Market overview

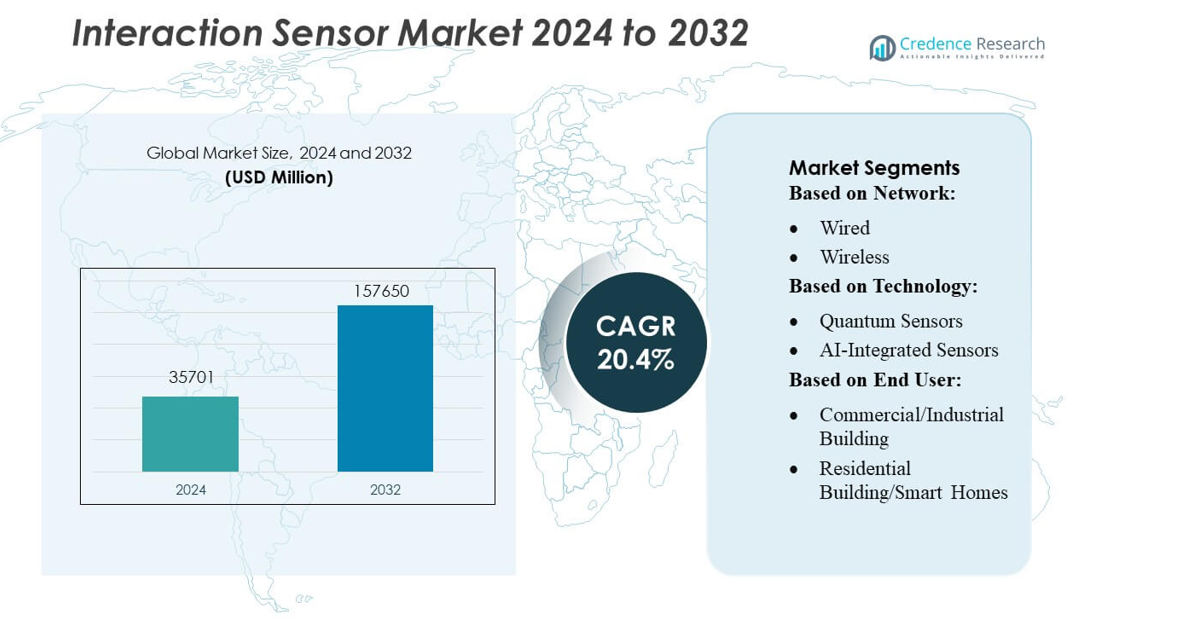

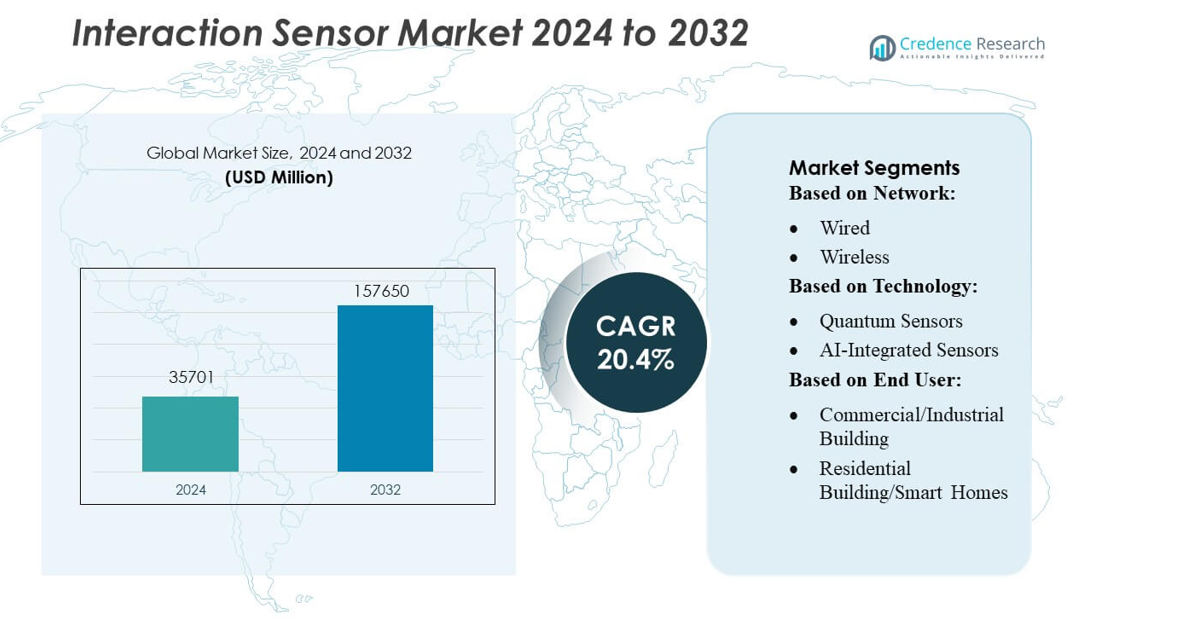

Interaction Sensor Market size was valued USD 35701 million in 2024 and is anticipated to reach USD 157650 million by 2032, at a CAGR of 20.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Interaction Sensor Market Size 2024 |

USD 35701 million |

| Interaction Sensor Market, CAGR |

20.4% |

| Interaction Sensor Market Size 2032 |

USD 157650 million |

The Interaction Sensor Market features strong competition among global technology innovators and specialized sensor manufacturers that continuously advance AI-enabled, MEMS-based, and photonic sensing solutions to support touchless interfaces, gesture recognition, and contextual automation across consumer electronics, automotive, industrial, and smart building applications. Companies strengthen their positions through R&D investments, product diversification, and integration of edge-processing and secure sensing architectures. Asia-Pacific leads the global market with an exact share of 30–32%, supported by large-scale electronics manufacturing, expanding smart home adoption, and rapid industrial automation. The region’s cost-efficient production ecosystem and strong OEM presence continue to reinforce its dominant position.

Market Insights

- The Interaction Sensor Market was valued at USD 35,701 million in 2024 and is projected to reach USD 157,650 million by 2032, registering a robust CAGR of 20.4%, driven by rapid penetration of touchless and AI-enabled sensing technologies across industries.

- Strong market growth is supported by rising adoption of gesture recognition, proximity sensing, and contextual automation in consumer electronics, the largest segment with 40–45% share, propelled by high device volumes and fast technology cycles.

- Key trends include integration of edge AI, MEMS miniaturization, and secure sensing architectures, enabling faster processing, reduced latency, and wider deployment in smart homes, automotive cabins, and industrial automation.

- Competitive activity intensifies as technology providers focus on R&D, product expansion, and embedded intelligence to differentiate performance, reliability, and interoperability in highly connected environments.

- Regionally, Asia-Pacific leads with a 30–32% share, driven by large-scale electronics manufacturing, rising industrial automation, and strong OEM ecosystems, while North America and Europe follow with accelerating adoption of advanced interaction technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Network

The wireless segment dominates the Interaction Sensor Market, capturing an estimated 62–65% share, driven by rapid adoption of IoT-enabled sensing modules and the rising deployment of battery-efficient, low-latency systems across smart buildings and consumer electronics. Its scalability and reduced installation complexity continue to accelerate uptake in both retrofit and new-build environments. Meanwhile, wired sensors maintain relevance in high-reliability industrial environments requiring stable bandwidth and EMI-resistant performance. However, the accelerating shift toward interoperable, cloud-linked platforms positions wireless connectivity as the long-term growth engine across commercial, residential, and industrial applications.

- For instance, Nemoto & Co. Ltd. offers its NE7-CO-H electrochemical carbon monoxide sensor, which delivers around 100 nA of output current per ppm of CO over a 0–1000 ppm detection range, and operates reliably in portable and fixed devices, underscoring how efficient power and sensitivity can be achieved even in distributed, IoT-style wireless deployments.

By Technology

AI-integrated sensors lead this segment with nearly 35–40% market share, supported by strong demand for real-time environmental interpretation, gesture recognition, and context-aware automation in smart devices and industrial systems. These sensors benefit from embedded machine-learning accelerators that enhance precision, reduce false triggers, and support autonomous decision-making at low power. Advanced MEMS and photonic sensors follow closely, expanding through automotive ADAS, robotics, and high-precision industrial automation. Edge-integrated and cybersecurity-hardened sensor technologies are gaining traction as enterprises prioritize localized processing, latency reduction, and protection against sensor-level cyber intrusions.

- For instance, GfG G450 multi-gas detector operates for up to 24 hours on a single charge and is capable of detecting oxygen from 0–25 vol% and hydrogen sulfide from 0–100 ppm.

By End User

The consumer electronics segment holds the largest share at approximately 40–45%, driven by exponential integration of interaction sensors into smartphones, wearables, laptops, AR/VR devices, and smart peripherals. High-volume production, short upgrade cycles, and user demand for intuitive gesture- or proximity-based interfaces strengthen this leadership. Commercial and industrial buildings increasingly adopt interaction sensors for occupancy analytics, touchless control, and energy optimization, while the automotive sector accelerates adoption through in-cabin monitoring and driver-assist systems. Aerospace, defense, and oil & gas follow with demand for ruggedized, high-reliability sensing in mission-critical environments.

Key Growth Drivers

Expansion of Smart Devices and Human–Machine Interfaces

The rapid proliferation of smart consumer devices continues to propel adoption of interaction sensors, as manufacturers integrate gesture, proximity, and motion interfaces to enhance user experience. Smartphones, wearables, AR/VR tools, and smart home appliances increasingly rely on multimodal sensing for seamless interaction. Higher device refresh rates and growing user preference for touchless functionality further accelerate demand. The shift toward intuitive and natural interfaces strengthens integration across both premium and mid-range electronics, solidifying interaction sensors as a core foundational technology in next-generation smart ecosystems.

- For instance, Robert Bosch LLC BMI270 inertial measurement unit operates at low current consumption and delivers low noise, while the BME688 environmental sensor supports four-gas detection with an integrated AI-based pattern recognition engine, enabling high-precision interaction sensing in compact, battery-powered devices.

Automation Acceleration Across Commercial, Industrial, and Automotive Sectors

Atomation initiatives across buildings, factories, and vehicles significantly boost the deployment of interaction sensors for monitoring, control, and intelligent decision-making. Smart commercial buildings utilize these sensors for occupancy detection and adaptive energy management, while industrial environments integrate them for worker safety, robotics coordination, and workflow optimization. In automotive applications, cabin monitoring, driver attention detection, and ADAS functions increasingly rely on advanced interaction sensing. As industries prioritize operational efficiency and safety, interaction sensors become essential components for enabling real-time responsiveness and automated system intelligence.

- For instance, AlphaSense Inc.’s O2-A2 oxygen sensor provides a measurement range of 0–25 vol% with an output signal of 60–100 µA and a typical response time under 15 seconds, while its CO-A4 sensor detects 0–2000 ppm CO with a sensitivity of 55–75 nA/ppm—demonstrating the company’s capability to deliver fast, precise, and robust sensing components suited for automated environments.

Advancements in AI, MEMS, and Photonic Sensing Technologies

Rapid technological advancements in AI-enabled sensors, high-precision MEMS devices, and photonic systems drive performance improvements and unlock new applications. Embedded edge AI enhances contextual understanding and reduces false alerts, enabling more sophisticated gesture recognition and environmental awareness. MEMS innovations deliver compact, low-power devices suitable for wearables and consumer electronics, while photonic sensors support high-speed, interference-resistant measurement. These technological improvements collectively reduce cost-to-performance ratios, broaden design flexibility, and accelerate adoption across sectors that require precision, reliability, and real-time sensing capabilities.

Key Trends & Opportunities

Growing Integration of Edge AI and On-Device Analytics

A major trend shaping the market is the shift toward edge AI processing within interaction sensors, enabling local decision-making without reliance on cloud connectivity. This reduces latency, enhances data privacy, and supports autonomous operations in critical applications such as automotive monitoring, industrial automation, and smart home systems. Manufacturers increasingly adopt micro-edge processors and low-power neural engines to improve performance while preserving battery efficiency. This trend creates opportunities for highly responsive gesture interfaces, predictive sensing, and fail-safe automation systems across both enterprise and consumer environments.

- For instance, Figaro Engineering Inc.’s TGS8100 ultralow-power MEMS VOC sensor operates at only 15 mW and offers a rapid response time under 10 seconds, while its TGS2611 methane sensor detects concentrations from 500 to 10,000 ppm.

Rising Demand for Touchless Interfaces in Post-Pandemic Environments

Touchless interaction continues to gain momentum as businesses and consumers prioritize hygiene, convenience, and seamless operation. Public infrastructure, retail spaces, healthcare facilities, and workplaces increasingly deploy gesture-based and proximity-based systems to reduce physical contact and streamline user experience. This shift is accelerating innovation in contactless kiosks, smart elevators, biometric-free authentication, and automated access systems. The opportunity lies in developing highly accurate, multi-sensor fusion solutions that can operate reliably in varied lighting and environmental conditions while maintaining user safety and operational efficiency.

- For instance, Siemens offers a wide range of highly responsive sensors for industrial automation. The SIRIUS 3SE6 magnetic non-contact safety switches provide robust operation with an effective operating range typically between 5 mm and 15 mm, suitable for a variety of safety functions.

Increasing Adoption in Emerging Applications such as AR/VR and Robotics

Interaction sensors are witnessing expanded opportunities in immersive technologies, collaborative robotics, and next-generation interfaces. AR/VR devices increasingly integrate advanced motion, eye-tracking, and gesture sensors to deliver lifelike interactions, while service and industrial robots depend on spatial awareness sensors for navigation and human collaboration. These emerging sectors demand ultra-low latency sensing and high-precision spatial mapping, opening avenues for specialized sensor modules. As AR/VR adoption grows and robotics ecosystems mature, interaction sensors become central to enabling intuitive, real-time, human–machine interaction.

Key Challenges

High Integration Costs and Complex System Compatibility Requirements

Despite growing demand, the high cost of integrating advanced interaction sensors into devices poses a challenge, especially for cost-sensitive consumer electronics and emerging markets. Manufacturers must address compatibility concerns related to power management, data synchronization, and multi-sensor fusion across varied hardware and software architectures. Additionally, incorporating AI accelerators and photonic components increases design complexity. These challenges slow adoption among smaller OEMs and limit large-scale deployment in low-margin applications, requiring industry-wide standardization and cost-optimized integration frameworks.

Privacy, Security, and Data Governance Concerns

Interaction sensors collect sensitive behavioral and environmental data, raising concerns around user privacy, cybersecurity, and regulatory compliance. Unauthorized data access, spoofing of sensor signals, and vulnerabilities within sensor-to-cloud communication pipelines pose substantial risks. Industries such as smart homes, healthcare, and automotive require stringent data protection frameworks to ensure safe adoption. Regulatory bodies increasingly enforce stricter guidelines on biometric and behavioral data usage, compelling manufacturers to integrate built-in encryption, anonymization, and secure processing mechanisms. These concerns can slow adoption unless addressed with robust security-by-design approaches.

Regional Analysis

North America

North America holds the largest share of approximately 34–36% of the Interaction Sensor Market, driven by strong adoption across consumer electronics, advanced automotive systems, and commercial building automation. The region benefits from mature IoT infrastructure, high R&D investment, and early integration of AI-enabled sensing technologies in industrial and residential environments. Major technology companies accelerate innovation in gesture control, touchless interfaces, and context-aware sensing, further strengthening market penetration. Demand grows steadily in healthcare, retail, and enterprise automation, supported by stringent safety regulations and increasing preference for intuitive, contactless user experiences.

Europe

Europe accounts for around 25–27% of the global market, supported by robust manufacturing capabilities, smart infrastructure programs, and rising automotive sensor integration led by Germany, France, and the U.K. The region prioritizes advanced sensing for smart mobility, energy-efficient buildings, and Industry 4.0 initiatives. Increasing adoption of gesture and proximity sensors in consumer electronics and connected home devices fuels additional growth. Strong regulatory focus on safety, sustainability, and data protection accelerates demand for secure, high-reliability sensors. Continuous innovation in photonic and MEMS technologies enhances Europe’s position as a high-value market for precision interaction sensors.

Asia-Pacific

Asia-Pacific represents the fastest-growing region, holding about 30–32% of the Interaction Sensor Market, driven by high-volume consumer electronics manufacturing in China, South Korea, and Japan. Rapid expansion of smart homes, industrial automation, and automotive electronics accelerates adoption. Local OEMs aggressively integrate AI-enabled and gesture-based sensors into smartphones, wearables, and home appliances, supporting large-scale deployment. Government-led digitalization programs and rising investments in robotics and AR/VR technologies further boost demand. Cost-efficient supply chains, high urbanization rates, and growing disposable incomes position APAC as the primary engine for future market expansion.

Latin America

Latin America captures approximately 5–6% of the global market, growing steadily as smart city deployments, retail automation, and digital banking channels adopt touchless and proximity-based interaction systems. Brazil and Mexico lead adoption due to expanding commercial infrastructure and increasing smartphone penetration. Industrial sectors gradually integrate sensors for automation and safety monitoring, although budget constraints limit high-end adoption. The region benefits from rising investment in connected home devices and improved logistics digitization. Despite slower technological maturity compared to developed markets, rising preference for intuitive, user-friendly interfaces supports long-term market potential.

Middle East & Africa

The Middle East & Africa (MEA) region holds around 3–4% of the market, with demand driven by smart infrastructure development, security automation, and high-end commercial projects in the Gulf states. Smart building initiatives in the UAE and Saudi Arabia increasingly incorporate gesture-controlled and occupancy-sensing systems to improve energy efficiency and user experience. Industrial automation in oil & gas, along with digital healthcare and retail transformation, contributes to gradual market expansion. Africa remains in early adoption phases but shows growing interest in smart devices and connected environments as digital access and affordability improve.

Market Segmentations:

By Network:

By Technology:

- Quantum Sensors

- AI-Integrated Sensors

By End User:

- Commercial/Industrial Building

- Residential Building/Smart Homes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Interaction Sensor Market features a diverse mix of global technology leaders and specialized sensing companies, including Nemoto & Co. Ltd., GfG Gas Detection UK Ltd., Robert Bosch LLC, AlphaSense Inc., Dynament, Figaro Engineering Inc., Siemens, Membrapor, ABB Ltd., and City Technology Ltd. The Interaction Sensor Market is characterized by rapid technological advancement, rising differentiation strategies, and strong focus on integrated sensing intelligence. Companies increasingly prioritize AI-enhanced interaction capabilities, MEMS miniaturization, and energy-efficient architectures to address growing demand across consumer electronics, automotive, industrial automation, and smart infrastructure. Market participants invest heavily in R&D to develop multi-modal sensing systems that combine gesture recognition, proximity detection, and environmental monitoring within compact, low-power formats. Strategic collaborations with IoT platform providers, semiconductor manufacturers, and smart device OEMs further accelerate innovation. Competition also intensifies around cybersecurity-hardened sensor designs and edge-processing features that enable faster decision-making, improved accuracy, and seamless ecosystem integration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Bosch Sensortec describes itself as a supplier of intelligent sensing systems that integrate MEMS technology, embedded software and edge AI. CEO Stefan Finkbeiner noted that these solutions supported applications in consumer health, smart homes, and smart cities, with AI and intelligent software as the core enablers.

- In October 2024, AlphaSense introduced PIDX, a new PID (Photoionization Detector) sensor technology designed to improve gas detection capabilities. The sensor offers higher sensitivity and accuracy, particularly for detecting volatile organic compounds (VOCs) at low concentrations.

- In January 2024, Texas Instruments (TI) launched the AWR2544 77GHz mm-wave radar sensor, the industry’s first single-chip radar sensor designed for satellite architectures to enhance automotive safety and intelligence. The part number in the original prompt, A5442WR, appears to be a minor error, as the released product is the AWR2544 (and related AWR294x family)

Report Coverage

The research report offers an in-depth analysis based on Network, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt AI-driven interaction sensors that deliver enhanced contextual awareness and real-time decision-making.

- Edge-processing capabilities will become standard as industries demand faster response times and improved data privacy.

- Gesture and touchless interfaces will expand rapidly across consumer electronics, smart homes, and commercial environments.

- Automotive applications will accelerate adoption through advanced driver monitoring and in-cabin interaction systems.

- Integration of multimodal sensing—combining optical, MEMS, and ultrasonic technologies—will strengthen performance reliability.

- Smart building automation will drive demand for occupancy analytics and energy-optimization sensors.

- Robotics and AR/VR ecosystems will increasingly rely on high-precision interaction sensors for immersive user experiences.

- Industrial sectors will deploy more rugged, high-accuracy sensors to support safety, automation, and predictive maintenance.

- Cybersecurity-hardened sensor architectures will gain importance as connected environments expand.

- Technological miniaturization and low-power design advancements will enable broader adoption across portable and wearable devices.