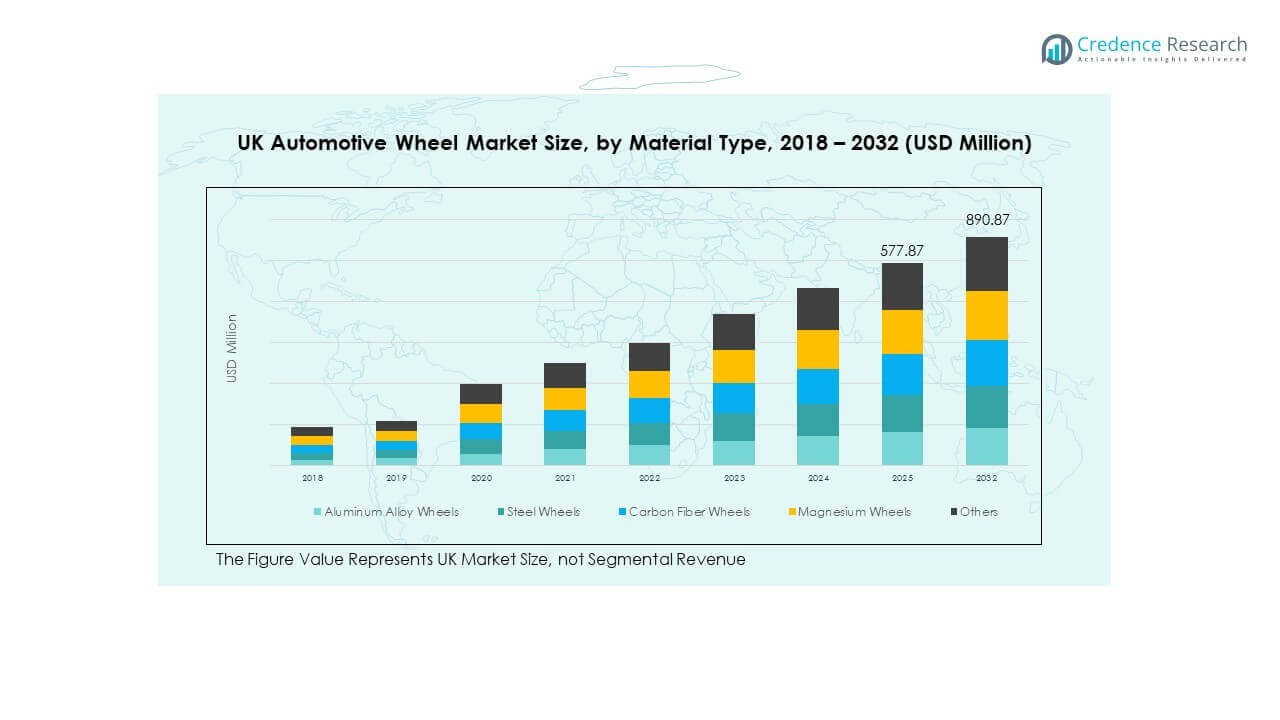

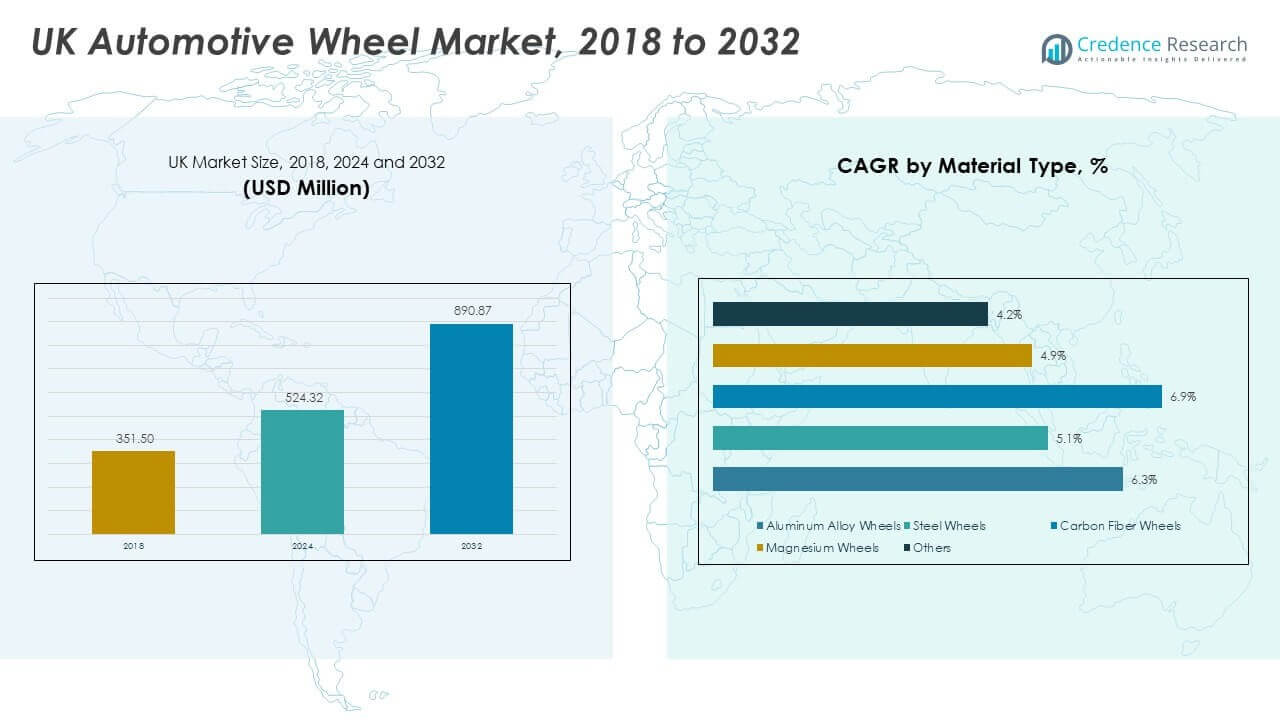

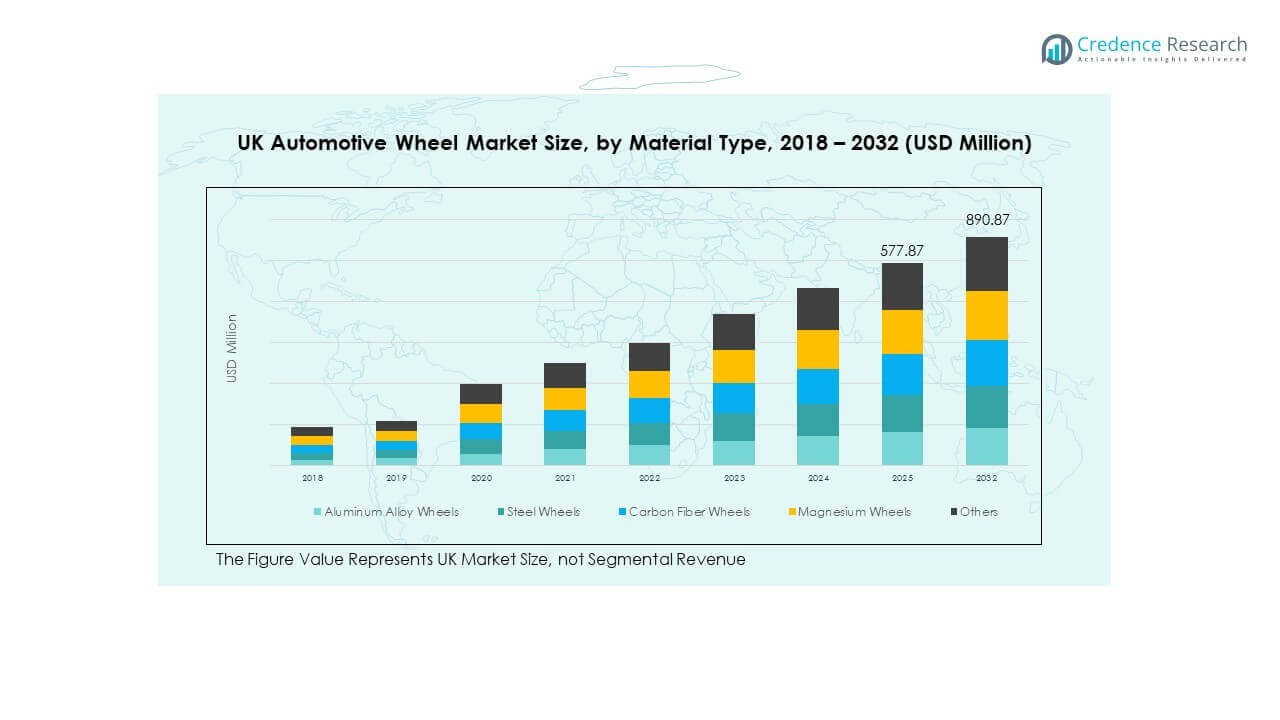

The UK Automotive Wheel Market size was valued at USD 351.50 million in 2018, rose to USD 524.32 million in 2024, and is anticipated to reach USD 890.87 million by 2032, at a CAGR of 6.38 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Automotive Wheel Market Size 2024 |

USD 524.32 million |

| UK Automotive Wheel Market, CAGR |

6.38% |

| UK Automotive Wheel Market Size 2032 |

USD 890.87 million |

Growth is being driven by rising demand for lightweight materials as manufacturers pursue improved fuel efficiency and handling. Consumers’ interest in alloy wheels and larger rim sizes is supporting aftermarket uptake. Meanwhile, innovation in manufacturing processes and the shift towards electric and hybrid vehicles are upping demand for advanced wheel solutions.

Regionally, the UK market benefits from strong legacy automotive manufacturing in Western Europe and a mature aftermarket sector. Emerging Eastern European countries are gaining traction as production and export hubs, thanks to lower labour costs and investment incentives. Meanwhile, Asia‑Pacific continues to lead globally in manufacturing and demand growth, supported by high vehicle production volumes and rising disposable incomes.

Market Insights:

- The UK Automotive Wheel Market was valued at USD 351.50 million in 2018, reached USD 524.32 million in 2024, and is projected to attain USD 890.87 million by 2032, growing at a CAGR of 6.38 % during 2024–2032.

- South East England (38 %), Midlands (27 %), and North West (18 %) dominate due to their concentration of OEM hubs, manufacturing strength, and a mature aftermarket distribution network.

- Scotland and Northern Ireland (10 %) represent the fastest-growing region, supported by rising EV adoption, government incentives, and expansion of local component production.

- From the chart, aluminum alloy wheels account for 62 % of total market share, driven by their lightweight efficiency and corrosion resistance.

- Steel wheels (20 %), followed by carbon fiber and magnesium (15 %), contribute the remainder, reflecting steady adoption across passenger and high-performance vehicle segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Lightweight Materials

The UK Automotive Wheel Market is benefiting from a growing focus on lightweight materials, particularly in response to fuel efficiency regulations. Manufacturers are increasingly using alloys such as aluminum and magnesium to reduce vehicle weight and improve fuel economy. This is especially important for the electric vehicle (EV) segment, where energy efficiency and vehicle range are directly impacted by weight reduction. The trend is also driven by stringent environmental regulations and government incentives encouraging the adoption of sustainable automotive technologies. As consumers demand more fuel-efficient and eco-friendly vehicles, manufacturers are compelled to adopt these advanced materials. This shift is expected to continue driving demand in the UK automotive wheel market. Lightweight wheels not only enhance fuel efficiency but also provide better handling and performance.

- For instance, Audi introduced wheels for its Q4 e-tron that use an alloy containing at least 70% recycled material. This is especially important for the electric vehicle (EV) segment, where energy efficiency and vehicle range are directly impacted by weight reduction.

Growth in Electric Vehicle Production

The rise of electric vehicles (EVs) is one of the key drivers of the UK Automotive Wheel Market. The increased production of EVs requires a shift in wheel technology to meet specific requirements for performance and durability. Manufacturers are innovating to meet the unique needs of electric cars, including lightweight, corrosion-resistant, and energy-efficient wheels. The growth in EV adoption is further bolstered by government policies and incentives aimed at reducing carbon emissions. As more manufacturers launch electric vehicle models, the demand for specialized automotive wheels is expected to rise. This shift also drives the need for advanced manufacturing techniques, including 3D printing and automated processes. The demand for wheels that can handle higher torque and offer improved aerodynamics will continue to fuel innovation in wheel design.

- For instance, Audi’s e-tron GT uses 20-inch aluminium alloy wheels produced with Alcoa’s low-carbon aluminium and flow-forming technology to optimise weight and aerodynamics. The growth in EV adoption is further bolstered by government policies and incentives aimed at reducing carbon emissions.

Aftermarket Demand for Custom Wheels

The demand for customized wheels is another major driver of the UK Automotive Wheel Market. Consumers are increasingly looking for personalized wheels to match their vehicle’s aesthetic and performance characteristics. This trend is particularly prominent in the premium vehicle segment, where vehicle owners seek high-quality, bespoke wheel options. The aftermarket for automotive wheels is driven by a growing interest in car customization, as well as the desire to enhance vehicle performance and aesthetics. Manufacturers are responding by offering a wide range of designs, sizes, and materials to cater to this evolving consumer demand. The increasing preference for custom and luxury wheels is expected to sustain market growth in the coming years.

Technological Advancements in Manufacturing

Technological advancements in wheel manufacturing processes are driving innovation in the UK Automotive Wheel Market. New technologies, such as lightweight alloy casting, 3D printing, and automated assembly lines, have significantly improved the quality and precision of wheels. These innovations enable manufacturers to produce wheels that are stronger, lighter, and more durable. The adoption of automation has also reduced production costs and increased efficiency. As the demand for high-performance wheels grows, manufacturers are investing in cutting-edge technologies to stay competitive. The use of advanced robotics and digital modeling is helping to streamline production processes while maintaining high standards of quality. The continuous evolution of manufacturing technology is expected to contribute to market growth in the UK.

Market Trends:

Focus on Sustainable Materials

Sustainability is becoming an increasingly important trend in the UK Automotive Wheel Market. Manufacturers are increasingly adopting eco-friendly materials such as recycled aluminum and biodegradable composites. This trend is driven by growing environmental concerns and regulations focused on reducing the carbon footprint of vehicles. The automotive industry’s push for greener solutions is pushing manufacturers to innovate and produce wheels that not only perform well but are also sustainable. The use of recycled materials helps reduce energy consumption in manufacturing processes, making the entire vehicle production cycle more environmentally friendly. As sustainability becomes a key consumer preference, the demand for eco-friendly wheels is expected to increase. The trend toward sustainable materials aligns with the broader automotive industry’s shift toward reducing emissions and adopting green technologies.

- For instance, Audi and AMAG developed a wheel alloy for the Q4 series that incorporates at least 70% recycled material, saving around 300 kg CO₂ per vehicle. This trend is driven by growing environmental concerns and regulations focused on reducing the carbon footprint of vehicles.

Shift Towards Larger Wheel Sizes

The trend towards larger wheel sizes is gaining momentum in the UK Automotive Wheel Market. Vehicle owners, particularly those in the luxury and performance car segments, are increasingly opting for larger wheels for both aesthetic and performance reasons. Larger wheels not only enhance the visual appeal of a vehicle but also improve handling and braking performance. The rise in demand for SUVs and crossover vehicles, which typically require larger wheels, is further propelling this trend. Additionally, technological advancements in tire and wheel construction allow for larger sizes without compromising safety or comfort. This shift toward bigger wheels is expected to continue, especially with the increasing popularity of high-performance vehicles. Larger wheels are also associated with premium vehicles, driving demand among high-end consumers.

- For instance, Aston Martin offers 23-inch magnesium wheels on its DBX S model, which alone reduce unsprung mass by 19 kg compared to standard forged aluminium items. Larger wheels not only enhance the visual appeal of a vehicle but also improve handling and braking performance.

Introduction of Smart Wheels

The UK Automotive Wheel Market is seeing the introduction of smart wheels, equipped with sensors and connectivity features. These wheels are integrated with sensors that monitor tire pressure, temperature, and wear, providing real-time data to the vehicle’s onboard systems. The growing focus on vehicle connectivity and the Internet of Things (IoT) is driving the adoption of smart wheels in the automotive sector. Smart wheels can enhance safety by providing crucial data to prevent tire blowouts or other potential hazards. They also improve the overall driving experience by allowing for better maintenance scheduling and real-time alerts. As connectivity becomes a standard feature in modern vehicles, the demand for smart wheels is expected to increase. The integration of smart technology into automotive wheels is an exciting trend that promises to revolutionize the industry.

Rise in Alloy Wheel Adoption

Alloy wheels continue to dominate the UK Automotive Wheel Market due to their superior strength, lightweight properties, and aesthetic appeal. The trend toward alloy wheels is being driven by their ability to improve fuel efficiency and vehicle performance. Alloy wheels are also highly resistant to rust, making them more durable compared to traditional steel wheels. As consumers demand higher-performance vehicles, alloy wheels are becoming a popular choice, particularly in the premium and luxury segments. The increasing availability of alloy wheels in various finishes and designs further drives their adoption. Moreover, alloy wheels are often used in racing and high-performance vehicles due to their lightweight and durable properties. The continuous evolution of alloy wheel design and manufacturing techniques ensures that this trend remains strong in the UK automotive sector.

Market Challenges Analysis:

High Cost of Premium Wheels

The high cost of premium wheels poses a significant challenge to the UK Automotive Wheel Market. High-quality materials, such as lightweight alloys and custom finishes, contribute to the elevated prices of premium wheels. While consumers in the luxury and performance vehicle segments may be willing to invest in these high-end products, price sensitivity remains a challenge for mass-market vehicle owners. The premium nature of these wheels also means they are often subject to higher production costs, which may limit their widespread adoption in the economy vehicle segment. The market faces the challenge of balancing affordability with quality, as consumers demand better performance and aesthetics without exceeding their budgets. With the increasing preference for custom wheels, the cost barrier is becoming a greater concern for the broader consumer base. Manufacturers will need to find innovative solutions to lower production costs while maintaining high-quality standards.

Competition and Market Fragmentation

Another challenge in the UK Automotive Wheel Market is the highly fragmented nature of the market. The presence of numerous manufacturers and aftermarket suppliers creates stiff competition, making it difficult for individual companies to secure a significant share of the market. This fragmentation leads to price wars, particularly in the economy vehicle segment, where consumers are more price-sensitive. As a result, manufacturers must continuously innovate to differentiate their products and stay competitive. The need to offer high-quality wheels at competitive prices, while keeping up with the latest trends and technologies, puts pressure on manufacturers to invest in research and development. At the same time, smaller companies may struggle to keep up with larger, well-established players that have significant resources to invest in new technologies and marketing. The challenge of standing out in a crowded market remains a significant hurdle for many businesses.

Market Opportunities:

Growth in Electric Vehicle Wheel Demand

The rise in electric vehicle (EV) production presents a significant opportunity for the UK Automotive Wheel Market. As more consumers shift to electric cars, the demand for specialized wheels that cater to EVs’ performance requirements is expected to grow. EVs require wheels that can handle higher torque and provide better durability due to the unique performance characteristics of electric engines. Manufacturers can seize this opportunity by focusing on the development of lightweight, energy-efficient wheels specifically designed for EVs. As the UK government pushes for greener transportation solutions, the increasing adoption of electric vehicles will continue to drive the demand for specialized wheels, offering a new avenue for market growth.

Focus on Sustainability and Eco-friendly Materials

The growing focus on sustainability and the adoption of eco-friendly materials presents a key opportunity in the UK Automotive Wheel Market. Consumers are becoming more environmentally conscious, leading to a rising demand for wheels made from sustainable, recyclable materials. Manufacturers who can capitalize on this trend by offering products made from recycled aluminum or biodegradable composites will be well-positioned to cater to this consumer demand. This shift towards sustainability is not only beneficial for the environment but also helps manufacturers meet regulatory requirements that are becoming more stringent over time. As the trend towards eco-friendly solutions continues, the market presents ample opportunities for companies to innovate and lead in this space.

Market Segmentation Analysis:

By Material Type

The UK Automotive Wheel Market is segmented by material type, with aluminum alloy wheels dominating due to their lightweight and corrosion-resistant properties. Steel wheels, known for their durability and cost-effectiveness, also hold a significant share. Carbon fiber wheels are gaining traction in the high-performance and luxury vehicle segments, owing to their superior strength-to-weight ratio. Magnesium wheels are increasingly being used for their lightweight advantages, particularly in sports cars and electric vehicles. Other materials, such as composite wheels, are emerging but still represent a smaller portion of the market.

- For instance, Mercedes-Benz uses aluminium alloy wheels in their S-Class, significantly enhancing vehicle performance and durability. Steel wheels, known for their durability and cost-effectiveness, also hold a significant share. Volvo’s use of steel wheels in their trucks exemplifies how cost efficiency remains critical in commercial vehicles.

By Vehicle Type

The market is categorized by vehicle type, with passenger vehicles leading the demand due to the growing number of personal car sales. Commercial vehicles follow, driven by the need for durable, cost-efficient wheels for trucks and buses. Off-highway vehicles, though a smaller segment, contribute to the demand, particularly in the agricultural and construction industries where heavy-duty wheels are required for rough terrains.

By End-User

The UK Automotive Wheel Market is divided into OEM and aftermarket segments. OEM wheels are primarily sold directly to vehicle manufacturers, forming the bulk of the market. Aftermarket wheels, offered through distributors and retail channels, cater to consumers looking for customization, performance enhancements, or replacement wheels.

By Price Range

The market offers a range of price options, with premium wheels commanding higher demand in luxury vehicle segments, while economy wheels dominate the mass-market vehicle category due to their affordability.

By Distribution Channel

The primary distribution channels are direct sales to OEMs, online sales catering to consumers and aftermarket buyers, and distributors/dealers for both OEM and aftermarket products.

By Application

The application segments include commercial and personal use, with personal use vehicles contributing the most to the market due to the higher volume of passenger cars on the road.

Segmentation:

By Material Type:

- Aluminum Alloy Wheels

- Steel Wheels

- Carbon Fiber Wheels

- Magnesium Wheels

- Others

By Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

- Off-Highway Vehicles

By End-User:

- OEM (Original Equipment Manufacturer)

- Aftermarket

By Country:

- UK Automotive Wheel Market Volume Share by Country

- UK Automotive Wheel Market Revenue Share by Country

By Price Range:

By Distribution Channel:

- Direct Sales

- Online Sales

- Distributors/Dealers

By Application:

- Commercial Use

- Personal Use

Regional Analysis:

South East England

The South East of England, with its proximity to London, is a key hub for the UK Automotive Wheel Market. This region accounts for a substantial portion of market activity, driven by a strong automotive manufacturing presence and the presence of several OEMs. The region’s strategic location allows for robust distribution networks, facilitating the easy flow of automotive wheels to various retail and commercial sectors. It also benefits from proximity to ports, making it ideal for the import and export of wheel components. With a large concentration of high-performance and luxury car manufacturers, this area sees high demand for premium automotive wheels, including alloy and carbon fiber wheels.

Midlands and North West

The Midlands and North West regions hold a significant share of the UK Automotive Wheel Market, especially in the manufacturing sector. These areas are home to numerous automotive production facilities, including major players like Jaguar Land Rover, which significantly drives demand for OEM wheels. The demand for steel and aluminum alloy wheels is particularly strong in these regions, as they cater to both mass-market vehicles and a growing number of electric vehicles (EVs). These regions also contribute heavily to the aftermarket sector, where custom and replacement wheels for vehicles are in high demand. As the UK moves towards a more sustainable future, these regions are adapting to the rise of EVs and the shift towards lighter and more eco-friendly materials for wheels.

Scotland and Northern Ireland

In Scotland and Northern Ireland, the UK Automotive Wheel Market is smaller but growing steadily. The demand for automotive wheels is driven largely by the regional automotive repair industry and smaller-scale manufacturing operations. Although these regions do not have the same scale of automotive production as the South East or Midlands, they are seeing an increase in the demand for steel and alloy wheels, particularly as consumer interest in personal and commercial vehicles grows. Additionally, with increasing interest in sustainable vehicle solutions, these regions are focusing on adapting to the electric vehicle revolution, with an emphasis on lightweight, energy-efficient wheel materials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ronal UK

- ATS Wheels UK

- OZ Racing UK

- Momo UK

- DYMAG Wheels

- WheelTech Europe

- Immobilize Wheels

- Supreme Wheels

- Ion Alloy Wheels

- Origin Wheels

Competitive Analysis:

The UK Automotive Wheel Market is highly competitive, with numerous manufacturers vying for market share. Leading companies such as Ronal UK, ATS Wheels UK, and Momo UK dominate the market with a broad range of offerings, from premium to mass-market wheels. Innovation in wheel materials, such as the introduction of lightweight alloys and carbon fiber, has been a significant differentiator. Companies are also leveraging technological advancements, including smart wheels with sensor integration, to cater to the growing demand for performance and safety. The competition is fierce in both the OEM and aftermarket sectors, where players compete on quality, price, and design. Smaller companies, while facing challenges from larger, well-established players, are capitalizing on niche segments like custom and luxury wheels. The market’s shift towards sustainability and electric vehicles is prompting manufacturers to innovate, with a focus on eco-friendly materials and lightweight solutions.

Recent Developments:

- In May 2025, DYMAG Technologies Limited, a wholly owned subsidiary of BORBET GmbH, announced a strategic partnership with BORBET and Advanced International Multitech Co., Ltd. (AIM) to accelerate the development and industrialization of carbon hybrid and composite wheel technology for the automotive and motorcycle industries.

- In October 2025, MOMO UK announced the re-launch of the MOMO Corse 2.0 steering wheel for 2025, which is a re-styled version of the hugely popular MOMO Corse steering wheel from the 1990s. The Corse 2.0 features a full leather rim with ergonomic grip on the rear face and red parallel stitching, black aluminium spokes complemented with a black centre ring, and a hand enamelled red and yellow MOMO Corse logo on the bottom spoke.

Report Coverage:

The research report offers an in-depth analysis based on material type, vehicle type, and end-user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The UK Automotive Wheel Market will see continuous growth driven by increased demand for electric vehicles (EVs).

- Innovations in lightweight materials, such as carbon fiber and aluminum alloys, will lead to a shift in product offerings.

- The premium segment will expand as consumer preference for high-performance and custom wheels rises.

- Increased regulatory pressures around fuel efficiency and emissions will push for sustainable and eco-friendly wheel solutions.

- The aftermarket segment will remain strong, with growing demand for replacement and customization.

- Technological advancements in smart wheels with integrated sensors will drive new product innovations.

- The market will experience a regional shift with emerging demand from regions outside of London and South East England.

- Manufacturers will focus more on automation and digitalization to streamline production processes.

- Competition will intensify as companies innovate to meet the demands of both the mass-market and high-end vehicle segments.

- Growth in commercial and off-highway vehicle segments will provide opportunities for durable, cost-effective wheel solutions.