Market Overview:

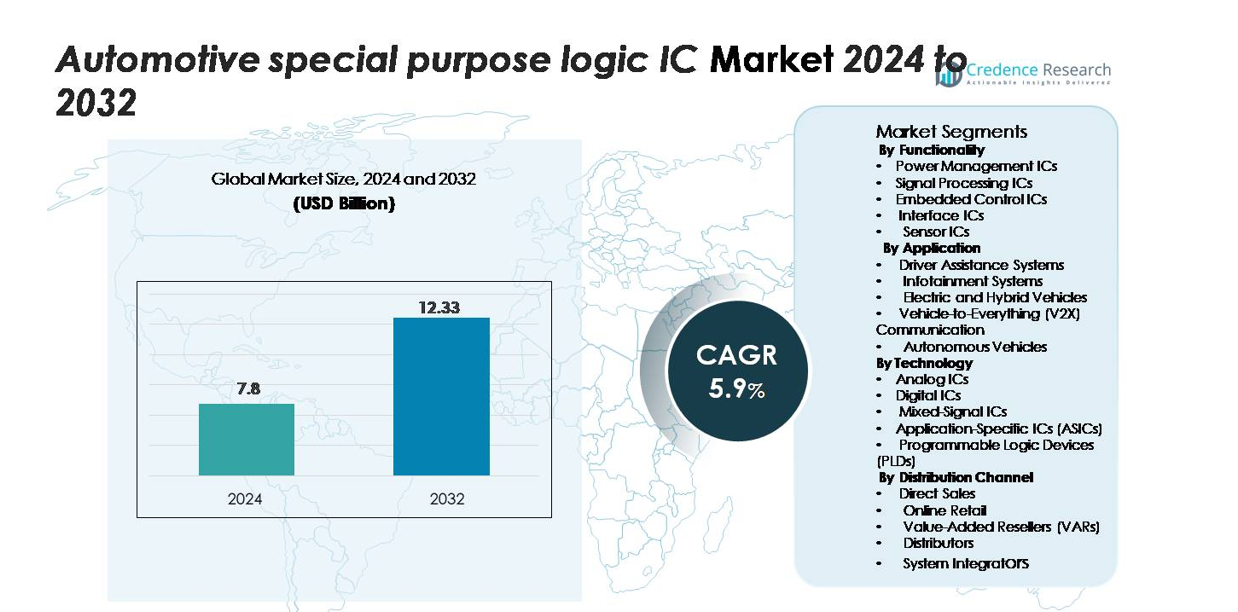

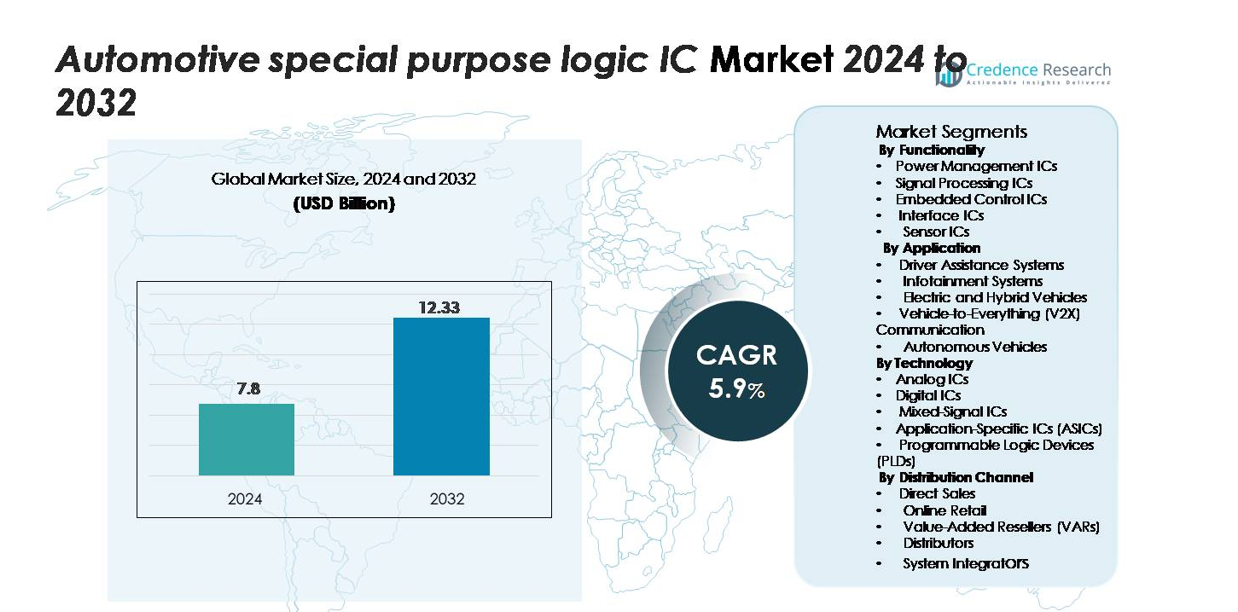

The Automotive Special Purpose Logic IC Market was valued at USD 7.8 billion in 2024 and is anticipated to reach USD 12.33 billion by 2032, growing at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Special Purpose Logic IC Market Size 2024 |

USD 7.8 billion |

| Automotive Special Purpose Logic IC Market, CAGR |

5.9% |

| Automotive Special Purpose Logic IC Market Size 2032 |

USD 12.33 billion |

Leading players in the Automotive Special Purpose Logic IC market include Texas Instruments, Infineon Technologies, NXP Semiconductors, STMicroelectronics, Renesas Electronics, and Analog Devices. These companies supply power management ICs, embedded control units, sensor processors, and System-on-Chip platforms for ADAS, infotainment, EV powertrains, and V2X communication. North America leads the market with a 34% share, driven by strong ADAS adoption and autonomous testing programs, while Asia-Pacific holds a 37% share, supported by high vehicle production and rapid EV penetration. Europe accounts for a 28% share, backed by strict emission rules and strong EV investments from premium automakers.

Market Insights

- The Automotive Special Purpose Logic IC market was valued at USD 7.8 billion in 2024 and is projected to reach USD 12.33 billion by 2032, at a CAGR of 5.9%.

- Demand rises due to the growth of ADAS, connected infotainment, and electric powertrains, increasing the use of power management ICs and sensor ICs across modern vehicle platforms.

- A key trend is the shift toward SoC and ASIC-based architectures that offer high computing density, reduced heat, and compact integration for EVs and autonomous systems; Asia-Pacific leads with a 37% share, followed by North America at 34% and Europe at 28%.

- The market remains moderately consolidated, with players like NXP Semiconductors, Infineon Technologies, Texas Instruments, and STMicroelectronics focusing on automotive-grade reliability, long-term supply contracts, and advanced packaging.

- Supply chain disruptions, certification costs, and strict safety and cybersecurity standards act as restraints, while power management ICs command the dominant functional share at 32%, driven by rising EV penetration and battery monitoring demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Functionality:

Power management ICs hold the dominant position with a 32% share, driven by rising use of electric powertrains, advanced infotainment modules, and energy-efficient architectures. These ICs help regulate voltage, protect circuits, and improve battery performance in electric and hybrid vehicles. Sensor ICs also gain strong traction due to wider deployment of LiDAR, radar, and thermal detection in ADAS platforms. Embedded control ICs support intelligent braking, transmission, and body electronics. Signal processing and interface ICs enhance connectivity between vehicle subsystems and external networks, strengthening real-time data exchange and system reliability.

- For instance, STMicroelectronics’ L9963E battery management IC supports monitoring for up to 14 lithium-ion cells in series with cell-balancing accuracy below 2 mV, improving thermal stability in EV battery packs.

By Application:

Driver assistance systems account for the largest share at 34%, propelled by mandatory safety norms and automaker focus on collision avoidance and lane detection features. Electric and hybrid vehicles increase reliance on logic ICs to optimize battery packs, regeneration modules, and thermal management. Infotainment systems integrate high-speed processors and mixed-signal ICs for seamless audio-video processing. V2X communication and autonomous vehicles create demand for low-latency computing, sensor fusion, and high-bandwidth communication ICs, shaping long-term growth.

- For instance, an Infineon HybridPACK™ Drive module in the 1200 V class, such as the FS380R12A6T4B variant, is rated for a continuous current of up to 380 A (or up to 400 A for certain CoolSiC™ versions). These modules improve efficiency in traction inverters. Infotainment systems integrate high-speed processors and mixed-signal ICs for seamless audio-video processing.

By Technology:

Application-specific ICs (ASICs) lead the segment with a 30% share, as automakers adopt customized chips for ADAS, powertrain control, and autonomous navigation. ASICs offer higher efficiency, lower latency, and improved thermal stability compared to generic ICs. Mixed-signal ICs also expand due to increased sensor integration and real-time digital-analog conversion. Programmable logic devices support flexible computing in prototypes and testing platforms, while analog and digital ICs remain core components in vehicle safety, communication, and infotainment circuits.

Key Growth Drivers

Rising Adoption of ADAS and Safety Electronics

Automakers add advanced driver assistance systems to meet safety rules. Camera, radar, and LiDAR units need fast logic control. Special purpose logic ICs handle real-time processing and sensor fusion. These chips support lane keeping, blind-spot alerts, and collision warnings. Governments push for active safety features in mass-market cars. Premium models use even larger chipsets for adaptive cruise and automated braking. Tier-1 suppliers pair logic ICs with high-resolution sensors to improve detection accuracy in poor light and harsh weather. Growing demand for Level-1 and Level-2 automation keeps purchasing volumes high.

- For instance, the NXP Semiconductors S32R45 radar processor’s linear algebra accelerator (LAX) provides over 300 GFLOPS of compute and supports up to four 77-GHz radar channels, enabling high-resolution imaging for adaptive cruise control.

Growth of Electric and Hybrid Vehicles

EVs and hybrids use more electronics than fuel-based models. Battery packs, inverters, thermal units, and charging systems all require logic control. Power management ICs regulate voltage and protect high-density cells. Sensor ICs watch temperature, current flow, and battery health. Special purpose logic ICs also improve motor control and power conversion efficiency. Faster charging networks need programmable and mixed-signal ICs. Governments promote EV adoption through incentives and emission goals. As EV volumes scale, semiconductor demand becomes a core revenue source for suppliers.

- For instance, STMicroelectronics’ L9963E battery management IC monitors up to 14 lithium-ion cells in series with cell-voltage accuracy better than 2 mV, improving thermal stability and state-of-charge estimation.

Expansion of Connected and Smart Vehicle Platforms

Cars now work as connected devices. Navigation, infotainment, over-the-air updates, and V2X communication all need stable processing. Logic ICs manage secure data exchange between cloud, sensors, and vehicle modules. Automakers deploy chips that support encryption, telematics control, and predictive maintenance. Fleet operators use real-time diagnostics to cut downtime. High-speed networking standards raise demand for interface and signal processing ICs. Growth of 5G improves bandwidth and reduces latency. Smart mobility ecosystems push electronics deeper into entry-level segments.

Key Trends & Opportunities

Shift Toward System-on-Chip and Miniaturized Architectures

Car makers want compact modules with high computing power. System-on-Chip solutions replace multiple discrete units, cutting heat, weight, and wiring. These SoCs support ADAS, infotainment, and powertrain control in one package. They improve design flexibility and reduce production cost for large OEMs. Miniaturized assemblies help fit electronics into tight spaces in EVs and autonomous vehicles. Suppliers also invest in high-temperature and automotive-grade packaging. The trend creates room for new designs in chip-dense zones such as battery packs and radar sensors.

- For instance, the Qualcomm Snapdragon Ride Flex SoC integrates a CPU, a GPU, and an AI accelerator (NPU) capable of varied performance levels on a single automotive-grade chip, supporting cockpit and ADAS/AD workloads simultaneously.

Rapid Growth of Autonomous and V2X Communication

Autonomous testing increases in passenger cars, robo-taxis, and logistics fleets. Special purpose logic ICs process sensor inputs, route data, and run safety algorithms. V2X networks allow vehicles to talk to roads, signals, and each other. Low-latency processing reduces crash risk and supports predictive driving. Mixed-signal and ASIC solutions help manage heavy data loads. As cities adopt smart traffic systems, suppliers see new contracts for embedded control and edge computing components. The opportunity expands with 5G and intelligent road infrastructure.

- For instance, Qualcomm’s Snapdragon 5G Automotive Platform supports C-V2X communications with latency measured below 10 milliseconds, enabling real-time hazard alerts and lane-change coordination.

Key Challenges

High Design Complexity and Cost Pressure

Automotive ICs need strict reliability, cybersecurity, and functional safety checks. Development cycles are long. Testing and certification add high cost. Automakers push suppliers to cut prices, even as chip density rises. Small errors can lead to recall risks and warranty losses. Only a few vendors hold the engineering capability and capital to keep pace. This limits new entry and slows innovation. Rising material and packaging costs add more pressure.

Supply Chain Volatility and Semiconductor Shortages

Automotive chips face long lead times. Disruptions from natural disasters, trade limits, or fab shutdowns impact production. During shortages, consumer electronics often get priority from chip foundries. Vehicle output drops when logic IC supply falls. EV and ADAS platforms need stable sourcing for high-grade semiconductor wafers. Many suppliers work on localization strategies and multi-sourcing. However, capacity gaps still affect delivery schedules and profit margins.

Regional Analysis

North America

North America leads the Automotive Special Purpose Logic IC market with a 34% share, supported by high adoption of ADAS, connected vehicle platforms, and autonomous testing programs. U.S. automakers and Tier-1 suppliers invest in safety electronics, LiDAR-based perception units, and advanced infotainment systems. Strong EV growth, especially in premium segments, increases demand for power management and sensor ICs. Regulatory standards on crash prevention, vehicle cybersecurity, and emission reduction encourage semiconductor integration. The region benefits from a strong semiconductor design ecosystem and partnerships between automakers and chip manufacturers, ensuring steady technology upgrades across passenger and commercial fleets.

Europe

Europe holds a 28% share, driven by strict safety and emission regulations. Automakers focus on electrified powertrains, V2X communication, and driver-assistance platforms, increasing consumption of mixed-signal, ASIC, and sensor ICs. German automotive OEMs and suppliers deploy advanced logic controllers in premium EVs, smart braking systems, and predictive powertrain management. Growing autonomous mobility trials in Germany, France, and the U.K. also support semiconductor demand. The region’s shift toward zero-emission manufacturing accelerates electronics integration in battery systems and charging infrastructure. Strong R&D investments and collaborative projects with semiconductor foundries boost long-term growth.

Asia-Pacific

Asia-Pacific accounts for the largest share at 37%, supported by high vehicle production, rapid EV adoption, and strong consumer demand for connected infotainment systems. China, Japan, and South Korea lead in battery technology, smart vehicle electronics, and mass-production of automotive ICs. Local OEMs adopt SoC and miniaturized IC designs to reduce costs and improve efficiency. Governments promote smart mobility, pushing V2X networks and autonomous pilot projects. Large-scale semiconductor manufacturing capacity ensures competitive pricing and steady availability. As EV penetration rises in China and India, suppliers witness heightened demand for power management and battery monitoring ICs.

Latin America

Latin America holds a 6% share, with gradual adoption of ADAS and connected infotainment systems across mid-range vehicles. Brazil and Mexico act as major automotive production hubs, supporting demand for embedded control and sensor ICs. Rising interest in hybrid and electric vehicles enhances the use of power management ICs. Automakers invest in vehicle safety upgrades and digital dashboards to meet consumer expectations. Import dependency on high-performance chips remains a constraint, but partnerships with global suppliers help improve availability. As local assembly expands, semiconductor integration in mainstream vehicle models will increase steadily.

Middle East & Africa

The Middle East & Africa region accounts for a 5% share, supported by growing deployment of connected infotainment systems, navigation units, and fleet-based telematics in commercial vehicles. Premium car imports feature high levels of ADAS and autonomous-ready electronics, increasing demand for sensor and signal processing ICs. Governments explore smart mobility initiatives in the UAE, Saudi Arabia, and South Africa, expanding opportunities for V2X and safety electronics. Market growth is slower in price-sensitive segments, and limited local semiconductor production leads to import dependency. Over time, EV adoption and smart infrastructure projects are expected to create new demand pockets.

Market Segmentations:

By Functionality

- Power Management ICs

- Signal Processing ICs

- Embedded Control ICs

- Interface ICs

- Sensor ICs

By Application

- Driver Assistance Systems

- Infotainment Systems

- Electric and Hybrid Vehicles

- Vehicle-to-Everything (V2X) Communication

- Autonomous Vehicles

By Technology

- Analog ICs

- Digital ICs

- Mixed-Signal ICs

- Application-Specific ICs (ASICs)

- Programmable Logic Devices (PLDs)

By Distribution Channel

- Direct Sales

- Online Retail

- Value-Added Resellers (VARs)

- Distributors

- System Integrators

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Automotive Special Purpose Logic IC market remains moderately consolidated, with global semiconductor leaders competing on performance, power efficiency, and automotive-grade reliability. Companies focus on ASICs, mixed-signal ICs, and SoC platforms that support ADAS, infotainment, battery management, and autonomous navigation. Tier-1 suppliers form long-term supply agreements with automakers to secure component continuity and reduce shortage risks. Key players invest in high-temperature packaging, functional safety certification, and cybersecurity-enabled architectures to meet industry standards. Strategic partnerships between chip manufacturers and EV producers strengthen production scale for power management and sensor ICs. Many firms expand 7-nm and 5-nm fabrication to improve computing density and reduce energy loss. R&D efforts also target integration of AI accelerators within automotive logic chips for faster perception and decision-making. Mergers and acquisitions continue as companies build broader product portfolios for electric and smart mobility ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Qualcomm

- ROHM

- Intel Corporation

- Renesas Electronics

- Cypress

- Texas Instruments

- STMicroelectronics

- Onsemi

- Infineon Technologies

- Analog Devices

- Broadcom

- NXP Semiconductors

Recent Developments

- In November 2025, Qualcomm announced that its Automotive & IoT business achieved 27 % year-over-year growth for fiscal year 2025, underpinned by increasing automotive chip shipments.

- In September 2025, ROHM launched a 2-in-1 SiC molded module “DOT-247” for automotive applications compliant with AEC-Q101, with sample shipments scheduled from October.

- In April 2025, at Auto Shanghai 2025 Intel unveiled a new next-generation automotive chip solution and announced expanded collaborations with ModelBest and Black Sesame Technologies for software-defined vehicles.

Report Coverage

The research report offers an in-depth analysis based on Functionality, Application, Technology, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as automakers expand ADAS and automated driving features in mass-market vehicles.

- EV production will increase the use of power management ICs and battery monitoring chips.

- SoC and ASIC designs will replace multiple discrete components to lower heat, weight, and wiring.

- V2X communication growth will push adoption of high-speed signal processing and secure logic controllers.

- AI-enabled logic ICs will improve perception, decision-making, and predictive maintenance in smart vehicles.

- Semiconductor makers will expand automotive-grade fabrication with advanced nodes for higher computing density.

- Partnerships between chip suppliers and EV manufacturers will grow to ensure long-term supply stability.

- Autonomous shuttles, robo-taxis, and logistics fleets will create demand for safety-certified logic processors.

- Cybersecurity-focused logic ICs will see wider adoption as connected cars require protected data exchange.

- Rising interest in compact electronics will boost adoption of miniaturized automotive SoC and multi-chip modules.