Market Overview:

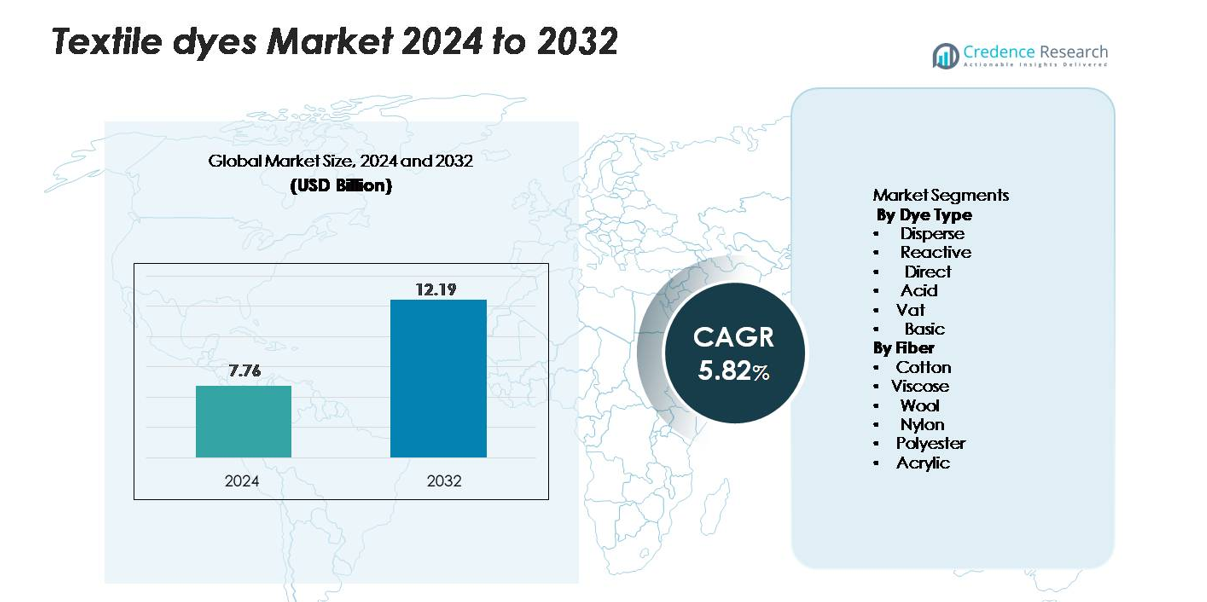

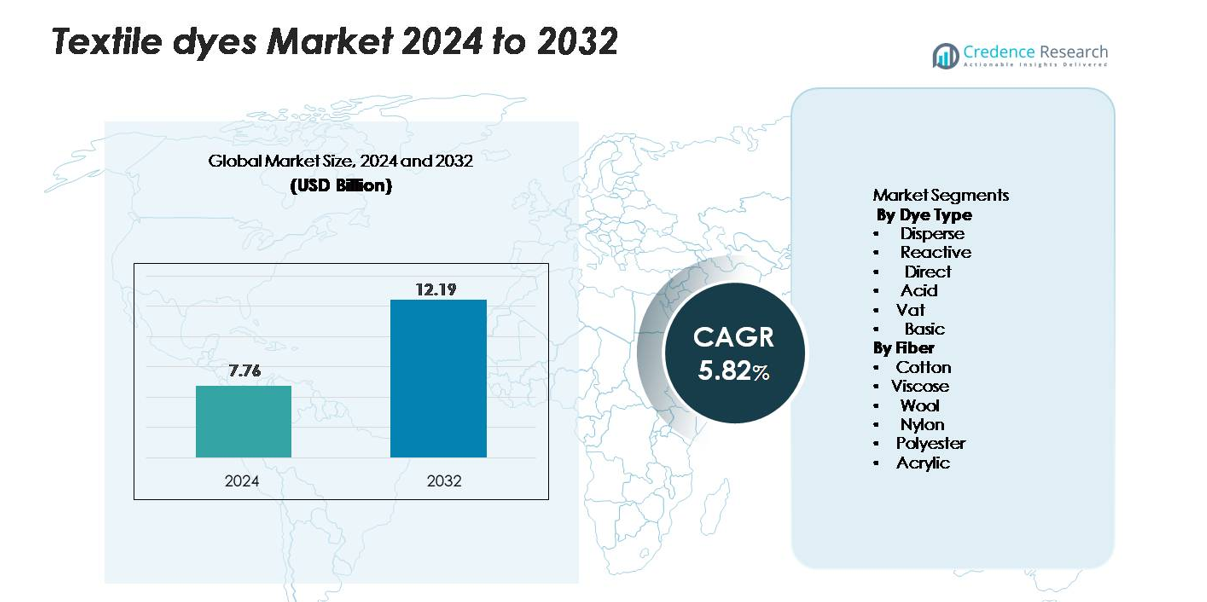

The Textile Dyes Market was valued at USD 7.76 billion in 2024 and is expected to reach USD 12.19 billion by 2032, growing at a CAGR of 5.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Textile Dyes Market Size 2024 |

USD 7.76 billion |

| Textile Dyes Market, CAGR |

5.82% |

| Textile Dyes Market Size 2032 |

USD 12.19 billion |

The textile dyes market is led by major chemical manufacturers with wide global distribution and strong portfolios in reactive, disperse, and specialty dye formulations. Multinational companies dominate high-value segments through investments in eco-friendly chemistry, low-salt reactive dyes, and high-fastness disperse technologies. Asia-Pacific remains the largest regional market with a share exceeding 60%, supported by large textile hubs in China, India, Bangladesh, Vietnam, and Indonesia. North America and Europe maintain notable shares driven by digital printing, technical textiles, and strict environmental compliance. Leading producers secure growth through capacity expansion, partnerships with textile mills, and product innovations targeting sustainable, water-efficient dyeing.

Market Insights

- The Textile Dyes Market was valued at USD 7.76 billion in 2024 and is expected to reach USD 12.19 billion by 2032, growing at a CAGR of 5.82% during the forecast period.

- Rising apparel production, fast-fashion growth, and expanding synthetic fiber usage drive large consumption of reactive and disperse dyes, especially across cotton and polyester segments, which together account for the highest share of total dye demand.

- Digital textile printing accelerates adoption of pigment, reactive, and disperse inks due to low water usage, short-run flexibility, and customized fashion output, strengthening demand across sportswear, home textiles, and décor applications.

- The market remains competitive, with global dye producers investing in metal-free, low-salt, and biodegradable formulations while smaller regional manufacturers face pressure due to wastewater treatment costs and volatile petrochemical raw material prices.

- Asia-Pacific dominates with over 60% share, driven by massive textile manufacturing hubs, followed by Europe and North America; cotton leads fiber usage, while disperse dyes hold the highest dye-type share due to polyester processing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Dye Type

Disperse dyes hold the dominant market share due to high consumption in polyester and blended fabrics. The segment benefits from rising demand for sportswear, athleisure, and fast-fashion products using synthetic fibers. Reactive dyes follow due to extensive application in cotton printing and superior washfastness. Acid, vat, direct, and basic dyes serve niche applications in wool, nylon, leather, and cellulosic fibers. Growth is driven by advancements in eco-friendly dispersions, low-temperature dyeing, and digital printing inks that reduce water usage and energy costs for textile processors.

- For instance, DyStar’s disperse dye portfolio for polyester includes a broad range of products like Dianix® and Palanil®, supported by technical centers in over 50 global locations to ensure consistent coloration.

By Fiber

Cotton remains the leading fiber segment in textile dye usage due to large-scale production across apparel, home textiles, and industrial fabrics. Reactive dyes dominate cotton processing because of strong bonding and color fastness. Polyester ranks second, driving demand for disperse dyes used in sportswear, uniforms, and technical textiles. Viscose, wool, nylon, and acrylic contribute smaller shares based on their specialty applications. Demand rises as manufacturers shift toward sustainable, bio-based dyes and waterless dyeing technologies to support regulatory compliance and lower environmental impact.

- For instance, Huntsman provides a wide array of high-performance dyes for cotton finishing and colorfast apparel, with an extensive library of thousands of specific color formulations (recipes) for textile mills globally. This effort is supported by application laboratories operating in numerous countries worldwide to optimize dyeing performance.

Key Growth Drivers

Rising Apparel Production and Fast-Fashion Demand

Global apparel output expands each year, and textile mills need stable dye supply. Fast-fashion brands release new designs weekly, which increases color variety and repeat dyeing cycles. Polyester and cotton clothing lead consumption, and both require high-performance dye solutions. Brands push vibrant shades, deep blacks, and improved washfastness. Online retail boosts volume as fashion orders scale across regions. Manufacturers install digital printing units for short runs and customized prints. These systems need advanced reactive and disperse dye formulations. Urbanization, higher disposable income, and shifting lifestyle trends strengthen clothing demand. Growth stays strong in Asia due to large textile hubs and export-oriented operations. The apparel sector remains the largest demand generator for textile dyes.

- For instance, DyStar supports global fast-fashion production through a portfolio of more than 7,000 commercial dye formulations, supplied via technical service centers operating in over 16 countries to ensure consistent shade accuracy for high-volume cotton and polyester apparel.

Shift Toward Synthetic Fibers and Technical Textiles

Polyester production grows fast because the fiber is durable, low cost, and easy to blend. The shift increases demand for disperse dyes, which deliver uniform penetration on synthetic fabrics. Sportswear, athleisure, and outdoor gear require colorfast shades that resist sweat, heat, and washing. Technical textiles in automotive, medical, and industrial sectors also need specialty dye formulations. Mills adopt high-temperature and high-pressure dyeing equipment to improve consistency. Global brands offer value-added fabrics like UV-protective and moisture-wicking textiles, which require stable coloration. These factors push producers to develop high-strength and eco-friendly disperse dyes. The synthetic fiber boom remains a strong driver for market expansion.

- For instance, Archroma supplies more than 160 disperse dye products under its Foron® range, engineered for polyester and performance textiles, and supports application testing through laboratories in over 30 countries to meet technical textile standards.

Growing Focus on Eco-Friendly and Sustainable Dyeing

Sustainability regulations force mills to reduce wastewater, salts, and hazardous chemistry. Governments restrict effluents, so brands switch to reactive, low-salt, and metal-free dyes. Waterless dyeing, digital printing, and supercritical CO₂ systems gain adoption in polyester processing. Bio-based dyes made from agricultural waste and natural pigments attract interest from eco-labels. Certifications like ZDHC, REACH, and Bluesign encourage clean chemistry. Brands promote transparent supply chains, which push mills to modernize processes. Investments rise in low-temperature dyeing that saves fuel and lowers emissions. Sustainability becomes a long-term growth engine.

Key Trends & Opportunities

Acceleration of Digital and Inkjet Textile Printing

Digital printing eliminates screens, reduces water, and supports customized designs. Fashion brands use small-batch production, on-demand printing, and localized manufacturing. Reactive, acid, and disperse inks gain traction in cotton, silk, nylon, and polyester printing. Photo-realistic designs and fast design changes benefit online fashion sellers. Home décor and sportswear printers adopt pigment inks that work on many fabrics. The shift reduces chemical waste and enables sustainable dyeing. Equipment makers develop faster printheads with higher resolution. Digital textile printing creates long-term opportunities for dye and ink suppliers.

- For instance, DuPont’s Artistri Brite inks support washfastness ratings of 4.0 or greater on cotton garments, which helps online printers maintain quality standards.

Expansion of Recycled and Bio-Based Fiber Dyeing

Recycled polyester and recycled cotton enter mainstream production. Mills test dye formulations that bond well with recycled fibers. Bio-based dyes made from plants, food waste, and algae gain acceptance in niche fashion. Luxury brands promote natural shade variations as a sustainability feature. Water-saving dyeing chemistry supports circular fashion goals. Research partnerships explore enzymes and microorganisms for natural coloration. These innovations open new revenue streams for green dye producers. Demand rises as consumers choose eco-friendly clothing.

- For instance, Archroma’s EarthColors project uses plant waste to create dyes for cotton, and the system has recorded over 20,000 color-fast garments produced for leading apparel brands.

Key Challenges

Environmental Regulations and Wastewater Treatment Costs

Textile effluents contain salts, auxiliaries, and chemical residues. Governments impose strict limits, so mills invest in effluent treatment plants. These systems need capital, power, and skilled labor. Small mills struggle with high operating costs. Non-compliance leads to closures and fines, especially in major textile clusters. Brands demand transparent compliance, which increases monitoring. Producers must redesign dyes to minimize pollution. Environmental pressure remains a major barrier.

Volatile Raw Material Prices and Supply Risks

Synthetic dyes rely on petrochemical intermediates. Fluctuating crude oil prices change production costs. Supply chain disruptions create shortages and delays. Currency swings affect import pricing for developing economies. Dye makers face margin pressure when customers resist price increases. Stable sourcing becomes hard during geopolitical issues. Producers try backward integration and long-term contracts. Raw material volatility remains a key risk to profitability.

Regional Analysis

North America

North America holds a notable share of the textile dyes market driven by strong demand for sportswear, home textiles, and technical fabrics. The United States leads regional consumption due to high apparel imports and localized textile printing operations. Brands prioritize low-impact and metal-free dyes to meet environmental compliance. Digital textile printing grows as fashion retailers adopt short-run and customized production. Sustainability regulations and advanced wastewater treatment push mills toward eco-friendly reactive and disperse dye solutions. Regional share remains supported by premium fashion segments and strong investment in automated dyeing technologies.

Europe

Europe commands a significant share of the market, supported by strict environmental policies and adoption of sustainable dye chemistry. Germany, Italy, Spain, and France lead in technical textiles and fashion exports, driving consumption of reactive and disperse dyes. Digital printing technologies gain traction in fast-fashion and home décor industries, reducing water and chemical discharge. Textile dye producers develop bio-based pigments and low-salt formulations to meet REACH and ZDHC requirements. The region maintains its share by focusing on clean production, specialty dyes, and high-value textile applications.

Asia-Pacific

Asia-Pacific holds the dominant share of the global textile dyes market, powered by massive textile manufacturing bases in China, India, Bangladesh, Vietnam, and Indonesia. The region benefits from high cotton and polyester processing, rapid urbanization, and apparel exports. Reactive and disperse dyes remain major revenue generators due to large cotton and synthetic fiber consumption. Growing investments in digital printing, waterless dyeing, and colorfast formulations support expansion. Government initiatives promoting modern dyeing facilities and effluent treatment help sustain long-term growth. Asia-Pacific remains the fastest-growing market and retains leadership in production volume.

Latin America

Latin America maintains a moderate market share led by Brazil, Mexico, and Argentina. The region supports cotton-based apparel, denim, uniforms, and home textiles, driving usage of reactive and direct dyes. Growing investments in textile machinery modernization and export-oriented production encourage dye adoption. Regional mills gradually shift to eco-friendly formulations to meet global compliance standards. Expanding retail fashion and sportswear consumption strengthens demand. Although market share is smaller than Asia or Europe, growth remains steady due to rising domestic manufacturing and regional trade agreements.

Middle East & Africa

Middle East & Africa hold a smaller but growing share of the textile dyes market. Turkey, UAE, Egypt, and South Africa lead consumption due to expanding textile clusters and export-oriented apparel production. Investments in polyester processing support demand for disperse dyes, while cotton-based textiles sustain reactive dye usage. International brands source fabrics from regional mills, pushing manufacturers to adopt sustainable dyeing and wastewater treatment. Low-cost labor, trade incentives, and modernization projects support long-term growth. Although overall share is limited, new textile parks and rising apparel exports contribute to steady expansion.

Market Segmentations:

By Dye Type

- Disperse

- Reactive

- Direct

- Acid

- Vat

- Basic

By Fiber

- Cotton

- Viscose

- Wool

- Nylon

- Polyester

- Acrylic

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The textile dyes market includes global chemical companies and regional manufacturers supplying reactive, disperse, acid, vat, and specialty dye formulations. Leading players compete on product range, color performance, pricing, and regulatory compliance. Firms invest in low-salt, metal-free, and biodegradable dyes to meet environmental norms and brand sustainability requirements. Partnerships with textile mills, garment exporters, and digital printing companies help strengthen distribution. Companies expand capacity in Asia due to high textile production and low manufacturing costs. Continuous R&D focuses on high-strength colorants, low-temperature dyeing, and waterless technologies that reduce wastewater loads. Digital printing inks gain strategic importance as small-batch and customized fashion output increase worldwide. Competition remains intense as multinational firms pursue acquisitions and long-term supply agreements to secure market presence across global textile hubs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Huntsman Corporation

- Vipul Organics Ltd

- Sumitomo Chemical

- Zhejiang Longsheng Group Co., Ltd

- Allied Industrial Corp, Ltd

- Organic Dyes and Pigments

- Atul Ltd

- Archroma Management LLC

- Kiri Industries

- Lanxess

Recent Developments

- In 2025, Zhejiang Longsheng announced its acquisition of full ownership of DyStar Group through a transaction of approximately USD 696.5 million, strengthening its global textile dye portfolio.

- In July 2024, Archroma Management LLC secured the EcoVadis Gold sustainability rating in July 2024, placing it among the top 5% of assessed companies and reinforcing its focus on sustainable textile‐dye solutions.

Report Coverage

The research report offers an in-depth analysis based on Dye type, Fiber and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as fast-fashion and sportswear production continue to expand worldwide.

- Digital textile printing will grow, creating higher need for specialty pigment, reactive, and disperse inks.

- Eco-friendly and biodegradable dyes will see stronger adoption due to strict environmental regulations.

- Waterless and low-salt dyeing technologies will reduce chemical discharge and operational costs.

- Technical textiles in automotive, medical, and defense sectors will push demand for high-performance dyes.

- Dye manufacturers will invest in R&D to develop high-fastness, low-temperature, and energy-saving formulations.

- Recycled polyester and sustainable fabrics will drive innovation in compatible dye chemistries.

- Regional production will shift toward Asia due to capacity expansion and cost advantages.

- Large players will strengthen market presence through mergers, acquisitions, and supply agreements.

- Digital color management and automation will improve consistency, reduce wastage, and boost mill productivity.