Market overview

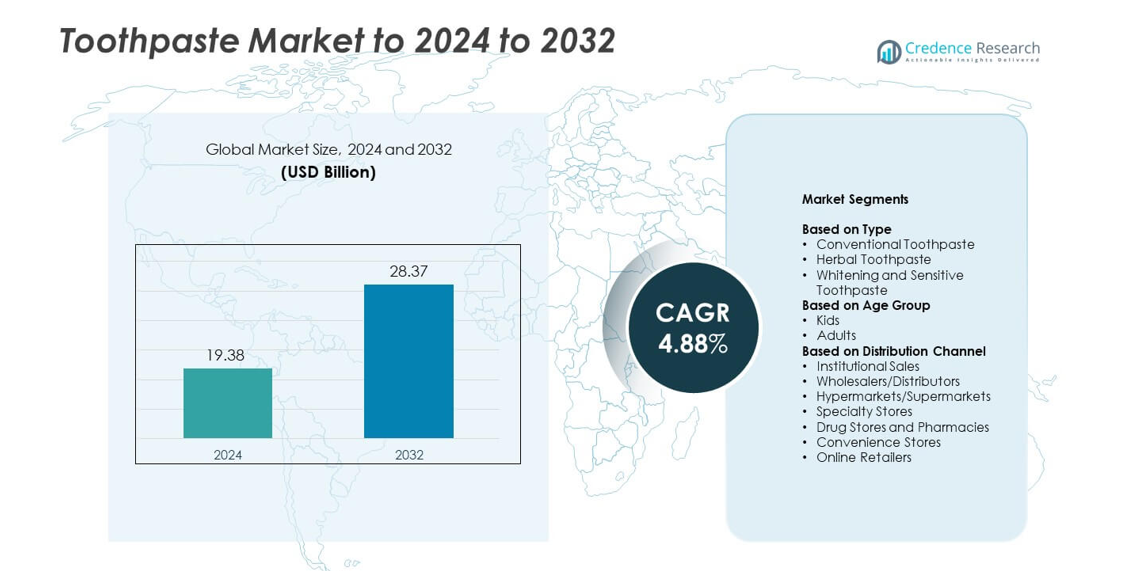

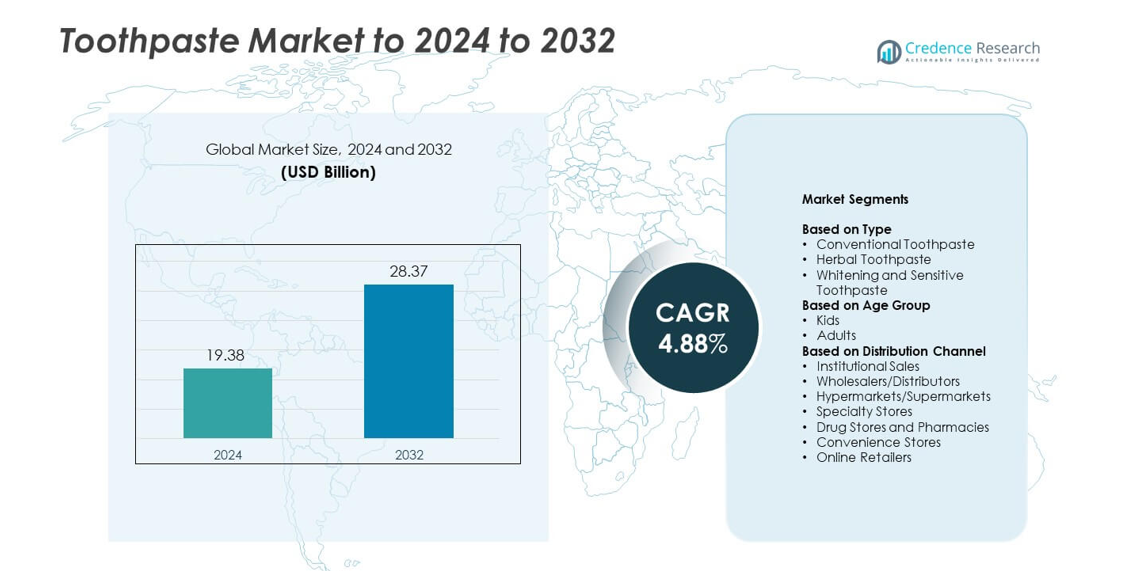

Toothpaste Market size was valued at USD 19.38 billion in 2024 and is anticipated to reach USD 28.37 billion by 2032, at a CAGR of 4.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Toothpaste Market Size 2024 |

USD 19.38 billion |

| Toothpaste Market, CAGR |

4.88% |

| Toothpaste Market Size 2032 |

USD 28.37 billion |

The Toothpaste Market is shaped by major players that lead through strong product portfolios, wide retail reach, and continuous innovation across whitening, herbal, and sensitivity-care segments. These companies compete by expanding premium and natural formulations while strengthening digital marketing and e-commerce visibility. North America remained the leading region in 2024 with about 32% share, supported by high spending on advanced oral care and strong dental awareness. Europe followed with nearly 28% share due to strict quality standards and rising demand for clean-label toothpastes. Asia Pacific held close to 27% share, driven by urbanization, growing income levels, and fast penetration of herbal and charcoal-based variants.

Market Insights

- The Toothpaste Market reached USD 19.38 billion in 2024 and is set to hit USD 28.37 billion by 2032, growing at a CAGR of 4.88%.

- Rising demand for whitening, herbal, and sensitivity-care toothpaste continued to drive strong product adoption across both premium and mass segments.

- Natural and clean-label trends accelerated as buyers preferred fluoride-safe, chemical-reduced, and plant-based formulations, boosting innovation in herbal and charcoal variants.

- Leading companies expanded competitive strength through wider retail distribution, new ingredient technologies, and strong digital promotions, while price pressure created restraints in saturated markets.

- North America held 32% share in 2024, Europe accounted for 28%, and Asia Pacific captured 27%, while conventional toothpaste remained the dominant type with nearly 62% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Conventional toothpaste led the Toothpaste Market in 2024 with about 62% share. Buyers preferred this category due to strong affordability, wide flavor choices, and broad availability across retail outlets. Growth increased as brands improved formulations with fluoride, anti-cavity agents, and plaque-control compounds. Herbal toothpaste gained steady traction as consumers shifted toward natural ingredients, while whitening and sensitive variants expanded with rising demand for enamel protection and stain removal. The dominant segment benefited from strong brand loyalty, heavy promotions, and continuous product innovation.

- For instance, Colgate-Palmolive operates in more than 200 countries and territories, as stated in its official corporate profile.

By Age Group

Adults dominated the Toothpaste Market in 2024 with nearly 78% share. Adult users showed higher purchase frequency, stronger brand preference, and greater demand for specialized benefits such as whitening, gum care, and sensitivity relief. Kids’ toothpaste grew at a moderate pace as companies launched fruit-flavored gels, low-fluoride formulas, and cartoon-themed packs. The leading age group segment expanded due to rising awareness of oral hygiene, increasing dentist recommendations, and wide adoption of multi-benefit products among working populations.

- For instance, Haleon reports its portfolio of brands, including Sensodyne, is available in over 150 countries and more than 170 markets.

By Distribution Channel

Hypermarkets and supermarkets held the dominant position in 2024 with around 34% share. Shoppers favored these outlets for bulk packs, strong promotional discounts, and broad brand visibility. Drug stores and pharmacies recorded strong sales due to trust in dentist-endorsed products, while online retailers saw rapid growth from convenience-driven buyers and subscription-based oral care kits. Wholesalers and specialty stores supported niche product demand, and convenience stores remained key for quick, on-the-go purchases. The leading channel grew due to high footfall and wide product assortment.

Key Growth Drivers

Rising Oral Health Awareness

Growing awareness of oral hygiene played a major role in expanding the Toothpaste Market. Consumers focused more on preventing cavities, gum infections, and sensitivity, which increased the demand for advanced daily-use formulations. Dental associations and government campaigns promoted regular brushing habits, boosting product penetration across both urban and rural regions. Strong educational outreach encouraged users to shift toward fluoride-rich and dentist-recommended variants, lifting market volume and premium product adoption.

- For instance, Procter & Gamble products are sold in more than 180 countries and territories globally, as specified in their official corporate information. The Oral Care division brands, including Crest and Oral-B, are widely available across many of these markets.

Expansion of Premium and Specialized Variants

Premium toothpaste categories gained strong traction as buyers looked for targeted solutions such as whitening, gum care, sensitivity relief, and enamel strengthening. Brands launched specialized formulas designed to address individual oral issues, which attracted higher-income consumers seeking better results. Continuous R&D supported ingredients like hydroxyapatite, herbal extracts, and advanced cleaning agents. This shift toward functional benefits significantly boosted value sales in both developed and developing markets.

- For instance, Henkel Beauty Care notes that its hair, body, skin, and oral products are available in 150 countries worldwide, reflecting broad global reach for specialized personal-care lines.

Growth of E-commerce and Digital Promotion

E-commerce accelerated TOOTHPASTE Market growth by offering easy product access, subscription packs, and personalized recommendations. Online platforms helped brands reach new customers through influencer outreach, reviews, and targeted ads. Digital campaigns increased trial purchases of new variants, while quick-delivery services improved repeat buying behavior. Strong online presence allowed companies to scale premium offerings and niche flavors more effectively than traditional retail channels.

Key Trends & Opportunities

Natural and Herbal Formulation Adoption

Herbal and natural toothpaste gained major traction as consumers shifted toward chemical-free oral care. Plant-based ingredients such as neem, charcoal, clove, and aloe vera became popular for their perceived safety and gentle cleaning benefits. This trend encouraged brands to expand eco-friendly, SLS-free, and paraben-free ranges. The opportunity lies in tapping health-conscious users who prefer sustainable products with clean labels and transparent ingredient lists.

- For instance, Dabur has a very wide and extensive product range across multiple categories with over 1,000 SKUs in total.

Rise of Whitening and Cosmetic Oral Care

Demand for whitening toothpaste rose sharply due to growing interest in visible cosmetic improvements. Consumers preferred products that offered stain removal, enamel brightening, and long-lasting freshness. This trend strengthened opportunities for brands to introduce multi-action formulas that combine whitening benefits with sensitivity protection. Social media influence and increasing focus on personal appearance boosted adoption, especially among younger users and working professionals.

- For instance, LG Household & Health Care reports its oral-care brands, including whitening variants, are sold in more than 20 countries, per its global business disclosures.

Growth of Smart and Functional Toothpaste Formats

Functional innovations such as probiotic toothpaste, enamel-rebuilding pastes, and sensitivity-minimizing gels created new opportunities in the TOOTHPASTE Market. Brands explored science-backed ingredients to support gum health and strengthen tooth structure. Smart packaging, flavor-enhancing technologies, and age-specific variants expanded consumer appeal. These advancements opened avenues for premium-priced products with high differentiation in competitive retail environments.

Key Challenges

Rising Competition and Market Saturation

Intense competition among global and regional brands created significant challenges. Many companies offered similar fluoride-based and multi-benefit variants, which reduced differentiation and pressured pricing strategies. High promotional spending and frequent product launches increased operational costs. Market saturation in developed regions also limited volume growth, pushing companies to explore underserved rural markets and premium niches for expansion.

Shift Toward Low-Chemical and Ingredient-Safe Products

Consumers showed growing concern about artificial additives, SLS, parabens, and synthetic flavors used in toothpaste. This shift toward clean-label preferences forced brands to reformulate products while ensuring the same level of performance, raising R&D and compliance costs. Maintaining product stability and shelf life without conventional chemicals posed manufacturing challenges. These changing expectations made innovation essential but also increased regulatory scrutiny and development complexity.

Regional Analysis

North America

North America led the Toothpaste Market in 2024 with about 32% share. The region benefited from strong spending on premium oral care products, high adoption of whitening and sensitivity variants, and increasing focus on dental hygiene. Established brands maintained dominance through continuous product launches and widespread retail coverage. Growing consumer interest in natural formulations also supported steady category expansion. The presence of strong dental associations, frequent check-ups, and rising cosmetic care awareness further strengthened market demand across both the United States and Canada.

Europe

Europe held nearly 28% share in the 2024 Toothpaste Market. Demand remained strong due to high standards of dental care, strong preference for herbal and sensitive-care products, and widespread awareness of enamel protection. Well-regulated ingredient policies encouraged manufacturers to focus on clean-label offerings. Growth increased as users adopted whitening pastes and anti-gingivitis formulations. The region also showed rising interest in sustainable packaging and organic variants, supporting premium segment gains. Countries such as Germany, the U.K., and France remained the largest contributors.

Asia Pacific

Asia Pacific accounted for about 27% share in 2024, supported by a large population base and rising disposable incomes. Expanding urbanization, greater interest in grooming, and strong penetration of affordable toothpaste brands fueled growth. The region saw fast adoption of herbal, charcoal-based, and whitening variants. Increasing retail expansion across India, China, Japan, and Southeast Asia strengthened product accessibility. Marketing campaigns and wider e-commerce reach encouraged trial purchases, helping companies grow across both mass and premium segments.

Latin America

Latin America captured close to 8% share in the 2024 Toothpaste Market. The region experienced stable growth due to rising oral hygiene awareness and increasing availability of economy and mid-range toothpaste options. Consumers showed interest in multi-benefit formulations offering cavity protection, freshness, and whitening. Expanding supermarket chains supported stronger product visibility, while e-commerce adoption improved in major cities. Economic fluctuations limited premium uptake, yet dental care campaigns in Brazil and Mexico continued to support long-term category expansion.

Middle East and Africa

The Middle East and Africa held nearly 5% share in 2024. Market growth remained moderate but steady, supported by expanding retail infrastructure and rising awareness of basic oral hygiene. Consumers preferred affordable fluoride-based variants, while demand for herbal and natural toothpaste increased in select markets. Urban regions adopted premium whitening and sensitivity products at a faster pace. Strong population growth, improving income levels, and higher exposure to global brands contributed to gradual market expansion across Gulf countries and key African economies.

Market Segmentations:

By Type

- Conventional Toothpaste

- Herbal Toothpaste

- Whitening and Sensitive Toothpaste

By Age Group

By Distribution Channel

- Institutional Sales

- Wholesalers/Distributors

- Hypermarkets/Supermarkets

- Specialty Stores

- Drug Stores and Pharmacies

- Convenience Stores

- Online Retailers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Toothpaste Market features leading players such as Himalaya Wellness, Henkel AG & Co. KGaA, Patanjali Ayurved, Dabur Ltd., Lion Corporation, Avon Products Inc. (Natura & Co), Amway, The Procter & Gamble Company, Colgate-Palmolive Company, and GSK plc. Competition remained strong as brands focused on product diversification and targeted benefits for different user groups. Companies expanded herbal, whitening, and sensitivity ranges to meet rising consumer expectations. Premium lines grew quickly due to advances in enamel protection and stain removal. Marketing efforts increased across digital platforms to boost visibility and drive trial purchases. E-commerce strengthened customer reach through subscription models and quick delivery options. Sustainability shaped innovation as brands tested recyclable tubes and reduced-plastic packaging. Clean-label trends pushed manufacturers to reduce chemical additives while maintaining performance. Retail networks widened in growing economies, enhancing product availability and boosting category uptake. Continuous R&D supported new formulations designed to improve daily oral hygiene outcomes.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Himalaya Wellness

- Henkel AG & Co. KGaA

- Patanjali Ayurved

- Dabur Ltd.

- Lion Corporation

- Avon Products Inc. (Natura & Co)

- Amway

- The Procter & Gamble Company

- Colgate-Palmolive Company

- GSK plc

Recent Developments

- In 2025, Himalaya Wellness Launched the Himalaya HiOra-D Toothpaste, a sugar-free, diabetic-friendly paste to address oral health issues in diabetic patients.

- In 2025, Lion Corporation launched the Dent Health Medicated Toothpaste DX Premium, formulated with the highest concentration and a large number of medicated ingredients aimed at enhancing gum recovery and providing comprehensive care for periodontitis.

- In 2024, Dabur Ltd. launched Dabur Herb’l Kids Toothpaste, marking its entry into the kids’ toothpaste category. It is specially formulated for cavity protection in children above three years with all-natural ingredients, free from fluoride, parabens, peroxide, triclosan, and SLS.

Report Coverage

The research report offers an in-depth analysis based on Type, Age Group, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for specialized toothpastes such as whitening and sensitivity care.

- Herbal and natural formulations will gain stronger acceptance among health-focused consumers.

- Premium toothpaste categories will grow due to higher interest in cosmetic oral care.

- E-commerce platforms will drive faster product adoption through subscription models and targeted promotions.

- Brands will invest more in clean-label and chemical-free ingredients to meet safety expectations.

- Sustainability efforts will increase, with recyclable tubes and eco-friendly packaging becoming standard.

- Advanced functional pastes, including probiotic and enamel-repair solutions, will see wider use.

- Innovation in flavors and texture formats will attract younger and urban consumers.

- Emerging markets will show strong growth as awareness of daily oral hygiene improves.

- Companies will focus on dental professional endorsements to strengthen product credibility and sales.