Market Overview

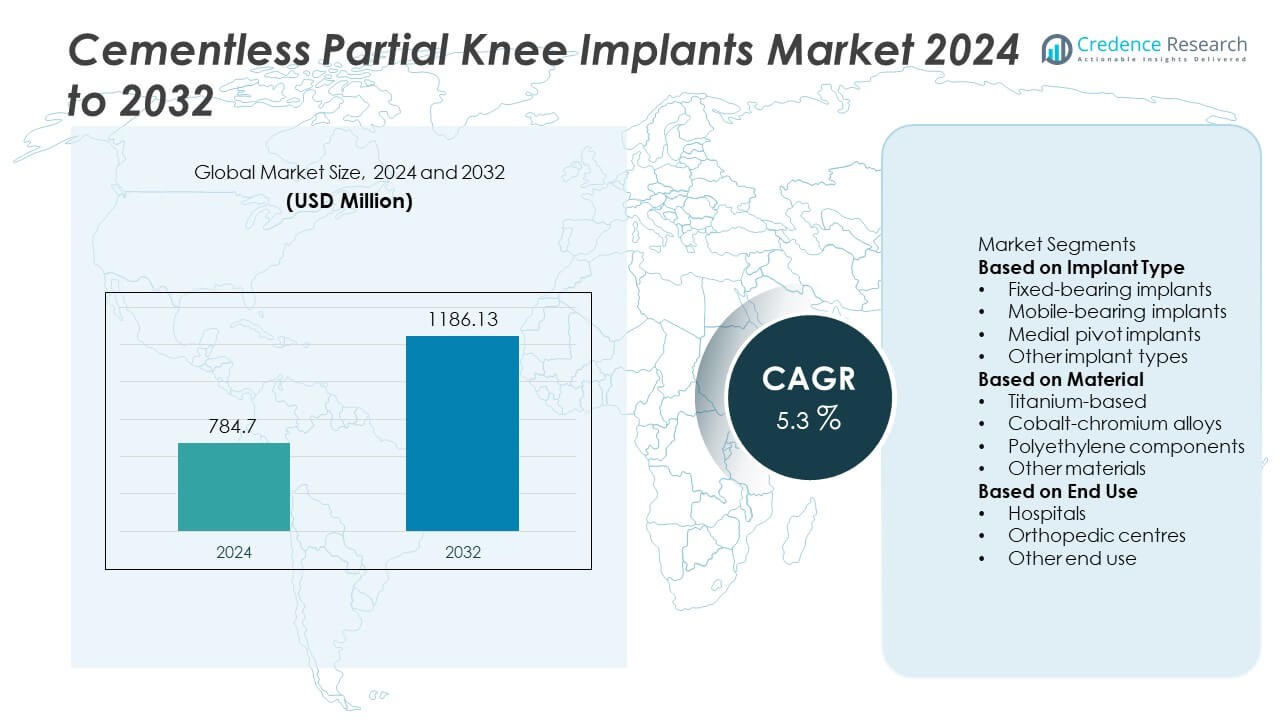

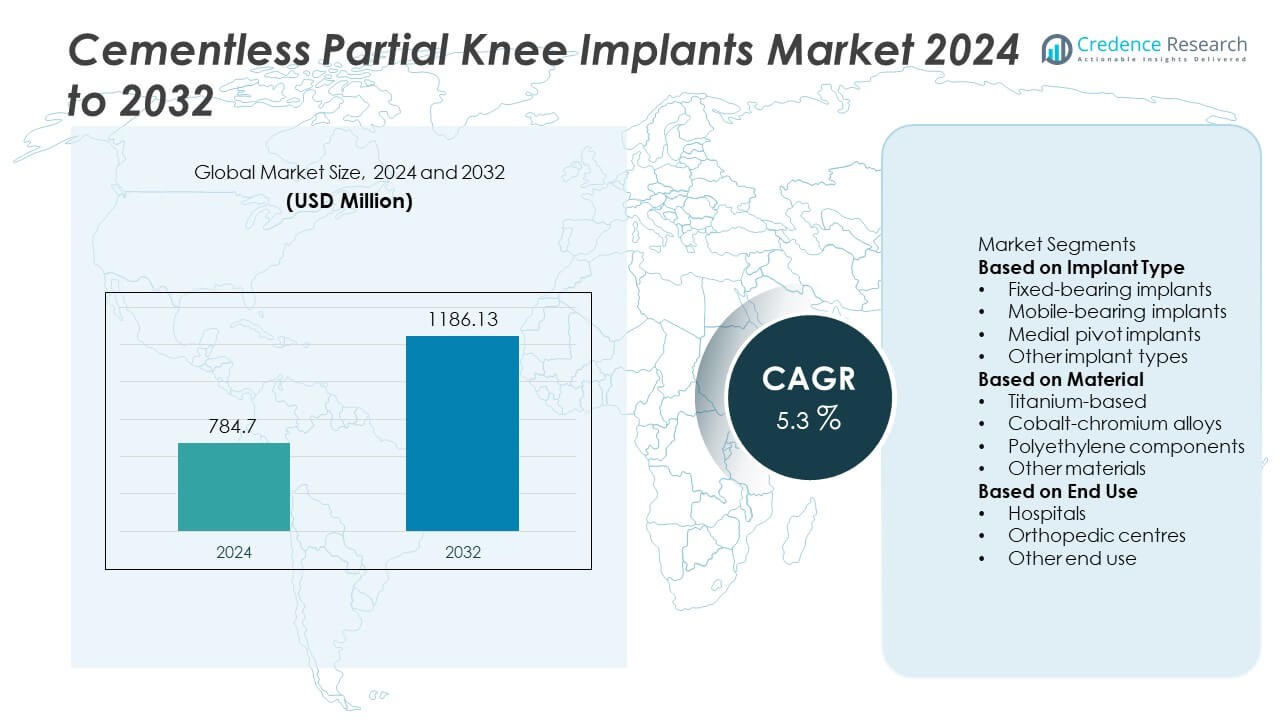

The Cementless Partial Knee Implants Market reached USD 784.7 million in 2024 and is projected to grow to USD 1,186.13 million by 2032, registering a 5.3% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cementless Partial Knee Implants Market Size 2024 |

USD 784.7Million |

| Cementless Partial Knee Implants Market, CAGR |

5.3% |

| Cementless Partial Knee Implants Market Size 2032 |

USD 1,186.13 Million |

North America led the Cementless Partial Knee Implants market with a 41% share in 2024, driven by strong surgical volumes and rapid adoption of cementless fixation systems. Top players such as Zimmer Biomet, Stryker, Smith & Nephew, Johnson & Johnson (DePuy Synthes), and Medacta strengthened their position through advanced porous coatings, 3D-printed designs, and robotic-compatible implants. Europe followed with a 32% share due to high diagnostic accuracy and broad acceptance of minimally invasive procedures, while Asia Pacific held 21% as hospitals expanded orthopedic capabilities. These regions will continue to lead market growth as demand rises for bone-preserving, durable cementless knee solutions.

Market Insights

- The Cementless Partial Knee Implants market reached USD 784.7 million in 2024 and will grow at a 5.3% CAGR through 2032.

- Demand continues to rise as surgeons prefer cementless fixation, with fixed-bearing implants holding a 49% share and titanium-based materials leading with a 52% share due to strong bone integration and stability.

- Minimally invasive and robotic-assisted trends strengthen market growth, helping hospitals maintain a dominant 61% share as they adopt advanced navigation and imaging technologies for precise implant placement.

- Competition intensifies as major players expand porous coatings, 3D-printed structures, and robotic-compatible systems, improving implant longevity but increasing development and training requirements.

- North America leads with a 41% share, followed by Europe at 32% and Asia Pacific at 21%, reflecting strong orthopedic infrastructure and rising preference for joint-preserving procedures across key regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Implant Type

Fixed-bearing implants led the Cementless Partial Knee Implants market with a 49% share in 2024, driven by their stable design, reduced wear risk, and ease of surgical placement. Surgeons prefer this type for predictable biomechanics and long-term performance in patients with localized osteoarthritis. Mobile-bearing implants followed due to their ability to support natural knee movement, while medial pivot implants gained traction for enhanced joint stability. Other implant types served niche requirements. Fixed-bearing implants maintained dominance because they offer reliability, lower complication rates, and broad suitability across patient groups.

- For instance, Zimmer Biomet’s Persona Partial Knee system uses a fixed-bearing construct and is designed for durability, building on the legacy of previous Zimmer systems that showed high survivorship at 10 and 20 years.

By Material

Titanium-based implants dominated the market with a 52% share in 2024, supported by strong biocompatibility, lightweight structure, and superior osseointegration, which are essential for cementless fixation. The material’s porous surface enhances bone ingrowth, enabling long-term stability. Cobalt-chromium alloys ranked second due to high strength and wear resistance, while polyethylene components remained vital for articulating surfaces. Other materials contributed to specialized applications. Titanium held the lead as orthopedic surgeons increasingly adopted materials that improve implant longevity and reduce revision rates.

- For instance, Smith+Nephew’s tibial component features a titanium baseplate with over 900 MPa ultimate tensile strength, which is typical for medical-grade Ti-6Al-4V alloy and supports strong load endurance during active use.

By End Use

Hospitals accounted for the largest share at 61% in 2024, driven by high surgical volumes, advanced orthopedic infrastructure, and broader access to skilled surgeons. Hospitals also benefit from better diagnostic capabilities, enabling accurate patient selection for cementless partial knee procedures. Orthopedic centres followed due to rising demand for minimally invasive surgeries and faster recovery pathways. Other end users, including specialty clinics, captured a smaller portion of the market. Hospitals maintained dominance because they provide comprehensive care, advanced imaging, and postoperative rehabilitation, supporting strong adoption of cementless implant systems.

Key Growth Drivers

Rising Preference for Cementless Fixation

Demand grows as surgeons prefer cementless partial knee implants for strong bone integration and fewer cement-related complications. Porous coatings support natural bone ingrowth, improving long-term fixation and reducing revision risks. Younger and active patients benefit from enhanced biomechanics and quicker recovery, driving wider use across hospitals and orthopedic centres. As minimally invasive procedures increase, cementless fixation continues to gain strong clinical preference.

- For instance, DePuy Synthes uses its POROCOAT porous technology, which features a pore size of 250 µm, a range documented in laboratory studies to be optimal for bone tissue penetration.

Increasing Incidence of Unicompartmental Osteoarthritis

Rising rates of medial compartment osteoarthritis fuel demand for partial rather than total knee replacement. Patients with early-stage disease choose cementless implants for faster rehabilitation and greater joint preservation. Advances in imaging improve patient selection, enhancing overall surgical outcomes. Growing elderly populations and higher diagnosis rates increase the need for effective joint restoration solutions, supporting the market’s long-term growth.

- For instance, Stryker’s Mako robotic system provides CT-based planning with sub-millimetre accuracy and assists in bone preparation using over 1,000 data points per second, improving alignment precision for unicompartmental procedures.

Advancements in Implant Materials and 3D Printing

Technological progress strengthens adoption as titanium materials, porous structures, and 3D-printed designs improve implant precision and fixation strength. Additive manufacturing enables anatomy-matched implants that enhance comfort and long-term stability. These innovations reduce micromotion, support quicker recovery, and improve implant durability. Manufacturers focus on next-generation designs that mimic natural knee mechanics, boosting surgeon confidence and market demand.

Key Trends & Opportunities

Growth in Minimally Invasive Orthopedic Procedures

Minimally invasive surgeries are rising due to reduced pain, shorter stays, and fast rehabilitation. Cementless partial knee implants align well with this trend by simplifying procedures and enabling quicker intraoperative workflows. Hospitals continue investing in robotic systems and navigation tools, which improve precision and outcomes. This creates opportunities for optimized implant designs tailored to minimally invasive approaches.

- For instance, Medacta’s GMK UNI system is designed for MIS approaches and uses a dedicated instrumentation set that reduces surgical steps by nearly 30%, while its M.O.R.E. surgical platform provides intraoperative guidance with tracking accuracy reaching 0.7 mm in controlled evaluations.

Rising Adoption of Robotic-Assisted Knee Procedures

Robotic systems are transforming knee implant surgeries through improved accuracy in bone preparation and implant alignment. Cementless implants benefit from this precision, enhancing fixation and long-term performance. Hospitals adopting robotic platforms create strong opportunities for robotic-compatible cementless systems. Surgeons rely on robotics to reduce variability and improve outcomes, accelerating market adoption.

- For instance, Johnson & Johnson’s VELYS Robotic-Assisted Solution uses an optical-based tracking system to help surgeons achieve accurate bone resections during knee replacement surgery. The system provides real-time feedback and data points to aid in surgical planning and execution.

Expansion of Outpatient and Ambulatory Surgical Centres

Outpatient centres are expanding as healthcare shifts to cost-efficient, patient-focused care models. Cementless implants support same-day procedures due to faster mobility and shorter surgical times. Rising insurance support and efficient recovery pathways strengthen adoption. This trend drives demand for compact implant kits and streamlined instrumentation suited for ambulatory settings.

Key Challenges

Higher Costs of Advanced Cementless Implant Systems

Cementless implants cost more due to advanced coatings, premium materials, and 3D-printed technologies. These costs limit adoption in price-sensitive regions and facilities with tight budgets. Smaller centres may delay upgrades despite clinical benefits. Managing affordability while maintaining innovation remains a key challenge for manufacturers targeting broader market penetration.

Need for Precise Surgical Technique and Experience

Cementless fixation requires accurate bone preparation, alignment, and experienced surgical handling to ensure stable bone ingrowth. Surgeons without specialized training may face difficulty achieving consistent outcomes, increasing revision risks. Adoption depends on investment in training, robotic assistance, and navigation tools. Variability in surgical expertise continues to challenge wider adoption in smaller hospitals and emerging markets.

Regional Analysis

North America

North America held a 41% share of the Cementless Partial Knee Implants market in 2024, supported by high procedure volumes, advanced orthopedic infrastructure, and strong adoption of minimally invasive techniques. The presence of leading implant manufacturers and widespread availability of robotic-assisted surgery strengthen regional growth. Growing awareness of joint preservation options encourages patients to choose partial rather than total knee replacement. Favorable reimbursement policies and skilled orthopedic surgeons further boost adoption. The United States remains the dominant contributor due to rising osteoarthritis prevalence and rapid integration of next-generation cementless implant technologies.

Europe

Europe accounted for a 32% share in 2024, driven by advanced healthcare systems, strong clinical adoption of cementless technologies, and high diagnostic penetration for early-stage knee osteoarthritis. Countries such as Germany, the UK, and France lead demand due to rising preference for bone-preserving procedures and broad access to modern orthopedic devices. Increased use of robotic navigation improves surgical precision, strengthening market acceptance. Supportive clinical guidelines and aging demographics contribute to steady demand. European hospitals also emphasize postoperative recovery improvements, encouraging wider use of cementless partial knee solutions.

Asia Pacific

Asia Pacific captured a 21% share in 2024, driven by rapid healthcare expansion, rising osteoarthritis cases, and growing investment in orthopedic specialization. China, Japan, and India lead demand as hospitals adopt advanced surgical systems and expand joint-replacement programs. Increasing preference for minimally invasive procedures accelerates uptake among younger and active patients. Economic growth and improving insurance coverage enhance access to premium cementless implants. The region’s growing orthopedic workforce and modernization of surgical facilities contribute to strong long-term potential, positioning Asia Pacific as one of the fastest-growing markets.

Latin America

Latin America represented a 4% share in 2024, influenced by moderate adoption of cementless partial knee implants and varying access to specialized orthopedic care. Brazil and Mexico lead demand due to growing private healthcare sectors and increasing acceptance of joint-preservation procedures. Expanding medical tourism and improved hospital capabilities support gradual uptake. However, limited reimbursement coverage and cost-sensitivity slow broader adoption. Despite challenges, rising awareness of minimally invasive surgeries and improvements in surgical training are expected to strengthen future demand for cementless solutions.

Middle East & Africa

The Middle East & Africa region held a 2% share in 2024, supported by growing investment in orthopedic services and rising demand for advanced joint reconstruction procedures. Gulf Cooperation Council countries lead adoption due to strong healthcare modernization and increased availability of robotic-assisted systems. African markets show early potential but face limitations related to implant affordability and specialist shortages. Efforts to upgrade surgical infrastructure and attract international healthcare providers support gradual growth. As awareness of partial knee replacement benefits increases, the region is expected to show steady but incremental adoption of cementless implants.

Market Segmentations:

By Implant Type

- Fixed-bearing implants

- Mobile-bearing implants

- Medial pivot implants

- Other implant types

By Material

- Titanium-based

- Cobalt-chromium alloys

- Polyethylene components

- Other materials

By End Use

- Hospitals

- Orthopedic centres

- Other end use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Cementless Partial Knee Implants market includes major players such as Zimmer Biomet, Stryker, Smith & Nephew, Johnson & Johnson (DePuy Synthes), Medacta, Corin Group, Exactech, B. Braun Melsungen AG, MicroPort Orthopedics, and Conformis. These companies focus on advancing cementless fixation technologies, porous coatings, and 3D-printed implant designs to improve stability, durability, and bone integration. Many manufacturers invest heavily in robotic-assisted surgical systems, which enhance accuracy and drive greater adoption in hospitals and orthopedic centres. Strategic collaborations with healthcare providers and continuous surgeon training programs further strengthen market presence. Companies also expand their product portfolios with anatomically optimized implants tailored for different patient populations. Rising demand for minimally invasive and joint-preserving procedures encourages innovation across the competitive landscape. Strong R&D pipelines, regulatory approvals, and global distribution networks help leading players maintain a dominant position in this growing orthopedic segment.

Key Player Analysis

- Zimmer Biomet

- Stryker

- Smith & Nephew

- Johnson & Johnson (DePuy Synthes)

- Medacta

- Corin Group

- Exactech

- Braun Melsungen AG

- MicroPort Orthopedics

- Conformis

Recent Developments

- In November 2024, Zimmer Biomet received U.S. FDA PMA approval for its Oxford® Cementless Partial Knee, marking it as the only cementless partial-knee implant approved in the U.S. at that time.

- In October 2024, Exactech gained 510(k) clearance from the U.S. FDA for its Truliant® Porous 3D Tibial Tray, a 3D-printed knee implant platform designed for cementless fixation.

- In August 2024, Medacta Group SA entered a partnership with THINK Surgical to provide its TMINI® robotic system for knee arthroplasty, positioning itself for cementless and personalized knee implants.

- In June 2024, DePuy Synthes (part of Johnson & Johnson) secured 510(k) FDA clearance for its VELYS™ Robotic-Assisted Solution applied to unicompartmental knee arthroplasty, compatible with its SIGMA™ HP Partial Knee implant that had shown improved 12-year survivorship in registries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Implant Type, Material, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as younger and active patients prefer bone-preserving knee solutions.

- Hospitals will expand adoption of robotic systems to improve implant alignment and outcomes.

- Manufacturers will increase use of 3D printing to produce patient-matched cementless implants.

- Porous coating technologies will advance to support stronger and faster bone ingrowth.

- Outpatient and ambulatory centres will perform more partial knee procedures due to faster recovery.

- Surgeons will receive more training in cementless techniques, improving consistency in results.

- Implant designs will evolve to mimic natural joint motion and reduce long-term complications.

- Emerging markets will adopt cementless systems as orthopedic infrastructure expands.

- Digital surgical planning tools will enhance preoperative accuracy and support better implant fit.

- Sustainability in manufacturing and streamlined instrumentation will gain importance in product development.