Market overview

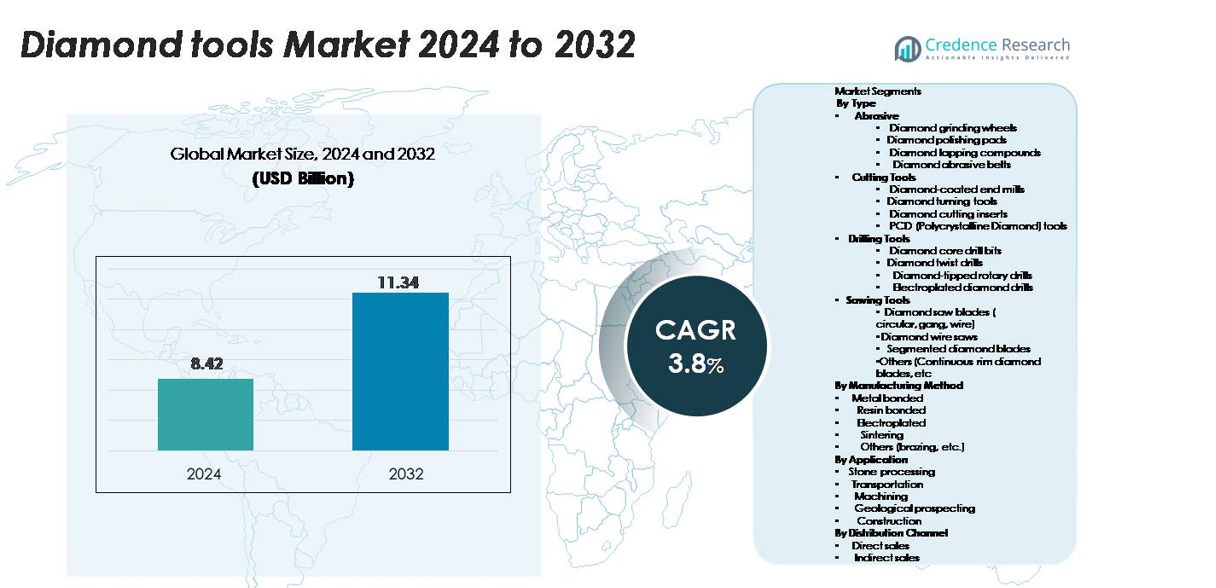

The global Diamond Tools market was valued at USD 8.42 billion in 2024 and is projected to reach USD 11.34 billion by 2032, expanding at a CAGR of 3.8% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diamond Tools Market Size 2024 |

USD 8.42 billion |

| Diamond Tools Market, CAGR |

3.8% |

| Diamond Tools Market Size 2032 |

USD 11.34 billion |

Leading companies in the diamond tools market include Husqvarna, Saint-Gobain, Tyrolit, Asahi Diamond Industrial, Ehwa Diamond, Bosch, Hilti, ICS Blount, and 3M. These players compete through advanced bonding technologies, high-precision cutting tools, and global distribution networks serving construction, stone processing, and precision machining. Product portfolios span diamond saw blades, grinding wheels, core drills, PCD tools, and electroplated solutions for industrial and infrastructure applications. Asia-Pacific remains the largest regional market with 42% share, driven by large-scale construction, semiconductor fabrication, mining, and automotive machining. North America and Europe follow due to high adoption of CNC machining, engineered stone fabrication, and continuous infrastructure upgrades.

Market Insights

- The Diamond Tools market was valued at USD 8.42 billion in 2024 and is projected to reach USD 11.34 billion by 2032, registering a 3.8% CAGR during the forecast period.

- Construction and stone processing drive most demand, with abrasive tools holding the largest segment share due to heavy use in grinding, polishing, and finishing of concrete, metals, marble, and engineered stone.

- Key trends include rising adoption of metal-bonded and electroplated tools for CNC machining, semiconductor production, and precision cutting of ceramics and composites, reducing downtime and improving tool life.

- Competition remains moderate, led by Husqvarna, Saint-Gobain, Tyrolit, Asahi Diamond Industrial, and Bosch, while regional manufacturers compete on pricing and localized distribution networks.

- Asia-Pacific leads with 42% market share, followed by North America and Europe; recent developments include product launches focused on longer tool life, heat-resistant blades, and PCD tool innovations for EV and aerospace machining.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Abrasive diamond tools hold the largest share in this segment, accounting for the majority of global revenue due to extensive use in grinding, polishing, and precision finishing. Diamond grinding wheels lead within this sub-category, supported by rising demand in metal fabrication, semiconductor processing, and ceramics. Cutting tools, including PCD inserts and diamond-coated end mills, continue to gain traction in CNC machining for automotive and aerospace components where high wear resistance and precision matter. Drilling tools and sawing tools also show strong adoption in construction and mining, driven by the need for fast cutting speed, lower wear, and reduced maintenance downtime.

- For instance, Tyrolit’s PREMIUM rough grinding wheel series is engineered with a coarse grain size, typically around 36 grit (approximately 500 µm), to support high material removal rates”.

By Manufacturing Method

Metal-bonded diamond tools dominate this segment with the highest market share because they offer superior durability, high thermal resistance, and long tool life for heavy grinding operations. These tools are extensively used in stone cutting, concrete finishing, and precision machining. Resin-bonded products are preferred for surface polishing and finishing applications, especially in electronics and optical components. Electroplated and sintered variants grow steadily due to rising adoption in drilling and detailed shaping jobs, where sharp cutting edges and customization are required. Other bonding types, including brazed tools, continue to expand across construction applications where aggressive material removal is required.

- For instance, many of Husqvarna’s Vari-Cut metal-bonded blades, such as the S25, S35, S45, S50, and S65 models in various common diameters (e.g., 300-400 mm), are manufactured with a segment height of 12 mm.

By Application

Stone processing remains the dominant application segment and accounts for the largest share of global demand. Diamond blades, core drill bits, and grinding wheels are widely used for cutting, carving, and polishing granite, marble, ceramics, and engineered stone. Construction follows as a fast-growing segment driven by infrastructure development, repairs, and concrete cutting tasks. Machinery and transportation also contribute steadily, using diamond tools for precision machining of composites, hardened metals, and engine components. Geological prospecting relies on diamond drills for mineral extraction, driven by deeper drilling requirements and rising exploration activities worldwide.

Key Growth Drivers

Rising Construction and Infrastructure Development

Growing investment in public infrastructure, residential projects, and commercial buildings drives strong demand for cutting, drilling, and sawing tools with high accuracy and long service life. Construction firms prefer diamond blades, core drill bits, and wire saws because they offer faster cutting speeds, cleaner edges, and reduced downtime when working with concrete, ceramic tiles, granite, and engineered stone. The rapid expansion of smart cities, metro rail networks, and road rehabilitation further increases the usage of diamond tools in heavy-duty operations. In developing economies, government-backed urban development projects, mining activities, and industrial upgrades continue to improve consumption of high-performance diamond tools. As contractors and builders require tools that can withstand abrasive surfaces and deliver precision with minimal wear, diamond-based solutions gain a competitive edge over carbide or traditional alloy tools, strengthening long-term market growth.

- For instance, Husqvarna’s ELITE-CUT S65 bladeis manufactured with a 15 mm segment height for most diameters and is designed for use on handheld power cutters and floor saws with appropriate operating speeds (e.g., typically around 4,700 RPM for a 14-inch handheld cutter).

Advancements in Precision Engineering and CNC Machining

The shift toward automation and precision manufacturing has significantly boosted demand for diamond-coated end mills, PCD tools, and grinding wheels used in high-speed machining. Industries such as electronics, aerospace, and automotive increasingly rely on diamond tools to process hard metals, composites, ceramics, and semiconductor wafers with strict tolerance levels. CNC technology continues to generate demand for tools that maintain sharp edges, reduce friction, and extend tool life in continuous production. The growth of electric vehicles also supports the use of diamond tools for machining battery components, braking systems, heat-resistant alloys, and lightweight structural materials. As global manufacturing adopts tighter quality standards and higher output speed, diamond tools remain essential in achieving smooth finishing, dimensional accuracy, and productivity gains with fewer tool replacements.

- For instance, Mitsubishi Materials’ PVD-coated MP9130 series is optimized for cutting titanium and other heat-resistant alloys by utilizing a new and enhanced super fine cemented carbide substrate with a multi-layer (Al-Ti-Cr-N) PVD coating (Tough-Σ Miracle Sigma technology).

Growing Adoption of Diamond Tools in Stone Processing and Mining

Stone processing remains a major consumer of diamond saw blades, grinding wheels, and core drills used for shaping marble, granite, and engineered stone for kitchen tops, flooring, tiles, and monuments. Rising demand for high-end architectural stonework, luxury interiors, and engineered quartz surfaces expands the adoption of precision diamond tools. The mining sector further supports market growth as diamond-tipped drills are essential for deep exploration, extraction, and sample collection. These tools provide superior penetration, thermal resistance, and longevity under high-pressure conditions. With ongoing investments in natural stone exports, mineral extraction, and quarry mechanization, industries continue shifting from conventional steel tools to diamond-based solutions to reduce downtime, increase output, and improve cut quality.

Key Trends & Opportunities

Shift Toward Electroplated and Metal-Bonded Tools for High-Precision Work

Manufacturers increasingly invest in electroplated and metal-bonded tools to meet demand from electronics, aerospace, and medical component machining where micro-tolerance and fine finishing are critical. These tools offer sharper cutting edges, excellent wear resistance, and stable performance at high speeds. Growing semiconductor production, ceramic component machining, turbine part finishing, and optical lens fabrication widen the market opportunity for ultra-precise diamond tools. In addition, custom-shaped electroplated drills and diamond burrs support emerging applications in 3D-printed metals and advanced composite materials. As modern manufacturing shifts toward difficult-to-cut substrates, specialty diamond tools with hybrid bonding and engineered grain distribution gain commercial potential.

- For instance, Asahi Diamond Industrial’s electroplated diamond drills for electronics feature a diamond grain size of 20 µm and achieve hole dimensional accuracy within ±0.003 mm on ceramic substrates, supporting precision micro-drilling.

Sustainability and Longer Tool Life Driving Replacement of Conventional Tools

Companies are shifting toward diamond tools as a sustainable and cost-efficient alternative to carbide or abrasive alloy tools, which wear out quickly when cutting hard materials. Diamond surfaces require fewer replacements, reduce machining waste, and maintain consistent cutting quality, supporting cleaner and more efficient production. Construction and quarrying industries now prefer segmented diamond blades and wire saws to lower dust emissions, reduce noise, and improve worker safety. Eco-friendly production methods, recyclable tool bases, and reduced coolant usage further position diamond tools as a greener option. Toolmakers offering re-tipping, re-plating, and refurbished product services gain additional revenue potential as industries push for lower lifecycle costs.

- For instance, the Husqvarna CS 2512 wire saw has a net wire storage capacity of 16 m (approximately 52 ft).

Key Challenges

High Initial Cost and Availability of Low-Cost Alternatives

Despite their advantages, diamond tools involve higher upfront costs compared with traditional metal or carbide tools, which limits adoption among price-sensitive contractors and small workshops. While operational savings appear over long-term usage, many end users hesitate due to budget constraints or shorter project durations. Additionally, abrasive-coated tools and carbide cutters still serve as viable substitutes in low-precision cutting, small-scale fabrication, or rentals. Increasing imports of low-cost diamond tools from local manufacturers also intensifies price competition, reducing profit margins for premium brands. Market penetration depends on educating users about total cost-of-ownership benefits and durability, which remains a challenge in cost-driven industries.

Tool Wear in Extreme Environments and Technical Limitations

Diamond tools, despite their durability, face performance challenges when exposed to extreme heat or improper operating conditions. Prolonged dry cutting, incorrect spindle speeds, and poor coolant management can cause thermal damage and premature tool wear. Machining ferrous metals also leads to rapid chemical wear due to carbon diffusion, limiting diamond tool usage for certain alloys. These technical constraints require specialized bonding materials, coatings, and application knowledge, which not all users possess. Distributors and manufacturers must provide operator training, material-specific tool recommendations, and customized tool designs to overcome these challenges and ensure consistent cutting quality.

Regional Analysis

North America

North America holds a significant share of the global diamond tools market, accounting for nearly 28% of total revenues. The region benefits from strong demand in construction, metal fabrication, aerospace, and semiconductor manufacturing, where high-precision machining is critical. The United States drives most consumption due to large infrastructure spending, automation in machine shops, and advanced CNC adoption across automotive and aerospace supply chains. The growing renovation of bridges, highways, and commercial buildings supports the use of diamond saw blades and drilling tools. Continuous investment in electronics, battery manufacturing, and high-performance materials further strengthens regional demand.

Europe

Europe represents approximately 24% of the global market and remains a key hub for automotive machining, stone processing, and industrial tooling. Germany, Italy, and the UK lead consumption due to advanced engineering capabilities and strong export-focused manufacturing bases. Demand for diamond grinding wheels, cutters, and polishing tools continues to grow in metalworking, ceramics, and precision component production. Rapid adoption of sustainable construction materials and high-grade engineered stone boosts the use of diamond saws and abrasive tools. The region’s shift toward automation and Industry 4.0 technology accelerates the need for durable, high-efficiency cutting and finishing tools.

Asia-Pacific

Asia-Pacific dominates the diamond tools industry with the largest market share of nearly 42%, driven by large-scale construction, mining, and industrial production. China, India, Japan, and South Korea represent core demand centers supported by extensive manufacturing clusters and rising semiconductor output. The region’s infrastructure expansion, urban real estate growth, and quarry mechanization drive high consumption of diamond saw blades, core drills, and grinding wheels. Automotive part machining, EV battery components, and electronics manufacturing further strengthen utilization of diamond-coated end mills and PCD tools. Cost-efficient production and availability of local toolmakers support steady market expansion.

Latin America

Latin America captures close to 4% of the global market, supported mainly by construction, quarrying, and mining activities across Brazil, Mexico, and Chile. Growing extraction of copper, iron ore, and precious metals boosts demand for diamond drill bits and wire saws due to deeper drilling and rugged geological formations. Residential and commercial construction growth also increases adoption of diamond cutting and sawing tools for concrete and stone finishing. However, limited industrial automation and price-sensitive buyers restrict rapid market penetration. Still, government infrastructure upgrades and mining investments create steady long-term potential.

Middle East & Africa

The Middle East & Africa region holds approximately 2% market share and shows gradual growth driven by commercial real estate development, quarry operations, and oil-sector construction. Countries such as the UAE, Saudi Arabia, and South Africa show rising adoption of diamond tools for stone cutting, drilling, and concrete shaping. High-value architectural stonework, marble processing, and luxury construction projects increase demand for precision sawing tools. Mining operations across Africa further support usage of diamond-tipped drill bits and coring tools. Market expansion is slow due to limited manufacturing capacity, but infrastructure diversification and industrial development continue to create opportunities.

Market Segmentations:

By Type

- Abrasive

- Diamond grinding wheels

- Diamond polishing pads

- Diamond lapping compounds

- Diamond abrasive belts

- Cutting Tools

- Diamond-coated end mills

- Diamond turning tools

- Diamond cutting inserts

- PCD (Polycrystalline Diamond) tools

- Drilling Tools

- Diamond core drill bits

- Diamond twist drills

- Diamond-tipped rotary drills

- Electroplated diamond drills

- Sawing Tools

- Diamond saw blades (circular, gang, wire)

- Diamond wire saws

- Segmented diamond blades

- Others (Continuous rim diamond blades, etc

By Manufacturing Method

- Metal bonded

- Resin bonded

- Electroplated

- Sintering

- Others (brazing, etc.)

By Application

- Stone processing

- Transportation

- Machining

- Geological prospecting

- Construction

By Distribution Channel

- Direct sales

- Indirect sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global diamond tools market remains moderately consolidated, with a mix of multinational manufacturers and regional producers competing on technology, product durability, and pricing. Leading companies focus on high-precision tools, advanced bonding technologies, and customized solutions for industries such as construction, stone processing, automotive machining, and semiconductor manufacturing. Many players invest in metal-bonded and electroplated tool innovations to improve cutting speed, heat resistance, and tool life for demanding applications. Strategic partnerships with OEMs, distributors, and construction contractors strengthen product reach and after-sales support. Smaller regional firms compete primarily through cost-effective offerings and localized supply chains, while established brands emphasize R&D, automation, and premium performance for high-value industries. With rising demand for precision machining and engineered stone processing, competitive intensity is increasing in segments like diamond saw blades, core drills, and PCD cutting tools. Companies also expand portfolios through acquisitions, capacity upgrades, and entry into fast-growing Asia-Pacific and Middle Eastern markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2023, the Construction Division signed an agreement to acquire the business of Total Diamond Products in the UK, strengthening its diamond tools portfolio for professional contractors.

- In April 2023, Husqvarna launches a new Ulti-Grit series of diamond blades for flat saws. The Ulti-Grit segment is a completely new design that uses Husqvarna’s latest advances in controlled diamond distribution. With this new technology, Ulti-Grit blades have increased cutting speeds and longer blade life.

Report Coverage

The research report offers an in-depth analysis based on Type, Manufacturing method, Application, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as construction, mining, and infrastructure projects expand worldwide.

- Diamond blades and core drills will gain higher adoption in concrete cutting and road rehabilitation.

- CNC machining and automation will increase consumption of PCD tools and diamond-coated end mills.

- Precision manufacturing in aerospace, EV components, and semiconductors will boost high-tolerance diamond tools.

- Electroplated and metal-bonded tools will continue to replace conventional abrasive tools.

- Stone processing and engineered stone fabrication will remain a strong revenue driver.

- Manufacturers will invest in heat-resistant, long-life tools to reduce downtime and increase productivity.

- Smart manufacturing will drive demand for customized and application-specific diamond tool designs.

- Asia-Pacific will retain dominance due to strong industrial and construction growth.

- Partnerships with OEMs and rental service providers will expand market reach for premium tools.