Market overview

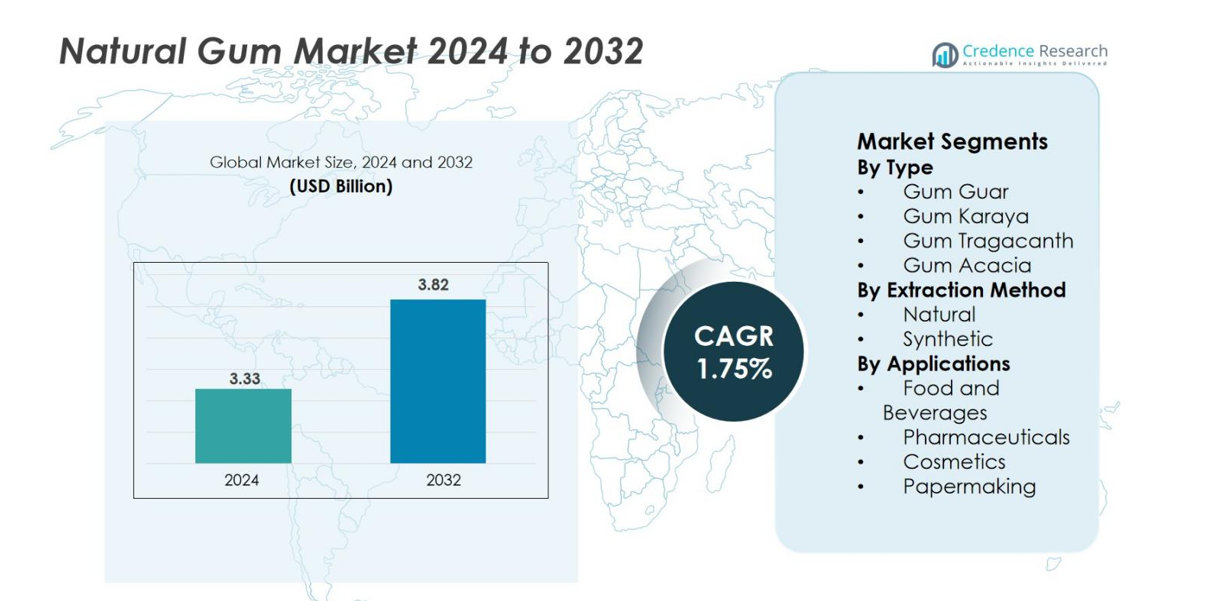

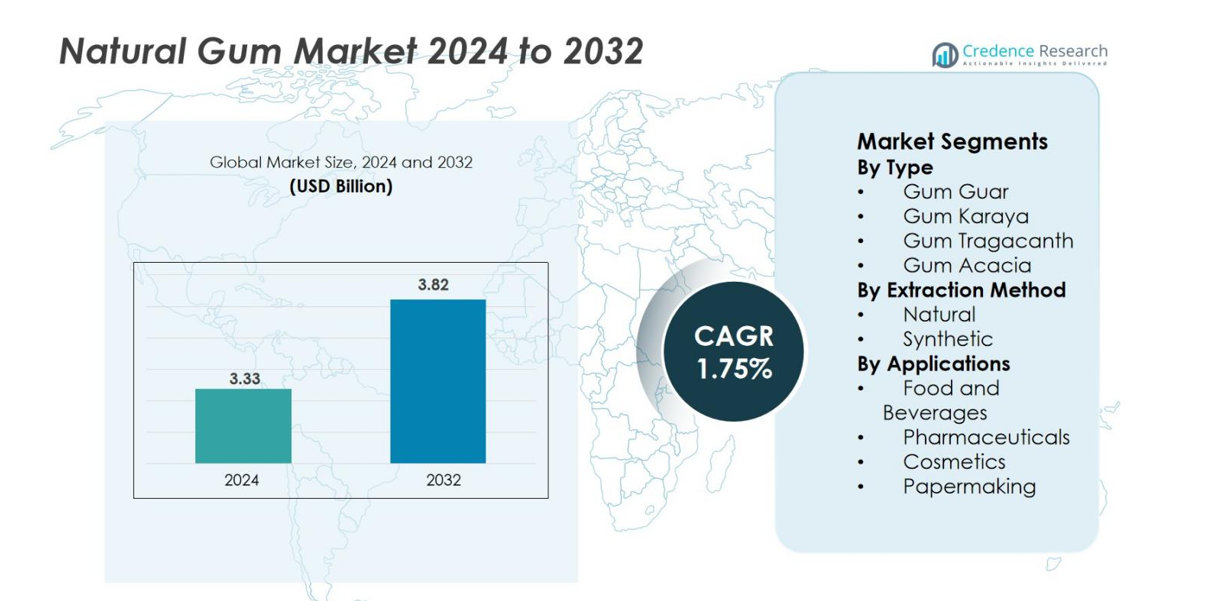

The natural gum market was valued at approximately USD 3.33 billion in 2024 and is expected to reach USD 3.82 billion by 2032, growing at a compound annual growth rate (CAGR) of 1.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Natural Gum Market Size 2024 |

USD 3.33 billion |

| Natural Gum Market, CAGR |

1.75% |

| Natural Gum Market Size 2032 |

USD 3.82 billion |

The Natural Gum market features major players including Cargill, Incorporated, CP Kelco, Tate & Lyle PLC, Ashland Global Holdings Inc., Archer Daniels Midland Company, Firmenich International SA, Sensient Technologies Corporation, Kerry Group plc, Palsgaard A/S and Ingredion Incorporated. These firms leverage global production networks, R&D investments and strategic partnerships to maintain a competitive edge. Regionally, North America leads with a market share of approximately 45.7 %, underscoring its dominance in clean‑label natural ingredients and high consumption of processed food and beverage products.

Market Insights

- The global natural gum market was valued at approximately USD 3.33 billion in 2024 and is projected to reach USD 3.82 billion by 2032, growing at a CAGR of 1.75% during the forecast period.

- Key drivers of the market include the rising demand for clean-label and natural ingredients, increased adoption in food, pharmaceutical, and cosmetic applications, and the focus on sustainability and renewable sourcing.

- Market trends highlight significant growth in emerging applications such as functional foods, pharmaceuticals, and cosmetics, with natural gums being increasingly used as stabilisers, thickeners, and emulsifiers.

- Competitive analysis shows that major players like Cargill, CP Kelco, and Ingredion dominate the market, with North America holding the largest regional share at approximately 45.7%. Companies are expanding globally to strengthen their presence in growing markets.

- Market restraints include the volatility of raw material prices, supply chain disruptions, and the challenge of meeting diverse regulatory standards across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The Natural Gum market is segmented into various types, including Gum Guar, Gum Karaya, Gum Tragacanth, and Gum Acacia. Among these, Gum Guar holds the dominant position, contributing the largest market share, driven by its versatile applications in food, pharmaceuticals, and industrial sectors. Gum Guar accounts for approximately 35% of the market share. This dominance is attributed to its natural thickening properties, which make it essential in food formulations, particularly in gluten-free products. The rising demand for natural and clean-label ingredients continues to bolster the market growth for Gum Guar.

- For instance, Lucid Colloids Ltd. focuses on customized guar gum derivatives serving food, pharmaceuticals, and personal care industries, reflecting the rising demand for natural and clean-label ingredients.

By Extraction Method

The market is divided into natural and synthetic extraction methods, with the natural extraction method taking the lead, holding about 70% of the market share. This preference is largely due to the increasing consumer shift toward clean-label and organic products, which enhances the demand for naturally sourced gums. Natural extraction methods are favored for their environmentally friendly and sustainable production processes, which resonate with the growing consumer demand for eco-conscious and health-oriented products. As consumer trends continue to lean toward authenticity and natural ingredients, the natural extraction segment will likely maintain its stronghold.

- For instance, Symrise focuses on green and sustainable extraction methods, producing natural ingredients that cater to food and personal care industries while meeting consumer demand for organic products.

By Applications

The Natural Gum market finds wide applications across food and beverages, pharmaceuticals, cosmetics, and papermaking. The food and beverage segment leads the market, holding the largest share of approximately 45%. This is driven by the growing consumer demand for natural additives, including stabilizers, emulsifiers, and thickeners, especially in clean-label, gluten-free, and organic food products. The food industry’s ongoing focus on healthier alternatives and natural ingredients is fueling the segment’s growth. Additionally, the increasing use of natural gums in functional foods and beverages further supports the dominance of this application segment.

Key Growth Drivers

Rising consumer demand for natural and clean‑label ingredients

The global shift toward healthier lifestyles and greater ingredient transparency has significantly elevated demand for naturally sourced gums in food, pharmaceutical, and cosmetic applications. As consumers increasingly prefer plant‑based additives and avoid synthetic alternatives, the market for natural gums grows accordingly. This shift is particularly evident in regions like North America where clean‑label trends are strong. The preference for natural gums is reinforced by their multi‑functional roles – as thickeners, stabilizers, emulsifiers and binders offering manufacturers a versatile ingredient option. The growing appetite for such ingredients drives producers to expand production capacity and diversify product portfolios, thereby accelerating market expansion.

- For instance, companies like Cargill and Ingredion are expanding production capacities and diversifying portfolios to supply natural gums for growing clean-label product lines in North America, reflecting the rising consumer preference for transparency, sustainability, and multifunctional natural ingredients.

Expansion of processed foods, convenience foods and functional applications

Processed and convenience foods continue to proliferate globally, especially in emerging economies with rising disposable incomes and changing dietary patterns. Natural gums have become vital in these sectors by improving texture, stability and shelf‑life of foods and beverages. The need to deliver consistent sensory quality in ready‑to‑eat meals, gluten‑free bakery goods and plant‑based dairy alternatives has enhanced the importance of natural gums. Additionally, the pharmaceutical and nutraceutical markets are leveraging natural gums for drug delivery systems and functional food formulations. This convergence of food‐industry growth and functional ingredient demand serves as a pivotal driver for the natural gum market.

- For instance, guar gum is widely used as a natural gluten-free binder in bakery products, enhancing dough performance, moisture retention, and texture, as seen in products from companies like Sunita Hydrocolloids.

Sustainability and renewable sourcing emphasis

Environmental concerns and regulatory pressures around sustainability are compelling manufacturers to favour renewable and biodegradable materials. Natural gums derived from plant sources meet this requirement and are increasingly preferred over synthetic additives. The adoption of sustainable harvesting practices, traceable supply chains and eco‑friendly processing reinforce the market’s growth potential. Companies aligning with sustainable development goals (SDGs) are also finding strategic advantage, which further bolsters the demand for natural gums. This emphasis on renewable sourcing and eco‑credentials creates a compelling value proposition for manufacturers and end‑users alike.

Key Trends & Opportunities

Penetration into new end‑use industries

While food and beverages remain the dominant application for natural gums, emerging fields such as cosmetics, pharmaceuticals, and advanced papermaking offer significant growth opportunities. For instance, natural gums are increasingly used as film‑formers, emulsifiers and stabilisers in skincare and haircare formulations, and as excipients or binders in controlled‑release pharmaceuticals. As industry boundaries blur and multifunctional ingredients are sought, natural gums are poised to penetrate these niche yet growing segments. Companies that adapt formulations to meet regulatory and performance requirements in these verticals can maximise opportunity.

- For instance, Gum Arabic is widely employed by companies like Givaudan and Nexira in natural cosmetic formulations for its thickening and emulsifying properties.

Geographic expansion in emerging markets

Emerging economies in Asia‑Pacific, Latin America and Africa present a major growth frontier for natural gum suppliers. Rapid urbanisation, a rising middle class and increasing food processing industry investment drive demand for ingredient‑rich products and clean‑label formulations in these regions. Manufacturers can tap local raw‑material availability and develop region‑specific offerings (e.g., locally sourced guar gum). Strategic partnerships, production capacity expansions and localisation of supply chains in these geographies can serve as key growth levers over the next decade.

- For instance, India and Pakistan remain leading producers of guar gum, supplying both local and export markets, while companies like Sunita Hydrocolloids have expanded production capacities to meet rising regional demand.

Key Challenges

Raw‑material supply volatility and cost pressures

Natural gums are sourced from plant species whose yield and quality are influenced by climatic conditions, agricultural practices and harvesting cycles. Fluctuations due to weather extremes, crop diseases or geopolitical trade disruptions can impact supply continuity and push input costs higher. These cost pressures challenge both producers and end‑users, potentially squeezing margins or forcing price increases. The dependency on agricultural raw materials therefore remains a key risk factor requiring mitigation through supply‑chain resilience and strategic sourcing.

Quality control, standardization and regulatory complexity

Natural gum ingredients must comply with varying food‑, pharma‑ and cosmetic‑grade standards across jurisdictions. Ensuring batch‑to‑batch consistency, managing contaminant thresholds, and aligning with region‑specific regulatory definitions of “natural” present operational burdens. Inconsistent quality or regulatory non‑compliance can impair market entry and erode trust. The lack of unified global standards for natural gums adds complexity, and companies must invest in rigorous testing, traceability and certification systems to manage this challenge effectively.

Regional Analysis

North America

The North America region dominates the natural gum market, capturing 45.7% of global revenue in 2024. Growth is propelled by strong demand for clean-label ingredients, high consumption of processed food and beverage products, and robust regulatory frameworks favouring plant-based additives. Manufacturers in the U.S. and Canada are prioritising natural extraction methods and sustainability, thereby reinforcing market leadership and encouraging continued investment in capacity and innovation.

Europe

Europe holds a substantial share of the natural gum market, accounting for 25% of the global market in 2024. Growth in this region is driven by consumer demand for natural, organic ingredients and advancing applications in food, pharmaceuticals, and cosmetics. The region’s mature processed-food and personal-care sectors support adoption of natural gums as stabilisers and thickeners. Its positioning just behind North America reflects its strategic importance and moderate growth outlook.

Asia Pacific

The Asia Pacific region is emerging as a high-growth market for natural gums, with a current share of 18% in 2024. The region is supported by a rising population, a growing middle class, an expanding food processing industry, and increased awareness of clean-label ingredients. Although its current share is lower than North America or Europe, the region is expected to register the fastest CAGR, making it a key target for capacity expansions and supply-chain localisation.

Latin America & Middle East & Africa (MEA)

Latin America and MEA collectively account for 11.3% of the global natural gum market. Emerging food-processing infrastructure, increasing cosmetic and pharmaceutical use of natural ingredients, and evolving regulatory frameworks all present growth opportunities. While share percentages are smaller compared to other regions, both regions are expected to gain in significance over the forecast period as companies seek to diversify regional risk and tap new end-use growth.

Market Segmentations

By Type

- Gum Guar

- Gum Karaya

- Gum Tragacanth

- Gum Acacia

By Extraction Method

By Applications

- Food and Beverages

- Pharmaceuticals

- Cosmetics

- Papermaking

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the natural gum market is characterised by moderate concentration, with leading global chemical and ingredients firms vying across food, pharmaceutical, and cosmetics applications. Companies such as Cargill, Incorporated, CP Kelco, Ingredion Incorporated, Tate & Lyle PLC, Archer Daniels Midland Company, Ashland Global Holdings Inc., Sensient Technologies Corporation, Kerry Group and Palsgaard A/S maintain substantial footprints in production, R&D, and supply‑chain integration. These players consistently invest in sustainable sourcing, clean‑label ingredient development and global manufacturing capacity expansions. They compete on the basis of product purity, functional performance, application versatility, and regulatory compliance. Despite a number of smaller niche suppliers, the dominance of these established firms—who collectively hold over half the market share—creates high entry barriers and drives consolidation, partnerships and innovation to differentiate and capture specialised sub‑segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Gift of Life Marrow Registry announced a partnership with DOUBLEMINT® (part of Mars, Incorporated) and Labcorp to launch “Hero Gum” a chewing-gum-based donor-registration kit.

- In 2024, Tate & Lyle significantly expanded its presence in the natural gum sector by acquiring CP Kelco for $1.8 billion.

- In 2023, CP Kelco reinforced its leadership in the natural gum sector by significantly expanding its biogum production capacities in the U.S. and China. The company completed a 40% capacity increase at its Okmulgee, Oklahoma facility and added low acyl gellan gum production capabilities at its Wulian, China plant

Report Coverage

The research report offers an in-depth analysis based on Type, Extraction Method, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will increasingly develop advanced processing technologies to enhance purity and functionality of natural gums, meeting stringent industry standards.

- The integration of natural gums into plant‑based food systems will gain momentum as demand for clean‑label, vegan and gluten‑free formulations expands.

- Expansion into emerging regions, particularly Asia Pacific and Latin America where food processing and cosmetic industries are growing rapidly, will open new market opportunities.

- Strategic alliances and acquisitions among key players will accelerate, enabling broader product portfolios and access to advanced extraction methods.

- Brands will emphasise sustainable sourcing, traceability and environmental credentials of natural gums to align with consumer preference for ethical ingredients.

- Diversification into non‑food applications such as pharmaceuticals, personal care and advanced papermaking will boost growth beyond traditional food markets.

- The share of premium natural gum grades with enhanced functional attributes will expand, driving higher value growth segments.

- Supply‑chain resilience, including vertical integration and raw‑material risk management, will become a competitive differentiator for leading players.

- Regulatory harmonisation and increased recognition of plant‑based stabilisers will support wider adoption across multiple geographies.

- Despite modest overall growth rates, niche high‑growth segments within the natural gum market will attract investment and innovation, shaping the market’s future trajectory.