Market overview

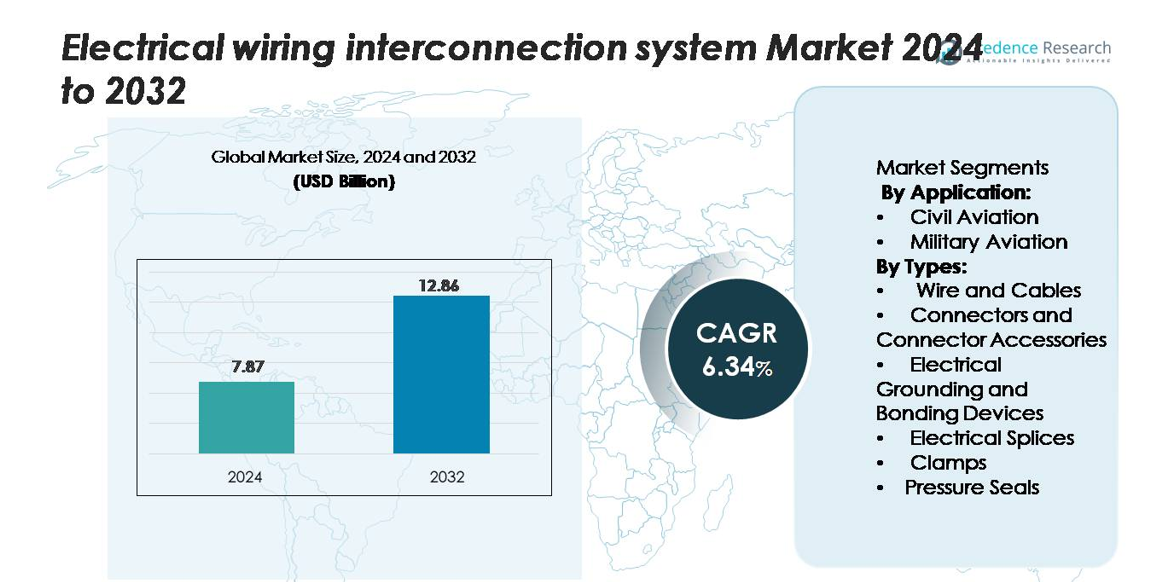

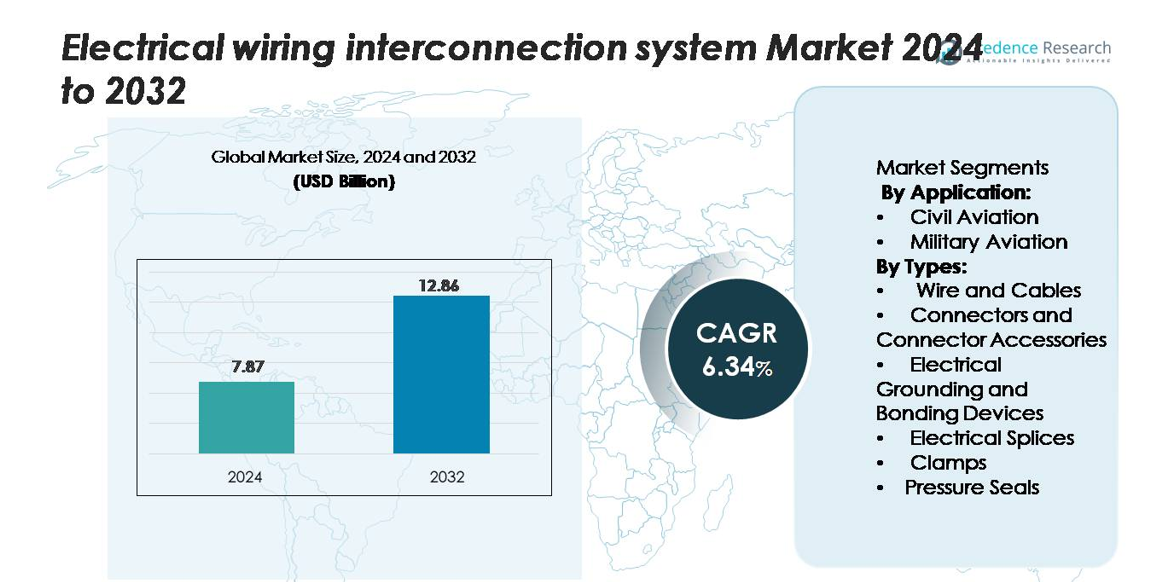

Electrical Wiring Interconnection System market size was valued at USD 7.87 billion in 2024 and is expected to reach USD 12.86 billion by 2032, growing at a CAGR of 6.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrical Wiring Interconnection System Market Size 2024 |

USD 7.87 billion |

| Electrical Wiring Interconnection System Market, CAGR |

6.34% |

| Electrical Wiring Interconnection System Market Size 2032 |

USD 12.86 billion |

The Electrical Wiring Interconnection System market includes strong participation from global aerospace suppliers and cable manufacturers. Leading companies focus on lightweight wiring, high-density connectors, grounding systems, and fiber-optic data links that support modern avionics and in-flight connectivity. Long-term partnerships with major aircraft OEMs help secure production and aftermarket contracts across commercial and military fleets. North America leads the global market with 35% share in 2024, supported by advanced manufacturing hubs, defense spending, and fleet modernization. Europe follows with about 28% share due to strong OEM presence and sustainability-focused innovation, while Asia Pacific holds nearly 26% as the fastest-growing region driven by expanding commercial fleets and regional MRO growth.

Market Insights

- The Electrical Wiring Interconnection System market was valued at USD 7.87 billion in 2024 and is expected to reach USD 12.86 billion by 2032, growing at a CAGR of 6.34%.

- Rising aircraft production, fleet modernization, and digital avionics drive strong demand for lightweight wiring, fiber-optic cables, and high-density connectors.

- The market sees increasing adoption of advanced materials, EMI-shielded cables, and predictive maintenance tools, creating opportunities for suppliers offering high-performance and modular wiring systems.

- North America holds 35% of the market, followed by Europe at 28% and Asia Pacific at 26%, while wire and cables remain the dominant product segment with nearly 40% share.

- High installation cost, strict certification requirements, and complex aircraft architectures act as restraints, encouraging OEMs to adopt modular harnesses and advanced routing designs to reduce production time and maintenance delays.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

Civil aviation accounts for the dominant share of the Electrical Wiring Interconnection System market, holding close to 65% of total demand in 2024. Commercial aircraft production and fleet modernization programs increase the use of advanced wiring harnesses, fiber-optic cables, and lightweight insulation materials. Airlines focus on fuel efficiency, safety, and in-flight connectivity, driving higher adoption of high-density wiring systems. Growth in narrow-body and wide-body deliveries from major OEMs strengthens long-term demand. Military aviation also sees steady growth supported by upgrades in combat aircraft, UAV platforms, and communication systems requiring secure and shielded wiring architectures.

- For instance, Airbus reported installing more than 530 kilometers of wiring on each A350-900 aircraft, including over 100,000 individual cables supporting avionics, power distribution, and cabin systems.

By Types

Wire and cables represent the largest sub-segment, accounting for nearly 40% of the market in 2024 due to extensive use in power transmission, avionics, and communication networks across all aircraft classes. Aircraft manufacturers prefer lightweight, heat-resistant, and EMI-shielded wiring to improve performance and reduce maintenance cycles. Connectors and accessories gain traction as modular and quick-disconnect solutions improve serviceability and reduce assembly time. Electrical grounding devices and splices support safety compliance and stable power flow, while pressure seals and clamps protect wiring from vibration, moisture, and fuel exposure.

- For instance, TE Connectivity reported that its Raychem wire families withstand continuous temperatures up to 260°C and maintain electrical integrity after exposure to 2,000 hours of thermal aging.

Key Growth Drivers

Rising Aircraft Production and Fleet Modernization

Aircraft manufacturers increase production to meet rising passenger traffic and new route expansions. Commercial airlines replace aging fleets to improve fuel efficiency, safety, and cabin connectivity. Modern aircraft use high-density wiring, lightweight insulation, and fiber-optic solutions. These components reduce weight, cut fuel burn, and improve data transmission. New aircraft platforms also offer advanced avionics, entertainment systems, and fly-by-wire controls that need reliable wiring networks. Maintenance, repair, and overhaul (MRO) providers upgrade wiring during periodic inspections, strengthening aftermarket demand. Military fleets also adopt upgraded wiring for radar, sensors, and electronic warfare systems. This combined production and upgrade cycle drives large and recurring demand for interconnection systems.

- For instance, Boeing utilized an innovative ‘more-electric’ design in the 787 Dreamliner to significantly reduce the total length of individual wires compared to older aircraft. The total length of wiring in a 787 is approximately 60 to 70 miles (around 100 kilometers), supporting flight controls, power distribution, and digital cabin systems.

Growth in Electrification and Digital Avionics

Aviation systems adopt digital cockpit technologies, satellite communication, and smart navigation suites. These systems require secure data transfer and EMI-shielded wiring. Electric aircraft concepts, hybrid propulsion, and more-electric aircraft architectures increase wiring density throughout airframes. Power transmission lines, battery management lines, and thermal management circuits expand wiring needs. OEMs invest in improved cable routing, fault detection, and high-voltage connectors. Civil helicopters, UAVs, and advanced air mobility vehicles also use compact wiring modules and data buses. The shift toward digital control and electric propulsion raises long-term wiring demand in both commercial and military sectors.

Growing Emphasis on Safety and Reliability Standards

Regulators enforce strict rules on fire resistance, insulation, grounding, and shielding. Airlines demand wiring systems that lower fire risks, prevent electrical faults, and withstand vibration, heat, and moisture. Modern systems offer fault detection, arc protection, and lightweight shielding materials. High-reliability wiring reduces downtime and supports operational safety. OEMs adopt new materials such as PTFE insulation, nickel-coated conductors, and fiber-optic cable assemblies. These systems support demanding avionics, radar, and communication workloads without signal loss. As safety standards tighten worldwide, suppliers gain steady demand for certified, aircraft-grade wiring solutions.

Key Trends & Opportunities

Adoption of Lightweight Materials and Fiber-Optic Wiring

Aircraft OEMs reduce airframe weight to improve efficiency and payload capacity. Lightweight wiring reduces fuel cost and supports sustainable goals. Fiber-optic cables replace copper in several communication and sensor networks. They offer faster transmission, low signal loss, and immunity to electromagnetic interference. Wiring harness suppliers develop heat-resistant, flame-retardant, and flexible cable jackets for harsh conditions. Composite clamps, shielded splices, and quick-lock connectors improve maintenance speed. This shift creates opportunities for suppliers offering advanced materials and compact cable assemblies.

- For instance, Amphenol’s high-speed fiber-optic interconnects, such as the ARINC 801 series, are designed to support data rates of 10 Gbps and beyond over multimode fiber, with the termini typically exhibiting insertion loss below 0.3 dB per mated pair, ensuring reliable performance in demanding avionics systems.

Expansion of Digital Maintenance and Health Monitoring Systems

Airlines adopt predictive maintenance to reduce component failures. Smart sensors, diagnostic software, and digital inspection tools monitor wiring health. Fault mapping systems predict insulation wear, grounding issues, and heat damage. MRO teams use automated routing and digital scanning to cut inspection time. OEMs integrate modular wiring blocks and quick-disconnect terminals to simplify servicing. This trend supports new business opportunities in software tools, maintenance contracts, and retrofitting of aging fleets.

- For instance, InterConnect Wiring specializes in the manufacturing and analysis of aircraft wiring harnesses, and has published studies on detecting faults and degradation mechanisms in wiring, often in conjunction with other testing methods or equipment.

Key Challenges

High Installation and Certification Costs

Aircraft wiring requires precise routing, shielding, and full certification. Certification follows strict testing for fire safety, EMI, and durability. Installation demands skilled labor, advanced tooling, and complex assembly processes. Any wiring issue can delay aircraft delivery or trigger costly maintenance. High material cost and long validation cycles challenge new suppliers. MRO tasks also take time because wires run through tight spaces. These factors increase cost pressure for OEMs and operators.

Complexity in Modern Aircraft Architectures

New aircraft platforms carry dense electronic systems and data networks. Wiring runs across wings, fuselage, cabin, and landing gear. Complex routing increases design time and risk of weight growth. EMI shielding, moisture protection, and grounding must meet strict standards. Integrating power lines, data cables, and avionics connectors without interference is difficult. OEMs need advanced 3D modeling, simulation, and modular harness systems. The complexity slows production and increases engineering workload for suppliers.

Regional Analysis

North America

North America holds the largest share of the Electrical Wiring Interconnection System market at nearly 35% in 2024, driven by strong aircraft production, defense spending, and constant fleet upgrades. The United States leads with major OEMs, MRO hubs, and aerospace suppliers focusing on lightweight wiring, EMI-shielded cables, and fiber-optic data links. The region invests in next-generation military aircraft, UAV programs, and more-electric aircraft platforms, increasing demand for advanced connectors and grounding systems. Strong regulatory standards and adoption of digital maintenance tools support continuous replacement and retrofit activity, strengthening aftermarket demand across commercial and military aviation.

Europe

Europe accounts for close to 28% of the market in 2024, supported by the presence of major aircraft manufacturers, defense contractors, and Tier-1 suppliers. The region focuses on lightweight cabling, high-density connectors, and eco-friendly materials to support sustainability goals. Growing investments in hybrid and electric propulsion aircraft drive higher wiring density and advanced power management circuits. Defense programs, including fighter jets and military transport aircraft, expand demand for shielded cables and radar-grade wiring. Strong MRO networks in France, Germany, and the U.K. encourage upgrades and retrofits, boosting long-term demand for certified wiring solutions.

Asia Pacific

Asia Pacific holds nearly 26% of the global market in 2024 and is the fastest-growing region due to expanding commercial fleets, rising passenger traffic, and new aircraft assembly programs. China, India, Japan, and Southeast Asian countries increase purchases of narrow-body aircraft and regional jets, creating large OEM and aftermarket opportunities. The region invests in modern avionics, in-flight entertainment, and predictive maintenance, boosting demand for high-capacity wiring harnesses, connectors, and grounding systems. Local manufacturing and MRO expansion strengthen supply chains, while military modernization programs in China and India add significant demand for secure communication wiring.

Middle East & Africa

Middle East & Africa account for nearly 6% of the market in 2024, supported by strong airline fleets and airport expansion. Gulf carriers upgrade wide-body aircraft and invest in premium cabin connectivity, driving adoption of fiber-optic wiring and advanced cabin systems. Regional MRO growth in the UAE, Saudi Arabia, and Qatar increases replacement and retrofit demand. Military aviation programs also require shielded wiring for radar, surveillance, and electronic warfare. Africa sees gradual growth due to commercial fleet expansions and infrastructure development, though budget constraints limit large-scale adoption of advanced wiring solutions.

Latin America

Latin America holds close to 5% of the market in 2024, driven by recovering airline orders and modernization of regional jets. Brazil and Mexico lead the demand with aircraft manufacturing, pilot training hubs, and growing MRO activity. Airlines in the region gradually replace aging fleets and adopt digital avionics, increasing need for lightweight wiring, connectors, and fault-resistant cable assemblies. Economic fluctuations limit new aircraft purchases, but aftermarket demand remains steady through maintenance, retrofits, and safety compliance. Government investments in defense aircraft and surveillance fleets also add niche demand for advanced wiring systems across key countries.

Market Segmentations:

By Application

- Civil Aviation

- Military Aviation

By Type

- Wire and Cables

- Connectors and Connector Accessories

- Electrical Grounding and Bonding Devices

- Electrical Splices

- Clamps

- Pressure Seals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electrical Wiring Interconnection System market features a competitive landscape driven by global aerospace OEMs, Tier-1 suppliers, and specialized cable manufacturers. Key companies compete on reliability, material innovation, weight reduction, and compliance with fire and EMI safety standards. Major aircraft suppliers collaborate closely with wiring manufacturers to design harnesses, connectors, and grounding systems tailored for modern avionics, entertainment platforms, and fly-by-wire controls. Suppliers introduce lightweight wires, fiber-optic assemblies, and corrosion-resistant shields to improve fuel efficiency and data integrity. Partnerships with aerospace OEMs secure long-term contracts across commercial and military fleets. Aftermarket players expand MRO services, offering replacement harnesses, retrofitting of aging aircraft, and predictive maintenance tools. Continuous R&D investment helps companies meet evolving regulatory needs while competing for upcoming electric and hybrid aircraft programs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GKN Aerospace

- Amphenol

- Co-Operative Industries Aerospace & Defense (Cia&D)

- Latecoere

- TE Connectivity

- Ametek

- Interconnect Wiring

- Ducommun

- UTC (Rockwell Collins)

- Safran

Recent Developments

- In 2024, Ametek announced plans to showcase cutting-edge aerospace innovations at the Farnborough International Airshow, particularly new interconnect and wiring harness solutions.

- In April 2024, Safran Electrical & Power announces the launch of GENeUSCONNECT, a line of high-power electrical harnesses, which completes its range of electrical systems dedicated to the new generations of all-electric and hybrid aircraft.

- In July 2023, TE Connectivity (TE), a world leader in connectors and sensors, has been a driving force behind the new IEC 63171-7 international electrotechnical standard, helping Single Pair Ethernet (SPE) interconnect technology to gain faster acceptance in the industry.

- In March 2023, New surface-mount RF switch connectors from Linx Technologies (Linx), is a part of TE Connectivity (TE), a world leader in connectors and sensors, provide high isolation between ports for improved data accuracy

Report Coverage

The research report offers an in-depth analysis based on Application, Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Aircraft OEMs will increase adoption of lightweight and heat-resistant wiring to improve fuel efficiency.

- Fiber-optic cables will replace traditional copper lines in high-speed data and communication networks.

- More-electric and hybrid aircraft platforms will raise wiring density across power and control systems.

- Smart harnesses with fault detection and health monitoring will support predictive maintenance.

- Modular connectors and plug-and-play wiring designs will reduce installation time during production.

- Advanced shielding solutions will improve EMI protection for radar, sensors, and digital avionics.

- Defense modernization programs will expand demand for secure and rugged wiring solutions.

- Growing MRO activity will increase replacement and retrofit opportunities for aging aircraft.

- Automation and 3D modeling in wiring design will improve routing accuracy and reduce engineering time.

- Emerging electric air taxis and UAV platforms will create new adoption opportunities for compact wiring systems.