Market Overview

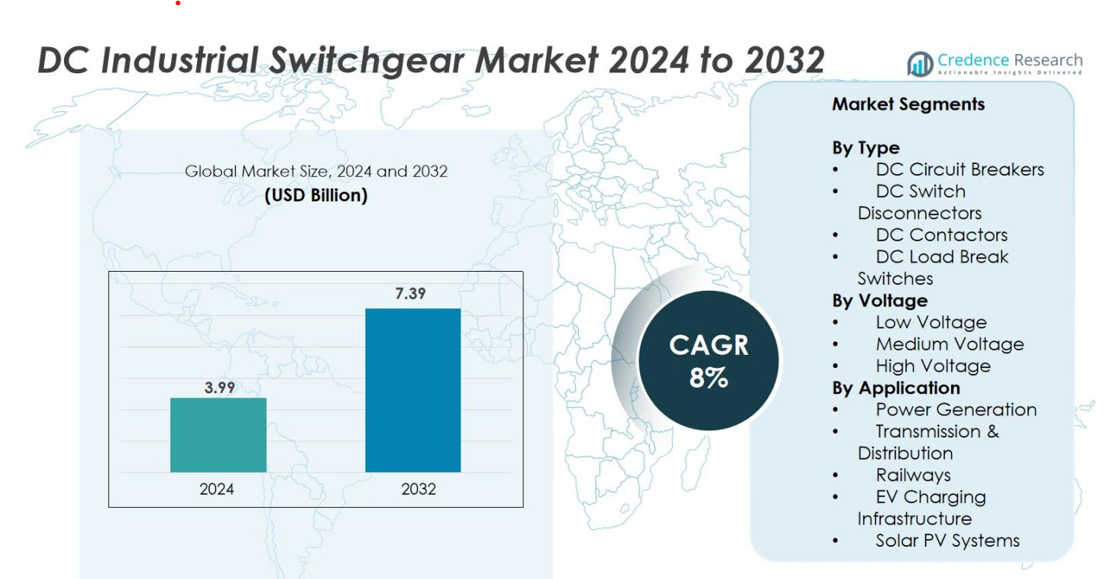

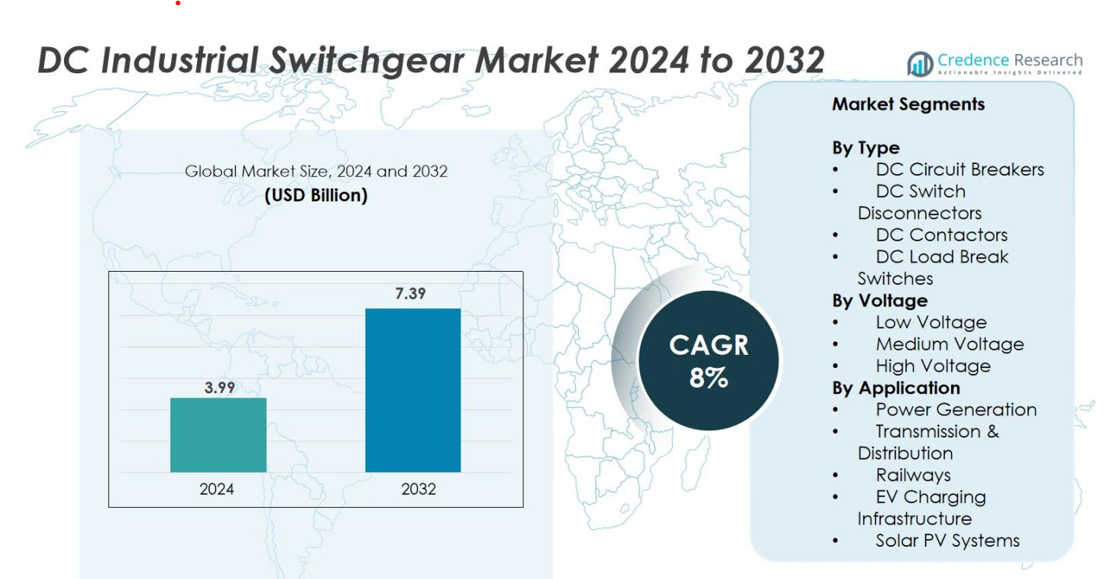

DC Industrial Switchgear market size was valued at USD 3.99 billion in 2024 and is anticipated to reach USD 7.39 billion by 2032, at a CAGR of 8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| DC Industrial Switchgear Market Size 2024 |

USD 3.99 billion |

| DC Industrial Switchgear Market, CAGR |

8% |

| DC Industrial Switchgear Market Size 2032 |

USD 7.39 billion |

DC Industrial Switchgear Market shows strong competition among multinational manufacturers offering high-capacity protection and control systems. Key players include ABB, Eaton, General Electric, Fuji Electric, Hitachi, Bharat Heavy Electricals, CG Power and Industrial Solutions, HD Hyundai Electric, Hyosung Heavy Industries, and E + I Engineering. These companies focus on advanced circuit breakers, smart monitoring features, and compact switchgear for renewable, rail, and utility applications. Asia-Pacific leads the market with a 33% share due to heavy investments in solar parks, metro rail projects, and HVDC transmission lines. North America follows with 29%, supported by grid modernization and EV charging expansion.

Market Insights

- The DC Industrial Switchgear market was valued at USD 3.99 billion in 2024 and is projected to reach USD 7.39 billion by 2032 with a CAGR of 8% during the forecast period.

- Demand rises due to renewable energy expansion, battery storage growth, and rapid investments in EV charging infrastructure, driving adoption of high-capacity DC circuit breakers and switch disconnectors.

- Digital and smart switchgear systems gain traction as industries shift to remote monitoring, predictive maintenance, and arc-flash protection for enhanced safety and reduced downtime.

- Asia-Pacific leads the market with a 33% share, followed by North America at 29% and Europe at 27%; transmission and distribution applications hold the largest segment share due to grid upgrades and solar integration.

- Market growth faces restraints such as high installation costs, limited standardization across countries, and reliance on skilled labor for system integration, slowing adoption in cost-sensitive regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

DC circuit breakers held the dominant share of 37% in 2024, driven by high adoption across utilities, solar plants, rail networks, and battery storage facilities. These breakers provide fast arc-quenching and reliable fault isolation, making them preferred for medium and high-capacity DC systems. DC switch disconnectors and contactors followed due to increasing industrial automation and grid modernization projects. DC load break switches continue to gain traction in renewable installations that require frequent switching under load. The shift toward distributed energy systems strengthens long-term demand across all DC switchgear types.

- For instance, Eaton’s Industrial Breaktor DC combines fuse and contactor features to provide seamless protection and switching in applications such as local DC grids, solar, battery systems, and DC charging

By Voltage

The medium-voltage segment accounted for 41% of total revenue in 2024, emerging as the leading category due to strong use in solar farms, rail traction systems, and utility-scale battery storage. Medium-voltage DC switchgear supports efficient long-distance power transfer with lower line losses, encouraging deployment in transmission and distribution upgrades. Low-voltage systems gained demand in EV charging stations, industrial plants, and commercial facilities. High-voltage units recorded steady growth, supported by grid interconnections and long-range renewable power evacuation projects.

- · For instance, Siemens Energy s MVDC PLUS® medium-voltage DC technology, which boosts transmission capabilities by up to 80%, facilitating efficient power transfer and minimizing grid losses in regional grid interconnections and renewable energy integration applications.

By Application

Transmission and distribution led the market with a 34% share in 2024, supported by continuous investment in grid modernization, substation upgrades, and protection devices for DC feeders. Renewable-linked demand from solar PV systems and utility-scale battery banks continues to rise as countries expand clean-power infrastructure. Railways represent another high-growth application, as electric trains and metro systems require high-capacity DC switchgear for traction power supply. EV charging infrastructure is becoming an emerging revenue stream as rapid charging stations prefer DC architecture for fast output and stable power delivery.

Key Growth Drivers

Expansion of Renewable Energy and Battery Storage Projects

Renewable energy deployment continues to surge, and DC industrial switchgear plays a crucial role in controlling and protecting power flow in solar farms, wind-to-battery systems, and utility-scale storage units. Solar PV plants use DC architecture at multiple points, including inverters, string connections, and power blocks, which increases the requirement for efficient breakers, disconnectors, and fuses. Battery energy storage systems depend on DC switchgear for fast fault interruption, thermal protection, and system isolation, especially in high-capacity lithium-ion banks. Government-led clean energy policies and electrification initiatives push utilities and project developers to replace outdated equipment with smart, higher-capacity DC switchgear. As global grid infrastructure shifts toward distributed and renewable-heavy networks, demand remains strong across transmission, distribution, and commercial power backup facilities.

- For instance, utility-scale solar inverters commonly operate at 1500 VDC, requiring DC switchgear capable of handling these high voltages for efficient fault interruption and system isolation, as demonstrated in recent battery energy storage systems integrated with solar plants.

Growth of Rail Electrification and Metro Projects

Railways represent one of the largest DC power consumers worldwide, as traction systems, substations, and rolling stock operate on DC power supply. Countries expand metro rail networks, high-speed trains, and freight electrification to reduce diesel use and emissions. Modern rail projects require high-voltage DC switchgear for safe power transfer, regenerative braking, and traction load management. Upgraded signaling and switching yards also integrate advanced DC breakers and disconnectors. Aging railway grids in Europe and Asia undergo modernization, creating retrofit demand for compact, arc-resistant, high-interrupting-capacity switchgear. As governments invest in public transport and sustainable mobility, rail electrification remains a long-term growth driver for DC switchgear manufacturers.

- For instance, Hitachi Energy equipped the Baranagar and Dakshineswar traction substations in India with advanced remote terminal units and SCADA systems to enhance operational reliability and fault response.

Rising Investments in EV Charging Infrastructure

Electric vehicle adoption pushes governments and private operators to deploy fast-charging networks, most of which rely on high-capacity DC output for rapid charging. Fast and ultra-fast chargers require DC switchgear to manage load peaks, protect charging circuits, and ensure safe power transfer to charging guns. Commercial hubs, fleet depots, and highway stations use modular DC switchgear to scale capacity as vehicle usage increases. Utilities and oil companies also invest in charging hubs linked to renewable energy and battery storage, boosting switchgear consumption. As EV penetration rises across passenger, commercial, and industrial vehicles, the need for DC fault protection and substation integration drives rapid market expansion.

Key Trends & Opportunities

Digitized and Smart Switchgear Systems

Smart switchgear equipped with real-time monitoring, arc-flash detection, IoT sensors, and predictive maintenance tools is transforming power protection operations. Utilities and industries now favor digital switchgear systems that allow remote diagnostics, fault prediction, and automatic shutdown during overload events. Software-enabled platforms improve asset health tracking and reduce downtime in solar farms, rail networks, and substations. As grids become decentralized and interconnected, digital DC switchgear offers greater uptime, cybersecurity features, and faster recovery after power disturbances. Manufacturers that integrate advanced electronics and data-driven control platforms have strong opportunities to capture premium demand.

- For instance, Schneider Electric’s smart switchgear enables real-time energy usage tracking and fault prediction through embedded sensors and controllers, enhancing operational transparency and failure prevention.

Opportunities in Microgrids and Off-Grid Power Networks

Remote industrial facilities, defense bases, islands, and mining sites increasingly deploy microgrids powered by solar PV and battery storage. These systems rely heavily on DC distribution to improve efficiency and avoid conversion losses. DC switchgear enables stable energy flow and protects microgrid components from overload, short circuits, and thermal faults. The rise of commercial and residential microgrids in North America, Asia-Pacific, and Africa creates a strong market opportunity. Growing demand for self-sufficient and disaster-resilient power supplies accelerates adoption, opening long-term revenue potential for manufacturers offering compact, low-maintenance DC switchgear.

- For instance, Ta’u Island in American Samoa, in collaboration with Tesla, installed a solar microgrid with over 5,300 solar panels and 60 Tesla Powerpacks, enabling the island to meet nearly 100% of its electricity demand through solar power while eliminating diesel generator use.

Key Challenges

High Installation and Maintenance Costs

Advanced DC switchgear systems require specialized components, thermal protection designs, and sophisticated arc-quenching mechanisms, which increase acquisition and installation costs. Many utilities and industrial buyers still rely on legacy AC switchgear or hybrid systems to avoid large capital expenditure. Skilled personnel are needed to install and maintain DC equipment, raising labor costs and deployment time. Budget constraints in small and medium industries delay upgrade decisions, especially in developing regions. Although lifecycle savings are higher in DC networks, the up-front investment remains a barrier for widespread adoption.

Limited Standardization Across Global Markets

Unlike AC systems with well-defined international standards, DC switchgear faces fragmented regulations, varying voltage classifications, and region-specific product certifications. Manufacturers must modify designs for different countries, increasing development time and cost. The lack of uniform standards complicates product interoperability, especially in cross-border transmission lines, microgrids, and EV charging networks. Utilities often face longer approval cycles and testing requirements. This delays project execution and affects purchasing decisions. The market continues to grow, but the absence of harmonized standards restricts faster commercialization and mass-scale manufacturing.

Regional Analysis

North America

North America held a 29% share of the DC industrial switchgear market in 2024, driven by strong investments in grid modernization, utility-scale battery storage, and solar power deployment. The United States leads installations across data centers, EV charging corridors, and commercial solar plants that require medium- and high-voltage DC equipment. Federal clean energy incentives accelerate demand for smart, arc-resistant switchgear in substations and renewable projects. Major utilities also upgrade protection systems to support bidirectional power flow and distributed generation. Canada follows with microgrids and off-grid renewable adoption in remote areas, strengthening long-term switchgear demand.

Europe

Europe accounted for a 27% market share in 2024, supported by aggressive decarbonization policies and heavy rail electrification. Germany, France, and the U.K. continue modernizing transmission infrastructure and metro networks with high-capacity DC circuit breakers and switch disconnectors. Utility-scale solar and offshore wind projects drive demand for reliable DC protection systems connected to battery storage units. The region also embraces digital switchgear with IoT monitoring and predictive maintenance for substation automation. Eastern Europe shows emerging growth as countries replace aging switchgear with compact and arc-flash-resistant systems, creating steady replacement demand.

Asia-Pacific

Asia-Pacific dominated the market with a 33% share in 2024, backed by rapid urbanization, heavy industrialization, and large-scale renewable deployments. China, Japan, India, and South Korea expand HVDC transmission lines, solar parks, and metro rail networks that rely on high-interrupting-capacity DC switchgear. Government-led clean energy targets and investments in public transport boost consumption across utilities and rail traction systems. The region also sees fast growth in EV charging and manufacturing facilities. Rising adoption of microgrids in commercial zones and islands creates additional opportunities for modular DC switchgear installations.

Latin America

Latin America captured a 6% share in 2024, supported by rising renewable electricity generation and utility upgrades. Brazil, Chile, and Mexico invest in solar PV farms, battery storage, and industrial electrification, driving demand for medium-voltage breakers and disconnectors. Mining-intensive countries deploy DC switchgear for power reliability in remote and high-load environments. Many utilities shift from legacy AC switchgear to hybrid systems to manage distributed generation. Although budget constraints slow large-scale adoption, energy reforms and private renewable investment strengthen future growth prospects in the region.

Middle East & Africa

The Middle East & Africa held a 5% share in 2024, driven by industrial electrification, solar mega-projects, and utility upgrades. The UAE and Saudi Arabia deploy DC switchgear in solar parks, desalination plants, and grid expansion projects. African nations adopt microgrids and off-grid solar to improve rural electrification, increasing demand for low- and medium-voltage DC equipment. Harsh climatic conditions encourage use of arc-resistant and thermally stable switchgear. Mining, oil, and industrial facilities also integrate DC protection systems for power reliability, creating long-term opportunities despite slower infrastructure spending.

Market Segmentations

By Type

- DC Circuit Breakers

- DC Switch Disconnectors

- DC Contactors

- DC Load Break Switches

By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

By Application

- Power Generation

- Transmission & Distribution

- Railways

- EV Charging Infrastructure

- Solar PV Systems

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The DC industrial switchgear market remains moderately consolidated, with global and regional players competing through advanced product portfolios and long-term utility contracts. Leading companies such as ABB, Eaton, General Electric, Fuji Electric, Hitachi, and Hyosung Heavy Industries focus on high-capacity circuit breakers, intelligent protection systems, and digital switchgear with remote diagnostics. Bharat Heavy Electricals, CG Power and Industrial Solutions, and E + I Engineering strengthen presence in India and the Middle East with cost-effective and robust designs suited for harsh industrial environments. HD Hyundai Electric and other Asian manufacturers expand globally through competitive pricing and strategic partnerships with EPC contractors. Most players invest in arc-flash mitigation, compact switchgear design, and predictive maintenance features to support grid modernization and renewable integration. Service capabilities, installation support, and lifecycle maintenance also influence customer preference, as utilities and industrial buyers seek long-term reliability and faster fault response.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2024, ABB Ltd. launched over 20 new products, including a revolutionized DC solid-state circuit breaker, marking significant innovation in DC switchgear-type products.

- In August 2024, Mitsubishi Electric signed an agreement with Siemens Energy AG to jointly develop DC switching stations and DC circuit‑breaker requirement specifications for large‑scale grid applications.

- In October 2024, ABB partnered with Zumtobel Group to advance smart-building solutions and DC industrial product applications

Report Coverage

The research report offers an in-depth analysis based on Type, Voltage, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Renewable power additions will increase demand for medium- and high-voltage DC switchgear.

- EV fast-charging networks will create steady orders for compact, high-capacity protection units.

- Smart and digital switchgear with remote monitoring will gain wider adoption in utilities and industries.

- Rail electrification and metro expansion projects will drive long-term procurement of DC breakers and disconnectors.

- Battery energy storage systems will rely on DC switchgear for safe load management and fault isolation.

- Microgrids and off-grid solar systems will create new growth in emerging markets.

- Manufacturers will invest in arc-flash protection, thermal stability, and compact modular designs.

- Service contracts and predictive maintenance platforms will become key revenue streams.

- Standardization efforts will improve product interoperability across global markets.

- Replacement of aging substation equipment will support retrofit demand in developed regions.