Market Overview

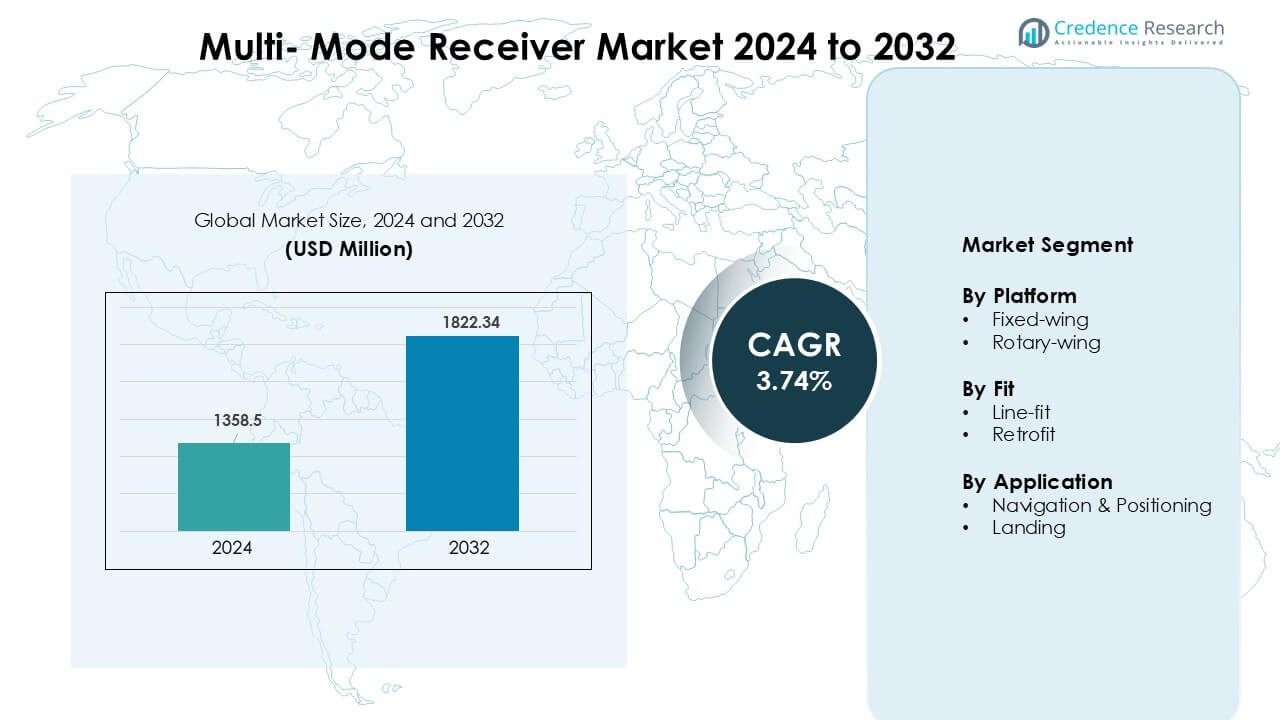

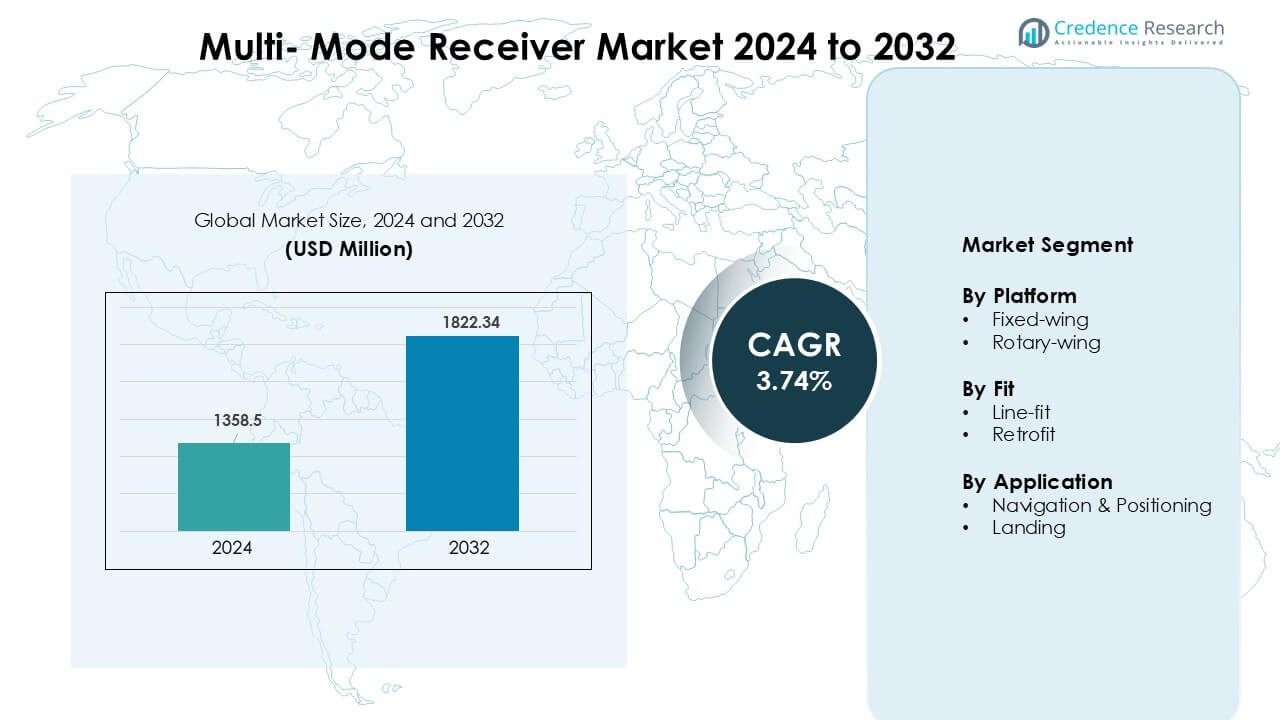

Multi- Mode Receiver Market was valued at USD 1358.5 million in 2024 and is anticipated to reach USD 1822.34 million by 2032, growing at a CAGR of 3.74% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Multi- Mode Receiver Market Size 2024 |

USD 1358.5 Million |

| Multi- Mode Receiver Market, CAGR |

3.74% |

| Multi- Mode Receiver Market Size 2032 |

USD 1822.34 Million |

The Multi-Mode Receiver Market is shaped by leading players such as Collins Aerospace, Indra Sistemas, Saab AB, Garmin Ltd., BAE Systems, Leonardo S.p.A., systemsinterface (FREQUENTIS), Honeywell International Inc., Intelcan Technosystems Inc., and Deere & Company. These companies compete through advanced GNSS-based navigation solutions, precision-landing technology, and integrated avionics designed for commercial, business, and military aircraft. Strong capabilities in system reliability, certification support, and multi-constellation compatibility help maintain their competitive positions. North America emerged as the leading region in 2024 with a dominant 37% share, driven by high aircraft production, strong defense spending, and rapid adoption of performance-based navigation standards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Multi-Mode Receiver Market reached USD 1358.5 million in 2024 and is projected to hit USD 1822.34 million by 2032, growing at a CAGR of 3.74%.

- Rising aircraft deliveries and mandatory adoption of GNSS-based navigation systems drive steady demand for advanced multi-mode receivers across commercial and defense fleets.

- Key trends include wider integration of satellite-based landing systems, growth of digital cockpit upgrades, and increased adoption of multi-constellation navigation for higher accuracy and safety.

- Competition intensifies as Collins Aerospace, Honeywell, Garmin, Leonardo, Indra, Saab, and others focus on advanced certification, modular designs, and OEM partnerships to expand market presence.

- North America led the market with 37% share, followed by Europe at 31% and Asia Pacific at 24%; fixed-wing platforms dominated with 63% share, while navigation and positioning remained the top application with 55% share.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Platform

Fixed-wing aircraft led the platform segment in 2024 with about 63% share. Fixed-wing adoption stayed high because airlines and defense operators rely on precise navigation and enhanced flight safety systems. Growth in commercial aviation fleets, fleet modernization programs, and wider integration of GNSS-based avionics strengthened demand. Rotary-wing platforms showed steady use, mainly in search-and-rescue, offshore operations, and military missions. Rising focus on reliable positioning in complex terrains continues to support segment expansion.

- For instance, The G500H TXi system does support Garmin’s HSVT (Helicopter Synthetic Vision Technology) as an optional feature, which enhances situational awareness during low-visibility operations.

By Fit

Line-fit dominated the fit segment in 2024 with nearly 58% share. Aircraft manufacturers preferred line-fit installation because it ensures seamless integration with onboard avionics and reduces certification delays. Strong aircraft production rates and higher OEM deliveries supported segment leadership. Retrofit solutions grew as airlines upgraded legacy fleets and improved compliance with updated navigation and landing standards. Operators also invested in modernization to improve accuracy, reduce operational risk, and meet evolving regulatory norms.

- For instance, Thales is a major supplier of avionics for Airbus aircraft, including the A320neo family. Airlines like IndiGo have signed maintenance contracts for Thales avionics on their A320 fleet.

By Application

Navigation and positioning held the dominant share in 2024 with around 55%. Demand rose due to the critical role of precise GNSS-based systems in flight planning, route optimization, and situational awareness. Airlines and defense agencies prioritized advanced receivers to improve safety and operational reliability across varying airspaces. The landing segment expanded with rising use of multi-mode receivers in low-visibility operations and CAT II/III landing procedures. Strong focus on minimizing delays and improving landing accuracy continues to support demand.

Key Growth Drivers

Rising Commercial Aircraft Deliveries

Growing commercial aircraft production acts as a major driver for the multi-mode receiver market. Airlines continue to expand fleets to meet rising passenger traffic and replace aging aircraft, which increases adoption of advanced navigation and landing systems. Multi-mode receivers support GNSS-based navigation, precision landing, and safety-critical flight operations, pushing OEMs to integrate them in new models. Stricter global aviation safety standards also require upgraded avionics, encouraging broader use. As major manufacturers boost output and air travel rebounds across regions, demand for integrated and reliable receivers grows, reinforcing steady market expansion over the forecast period.

- For instance, the Boeing 787 use a Honeywell navigation package, which includes an Integrated Navigation Receiver (INR) that is standard equipment on the aircraft.

Regulatory Mandates for Navigation Modernization

Global aviation authorities continue to enforce mandates for advanced navigation and landing capabilities, which supports strong growth in multi-mode receivers. Requirements for performance-based navigation, next-generation landing systems, and improved situational awareness push operators to adopt compliant avionics. Transition to satellite-based systems such as GBAS and modernization of instrument landing systems drive wider installation across both commercial and military fleets. These regulations help reduce congestion, enhance fuel efficiency, and improve runway throughput. As more airports adopt precision landing infrastructure and regulators tighten compliance deadlines, aircraft owners invest in upgrades, strengthening long-term market growth.

- For instance, Collins Aerospace’s Multi-Mode Receiver (MMR) facilitates WAAS and SBAS-based approaches, offering continuous position updates at 10 Hz with sub-3 m accuracy, helping operators meet FAA NextGen navigation mandates.

Expansion of Military and Defense Aviation Programs

Defense aviation modernization remains a key growth factor as armed forces upgrade fleets with advanced navigation, targeting, and situational-awareness systems. Multi-mode receivers support mission accuracy, low-visibility operations, and secure positioning, making them essential for next-generation fixed-wing and rotary-wing platforms. Rising procurement of transport aircraft, fighters, and helicopters drives higher integration. Increased spending on border security, surveillance missions, and tactical operations also strengthens adoption. Many nations prioritize upgraded avionics to meet NATO and global defense standards, encouraging more installations in retrofitted and newly manufactured aircraft. These programs continue to create stable, long-term demand.

Key Trend & Opportunity

Shift Toward Satellite-Based Landing Systems

The transition from ground-based to satellite-based landing solutions presents a major opportunity for the multi-mode receiver market. GNSS, SBAS, and GBAS systems support greater precision, reduce airport infrastructure needs, and improve landing reliability in challenging conditions. As more airports adopt advanced landing systems, aircraft operators upgrade receivers to support multi-constellation navigation. This evolution also aligns with global air traffic modernization programs, improving efficiency and reducing delays. Manufacturers that provide compatible and scalable multi-mode receivers gain an advantage as aviation shifts toward fully digital and satellite-enabled landing operations across commercial and defense fleets.

- For instance, Ground-Based Augmentation Systems (GBAS) are designed to provide the high integrity and accuracy necessary for precision approaches, with demonstrated position errors typically less than one meter in both horizontal and vertical planes. GBAS is capable of supporting Category I (Cat I) operations and is on the way to Cat III.

Integration with Next-Generation Avionics Suites

Growing interest in integrated avionics suites offers strong potential for multi-mode receivers. Modern cockpit systems rely on seamless communication between navigation sensors, flight management systems, and data processing modules. Multi-mode receivers enhance operational accuracy by combining multiple navigation inputs within one unit, lowering lifecycle costs and reducing system complexity. As airlines and militaries adopt advanced cockpits, demand rises for receivers that support digital flight decks and future air traffic management standards. This trend creates opportunities for suppliers offering compact, high-reliability, and interoperable systems optimized for both new aircraft and retrofit programs.

- For instance, the G3000 is a real and widely used integrated flight deck, primarily found in light business jets and turboprops, such as the HondaJet, Cessna Citation M2, Daher TBM 940, and Pilatus PC-12 (with the new G3000 Prime).

Increasing Adoption in Emerging Aviation Markets

Emerging economies expand their aviation networks, creating opportunities for multi-mode receiver suppliers. Growing passenger traffic, airport modernization, and regional fleet expansion drive installation of advanced navigation and landing technologies. Governments invest in new airport projects and upgrade existing runways to meet global safety norms, encouraging airlines to adopt multi-mode-enabled avionics. Lower-cost carriers also expand operations in Asia, Africa, and Latin America, increasing demand for compliant receivers. As these markets scale up aviation capacity, suppliers benefit from broader fleet upgrades and new aircraft orders, supporting long-term growth prospects.

Key Challenge

High Installation and Upgrade Costs

Multi-mode receivers involve high procurement and installation costs, creating financial challenges for operators with aging fleets and tight budgets. Retrofit programs require aircraft downtime, specialized labor, and certification approvals, adding to total expenses. Smaller airlines often delay upgrades due to capital constraints, even when regulatory deadlines approach. Newer integrated cockpit systems also require compatibility checks, increasing technical complexity. These cost pressures slow adoption, especially in developing markets where fleet modernization occurs gradually. Balancing regulatory compliance with financial limitations remains a major barrier for many operators across the commercial and defense sectors.

Dependence on Navigation Infrastructure Modernization

The adoption of multi-mode receivers depends heavily on the availability and modernization of navigation and landing infrastructure. Many regions still rely on outdated ground-based systems and lack investment in GBAS or satellite-based landing upgrades. Limited airport readiness delays full utilization of multi-mode capabilities, reducing short-term demand. Regulatory timelines for infrastructure upgrades also vary across countries, creating inconsistent adoption rates. Without synchronized airport and aircraft upgrades, performance benefits remain underused. This dependency slows market penetration and creates uncertainty for manufacturers planning long-term production and development cycles.

Regional Analysis

North America

North America led the Multi-Mode Receiver Market in 2024 with around 37% share. Strong aviation modernization programs, high commercial aircraft deliveries, and robust defense spending supported regional demand. The U.S. continued to upgrade fleets with GNSS-based navigation and precision-landing systems, which boosted adoption across fixed-wing and rotary-wing platforms. Major OEM presence and stringent FAA mandates further accelerated integration. Canada improved fleet capabilities through avionics upgrades linked to expanding regional air travel. Broad investment in airport infrastructure and advanced landing technologies kept North America the leading market throughout the year.

Europe

Europe accounted for nearly 31% share in 2024, driven by strong regulatory alignment and widespread adoption of performance-based navigation standards. The region continued to integrate advanced satellite-based landing systems across major airports, supporting higher demand for multi-mode receivers. Fleet modernization in commercial and defense aviation added further momentum. Countries such as Germany, France, and the U.K. invested heavily in digital cockpit upgrades and next-generation avionics. Growing emphasis on reducing airspace congestion and improving runway efficiency also encouraged broader deployment. Europe maintained steady growth due to coordinated aviation modernization efforts.

Asia Pacific

Asia Pacific held about 24% share in 2024 and remained the fastest-growing region. Expanding passenger traffic, large-scale fleet additions, and rapid airport development supported strong adoption of multi-mode receivers. China, India, Japan, and Southeast Asian markets invested in navigation modernization to meet ICAO standards and enhance flight safety. Rising presence of low-cost carriers and wider integration of GNSS-based systems strengthened demand. Defense aviation upgrades also contributed as regional forces improved operational capability. Growing aviation infrastructure and rising airline capacity kept Asia Pacific on a solid growth path.

Latin America

Latin America captured around 5% share in 2024, driven by gradual fleet renewal and improved compliance with global aviation standards. Brazil and Mexico led regional adoption as airlines invested in avionics upgrades to support higher operational reliability. Airport modernization programs introduced more advanced landing systems, which encouraged wider use of multi-mode receivers. Economic constraints slowed fleet expansion in some countries, but regulatory alignment and rising intra-regional travel supported moderate growth. Adoption remained steady across major carriers focused on improving safety and navigation accuracy within busy air routes.

Middle East & Africa

The Middle East & Africa region held nearly 3% share in 2024, supported by selective yet strategic aviation investments. Gulf countries expanded fleets and introduced advanced satellite-based navigation capabilities to enhance long-haul and regional operations. Major carriers continued integrating modern avionics to meet global performance benchmarks. Africa progressed more slowly due to limited infrastructure, though key nations upgraded airports and improved compliance with international safety norms. Defense procurement and business aviation growth added incremental demand. Adoption remained uneven but showed long-term potential as more airports modernize navigation and landing systems.

Market Segmentations:

By Platform

By Fit

By Application

- Navigation & Positioning

- Landing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Multi-Mode Receiver Market features strong participation from leading avionics and aerospace companies such as Collins Aerospace, Indra Sistemas, Saab AB, Garmin Ltd., BAE Systems, Leonardo S.p.A., systemsinterface (FREQUENTIS), Honeywell International Inc., Intelcan Technosystems Inc., and Deere & Company. These manufacturers compete through advanced GNSS-enabled receivers, integrated landing systems, and high-reliability navigation solutions designed for both commercial and defense aviation. Market players focus on improving precision, reducing system weight, and enhancing multi-constellation compatibility to meet evolving regulatory and safety requirements. Strategic partnerships with aircraft OEMs, investments in digital cockpit integration, and long-term government contracts support their market positions. Many companies expand portfolios through software-driven upgrades, satellite-based augmentation compatibility, and modular designs that fit new production and retrofit programs. Continued demand for advanced navigation technology and increasing adoption of satellite-based landing systems further intensify competition among these established global suppliers.

Key Player Analysis

- Collins Aerospace

- Indra Sistemas

- Saab AB

- Garmin Ltd.

- BAE Systems

- Leonardo S.p.A.

- systemsinterface (FREQUENTIS)

- Honeywell International Inc.

- Intelcan Technosystems Inc.

- Deere & Company

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In September 2025, Saab secured a contract for Giraffe 4A radar systems (with associated services) for a country in Latin America their first Giraffe 4A contract in that region.

- In December 2024, Indra formalized a joint venture with EDGE Group called PULSE to design and manufacture radar systems (air, land, sea) a move that could influence demand for multi-mode radar & receiver technologies globally.

- In December 2024, Saab received a ~USD 48 million contract from BAE Systems on behalf of U.S. Air Forces in Europe (USAFE) to supply multiple units of its 3D, multi-function radar system Giraffe 4A. Deliveries are scheduled to start in 2027.

Report Coverage

The research report offers an in-depth analysis based on Platform, Fit, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for multi-mode receivers will rise as airlines expand fleets and modernize avionics.

- Adoption of satellite-based landing systems will increase, improving precision and reducing reliance on ground systems.

- Defense aviation programs will continue to integrate advanced navigation receivers for mission accuracy.

- Retrofit activity will grow as operators upgrade older aircraft to meet new navigation standards.

- Integration with digital cockpit systems will expand, supporting future air traffic management requirements.

- Asia Pacific will show the fastest growth due to large fleet additions and airport upgrades.

- Manufacturers will focus on multi-constellation capability to enhance accuracy and reliability.

- Partnerships between OEMs and avionics suppliers will strengthen to support long-term production.

- Regulatory push for performance-based navigation will accelerate system upgrades globally.

- Increased investment in resilient navigation systems will improve protection against signal disruptions.

Market Segmentation Analysis:

Market Segmentation Analysis: