Market overview

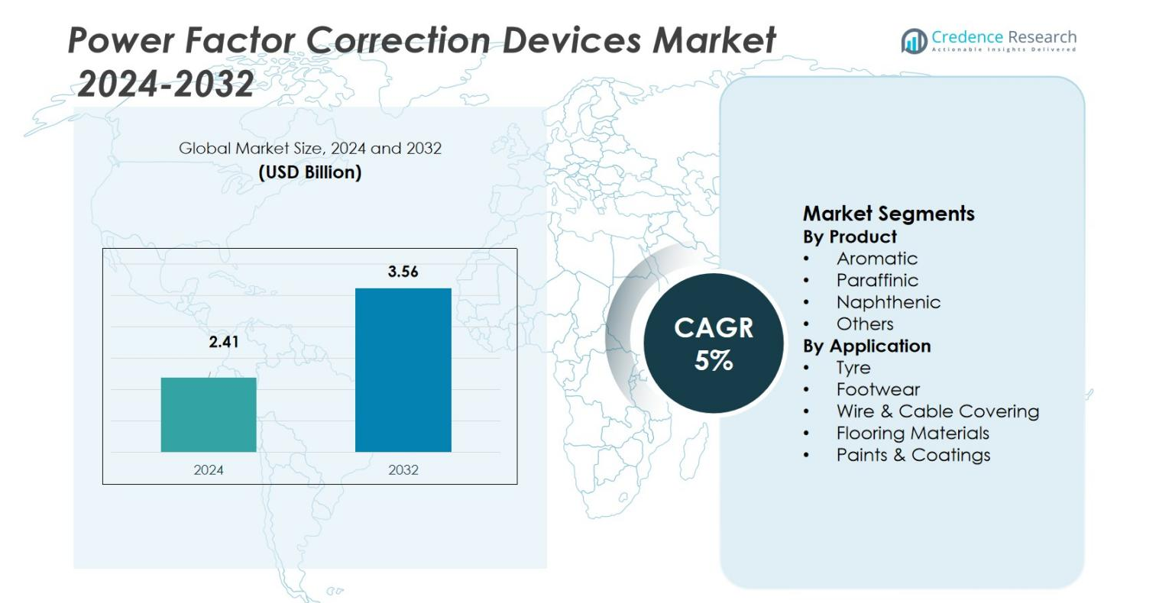

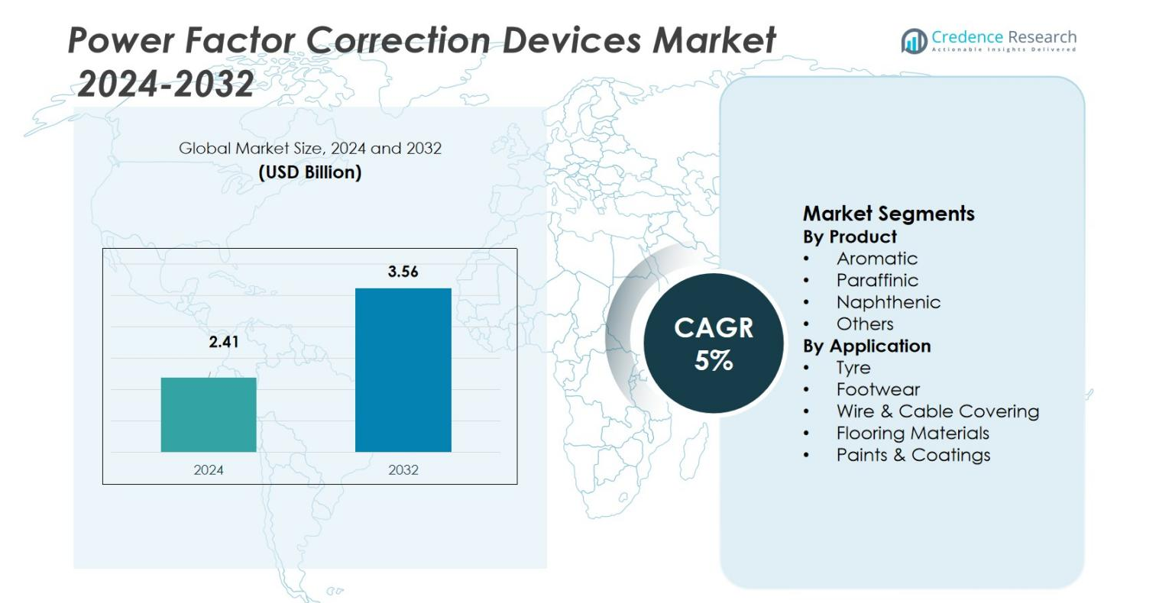

Power Factor Correction Devices Market size was valued at USD 2.41 Billion in 2024 and is anticipated to reach USD 3.56 Billion by 2032, registering a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Power Factor Correction Devices Market Size 2024 |

USD 2.41 Billion |

| Power Factor Correction Devices Market, CAGR |

5% |

| Power Factor Correction Devices Market Size 2032 |

USD 3.56 Billion |

Power Factor Correction Devices Market is shaped by the presence of leading companies such as GE Grid Solutions, Siemens, Eaton, ABB, Schneider, Hubbell, Guilin Power Capacitor, Herong Electric, Xian XD Power, and NISSIN ELECTRIC, all focusing on advanced correction technologies to improve power quality and energy efficiency. These players strengthen their positions through smart capacitor banks, automated controllers, and grid-stabilizing solutions adopted across industrial and utility sectors. Europe leads the global market with a 33.1% share, supported by stringent energy-efficiency regulations, rapid renewable integration, and extensive modernization of electrical infrastructure across major economies.

Market Insights

- Power Factor Correction Devices Market was valued at USD 2.41 Billion in 2024 and will reach USD 3.56 Billion by 2032, registering a CAGR of 5% during the forecast period.

- The market grows due to rising demand for energy-efficient electrical systems across industrial, commercial, and utility sectors, with Industrial Utility leading the application segment with a 51.4% share in 2024.

- Smart and IoT-enabled correction technologies are shaping market trends as industries adopt automated capacitor banks and real-time monitoring systems to enhance power stability and reduce operational inefficiencies.

- Key players such as GE Grid Solutions, Siemens, Eaton, ABB, and Schneider continue to expand their portfolios, focusing on advanced correction devices while addressing restraints linked to high installation and maintenance costs.

- Europe leads the global market with a 33.1% regional share, followed by Asia-Pacific at 29.6% and North America at 27.4%, supported by strong grid modernization programs and growing adoption of centralized and distributed correction systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

The Power Factor Correction Devices Market by type is dominated by Centralized Power Factor Correction Devices, holding a 46.3% share in 2024, driven by their ability to deliver high efficiency, easy integration, and reduced installation costs across large industrial and commercial loads. Distributed devices captured 32.7% share, supported by rising adoption in decentralized grids and facility-level corrections. Combined systems accounted for 14.8% share, driven by hybrid configurations offering flexibility for mixed load profiles. The remaining 6.2% share came from other device categories that serve niche applications requiring customized power factor solutions.

- For instance, Schneider Electric’s centralized automatic power factor correction systems are designed to enhance energy efficiency in large-scale industrial applications through real-time monitoring and optimized control, contributing significantly to this segment’s leadership.

By Application:

The market by application is led by Industrial Utility, commanding a 51.4% share in 2024 due to increasing electricity consumption, continuous load operations, and stringent regulations promoting power quality improvements in manufacturing and heavy industries. Commercial Utility accounted for 33.6% share, propelled by growing usage of HVAC systems, data centers, and commercial establishments demanding efficient reactive power management. Public Power Supply held the remaining 15% share, supported by investments in grid modernization and utilities’ focus on reducing transmission losses and improving voltage stability.

- For instance, Siemens Energy’s SVC PLUS STATCOM systems, ordered by Power Grid Corporation of India for four 400 kV substations, provide 2,000 MVAr of dynamic reactive power support to stabilize supply for large industrial loads and improve voltage quality.

Key Growth Drivers

Rising Demand for Energy Efficiency Across Industries

The Power Factor Correction Devices Market experiences strong growth due to rising demand for energy-efficient electrical systems across manufacturing, commercial, and utility sectors. Industries aim to reduce electricity wastage, lower operational costs, and meet stringent energy-efficiency regulations, driving widespread adoption of both centralized and distributed correction systems. Growing awareness of reactive power optimization, combined with an increasing need to maintain voltage stability in high-load environments, continues to accelerate the demand for advanced PFC devices, particularly in regions undergoing rapid industrialization and infrastructure expansion.

- For instance, Quality Energy designed and installed a bespoke power factor correction system for Covino Farms in Australia, markedly improving their power factor and reducing energy wastage at the site.

Grid Modernization and Expansion of Transmission Networks

Ongoing grid modernization initiatives significantly fuel market growth as utilities invest in improving power quality, minimizing transmission losses, and enhancing load management. Governments and energy agencies worldwide are deploying smart grid technologies that rely heavily on power factor correction to maintain system reliability. Expansion of transmission and distribution networks to support renewable energy integration also increases the demand for robust PFC devices. These investments not only strengthen grid stability but also drive long-term demand for automated and intelligent correction solutions across utility-scale operations.

- For instance, Consolidated Edison (ConEd) in New York City is investing in smart meters, underground cable upgrades, and substation automation to enhance grid reliability and resilience, including deploying advanced energy storage systems in multiple locations.

Increasing Industrial Automation and Electrification

Rapid growth in industrial automation and widespread electrification initiatives drive substantial adoption of PFC devices to manage fluctuating loads from automated machinery, robotics, and power-intensive equipment. Manufacturers are prioritizing stable power delivery and reduced harmonic distortion to support high-performance operations, increasing the need for centralized and combined correction systems. Electrification of transportation, logistics, and building systems further adds to the load complexity, compelling companies to implement advanced reactive power management solutions. These factors collectively support steady market expansion across industrial sectors globally.

Key Trends & Opportunities

Adoption of Smart and IoT-Enabled PFC Solutions

A major trend shaping the market is the rapid adoption of smart and IoT-enabled PFC devices capable of real-time monitoring, predictive maintenance, and automated correction adjustments. Digitalization of power management systems allows industries and utilities to optimize performance remotely, reduce downtime, and achieve precise reactive power control. The integration of cloud-based analytics and AI-driven optimization presents significant opportunities for manufacturers to offer value-added solutions that enhance operational efficiency and support grid stability in both commercial and industrial environments.

- For instance, Electric’s EcoStruxure Power Advisor leverages cloud-based analytics to provide data quality insights and maintenance recommendations for power factor correction equipment, enabling real-time diagnostics, intelligent alarm grouping, and trend analysis that maximize energy efficiency and equipment lifespan.

Growing Opportunity in Renewable Energy Integration

The increasing penetration of renewable energy sources such as solar and wind introduces grid fluctuations that require advanced power factor correction to maintain voltage balance and minimize losses. This shift creates strong opportunities for PFC devices designed for distributed and utility-scale renewable installations. As countries expand renewable capacity, the need for correction devices that can handle variable loads and intermittent power generation grows significantly. Manufacturers are leveraging this trend by developing durable, grid-compatible solutions that ensure seamless integration of renewables into existing electrical networks.

- For instance, Schneider Electric has developed automatic and static PFC panels equipped with advanced monitoring capabilities to stabilize voltage and improve grid compatibility at solar and wind farms.

Key Challenges

High Installation and Maintenance Costs

Despite strong growth potential, high installation and maintenance costs remain a major challenge for the Power Factor Correction Devices Market. Industrial and utility-grade systems, particularly centralized and automated units, require substantial upfront investment and skilled labor for setup and calibration. Small and medium enterprises often delay adoption due to budget constraints, slowing market penetration. Additionally, ongoing maintenance requirements for capacitor banks and controllers increase operational expenses, creating a barrier for cost-sensitive sectors despite long-term savings offered by improved energy efficiency.

Impact of Harmonics and Load Variability on Device Performance

Another key challenge is the impact of harmonics and fluctuating loads on the performance and lifespan of PFC devices. Non-linear loads from modern industrial equipment, HVAC systems, and power electronics can cause capacitor overheating, resonance issues, and reduced correction effectiveness. These technical complexities require advanced harmonic filters and hybrid correction systems, increasing system complexity and cost. Failure to manage these challenges can lead to operational inefficiencies, equipment damage, and reduced reliability, making it critical for manufacturers to innovate toward more resilient and adaptive PFC solutions.

Regional Analysis

North America

North America holds a 27.4% share of the Power Factor Correction Devices Market, driven by strong investments in industrial automation, advanced manufacturing, and smart grid modernization. The U.S. leads regional demand due to its extensive commercial infrastructure, rising electricity consumption, and adoption of IoT-enabled power management solutions. Utilities across the region are upgrading aging transmission networks, increasing the need for centralized and distributed correction systems. Growing emphasis on reducing energy losses, improving voltage regulation, and meeting stringent regulatory standards further strengthens market growth across industrial, commercial, and public utility segments.

Europe

Europe accounts for a 33.1% share of the global market, making it the leading region, supported by widespread implementation of energy-efficiency policies, strong focus on carbon reduction, and advanced electrical network modernization. Germany, France, and the U.K. drive demand due to large industrial bases and strict power quality regulations that mandate optimized reactive power usage. The region’s rapid expansion of renewable energy capacity also increases the need for stable power factor correction to manage variable loads. Continuous investments in grid reliability and industrial automation reinforce Europe’s dominant position in the market.

Asia-Pacific

Asia-Pacific holds a 29.6% share, emerging as one of the fastest-growing regions due to large-scale industrialization, expanding manufacturing sectors, and substantial growth in commercial infrastructure. China, India, Japan, and South Korea are major contributors, driven by rising electricity demand and government initiatives aimed at improving grid stability. Increasing adoption of automation technologies and rapid expansion of renewable power generation create significant demand for high-capacity power factor correction systems. Strong investments in transmission upgrades and utility modernization further enhance the region’s growth trajectory across both industrial and public power supply applications.

Latin America

Latin America captures a 5.4% share, supported by growing industrial activities, infrastructure development, and efforts to strengthen power distribution networks. Brazil and Mexico lead market demand as utilities focus on reducing losses and improving grid efficiency through modern correction systems. The region benefits from increasing commercial construction and rising deployment of automated industrial machinery, which require reliable reactive power management. Although adoption rates vary due to economic constraints, government programs for energy optimization and investments in renewable energy projects continue to create steady demand for both centralized and distributed PFC devices.

Middle East & Africa

The Middle East & Africa region holds a 4.5% share, driven by expanding industrial zones, rising electricity consumption, and investments in modernizing transmission and distribution infrastructure. Countries such as the UAE, Saudi Arabia, and South Africa are adopting advanced power factor correction devices to support large industrial operations, commercial facilities, and growing utility networks. Increasing integration of renewable energy, particularly solar, also contributes to demand for devices that maintain voltage stability under fluctuating load conditions. Continued infrastructure development and regulatory emphasis on energy efficiency support long-term market growth in the region.

Market Segmentations:

By Type

- Distributed Power Factor Correction Devices

- Centralized Power Factor Correction Devices

- Combined Power Factor Correction Devices

- Others

By Application

- Commercial Utility

- Industrial Utility

- Public Power Supply

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Power Factor Correction Devices Market features leading players such as GE Grid Solutions, Guilin Power Capacitor, Herong Electric, Siemens, Eaton, Xian XD Power, ABB, Schneider, Hubbell, and NISSIN ELECTRIC. The market is characterized by strong product innovation, expanding global footprints, and growing investments in smart and automated power factor correction technologies. Key companies focus on developing advanced capacitor banks, intelligent controllers, and IoT-enabled correction systems that offer higher efficiency, real-time monitoring, and improved grid stability. Strategic partnerships with utilities, industrial clients, and energy management service providers strengthen competitive positions while enabling wider adoption across commercial and industrial sectors. Many players also emphasize cost-effective solutions to address rising demand in emerging markets. Continuous R&D efforts aimed at improving harmonic filtering, load balancing, and energy optimization further enhance competitiveness, supporting sustained market growth worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GE Grid Solutions (U.S.)

- Guilin Power Capacitor (China)

- Herong Electric (China)

- Siemens (Germany)

- Eaton (U.S.)

- Xian XD Power (China)

- ABB (Switzerland)

- Schneider (France)

- Hubbell (U.S.)

- NISSIN ELECTRIC (Japan)

Recent Developments

- In October 2025, Domel introduced its next-generation 792 series blowers featuring integrated Power Factor Correction (PFC) within the same compact dimensions as the standard model.

- In June 2025, Eaton and Siemens Energy announced a fast-track partnership to build data centers with integrated onsite power systems.

- In May 2025, Navitas Semiconductor launched a 12 kW GaN & SiC platform that includes a 3-phase interleaved totem-pole PFC (power factor correction) designed for hyperscale AI data-centres

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Power Factor Correction Devices Market will witness steady adoption driven by rising global demand for energy-efficient electrical systems.

- Industrial automation growth will accelerate the need for advanced correction devices to handle complex and fluctuating loads.

- Smart and IoT-enabled PFC technologies will gain significant traction for real-time monitoring and predictive maintenance.

- Utilities will increasingly deploy centralized correction systems to reduce transmission losses and improve grid stability.

- Expansion of renewable energy capacity will boost demand for devices capable of managing variable and intermittent power.

- Emerging economies will experience rising installations due to industrial expansion and strengthening commercial infrastructure.

- Manufacturers will focus on improved harmonic filtering solutions to address challenges from non-linear loads.

- Regulatory pressure toward energy optimization will compel industries and commercial facilities to adopt PFC systems.

- Hybrid and combined correction devices will gain market share as facilities seek flexible, scalable solutions.

- Strategic partnerships between technology providers and utilities will drive innovation and enhance market penetration.