Market Overview:

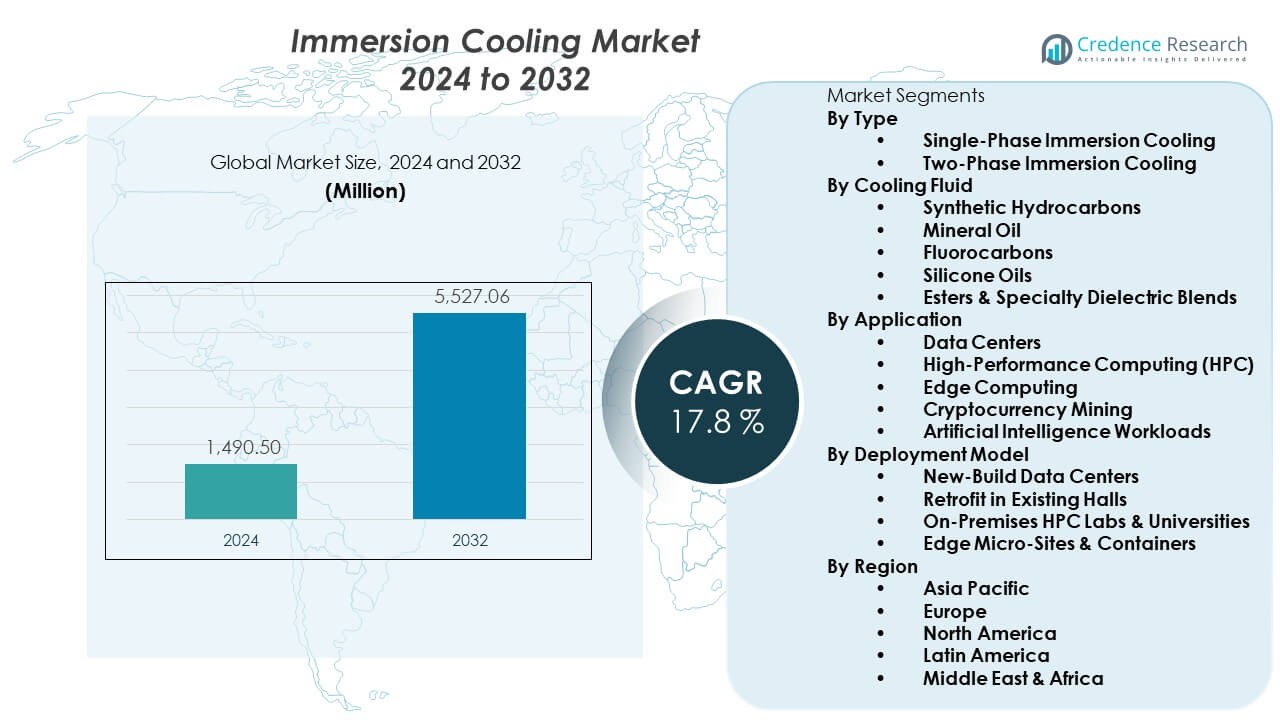

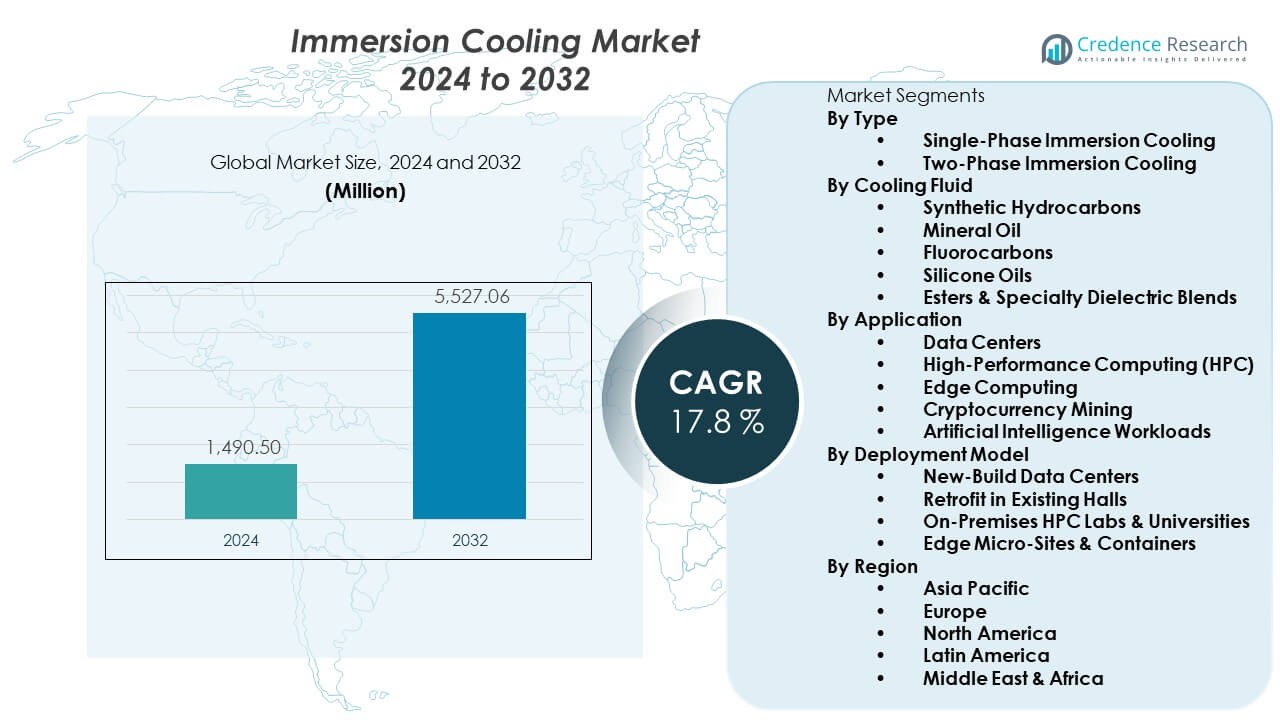

The Immersion Cooling Market is projected to grow from USD 1,490.5 million in 2024 to USD 5,527.06 million by 2032, with a CAGR of 17.8% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Immersion Cooling Market Size 2024 |

USD 1,490.5 Million |

| Immersion Cooling Market, CAGR |

17.8% |

| Immersion Cooling Market Size 2032 |

USD 5,527.06 Million |

Growing use of high-density data systems drives stronger interest in immersion cooling. Buyers choose this method because it lowers heat stress in compact racks. Data centers adopt liquid systems to handle faster chips and rising workloads. Operators prefer these designs due to steady temperature control. Cloud platforms expand capacity and push demand for efficient cooling. Firms select immersion methods to reduce energy loss across peak loads. Sustainability goals also increase attention toward cleaner and safer cooling setups.

North America leads due to strong data center growth and active tech investments. Europe follows as firms push greener cooling practices across developed regions. Asia Pacific grows fast because cloud adoption expands within major countries. China and India show rapid uptake due to rising digital activity. Japan and South Korea adopt new cooling due to advanced semiconductor use. Emerging regions gain interest as new facilities look for efficient solutions. Adoption spreads as global firms upgrade infrastructure across wider networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Immersion cooling market grows from USD 1,490.5 million in 2024 to USD 5,527.06 million by 2032, supported by a 8% CAGR driven by dense computing, AI workloads, and energy-efficient cooling demand.

- North America holds ~35%, Asia Pacific ~30%, and Europe ~25% due to strong hyperscale expansion, rapid cloud adoption, and strict energy-efficiency rules that increase immersion system deployment.

- Asia Pacific is the fastest-growing region, supported by rising cloud investments, AI adoption, semiconductor activity, and large data center construction across China, India, Japan, and Singapore.

- Data centers lead with the largest segment share, supported by heavy rack density and sustainability-driven upgrades across hyperscale facilities.

- Single-phase systems hold a higher share than two-phase designs, driven by simpler integration, lower maintenance needs, and broader acceptance across global data center projects.

Market Drivers:

Rising Demand for High-Density Computing

The Immersion cooling market gains strength from rapid growth in high-density servers. Enterprises deploy compact racks that generate heavy heat loads under peak activity. Operators choose liquid systems to stabilize thermal conditions across critical workloads. Cloud providers expand hyperscale structures that need steady cooling performance. Buyers value consistent temperatures that support stronger hardware life cycles. Firms adopt these systems to reduce downtime in data-heavy environments. Sustainability goals guide many upgrades toward more efficient cooling choices. Investments rise as organizations target lower operational costs across digital infrastructure.

- For instance, GRC’s ICEraQ Series 10 supports racks up to 200 kilowatts of server capacity.

Shift Toward Energy-Efficient Data Center Operations

Data centers move toward designs that cut power use across core systems. Businesses rely on immersion setups to reduce electricity consumption in dense racks. Operators aim to meet strict efficiency standards in advanced facilities. Immersion systems help reduce cooling overhead through direct liquid contact. Enterprises value predictable performance during intensive workloads and long duty cycles. Many facilities use these installations to lower resource waste. Global pressure to reduce carbon impact pushes firms toward cleaner alternatives. Adoption expands as companies seek greener cooling paths.

- For instance, NTT Data saw LiquidStack two-phase immersion cut cooling energy use by 97 percent.

Growth in AI, ML, and HPC Workloads

AI and HPC platforms demand powerful systems that generate intense heat loads. Immersion designs support advanced processors with greater thermal stability. Firms use these methods to maintain speed across complex computing cycles. Operators adopt optimized liquids to manage rapid workload fluctuations. Many institutions rely on strong cooling to handle dense chip architectures. Businesses upgrade environments that support continuous training tasks. These deployments push rapid expansion across innovation-led sectors. Favorable performance outcomes create wider interest among global users.

Rising Adoption Across Cryptocurrency Infrastructure

Crypto mining operations use immersion cooling to handle energy-intensive rigs. Miners seek temperature stability to protect hardware during long cycles. Direct liquid contact helps reduce heat spikes in stacked modules. Demand rises as miners shift from air setups to liquid systems. Many operators increase interest due to stronger uptime across mining farms. Competitive mining conditions push faster adoption of advanced cooling. Firms also explore immersion designs to control electricity waste. Scaling of mining hubs strengthens industry demand.

Market Trends:

Expansion of Two-Phase Cooling Architectures

The Immersion cooling market observes wider adoption of two-phase systems. Operators use these designs to support rising rack densities. Facilities apply evaporative behavior to stabilize high-load equipment. Demand increases across next-generation processor deployments. Data centers test new fluids for improved heat performance. Adoption rises in advanced digital hubs with complex workloads. Interest strengthens due to predictable thermal control in constrained spaces. Vendors refine designs that address rising global installations.

- For instance, Chemours cites LiquidStack two-phase designs eliminating 90 percent of server cooling energy.

New Fluid Formulations for Safer Operation

Manufacturers develop fluids with stronger fire resistance and chemical safety. Data centers prefer liquids that support longer operational cycles. Firms seek stable formulas that reduce degradation during heavy use. Many organizations request improved material compatibility across hardware. Engineers test liquids that lower failure risks in high-heat regions. Buyers expect stronger thermal properties as rack power rises. New formulations support faster adoption in emerging zones. Product upgrades expand choices for large-scale facilities.

- For instance, Shell cites immersion fluids reducing cooling water consumption 99 percent in case evaluations.

Growing Integration into Modular Data Centers

Modular sites adopt immersion setups for flexible infrastructure needs. Many operators choose these systems for rapid deployment. Compact structures benefit from direct liquid cooling efficiency. Demand grows where firms expand edge computing footprints. Users rely on immersion designs to stabilize mixed workloads. Scalable blocks support faster site expansion across varied regions. Interest rises among companies seeking efficient on-site cooling. Modular growth enables broader industry penetration.

Adoption of Immersion Cooling for Semiconductor Testing

Semiconductor facilities use immersion systems to manage chip test heat loads. Firms adopt cooling setups to stabilize advanced wafer processes. High-power devices require predictable control during stress cycles. Operators integrate liquid systems for consistent quality checks. Testing environments shift toward designs that reduce equipment strain. Demand rises where chip complexity expands across fabrication units. Vendors supply specialized tanks for testing labs. Wider semiconductor growth supports stronger industry momentum.

Market Challenges Analysis:

High Transition Costs and Complex Infrastructure Needs

The Immersion cooling market faces high cost barriers during initial deployment. Many facilities require major redesigns to support liquid systems. Operators invest in tanks, fluids, and structural upgrades. Skilled teams are essential to manage installation timelines. Firms hesitate where budgets limit large capital shifts. Technical complexity restricts adoption across older facilities. Many organizations require long planning cycles for infrastructure change. Slow transition rates reduce faster market penetration.

Limited Industry Standards and Vendor Alignment

Data centers struggle due to limited global standards for immersion systems. Vendors supply varied components with limited cross-compatibility. Many buyers hesitate due to inconsistent certification processes. Operators face risks during long-term maintenance planning. Technical teams demand clear guidelines for safe deployment. The market needs unified benchmarks for fluid quality and system safety. Fragmentation slows confident adoption across regions. Lack of alignment affects procurement decisions in many facilities.

Market Opportunities:

Rising Build-Out of Green Data Center Infrastructure

The Immersion cooling market benefits from strong interest in green facilities. Operators pursue systems that reduce power waste across dense racks. Many regions support cleaner cooling through policy incentives. Enterprises invest in designs that cut carbon output in digital hubs. Demand grows as firms shift toward long-term sustainability goals. Wider adoption in new sites creates strong commercial opportunities. Vendors gain traction by offering efficient turnkey solutions. Global environmental focus supports faster market advancement.

Expanding Edge and Remote Data Deployment Potential

Edge sites need compact cooling for limited-space environments. Immersion systems offer stable control for fast-moving workloads. Remote zones prefer low-maintenance cooling with predictable efficiency. Many industries explore immersion setups for industrial edge tasks. Energy savings create interest among logistics and automation hubs. Small sites benefit from reduced mechanical complexity. Growth in distributed computing supports wider deployment. Vendors gain access to new markets through targeted solutions.

Market Segmentation Analysis:

By Type

The Immersion cooling market includes single-phase and two-phase designs that support rising thermal needs across high-density infrastructure. Single-phase systems gain traction due to lower maintenance demands and simpler installation processes. Many operators choose these models to stabilize rack temperatures in compact environments. Two-phase systems attract interest where extreme heat loads require rapid heat transfer. These setups deliver strong performance for next-generation processors and advanced compute clusters. Enterprises evaluate type selection based on power density targets and operational risk. Data-heavy sectors rely on both formats to maintain uptime. Demand for both segments continues to rise across global deployments.

- For instance, GRC reports single-phase immersion cutting cooling power use by up to 95 percent.

By Cooling Fluid

Cooling fluid options influence system efficiency and long-term equipment protection. Synthetic hydrocarbons support broad adoption due to stable dielectric properties. Mineral oil remains a cost-effective choice across many facilities. Fluorocarbons offer strong heat transfer for demanding workloads. Silicone oils provide wide temperature resistance in specialized setups. Esters and specialty blends attract interest where low environmental impact is important. Buyers compare fluid longevity and hardware compatibility before final selection. Each fluid category supports different performance goals across digital operations. Fluid innovation strengthens adoption in new builds and retrofit programs.

- For instance, Shell’s S3 X immersion fluid lists a 198-degree-Celsius flash point for safety.

By Application

Key applications include data centers, HPC, edge computing, mining, and AI systems. Data centers lead adoption due to rapid growth in dense racks. HPC facilities use immersion setups to manage heat from high-load tasks. Edge environments value compact cooling that fits limited space. Cryptocurrency mining sites adopt immersion to stabilize hardware under continuous cycles. AI workloads depend on thermal consistency for model training tasks. Sector diversity helps expand market reach across global regions. Workload intensity shapes design choices in each application group. Broader digitalization drives steady interest across all segments.

By Deployment Model

Deployment models influence integration speed and structural planning. New-build sites adopt immersion systems to support long-term capacity goals. Retrofit projects upgrade existing halls with liquid-based designs to improve efficiency. On-premises HPC labs and universities use these installations to support research workloads. Edge micro-sites rely on immersion cooling to manage heat in constrained locations. Each model aligns with different infrastructure lifecycles. Operators choose deployment paths based on budget, facility age, and workload needs. Immersion setups offer flexibility for varied project scopes. Growing build-out across regions strengthens demand in all deployment categories.

Segmentation:

By Type

- Single-Phase Immersion Cooling

- Two-Phase Immersion Cooling

By Cooling Fluid

- Synthetic Hydrocarbons

- Mineral Oil

- Fluorocarbons

- Silicone Oils

- Esters & Specialty Dielectric Blends

By Application

- Data Centers

- High-Performance Computing (HPC)

- Edge Computing

- Cryptocurrency Mining

- Artificial Intelligence Workloads

By Deployment Model

- New-Build Data Centers

- Retrofit in Existing Halls

- On-Premises HPC Labs & Universities

- Edge Micro-Sites & Containers

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the Immersion cooling market at nearly 35%, driven by strong demand from hyperscale data centers and advanced cloud infrastructure. Firms in the region deploy immersion systems to improve efficiency across high-density racks. Operators in the U.S. lead integration due to rapid AI and HPC expansion. Canada supports adoption through investment in sustainable cooling technologies. Vendors strengthen regional presence through pilot programs and commercial rollouts. Adoption grows as enterprises target lower operational energy use. The market maintains momentum through ongoing digital expansion across major industries.

Asia Pacific

Asia Pacific accounts for about 30% of the global share and expands rapidly due to strong data center build-outs across China, India, Japan, and Singapore. The Immersion cooling market gains traction as regional operators add capacity to support cloud and AI workloads. China accelerates deployments through large-scale facility expansion. India increases interest through government-backed digital programs and rising computing loads. Japan and South Korea adopt immersion designs to manage advanced semiconductor and HPC tasks. High regional growth reflects the shift toward efficient cooling in dense environments. Strong investments support wider deployment across emerging zones.

Europe, Latin America, and Middle East & Africa

Europe holds roughly 25% of the global share, supported by strict energy-efficiency rules and steady growth in sustainable data centers. Firms in Germany, the Netherlands, and the Nordics adopt immersion systems for greener operations. Latin America represents nearly 5%, with interest rising across Brazil and Mexico as digital infrastructure expands. Middle East & Africa contribute about 5% through emerging deployments in the UAE, Saudi Arabia, and South Africa. Europe drives demand for low-impact cooling solutions that align with environmental standards. Latin America and MEA adopt immersion cooling slowly but show clear long-term potential. Growing regional investments support broader adoption across diverse climate conditions.

Key Player Analysis:

- Green Revolution Cooling (GRC)

- Submer

- Asperitas

- Iceotope Technologies

- Fujitsu

- LiquidStack

- Midas Green Technologies

- Shell plc

Competitive Analysis:

The Immersion cooling market shows strong competition driven by technology innovation and rapid workload expansion. Leading vendors focus on fluid development, optimized tank architecture, and high-density support systems. Companies refine solutions that improve thermal performance for AI, HPC, and hyperscale environments. Many players invest in modular designs that enhance deployment flexibility across new facilities. Partnerships with data center operators strengthen product validation and global reach. Firms expand portfolios to address growing demand for sustainable cooling models. Competitors target differentiation through efficiency gains and long-life dielectric fluids. The market advances as vendors pursue wider adoption across digital infrastructure.

Recent Developments:

- In October 2025, Green Revolution Cooling (GRC), headquartered in Texas, signed a memorandum of understanding with LG Electronics and SK Enmove to jointly develop and expand next-generation liquid immersion cooling solutions optimized for artificial intelligence data centers. The collaboration will focus on integrating data center cooling systems, providing advanced thermal fluids, and enhancing system design and deployment, aimed at addressing the escalating demands of AI workloads with high energy efficiency and sustainability.

- In October 2025, Submer introduced a smart immersion cooling system featuring AI-powered thermal management and predictive maintenance capabilities. This innovation enhances operational efficiency and system reliability, marking a significant enhancement in immersion cooling technology for data centers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on By Type and By Cooling Fluid. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Adoption rises across AI and HPC workloads due to strong thermal demands.

- Vendors expand fluid innovation to support longer system life cycles.

- New-build data centers integrate immersion systems to meet sustainability goals.

- Retrofit projects grow where operators upgrade aging air-based cooling.

- Edge facilities adopt compact immersion setups for space-limited sites.

- Semiconductor testing labs continue shifting toward liquid-based cooling.

- Partnerships increase to validate hardware compatibility with immersion systems.

- Regions with strong cloud growth accelerate deployment of liquid cooling.

- Cost optimization improves through scalable tank designs and optimized fluids.

- Market penetration strengthens as enterprises aim for lower operational energy use.