Market overview

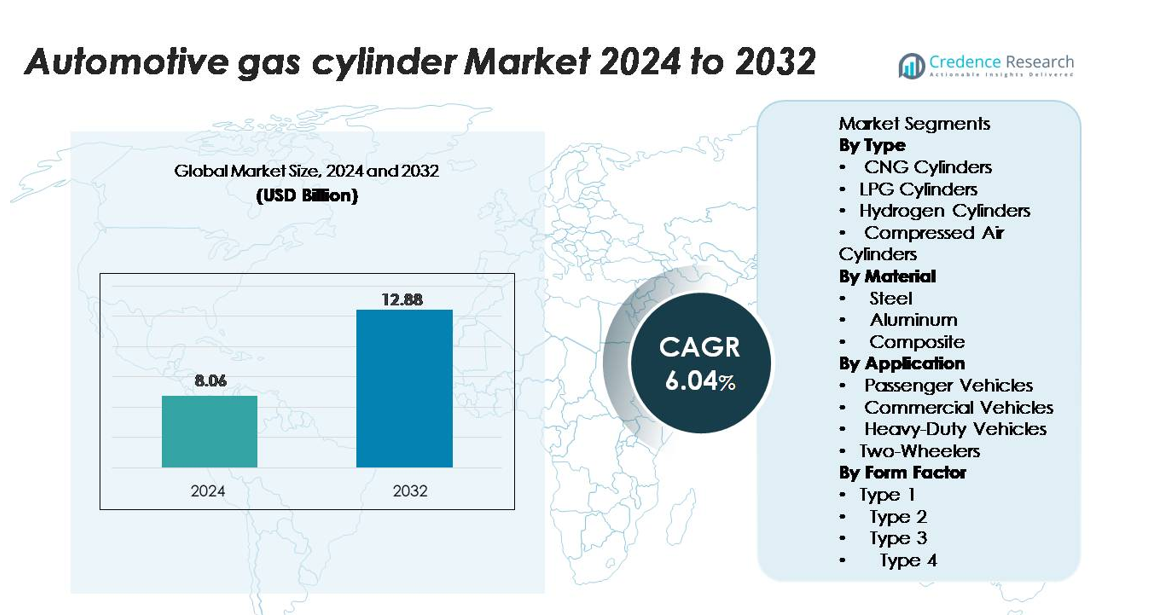

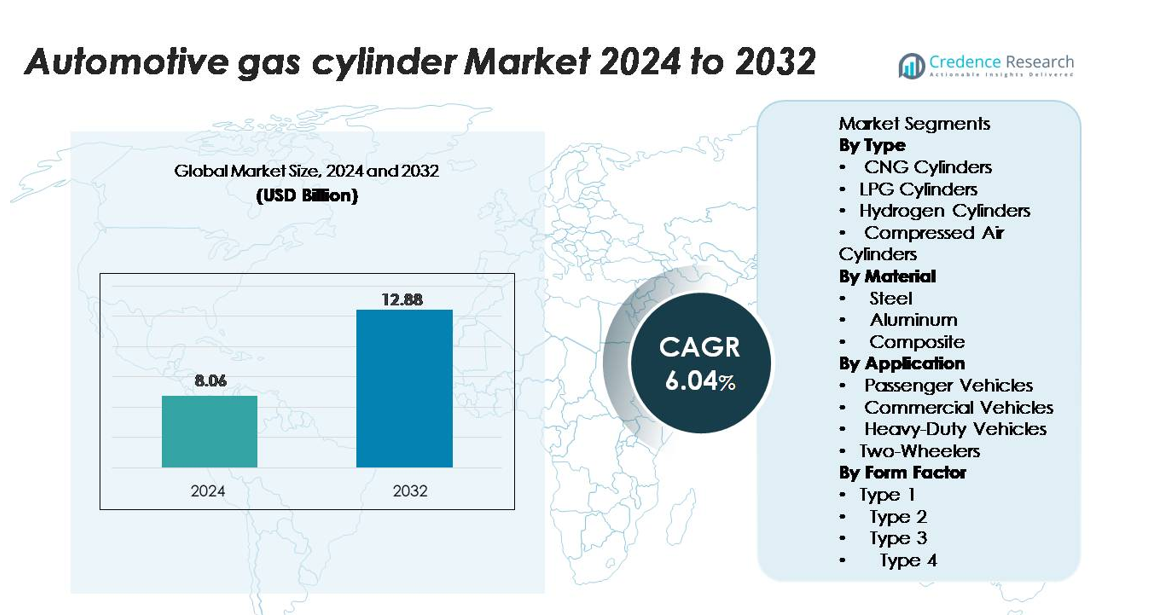

The Automotive Gas Cylinder Market size was valued at USD 8.06 billion in 2024 and is anticipated to reach USD 12.88 billion by 2032, expanding at a CAGR of 6.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Gas Cylinder Market Size 2024 |

USD 8.06 billion |

| Automotive Gas Cylinder Market, CAGR |

6.04% |

| Automotive Gas Cylinder Market Size 2032 |

USD 12.88 billion |

Major companies in the automotive gas cylinder market include Worthington Industries, Luxfer Gas Cylinders, Everest Kanto Cylinder, Hexagon Agility, Faber Industrie, and CIMC Enric. These players compete through advanced composite technology, global certifications, and partnerships with vehicle OEMs. Hexagon Agility and Luxfer focus on lightweight Type-4 hydrogen and CNG cylinders for long-range fleets, while Worthington and Faber maintain strong portfolios in steel and aluminum cylinders. Asia-Pacific remains the dominant region with 39% share in 2024, supported by large CNG passenger fleets, expansion of public transport, and government-backed refueling networks. Companies expand manufacturing operations in India and China to meet rising local demand.

Market Insights

- The automotive gas cylinder market reached USD 8.06 billion in 2024 and will grow at a 6.04% CAGR through 2032.

- Rising adoption of CNG and hydrogen vehicles drives demand, with composite cylinders gaining popularity due to low weight and higher fuel capacity.

- Leading companies invest in Type-4 technology and OEM partnerships, while aftermarket suppliers grow through retrofit demand in taxis and commercial fleets.

- High composite cylinder cost and limited refueling infrastructure in developing regions remain major restraints affecting large-scale transition.

- Asia-Pacific holds 39% share, making it the top region, while CNG cylinders lead with 41% segment share, supported by expanding public transport fleets in India, China, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

CNG cylinders held the dominant share of 41% in 2024, driven by rising adoption of natural gas vehicles in Asia-Pacific and Europe. Their lower fuel cost, lower emissions, and wide availability support strong demand in passenger and commercial fleets. LPG cylinders continue to gain traction in regions with established autogas infrastructure, while hydrogen cylinders grow due to fuel-cell vehicle deployment. Compressed air cylinders remain a small niche but find usage in emerging pneumatic hybrid systems. Government subsidies for clean mobility further strengthen CNG cylinder sales and long-term fleet conversion.

- For instance, Everest Kanto Cylinder supplies automotive CNG cylinders certified for 20 MPa working pressure and tested to 45 MPa burst pressure under ISO 11439, while Luxfer Gas Cylinders offers Type-4 hydrogen tanks rated to 700-bar operating pressure and validated for more than 10,000 fill cycles in commercial duty conditions.

By Material:

Composite cylinders accounted for 46% of the market in 2024, making them the leading material segment due to lightweight design, higher fuel capacity, and improved safety performance. Their low weight enhances vehicle range and payload efficiency, especially in CNG and hydrogen-powered vehicles. Steel cylinders remain common in cost-sensitive markets, while aluminum cylinders offer weight advantages in premium fleets. Composite demand rises as regulators enforce stringent weight reduction goals and OEMs integrate high-pressure storage solutions for next-generation energy-efficient vehicles.

- For instance, Hexagon Purus manufactures Type-4 composite cylinders that weigh up to 70% less than steel equivalents and are certified for 700-bar operating pressure, while Luxfer Gas Cylinders documents burst strength values above 1,650 bar for its carbon-fiber reinforced hydrogen tanks based on company product specifications and EU safety test results.

By Application:

Passenger vehicles represented the dominant application segment with 38% share in 2024, supported by rising CNG and hybrid vehicle adoption. Urban commuters prefer cleaner and cheaper fuel options, while carmakers integrate factory-fitted gas cylinder kits to meet emission targets. Commercial vehicles and heavy-duty fleets use high-capacity cylinders to reduce fuel expenditure and meet low-emission transportation policies. Two-wheelers show growth in South Asia and Africa, where affordable CNG retrofit systems support last-mile mobility. Improved refueling networks and government incentives continue to drive adoption across all vehicle categories.

Key Growth Drivers

Shift Toward Low-Emission Transportation

Governments promote cleaner mobility through emission rules and tax benefits. Passenger and commercial fleets adopt CNG, LPG, and hydrogen cylinders to cut carbon output. Fuel costs stay lower than gasoline or diesel, which attracts high-mileage operators. Automakers launch factory-fitted gas variants to meet efficiency targets. Urban transport agencies replace diesel buses with CNG fleets to improve air quality. Cylinder producers benefit from bulk orders and long-term fleet contracts. Asia-Pacific and Europe witness strong infrastructure growth for refueling stations. Better safety standards and quality certification boost customer confidence. Gas-powered mobility becomes a practical bridge toward full electrification. This transition drives consistent demand for new cylinders and replacement units.

- For instance, Hexagon Agility, a global provider of clean fuel solutions, supplies Type-4 composite CNG cylinder modules for commercial vehicles, including municipal buses in Europe. These systems are designed to operate safely at standard CNG working pressures (typically 200-250 bar) and are manufactured to withstand pressures significantly higher than their working rating, adhering to international safety standards such as ISO:11119-3.

Lightweight and High-Capacity Cylinder Development

Composite technology delivers low weight and strong burst strength. Vehicles gain higher fuel capacity without reducing payload or range. Fleet owners save fuel due to reduced vehicle mass. Passenger cars use composite CNG tanks to improve mileage and cargo space. Heavy-duty trucks adopt hydrogen cylinders with high pressure limits. Automakers prefer composite tanks for improved stability and crash resistance. Testing standards ensure leak-proof designs under extreme conditions. Research improves resin systems and fiber winding accuracy. Long service life lowers maintenance cost for fleet owners. These benefits accelerate the shift away from steel and aluminum tanks.

- For instance, Luxfer Gas Cylinders produces carbon-fiber Type 4 hydrogen tanks, with commercially available models such as the G-Stor Go H2 series certified for a 350-bar (5,000 psi) operating pressure. Luxfer is also actively engaged in the development of a next-generation 700-bar (10,000 psi) Type 4 cylinder.

Expansion of Commercial and Public Transport Fleets

Cities add CNG buses, taxis, vans, and delivery trucks to cut pollution. Refueling networks grow near industrial corridors, ports, and highways. Rising e-commerce activities demand cost-efficient last-mile delivery vehicles. Logistics operators choose gas fleets for better cost control. Government grants support bus fleet conversion across developing economies. Cylinder makers supply high-capacity tanks for long-route carriers. Fleet growth triggers recurring replacement demand for cylinders at end-of-life. Leasing models help small operators adopt gas vehicles easily. Municipal tenders and green funding increase project pipelines. This steady shift drives large-volume cylinder consumption worldwide.

Key Trends & Opportunities

Lightweight Hydrogen Cylinder Adoption

Fuel-cell vehicles need high-pressure hydrogen storage. Composite cylinders handle these pressures with strong leak resistance. Car and bus makers introduce long-range hydrogen models for zero-emission transport. Countries invest in hydrogen corridors and fast-fill stations. Cylinder firms develop Type-4 tanks with enhanced safety. Aviation and marine pilot projects explore hydrogen propulsion. These areas create profitable niches for advanced cylinder suppliers. Long-term contracts with automakers ensure stable revenue. As hydrogen mobility scales, cylinder demand rises sharply.

- For instance, Hexagon Purus produces Type-4 hydrogen cylinders certified for 700-bar operating pressure, with burst pressure above 1,050 bar, and validated for more than 10,000 refueling cycles under EU hydrogen tank qualification tests, enabling long-range bus and truck platforms to achieve driving ranges exceeding 400 kilometers per fill.

OEM-Integrated Cylinder Systems

Automakers now offer factory-installed gas kits in passenger and commercial models. Factory systems ensure safety, performance, and warranty coverage. Customers avoid retrofit risks and certification issues. Vehicle layouts optimize space for cylinders without reducing trunk area. Heavy vehicles receive under-chassis cylinder modules for easy service. OEM partnerships give suppliers high production volumes. Standardized platforms reduce cylinder cost. Integrated systems support global compliance and export growth. This trend creates large OEM-backed opportunities for cylinder manufacturers.

- For instance, Hexagon Agility supplies OEM-integrated CNG cylinder modules to leading truck manufacturers, including under-frame Type-4 assemblies rated at 250-bar operating pressure and tested to burst pressures above 600-bar, with module capacities exceeding 190 diesel-gallon equivalent for long-haul fleets, confirmed in its certified product specifications.

Key Challenges

High Cost of Composite Cylinders

Composite tanks cost more than steel or aluminum tanks. Small buyers struggle with upfront pricing. Fleet operators compare payback times before upgrading. Production needs advanced fibers, resins, and winding machines. Manufacturers face cost pressure in price-sensitive markets. Cheaper steel tanks remain popular in developing regions. Cost barriers slow composite adoption in two- and three-wheelers. Suppliers work on automation to reduce unit cost. Until prices fall, mass rollout remains limited.

Limited Refueling Infrastructure in Emerging Regions

Many countries lack dense gas refueling networks. Drivers face range anxiety during long trips. Commercial fleets hesitate to switch without reliable supply. Rural areas depend on diesel due to poor grid access. Hydrogen stations remain scarce outside major cities. Building stations requires high investment and complex approval. Without infrastructure, adoption of gas cylinders grows slowly. Governments need long-term plans to support rollout. Infrastructure gaps remain a major bottleneck for market expansion.

Regional Analysis

North America

North America held 22% of the market share in 2024, driven by adoption of CNG-powered commercial fleets and municipal bus programs. The United States expands natural gas refueling stations along highways, supporting long-haul logistics and waste collection fleets. Fleet operators prefer CNG cylinders to reduce operating cost and meet low-emission policies. OEMs offer factory-fitted natural gas models, boosting sales in urban transport. Hydrogen mobility projects in California create early demand for high-pressure composite cylinders. Replacement demand also rises, as fleets upgrade older steel tanks to lighter, safer alternatives.

Europe

Europe accounted for 25% of the global market in 2024, supported by strict emission norms, carbon-neutral goals, and incentives for clean mobility. Germany, Italy, and Spain record strong CNG and LPG vehicle penetration. European automakers invest in composite cylinder technology to reduce weight and enhance vehicle range. Hydrogen buses and trucks gain momentum across the UK, France, and Nordic countries. The region focuses on sustainable materials and recyclability mandates, pushing manufacturers toward advanced designs. Expanding public transport fleets and eco-friendly mobility policies drive long-term cylinder demand.

Asia-Pacific

Asia-Pacific dominated the market with 39% share in 2024, making it the leading region. India, China, and Southeast Asia witness rapid growth in CNG passenger cars, rickshaws, and delivery fleets. Government subsidies, rising fuel prices, and emission restrictions increase gas-powered vehicle sales. Public transport agencies shift to large CNG and LNG bus fleets to reduce urban pollution. Composite cylinder adoption grows as OEMs seek weight reduction and higher onboard fuel capacity. The expanding aftermarket sector also supports volume sales for replacement and retrofit kits.

Latin America

Latin America held 8% of the market share in 2024, with strong LPG and CNG usage in Mexico, Brazil, and Argentina. High fuel cost and subsidy-driven autogas programs make gas vehicles popular among taxis and small commercial fleets. Retrofitting workshops offer cost-effective conversions, driving recurring demand for cylinders. Governments promote clean mobility to reduce urban smog, especially in major cities. Brazil explores hydrogen pilot projects, creating future prospects for composite cylinders. Limited infrastructure in rural areas remains a restraint, but widespread urban adoption keeps demand steady.

Middle East & Africa

The Middle East & Africa region represented 6% share in 2024, supported by natural gas abundance and growing CNG fleet deployment. Countries like Iran and Egypt lead adoption of CNG taxis, buses, and minibuses. Government fuel subsidy reforms push consumers toward cost-efficient gas vehicles. Infrastructure development projects introduce new filling stations along transport corridors. The region sees rising procurement of high-capacity cylinders for commercial fleets. However, limited refueling access in remote regions slows broader penetration. Composite cylinders gain interest due to heat resistance and safety advantages in harsh climates.

Market Segmentations:

By Type

- CNG Cylinders

- LPG Cylinders

- Hydrogen Cylinders

- Compressed Air Cylinders

By Material

By Application

- Passenger Vehicles

- Commercial Vehicles

- Heavy-Duty Vehicles

- Two-Wheelers

By Form Factor

- Type 1

- Type 2

- Type 3

- Type 4

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The automotive gas cylinder market features a mix of global manufacturers and regional suppliers competing on safety standards, material innovation, and OEM partnerships. Leading players focus on composite cylinder development to reduce weight, increase storage capacity, and improve burst resistance. Companies expand production facilities near high-demand markets to lower logistics cost and support faster delivery. Strategic alliances with automobile manufacturers help secure large-volume contracts for factory-fitted CNG, LPG, and hydrogen vehicles. Product portfolios include steel, aluminum, and Type-4 composite cylinders tailored for passenger, commercial, and heavy-duty fleets. Certification to global standards such as ISO, ECE R110, and DOT boosts customer confidence and supports international trade. Vendors invest in automated winding systems, robotics, and quality-testing rigs to ensure reliability and leak-proof performance. Competition also intensifies in the aftermarket sector, where smaller companies supply retrofit kits for taxis, delivery fleets, and two-wheelers. Continuous innovation and compliance remain key advantages for leading brands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hexagon Purus ASA

- Stelrad Group plc

- Chengdu Yachuan Gas Equipment Co., Ltd.

- Ryder Industries Ltd.

- Krosaki Harima Corporation

- Everest Kanto Cylinder Ltd.

- Nexteer Automotive Corporation

- Worthington Cylinders GmbH

- Stellantis N.V.

Recent Developments

- In 2024, Confidence Group announced the launch of advanced Type-4 hydrogen cylinders, becoming India’s first company to import this technology. These cylinders, lighter and corrosion-resistant, will support the green hydrogen market and sustainable energy goals.

- In September 2022, Worthington Industries will produce Type 3 and 4 composite pressure cylinders that are lightweight and made of metallic or polymeric liners with carbon fiber reinforcement that can withstand high pressures. Various applications include onboard fueling systems for trucks, cars, and buses and can be used to transport compressed hydrogen and compressed natural gas CNG.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application, Form factor and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of lightweight composite cylinders will increase across passenger and commercial fleets.

- Hydrogen vehicle growth will boost demand for high-pressure Type-4 cylinders.

- OEM-integrated gas cylinder systems will replace aftermarket retrofits in many markets.

- Public transport agencies will expand CNG and hydrogen bus deployments.

- Cylinder manufacturers will invest in automated winding and testing technologies.

- Replacement demand will rise as aging steel tanks reach end-of-life.

- More refueling stations will support long-distance commercial operations.

- Safety certifications and global standards will drive export opportunities.

- Fleet owners will shift to cost-efficient gas solutions for last-mile logistics.

- Government emission rules will sustain long-term transition toward gas-powered mobility.